Good morning, it's Paul & Graham here. Raring to go, especially as it's daylight again when getting up at 06:30 here in the UK, after the weekend's clock changes - thank goodness everything is updated automatically these days, as it always used to confuse the c*#p out of me in the old days! Disrupting all my pre-recorded video settings, getting up at the wrong time due to forgetting how to change the time on my clock/radio, etc. Although it never made any difference to cooking, as the oven permanently flashes 00:00 all year round.

Lots of profit warnings at the moment, let's see what further horrors this week holds. Or will we get the long-overdue bounce? Who knows.

Graham's YouTube link today (live at 11:30, a recording thereafter)

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

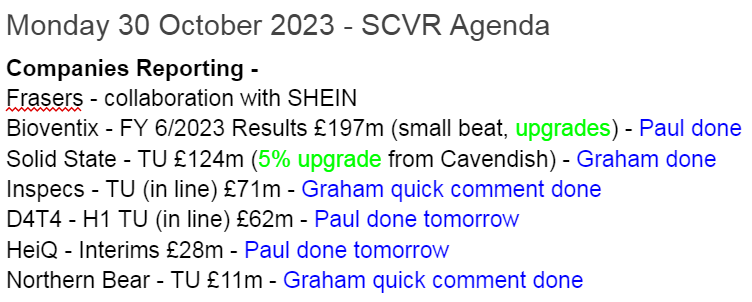

A nice manageable list today, and some decent companies here, so we'll aim to get at least the top 5 done by lunchtime -

Summaries

Solid State (LON:SOLI) - up 7% to 1168p (£132m) - Trading update (ahead) - Graham - GREEN

I’m taking a positive stance on this electronics manufacturer after another positive update. EPS momentum has been great here while the share price has drifted in recent years. Revenue growth is encouraging and debt is minimal. Worth investigating further in my view.

Bioventix (LON:BVXP) - Down 5% to 3,580p (at 11:38) £187m - FY 6/2023 Results - Paul - GREEN

Very impressive numbers. Ultra-high profit margins might eventually attract competition, but BVXP seems to have considerable moats.

Inspecs (LON:SPEC) - Up 7% to 74.6p (market cap £76m) - Q3 Trading Update - Graham - AMBER

Graham posts a quick comment below, on this in line update.

Northern Bear (LON:NTBR) - Unchanged at 56.6p (market cap £11m) - Graham - GREEN

Graham gives a quick comment below on this trading update. Looks cheap.

Paul’s Section:

Bioventix (LON:BVXP)

Down 5% to 3,580p (at 11:38) £187m - FY 6/2023 Results - Paul - GREEN

Bioventix plc (BVXP), a UK company specialising in the development and commercial supply of high-affinity monoclonal antibodies for applications in clinical diagnostics, announces its audited results for the year ended 30 June 2023.

I’ve followed this remarkable company since it listed on AIM in 2014. I have a feeling it was previously listed on a junior market. I can still remember a presentation at Mello when it moved to AIM, and thinking at the time what a remarkable company it was - with an extraordinarily high profit margin (currently 79% PBT margin), due to considerable moats around its products - which take years to develop, and rely on the knowhow of a small group of people working for BVXP, especially Peter Harrison (who has sold some over the years, and reduced now to 6.8%).

The Stockopedia graphs below tell me that the company is in a long-term growth trend still, makes astonishingly high profit margins (moat, pricing power), steamed through covid with barely a blip, enjoys a PER almost always above 20, and pays out almost all profits as dividends - hence little capital required, and plenty of cash generation. These 5 little graphs tell us almost everything we need to know, to determine whether something is worth doing more work on, I find. A great shortcut when looking at hundreds of companies, as we do here -

These are clean, unadjusted numbers, with no funnies in them.

Share options are notable for the lack of greed, £174k FY 6/2023, and £245k FY 6/2022. That’s only 1.7% of PBT for FY 6/2023.

Revenue up 9.4% to £12.8m

Gross margin a remarkable 93.5%

Admin costs very small at only £1.8m - demonstrating that this is a high IP company, operating with few staff, almost on a shoestring really.

PBT £10.1m, a remarkable 79% of revenues! Margins this high often attract competition, but so far anyway, BVXP’s moats seem reassuringly deep.

Diluted EPS is 158.3p (up 8.5%) - PER of 22.6x - at the bottom of the range of PERs that BVXP has generally been valued at (albeit that was during the zero-interest rates era, which fed higher valuations).

Balance sheet - is fine. There’s hardly anything in fixed assets, and I can’t see any capitalisation of development costs, which is nicely conservative.

Receivables are high at £5.8m, but I queried this in the past and am happy with the explanation - that large pharmas are the customers, and report usage stats in arrears to BVXP, so it bills customers several months after period ends. Hence revenues are booked in advance, and cash collected later. If this was a spivvy AIM stock, I’d be very sceptical of high receivables (often a precursor to serious problems). However in this case, BVXP’s track record reassures me that there’s nothing wrong in these numbers, it’s just how the business works, and the cash has always been collected in fine historically, and paid out in generous divis.

Very healthy £5.7m cash pile - more than enough, as the business doesn’t need any cash for anything - it’s just paid out as divis.

Cashflow statement - is gorgeous, and very simple.

A small positive change is the receipt of £101k interest received, compared with almost nothing throughout the zero interest era.

Negligible capex this year (£10.6k) and last year (£11.8k)

New shares issued £139k.

Slightly more than all the cashflow was paid out in divis (£8.4m FY 6/2023, and £7.9m FY 6/2022).

Outlook - this is such a specialised company, that I cannot add anything more than repeating what the company says, and refer you to the broker note (available on Research Tree) -

We are pleased with our financial results for the year which we believe reflect steady growth in the use of our established products and the continued roll-out of the high sensitivity troponin assays.

Excellent technical progress has been made with our research projects and we anticipate that our pipeline of opportunities will create additional shareholder value in the later 2020s and 2030s and we look forward to further progress in the years ahead.

This share has always been a long-term project, and it’s delivered tremendously well to date. Hence why I place a fair deal of reliance on its outlook comments.

I think people need expert knowledge to assess what its future pipeline might be worth, which I don’t have. Or, just trust management.

Forecasts - thanks to Cavendish, via Research Tree, for an update note.

It works on a (slightly) adjusted EPS of 161.6p for FY 6/2023, and has increased (by 2%) FY 6/2023 EPS to 168.4p, growth of 4.2% - although this modest growth is mainly due to absorbing a higher Corp Tax charge. Underlying growth of PBT is forecast at +10.7%

Then 181.5p EPS for FY 6/2025 - a forward PER of 19.7x - fairly expensive for an ordinary company, but this is not an ordinary company.

Paul’s opinion - the main risk I see here is not valuation (which is nearly always at the top end of reasonable), it’s that some unforeseen competitive threat emerges. Bulls point out that designing new products takes great expertise, years, and the volumes are relatively small so not likely to attract any major enterprises. Powerful arguments, but competition could come from some tiny startup that probably wouldn’t even be noticed by anyone until products were launched. Massive profit margins do attract interest in any sector. So that’s worth keeping in mind.

In all other respects, BVTX looks fantastic to me. It’s a buy and hold forever type of specialist company in my view, and you get a healthy dividend yield of almost 4.8% (after today’s 7% fall in share price) to enjoy whilst you wait.

The eventual outcome? Probably a sale of the business, I imagine. How long does key management want to keep running the company, I wonder?

Overall, I think this share appeals considerably, so I’ll go with GREEN (Graham was amber last time, but it’s fallen in share price a bit since then, and we’ve just had good results today, and a small broker upgrade).

Graham’s Section:

Solid State (LON:SOLI)

Share price: 11168p (+7%)

Market cap: £132m

Solid State plc (AIM: SOLI), the specialist value added component supplier and design-in manufacturer of computing, power, and communications products, announces a trading update for the six months ended 30 September 2023.

Some good news here for shareholders, although it’s unlikely to be life-changing good news: Solid State says that FY March 2024 is now expected to be “marginally ahead of current consensus revenue and adjusted PBT expectations”.

The company helpfully names the brokers whose forecasts it is using, and gives us a table of expectations:

Key points from today’s update:

H1 revenues up 48% to £88m, including acquisitions. Organic growth is 35%.

H1 adjusted PBT up 67% to £7m.

The company reports strong demand from security/defence clients, however:

…we are seeing clients move to more normalised levels of stocking because of improving component lead times combined with the higher interest rate environment, resulting in increased customer focus on managing working capital.

The order book has been a talking point here (see SCVR comments in April) as manufacturing supply chain issues saw orders backing up. This has cooled down now and the order book reduces to £99.7m (September 2022: £112m, and March 2023: £120m). It’s more like business as usual now, I think.

Solid State gives us one of the benefits of a smaller order book containing fewer long-term orders:

“the shorter lead times will enable more efficient conversion of the order book into billings”.

Estimates: with thanks to Research Tree, I can confirm the following changes to FY March 2024 forecasts at Cavendish.

Revenue +5.6% to £155.5m

Adjusted PBT +5% to £12.5m

Net debt is forecast to finish the year at £4m (it started the year at £8m)..

They make no changes to FY March 2025 forecasts.

Graham’s view

If you see my comments in April and in Dec 2022, I’ve generally been impressed by this company.

Even after this morning’s 7% rally, it’s still nestled firmly within the range of the past two years:

That’s despite positive earnings forecast momentum, with another upgrade today:

Given the very strong revenue growth figures and the improved balance sheet with debt and deferred consideration being paid, I’ll switch my stance on this from neutral to positive. At a PER of about 13x,I think it might offer enough value at this level to justify a second look.

Quick comments

Inspecs (LON:SPEC)

Up 7% to 74.6p (market cap £76m) - Graham - AMBER

Today’s Q3 update is in line with expectations. Year-to-date revenues are up 4.6% to £159m. At constant currencies, only up 2.4%.

Investors in this eyewear manufacturer can be encouraged that net debt (excluding leases) has fallen £6.4m year-to-date to £21m.

CEO comment -

"All of the Group's major markets are performing as we expected. Construction of our new manufacturing facility in Vietnam is progressing well with completion expected in H1 2024.”

Graham’s view - this one floated in 2020 and has been a difficult stock to hold through a serious profit warning, debt worries, and the loss of its original CEO. Recent interim results gave PBT of £4m on revenues of £111m. Production takes place primarily in China and Italy, with lens manufacturing also taking place in England and a new factory opening soon in Vietnam.

Unfortunately, the underlying quality of the business remains questionable in my view (what IP, if any, do they own?). It might be “cheap” at this level but I would continue to treat the shares cautiously given the mixed track record.

Northern Bear (LON:NTBR)

Unchanged at 56.6p (market cap £11m) - Graham - GREEN

The third trading update in seven weeks from this building services group. It appears to be in line, with a small increase in H1 of this year (period to September) compared to last year. H1 adjusted operating profit should be £1.7m to £1.8m, and today’s update includes a promise that adjusting items will be almost zero.

Outlook

The Group's forward order book remains strong and should support trading performance in the coming months, subject to ongoing uncertainties in the macro-economic climate in which the Group operates.

Graham’s view - the company is trying very hard to convince the market that its shares are underpriced, as the Chairman is currently looking to sell his 25% stake. For what it’s worth, I do think these shares are worth considering at a reasonably clean PER of about 4x and with a balance sheet that should hopefully still be ok after the planned £3m tender offer.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.