Good morning! It's Paul & Jack here with the SCVR for Monday.

Mello - details of tonight's show are here. Cerillion (LON:CER) is certainly an impressive company.

Agenda -

Paul's Section -

Angling Direct (LON:ANG) - 2 more updates re cybersecurity incident were issued last week, so I recap on the situation, which now looks under control.

Cerillion (LON:CER) - tremendously impressive results from this telecoms billing software company. Profits are soaring, and the order book is strong, suggesting another good year is in the pipeline. Broker forecasts are up, but still look too cautious. Superb balance sheet & cashflows. This is a really impressive business, not without risk though. I think the valuation seems justified, there's a lot to like here.

Frontier Developments (LON:FDEV) - profit warning slams this computer games company down about 37%. This is due to disappointing sales of 2 games, but the company doesn't know if it can recoup this over the festive season. Lack of revenue & profit visibility worries me. Might be a buying opportunity, if you know more than I do about the company, and you like it?

Everyman Media (LON:EMAN) - trading ahead of expectations, helped by James Bond, which has led to a broker forecast increase today. I've heard good things from friends who have visited Everyman cinemas, with a differentiated offering. But is it a viable business model? That's not been proven yet, in my view.

Jack's Section -

Centralnic (LON:CNIC) - growing, acquisitive company dealing in domain name services and online marketing. Organic growth is picking up after a burst of acquisitions. The result could be an inflection point as a more complete platform drives further growth and margin expansion. Results remain adjusted and the situation requires a certain time investment due to the acquisitions, business operations, and growing markets.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Angling Direct (LON:ANG)

59.5p (Friday’s close) - mkt cap £46m

Both Jack and I think this company looks potentially interesting, so this section is to get us fully up-to-date. Delving through the archive;

13 Oct 2021 - Jack reviewed ANG’s interim results, and sounded positive about the numbers & potential. I agree with his cautious optimism.

8 Nov 2021 - I (Paul) commented on ANG’s announcement of a cyber attack, where hackers had taken down its transactional website (about half its business), and redirected it to PornHub.

Since then, there have been 2 more updates on the cybersecurity issue, so let’s get up-to-date.

10 Nov 2021 - Cybersecurity incident update - sounds like things have been resolved -

... the Company is confident it has now eradicated any threat from its systems. It has also regained control of its websites and social media channels.

Website may be slower to load

Investigations ongoing to determine if any personal data has been affected

No financial data is held for customers, as payments are processed by third parties - this strikes me as an important point

39 retail stores unaffected

Board currently believes this incident won’t hurt underlying trading (underlying being the key word, because of course there are likely to be exceptional costs relating to this incident)

Security measures have been increased.

12 Nov 2021 - Further update -

Websites trading normally now, and warehouse is working through the order backlog.

Reiterates that this incident should not affect underlying trading.

Talking to insurance company.

My opinion - we don’t yet have the full facts, but it seems to me this has been quickly resolved.

The main questions I have are;

- What is the total cost likely to be? It’s not cheap to bring in cybersecurity experts

- Are there likely to be regulatory fines? If so, how much?

- Who pays for the above? I.e. will insurance cover some or all of the costs?

So there’s still some uncertainty here, but given the company had almost £20m in net cash at the interim results, then I imagine this incident is not likely to come close to threatening the solvency of ANG. Therefore, unless some new, more damaging information is revealed, shareholders probably don’t need to worry too much about this cybersecurity incident.

Overall, I think ANG shares seem good value. It’s sitting on a ton of cash, over 40% of the market cap, and is now profitable.

It therefore seems odd that the share price really just gone sideways over the last 3 years, despite the business making considerable progress over that time.

.

.

Cerillion (LON:CER)

900p (up 4% at 08:40) - mkt cap £265m

Cerillion plc, the billing, charging and customer relationship management software solutions provider, presents its annual results for the 12 months ended 30 September 2021.

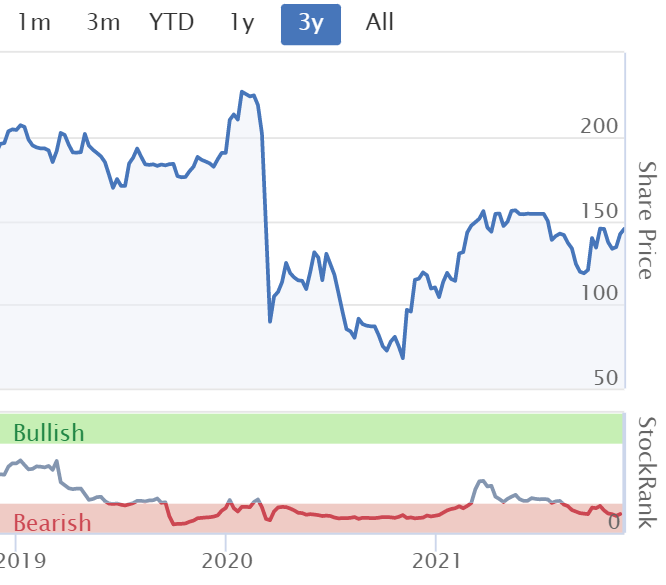

Very impressive results from this interesting software company, but of course strong performance has already been reflected in a stellar share price & re-rating. Note from the 3-year chart below, how CER shares have remained buoyant, despite market conditions for small caps feeling distinctly bearish in the last few months -

.

Summarising a few key numbers , with my comments added -

Performance is at record highs

Modest revenues of £26.1m (up 25%), but it’s a very high margin business

Adj profit before tax up 131% to £8.5m (statutory PBT is £7.4m, so not a huge difference)

Adj EPS up 105% to 25.5p - giving a PER of 35.3 - not outrageous given the stellar growth in profits, but obviously leaves no room for disappointments in future. There are plenty of other less impressive, slower growing software companies on higher ratings than this.

Adjustments look reasonable to me, and are the usual things like acquired intangibles amortisation, share based payments, and exceptional items (see footnotes 5 & 6)

Dividends small but growing, under 1% yield, people are not buying this share for income, more for capital gains, so that’s fine

Strong balance sheet with £13.2m net cash

Impressive cashflow statement, with no funnies, and lots of genuine cash generation

Only £970k capitalised intangibles, which suggests fairly prudent accounting to me

Impressive order book - up 36% to £42.1m

Largely unaffected by pandemic - e.g. staff working from home/hybrid model (2 days per week in office)

Broker consensus is showing as 20.3p on the StockReport, so actual of 25.5p for FY 09/2021 is a significant beat, although the 2 broker notes I’ve seen seem to have been far too conservative in their forecasts, which are raised to more realistic levels this morning in update notes.

Today, FY 09/2022 forecasts are raised considerably (from way too low levels) to c.27.0p - only 6% higher than FY 09/2021 actuals. I’m not sure why brokers are being so cautious, which I don’t think is particularly helpful - why can’t we just have realistic forecasts, instead of irrationally low forecasts? Although the under-promise, over-deliver mantra is quite good I suppose, so it depends how you view things.

The way things are set up, Cerillion should be putting out ahead of expectations updates in future, because the bar is set quite low, and the high valuation demands that it continues to beat expectations. The forward PER is 33.3 times forecast of 27.0p, which is too high for just 6% earnings growth, so it needs to out-perform, and probably will, judging by the year end order book being up 36% on a year earlier, and positive outlook comments -

Outlook -

The Company delivered a record set of results, and our products are gaining greater visibility in the marketplace. In addition, Cerillion's financial position is very strong, supported by a growing base of recurring income, increased cash flows, and no debt.

We believe that Cerillion remains well-positioned to deliver another strong performance over the new financial year. The back-order book stands at a record level, providing strong visibility of revenues, and the pipeline of new business is strong. In addition to these strong organic growth prospects, we also continue to assess a range of inorganic growth opportunities as they arise.

The market backdrop is favourable, with increasing investment by telecom companies in their networks and in digital transformation, and this long-term trend should continue to benefit Cerillion's growth prospects.

My opinion - terrific numbers here, and if growth continues, then the valuation looks justified.

The new financial year looks set to be another strong performance, since the order book & pipeline are so strong.

One particular phrase caught my eye - “the trend for bigger contracts & larger customers” - that suggests to me that something structurally good seems to be going on at Cerillion, i.e. a step change in size & profitability of the company. Customers seem to be very sticky too.

Although only 33% of revenues are recurring, which could be a big problem if new orders dry up, since the bumper profitability is mainly being fuelled by licence wins, which of course are one-offs. We’ve seen before how some software companies have a wave of big contract wins, profits soar, but then they dry up & profits crash. Let’s hope that doesn’t happen here, but it is a risk when two thirds of revenues are non-recurring, and very high margin. That risk has to be considered, but on balance I think the strong momentum of contract wins & big order book probably outweigh any such worries for me anyway.

Overall - very impressive indeed, and it is tempting to pick up a few shares in CER for my SIPP as a long-term holding (no position currently).

A reminder that Cerillion are on first at tonight's Mello Monday online investor event. I spoke to management a couple of years ago, and remember thinking how smart they sounded, and thinking I should invest in this management team, but sadly didn't stay in the share for long, can't remember why. Which reminds me that sometimes it can be better to back good management long-term, and not pay too much attention to valuation, something I still find quite difficult, but am trying to do more of it.

Frontier Developments (LON:FDEV)

1596p (down 36% at 10:39) - mkt cap £615m

Ouch, bad luck to any FDEV shareholders here. This is not a sector I understand well, and find valuations too difficult to fathom. So this section is really just to take a look at what’s gone wrong, rather than to impart any insights - reader comments might do so, so please let us know your view, if it’s a share you’ve researched.

Frontier Developments plc (AIM: FDEV, "Frontier" or the "Company"), a leading developer and publisher of videogames based in Cambridge, UK, provides an update on trading for the current financial year FY22, the 12 months ending 31 May 2022.

My summary of this update -

Well established titles continue to perform well

Elite Dangerous: Odyssey - sales have been “more muted”

Jurassic World Evolution II - expected to be this year’s largest revenue earner, but initial PC sales have disappointed, possibly a short-term issue.

Revenue guidance revised (from?) to £100-130m for FY 5/2022 - wide range is due to unpredictability of peak trading over holiday season

Next trading update in early 2022

Info given on other new product releases

Broker update - many thanks to Liberum for making available to us (via Research Tree) commentary and revised numbers.

The latest EPS estimate for FY 5/2022 is 34.7p, down from 60.9p last year, rising to 87.2p next year.

Stockopedia is showing 72.1p consensus EPS (before today’s profit warning), so today’s update is for earnings (at 34.7p) to be just under half what was previously thought. That’s a pretty bad downwards revision. However, maybe the broker is being too pessimistic, and this revised forecast could be too low, if Xmas sales surprise on the upside?

My opinion - what this is shouting out to me, is that there doesn’t seem much earnings visibility with this company. I understand the point that computer games are “franchises” now, or the best ones are, and eagerly-awaited updated versions can be lucrative (for a year or so), with operationally geared sales. So there must be considerable value in established hit games.

How on earth do we value the shares though? With earnings so volatile, a PER basis looks problematic.

Do you try to work out a value for each “franchise” instead, and do a sum-of-the-parts valuation?

There’s been takeover activity in this sector, so that might be another way to value this share.

Overall, it’s all too uncertain for my tastes, but I can see why some people might see this as a possible buying opportunity - if you think the problems are temporary (which they might be). It doesn’t sound as if anything has gone permanently, or drastically wrong.

Personally, I don’t know enough about the company or sector to form a view on this. Good luck whatever you decide.

.

.

Everyman Media (LON:EMAN)

148.5p (up 4% at 12:10) - mkt cap £134m

Everyman Media Group PLC, the independent, premium cinema group is pleased to announce a trading update for the financial year ending 30 December 2021.

What a refreshingly clear update, top marks for this -

Admissions have been ahead of expectations since publishing its interim results in September 2021. Therefore, Group revenues and EBITDA for the financial year ending 30 December 2021 will exceed current market expectations.

On the basis of no further COVID-19 restrictions in 2021, the Group expects to report turnover of not less than £46.3m and EBITDA of not less than £7.0m.

This type of business has obviously seen a lot of disruption to trading, and also received Govt support (e.g. furlough, business rates relief, etc), so we have to be very careful interpreting figures, because in future years, revenues should recover, but costs are also going to rise as Govt support measures disappear.

Broker update - many thanks to Canaccord Genuity for an update note, which they have helpfully made available on Research Tree. It’s great to see them joining the RT platform, as I’ve always liked Canaccord research notes, but often previously struggled to get hold of them.

There’s a big upgrade in EBITDA, from £4.8m to £7.0m.

However, that still results in a hefty adj loss before tax of £(6.7)m.

Large increases in revenues forecast for FY 12/2022 and FY 12/2023, result in more losses in 2022, and only just above breakeven in 2023. That doesn’t strike me as very good, for a company valued at £134m.

The forecast EBITDA numbers look impressive, but it’s nearly all wiped out by depreciation charges on the heavy capex to fit out each site.

My opinion - it’s not clear that Everyman has a viable business model yet.

James Bond has come to the rescue recently, boosting the figures.

The format is certainly differentiated, but I worry that the company might be rolling out a format that doesn’t really make any money. That’s not attractive to me, but maybe it could beat forecasts as audiences return?

It seems to me that there are probably other, much better re-opening, or roll out concepts in other sectors - e.g. restaurants or bars groups where they can clearly demonstrate favourable economics, with each site already being profitable, hence opening new ones results in more profits. That's far from clear what we're getting at EMAN, and I worry it needs to spend a lot on capex for new sites.

Although I see it was profitable pre-covid, in 2017, 2018, and 2019, so maybe there could be a decently profitable business here in future? There's too much guesswork involved for my liking, so I'll pass on this one.

Maybe it's the sort of share that people buy because they enjoy the concept as a customer? That can be a good strategy sometimes, a bit like the Peter Lynch approach.

.

.

Jack’s section

Centralnic (LON:CNIC)

Share price: 152.2p (+1.47%)

Shares in issue: 251,160,084

Market cap: £382.3m

This is an interesting developing situation, albeit one that can be hard to wrap your head around: CentralNic is a global vendor of online services (around 12% of domains globally use at least one of CentralNic’s platforms), supplying the tools needed for businesses to develop their online presence.

Such activities include the provision of domain names and domain monetisation services using a proprietary technology stack and its millions of registered domains.

CNIC now reports as two divisions:

- Online Presence: selling domain name subscriptions required for operating email and websites. Sometimes companies buy these to use, or buy them so others can’t use them (brand protection). Domain investors also own domain name portfolios and monetise the traffic they generate.

- Online Marketing: internet traffic monetisation is the group’s second core activity, established in 2019 with the acquisition of Team Internet, and growing to represent the majority (59%) of gross revenue in 9M21.

It’s arguably the latter segment that might warrant a racier multiple in time, although both markets are attractive.

In 2020, c$400bn was spent acquiring internet traffic by online marketers, with demand growing at over 20% annually (this is Online Marketing). Management estimates the size of the domain name market to be around $5bn with 3% growth, while the value-added services related to and bundled with domains has annual revenues of an additional $25bn, growing at 6% annually (Online Presence).

Each of these markets is highly fragmented, with a large number of small and mid-sized companies addressing specific market niches or territories.

The central idea is that, similar to Tremor International (LON:TRMR) before it, CentralNic is reaching an important inflection point having hit a certain scale as a result of acquisitions and internal investment. The market has recently rerated the company and it is attracting interest from the community.

The group has attractive recurring revenue and cash generation characteristics, and the $36m acquisition of Codewise makes CNIC ‘full stack’, selling directly to publishers and buying directly from domain owners, in a similar manner to Tremor.

Key acquisitions include:

- KeyDrive (August 18),

- GlobeHosting (September 18),

- TPP (May 19),

- Hexonet (July 19),

- Ideegeo (Aug 19),

- Team Internet (Nov 2019),

- Verisign (2020),

- Codewise (Jan 2021),

- Wando (Feb 2021)

- SafeBrands (Feb 2021).

Trading update - nine months to 30 September 2021

Significant investment in new management, staff and systems accelerated organic growth to record levels and positions the Group well for continued growth

Highlights:

- Net revenue +60% to $85.5m; organic revenue growth up from +9% to +29%,

- Adjusted EBITDA +46% to $32.3m,

- Operating profit up from $0.7m to $8.9m,

- Adjusted operating cash conversion up from 93% to 113%,

- Net debt down from $85m to $78.6m despite $13m spent on acquisitions,

- Adjusted EPS +5% to 7.73 cents.

‘Now more than 45m domains use at least one of CentralNic’s platforms (12% of domains worldwide).... As CentralNic consolidates, it is taking out costs, deploying technology to automate process and so is increasing EBITDA.’

Post period-end acquisition - a publishing network of revenue generating websites for $6.5m in cash and assumed working capital liabilities, completed on 15 November 2021. This is expected to generate at least $2.0m in annualised revenue and $1.5m in annualised EBITDA.

Outlook - The company expects to trade comfortably at the upper end of market expectations for the year for both revenue and adjusted EBITDA. Analyst expectations currently range from $349.0m to $384.1m and $41.8m to $43.0m respectively.

The accelerated organic growth seen during Q3 2021 YTD is expected to be sustained for the full year following the investment in new management, staff and systems

Ben Crawford, CEO, commented:

A virtually pure play recurring revenue business with cash conversion of over 100%, CentralNic continues to improve its cash position, interest coverage and net debt to EBITDA ratio as it grows. As our investment levels plateau moving forward, we expect future periods to benefit from increasing operational leverage.

These robust results reflect CentralNic's continued success in sourcing, completing and integrating transformative acquisitions and driving the organic growth of our businesses. The pipeline of future acquisition targets remains strong, and we are confident in continuing our trajectory towards joining the ranks of the global leaders in our industry.

Conclusion

The company's market consolidation strategy continues in what is a large, globally fragmented market. That said, this remains a fast-moving, acquisitive situation with quite heavily adjusted results. Note how the strong revenue growth does not yet translate into significant profit growth. That, plus the fact that the group’s businesses can be hard to understand, might make some wary.

But there are some more universal investment concepts to hold onto here. The recurring revenue and strong cash conversion in growing, fragmented target markets for example. CNIC says the online presence market is worth $40bn and the online marketing market is worth $400bn, so there is ample runway for growth.

Both divisions share characteristics including high recurring revenues, c 100% operating cash conversion and attractive customer stickiness, with significant opportunities for upselling and cross-selling across its c45m domains.

The result of its aggressive strategy is an impressive revenue compound annual growth rate.

This has so far come at the expense of profits but, with the group shifting its focus, the market expects quick progress here.

Operationally, management’s strategy is to benefit from structural market growth, building its marketing business as well as on the group’s underlying domain registry customer base, diversifying the group’s revenues through the cross-selling and upselling of services. Growth is supplemented by acquisitions in a fragmented market.

Margins should improve as the business scales, and management expects the strong organic growth seen in the first nine months to continue at least for the remainder of the year.

In the medium term, investment levels should plateau and management expects the recurring revenue model and strong cash generation to provide operating leverage as the business scales. All in all, an interesting growth situation, albeit one that takes some effort to understand. Its markets remain new and high growth - an opportunity, but there’s always scope for technological disruption as well in these areas.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.