Good morning from Paul & Graham!

Today's report is now finished.

Paul's Podcast summarising the week's SCVRs, with some macro/markets commentary went up on Saturday morning, here's the web link.

My summary spreadsheet is also now up-to-date.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Summaries

McBride (LON:MCB) - 51.9p (pre market) £90m - Trading Update (AGM) - Paul - AMBER

Another ahead of expectations update, following the last one in Oct. Heavy debt remains the biggest issue here, but improved trading means it expects to comply with covenants when they're reintroduced. It's been a good trade so far, but not sure I'd want to hold this low quality, indebted company long-term, where its track record has been poor.

Begbies Traynor (LON:BEG) - up 0.3% to 130.4p (£205m) - Half-Year Trading Update (in line) - Graham - AMBER

A solid update from this insolvency practitioner, confident of meeting full-year expectations for FY April 2024. I admire Begbies but continue to believe it is fairly valued. On the macro side, we might need to start thinking about when the current tailwind of higher rates will start to weaken.

Halfords (LON:HFD) - Unch 234p (512m) - Press speculation - Paul - AMBER/GREEN

Fresh bid rumours swirling in the press over a possible takeover/merger of Halfords by Redde Northgate (LON:REDD) . I bounce ideas around below. Surely Halfords is now required to make a statement, under Takeover Panel rules? I think it's a pretty good business, and a credible bid target, so I'm going up from amber to AMBER/GREEN.

Musicmagpie (LON:MMAG) - up 28% to 24p (£26m) - Response to speculation re possible offer - Paul - RED

Shareholders might be put out of their misery here with 2 potential bidders in early stage talks with the company. Given its very weak business model, profit warnings, now generating losses & accumulating bank debt buying secondhand phones, I remain negative on the fundamentals. But bidders don't necessarily see things the same way. Good luck to holders!

Polar Capital Holdings (LON:POLR) - up 2% to 461.2p (£467m) - Interim Results - Graham - GREEN

These are encouraging interim results: AuM is flat and profits are holding up. Against that, there is a slight dip in relative performance over three years, and a reducing cash balance. POLR’s shares are more expensive than its rivals but I consider this to be justified.

Cerillion (LON:CER) - unch 1,310p (£385m) - Final Results - Paul - GREEN

Very impressive results, which look ahead of forecast. Pricey shares, on a PER of 28x, but it's performing brilliantly. Very strong finances too. Small divis. Who knows what the future holds, but I can't see any signs of trouble in the figures or commentary, so I remain positive.

SRT Marine Systems (LON:SRT) - down 3% to 38.5p (£74m) - Interim Results - Paul - RED

[Quick comment, no section below] - Lousy H1 figures, as indicated in 6/10/2023 update. Expecting a gigantic H2 weighting.

It’s impossible to value this company, as its revenues/contracts are ridiculously lumpy, with seemingly no visibility. I’m not happy with the balance sheet either, despite another placing done near the end. It’s running up debt too, with £9.7m borrowings within current liabilities. It’s much too risky, and uncertain for me, so unfortunately I’m forced to shift to RED, to highlight the considerable risks here. Hopefully it will work out well for shareholders, but as always with SRT, that has to be more based on a leap of faith, than any certainty.

Thruvision (LON:THRU) - unch 20p (£29m) - Interim Results - Paul - AMBER

Promising-sounding products, but it warned on profits on 2/10/2023 when a big expected order from US customs fell through. Raised £3.2m in a placing in Oct 2023. Poor H1 - only £3.5m revenues, and £(1.6)m LBT. Balance sheet should be OK since placing done. Intriguing comments about Pentland (51% owner of JD Sports Fashion (LON:JD.) ) taking a 10% stake in THRU - could it be a takeover target I wonder? Outlook section says expecting strong growth in H2 and beyond.

Paul’s opinion - I was amber/red at the last profit warning, but it sounds as if things might be improving a bit. Speculative, but I do think there’s something interesting here, so I’ll shift up to AMBER. Still a loss-making, rather jam tomorrow company though, at this stage.

Paul’s Section:

McBride (LON:MCB)

51.9p (pre market) £90m - Trading Update (AGM) - Paul - AMBER

McBride plc (the "Group"), the leading European manufacturer and supplier of private label and contract manufactured products for the domestic household and professional cleaning and hygiene markets, today provides the following trading update ahead of its 2023 Annual General Meeting.

The current financial year is FY 6/2024.

Looking back through our archive, trading updates have been improving this calendar year -

28/2/2023 - Moves back into operating profit. (RED)

14/7/2023 - Top end of forecast range for FY 6/2023. (AMBER/RED)

19/10/2023 - Ahead expectations TU. (AMBER/RED)

We would have been amber or green, were it not for the huge debt load (and high interest costs), which shouldn’t be ignored. Although as trading performance improves, debt becomes less of an issue. It also gives leveraged upside to equity holders if a highly indebted company trades it way out of trouble without needing a placing. The bank has been very supportive to date as well, with generous relaxation of covenants.

Current trading - is also ahead of (presumably increased?) expectations -

The Group has continued to trade ahead of our expectations in October and the early part of November, mostly a result of the continuing consumer shift to value driving strong demand for our high-quality private label products from our retail partners.

For the first four months of the current financial year, overall volumes were 8.2% higher compared to prior year, with private label volumes growing 11.7%.

Interesting what they say there about consumers switching to cheaper products.

I’m not sure why the above quotes volumes. Surely value is more important to investors? Presumably value would be more than 8.2% up, given likely price rises to MCB’s customers? So why not disclose the number?

Debt & covenants - is still very high, but rising earnings means a 2x EBITDA multiple by 6/2024 year end is much more manageable. Good progress being made, by the looks of it. Also encouraging news on the (currently suspended) covenants - so it's off life support, and is now comfortable, and recovering -

Net debt reduction is progressing well and at our half year of 31 December 2023 we expect to be fully compliant with debt cover and interest cover banking covenants, some nine months ahead of when testing recommences in September 2024. By our year end of 30 June 2024, we anticipate net debt / adjusted EBITDA will be close to 2x.

Outlook - this is the closest we get to an outlook statement, which sounds cautious I’d say. Or is this just the standard type of macro uncertainty that we’re hearing from many companies?

With only four months of the financial year complete, the Group remains alert to the possible risk to full year results from world events which could lead to macro-economic instability and potential increased volatility in commodity markets and ultimately into further input cost pressures.

That seems OK to me, it doesn’t indicate any company or sector-specific problems. Just potential risk that’s outside their control.

It would be interesting to hear whether MCB has managed to improve its business model through hedging of costs, and pass-through contracts with customers? The danger is that every time something unexpected happens, MCB gets walloped.

Broker updates - nothing available. This is a recurring problem with MCB, it’s leaving private investors in the dark. So City insiders get the detailed information, and we have to wait for the scraps to fall from their table when the broker consensus graph is updated.

As you can see below, there’s be a lovely upward progression in EPS forecasts, so this turnaround does seem to be working - hence why the share price has been recovering this year.

Paul’s opinion - I like the turnaround here, so a thumbs up for that.

Although it’s not a business that I would want to invest in long-term, due to the low margins, and as we’ve seen in recent years, vulnerability to unexpected input cost increases.

There’s also the issue of substantial debt. This was £166.5m at 30 June 2023, less £5.5m lease liabilities, so £161m bank debt. Note that last year, interest on bank debt was £11.1m, plus another £12.2m costs for “independent business review and refinancing”, so the bank has certainly got its pound of flesh out of this (not to mention all the advisors on the gravy train).

Getting debt down to 2x EBITDA by 6/2024 sounds impressive, but bear in mind that EBITDA is a long way from profit. Last year, it made £34m positive adj EBITDA, but free cashflow was slightly negative, at £(2.2)m. The P&L was only a whisker above breakeven at £0.3 PBT, which ignored £15.4m of one-off refinancing costs. So an overall loss of £(15.1)m.

This year looks as if it’s going to be considerably better though. The StockReport is showing forecast (before any possible upgrades today) EPS of 12.4p, which is £21.8m net (after tax) profit. That doesn’t leave much scope to pay down debt, let alone pay any divis.

Overall, I can see why the share price has recovered, because MCB is no longer in the “could go bust” tray. But it’s still very much in the “has loads of debt” tray, which means the prospect for generous divis is very small, and it would in any case be unwise to pay big divis whilst burdened with excessive debt (and a pension deficit).

Am I worrying too much about the debt? Possibly, and the forecast PER of only 4.0x does factor in a big discount for this problem.

Note there’s also a pension deficit, requiring £4m pa in recovery payments (cash), which further reduces cash available for divis.

On balance, with another positive trading update under its belt, I feel obliged to shift up to AMBER. Although bulls might need to avoid getting too carried away, there are still significant issues here.

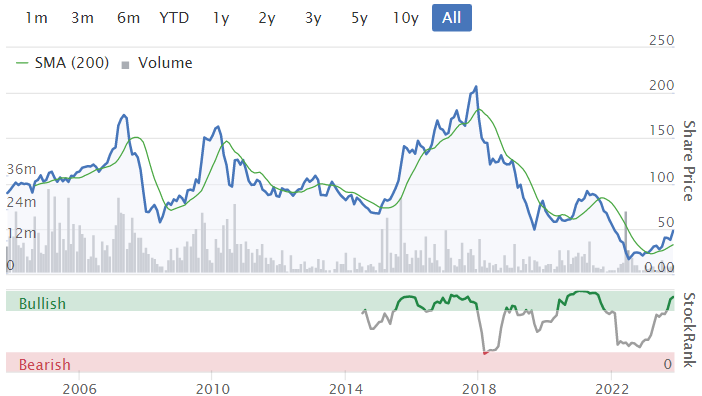

Long-term it's been lacklustre, it's just not a very good business, with little pricing power, and lots of competition I'd say -

Halfords (LON:HFD)

Unch 234p (512m) - Press speculation - Paul - AMBER/GREEN

We covered this car/bike superstores and servicing/repair group here on 13/10/2023, when Betaville (bid rumour website) apparently claimed that HFD was a potential bid target. The price spiked up 19% to 216p, but then almost immediately fell back down again. HFD didn’t publish any statement re the rumours.

Interestingly though, the share price has now climbed back up again, and beyond to 234p.

I gave it the once over on 13/10/2023, concluding that the bid rumours seemed credible, as HFD looks reasonably priced, and could credibly become a bid target in my view.

Anyway, the latest bid rumours which I think originated in the Telegraph, suggest that vehicle hire group Redde Northgate (LON:REDD) (which we like here as a value share) might have proposed a nil premium merger with Halfords. Given that REDD has the larger market cap at £836m, compared with HFD £512m, then it would probably be better seen as an acquisition of HFD by REDD. But given REDD shares are so lowly rated, at a PER of 7.1x, 6.7% yield, and P/TBV of 1.11, why would REDD shareholders want new REDD shares issued to fund HFD which is valued on a higher rating? Surely that would needlessly dilute REDD shareholders, and how would buying HFD add value or synergies?

Both companies know about cars, but apart from that it’s difficult to imagine any particular benefits from combining the companies.

Neither company seems to have issued an RNS. I thought they are obliged to say something if takeover rumours swirl, under the (unsatisfactory) Takeover Panel rules, which allow a false market to happen in target companies' shares, often for months?

Here’s an excerpt below from the Takeover Panel rules. It seems to me, that having twice been the subject of press speculation re bid approach(es) for Halfords, this must have triggered these requirements, surely? -

2.2 WHEN AN ANNOUNCEMENT IS REQUIRED An announcement is required…

… (c) when, following an approach by or on behalf of a potential offeror to the board of the offeree company, the offeree company is the subject of rumour and speculation or there is an untoward movement in its share price;

(d) when, after a potential offeror first actively considers an offer but before an approach has been made to the board of the offeree company, the offeree company is the subject of rumour and speculation or there is an untoward movement in its share price and there are reasonable grounds for concluding that it is the potential offeror’s actions (whether through inadequate security or otherwise) which have led to the situation;

Paul’s opinion - HFD needs to issue a statement to tell the market what (if anything) has been going on.

I’m upping my view from amber to AMBER/GREEN, as HFD looks a credible bid target to me, given that it’s profitable & cash generative, and has a dominant brand in its niche.

Note that the share count rose about 13% from 200m to 227m during the pandemic. Also note the very high StockRank -

Musicmagpie (LON:MMAG)

Up 28% to 24p (£26m) - Response to speculation re possible offer - Paul - RED

The Board of musicMagpie notes the recent speculation and confirms it is in early-stage discussions with both BT Group plc and Aurelius Group (together "the Parties") as to a possible offer to acquire the entire issued and to be issued share capital of musicMagpie.

Discussions between the parties are ongoing and remain at a very early stage. Accordingly, there can be no certainty that any offer for the Company will be made from either of the Parties, nor as to the terms of any such offer. Accordingly, shareholders are advised to take no action at this time. A further announcement will be made as appropriate.

This looks like one of those announcements which could have been deliberately leaked, to get the company into play, and see if any other bidders surface. Takeover Panel rules have now kicked in, so we'll get a daily deluge of 1%+ holder disclosures now.

Why anyone would want to buy this company is beyond me. Although as we’ve seen with some very surprising bids this year, acquirers sometimes see things completely differently to how stock market investors perceive a standalone company.

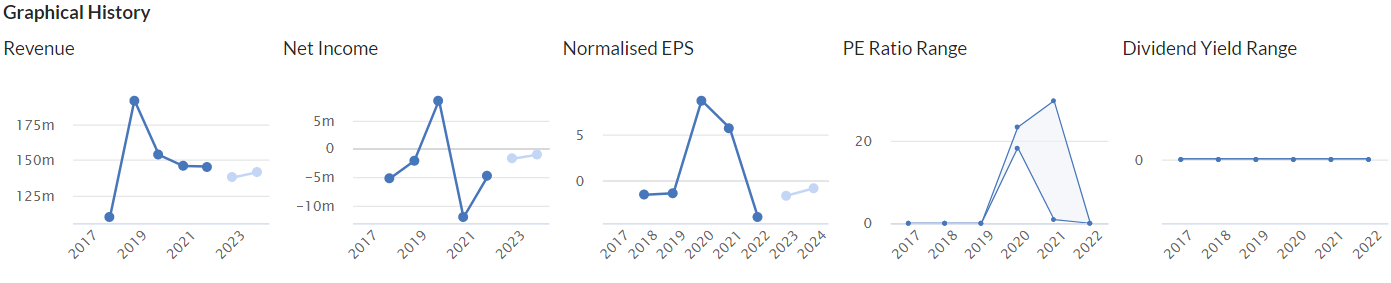

MMAG has been a very poor investment, losing c.90% of its 2021 (again!) float price. It was one of many opportunistic pandemic boom floats, wildly overpriced, based on only fleeting profitability.

Every time I review MMAG’s results, I just cannot see that this is a viable business. It’s building up bank debt buying used phones/tablets to rent out, but it doesn’t make a profit from doing this. So what’s the point?

Maybe MMAG’s kiosks in ASDA have caught the eye of the EE mobile part of BT, as a way to recycle mobile phone handsets? That seems credible, and it could stack up if much greater volume is pushed through MMAG's established kiosk network.

Aurelius seems to be an investment firm, so a financial buyer.

Paul’s view - I have a very dim view of MMAG shares, because profitability has collapsed, so it’s now loss-making and accumulating bank debt on what seems an irrational, and deeply flawed business model. So it’s certainly not negotiating from a position of strength with potential buyers.

That said, it’s conceivable that the potential buyers might see things more positively, especially BT/EE, which strikes me as a potentially good fit for MMAG.

The fundamentals are dreadful, so I have to stick at RED, but there’s a chance shareholders might be given an exit in a takeover bid, especially with apparently 2 named parties interested. It will be interesting to see how this develops, and good luck to any holders, I hope it works out well for you! We like to see readers make a bob or two, even if it’s in a pretty rubbish company like this.

Very weak historical track record, apart from the one-off pandemic boom -

Cerillion (LON:CER)

Unch 1,310p (£385m) - Final Results - Paul - GREEN

Cerillion plc, the billing, charging and customer relationship management software solutions provider, presents its annual results for the 12 months ended 30 September 2023.

Record financial performance

Strong platform for continued growth

Feast your eyes on this highlights table!

Another year of excellent growth, and the 46.2p adj EPS looks a beat against the consensus of 43.1p shown on the StockReport. Yes it is a beat, I’ve just confirmed that to a recent Liberum note (many thanks) dated 2/11/2023 which forecast 42.6p, so today looks an 8.5% earnings beat. Very nice.

The PER is a lofty 28.4x - you have to pay up for quality and growth, as they say. And of course hope that nothing goes wrong and growth doesn’t slow.

Hence we need to focus on the forward-looking facts & figures as of key importance.

Order book -

Back-order book3 at £45.4m at the financial year-end (30 September 2022: £45.4m); now at a record £52.5m following the recent €12.4m contract win with a new European Tier-1 customer.

Pipeline - very substantial, and rising nicely, at over 6x revenues, but of course only part (unknown %) of this will turn into actual contracts -

New customer sales pipeline7 up 16% to a record £243m at 30 September 2023 (30 September 2022: £209m)

Note 7 New Customer Sales Pipeline is the total, unweighted value of all qualified sales prospects.

Outlook - this sounds confident, and positive to me -

The Company is growing strongly, and its product-based SaaS approach leaves it well placed to continue to benefit from the broad range of positive market drivers, as discussed above. We are also encouraged by the increasing visibility the brand is gaining in what remains a huge marketplace. Our recent Tier-1 new customer win reflects this and Cerillion's inclusion in two Gartner Market Guides* (which evaluated suppliers based on product portfolio, geographic spread and progress in the last year), published earlier in 2023, also highlights the Company's growing reputation and the breadth and completeness of its product portfolio.

Looking ahead, the recent new customer win, ongoing implementation work with existing customers, and the major new deals signed with existing customers all create a strong platform for further growth. The back-order book, now at a record £52.5m, underpins revenue visibility, and the new customer sales pipeline, also at a new high, contains large deal opportunities. This leaves Cerillion well-placed to deliver another strong performance in the new financial year and beyond.

Cerillion's financial position remains very strong, supported by significant net cash, increasing levels of recurring income and strong cash flows. We therefore view the future with confidence and will continue to invest across the business to support ongoing growth.

Balance sheet - very strong. NAV £36.9m, NTAV £32.5m, including cash of £24.7m and no interest-bearing debt. I ignore lease liabilities, which are minimal here at £3.2m anyway.

Receivables are rather high, note 13 shows this is mostly “Contract assets” (also called “accrued income”) of £15.5m - ie work done but not yet invoiced (eg pending contract performance milestones), nicely explained in the text of note 13.

Within creditors there is also (rather confusingly) “Deferred income”. This is the creditor relating to cash that’s been received up-front by customers.

Let’s move on. It’s all fine, I think, although I would ask management for more detail on why receivables overall are pretty high, relative to revenues.

Cashflow statement - very good, but again this flags up the increase in receivables of £6.5m, which has absorbed about a third of the £18.1m cash generation.

Capitalisation of development spend is modest at only £1.1m, showing conservative accounting I think.

Dividends cost £2.9m, with a very modest yield of only 0.9%, but there’s scope to raise divis in future I think. But you don’t expect a large yield on a share with a PER of 28x.

Paul’s opinion - fantastic figures, and a full valuation to reflect that.

I’m reassured by the forward-looking comments, and it does seem that CER is in a sweet spot where there’s increasing acceptance of its cloud products, in a huge global telecoms market.

Something unknown could go wrong of course, but based on the facts, figures, and forecasts we have today, I can’t help but retain my GREEN view of CER shares.

Graham’s Section:

Begbies Traynor (LON:BEG)

Share price: 130.4p (+0.3%)

Market cap: £205m

Begbies Traynor Group… the professional services consultancy, announces an update on trading for the six months ended 31 October 2023.

The past five years have been a pleasant time to own shares in this insolvency practitioner, although the share price has been range-bound more recently:

Today’s update confirms that the company is “confident of delivering full year expectations”. Here are the key points from H1:

Revenue and adj. Operating profit both expected to increase by c. 13% (organic plus acquired growth).

Adjusted PBT expected to increase by c. 10% due to higher finance costs.

Net cash as of October 2023 of £1.1m, thanks to strong free cash flow over the six months.

The range of forecasts for adjusted PBT, as compiled by the company, is £21.9m - £22.5m.

So with a market cap of about £200m, these shares could be considered to offer reasonable value. But remember to apply 25% tax, so that adjusted net income is around £17m. Also remember that the accounts are full of adjustments, and the balance sheet offers little by way of tangible asset backing. Value investors might not find everything they are looking for here.

Operational highlights:

Insolvency teams are “busy with increased year on year activity levels”. Overall volumes are “continuing to increase in current interest rate and inflation environment”.

Comment by Exec Chair Ric Traynor:

With 80% of income generated from counter-cyclical and defensive activities, and a strong balance sheet, we remain well-positioned to continue investing in and growing the business."

Graham’s view

Please check the archives for our full coverage of this share. Paul and I tend to have a fairly similar view on this one; my most recent view on it was neutral in July (at a share price of 132p).

At a share price of 130p today and with an outlook in line with expectations, not much has changed:

This seems fair value to me for a professional services company with a very good track record and with a mixture of organic and acquired growth. Generally speaking, valuations in this sector should be more modest than other sectors.

Note that the Bank of England is widely expected to start cutting rates again in 2024 and into 2025. Therefore, while there might currently be large numbers of zombie companies heading for extinction in the short-term, financial conditions might start to ease again over the next two years. This will eventually reduce the pressure on companies to undergo insolvency.

I’m guessing that the next two years will also see the start of a new bull market in UK small and mid-caps. When this happens, I don’t think I’d want to have a very large position in a counter-cyclical and defensive stock like Begbies!

Polar Capital Holdings (LON:POLR)

Share price: 461.2p (+2%)

Market cap: £467m

This fund manager has not been de-rated as severely as its peers since 2021, though it is still down by about 50%:

Its fund range can be viewed here. It has a particular emphasis in technology and healthcare.

Here are the highlights from today’s results for the period to September 2023::

Asset under management £19.1 billion, about the same as March 2023.

Net outflows £581m in H1.

In H1 last year, there were outflows of £753m (plus some other outflows relating to fund closures, buybacks, etc.). This rose to £1.5 billion of net redemptions by year-end.

In this context, £581m of net outflows from Polar in H1 of the current year can be seen as an improvement.

As for profits, we have:

“Core operating profit” £22.5m (H1 last year: £25.8m)

PBT £21.1m (H1 last year: £23m)

Core operating profit excludes a range of items which aren’t essential to the business of fund management, including performance fees.

These H1 results from Polar are a mixed bag: core operating profit is lower, but the reduction is offset by fewer exceptional costs. In the end, it’s a solid result in the circumstances.

EPS comes in at 16.2p, which in theory (with perfect cash generation) is sufficient to fund the interim dividend of 14p. There has been a question mark over the sustainability of the payout; Stockopedia puts the yield at around 10%.

Balance sheet: net assets of £123m (of which about £108m is tangible). It was stronger a year ago, but should still provide investors some comfort.

CEO comment:

"The past six months have been a challenging period for equity markets driven by a volatile macro environment. Like many of our peers, Polar Capital has not been immune from these challenges, but net outflows as a percentage of opening AuM have been relatively modest, and in fact, have materially slowed vs the prior comparable period. This was helped by net inflows into a number of funds…

"Long-term performance remains positive across the UCITs fund range with all funds bar one in the 1st or 2nd quartile of their Lipper peer group since inception. More recently, 77% of Polar Capital's total AuM is in the top two quartiles of the Lipper peer group calendar year-to-date.

Performance across Polar’s funds has weakened on a three-year view (only 48% of AuM in the top two quartiles) but remains good in the short-term and when you view funds since inception.

Graham’s view

I continue to rate this one highly within the fund management sector. Note that not all of its AuM is open-ended and therefore vulnerable to quick withdrawal:

There is also an important specialisation in the technology sector (and to a lesser extent in healthcare and insurance):

Combine that with outflows which are moderating, and I think the overall picture here is encouraging. AuM is about flat year-on-year. No reason at all for investors to be despondent, in my view.

This is reflected in a valuation that is far more premium than others in the space. Investing £1 in Polar shares today only gets you about £42m of AuM (compare that to others we have covered in this report recently - example).

So this share isn’t offering deep value, but it is offering a high-quality company at a reasonable price, in my view. So I’m giving it the thumbs up.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.