Good morning!

Agenda -

Paul's Section:

Equals (LON:EQLS) - finally! Guilt overcame me on Sunday, so I prepared some notes on this interesting growth company. Looks good to me, but I don't understand the sector.

Card Factory (LON:CARD) - is ditching its CFO, after 5 years service, which is bound to worry some investors. An in line with expectations trading update is buried in today's news. It's a potentially interesting turnaround, but the weak balance sheet still puts me off, despite a bank funding agreement that has greatly reduced the risk of an emergency placing. Could be good, we'll keep an eye on it.

Naked Wines (LON:WINE) [no section below] - another CFO leaving, "by mutual agreement", effective last Friday, so no transition period. Although the RNS strangely says there has been a "smooth transition" - I wonder if that just means, here are the passwords, bye!? This one sounds like a falling out, since it's happened with immediate effect. The old CFO (2015-2020) is resuming that role on an interim basis. I've never been keen on this share, and think wine subscription services are not a good place to be right now. I was unimpressed with the FY 3/2022 results, reviewed here.

Graham's Section:

Judges Scientific (LON:JDG) (£467m) - today’s H1 update is in line with expectations. Order intake was up 4%, with very different trends seen in different geographies. Economic conditions remain “challenging”, and revenue growth is held back by supply chain/recruitment issues, and by staff needing to self-isolate. I provide some analysis of the £80m deal announced by Judges in May, the largest deal ever made by this highly successful buy-and-build operator.

Ebiquity (LON:EBQ) (£67m) (+10%) [no section below] - this media consultancy made over £20m of acquisitions in March, raising equity to do so. Today’s H1 trading update shows organic revenue growth of 10%, and total revenue for the six-month period of £37m. That’s half of the full-year revenue estimate shown on the Stock Report, but only includes three months of contribution from the acquired businesses.

Underlying operating profit in H1 has more than doubled compared to last year: margin improved due to “growth in higher margin digital products and improved operating efficiencies”. Net debt is £12.9m.

Historically, there have been huge discrepancies between underlying profits and actual profits (i.e. losses) at this company. Consultancies are a difficult place to invest and I would preserve a cautious attitude to this share.

Venture Life (LON:VLG) (£43m) (+6%) [no section below] - this consumer self-care company is “confident” it will meet market expectations this year. Organic revenue growth is approximately zero at VLG’s existing businesses, but newly-acquired businesses help the overall group to achieve 36% revenue growth compared to last year.

“There are signs that the supply chain issues have plateaued”, according to the outlook statement, and profit margins are being maintained through cost control and passing on price rises to customers where possible.

These shares are lowly-rated on a single-digit PE ratio but I suspect that this is fair, given the lack of meaningful organic growth.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Equals (LON:EQLS)

95p

Market cap £171m

H1-2022 Trading Update

I couldn’t put this off any longer, as have been promising to review this share for a while now! I briefly reviewed its in line with expectations trading update here in Jan 2021 - which mentioned an expected recovery in travel money FX transactions, and high development spending which was expected to moderate in 2023 - both seemingly good drivers for profits.

The current financial year is FY 12/2022.

Reviewing the StockReport here for EQLS, I made the following notes -

High relative strength of +11% in the past year, and +23% in the last 6 months - so something positive is happening with this share, given this strong share price performance, when most small caps have wilted.

EQLS appears in a top momentum screen here, which throws up some interesting companies that are bucking the downward market trend - so could be fertile ground for future winners, maybe?

Loss-making from 2019-21, so the bullishness must be driven by high expectations for the future, not its historic track record.

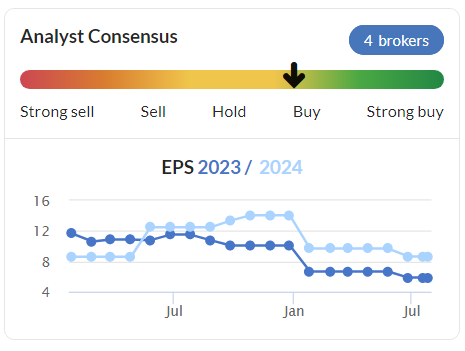

Valuation is 20.7x forecast earnings this year FY 12/2022, moving down to 15.3x FY 12/2023 earnings, and as you can see below, earnings forecasts have been rising, despite macro headwinds, reinforcing the view that positive things seem to be happening at Equals -

.

.

Some Director buying in recent years, but nothing huge.

P/TBV 17.2, so little asset backing.

Poor value rank of 13.

No dividends.

Listed competitors that Jack referred to here previously, are Alpha FX (LON:AFX) and Argentex (LON:AGFX)

Major shareholders - overhang from Crystal Amber selling is now small, with latest holding being 5.8% (down from 10.0%). Ameriprise looks like the buyer, increasing from 5.0% to 11.2%.

H1 Trading Update - was issued on 5 July 2022.

Key points -

H1 revenues up 84% to £31.3m - highly impressive growth.

Big increase in large enterprise solutions division, up from £0.2m revenues in H1 LY to £6.2m this time - is this sustainable, and what is driving it, I wonder?

Estimated gross profit is up strongly at £15.0m (up 47% - very good, but not as big an increase as revenue growth)

Cash has risen to £15.1m (June 2021: £10.1m)

Adj EBITDA for FY 12/2022 anticipated to be ahead of market expectations (no numbers given)

Business model is “highly inflation-resistant” - interesting point. As it takes a tiny cut of FX transactions, then those transactions would naturally rise with higher inflation.

Canaccord (many thanks) published an updated note, raising forecast FY 12/2022 adj PBT from £9.3m to £10.3m.

Adj EPS is forecast at 4.6p for 2022, rising to 6.2p in 2023 - PERs of 20.7, and 15.3 respectively, which looks a sensible valuation to me.

No divis forecast.

Bear case is noted by Canaccord as being execution & regulatory risks.

My opinion - I wouldn’t normally be interested in a forex dealer, because margins are so tiny, and there’s always the risk of catastrophe when huge amounts of money (£ billions) are being moved around, from system failures, or fraud.

It’s also such a competitive space, where customers shop around for the best deal.

On the upside, EQLS is clearly performing very well, with stellar growth in H1, and a valuation that looks reasonable still, despite a strong share price.

I’m not familiar with the company, but would like to learn more about it - management should get some webinars up, to inform more people about what the company does, etc.

I’ve just found an audio interview with management here on Vox Markets, hosted by my friend Paul Hill. I would certainly benefit from a simpler webinar, explaining the basics of what the company does, and its competitive position, etc. The key message from the CEO seems to be that the company is in a sweet spot, and enjoying the strong growth it’s generating.

At this stage, I’m not sure what to make of EQLS, because I don’t properly understand the business model, or competitive position. Although the very impressive growth, and strongly rising forecast profits, together with a valuation that still looks reasonable, sounds interesting, and makes me lean towards viewing it positively.

.

.

Card Factory (LON:CARD)

50.6p (down 2.5% at 08:34)

Market cap £174m

It’s worth reading this type of announcement, because sometimes companies put other information in it, like a brief trading update, as in this case. Not ideal really, because trading updates should be clearly marked as a trading update, otherwise investors can miss them.

This is a bit strange - the CFO is being sacked (as is usual, no proper reason is given) but staying on until they find a successor -

Card Factory announces that the Board and Kris Lee, Chief Financial Officer have agreed that Kris will leave the Company following a transition period…

…the Board and Kris have agreed that now is the right time for change.

The Company will commence a process to identify his successor. Kris will remain in role for the transition period, working with the Company to assist in this process and help ensure an orderly succession.

The RNS profusely thanks him, including that -

“he has worked tirelessly to deliver a successful refinancing in recent times and leaves the Company with a solid platform to move forwards”.

The reward for 5 years’ work, described today as a “significant contribution”? Being shown the door, and getting a £40k termination payment! I’d be mortified if that happened to me, and would tell them to stuff it, whilst walking out of the door for the last time! Wouldn’t you?

It doesn’t sound like a bad leaver situation, as bonus & share options are being honoured.

The Company will commence a process to identify his successor. Kris will remain in role for the transition period, working with the Company to assist in this process and help ensure an orderly succession.

Trading update - partially reassures me -

The Group's trading performance for the year to date is in line with the Board's previous expectations. The Group will publish its interim results on 27 September 2022.

In line is good, but that's in the context of forecasts which have been lowered a fair bit this year -

My opinion - I’m a bit unsettled by the unexpected departure of a CFO, as they usually stay put when things are going well.

Has there been a falling out in the Board room? Or did the rest of the Board not think he was up to the job? Or maybe just a culture change under the CEO who joined in Mar 2021? I think the outgoing CFO worked wonders, maintaining the support of the bank, when the business was seriously under-capitalised during the pandemic. Who knows. It’s frustrating when Directors depart, because the culture in the UK often seems to be to cover up the real reason, and leave small investors guessing, whilst the big shareholders often know what’s really going on behind the scenes.

Renowned investor Richard Crow (@RebelHQ on Twitter), talked positively about the turnaround under new management at CARD on Friday, when I interviewed him here - well worth a listen, Richard is always full of common sense investing wisdom, and interesting stock ideas.

The forward PER looks reasonable, at 7.2 on the StockReport, although the weak balance sheet still worries me - NTAV was negative £(101)m when last reported.

I’ll keep an open mind on CARD shares, for a potential turnaround. Although I think Moonpig (LON:MOON) probably attracts me more, and seems to have eaten CARD’s lunch online. If CARD can catch up online, then it might get interesting. That’s a tall order though, with MOON (and others) now so well established, and able to fund big marketing budgets from strong cashflow.

Note that the share count has barely changed, at 342m in the last 6 years, so theoretically, there's no reason why the share price couldn't get back to pre-pandemic levels, if performance improves -

.

Graham’s Section:

Judges Scientific (LON:JDG)

- Share price: £73 (-4%)

- Market cap: £467

This buy-and-build operator in the scientific instruments sector provides a half-year trading update.

As many of you will know, Judges has been a successful long-term compounder thanks to an efficient approach to acquisitions. It bought many small, founder-led businesses at very cheap multiples, used some debt to fund the deal, and then paid off the debt (along with any contingent consideration) using the profits of the acquired business..

Geotek

Earlier this year, Judges announced a large (up to £80m) acquisition.

The website for the newly-acquired business, Geotek, can be viewed here. It specialises in the analysis of geological samples.

Judges agreed to pay a multiple of 7x Geotek’s operating profit in 2022, with a lower limit of £45 million (paid upfront) and an upper limit of £80 million (£35m of contingent consideration). The lower limit was based on Geotek’s average performance over the three years prior to Covid.

Bonus payment - non-execs at Judges are entitled to a bonus worth 1% of the enterprise value of any acquired business they introduce.

As a result, one of Judges’ non-execs will receive up to £800k (in a mixture of cash and shares), for suggesting the Geotek acquisition. Judges argues that this 1% fee is “materially lower” than the fees charged by brokers.

I acknowledge that setting remuneration is a difficult task, but will always issue caution when incentives are geared towards size rather than profitability. This bonus scheme at Judges seems a bit too heavily geared towards the former.

Quality of earnings? - I note the following disclosure by Judges, regarding Geotek:

This is the first acquisition by the Group that derives a substantial proportion of revenues from services. It will provide the Group with greater medium-term visibility but also reliance on a small number of large contracts.

In connection with this, I also note the disclosure by Judges regarding Geotek’s Service Director and its Chairman, who are the founders of Geotek and are involved in selling it to Judges. These two individuals will continue in their roles on one-year contracts.

These are helpful disclosures, to help investors understand the risks involved in the deal. It’s certainly not without risk - and hopefully Judges are ready for the challenge of managing this larger business!

Today’s H1 2022 update.

Let’s get into this. It’s in line with expectations but the key points are:

- Organic revenues (i.e. excluding Geotek) +7%.

Revenues would have done even better if not for supply chain issues, recruitment difficulties and staff being required to self-isolate.

- Order intake +4% organically in H1 2022, after achieving a 25.1% gain in H1 2021.

- The order book measured in weeks reaches an all-time high, but this partially reflects the “ongoing supply chain difficulties”. So I perhaps wouldn’t read too much into this.

Despite the growing order intake, Judges argues that it still hasn’t caught up with the “pre-Covid growth trajectory”.

And while other regions were more positive, I note that China/Hong Kong and the UK both saw reductions in order intake, compared to H1 2021.

My view

The topic of scalability often came up with respect to Judges. While the strategy worked well with very small, founder-led businesses, would it continue to work when Judges had much larger funds to invest?

My view was that I would have more trust in Judges when it came to larger deals, than I would with most other management teams. After all, it had proven its ability at the smaller end of the spectrum, and therefore had earned the right to employ larger amounts.

However, I did have a concern in November 2019, when Judges announced a £12m special dividend. Its cash balance at the time was only around £20m. I wondered if this meant that Judges were not looking for larger deals, and if it meant that the era of rapid growth was over.

Obviously I’ve been proven wrong by the £80 million deal for Geotek, a couple of years later.

But I still think the jury is out (forgive the pun) when it comes to the success of Judges at this larger scale.

I don’t think we can completely take it for granted that Judges will be able to successfully execute eight-figure and nine-figure deals. And it probably needs to do that, if it’s going to kick on from its current scale. Small deals don’t move the needle anymore.

As with Berkshire Hathaway (in which I hold a long position), there’s also some key man risk in the form of the Judges CEO David Cicurel.

However, Warren Buffett is c. 20 years older than Mr. Cicurel, and still doesn’t want to retire, so maybe I’m overthinking it?

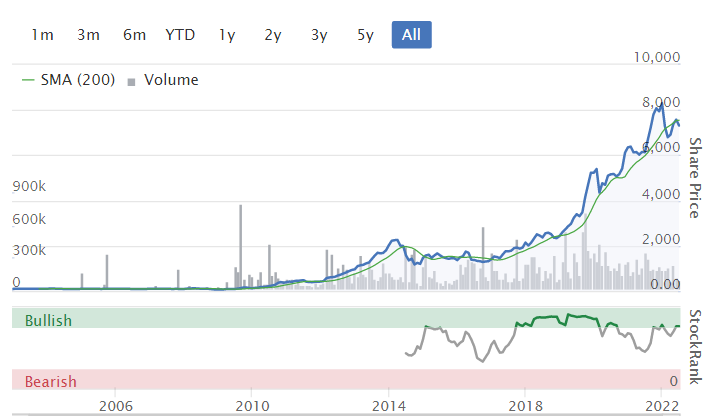

Personally, I agree with the StockReport and I find these shares more than fully valued at current levels.

That’s always a dangerous thing to say about any long-term compounder. But this share does provide very decent buying opportunities from time to time, and I don’t believe that this is one of those times.

As a long-term hold, however, I’m sure that its shareholders are feeling very comfortable indeed - congratulations, if you are one of them!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.