Good morning!

Sorry for the slow start today.

Candidates for coverage:

- Sprue Aegis (LON:SPRP)

- Elecosoft (LON:ELCO)

- Fishing Republic (LON:FISH)

- Xpediator (LON:XPD)

- Trifast (LON:TRI)

Any other requests? Please let me know. (Edit: Switched in Elecosoft (LON:ELCO) to the above list, took out Spaceandpeople (LON:SAL) as too small.)

Cheers,

Graham

Sprue Aegis (LON:SPRP)

Share price: 210p (unch.)

No. of shares: 46 million

Market cap: £97 million

This is a maker and marketer of fire alarms and carbon monoxide detectors which has been making decent share price gains in 2017 (up from c. 180p in January).

It had some damaging inventory problems in 2016 which it now appears to have moved on from, and has recovered to profitability. Basic EPS is 2.8p per share, up from a 1.3p loss in H1 2016.

Highlights:

- Group revenue of £26.0m (H1 2016: £25.9m)

- Adjusted operating profit* of £1.5m (H1 2016: operating loss* £0.9m)

- Gross margin pre-BRK distribution fee up by 6.2% to 31.7% (H1 2016: 25.5%)

Note that the BRK distribution fee is a specific payment to one of its suppliers in exchange for the right to distribute that company's products. The agreement with that supplier is ending next year, so it's probably irrelevant to analysis of Sprue's future value!

Sprue has net cash of £10 million and the dividend is maintained.

Adjusted operating profit is before £0.2 million of share-based payments, so I would make sure to also deduct them from the profit figure.

The highlights also mention that inventory has reduced - making the probability of another stocking mishap less likely! Continuing to reduce inventory remains an objective, so hopefully the probability will reduce even further.

I won't pretend to be an expert in the alarm industry but the strategic report sounds quite promising, with new partnerships and products on the way, e.g. "Europe's first domestic battery powered gas alarm"!

Today's share price is unchanged because ultimately, today's numbers and the outlook are in line with expectations:

Our product roadmap out to 2020 provides Sprue with a clear direction to expand our range and increase sales. Whilst continuing to enhance our core technology and connected products offering, we remain committed to leveraging the full commercial value of our FireAngel brand through the launch of additional complementary product sets.

During H2 2017, the Board expects a stronger UK sales bias, with full year results expected to be in line with market expectations.

My opinion

It seems like the company has done about as well as could have been hoped over the last year or so. It has its own brands and IP as well as plenty of partnerships with others in the industry, and has learned from the mistake last year.

So overall, it seems like a pretty reasonable holding and a decent-quality smallcap.

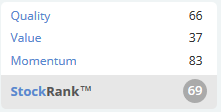

Stockopedia is overall quite favourable to it too:

Elecosoft (LON:ELCO)

Share price: 48.5p (+12%)

No. of shares: 77.2 million

Market cap: £37 million

This is a software developer offering solutions to construction companies. It makes "digital construction software" used in project management, visualisation, estimating (for bid management), etc.

These are some nice figures:

- Revenue up 14% to £10,010,000 (2016 H1: £8,769,000) of which 48% was from recurring maintenance and support revenue (2016 H1: 47%)

- Operating profit up 76% to £1,059,000 (2016 H1: £601,000)

- Profit before tax up 81% to £1,007,000 (2016 H1: £557,000)

£0.5 million of software development spending was capitalised. So there is a slight build-up of intangibles on the balance sheet, as the amortisation charge was only £420k. Although the mismatch is pretty small, so this wouldn't be a big concern for me.

The interim dividend increases to 0.2p.

There was a small acquisition made in October 2016, and without it, UK revenue would have been approximately flat compared to last year. Overseas revenue increased 12% and that appears to have been organic.

The financial structure is a tad unusual: it has cash in overseas currencies (SEK, EUR, USD) and borrowings in GBP, because of that acquisition, so overall there is a small net cash position.

Outlook sounds good, and presumably means that expectations can be increased?

Elecosoft delivered a positive performance in the first six months of 2017, with growth in all geographic regions and we have enjoyed an excellent start to the second half.

My opinion: I haven't studied this company before, but it seems like a fairly good-quality, international software company.

I'm terrified of certain tech valuations at the moment, however, and anything that says "SaaS" is something I'd almost want to automatically avoid now, on valuation grounds! Simply based on the sector and the growth profile, I'm not surprised to see that Stockopedia gives this a ValueRank of 27.

In fairness, I don't know enough about the specifics of Elecosoft yet to write it off on purely valuation grounds. It mentions McCarthy & Stone (LON:MCS) as a major client which won a "Digital Construction" award recently, so that's certainly worth some credibility. It has unified its various software brands under a single name, which is a move I like. Brokers are forecasting 2.1p in EPS this year, rising to 2.6p/2.8p in 2018.

Fishing Republic (LON:FISH)

- Share price: 39.5p (-6%)

- No. of shares: 38 million

- Market cap: £15 million

This is marginally above our market cap limit of £10 million, and I've looked at it before, so will cover it again now.

It's a small chain of fishing tackle retailers, though the size is beginning to look more impressive as it now has 19 stores (up from 12 at the start of the year). The like-for-like sales growth of 22% should hopefully be enough to continue justifying the expansion drive. But I think at least three of the stores being measured were still very immature in H1 2016, so it might be a slightly soft comparative measure.

The total sales growth was also achieved by discounting higher value items in new stores, with the effect that gross margin collapsed to 36% (from 50%). The end result was in line with expectations, a pre-tax loss of £0.1million. The costs of opening new stores are blamed, with the hope that profitability will resume in H2.

My opinion

I'm a bit spooked by the size of the decrease in gross margin, though the reason given is acceptable on the face of it.

But as Paul and I have discussed before, stock turn is slow at Fishing Republic. Inventories seem to hang around for about a year, and are large relative to the size of the company (now £5.3 million).

That makes margins all the more important: to generate a good return on assets, you'd ideally have both of these drivers (stock turn and margins) working for you. But you have to have at least one!

Own-brand product sales declined too, another cause of concern from my perspective, as a sign of potentially weak pricing power.

I had been mildly optimistic on Fishing Republic but have a few concerns about these results. Cash has also reduced to less than £700k. I'm now thinking that another Placing might be needed in due course.

Xpediator (LON:XPD)

- Share price: 28.5p (+4%)

- No. of shares: 100.8 million

- Market cap: £29 million

This is a new stock, listed last month, and my first time looking at it. It's a freight management company with operations in eight central and eastern European countries.

Business areas are as follows: freight forwarding, logistics & warehousing, and transport services.

Total revenues are up 56% to £49 million, and it looks like most of this growth is organic (only the transport services division had an acquisition during the period). But the changes in operating profit at each segment was fairly modest. For example freight management revenues increased from £25 million to £39 million, but operating profit only increased from £0.6 million to £0.7 million!

Freight forwarding means organising transportation for customers rather than actually operating the mode of transport. Xpediator has made a strategic decision to focus on larger contracts, but the margin is very low. It is effectively just buying services on behalf of its customers and taking a small sales commission. So the total sales figure is not terribly important, in my view.

The outlook is for more organic growth and also growth by acquisition. And a £350k dividend has been declared (it seems a bit counter-productive to raise £4 million in a placing in August and then give nearly 10% of it back in a dividend two months later, but whatever!)

Net income is c. £0.5 million for the period. Broker forecasts are missing (always a good thing, since it means fewer people are looking at the stock), but I can see there was a lot of seasonality in last year's result, so H2 should perhaps be much strong than this. Which would make the valuation on current earnings fairly reasonable.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.