Good morning from Paul & Graham!

Mello Monday is tonight at 17:00, details here.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Summaries

XP Factory (LON:XPF) (Paul holds) - 16.0p (£27m) - Trading Update (18/1/2024) - Paul - AMBER/GREEN

Strong Xmas trading, but only expects in line for 15-months to 31/3/2024. Singers forecasts continuing PBT losses, and only breakeven FY 3/2025. Possible upside though from high operational gearing, and a resurgent consumer in 2024 maybe?

Trifast (LON:TRI) - down 27% to 68p (at 08:08) - £93m - Trading Update - Paul - BLACK (profit warning flag) - AMBER/RED on fundamentals

A stinker of a profit warning, with FY 3/2024 forecast adj PBT slashed by 46% to £6.0m. The company only discloses operating profit (EBIT), but that ignores finance costs, which use up half of EBIT. Balance sheet is quite strong, although inventories seem excessive. Outlook sounds grim, so I'm steering clear for the foreseeable future, am not tempted to catch this falling knife personally.

Midwich (LON:MIDW) - 371p (£383m) - Trading Update - Paul - AMBER/ GREEN

In line trading update for 2023, despite challenging market conditions. This share is looking cheap on a low PER, and with a nice yield. Could be worth a closer look, although I don't know how 2024 is likely to pan out.

Kooth (LON:KOO) - down 2% to 287.5p (£104.5m) - Trading Statement - Graham - AMBER

I’ve softened my stance on this from negative to neutral. The company is “cash flow positive” although will probably still post a loss for 2023. Revenues have surged higher thanks to US contracts and the company has plenty of liquidity after raising funds last year.

City of London Investment (LON:CLIG) - up 6% to 340.2p (£172m) - Six Month Trading Update - Graham - AMBER

This investor in closed-end funds announces an unchanged interim dividend on similar H1 profits to last year. Newly delivered cost savings will improve results. I admire the long-term track record here and see the yield as attractive, but see few signs of potential growth.

Paul’s Section:

XP Factory (LON:XPF) (Paul holds)

16.0p (£27m) - Trading Update (18/1/2024) - Paul - AMBER/GREEN

Just for full disclosure, this used to be a large position for me personally, but it’s only small now, because I needed the money for something else. It's frustrating when something you think is good doesn’t go anywhere, and of course there’s an opportunity cost in missing out on other shares that are attracting more interest. I’m sure we all have the same dilemma from time to time.

Background - XPF was originally just an Escape Room format, but it made the transformational acquisition of Boom Battle Bars in late 2021, then embarked on a breakneck pace expansion of new sites particularly in H2 2022, so those new sites contributed a full year in 2023, hence very rapid revenue growth in both 2022 and 2023. Some sites are owned/operated by XPF, whilst others are franchised.

“Experiential leisure” is an interesting growth concept at present, with competition emerging and growing. The idea is you play games of various types whilst socialising, which is proven as a good team-building thing for corporates, and is a lot more interesting and fun than just sitting around talking in a conventional bar. I think this is taking a chunk out of the business for traditional bars targeting younger people (XPF’s core customers are 25-35 it says).

Anyway, on to the latest news -

XP Factory, one of the UK's pre-eminent experiential leisure businesses operating the Escape Hunt and Boom Battle Bar brands, is pleased to provide an update on trading for the 52 week period to 31 December 2023.

The financial year end was changed, so the current period is going to be 15-months to 31 March 2024.

52 weeks to 31 Dec 2023 -

Revenue up 95% to £44.5m

Very strong LFL sales growth for the whole year, +29% Boom, and +17% Escape Hunt (“EH”) - although I would expect strong LFL growth from the new Boom sites at first, as they get established after opening mostly in late 2022.

Dec 2023 particularly strong (LFLs +50% for Boom, and +20% EH)

That’s all great, but the overall performance is only in line -

Performance provides confidence of meeting market expectations for the financial year to 31 March 2024

Hopefully they’re holding something back for a beat?

Broker forecast - thanks to Singer (via Research Tree) for an update.

It shows 15-month forecast for 3/2024, with an adj EBITDA (pre-IFRS 16) of £6.1m, which sounds good until you notice that this translates into a loss before tax of £(1.6)m.

Looking at H1 results, the depreciation charge for fixed assets is about £3m per half year, so that makes up the bulk of the difference above between EBITDA and the PBT loss, when annualised to c.£6m.

The good thing though is that site fit-outs are a sunk cost, so EBITDA is actually a rough approximation to cash generation in this sector, and is widely used for acquisition pricing, and by banks. So it’s one of several useful measures.

XPF should be generating cash now, and it can therefore open as few, or as many new sites as it can afford - it’s all discretionary spending after all (maintenance capex should be minimal, as most sites are new). Therefore it doesn’t need to raise more equity, but might choose to do so, if it wants to accelerate the roll-out pace. Large landlord incentives are available to fund much of the new site fit-outs.

Management clearly needs to get the share price up considerably, before raising any fresh equity.

Costs - there was an interesting CEO interview on Vox recently. Bear in mind these are promotional, PR things, not independent. Nevertheless, a couple of points stood out for me -

Increased living wage in April 2024, the CEO indicated they can absorb the extra cost due to strong LFL revenue growth combined with 70-80% gross margin (remember the games revenue is 100% margin).

Energy costs have fallen right back down again he said. I checked this, and wholesale energy is now cheap again, so it depends what deals and what hedging companies have done.

Paul’s opinion - it was meant to be profitable by now, proper profits (PBT), but doesn’t seem to be. That’s muddied by the change in year end, with a 15-month period ending 2/2024.

However, the Singers forecast for FY 3/2025 only shows £0.1m PBT on £58m revenues. It should be making more than that. So all these great LFLs and high gross margins, only results in breakeven. That doesn’t excite me at all.

The upside comes from a rebound in consumer discretionary spending, which may well happen in 2024, particularly from April. Therefore I see XPF as conceptually similar to Tortilla Mexican Grill (LON:MEX) (I hold) - where they’re operating around breakeven (but cashflow positive) in current, difficult macro conditions. So investors that hold these shares (and other hospitality companies) are betting on increased demand (at high gross margins) creating future operational gearing, and much higher profits. Food/drink and energy costs also now abating is helpful, but higher living wage is both a negative (higher costs) but also helpful in giving a lot of its customers a considerable real terms pay rise, which is bound to increase demand.

Overall then, I think £27m market cap for XPF does leave upside potential, if consumer spending accelerates in 2024 as I expect it to. But on the downside, I’m disappointed it’s not yet properly profitable. So let’s go with AMBER/GREEN and see how it pans out. The strong peak trading performance should mean it delivers at least in line with forecasts, hopefully.

So far the market hasn't given XPF any credit at all for the rapid expansion of the business - that might change in the next bull market, especially if it starts beating forecasts (but there's no guarantee that will actually happen of course) -

Trifast (LON:TRI)

Down 27% to 68p (at 08:08) - £93m - Trading Update - Paul - BLACK (profit warning flag) - AMBER/RED on fundamentals

Leading international specialist in the design, engineering, manufacture, and distribution of high-quality industrial fastenings and Category 'C' components principally to major global assembly industries

This year is FY 3/2024.

Profit warning -

…the Board now expects that the Group's results for the year ending 31 March 2024 to be significantly below its previous expectations, with revised revenue at c.£230m and adjusted EBIT margin percentage of c.5%.

That works out at £11.5m adj operating profit (EBIT).

*Consensus forecasts FY24 prior to this announcement were revenue of £254m adjusted EBIT £15.5m

However, EBIT is a poor measure here, ignoring the substantial finance costs lower down the P&L.

It gets worse -

The more testing environment that we are now experiencing in 2024 in terms of growth is being severely impacted by a further slowdown in customer demand and volumes across the business and to an extent by the reported macro-economic challenges and geopolitical events.

Further details -

Q3 (Oct-Dec 2023) - “low visibility and volatile demand…”

Dec - “significantly lower than forecasted volumes…”

“Excess customer inventory levels…”

“Challenging conditions to persist” until year end 3/2024.

Recovery later in 2024.

Focused on improving efficiency & productivity, but not enough to offset lower revenues.

Cutting 10% of non-operational staff globally, to save £3m, but at what impact to the business I wonder?

Further strategic reviews, possible closures of sites I wonder?

Trying to reduce debt to below 1.5x EBITDA

Broker updates - thanks to Cavendish & Zeus, who both update via Research Tree. Cavendish withdraws forecasts, and will update later after talking to management, but points out that the revised guidance is 26% lower than its previous forecast at EBIT level.

Zeus reduces its FY 3/2024 adj PBT by 46% to only £6.0m. That’s 3.5p adj dil EPS. So at 68p/share I make that a PER of 19.4x

It lowers next year (FY 3/2025) from 9.3p to 5.8p, a PER of 11.7x - probably about the right price, but that’s assuming it can significantly improve profits in FY 3/2025.

Balance sheet - I’ve flagged before that TRI has much too high inventories. These have come down in the last 18 months, but were still £83m at 30/9/2023. I worry that this is not only tying up a lot of capital, but could contain obsolete items - so I see an elevated risk of a stock provision being needed maybe as part of the FY 3/2024 audit? With poor results anyway, the CFO might decide to kitchen sink the figures, to give a nice springboard for future recovery? That’s guesswork on my part, but the inventories are clearly much too high, at about 6-months cost of sales.

Other than that, the last balance sheet is pretty sound, with £93m NTAV, and a big surplus on working capital, albeit funded partly with gross long-term debt of £60m. Net debt was £28m at 30/9/2023, and they should be able to reduce that further by liquidating excess inventories. So overall, solvency & dilution don’t seem to be significant risks.

Paul’s opinion - I would be running a mile after reading this phrase -

…severely impacted by a further slowdown in customer demand and volumes across the business

I can understand tough macro causing a bit of a profit warning, but this seems altogether more severe. Is something more serious going wrong - ie customers shopping around and buying their fastenings elsewhere?

The PBT margin is now down to only <3% of revenues, and it doesn’t sound like there’s much chance of a short-term recovery.

Overall, I see this negatively, but with no solvency worries, it’s not bad enough to go red, so I see it as AMBER/RED. A possible future recovery, but I don’t see any rush to get involved here. It’s increasingly looking a rather poor quality business. More restructuring usually means more one-off cash costs too (redundancies, etc).

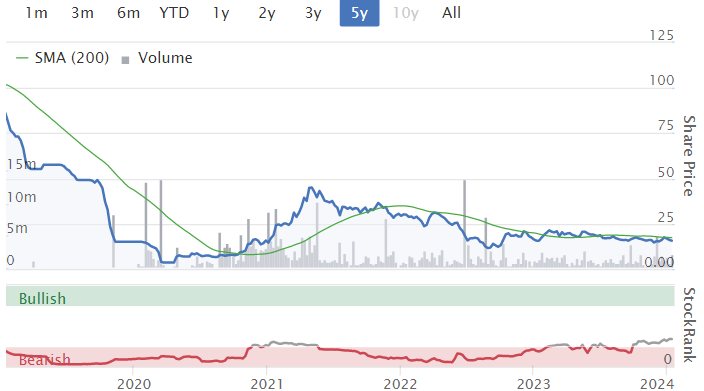

The long-term chart looks like a business in decline, and it's been almost constantly restructuring in recent years too. Maybe it's just too competitive a sector to make a decent return?

Midwich (LON:MIDW)

371p (£383m) - Trading Update - Paul - AMBER/ GREEN

Midwich Group plc (AIM: MIDW), a global specialist audio visual distributor to the trade market, is today providing a trading update for the year ended 31 December 2023.

This is concise, and self-explanatory - and it's great to see another company reporting adj PBT, instead of the often meaningless EBITDA -

The Group finished the year well and the Board now expects to report record revenue for 2023 of c.£1.3 billion, representing growth of approximately 7% over the prior year (6% at constant currency), with organic revenue in line with the prior year.

Positive product mix resulted in gross margin of c.16.8%, exceeding pre-Covid levels. The Board anticipates reporting adjusted profit before tax of approximately £50 million, which is in line with market expectations*.

The Group delivered strong cash generation in the year, of around 100%, ahead of our long-term expectations of 70-80% of adjusted EBITDA. Adjusted net debt** at 31 December 2023 was c.£90 million (representing approximately 1.3 times adjusted EBITDA***).

*Market consensus based on an average of £50.3m and a range of £49.4m to £51.0m, as at 16 January 2024

Outlook - the rest of the commentary sounds quite cautious, with acquisitions having taken up the slack in 2023. It raised some additional equity for acquisitions in June 2023, so I'm happy that the balance sheet is not stretched, despite intangible assets growing with each deal -

"After two years of exceptional revenue growth, the market backdrop throughout 2023 was much more challenging, with demand for our more mainstream AV products impacted significantly in many territories. We responded to this by focusing on our technical product categories, completing a record seven acquisitions in 2023 and ending the year with a strong M&A pipeline…

Whilst the broader market backdrop remains uncertain, the recent acquisitions have integrated well and continue to trade broadly in line with our expectations. Consequently, the Group remains well positioned to continue to deliver both organic and inorganic growth in 2024 and the longer term."

Brokers have trimmed forecasts a little -

Paul’s opinion - I honestly don’t know what to make of Midwich.

Despite difficult conditions, it’s met market expectations in 2023, helped by improved (but still very low) gross margins. Although it depends what costs they are absorbing into cost of sales, it may be more than just direct product costs? It makes sense for distributors to minimise the reported gross margin, so suppliers and customers all think they're not making much of a markup.

The forward PER is only 9.3x, with a nice 4.7% yield on offer too - attractive value, if forecasts are achieved.

Lots of acquisitions might be taking management eyes off the ball a bit, maybe?

The share price is close to a 5-year low, which seems harsh. Maybe the market doesn’t have lot of faith in the 2024 forecasts, who knows?

On valuation grounds, it looks intriguing, so might be worth a closer look. So I’ll go with AMBER/GREEN based on the info available to me today. Obviously I have no idea how trading will progress in 2024, so it might out-perform, or it might warn on profits, we simply don’t know at this stage.

Graham’s Section:

Kooth (LON:KOO)

Share price: 287.5p (-2%)

Market cap: £104.5m

Kooth, a global leader in youth digital mental well-being, announces a trading update for the financial year ended 31 December 2023.

Paul and I have been inconsistent on this one - I’ve been bearish, Paul (briefly) bullish, and more recently Paul took a neutral stance.

Today’s announcement sees 2023 revenues up by c.65% to £33.3m.

Despite this tremendously strong rate of growth, this result appears to be below expectations (£34.3m forecast on the StockReport). There is an explanation:

c.$4 million of revenue billed in 2023 relating to revenues received from US contracts, which had been expected to be recognised in 2023, but will now be paid and recognised in early 2024.

The opportunity in the US for Kooth is still very young and I don’t think investors will be overly concerned about a few million dollars of revenues slipping into the current year from 2023.

Other points from this update:

“Positive operating cash flow” - Kooth has been EBITDA positive but is probably still loss-making at the net income level.

Net cash balance £10.9m, plus an undrawn working capital facility for USD $9.5m.

In the key US markets, we have the following news. The Soluna mental health app has launched in California. In Pennsylvania, Kooth is “finalising discussions” around extending its existing service contract.

In the UK, there continue to be headwinds, “reflecting a focus on NHS cost saving and the ongoing acute care backlog”.

CEO comment: he says that Kooth “is now a leader in the important US digital mental health market and a provider of choice for the provision of services to children and young people.”

Graham’s view

I’m inclined to play it safe and stick with an amber view on this. Last April, I gave the company the thumbs down (at a share price of 230p), pointing to limited UK growth prospects and uncertainty around US growth.

Here we are nine months later and arguably both of these things are still true, but the company can point to extremely strong revenue growth for 2023 and is probably not far off breakeven.

I still struggle with the £100m+ valuation and for the avoidance of doubt I still suspect that it’s overvalued at a P/S ratio of 3x for 2023. But I’m happy to take a neutral stance: I can’t rule out the possibility of continued sales revenue growth, led by US contracts. And who knows what profit margins it might ultimately achieve?

This is less speculative than most of the early-stage, blue-sky companies we have previously covered in this report, but it is still at an early stage in its development.

City of London Investment (LON:CLIG)

Share price: 340.2p (+6%)

Market cap: £172m

We don’t cover this one very regularly but the market has reacted favourably to today’s interim trading update.

The company reports that funds under management increased in H1, from $9.4 billion to $9.6 billion. This is despite outflows of $294m.

In table format:

I don’t study this one often, so I’ve had to refresh myself on how CLIG operates.

Funds are spread out as follows:

EM = emerging markets.

KIM = Karpus Investment Management, closed-end fund strategies for wealth management clients in the US.

INTL = international.

OV = “opportunistic value”.

Performance: “mainly positive” in H1, some strategies outperforming and some strategies underperforming.

CLIG is an investor in closed-end funds, whose discounts to Net Asset Value have been notoriously large in recent times, at least in the UK. In this regard CLIG says:

Significant CEF discount widening through late 2023 was partly reversed in Q4 which helped relative performance into year-end while NAV performance was positive.

They also say:

We are focused on new mandates in a number of the Group's asset classes with very good long-term performance as CEF discounts are at compelling levels and there is ample capacity.

Operations: the company transparently discloses that its run-rate of operating profit is c. $3.2m, before any profit-sharing with fund managers.

70 basis points of management fee income = $67m annually based on current FuM.

On a monthly basis this is $5.6m of fee income.

Fixed monthly costs are $2.3m.

So deducting that leaves c. $3.2m in operating profit per month.

Profits in H1: Adjusted PBT in H1 (to December 2023) is around $13.9m, the same as H1 in the previous year. Note that we can’t expect this to match up against the calculation of monthly profits shown above for a couple of reasons, one of which is the profit-sharing arrangements. Also, the funds under management figure is constantly changing.

Cost savings: $2.5m of annualised cost savings have been delivered and will be seen in the new financial year.

Cash: $28.8m.

Interim Dividend: unchanged at 11p.

Graham’s view

I’m going to adopt a neutral stance on this one for now, as further research is needed on my part to build a more robust view on it.

Comparing my notes with Roland’s notes in 2022, I see that CLIG’s net fee margin then was 0.74%. If that’s on a steady decline it’s no surprise, given the pressures in the fund management industry, but it’s something to be aware of.

According to Roland, FuM were $11.4 billion in Dec 2021. Again, no huge surprise to see FuM on the decline (a 16% fall over two years), but it’s important to bear this in mind.

Back then, the company was talking about “capacity limitations” - it’s only sensible for a strategy to invest so much in closed-end funds on the secondary market, as you don’t want to overpay or to be responsible for closing their discount to NAV.

Today, the company appears to be more optimistic about capacity. But I must say that CLIG’s investment universe seems quite narrow.

Over ten years, CLIG’s share price has made little progress, but the company has paid an enormous regular dividend. Perhaps it’s best to treat this as a relatively boring but hopefully a reliable income stock, and not expect much growth?

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.