Good morning, it's Paul & Graham here!

Podcast - I didn't have any inspiration this weekend, so it's a bit delayed. Hopefully I should catch up later today. With my apologies to the financial wing of the dog walking community! EDIT: podcast now done, sorry it was late. Published 26/10/2024.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

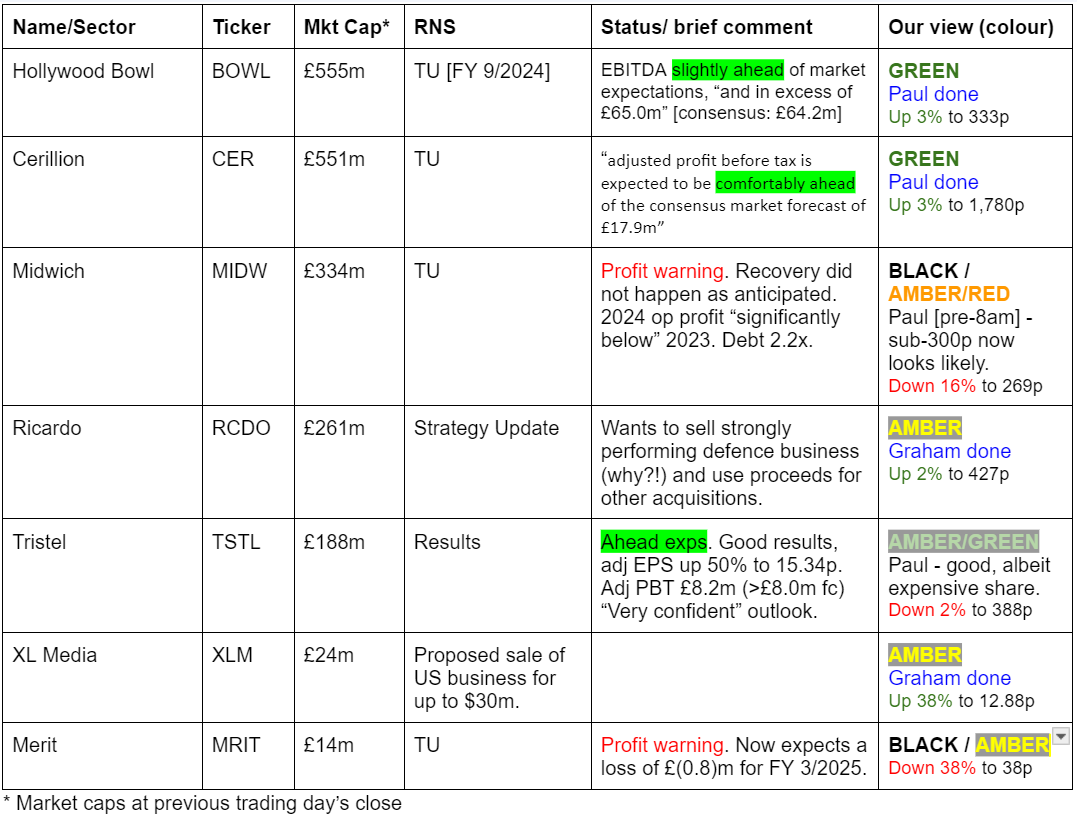

Companies Reporting

Summaries

Hollywood Bowl (LON:BOWL) - up c.2% to 332p (at 08:15) (£570m mkt cap) - Trading Update [FY 9/2024] - Paul - GREEN

A slight beat against forecast is announced today, ending FY 9/2024 with a flourish. Not much said about the outlook. Lack of revenue growth slightly concerns me, which raises the question of whether we've hit peak bowling, after several year's strong growth? I'll stick at GREEN because this is an excellent business, generating lots of cashflow, which enables it to self-fund new sites, and pay decent 4% divis on top. Valuation seems reasonable.

XLMedia (LON:XLM) - up 40% to 13p (£34m/$44m) - Proposed Divestment of North America business - Graham - AMBER

XLM is leaving us after 10 years on the market, as it plans to convert into a cash shell. They have conditionally agreed to sell their North America business for up to $30m. I do some quick calculations and can see a potentially attractive return over the next year from the current share price, with some caveats.

Cerillion (LON:CER) - up 3% to 1,780p (£516m) - Trading Update - Paul - GREEN

Another beat against expectations, as we suspected was being lined up given the soft forecast. Order book & pipeline sound exciting, and historically Cerillion has delivered on its prospects. Hence why despite a lofty valuation, I'm taking a risk and staying GREEN. We just have to hope nothing goes wrong, as it heavily relies on licence sales still - risking that a gap in the order book could bring a profit warning unexpectedly.

Ricardo (LON:RCDO) - up 2% to 426.5p (£265m) - Strategy update - Graham - AMBER

Ricardo is looking to sell its Defence business despite that business contributing a huge chunk of last year’s operating profit. Perhaps it is excellent timing and the sale will free it up to focus on environmental markets? I don’t see any reason to object to the decision, but the price is all-important.

Paul’s Section:

Cerillion (LON:CER)

Up 3% to 1,780p (£516m) - Trading Update - Paul - GREEN

Cerillion, the billing, charging and customer relationship management software solutions provider, is pleased to provide an update on trading for the financial year ended 30 September 2024.

This niche software company is one of AIM’s star performers, having roughly 20-bagged since 2016. Although most of the gains have come in just the last 4 years. It seemed to find a sweet spot, in cloud-based billing services for telecoms companies and has won bigger & better orders as each order develops into another reference site.

This year to date, I was GREEN on both 22/4/2024 and 13/5/2024, noting that modest forecasts for FY 9/2024 looked beatable. Reservations include its dependence on licence wins, with only about a third of revenue being recurring. Plenty of cash, and big management shareholdings, so it has the owner’s eye - which often seems to deliver better long-term performance.

CER was one of my top 20 share ideas for 2023, despite it looking expensive at the time (at 1210p), it’s risen 46% since then - demonstrating that occasionally it is worth paying up for high quality growth companies. It’s so difficult though, to identify in advance which companies will actually deliver on their forecasts, and which ones will disappoint. Everything is obvious, but only after the event, I find!

What’s the latest? Today it says -

“The Company traded well over the second half of the financial year, after record first-half revenue and adjusted pre-tax profit. Revenue for the year is expected to be approximately £43.8m (2023: £39.2m), and adjusted profit before tax is expected to be comfortably ahead of the consensus market forecast of £17.9m (2023: £16.8m).

The balance sheet remains strong, with net cash at the financial year-end increased to £29.8m (30 September 2023: £24.7m).”

I like that they’re using actual profit as the performance benchmark, not EBITDA (which can often be wildly inflated at software companies, and nothing even remotely similar to cashflow due to capitalised payroll costs).

What does “comfortably ahead” of £17.9m forecast mean here? At a guess, I imagine perhaps £19-20m adj PBT?

H2 revenue by implication must be £21.3m, because H1 actual was £22.5m, and the total for FY 9/2024 is £43.8m. So H2 revenue down c,5% on H1.

Adj PBT in H1 was £10.5m, so expecting H2 profit to be down a bit on H1, is also pointing towards c.£19m FY 9/2024 adj PBT.

Note the really high profit margin - adj PBT was 47% of revenue in H1, showing that this is a quality business with very good pricing power, and lean overheads.

Broker update - I’ve just noticed Panmure Liberum has updated us, most helpful. I could have saved myself the job of reasonableness checking the numbers, as they’ve done it for us, and come in at exactly the same number as me, £19m adj PBT.

That turns into fully diluted EPS of 49.4p, giving a PER of a tooth-suckingly high 36.0x.

Forecast for FY 9/2025 is left unchanged at 52.8p - obviously this will have to be significantly beaten to justify a share price of 1,780p, let alone any higher. The contract win news has been very strong, so I think we need to work on the basis that something nearer say 60p EPS is likely, otherwise there’s no way such a high share price could be maintained.

Order book - most of this has already been announced, but is still exciting -

“Total new orders signed in the year were significantly greater than in any previous year, reflecting new customer wins as well as the growing value of the installed base. The full benefit of these new orders is still to come through. New orders secured in the period included two major new customer agreements; a €12.4m win signed in early November 2023 with Virgin Media Ireland and an $11.1m contract signed in May 2024 with a leading provider of connectivity solutions in Southern Africa. As part of its expanding commitment to near-shoring in Bulgaria, the Company also moved to a new office in Sofia, in line with its growth plans.

The Company has entered the new financial year with a robust back-order book* and a strong sales pipeline, which includes some large opportunities. The Board continues to view growth prospects very positively.

*Back-order book consists of sales contracted but not yet recognised as revenue at the end of the reporting period plus annualised support and maintenance revenue.

Paul’s opinion - this is so tricky, because CER shares undoubtedly look significantly over-priced, based on the current forecasts.

However, it tends to set forecasts prudently, via the brokers, and it is clearly enjoying a remarkable trend of success since 2020 -

Graph 4 shows that the valuation is always high, so why baulk at a high valuation now, given that the company keeps delivering excellent growth?

I think the phrase “includes some large opportunities” above swings it positively for me, because CER has such a good track record of converting big opportunities into revenues.

Hence I think this is a rare occasion where I can stay GREEN despite a toppy valuation.

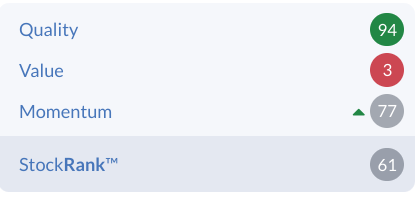

The StockRank starkly points out that CER is high quality, but certainly not good value!

Hollywood Bowl (LON:BOWL)

Up c.2% to 332p (at 08:15) (£570m mkt cap) - Trading Update [FY 9/2024] - Paul - GREEN

Good news today from the UK’s largest operator of ten pin bowling (72 sites), and with smaller operations too in Canada (13 sites). That includes 8 new sites that were added this year. The plan is to grow to 130 sites by 2035, which looks realistic and fundable from internal cashflows.

We’ve been positive on this share for some time here at the SCVR, because it’s a reasonably-priced self-funding roll-out of new sites, and is an impressively cash generative business model that also pays good divis.

Previous SCVR coverage this year -

3/6/2024 - GREEN at 344p - good H1 results, and in line FY outlook.

16/4/2024 - AMBER/GREEN at 333p - badly worded, vague TU that didn’t directly mention performance vs mkt exps - thus introducing doubt. Also I felt that shares had had a good run up at the time, hence moderating my view slightly.

Today’s trading update is much clearer -

“The Group expects to report EBITDA pre-IFRS 16 ahead of market expectations4 and in excess of £65.0m”

4. Based on company compiled consensus average of analysts' expectations for FY2024 where EBITDA pre IFRS 16 is £64.1m.

Slight beat - that’s only 1.4% ahead of expectations, which is nice to have, but not I would suggest a fundamental out-performance. All good FDs should leave a little caution in the forecasts, just in case something untoward crops up, enabling the company to finish the year with a little flourish, which is what this is - it’s good, but not exciting. Hence also why the share price reaction of +2% at the time of writing is only modest, and looks about right . Still, it leaves us the opportunity to buy back in (I’m not currently holding, as needed some money to buy something else recently in my trading account) at a similar price to where it was six months ago.

Note that BOWL shares are fully listed, so not at risk from the threat of AIM inheritance tax being possibly curtailed.

Net cash has reduced a lot, but still looks ample. The business model is terrific, in that it gets paid in cash from customers (hence little in receivables), and also little in inventories (just some food & drink). Hence a very favourable negative working capital model -

“£28.6m net cash at year end, following record levels of capital investment in FY2024 (FY2023: £52.4m)”

There’s also an unused backup bank facility of £25m.

Demand - note that there was no like-for-like revenue growth in the UK, which it says is due to demand normalising after several years of strong growth. So it looks as if we reached peak bowling in 2024. That’s not ideal, as some costs will have increased (especially wages), although the commentary points out that 70% of revenues are not subject to “cost-of-goods inflation”.

Outlook - not a great deal said, and mention of the longer term below might be interpreted as being a little hesitant about the shorter term? - plus the use of the vacuous phrase “profitable growth” of course, deliberately vague, and always jars with me whenever it appears - because it confirms they're not able to say anything stronger -

“We remain confident in the long-term opportunity for future profitable growth across both the UK and Canada. Our strong cash position means we are well placed to continue to invest in our growth, increasing the size and quality of our estate and looking to continually enhance the customer experience."”

I like the self help things BOWL has been doing, eg automating customer reservations (hardly rocket science in this day and age), and installing solar panels on lots of sites to reduce energy bills.

Valuation - no broker notes are available. Stockopedia shows broker consensus of 21.8p for FY 9/2024, rising slightly to 23.2p FY 9/2025 - good to see only a modest forecast increase, making it more likely that plan is met or beaten. Also that seems realistic, given that organic growth from existing sites is now harder to achieve after strong growth in the aftermath of the pandemic. Maybe people went bowling in 2022 and 2023, but are now focusing disposable income more on foreign holidays?

BOWL should be able to bolt on more growth from acquiring independent operators and building its own new sites too. Plus it’s been refurbishing some existing sites.

Hence I’m wondering if we should see its core business as having reached maturity, with maybe low expectations for any further growth from existing sites? The danger with new sites is how do they avoid market saturation? That could be an issue that’s worth asking management - what is their process for identifying new sites with enough unmet demand?

At 333p per share this morning, the forward PERs are 15.3x, which I’ll adjust to 15.0x to allow for the slight beat announced today. That falls to 14.4x FY 9/2025 forecast (which should be achievable/beatable). That seems a reasonable price. The dividend yield is about 4%, with roughly half earnings paid out as divis.

Paul’s opinion - the lack of LfL (like for like) revenue growth does concern me a little. That said, ending the year with a slight beat is pleasing. Going forward, I don’t see particular scope for this share to re-rate any higher in terms of PER as the market seems comfortable to price it around 14-15x PER, which is where we currently sit. Is there scope to beat forecast? Maybe, but looking at historical performance, 2020 and 2021 were obviously hit hard by the pandemic, but demand then bounced back strongly in 2022 and 2023. It seems to me that BOWL probably enjoyed peak trading in 2022 and 2023, and might now be struggling to maintain that growth - with new & refurbished sites possibly taking up the slack from it not being possible to deliver any further growth from existing sites in the shorter term?

The good news is that household incomes are now rising again, well above inflation. This should mean that plenty of working households will be enjoying more disposable income again. As an affordable leisure activity, I think bowling could benefit from that macro effect.

We don’t know what the future holds, all we can work on is the figures available today. These show a reasonably priced share, in a company with prodigious cashflows, which it utilises to self-fund further expansion, and pay decent divis. That’s such a good combination, that I have to stay at GREEN.

There’s also the possibility of a buyout offer - BOWL is the only remaining listed bowling operator, with a smaller competitor having been bought out - private equity like to buy these companies, grow them further, then sell them back to the city for a higher price a few years later. I imagine an offer of 400-450p would be likely to succeed, as institutions like liquidity events that enable them to cash out for a premium.

Graham’s Section:

Ricardo (LON:RCDO)

Up 2% to 426.5p (£265m) - Strategy update - Graham - AMBER

Paul covered Ricardo’s full-year results in detail here (results to June 2024).

Ricardo is a consultancy with its fingers in a lot of pies: eight sectors in total. If I had to describe it in two words I would say it's an engineering consultancy, but it provides very broad expertise that is beyond what you might typically expect from that.

However, it announces today that it’s seeking to narrow down with the divestment of its Defense business.

This business “provides capabilities in engineering and production services for land vehicles in the defence sector”.

I’ve checked those revenue full-year results again and I see that Defense contributed £123m of revenue (Ricardo total: £496m).

It also contributed £23.5m of underlying operating profit (Ricardo total: £57m before central costs. After central costs, Ricardo’s total underlying operating profit was £39m).

In other words, Defense was by far the most profitable business in Ricardo in FY 2024.

It also made a major contribution in FY 2023, although at a lower level.

Clearly this new strategy is going to make an enormous difference to Ricardo’s future profitability, assuming that a divestment takes place. They observe that “the potential divestment is expected to be dilutive to the Group’s earnings per share in the near term”, which is a very calm way of saying this!

They continue:

Depending on the level of proceeds received from the potential divestment, the board will consider the appropriate use of proceeds in line with the Group's capital allocation policy. As part of this, Ricardo has been actively exploring potential acquisition opportunities to reinvest some or all of the proceeds in the event of a completed divestment. Any potential acquisition would be expected to be earnings accretive and in line with Ricardo's strategy to increase its presence in the environmental consulting market, thereby accelerating our portfolio transition to a high-growth, high-margin, lower-capital intensive business.

Graham’s view

I initially suspected that the planned divestment might be intended to get Ricardo’s debt levels under control, but the leverage multiple as of June was only 1.25x which would almost always be considered a safe and conservative level of borrowing. Net debt was £47m.

Since that theory has no legs, I am inclined to take Ricardo at its word: it wants to focus on “environmental and energy transition”, in line with its long-term (5-year) strategy announced back in 2022.

I’m rarely opposed to a company increasing its level of focus, so in theory I have no problem with this move.

That leaves one potential hair in the soup: the price. Let’s see what sort of deal Ricardo can come up with.

My overall view on Ricardo is the same as Paul’s: neutral, even at this lower share price (it was trading at 500p when Paul covered it). Consultancies make for tricky investments in my experience, and even a large and highly accomplished one such as this could be fully valued here:

The StockRanks are a little tempted, giving it a 72:

I suppose much depends on the price achieved for the Defense business. If they manage to strike a great bargain, and if future performance benefits from increased focus on their selected markets, then perhaps Ricardo could be cheap at this level.

XLMedia (LON:XLM)

Up 40% to 13p (£34m/$44m) - Proposed Divestment of North America business - Graham - AMBER

This company may be leaving up after ten years on the stock market. Ultimately, it didn’t produce a long-term sustainable business:

The news today is that XLM has agreed to another disposal. This follows the sale of its “Europe business” for up to $42.5m earlier this year.

We now have the agreed sale of XLM’s North America business. Key points:

$20m up front, plus up to $10m additional in April 2025 depending on performance. Equivalent to up to 8p per share for XLM shareholders.

31% of XLM shareholders have already pledged to back the deal, so it’s highly likely to be approved.

After the deal goes ahead, XLM will be a cash shell (as defined under AIM rules).

The deal values XLM’s North America business at 5.5x adjusted EBITDA for 2023

Rationale for the sale: after the disposal of its Europe business, XLM did not have the scale to compete in the US, and the remaining North America business may have been “too small to remain listed”. Sounds reasonable to me.

Graham’s view

Our historic concerns about the quality of XLM’s online marketing operations are irrelevant now, as the company has decided to convert its assets into cash and move on.

The only big question now is whether there is any value in XLM as it turns into a cash shell and distributes sale proceeds to investors. After that, we might wonder how the cash shell might be used.

Here is all the cash that is likely coming XLM’s way.

Firstly, the cash balance as of June 2024: $19.4m, minus $4m in a deferred acquisition payment that was due, so let’s call it net cash of $15m.

Additional $10m due in October 2024 (second payment for Europe disposal)

$7.5m plus an earnout of up to $5m due in April 2025 (final payment for Europe disposal)

$20m initial payment for the sale of the North America business, assuming it goes ahead.

Up to an additional $10m in April 2025 (final payment for North America business).

Roughly speaking, this says to me that XLM should have net cash of between $52.5m and $67.5m by April 2025, depending on the sizes of the final payments for their disposals.

Some costs may drag these estimates lower. In its interim results for the period to June 2024, XLM said that it “continues to incur transition and rightsizing costs”. With the Europe business having been sold, its remaining operations were costing about $1m per month in terms of its operating losses.

The share price is up by 40% this morning to 13p, equivalent to a market cap of about $44m. I’m inclined to trust that the market is right to be cautious, even though $44m is lower than the lower bound of my simple cash estimate ($52.5m).

There is always the risk that the deal falls through, there is the problem of cash drain until the North America business is sold, there is the discount for time as payments to shareholders may not be completed until next summer, and there is the question of whether the cash shell will want to retain some funds for future plans.

Perhaps I would put the market cap a little higher, maybe around $50m, but I don’t want to stray from a neutral stance on this for the sake of a few million dollars, so I’m staying AMBER.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.