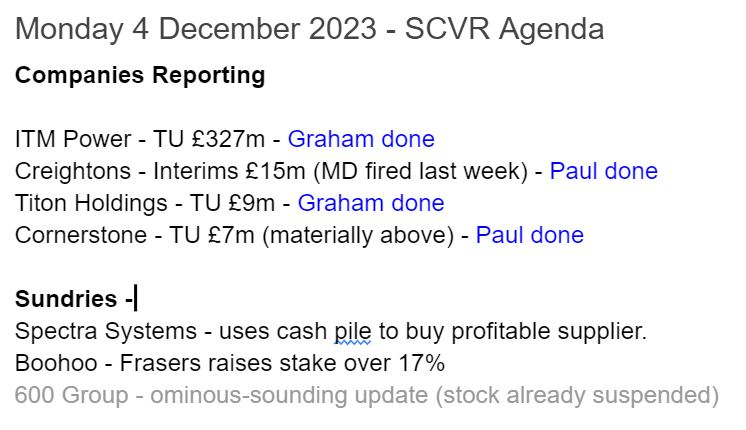

Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Thin pickings today -

Summaries

ITM Power (LON:ITM) - up 8% to 55.5p (£342m) - Trading Update (in line) - Graham - RED

A confident update from this renewable energy company. Expectations for FY April 2024 were very low to begin with, but the company says it does expect to meet those expectations and should finish with £200m (maybe more?) of net cash. But it remains highly speculative.

Creightons (LON:CRL) - 22.5p (pre-market) £15m - Interim Results - Paul - AMBER

H1 results reveal a modest profit and fairly sound balance sheet, so will probably come as a relief to existing holders, after the shock sacking of its long-serving CEO last week. There's still a lot to do, to rebuild to anything near previous levels of profitability. So no strong view either way from me.

Titon Holdings (LON:TON) - unchanged at 80p (£9m) - Trading Update (in line) - Graham - AMBER

This nano-cap provides ventilation systems and window and door hardware. It has a remarkable track record of dividend payments stretching back over 30 years. Current trading is poor, however. I like the story but the underlying quality of the business seems limited.

Cornerstone FS (LON:CSFS) - up 30% to 15p (£9m) - Trading Update - Paul - GREEN

My first look at this tiddler, a payments/forex company. What's interesting, is that a series of out-perform updates have set it up to report a real profit this year, and hence should reduce the risk of a placing to raise more cash, as it looks a bit tight. I like turnarounds, and this looks promising, after its over-priced float flopped in 2021.

Paul’s Section:

Creightons (LON:CRL)

22.5p (pre-market) £15m - Interim Results - Paul - AMBER

Creightons manufactures branded shampoo, conditioners, fake tan, and lots of other products here which are a mystery to most men.

Shares were a stunning, and major multibagger as you can see below on the 10-year chart.

This has unravelled in the last couple of years, with the strong track record of profit growth coming unstuck, blamed on the energy crisis, supply chain constraints and input price increases. Surely there must be more to it than that? Some investors have questioned the acquisitions strategy, which doesn’t seem to have worked.

Most other companies are recovering from these temporary supply chain problems (eg McBride (LON:MCB) ). The abrupt sacking of the long-serving Managing Director last week (who was not thanked) is another signal that something’s not right here.

Although I’m also intrigued as to whether performance could recover back to previous highs, in which case suffering shareholders might have a renewed bull run to look forward to maybe?

As you can see below, profitability has crashed, after a previously good track record. Things are not helped by the fact that Creightons doesn’t get any broker forecasts out to the market, so we’re in the dark. Maybe the new CEO could address that as a first step? Chairman William McIlroy is shown as being Chairman and Chief Executive now.

Interim results - 6 months to 30 Sept 2023.

Revenues - did alright at the larger Private Label division, up 10% to £12.3m, but a large 37% fall at the Contract division saw the total negative 7% to £27.6m group revenues.

Gross profit margin increased to 42.2%, from 40.4% in H1 LY - supply chain problems easing maybe? This is consistent with historic, pre-covid gross margins, which were in a range 39-42%. So further margin increases could be difficult to achieve.

H1 EBITDA of £1.4m and £0.5m pre-exceptional operating profit are both improved but still quite low.

Profit before tax is only £302k, although improved from the £(359)k loss in H1 LY.

Historically, there doesn’t look to be any obvious H1:H2 bias to profitability.

Going concern statement is clean, saying it could survive even in a downside scenario.

Balance sheet - looks OK to me - no evidence I can see of financial distress.

NAV £25.9, less intangibles £13.8m and deferred tax of £2.9m, gives my adj NTAV of £15.0m.

It has £6m of bank borrowings, less £1.7m cash = net bank debt of £4.3m, which seems reasonable. Note that £2.4m of the debt is a mortgage, so there will be an offsetting freehold asset, which makes me much more comfortable about the bank debt. I wonder when the freehold property was last valued? Maybe some upside there?

Inventories £10.4m and receivables £12.5m are tying up a fair bit of working capital.

Cashflow statement - it’s generating enough cash to pay for the modest capex, but there’s nothing left over to pay any divis.

So the business needs a significant improvement in cash generation before it can pay meaningful divis again. This is my main concern with this share.

As you can see above, meaningful divis stopped in the late 1990s, and only returned on a small scale more recently.

New management need to decide if this is a growth company, or if it will focus on paying divis in future (once debt has been repaid, I hope)?

Share options - just to flag that these are excessive. The notes show 68.4m shares in issue, and 9.14m of potential dilution re share options. Personally I don’t like to see anything over 5% in dilution from share options, so this 13.4% is completely over the top, and indicates (former?) management focused on themselves rather than outside shareholders.

Outlook - there’s no separate section, but plucking some forward-looking comments from other sections -

The Branded division has been challenged in the current year. There has been a significant decline in a key export market which has suffered a sharp economic downturn. We anticipate this will start to recover during the second half as orders are starting to flow through again.

As highlighted last year, the Contract side of the business continues to see reductions in order demands. This is due to brands being overstocked and therefore, requiring less manufactured stock during 2023. However, both the Private label and Branded divisions continue to gain momentum.

We remain committed to seeking further cost and overhead reductions and to restoring margin and overall profitability to previous levels…

Once the financial stability has been successfully achieved, the Group's focus will be to pursue new growth opportunities through continuing to invest in research and development, improving manufacturing efficiencies and expanding into new markets.

The margin recovery and pro-active cost reduction measures we have taken will continue to deliver an improved performance in the second half of the year.

Paul’s opinion - I think this depends on whether you’re an existing shareholder (in which case I would be feeling relieved at these numbers, which show the business stabilising), or a potential new shareholder (where I’m not seeing anything much of interest to make me want to get involved).

It sounds like a business that’s not been very well managed, hence why profitability has crashed in the last couple of years, as supply chain problems hit. There’s not a lot of evidence from today’s numbers that these issues have been satisfactorily resolved - despite all the remedial action, H1 profitability is negligible.

So for me, I’m neutral on CRL shares, AMBER. I don’t see any particular downside risk, with an OK balance sheet. Upside might come from new management. But is it a great business? No.

£CSFS

Up 30% to 15p (£9m) - Trading Update - Paul - GREEN

As it’s quiet today, and this share is up 30%, I’ll take a quick look at it (we’ve not covered CSFS before here).

It’s one of many forex/payments companies, which I find difficult to distinguish between, as they all seem to make similar claims about having proprietary tech, offering great customer service, etc.

CSFS floated in April 2021, and predictably has been a poor IPO, losing about 90% of its float value by end 2022, although it's put in a partial recovery this year.

The revenue growth below has been impressive, but that came with heavy historic losses. Note that the lighter blobs below, indicating a move to breakeven, are only broker forecasts, so could be pie-in-the-sky, as they often are at this end of the market.

Reviewing the recent newsflow -

11/7/2023 - Positive TU, expects maiden EBITDA profit. New sales team doing well.

12/9/2023 - InvestorMeetCompany webinar from mgt (recording available).

12/9/2023 - Interim Results - big improvement, now c.breakeven. Cash tight, but claims to have enough. Note £2.2m loan notes. Ahead exps FY.

24/10/2023 - Ahead expectations trading update.

4/12/2023 (today) - another ahead (“materially above”) of expectations update.

The CEO sounds pleased, and I like the use of “operational gearing” -

James Hickman, CEO of Cornerstone, said: "I am pleased to be able to report that we are continuing to experience excellent trading momentum. This reflects the actions that we have taken during the year to enhance our sales team and expand our offer, such as by broadening the range of currencies and countries where we can transact.

With a highly scalable platform, along with careful management of our cost base, we are now benefitting from the operating leverage within our business as the increase in sales is driving even stronger growth in adj. EBITDA. Accordingly, the Board continues to have great confidence in the future of the Group."

Broker update - many thanks to Shore Capital, which issues a nice update today. EBITDA here is actually quite close to PBT (proper profit). It has significantly upped forecast PBT for FY 12/2023, from £0.1m to £0.7m. That’s a very significant upgrade, I think we might have spotted something interesting here - although the market got there first, with a decent rebound in the share price in the last year -

Paul’s opinion - I like turnarounds, and moving from persistent losses into a worthwhile profit this year FY 12/2023, strikes me as very much worthy of more detailed investigation. So I’m flagging it up here, so you can take a more detailed look yourself.

This year’s numbers are assisted from a £200k profit on a dormant subsidiary, but even so, there should be a clean profit this year.

Shareholdings look mainly individuals - management maybe?

Overall, dare I go green, given the weakish cash position? Yes, I think so, as the latest forecasts show it profitable & cash generative now, and we’ve just been told that it’s trading well. So the risk of a placing could be receding. Overall then, although it’s small and illiquid, I’ll push the boat out with GREEN, due to the series of out-perform updates, and a financial position that looks OK now that it’s moved into profit & cash generation. Any views from readers, as it’s a new one for me?

Graham’s Section:

ITM Power (LON:ITM)

Share price: 55.5p (+8%)

Market cap: £342m

The flurry of news updates this morning isn’t too thick, so I’ll take a quick look at the trading update from this one.

ITM Power is not a company I write about or study regularly; here are its headline numbers for recent years:

Losses twenty times larger than revenues don’t usually make for “value” investments!

Company description:

Headquartered in Sheffield, England, ITM Power designs and manufactures electrolysers based on proton exchange membrane (PEM) technology to produce green hydrogen, the only net zero energy gas, using renewable electricity and water.

If you know what any of this means, please let me know. I’ll stick to the financial figures.

Here are the bullet points from today’s H1 trading update:

“Revenue of £7.5m (well on track for full year guidance of £10m-18m)”

Note the very wide range of possible revenues.

“Adjusted EBITDA loss between £22-23.5m (trending well against lower end of full year guidance of £45-55m)”

“Net cash at the end of the first half of the year of £253.7m (against full year guidance of £175-200m), with an outflow in H1 of £28.8m, already reflecting the very early effects of the significant progress against our 12-month plan in H1”

And so:

Given this reassuring performance we confirm our full year guidance.

I agree that the performance seems to be very good, relative to guidance. However, I’m not sure that’s really saying very much!

CEO comment excerpt:

The first 6 months of the financial year from May to October already paint the early picture of a new ITM, surpassing the full year revenue of each of the last two years by about 50% in just the first half of this year. We are pleased with the improvements achieved across all areas of the company, many of which have a positive effect on how we manage cash and scrutinise capital spend.

Graham’s view

I recommend taking a look back at Paul’s comments in August on ITM’s full-year results.

In those results, the company took provisions for “inventory and contract losses”, but still finished the year with inventory of £59m, a remarkable figure given the current rate of revenue generation.

Consensus forecasts suggest that revenues will leap higher in FY April 2025. I would say that revenues need to leap higher very soon, or this inventory balance surely will have to suffer more writedowns?

FY April 2023 results recognised £23m of inventory losses, with the explanation:

The losses originate from continued iterations of product designs during manufacturing, together with some manufactured products being considered obsolete.

More positively, the company will hopefully finish the current financial year with net cash in the region of £200m, or over half the current market cap.

Given the cash balance, this is certainly not a stock that I would consider to be suitable for shorting. So I wouldn’t say that I am outright bearish on this one. But I’ll maintain Paul’s RED stance, as we know from experience that blue sky stocks rarely succeed.

Titon Holdings (LON:TON)

Share price: 80p (unch.)

Market cap: £9m

This is “a leading manufacturer and supplier of ventilation systems and window and door hardware”. It sometimes crops up in discussions among nano-cap investors.

Long-term performance has been mixed:

And I see that Harwood is now a major shareholder:

Today we have an update for FY Sep 2023 and an outlook for FY Sep 2024.

Sep 2023:

Trading in UK and Europe through to the end of FY22/23 surpassed the Group's expectations most recently set out in its interim results on 19 May 2023. However, Titon's South Korean business has reported to the Group a further decline in statutory profitability for FY22/23, due to year-end taxation and other provision adjustments, which will increase the reported FY22/23 Group loss before tax compared to the Board's prior expectations once Titon's share of the losses of the Group's associate, Browntech Sales Co. Ltd, are taken into account.

According to Titon’s investor relations website, the joint venture in Seoul “has captured over 75% of the market share for natural ventilation in the new build market in South Korea”.

The taxation “adjustments” in Korea that have impacted profitability for Titon could really use a fuller explanation. I presume we will get that in the full-year results.

A little bit of digging tells me that corporate tax rates in Korea have in fact been cut this year.

But Titon’s Korean business seems to be loss-making, and so tax cuts wouldn’t help it - and could even hurt its statutory results.

Balance sheet - cash of £2.2m, no debt.

Sep 2024 outlook:

Trading in the UK and Europe in the first two months of FY23/24 has been in line with the Board's expectations. Titon currently expects the UK and European business to report a loss before tax for H1 FY23/24 due to the impact of the decline in new build activity in the construction market on the Group's first quarter trading. However, the Group expects to return to profitability in the UK and Europe from the second quarter of FY23/24.

Titon Korea is expected to remain loss-making in FY23/24 due to the continuing challenging conditions in that market, and the Group is taking steps to progress its plan to streamline the Korean corporate structure and operations.

Not a very encouraging outlook statement, it must be said. But hopefully a realistic one!

New CEO: joining in April 2024.

Graham’s view

I want to like this one but it has been around for a long time and the best that can be said about it is that it’s a steady performer. It doesn’t dilute its shareholders, and it has relatives of its founder on the shareholder register, plus one on the Board (a son). So you would hope and expect to see good continued stewardship of shareholder value.

It also seems that Titon has paid a dividend every year for several decades, which is remarkable for a company of this size. Although the last one (0.5p) was really just a nominal payment to keep the record going, I think.

So yes, I think it’s worth researching this stock, for anyone interested in nano-caps.

However, I’m not sure about the company’s growth prospects and quality. Revenues seem to be stagnant, and margins and returns have been modest. So I’m neutral.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.