Good morning from Roland and Graham!

Today's report is now finished (10am).

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Roland's Section

Tracsis (LON:TRCS)

- Share price: 895p (pre-open)

- Market cap: £267m

“Unchanged expectations for the full year”

This company provides software and related services for the rail industry in the UK and North America. Tracsis is an AIM success story that’s four-bagged over the last 10 years and 20-bagged since its 2007 listing.

It’s not such a small business anymore, though, so I’m interested to see if the growth rates and profitability seen in the past can be maintained.

Today’s half-year results cover the six months to 31 January and appear to show solid growth in both revenue and profit:

Revenue: 34% to £39.2m

Adjusted EBITDA: +21% to £7.5m

Statutory pre-tax profit: +76% to £2.3m

Interim dividend: +11% to 1p per share

Net cash: £17.0m (July 2022: £17.2m)

It’s probably worth pointing out that last year’s pre-tax profit was depressed by various acquisition-related costs, so the increase in EBITDA is probably more representative of the underlying growth rate here.

Operating update: Tracsis has two main operating divisions. Both appear to be performing quite well:

Rail operations and planning (revenue +43% to £7.6m): this provides software solutions to help with staffing and operational planning. Around 20% of UK rail journeys are said to be supported by the company’s flagship TRACS Enterprise system.

A new deployment of TRACS went live with a UK train operator in January, but these large projects are typically quite lumpy and the next full TRACS go-live is not expected until the next financial year.

Digital Railway & Infrastructure (revenue +76% to £8.8m): this division is primarily involved with remote monitoring of railway network equipment and other safety and risk management services.

UK sales are linked to the five-year investment cycles (control periods) of the UK rail network. The company has “several large contracts” for the supply of RCM equipment through to the end of the current control period in March 2024. Visibility beyond that appears to be more limited, but my impression is that Tracsis is quite well embedded in this market.

In North America, demand for RCM products is said to be increasing, with new orders from an existing customer and a number of new customer trials underway.

Balance sheet & cash flow: free cash flow for the first half of the year was less than £0.5m due to a £4.7m increase in working capital and a c.£1m payment of contingent consideration for a previous acquisition.

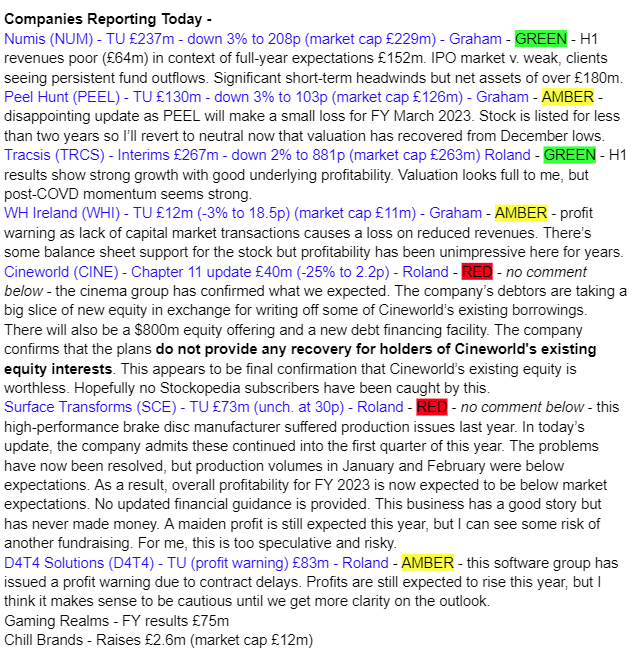

However, the company says this reflects normal seasonal trading patterns. Stockopedia’s data reflects this, confirming that the business is normally more cash generative in the second half of the year:

Tracsis’s net cash position continues to provide a strong underpinning for its growth. However, I note that the balance sheet shows nearly £9m of contingent consideration for past acquisitions, of which £8.1m is due in the next 12 months. So perhaps we should adjust down the true net cash position, slightly.

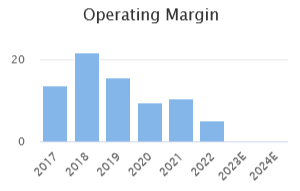

Profitability: One point that’s probably worth making is that the company’s acquisitive business model has depressed its reported profitability in recent years.

This has happened because each acquisition has typically included a proportion of intangible assets (software, brands, customer lists). These are booked on the balance sheet and then gradually amortised (written off), resulting in a corresponding deduction from profits.

These amortisation charges are non-cash today, but they reflect capital allocated to acquisitions in the past. I think they’re worth considering to understand the success of past capital allocation decisions, but they don’t affect the free cash flow of the business today.

Adjusting out these amortisation charges gives Tracsis a trailing 12-month operating margin of around 15%, by my calculation. That’s significantly above the 9% figure suggested by statutory operating profits.

Outlook: management says that Q3 has started strongly and that full-year expectations are unchanged.

There’s an updated broker note from finnCap available on Research Tree this morning. Earnings forecasts for the current year have edged up from 37.1p to 37.3p per share. That’s broadly in line with Stockpedia’s consensus estimates of 36.6p.

These numbers put the stock on an adjusted forecast P/E of 24x for the year ending 31 July 2023.

My view: Tracsis’s acquisitive business model appears to have worked well to drive growth and create new expansion opportunities.

I’d like to do further research to understand the profitability and growth profile of the different businesses within the group. But on balance, my view on this stock remains positive.

In terms of valuation, I’d probably be more comfortable with a P/E of under 20x earnings. The shares first reached their current level nearly two years ago and have made limited progress since then.

However, taking a longer view, Tracsis has been an admirable investment for patient investors. My guess is that this could remain true.

D4t4 Solutions (LON:D4T4)

- Share price: 173p (-16.5% at 09.00)

- Market cap: £69m

Today’s trading update from this AIM-listed data solutions provider is unfortunately a profit warning.

D4T4 Solutions’ products are used to help companies to manage and extract insights from their customer data.

Checking back in the archives, Paul commented in December that H1 results were not very good, showing a £1.3m loss. However, the company’s results had historically had a strong H2 weighting, so this wasn’t necessarily a problem.

Contract delays: The company says that it’s encountered delays signing two contracts. One of these is with an existing banking customer, while the other is with a new customer for the company’s Celebrus system.

My guess is this may be the same contract wins announced here in November, but I should stress this is only an assumption.

D4T4’s financial year ended on 31 March, so this clearly came down to the wire.

Trading update: management says that annual recurring revenue from software and related services is expected to have risen by 14% to £16m during the year just ended. I’d imagine this should drive an increase in profit margins, although this isn’t explicitly confirmed.

The company says new wins during the second half of the year included a bank in Spain, a US healthcare organisation and an Asian insurer. A “key upsell” was also secured with a US bank client.

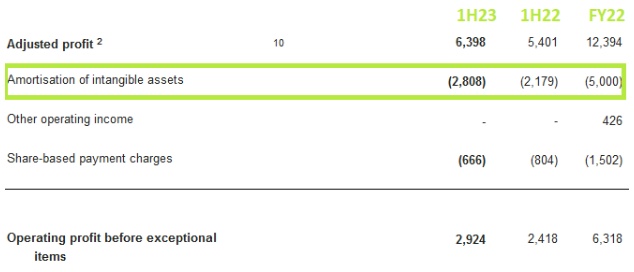

Revised guidance: Helpfully, the company has provided clear guidance on the financial impact of these contract delays:

FY23 Revenue: £21.5m (FY22, £24.5m, previous forecasts: £28.1m)

FY23 adjusted pre-tax profit: £3.5m (FY22: £3.3m, previous forecasts: £4.2m)

While D4T4 still looks set to deliver double-digit profit margins this year, we can see that profit growth this year is likely to be fairly minimal, compared to previous expectations.

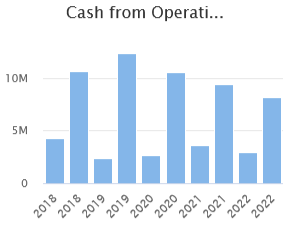

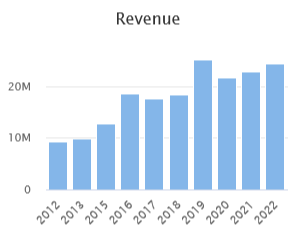

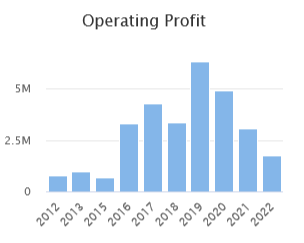

My view: I’ve always had a fairly positive view of this business, which has a long track record of revenue growth and (mostly) double-digit profit margins:

However, profitability has weakened over the last couple of years. Management said last year that this was due to a temporary increase in sales of low-margin third-party products.

This mix was expected to improve in FY23, so I’ll be interested to see how margins have improved over the last year, perhaps driven by the higher recurring revenues.

By my estimate, today’s profit warning has left D4T4 shares trading on c.22x FY23 earnings. That seems high enough to me for now. Profit warnings often travel in company, so I’d like to see the company’s FY23 results and get some visibility on the outlook FY24 before forming a more detailed judgement.

Graham's Section

Numis (LON:NUM)

- Share price: 208p (-3%)

- Market cap: £229m

Numis is one of the higher-quality investment banks I cover. This morning. it gives us an update for H1 (the period to March 2023).

Revenue will be c. £64m, which is 14% below H1 last year.

This doesn’t sound very good in the context of full-year revenue expectations of £152m. To hit expectations, they would need to generate £88m in the second half.

Let’s check performance at each of their divisions:

1. Investment Banking

In the first half we have continued to build on the successful diversification of our UK investment banking business…

In line with the broader industry, capital markets revenues will be materially lower than the comparative period. Whilst our ECM market share in the UK has increased relative to FY22, overall market levels of issuance remain at historic lows.

Numis has broadened the scope of its investment banking activities, to help shield itself from the volatile UK stock market fundraising cycle. Unfortunately, it sounds like the volatility in this division is still at an uncomfortably high level.

2. Equities

Numis has expanded its EU-focused activities and reports that its European client base continues to grow.

Back at home, domestic funds saw “persistent fund outflows” during H1:

As a result, institutional income was lower than the comparative period and our trading profit was flat over the last two months of the half year as market conditions remained challenging.

Outlook

Numis is positive on the flow of advisory work for its investment banking business, but it doesn’t see any meaningful improvement in IPO activity during this financial year.

My view

This update doesn’t read very well to me and I don’t think other investors will like it much, either.

I still think Numis is a high-quality operation and referring back to my previous notes, the company had net assets (that were nearly 100% tangible) of £185m as of September 2022.

That’s very significant asset backing at the current market cap. I will retain my positive view on the stock, which I initiated at 183p and which is based on my view that the current conditions in the equity market can’t last forever. However, there’s no denying that the short-term headwinds are significant.

Peel Hunt (LON:PEEL)

- Share price: 103p (-3%)

- Market cap: £126m

I warmed to this stock in December 2022, after it published reasonable H1 results.

Now we have a full-year trading update (FY March 2023).

Revenues are £82m (FY 2022: £131m), with “capital markets activity at historic lows” throughout the year.

Investment banking revenue will be much lower than the prior year.

Trade execution revenue is also down year-on-year “due to lower market volumes”.

Research revenue is “resilient” although is also likely to be down by a few percentage points compared to the prior year.

I’m disappointed to read that the company is going to make a full-year loss, even if it’s only a symbolic one. Ideally, I like to see a breakeven performance achieved even in terrible years:

Administrative expenses increased following our IPO, as expected, and we have continued to face inflationary cost pressures. Notwithstanding actions taken to rationalise costs, we expect the business will now be marginally loss making for the full year against market expectations of broadly break even.

Strategy - more clients added from the FTSE-350 and like Numis, they are diversifying their investment banking activities. They are also expanding to Copenhagen.

Their retail fundraising platform Rex has been relaunched as Retailbook, a standalone business, and the website looks promising to me.

Outlook:

We have seen a gradual improvement in our pipeline having been mandated across all Investment Banking products during the last few weeks. However, execution risk remains high in light of continuing negative macroeconomic news, most notably the recent bail out of a number of banking institutions on both sides of the Atlantic.

My view

I previously estimated that Peel Hunt’s balance sheet was worth about £90m. When the market cap was around there, I was happy to take the view that it offered investors a value opportunity.

At these slightly higher levels, I’m on the fence between Green and Amber, and I think I’ll stick with a neutral view. My main reason is that unlike Numis, Peel Hunt doesn’t yet have a proven track record of earning profits and dividends for its stock market investors. As a smaller business without such a long track record, it seems a riskier bet.

WH Ireland (LON:WHI)

- Share price: 18.5p (-3%)

- Market cap: £11m

This small wealth manager and investment bank also provides an update for FY March 2023. It makes it clear that this is a profit warning:

The Group continued to be impacted by market conditions throughout the second half of its financial year and accordingly trading is now below previous management expectations.

Revenue is £26m (prior year: £32m) and there will be an underlying pre-tax loss of £2.2m (prior year: underlying PBT of £1.4m).

The reason is the same as for the companies discussed above: “the widely reported lack of transaction activity across capital markets”. The number of retained clients is unchanged.

In wealth management, AUM remains impressive at £1.5 billion (last year: £1.6 billion).

My view

I don’t have a strong view on this one - it seems to offer a decent service to its wealth management clients, but it hasn’t done enough over the years to suggest that its stock is worth buying:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.