Good morning from Paul & Graham!

Today's report is now finished.

Woodford Views - this is a new blogging site, started by Neil Woodford - the famous fund manager whose career and business unravelled a few years ago when he strayed out of his area of expertise into speculative small caps in an open-ended fund, with disastrous results. Unlike many other commentators, I don't see it as my job to chastise or pour scorn on him. My view is that he's had a remarkable career, with huge highs and lows, and like many of us, has made mistakes along the way - which he addresses in his three blog posts so far. Anyway, somebody with that level of experience is going to be worth listening to, and I find his blog posts very interesting. So thought I'd flag them up to you here.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Monday 29 April 2024 - SCVR

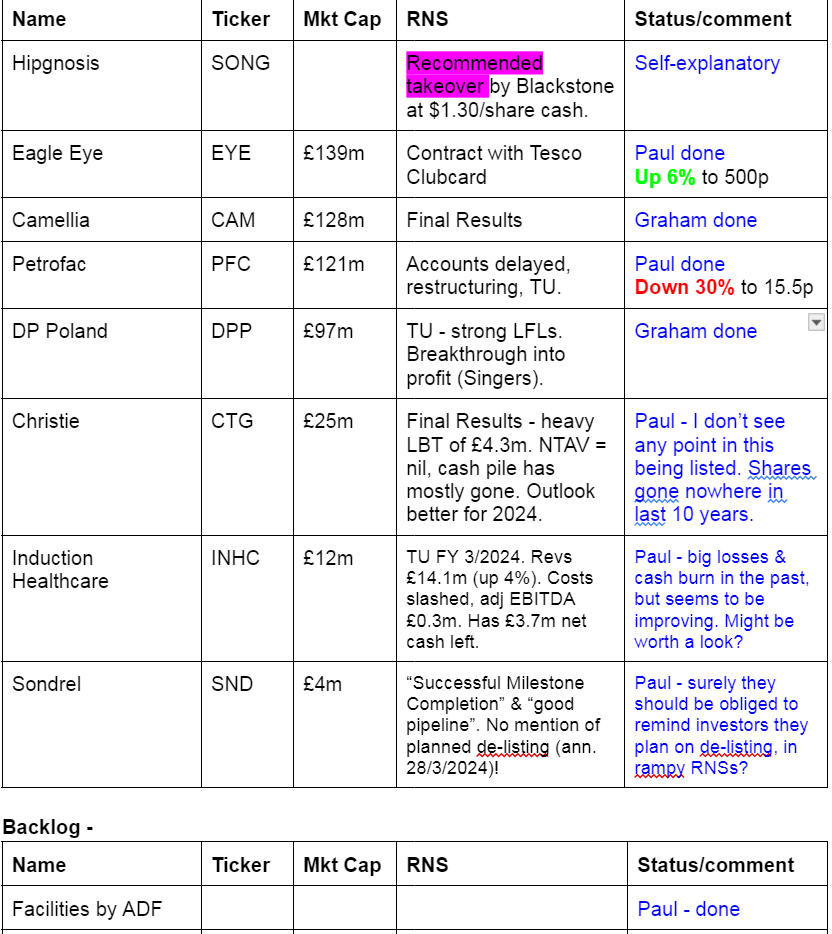

Companies Reporting -

Other mid-morning movers (with news) -

Zenova (LON:ZED) - up 24% to 2.35p (£3m) - £2.4m Fire Protection Paint Order - Paul - Speculative

Speculative nano-cap that has promising-sounding products, but very weak finances - loss-making, cash burning, under-capitalised. We had a quick look at it here on 25 Aug 2023 after “FoolHardy” flagged it as potentially interesting.

Today it says a customer has placed an order for £2.4m over 2 years, for 200,000 litres of its fire retardant coating for steel.

Securing a contract of this size further demonstrates the value-add of Zenova and its suite of high performance products, as we bring solutions to global needs. I fully expect our team to continue to deliver new business across all of our paint and extinguisher products, and look forward to updating the market on those developments in the near-term and beyond."

Paul’s opinion - sounds intriguing. I need reassurance on the finances though - a tiny £677k placing was done at 2p recently. It is almost certainly going to need another placing. With a large order received, and talk of a strong pipeline (talk is cheap!), maybe something interesting might be developing here? Just for gamblers at this stage.

Spaceandpeople (LON:SAL) (I hold) - up 16% to 93p (£2m) - FY 12/2023 Results - Paul - Speculative

A long-standing nano-cap that does promotional work for shopping centres in the UK and Germany. Considering the market cap is only £2m, these figures aren’t bad - revenue up 23% to £5.8m, and £103k PBT. I have some queries on the accounts, (1) what is the £241k “Ancillary charges” shown in note 5 that creates all the operating profit? Weak balance sheet with negative NTAV of £(2.2)m. Clean going concern note reassures. Note 14 shows a £551k provision for doubtful debt - why do business with customers that don’t pay up? Note 17 - what is in the £3.1m “Other creditors”?

Paul’s opinion - has survived the pandemic lockdowns, and seems to be on the mend. Commentary sounds fairly upbeat. Speculative punt at this stage, but the £2m market cap tempted me to have a nibble. My main worry is now de-listing risk.

Smarttech247 (LON:S247) - up 10% to 22p (£27m) - $2.1m Contract Win - Paul - AMBER/GREEN

Cyber- security company which floated on AIM in Dec 2022, which was brave of them! Ronan Murphy (Exec Chmn) owns 70%, and the EBT 9%, so I think that more-or-less rules it out for me. What’s the point in having a listing, when there’s negligible free float? Pity, as the FY 7/2023 results look good - well the adjusted numbers do anyway, with E2.15m adj operating profit, but only £204k of statutory PBT. Good balance sheet with E6m of net cash, mostly raised in the IPO. Loads of RNSs about contract wins. Today’s news is a $2.1m, 3-year contract with an existing pharmaceuticals client.

Paul’s view - this actually looks quite an interesting company, might be worth a closer look, if you can live with the Exec Chairman being in complete control with 70% ownership.

Summary of main sections

Eagle Eye Solutions (LON:EYE) - 470p (pre-market) £139m - Tesco - Clubcard Challenges - Paul - GREEN

A non-regulatory announcement, but quite interesting. Tesco clubcard has signed up for a 1-2 year contract with EYE to offer personalised promotions to its customers. This sounds a striking endorsement of EYE's tech, acquired through UntieNots, which seems to back up management assurances that this was a key acquisition in early 2023. Shares look expensive, but could be worth it, in my view.

Camellia (LON:CAM) - down 3% to £44.80 (£124m) - Final Results - Graham - GREEN

Times are tough as tea, Camellia’s main product, remains oversupplied. Despite its operating losses, and a long delay in the sale of an insurance investment, I think I have to remain positive on this. It’s trading at only about a third of net assets and if that sale goes ahead, I expect it to carry out a meaningful buyback.

Petrofac (LON:PFC) - down 30% to 15.5p (£82m) - Delayed results, restructuring, TU - Paul - RED

A very complicated, very high risk special situation. Equity could easily end up worth nothing, as control seems to be slipping away to the bondholders. Large debt for equity swap seems on the cards. With so much risk and uncertainty, why get involved? I've no idea how things will pan out, but usually in situations like this, equity gets clobbered, as it ranks behind all creditors.

Facilities by ADF (LON:ADF) - 51.5p (£41m) - FY 12/2023 Results - Paul - AMBER

2023 results were clobbered by disruption from the US sector strikes. Recovery so far seems rather hesitant, and I'm not convinced 2024 targets are achievable. Could be a good share if 2025 targets are hit though. So I'll sit on the fence for now. Quite a nice niche business, but I'm not convinced it's scaleable much further without risky overseas acquisitions.

DP Poland (LON:DPP) - up 5% to 11.4p (£105m) - Trading Update - Graham - AMBER

We are usually negative on this Polish Domino’s Pizza business, but I am more comfortable with a neutral stance on it today given the involvement of Domino's Pizza (LON:DOM) on the shareholder register, good like-for-like numbers, and bullish broker estimates suggesting that profitability is on the cards in the near-term.

Paul’s Section:

Eagle Eye Solutions (LON:EYE)

470p (pre-market) £139m - Tesco - Clubcard Challenges - Paul - GREEN

This is a non-regulatory “Reach” announcement which looks interesting.

I’ve warmed to this share in the last year, as it’s proving to be a credible organic growth company, that specialises in sophisticated customer loyalty programmes for big grocery chains, internationally.

I asked management about competition recently, and they confirmed that the main competition is from supermarkets doing their own loyalty schemes, with of course the Tesco Clubcard being very important in the UK.

Today we’re told that Tesco Clubcard has signed up for a 1-year contract with EYE, with an option to extend for another year, to offer customers personalised promotions -

Following a successful trial, with a higher than anticipated participation rate, Tesco will roll out Personalised Challenges to more Clubcard members in the coming months, under the name Clubcard Challenges. The solution will power personalised and gamified offers and promotions to each individual Clubcard member.

Paul’s opinion - this strikes me as a significant validation of what EYE does, if the UK’s leading supermarket, with its own highly developed loyalty scheme, thinks that EYE offers something additional which it seemingly hasn’t got in-house.

I struggle to know how to value EYE shares, and it does look expensive on conventional metrics. However, I also think there’s something special here, and a high valuation could well be justified. Today’s news reinforces that view.

Petrofac (LON:PFC)

Down 30% to 15.5p (£82m) - Delayed results, restructuring, TU - Paul - RED

I’ve only looked at this large engineering group for the energy industry once here on 12/4/2024 when it came up on my top % movers section, being down 30% on an ominous update. I flagged it as RED due to the considerable risk of equity dilution (or wipe-out) in a restructuring. There could be a very wide range of potential outcomes, from zero, to a multibagger, it all depends on negotiations.

It’s done the same thing again today, dropping 30% on another worrying update. Main points today -

FY 12/2023 accounts delayed, now expected by 31 May 2024.

Audit “substantially progressed”, but more time needed to complete annual report.

Shares will be suspended from 1/5/2024 due to late accounts, so last day of dealings for now will be tomorrow, 30 April - hence today’s stampede for the exit.

Some bondholders have offered $300m in fresh credit lines for necessary guarantees on existing contracts. Conditions include a “significant proportion” of existing debt to convert to equity (but not indicated at what price the fresh equity would be issued at).

Discussions ongoing with credit providers.

Bond coupon - expects to default on 15 May, but has a 30-day grace period. Holders of 41% of the notes have agreed forbearance until 30 June.

“Good progress” on disposals.

Problem contract in Thailand won’t be resolved by accounts publication date, so $130m extra provision required. Another problem contract has caused a $15-20m hit to profit.

Excluding these contracts, performance is “broadly in line” with TU of 20/12/2023.

Net debt at 31 Dec 2023 was $583m, less than expected.

Outlook -

“Petrofac has a large order book of high-quality projects, strong market positions and compelling future opportunities which are evident from the recently announced awards. We are working to put the performance guarantees and the right capital structure in place, in order to deliver on this potential.”

Paul’s opinion - clearly this is a highly complicated financially distressed special situation. Only get involved (long or short) if you really know what you’re doing. This is a classic tussle between bondholders and equity. Remember that equity ranks bottom, below all creditors, and often gets all but wiped out in situations like this. No view from me, other than it’s super high risk, and the range of outcomes possible is probably wide. Why get involved when big dilution is coming even in a positive outcome? RED.

It joined the 99% club today -

Facilities by ADF (LON:ADF)

51.5p (£41m) - FY 12/2023 Results - Paul - AMBER

Facilities by ADF, the leading provider of premium serviced production facilities to the UK film and high-end television industry ("HETV") announces its audited final results for the year ended 31 December 2023 ("FY23").

Main issues/questions from me -

- Impact of US strikes, and recovery from that?

- Streaming boom might have been a one-off?

- Brexit - difficult to cross the channel with kit, visas needed? Any impact?

As you can see from the table below, the Hollywood strikes badly hit forecast for FY 12/2023 in July 2023. Slower than expected recovery also caused a profit warning which Graham covered here on 29/2/2024. Despite the problems, both Graham and I are quite positive on the company fundamentals. This was a sensibly priced and well financed IPO in Jan 2022 from Cenkos (now part of Cavendish). The problems since have been caused by external factors, although you never can be entirely sure if there might be other internal problems too.

I really like the P&L table below, which splits out performance into H1 & H2, to clearly show how it was doing well in H1 (PBT £2.8m) but then was clobbered with a sharp slowdown in H2, plunging into a loss of £(2.2)m due to the Hollywood strikes causing delays to TV productions.

This table also neatly reconciles adj EBITDA £7.4m down to PBT of only £0.6m. I am really growing to despise EBITDA. The main item is the hefty £5.0m depreciation charge, since ADF is renting out large items of physical equipment, so the capital cost of those cannot simply be ignored, and of course they wear out and have to be replaced over time, which is what the depreciation charges try to account for.

Similarly with finance costs, those are real world cash outflows, so cannot just be ignored.

Overall then with a loss-making H2, 2023 as a whole wasn’t much above breakeven.

Obviously the hope is that in future, it might be able to annualise the £2.8m H1 profit, so perhaps c.£5-6m might be a sensible ballpark future target for PBT?

Webinar - there’s an IMC webinar tomorrow (Tues 30/4/2024) at 10:30. They put the wrong date in the RNS. I find these webinars wonderful, it’s great to see many companies connecting with us in this way.

Outlook - it seems to be taking time for things to improve, so I’d say we’re being prepared for lacklustre H1 results in due course -

Balance sheet - looks reasonable at c.£19m NTAV.

Most of the assets are leased, rather than owned outright - which is much better than having large bank borrowings, and the worry of having to meet covenants.

Paul’s opinion - this looks OK. We should see a gradual return to more normal business, by 2025. I don’t see enough scaleable upside here to excite me though. Probably priced about right? So I’ll go with AMBER, and that’s already factoring in the likely improvement in profits by 2025. It’s an OK business I think, but I suspect it might struggle to meet 2024 broker forecast of £5.0m adj PBT, given the hardly scintillating outlook comments. So I’m happy to sit on the sidelines, as I think there’s a medium risk of another profit warning here.

If it succeeds in achieving £8.0m adj PBT forecast for FY 12/2025, which is 8.8p EPS, then I suspect the shares would have good upside, maybe to something like 75-100p in a bull market? Tricky one, we’ll just have to wait to see what happens, my crystal ball is a bit foggy today!

Actually not a bad track record as a listed share, considering the pandemic, small caps bear market, energy crisis and Hollywood strikes -

Graham’s Section:

Camellia (LON:CAM)

Down 3% to £44.80 (£124m) -Final Results - Graham - GREEN

This is primarily an agricultural group, with its core products being Tea, Nuts & Fruits. But it also owns an unusual collection of other assets (property, insurance investments and an engineering company), for reasons that are difficult to understand.

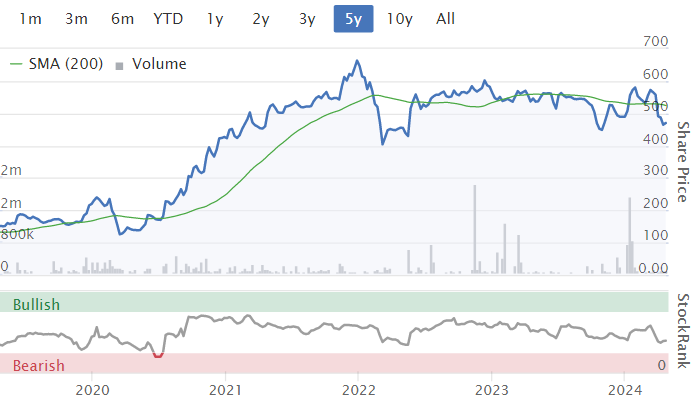

I think it’s fair to say at this point that the unusual capital allocation hasn’t been successful. Camellia’s share price hasn’t progressed over the years (it doesn’t really matter what timeframe you use for the chart):

Last June, the market was excited by the news of a disposal (and I turned GREEN on the stock), but the excitement was short-lived as the deal still hasn't been completed yet.

However, the situation remains fluid as a programme of non-core disposals continues. More on that in a minute.

Here are the headlines from today’s full-year results.

Difficult conditions in key agriculture markets impact 2023 performance; continue to focus on our primary agricultural businesses and investment to diversify activities by crop and location

2023 was a tough year:

Revenue down 8% to £272m

Trading loss for agriculture £5.6m (LY: trading profit £15.5m)

Tea production rose but “tea prices significantly lower and wage costs were up in all regions resulting in a £9.8m fall in profit”.

There was also a £5.8m fall in profits from macadamia, offset by a £2.6m increase in profits from avocados.

Overall operating loss across the entire Camellia group £1.3m.

This figure includes some positive exceptional items. The “adjusted” operating loss, which excludes exceptional items, is much larger at £18.1m.

Net cash was £22m at the end of the year.

Balance sheet showed net assets of £326m for Camellia shareholders.

Outlook is “challenging”:

…revenues are expected to be above 2023 but with a significantly higher adjusted loss before tax. This reflects the effect of continuing low tea prices, lower macadamia and soya crop volumes, lower cereal pricing, the consequence of strengthening of the Kenya shilling as well as the as yet unclear impact of the Red Sea crisis on shipping times and therefore on avocado exports.

CEO comment: reiterates that tea is oversupplied. The other commodity prices don’t seem to be helping much, either. He finishes by saying:

...The Board recognises that the Company's financial performance falls short of shareholder expectations and is working with the Group companies to identify potential operational improvements, and actively examining the long term risks and opportunities for the Company more broadly. Despite the outlook, our substantial cash resources, our investment portfolio and limited gearing mean we are well placed to withstand these difficult market conditions."

Graham’s view

I think I would now classify this as a special situation, rather than a value play.

Last June, the major announcement from Camellia was the sale of a stake in an insurance company for $96m (£76m). This would transform Camellia’s balance sheet and allow for a share buyback: this was a key reason that I was positive on Camellia’s stock last year.

The problem is that this sale hasn't been completed yet. It appears that the insurance company might not be too keen on Camellia’s plan.

In an announcement last month, Camellia explained that the insurance company (“BF&M”) first of all created a poison pill, a device whose purpose typically is to prevent a change of ownership.

After that, the insurance company entered into a complicated partnership with a 3rd party. The result of all of this is:

As previously communicated, these developments have impacted the anticipated timetable for regulatory approvals for the Sale. While a number of the required regulatory and tax approvals have been forthcoming, some key approvals remain outstanding which we now expect in Q2 2024.

In today’s results, the auditors say in relation to the planned disposal:

There is a risk that the sale is not highly probable, and that the sale will not complete within one year from June 2023.

On the balance of probabilities, I think that the sale of BF&M is still more likely than not to go ahead, although it’s not a sure thing.

The Camellia Board today say that they still intend to consider a share buy-back, “subject to the sale of BF&M completing, and the Group's balance sheet permitting”.

Overall, I continue to view this as an interesting value play.They have made progress in disposing of non-core assets over the past year. Although I wouldn’t say they are acting with a great deal of urgency: they still own an engineering company, a portfolio of listed equities, another insurance company investment, and various investment properties.

The listed equities, in particular, could be sold very quickly and the funds returned to shareholders.

But with a market cap of only 38% of balance sheet net assets (almost entirely tangible), and with the sale of BF&M still, I think, likely to go ahead at some point this year, I feel obliged to leave my GREEN stance unchanged here. However as is the case with many value stocks - and value traps! - the time required to see value realised may prove to be a source of frustration.

DP Poland (LON:DPP)

Up 5% to 11.4p (£105m) - Trading Update - Graham - AMBER

DP Poland, the operator of Domino's pizza stores and restaurants across Poland and Croatia, is pleased to announce a trading update for Q1 2024.

This is a positive update, with key points:

Full-year EBITDA for 2023 in line with expectations.

Q1 2024 like-for-like system sales up 17.9% year-on-year.

Q1 2024 like-for-like orders up 14.8%, thereby driving most of the increased sales.

Non-delivery and delivery sales are both up by similar amounts.

The CEO is bullish:

After almost two years since the adoption of a High Volume Mentality across all operations, we have transformed the Polish business into one of the fastest growing Domino's markets globally. Momentum in the business is very strong and we are in an excellent position to drive Company expansion.

The plan is “to deliver 200 stores by the end of 2026 and transition the business towards a franchise led model”.

Note: as of the most recent interim results (to June 2023), they had 116 stores.

Graham’s view

As regular readers will know, I greatly approve of the franchise business model. However, despite the company’s plans to transition towards a franchise-led model, it may take some time for the company to get there.

According to the recent fundraising announcement, out of the company’s total store portfolio of 116, only 8 were franchised.

Therefore, even if they grew exclusively using franchise stores, they would still operate most of their own stores when they hit the 200-store milestone.

Their actual plan, again going back to that fundraising announcement, is:

DP Poland is targeting 45% of its store network to be franchised by the end of 2026. DP Poland expects the majority of the new openings to be corporate stores with the additional openings of 5-10 franchised stores.

Therefore, I can’t see DPP as a franchise-led business for the foreseeable future. Maybe by 2027-2028?

Remember that its own corporate stores have been loss-making for a long time. Hopefully the situation can improve with increased scale?

Domino's Pizza (LON:DOM) invested £11m in DPP in the most recent fundraise. That’s peanuts for them, but surely they must have done due diligence on the plans?

Estimates from Singer suggest the company will make a small adj. PBT this year (<£1m) before making £2.9m next year, and on an improving trend from there.

Normally I give this one the thumbs down, but I agree with Paul that it’s more reasonable to be AMBER in these circumstances. There are signs of life.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.