Good morning from Paul!

It's quiet again for news today, so hopefully I might be able to enjoy some sunshine later! Isn't it strange how the media today see a heatwave as a desperate threat, and give us alarmist warnings - keep in the shade, drink plenty of fluids (what else would I drink, gas?!), and the weather charts are angry shades of red. Whereas back in the 1970s, the weather charts were shiny, happy bright yellow, and the forecasters told us to get out and enjoy ourselves. What went wrong? When (and why?) did common sense disappear?

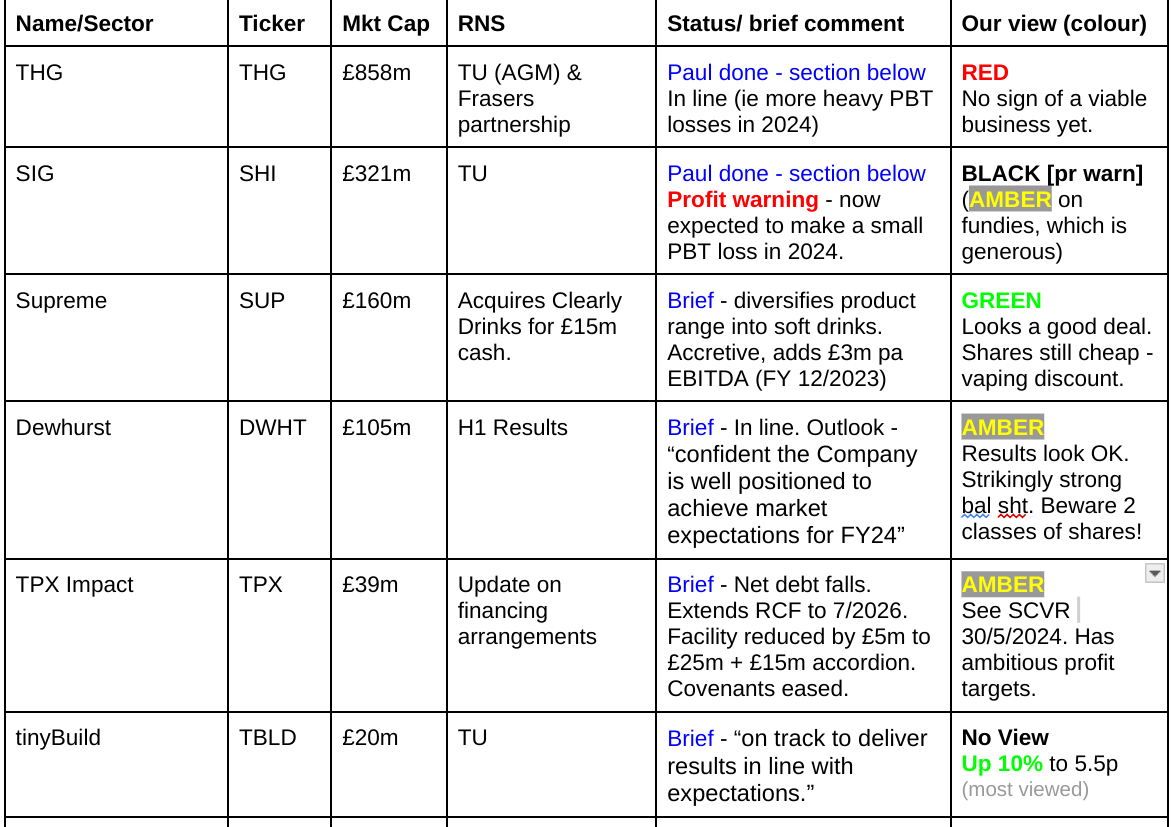

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

Companies Reporting

Other mid-morning movers (with news)

Britvic (LON:BVIC) - up 8% to 1,178p - Statement by Carlsberg re Britvic - Paul - PINK

We covered the bid approaches (1200p and 1250p) announcement last week. Carlsberg says this today -

“Further to the speculation in the weekend press, Carlsberg confirms that it has reached agreement with PepsiCo, Inc. ("PepsiCo") whereby PepsiCo has agreed to waive the change of control clause in the bottling arrangements it has with Britvic. This waiver will come into effect should an acquisition of Britvic by Carlsberg, which has the recommendation of Britvic's board, proceed to completion. Carlsberg is considering its position. There can be no certainty that any offer will be made.”

The newswire says that the market is interpreting this as meaning a takeover deal is becoming more likely. Interesting point about change of control clauses in commercial contracts, I hadn’t thought about that before, but it could be why some other takeover deals fall through perhaps?

Prudential (LON:PRU) - up 6% to 751p - Capital Management Update - Paul - NO COLOUR

Announces a bumper $2bn share buyback, although could be up to 2 years (complete by mid-2026). Also says there’s potential for further shareholder returns. Says it has “significant growth opportunity ahead”.

Buybacks sound good, but the dividend yield is only 2.6%, so arguably this buyback is just in lieu of divis, to get to a similar % shareholder return as, say the 7.6% dividend yield from Aviva (LON:AV.) ). Note that forecast earnings, and the share price at PRU have been in a downtrend for c.18 months.

No opinion from me, as I’ve not properly researched it, just flagging an interesting announcement and an unusual % up move in shares today. Could this be a low for the shares, who knows?!

Belluscura (LON:BELL) - up 8% to 16.25p - Update re convertible loan notes - Paul - AMBER/RED

Tiny equity raise of £300k announced from an investor at 15p. Says it will soon be able to give more details on its proposed convertible loan notes.

I’m wary of this company, under-funded, and a jam tomorrow story for a supposedly revolutionary new product. It sounds financially distressed, and who knows what the terms of the dilution might be for the convertible loans? I’ll be happy to move up to a more positive view once the risks are lower, with proper funding in place, and real profits and cashflows are flowing. I don’t mind missing out on the occasional multibagger, when the vast majority of similar companies are dismal failures and destroy shareholder value. Why take the risk?

Summaries

SIG (LON:SHI) - down 15% to 23.3p (£275m) - Trading Update [profit warning] - Paul - BLACK (AMBER on fundamentals)

More bad news from this low margin building products supplier. It's now expected to trade at a PBT loss in FY 12/2024, conveniently concealed by quoting adj operating profit instead (which ignores its hefty finance costs from a 300m Euros bond). A weakish balance sheet, no divis, and no signs (yet) of any trading recovery, mean this looks weak. However, optimists might be factoring in potential upside once its markets recover. I'm being generous with AMBER.

THG (LON:THG) - up 2% to 63.2p (£875m) - Trading Update (AGM) - Paul - RED

An in line with expectations update. THG likes to focus on EBITDA only, but I reiterate below how misleading these numbers are here. It's actually still loss-making, and with a dangerously weak balance sheet. The valuation looks nuts to me for such a poorly performing business. Deal with Frasers - not enough info to assess it.

Paul’s Section:

SIG (LON:SHI)

Down 15% to 23.3p (£275m) - Trading Update [profit warning] - Paul - BLACK (AMBER on fundamentals)

SIG plc ("SIG", or "the Group"), a leading supplier of specialist insulation and building products across Europe, issues a trading update for the year ending 31 December 2024 to date.

What’s gone wrong? No improvement in demand, with sales in May & June continuing at -7% vs LY (on a like-for-like [LFL] basis).

Reduced profit guidance -

“Given the weaker than expected trading in recent weeks and a consequently more cautious view of the timing of any potential market improvements during H2, the Board now expects our 2024 full year underlying operating profit2 to be in the range £20m-£30m, which is below the current analyst range.3”

3. Company collated analyst expectations is for Full Year 2024 underlying operating profit (EBIT) of £41.1m, within a range of £36.7m to £43.0m, as at 21 June 2024.

Good clarity in the footnote above, which is much better than the nonsense we had to deal with last week from YouGov (LON:YOU) , spending ages trying to find out what the old guidance was, and what the new broker forecasts are. It’s bad news from SHI, but is at least presented clearly.

Forecast revenue for FY 12/2024 is c.£2.7bn, so it’s barely above breakeven now, with an operating margin that looks to be c.1%.

An annoyance with SIG is that its name is just 3 letters, and the ticker is a different 3 letters. Let’s hope companies will go back to having proper names, not just some seemingly random collection of 3 letters.

Checking our previous notes, neither Graham nor I like this company. It’s a low margin, long-term disappointer, selling lots of stuff from many locations, but not really making any money. So what’s the point in it existing? Why would anyone want to own shares in this? I suppose hopes for a cyclical recovery would be the main reason. To be fair, we’re not yet seeing any significant cyclical recovery starting in other companies we’ve looked at in the building supplies space. Although it seems reasonable to anticipate some recovery maybe later this year, or in 2025. Housebuilders are making positive sounds about a recovery next year, for example.

Outlook - going back to today’s profit warning, it provides the expected split between H1 (to June 2024) and the full year (to Dec 2024) -

H1 -

“Based on the performance in the year to date, the Board now expects the Group to report an H1 2024 LFL sales decline of c7%, and an underlying operating profit in the range of £10m-£12m.”

FY - this bit below sounds to me as if there’s plenty of scope for the figures to change again, up or down -

“Given the weaker than expected trading in recent weeks and a consequently more cautious view of the timing of any potential market improvements during H2, the Board now expects our full year 2024 underlying operating profit to be in the range of £20m-£30m, which is below the current analyst range. The increasing benefit from productivity and cost initiatives underpins our continued expectation of a stronger second half. The extent of this improvement is subject to the evolution of demand conditions, particularly given market uncertainties in France and Germany, and recognising the sensitivity of operating profit to relatively small movements in sales.

Whilst market conditions remaining challenging in a majority of areas, the Board continues to expect its strategic and commercial initiatives to benefit medium term margin and profit growth, also supported by meaningful operating leverage when market volumes recover.”

Any broker updates? - nothing I can find, but since the company itself has given revised profit guidance, then we don’t really need any more information from brokers.

Going through the numbers myself, the previous years adj operating profit was £53.1m (on £2,761m revenues) for FY 12/2023, and £80.2m in FY 12/20222. So with £20-30m now expected for FY 12/2024, there’s a worryingly negative 3-year trend of profit falling.

Worse still, the infuriating recent trend for companies/PRs to quote operating profit, conceals the full picture, which of course is why they do it, quoting misleading EBITDA or operating profit measures. SHI has large finance costs in its P&L. Eg FY 12/2023 saw £53.1m adj operating profit, but only £17.4m adj PBT. There were also £49m of additional costs adjusted out (mostly £34m goodwill impairment charges). So it was loss-making at a statutory level in 2023.

2024 results - it’s guiding £20-30m adj operating profit, so if net finance charges are unchanged on 2023, that means c.£35m to come off, hence I make the adj PBT for 2024 being a loss of £(5)m to £(15)m.

Balance sheet & cashflow - the 2023 results show that free cashflow was only £4.2m, and in 2022 it was £10.6m. Both poor. I imagine given the lower profits, that 2024 could see a cash outflow, unless they can massage working capital positively.

The Dec 2023 balance sheet showed £82m NTAV. However, it has large inventories & receivables, which has to be financed with substantial gross debt. Hence why the finance charges are so high on the P&L. It seems to me that SIG is basically a bank for its customers, giving them credit on sales, and having to fund the hefty finance costs of that through bank borrowings.

Paul’s opinion - this looks a lousy business. It’s not making any profit or cashflow. However, maybe this is bottom of the cycle earnings, and a recovery might kick in at some point in the future?

It’s financed mainly with a 300m euros 5.25% bond, which matures in Nov 2026. So no immediate crisis there, but if recovery is slower than expected, then refinancing this in 2026 might become an issue. The last results said the bonds had incurrence based covenants only, which I had to look up -

“Incurrence Covenant means a covenant by the borrower to comply with one or more financial covenants only upon the occurrence of certain actions of the borrower including, but not limited to, a debt issuance, dividend payment, share purchase, merger, acquisition or divestiture.”

So that looks OK for the time being re debt.

Overall, with too much debt, no divis in prospect, a series of disappointing trading updates over the last year resulting in it now being loss-making at the PBT level, I can find nothing of any interest in this share other than hoping for a trading recovery which may or may not happen.

The advantage of large revenues (c.£2.7bn pa here) is that a rise in demand can drop through nicely to the bottom line. Hence I don’t want to colour code this negatively, just in case a trading recovery begins and sees the shares recover.

So I’ll just sit on the fence with AMBER, but that’s being generous for what just looks a poor quality business. Maybe it needs new management to do a massive restructuring to strip out tons of cost, and focus on higher margin products? That would be expensive though. Definitely not for me, but good luck to anyone here holding SIG.

The 10-year chart below shows a dismal picture, with the current price at/near the 2020 pandemic lows again -

THG (LON:THG)

Up 2% to 63.2p (£875m) - Trading Update (AGM) - Paul - RED

THG PLC operates three distinct businesses in Beauty, Nutrition and Ingenuity, each scaled from the UK to hold global leading positions in their respective sectors.

I see THG as a dismal, over-priced, over-hyped float in the pandemic. The share price now is >90% down on the Jan 2021 high of c.800p.

See my review here on 10/4/2024 for a whizz through its (bad) numbers for FY 12/2023 and why I think this share could end up at zero. The upside case is that on £2bn pa revenues, a significant improvement in margins could transform it into a profitable business in the future, maybe?

Today’s trading update sounds in line -

“Group performance on track, FY 2024 guidance unchanged”

For context, that means more losses in both 2024 and 2025, albeit shrinking.

At least revenue seems to be rising now, but I’m more interested in the size of the losses -

“Q2 will represent the third consecutive quarter of year-on-year (YoY) revenue growth. The Group's performance is underpinned by positive trading within the Beauty, external Ingenuity and offline Nutrition businesses, which have helped offset continuing FX headwinds within Asia. Guidance for FY 2024 remains unchanged[1].

THG shows its calculation of analyst consensus on its website, which is really helpful. Less helpful is that it only discloses fantasy EBITDA profits, which bear no similarity with commercial reality, since it capitalises about £79m of development spend, and EBITDA also ignored the heavy physical assets depreciation charge, heavy finance costs (£80m LY!) on its large debt pile, and other adjustments. Put all the real world costs into the pot, and THG remains loss-making. It’s a great example of how misleading & dangerous EBITDA-based valuations can be.

The StockReport thankfully uses PAT, and here we see below the lighter blobs (forecasts) are still losses of £(108)m in 2024, and £(76)m in 2025.

As I always ask, why is this company still valued at £875m, when there’s hardly any growth, and it’s bumping along generating losses every year? With a weak balance sheet that was heading towards NTAV of £(200)m negative when last reported?

There’s some additional upbeat-sounding commentary about each of the 3 divisions, see the RNS.

Deal with Frasers - various elements to this, including THG selling its luxury websites to FRAS, price undisclosed. Given that they generated sales of £43m, and were only “broadly breakeven” in 2023, then I’d be surprised if the proceeds were anything other than very modest, maybe £5-10m at a complete guess? So this is nothing to get excited about.

Other elements include FRAS using THG’s services in Australia, and FRAS stocking some of THG’s products in-store. As there are no financial details, I can’t judge if any of this is significant or not.

Paul’s view - as always, I’m not trying to predict the future. That’s your job! All we do is review the facts, figures, and forecasts on today’s date. And they remain very poor with THG. The market seems convinced that it can execute a turnaround, so we’ll just have to wait and see. I don’t see any sign of this yet being a viable business at all. Happy to revise that view once the facts change. As things stand though, it remains a clear RED.

Since IPO -

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.