Good morning, it's Paul & Roland here today. Welcome back Roland!

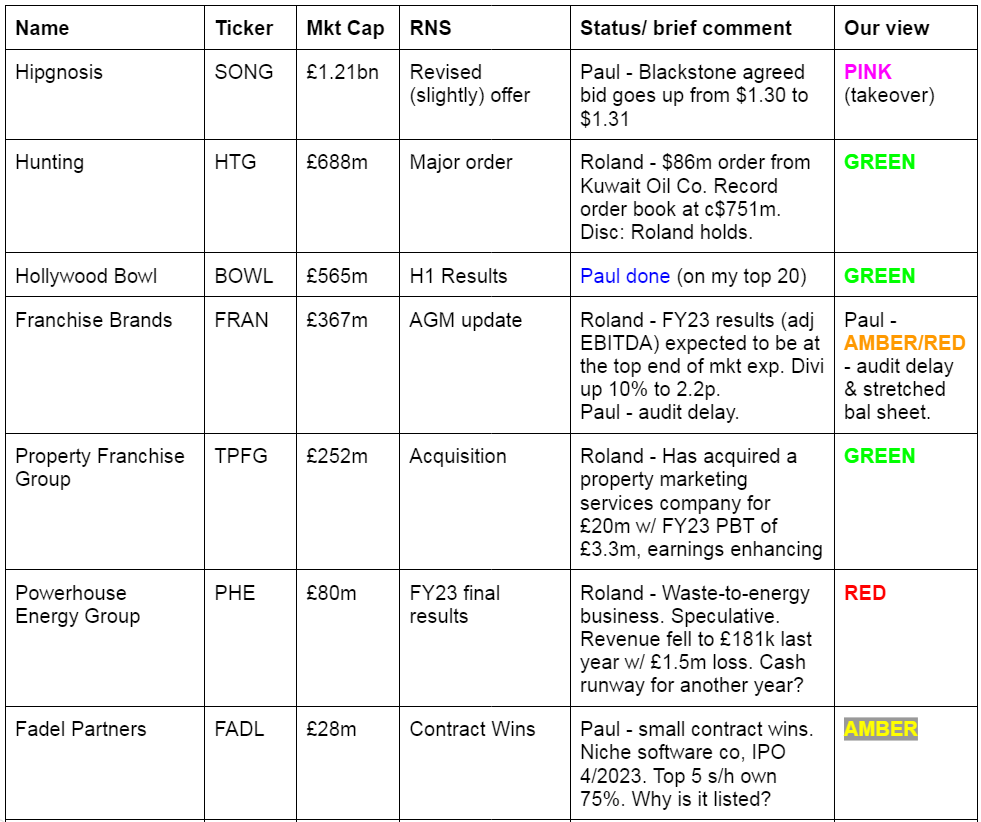

That's it for today! 3 main sections for the things we found most interesting, and then loads of brief comments on everything else. I've tweaked the format again, so hopefully that goes down well, including our colour-coding in the list of companies reporting. Let me know either way.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Companies Reporting

Quick comments & Movers

Treatt (LON:TET) - new CEO David Shannon appointed today.

hVIVO (LON:HVO) - signed £2.5m contract with mid-sized pharma. Most revenue to be recognised in FY 12/2025. Interesting detail. Says its new Canary Wharf facility is largest of its type in world, and about to open. No change to forecasts, but "gives a little more clarity" to FY 12/2025 revenues (per Cavendish), on top of existing "good visibility". We like HVO here, and have been GREEN on it multiple times this year & last.

ImmuPharma (LON:IMM) - up 17% to 2.5p (£11m) - Disposal - Paul - No colour (too speculative)

IMM has raised £1.5m from selling shares all its 9.9m shares in Aquis-listed Incanthera (OFEX:INC) (which have risen in the last 6 months from 6.3p to 18.6p). I looked at Incanthera a few weeks ago, and it’s an interesting-sounding story, of major orders from a large client, which it claims keep being increased, and will see Incanthera into profitability. As Incanthera has been a zero revenues jam tomorrow company to date, punters in its shares are taking an all-or-nothing binary bet on management telling the complete truth, as there are no historical numbers to rely on, and on nothing going wrong. Good luck with it!

IMM itself has a bit more cash to play with now, and also retains 7.3m warrants in INC (exercise price of 9.5p is in the money now, expiry 6/9/2024)

See our archive here for two previous mentions of IMM in Mar 2024. I did have a brief dabble in this share myself, and made a bob or two as a fun punt only, but don’t currently hold. As previously, I don’t think we can sensibly give either IMM or INC a colour code, as both are too speculative.

Summaries

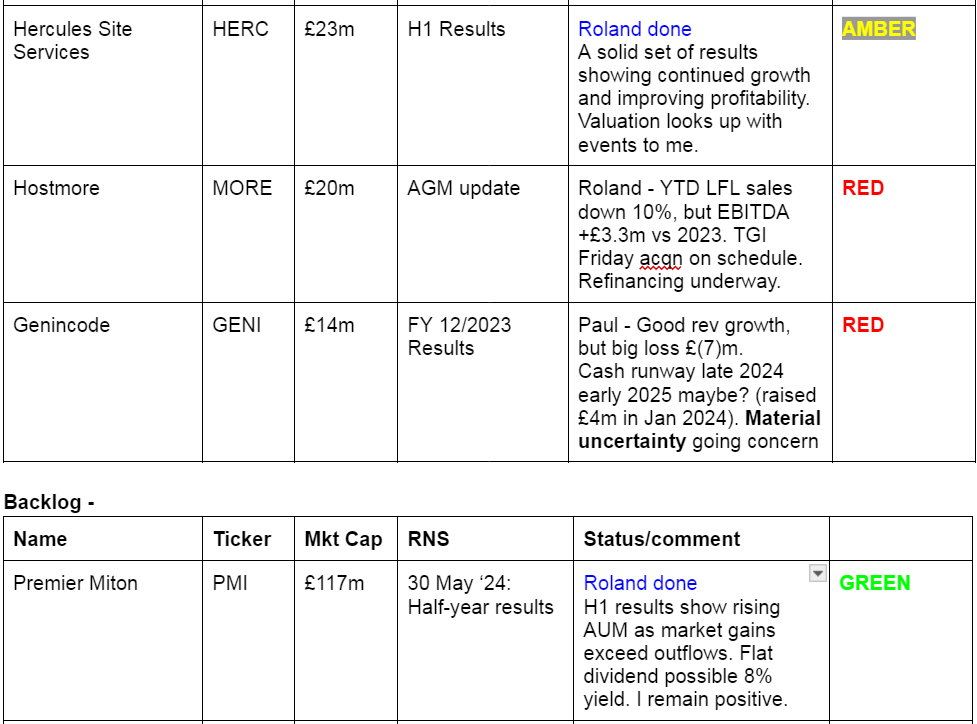

Hercules Site Services (LON:HERC) - up 4% to 38p (£24m) - 23/24 interim results - Roland - AMBER

This construction manpower specialist has delivered solid growth over the last year. Both profitability and cash generation appear to have improved and I’m more positive about this business than I was a year ago. The valuation looks up with events to me, for now, but I think Hercules could be worth watching.

Hollywood Bowl (LON:BOWL) - up 3% tp 344p (£587m) - H1 Results - Paul - GREEN

Profit and divi both rise in H1, and we get an in line with expectations full year outlook. Balance sheet and cashflow are both fine. I wobbled with the last (annoyingly vague) trading update, but seeing these numbers and reassuring update, makes me reinstate it to fully GREEN! A smashing self-funding roll-out of a successful leisure format, that is also paying decent divis along the way.

Premier Miton (LON:PMI) - up 2% to 74p (£117m) - 23/24 interim results (30 May ‘24) - Roland - GREEN

This small-cap fund management specialist has seen assets under management return to growth as market gains outweigh continued net outflows. Fee margins remain under pressure but net cash of £30m helps underpin the dividend and the valuation looks undemanding to me. I remain positive.

Paul’s Section:

Hollywood Bowl (LON:BOWL)

Up 3% tp 344p (£587m) - H1 Results - Paul - GREEN

This is the UK’s largest operator of 10-pin bowling centres. Also a smaller, but growing operation in Canada. We’ve been positive about this share here for a while, as it’s a lovely cash generative business that has a proven ability to self-fund expansion into new sites, refurbs, whilst at the same time paying decent divis.

Checking our previous notes -

18/12/2023 - 285p - GREEN - I positively reviewed its FY 9/2023 results, in line with previously raised forecasts, and found nothing I could fault.

16/4/2024 - 333p - AMBER/GREEN - I moderated my positive view slightly, due to an unclear TU, and share price looking up with events.

Turning to the latest news, interim results for the 6 months to 31 March 2024 - I’ve highlighted the most important numbers (to me) below. I find EBITDA numbers now so unreliable, that I tend to ignore them. Pre-IFRS 16 EBITDA has some use, but post IFRS 16 EBITDA is completely meaningless, as much of the rental operating costs by-pass it.

Adj PBT is fine, providing the adjustments are sensible (which I think they are here).

Profit (and divis) are still moving in the right direction, upwards, as you can see below -

UK (71 sites) LFL revenue growth was less than I would have expected, at only +1.3% - that’s not good when its wages costs will have risen by c.10% vs last year (LY). Much better 8.0% LFL revenue growth in Canada (11 sites).

Note that finance costs of £5.9m nearly all relates to leases. Finance income is £1.0m (interest on bank balances, which confirms it usually operates in a cash surplus position), and only £100k interest on bank borrowings. So it doesn’t really use, or need the bank facility I would argue. Although maybe there might be blips where it briefly goes overdrawn due to timing of supplier payment runs, VAT, payroll, etc? Anyway I always like to check finance income/charges to make sure it ties in with the reported balance sheet snapshot of cash/debt, which it does here, everything looks fine (see note 5).

There are two outlook sections, here are both -

I see the ridiculously vague “profitable growth” buzz phrase has found its way into the second outlook section above, albeit with a comma. All this actually means is that they expect to remain profitable - I would hope so! It doesn’t mean profits will grow. This doesn’t fool anyone, and it irritates the hell out of me every time I see it. “Profitable growth” does not mean profits are going to grow, it’s a deception that I wouldn’t expect to hear from a quality company like this.

On the positive side, I am pleased to see it specifically state above that trading is in line with expectations. Board/market are interchangeable really, but market expectations is better, with a footnote to say what it is. Communications at BOWL is not very good, there’s always something that gets up my goat every time I report on BOWL. It’s a pity to see own goals, but doesn’t alter the investing case, so let’s move on.

Broker forecasts - I can’t find any detailed notes, which is another gap in BOWL’s communications. All small to mid caps need to make sure that broker notes get out to private investors, as we create the liquidity and set the share price! Such an obvious oversight, which is all too often the case I’m afraid.

The consensus graph below shows that 7 brokers cover it, none of whom let us see their notes. So only for the privileged to get access to information that will have obviously been guided by the company itself.

Current year FY 9/2024 is 21.8p, giving us a PER of 15.8x which strikes me as a reasonable valuation for a cash-generative, self-funding roll-out. We’ve had a disposable income squeeze on consumers, which has now more recently reversed, as inflation has dropped to only 2.4%, and average wages are rising well above that. Therefore I think this could be an interesting time for leisure companies to possibly start beating forecasts as households relax the purse strings.

Also, think about the big gross margins that BOWL achieves. Of its £119m H1 revenue, direct cost of sales was only £19.8m, giving a ludicrously high gross margin of 83%. So even a small rise in revenues mostly drops through to the bottom line. Although it would probably have to employ more staff to deal with significantly increased customer numbers.

For this reason, I think there could be significant potential upside on the forecasts.

Balance sheet - NAV £151m, less intangibles of £94m, gives NTAV of £57m. That’s not huge, but it’s ample for this business model, since current assets contains little in receivables or inventories. The big numbers are fixed assets (the fit-outs of all the sites) of £91m, and lease entries - which show a surprising negative net liability of £44m. I got into trouble before with another company XPF, for assuming that negative lease entries means it has loss-making sites, which management strenuously denied. The shortfall there was claimed to be due to rent-free and reverse premium incentives from landlords being netted off. Lease accounting is complicated, so all I would say is that if management at BOWL do a webinar, it would be worth asking the question why there is a £44m deficit on all the lease entries, and does this mean they have some problem, loss-making individual sites? Even good retail/leisure operators would normally have a few loss-making sites, so that is quite normal. The question then is what are they doing about it, and can they exit problem leases?

In all other respects the balance sheet is fine, and includes £41m in cash (with no interest-bearing borrowings).

Cashflow statement - we have to manually adjust these, to make commercial sense, given that IFRS 16 stupidly puts some of the property rental costs into financing activities, thus overstating the cash generation above that line. Adjusting the figures, I get to £32m post-tax cash generation in H1. This was spent as follows: £7.5m acquisition of 3 subsidiaries (Lincoln Bowl, Woodlawn Bowl Inc, and Lucky 9 Bowling). Then there was £15.5m in conventional capex (which will be for new sites, and refurbs), and £19.4m in dividends paid in H1. With a few other small items, that adds up to an £11m cash outflow in H1, which is why the cash pile reduced from £52m to £41m in H1. I’m not concerned by this, as the big cash outflows are almost all discretionary items (divis, capex, etc), not a sign of any underlying malaise. Also there’s ample cash remaining. Still it’s good to check these things, and the very useful cashflow statements are often overlooked by many investors, which is a mistake I think, as cashflows often show reality a lot better than easily manipulated P&L statements in my opinion.

Paul’s opinion - seeing the figures in full has renewed my confidence in BOWL. It’s such a good business, and will continue growing organically with each new site it opens.

I think the valuation stacks up on existing forecasts, looking probably about right. However, I suspect there could be good, highly operationally geared upside to the forecasts as consumer disposable incomes are now rising well above inflation. The GfK consumer confidence numbers are also strikingly better than a year ago, as I mentioned in my podcast over the weekend.

Therefore, whilst BOWL looks priced about right, I suspect there could be (can’t be certain of course), a decent probability that BOWL might start to out-perform the existing forecasts as 2024 progresses. If that’s what happens, then progress for this share could be driven by ahead of expectations updates maybe. With an 83% gross margin, the profit numbers could really fly - eg a 10% increase in LFL revenues would add £9.9m extra gross profit. Even if it had to increase centre staff by 10%, that would still be a £7.9m increase in gross profit, which would drop through to roughly a 25% increase in PBT (profit before tax). Those are only my rough numbers of course.

Put all this together, and the potential for a private equity takeover offer, and I’m moving back up again to GREEN.

Roland’s Section:

Hercules Site Services (LON:HERC)

+4% to 38p (£24m) - 23/24 interim results - Roland - AMBER

Confidence we will match market expectations for the whole of FY2024

Hercules Site Services is a construction and manpower group that floated in early 2022 and was founded in 2008 by CEO Brusk Korkmaz, who remains a 66% shareholder.

I covered last year’s half-year results in June 2023, when I was cautious about cash consumption and low margins. Since then the shares have round-tripped and are now unchanged from when I last covered them.

However, the business appears to have expanded significantly over this period. Hercules’ StockRank has also improved, as the chart above highlights – when I looked at the shares a year ago, they scored 16/100. Today, the StockRank is a more promising 88/100.

I’m curious to see if an opportunity may be emerging here.

H1 24 financial highlights: These figures cover the six months to 31 March 2024. Hercules’ results are typically weighted to the second half of the year, but these numbers seem to show good momentum. Management are confident the group is on track to hit full-year expectations.

Revenue up 32% to £48.8m

Gross profit up 21% to £8.1m

Pre-tax profit of £0.2m (H1 2023: -£0.2m)

Free cash flow of £2.3m (H1 2023: -£1.5m)

Net debt ex. leases : £4.3m (H1 2023: £6.1m)

Interim dividend held at 0.6p per share

Cash generation and profitability appears to have improved versus the first half of last year.

To allow for the second-half weighting I’ve calculated trailing 12-month figures for profitability. My sums suggest a TTM operating margin of 2.8% and TTM ROCE of 13.3%.

Low margins are typical in staffing and recruitment businesses, but both figures show an improving post-IPO trend:

Operational highlights: Hercules is still very much in growth mode. So far this year, the company has opened up a new Rail contracting division and has launched its Construction Academy. This initiative aims to work in partnership with education and business to train new generations of construction workers.

Hercules also made its first ever acquisition in November, buying Future Build Recruitment for £1.25m. Management describe this as a white collar recruitment company operating in the UK construction sector. Future Build is expected to be complementary to Hercules’ existing blue collar business (this is how the company describes it).

Relying too heavily on acquisitions for growth is always a risk, but organic growth still seems quite strong.

Management says that Labour supply to HS2 Phase 1 (Northern Section) increased to 450 operatives at the end of March, up from 400 one year ago.

The new Rail division is said to have “started well” with “steady growth continuing”.

Meanwhile, labour supply to other sites has increased to 550 operatives at 31 March, from 500 one year ago.

Various new contract frameworks have been secured, but for me the highlight is the company’s first contract in the nuclear industry, at Sizewell C. This power station project is apparently expected to be in construction for up to 20 years with an estimated cost of £30bn.

I see nuclear power as important going forward, so I think securing a reputation in this industry could be valuable, long term. Renew Holdings (LON:RNWH) is one example of a construction/engineering group that’s done very well by specialising in areas such as nuclear and rail.

Outlook: management sound confident in the outlook this year and full-year guidance has been left unchanged:

The opening of the construction academy, the steady growth in the new rail business, as well the development of the commercial possibilities from Future Build, all give us confidence we will match market expectations for the whole of FY2024.

However, Hercules’ profits are actually expected to dip this year before returning to growth in FY25. This is due to the drag from the setup of the new Rail and Construction Academy divisions.

An updated note from Cavendish on Research Tree today leaves FY24 adjusted earnings per share at 1.1p, down from 1.27p per share in FY23.

Interestingly, the dividend is expected to rise to 1.9p per share this year (FY23: 1.8m), at a cost of about £1.2m.

To me, the dividend looks like it may be covered by free cash flow but not earnings. So it may be more affordable than it first appears.

These forecasts put Hercules on 34 times FY24 forecast earnings, albeit with a useful 5% dividend yield.

Roland’s view: My normal reservations about this sector remain – low margins and the potential for losses on big contracts. However, financial performance seems to have improved over the last year and I am encouraged by progress.

The growth focus on infrastructure as well as general construction makes sense to me and will hopefully help to create a business that is more differentiated and less exposed to cyclical downturns.

One point I’d make is that much as I like dividends personally, I would argue that Hercules’s payout seems a little generous, given its lack of earnings support.

Given the growth focus of the business I would prefer to see a focus on eliminating bank borrowings and paying a reduced dividend. But perhaps this payout is a sign of the group’s owner management – CEO Brusk Korkmaz is in line to take home two-thirds of any dividend payout.

On balance, I don’t see any fundamental problems, but I think the shares are up with events for now. So I’ll go AMBER.

Premier Miton (LON:PMI)

+2% to 74p (£117m) - 23/24 half-year results (30 May ‘24) - Roland - GREEN

we are encouraged that shorter term investment performance is on an improving trend as market breadth improves and mid and small cap stocks recover.

As it’s a quiet day for news today, I thought I would circle back to take a look at last week’s half-year results from this well-known small-cap fund manager.

Conditions have been tough for most UK asset managers over the last year. But this comment from CEO Mike O’Shea really highlighted the longer-term scale of the headwinds companies such as PMI have been facing (my bold):

It is estimated that the Investment Association UK equity sectors have now seen net outflows every year since 2015, totalling more than £50 billion, equivalent to almost a quarter of the total 2015 assets under management.

One might argue that the UK asset management sector has clearly not been doing a good job of demonstrating the value it can create for investors. Or perhaps domestic asset managers have simply been the victim of wider macro and structural trends, such as US tech growth and the shift to passive funds.

To be fair, O’Shea also acknowledges these points directly in his comments:

Looking forwards, it seems logical to us that the demand for savings will continue to grow as investors have to fend for themselves. Active managers such as Premier Miton will definitely have a role to play in managing these savings. To do so, our funds will need to demonstrate that they can add value, over and above the returns from the major indices [...]

Moving on, let’s take a look at the results,

2023/24 half-year results summary: Premier Miton’s half-year results present a mixed picture, in my view. The good news is that assets under management rose, thanks to strong market/investment gains (and an acquisition).

The less good news is that net outflows continued and the company continues to see fee erosion, with profits down sharply.

Total assets under management rose by 9% to £10.7bn during the six months to 31 March. However, this included a £560 contribution from the acquisition of Tellworth Investments in November. Excluding this, AUM rose by 3.4% during the period, as market gains of £937, outweighed net outflows of £486m:

To put these figures in context, Premier Miton’s AUM was £10.8bn at the end of Sept 2023 and £12.6bn at the end of Sept 22.

Net revenue for the half year fell to 14% to £30.1m, with adjusted pre-tax profit down 28% to £5.7m. Amortisation and share-based payment charges meant that reported pre-tax profit fell by 75% to £0.6m.

Premier Miton did report some cost savings during the period, cutting overheads by 8.5% to £24.8m. However, these savings did not outweigh the 15% drop in management fees. This reflects a lower average AUM during the half year than the prior H1 and a reduction in fee margins:

Management say the reduction in fee margin was “primarily” due to a change in business mix, but I suspect there could still be some pricing pressure here, too.

PMI’s fee margins have now fallen from 64.6 basis points (0.646%) in FY22.

Balance sheet/cash: the impact of this lower profitability on the balance sheet seems to have been limited. Net cash was £30.7m at the end of March, down from £31.5m one year earlier.

The group reports an equity value of £120.7m, which is broadly in line with the current market cap. According to Stockopedia, PMI’s average return on equity has been 10.4% since 2019. So a valuation in line with book value seems about right, to me.

However, if profitability does start to recover, I think there’s scope for a significant re-rating here.

Dividend: the group’s strong cash position has allowed management to maintain the interim dividend at 3p per share. If the full-year payout is held at 6p this year, that would give a tempting 8.2% yield.

However, management reiterated that the company’s dividend policy is to payout 50%-65% of adjusted net profit. This slightly cryptic comment was also included:

We will of course consider all relevant circumstances when we decide on the overall level of dividend for this year

Outlook: no specific guidance was provided with the results and I’m not able to access any broker notes for this company.

However, consensus forecasts shown on Stockopedia appear to be unchanged following the results and suggest adjusted earnings could fall by a further 30% to 6.1p per share this year, before starting to recover in FY25.

For what it’s worth, these forecasts also suggest the dividend will be held at 6p, a view I share given the group’s strong cash position.

These estimates put the shares on a P/E of 12, with an 8.2% dividend yield.

Roland’s view: To some extent, Premier Miton is at the mercy of market conditions and external events. The rampant outperformance of US markets over the last few years has meant that even beating UK indices is not necessarily enough to outperform a cheap S&P 500 tracker.

Premier Miton’s performance track record seems a bit mixed to me – the company says that 68% of its funds are above the median investment performance since launch or tenure, down from 76% one year ago.

However, in fairness, even the UK market has been distorted by a few big cap performers (oil, pharma, banks) over the last year or so. For a small-cap specialist like Premier Miton, it’s not been an easy market.

For me, the key point to remember is the operating leverage that fund managers can deliver when they achieve net inflows in a rising market. Profits could rise sharply if this kind of favourable environment reappears.

Of course, there’s the risk that this might not happen.

Personally, I remain positive on UK fund managers generally at current levels and believe Premier Miton probably offers decent value at this level, with useful backing from a cash-rich balance sheet. I’m happy to stay GREEN on this one.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.