Good morning from Paul & Graham! Here we go again.

Normal service resumed over the weekend with my summary podcast here. Hopefully the SSL certificate works now. Let me know in the comments below if you're still having any technical problems. Or it's available on the main podcast platforms.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

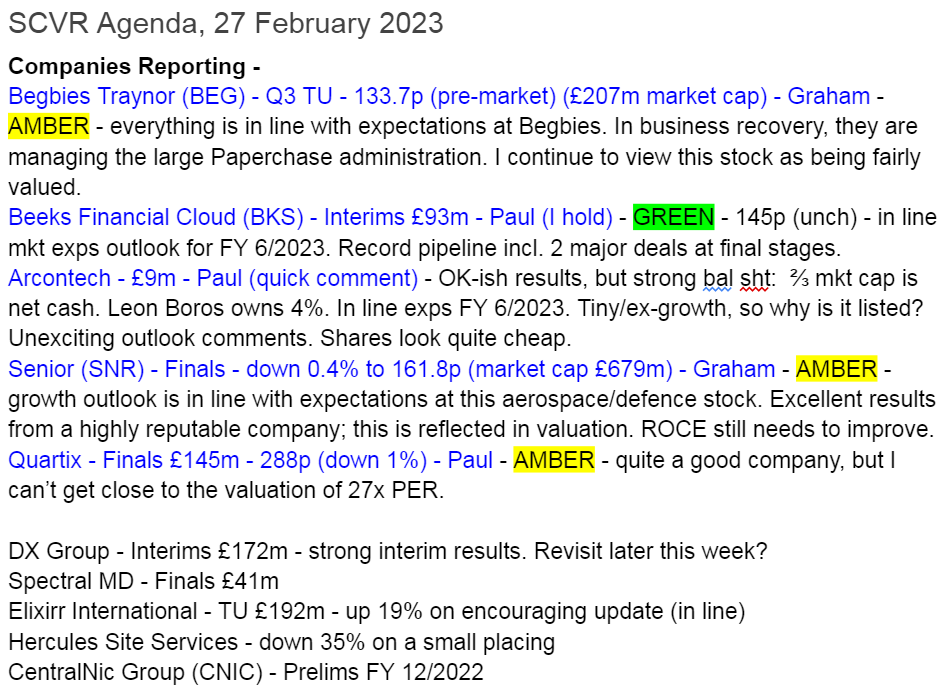

Here's our to-do list for today - sorry we didn't finish all the items on the list, got a bit bogged down in the others.

Paul’s Section:

Quartix Technologies (LON:QTX)

288p (down c.1% at 14:26)

Market cap £141m

Quartix Technologies plc (AIM:QTX), a leading supplier of subscription-based vehicle tracking systems, analytical software and services, is pleased to announce its audited results for the year ended 31 December 2022.

Revenue up 8% to £27.5m

Statutory profit before tax (PBT) was £5.5m, up slightly on 2021’s £5.4m

It’s confusing as to which numbers are which, adjusted or unadjusted. The way they’re presented, looks the wrong way around to me. It would be clearer if they had called the columns "Statutory results" and “underlying results” rather than “adjusted”, perhaps?

EPS is either 10.9p or 10.4p, two measures are provided, giving a PER of about 27x, which as I’ve mentioned before, just looks much too high to me, given this track record & forecasts of slowly declining profitability, falling dividend yield, and rising PER -

Balance sheet - looks OK. NAV of £20.9m, less goodwill of £14.0m, gives NTAV of £6.9m. Net cash looks more than adequate at £5.1m. This business has almost nothing in fixed assets, and is paid by many clients on reliable monthly subscriptions. Therefore it’s a very stable, and favourable financial setup. So shareholders can sleep soundly at night, or indeed at any other time of their choosing.

Cashflow statement - is very simple. It’s a reliable cash generator each year, and pays out those cashflows in divis. That’s pretty much it! Very easy to understand, which I like a lot.

Note that it overpaid divis (well above cash generated) in 2021, which was obviously a policy decision to return surplus cash to shareholders. Again, that’s a nice sign, if a business is in a position to do that.

Dividends - Quartix has a good track record of being generous with divis, including special divis (see below). So this is unusual for a smaller tech company, in being nicely cash generative, and dividend paying -

My opinion - in the last 5-6 years, QTX seems to have been running to stand still, or even going slowly backwards in profitability. The trouble is that it’s facing constant price erosion (nearly 5% on average in 2022), and customer attrition. Therefore it needs to generate strong new business just to compensate for these two negative factors.

The current strategy is to be more aggressive with expansion internationally - going quite well in France, less well in USA.

This is a very competitive sector, so Quartix must have a decent product, because it makes a good profit margin, and is managing to expand overseas.

For me though, a PER of 27x is still way too high for me to want to consider investing, given the track record of declining profitability, and only marginally higher revenues, over the last 5 years. I’d need to see more evidence that growth is genuinely accelerating, and that profitability has stopped falling.

To assess this share, the best course of action would be to speak to independent people in the transport sector, who know Quartix’s product, and have also used competitors' products. If they rave about Quartix, then we could be onto something with the shares. Without that information, we're just investing blind.

Beeks Financial Cloud (LON:BKS) (Paul holds)

143p (pre market)

Market cap £93m

27 February 2023 - Beeks Financial Cloud Group Plc (AIM: BKS), a cloud computing and connectivity provider for financial markets, is pleased to announce its unaudited results for the six months ended 31 December 2022.

To save me re-typing the numbers, here’s the table for key numbers below. As you can see, EBITDA turns into only a small adjusted PBT number -

Overall, BKS made a statutory loss of £478k after tax. I tend to use PAT as the key profit number for companies like this, which can claim significant tax credits related to R&D.

Outlook - this is more important than the unexciting H1 figures. Crucially, it confirms that FY 6/2023 market expectations should be met.

Canaccord has £25.0m revenues and £3.3m adj PAT pencilled in for FY 6/2023. I’m not entirely happy with the adjustments. In particular, share-based payments of c.£2m is repeating staff remuneration, so should not be adjusted out, in my opinion.

Some excitement is provided with “two material contracts at the final negotiation stage”, so that should give the shares a boost when/if those contracts are signed. Long sales cycles are mentioned, which has been flagged before.

“Record pipeline”.

Canaccord’s update note (many thanks) this morning says that FY 6/2023 forecasts are well underpinned (remember BKS is mostly recurring revenues), and that there’s scope to upgrade FY 6/2024 forecasts, depending on when the strong pipeline converts into signed contracts.

Price rises have been put through, to recover higher energy costs at data centres.

Supply chain is said to be easing for supply of equipment. Note that inventories of £2.4m has gone up in the last 6 months - this is a stockpile of computing equipment, to enable faster deployment of new contracts. This should be capable of being run down again once supply chains are eventually back to normal, I imagine.

Balance sheet - looks adequate. Although note that BKS is unusual for a software company in that it has relatively large fixed assets (computers and cabling in its data centres). This often requires up-front expenditure for new contract wins. So PPE is on a rising trend, and is now £17.8m. This has required several placings over the years, although quite modest dilution for a rapid growth company. The share count has risen from c.51m in 2019, to c.65m now, which has enabled revenues to more than triple, so I think that’s OK. Note the founder/CEO Gordon McArthur owns c. 37% of the company still, so I like that owner’s eye, making dilution much less likely than at similar companies where management only have some share options, which often drives empire-building with new shares being thrown around like confetti. Not the case here.

NAV is £31.5m. I would take off intangible assets of £7.3m, which gives a still-healthy NTAV of £24.2m, most of which (about 74%) is fixed assets.

Net cash of £3.4m isn’t particularly great. We can’t rule out the possibility of another smallish placing being needed to help fund big contract wins (the up-front capex associated with them), but on a £93m market cap, a bit of dilution wouldn’t be ruinous, so I’m not panicking over that possibility. Institutions would probably be happy to fund a small placing to fund major new contracts, such as the two that are said to be in final negotiations.

Shareholders just have to accept that the business model of rapid growth, and up-front capex for new contracts, probably will require some further additional funding. The temptation is to hope that it won’t need to do another placing, and then be disappointed when it does! So I feel most comfortable assuming there might be another placing or two, which in the past have only enlarged the share count by roughly 10% each, so not a big deal.

Cashflow statement - it’s cashflow negative in H1, due to increased working capital, and heavy capex. Note also that £1.4m in H1 of development spending (i.e. payroll!) was capitalised onto the balance sheet. Perfectly permissible, but this inflates EBITDA, which it by-passes completely.

My opinion - no surprises here in the numbers, plus an in line with expectations outlook for FY 6/2023. I was hoping for an upgrade to expectations, although maybe that was being greedy, as a jump from £18.3m last year, to £25.0m this year, would represent very strong revenue growth, and I’m pretty sure that’s substantially all organic growth too. Revenues are high quality, being mostly recurring, from sticky customers. Profits should follow in future, once the business has scaled up through the current rapid growth phase.

I very much like the whole investing theme of cloud computing niche businesses, where strong growth is in evidence (small cap examples off the top of my head include Beeks (I hold), Cerillion (LON:CER) , and WANdisco (LON:WAND) (I hold).

Beeks is being run for growth, rather than immediate profit, which is fine, that’s the deal with this share. It won't appeal to everyone.

Overall, I think the upbeat outlook comments mean that I’m happy to go to sleep again with this share for another 6 months. There should be some decent contract win announcements in the pipeline, that could give the share price a boost along the way. Although for now, in a more bearish stock market, £93m market cap strikes me as high enough.

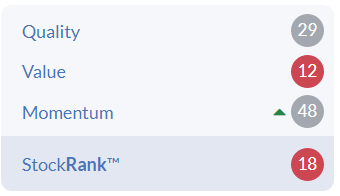

The Stockopedia computers doesn't like it - always a good sense check, to make sure the bull case really is as good as investors think -

Graham’s Section:

Begbies Traynor (LON:BEG)

Share price: 133.7p (pre-market)

Market cap: £207m

It’s a Q3 update from this “business recovery, financial advisory and property services consultancy”.

Once upon a time, it was reasonable to think of this company as simply an insolvency practitioner.

Trading in Q3 has been in line with H1. As a result, “the outlook is unchanged and the board therefore remains confident of delivering market expectations”.

There is “an encouraging level of new insolvency appointments”, and this includes the administration of Paperchase (a high-value case).

In financial advisory, there is “a good pipeline of engagements to meet expectations for the full year”.

Estimates - the company helpfully observes that forecasts for revenue are £117.7m - £121.4m and for adjusted PBT £19.7m - £20.6m.

My view - there’s no reason to change the detailed view that I expressed in December (and November), namely that I think Begbies is fairly valued around the £200m mark.

Bull points:

Low net debt

Excellent leadership from Ric Traynor

Usually has good operating cash flow

Insolvency market very strong

Bear points:

Limited balance sheet support (i.e. not much tangible asset backing)

Macro conditions perhaps can’t get any more favourable for Begbies than they are right now?

People-based business

Overall, I think Begbies should trade at an average earnings multiple. That being the case, I’m neutral on the stock.

Senior (LON:SNR)

Share price: 161.8p (-0.4%)

Market cap: £679m

I’m intrigued to see how far this defence stock has rallied since we covered it in January.

The share price is up by another 11% (and it already rallied 7% on January’s trading update).

At this rate, it will be beyond our SCVR market cap limit soon!

Let’s quickly review these full-year results, for the period to December 2022.

Revenue +20% at constant FX to £848m

Adj. operating profit +285% at constant FX to £28.5m

These results are even better if you use actual exchange rates (but constant exchange rates probably provide a fairer comparison).

Pre-tax profit, without any adjustments, was £22.4m.

Net debt (excluding leases) rises by £20m to £100m thanks to an acquisition made in 2022. This acquired company contributed only negligible amounts to revenue and profits.

Net debt to EBITDA is 1.47x, an improvement from 1.87x last year (due to improved profitability).

Annual ROCE improves from 1% to 4.7%.

I think the low ROCE is the Achilles Heel of any bullish argument for Senior shares. We know it, and the company knows it: its returns are too low. From the StockReport:

Let’s see what the company has to say about that today.

The CEO:

We remain on track to drive the Group ROCE to a minimum of 13.5% in line with our previously stated ambition…

The increase in ROCE reflected the significant increase in profitability, while managing the increase in capital employed which was mainly due to the acquisition of Spencer Aerospace. This improvement in ROCE is an important step to delivering our Group ROCE target of 13.5% over the medium term.

Will they succeed in reaching 13.5%? Perhaps. If you look into the distant past (10-15 years ago), Senior regularly earned double-digit ROCE. But based on where they are now, they have their work cut out if they are to achieve that again.

Dividend - this stock abruptly cut its long-standing dividend stream in 2020.

Today, the company announces a 1p final dividend, making the total payout for the year 1.3p. Adjusted earnings per share was 4.36p, so the majority of earnings are being retained.

Outlook

Strong growth in 2023 is set to be in line with expectations.

As we start 2023, our order book is healthy, reflecting favourable market dynamics, with commercial aerospace recovery in full swing and other important markets remaining buoyant. Demand is currently holding up well, though we remain mindful of the potential impact of the ongoing supply chain pressures in aerospace, as well as the broader macro-economic situation and geopolitical uncertainty.

My view

I’m happy to reiterate my view expressed in January that Senior is one of the higher-quality aerospace/defence stocks, although it still doesn’t tick enough of the quality boxes that I look for in companies generally. However, in the context of aerospace and defence, Senior deserves its positive reputation.

When you read the detailed review of its divisions, you find a company with exposure to the enormous North American markets (and the US dollar, which nearly always helps), to the long-term structural growth of civil aviation, and to valuable power and energy markets. This is a very reputable international company and a worthy member of the FTSE-250 index. I wouldn’t buy it at the current valuation, so I’ll stay neutral on it for the time being:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.