Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

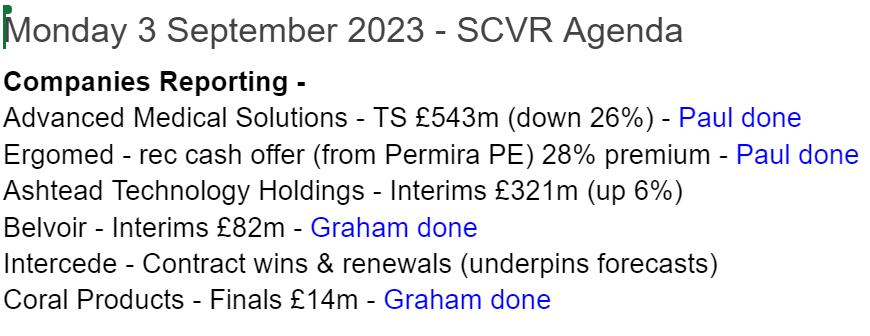

Summaries

Belvoir (LON:BLV) - up 2% to 225p (£84m) - Interim Results (forecasts upgraded) - Graham - GREEN

I’m surprised these are only up by 2% as brokers upgrade EPS forecasts by 7-8%. As usual, lettings income has come to the rescue for Belvoir as the sales market stalls. I’d like faster revenue growth but in these tough conditions I think BLV has demonstrated resilience.

Advanced Medical Solutions (LON:AMS) - down 25% to 185p (£407m) - Trading Statement - Paul - AMBER

This high quality business loses a quarter of its market cap today, with a profit warning. I'm lacking information on it, but have a stab at quantifying the damage below. It looks pricey, but when you adjust out the £82m cash pile (20% of the market cap), things look more interesting. Could be worth a closer look possibly.

Ergomed (LON:ERGO) - up 27% to 1336p (£679m) - Recommended cash offer - Paul - GREEN

Ergomed receives a recommended (by management) 1350p cash offer from private equity firm Permira. I think this looks a fair deal on quite a punchy valuation. The 18% shareholder, founder, Chairman agrees, having accepted the deal. A nice outcome for shareholders, well done to any holders here!

Paul’s Section:

Advanced Medical Solutions (LON:AMS)

Down 25% to 185p (£407m) - Trading Statement - Paul - AMBER

Winsford, UK: Advanced Medical Solutions Group plc (AIM: AMS), the world-leading specialist in tissue-healing technologies, today announces a trading update following recent events that have impacted financial expectations for the year ending 31 December 2023.

Reduced royalty revenues now expected from Organogenesis in USA.

Not able to estimate impact, so have prudently removed all royalties from this customer from forecasts.

Financial impact is a £2m aPBT (adj profit before tax) impact to FY 12/2023 guidance, and £4m aPBT impact in FY 12/2024 and FY 12/2025.

Customer de-stocking will impact 2023 only, for Liquiband. Explanation provided seems muddled to me - I don’t understand why a growth product would see de-stocking?

Revised guidance - clear guidance here, but as with many companies, it doesn’t say what the previous guidance was, which wastes everyone’s time in having to look it up.

Unfortunately, there are no broker notes available on Research Tree, so I’m working with limited information here.

The combined effect of these factors is expected to impact the Group's FY23 financial performance with revenues now anticipated to be approximately £124 - £127 million and adjusted pre-tax profit of approximately £25 - £27 million. Reflecting the Board's confidence, with the exception of the adjustment to the Organogenesis royalty, guidance for future years remains unchanged.

CEO comments suggest this might just be a current year glitch, which if true, could mean we’re getting a buying opportunity maybe? -

Chris Meredith, Chief Executive Officer of AMS, commented: "While the uncertainty in the Organogenesis royalty stream and the higher de-stocking of US LiquiBand® is clearly disappointing, my confidence in AMS's long term growth prospects is stronger than ever. We remain convinced that our new US LiquiBand® partner strategy will drive accelerated growth from early 2024 and that this, in conjunction with other initiatives such as the imminent launch of LiquiBand® Fix8 in the US, will enable AMS to return to strong growth in 2024 and beyond."

Valuation - this is only rough, as I don’t have proper numbers.

An H1 trading update on 11 July indicated that H1 would be revenue of c.£63m, and aPBT c.£13.6m.

Today’s FY guidance says £124-127m revenues, and aPBT £25-27m.

Therefore H2 is implied at £61-64m revenues (very similar to H1’s £63m), and £11.4-13.4m aPBT for H2, a bit below H1.

That doesn’t sound a disaster to me.

Broker consensus is 10.7p adj EPS (from the StockReport here), so my rough figures suggest this might be revised down to c.8-9p EPS (we should see updated broker consensus numbers on the StockReport quite quickly).

AMS shares are currently down 25% to 185p today. That gives a PER of between about 20-23x, based on my guess of 8-9p EPS this year. Is that cheap? No, it’s not. The problem is, AMS is now looking ex-growth, in profit terms. It’s been producing around 9-10p EPS for the last 6 years, excluding a one-off bad year in the pandemic. So why would we value a company with static profits on a PER in the twenties? The risk is that today’s profit warning might be triggering a permanent de-rating of the shares from growth, to value. Which would mean it could have a good bit further to fall.

Or, a more bullish take would be that today is a glitch due to one-off factors, and profit growth might resume in 2024.

Balance sheet - I’ve checked the last one, as at 31 Dec 2022, and can say that it’s a glorious thing to behold. There’s obvious excess capital on the balance sheet, which gives management options re increasing shareholder returns, or making acquisitions. The £82m net cash looks surplus to requirements - given its strong profit margin, and cash generation, I think AMS could operate with a modest overdraft to dip into from time to time, hence it doesn’t need the cash pile at all really. Cash constitutes about 20% of the market cap now, which might catch the eye of a bidder, who could buy the company, using its own cash to part-fund the deal, and then load it up with debt.

Paul’s opinion - if we adjust out the cash, the PER falls to a more palatable level.

It’s undoubtedly a high quality business.

This sector is often attractive for generously priced takeover bids.

Overall then, despite a disappointment today (both factors had already been mentioned in the July update), I’d say this share is now looking potentially interesting, and could be worth a closer look. I’ll go with AMBER, as I can see both bull and bear points here.

Ergomed (LON:ERGO)

Up 27% to 1336p (£679m) - Recommended cash offer - Paul - GREEN

I’m not familiar with this company, as Jack always used to cover it here, and we’ve not looked at it in 2023. Although I have a generally favourable impression of the company, who wouldn’t with a track record like this?! -

Management has agreed it, so the deal should now go to a shareholder vote.

The offer is 1350p in cash, a 28% premium to Friday’s closing price, from Permira, a well-known private equity firm.

Valuation looks quite punchy to me, so I’d say this is a favourable deal for shareholders, eg. -

...implied Ergomed enterprise value multiple of approximately 21.0x its forecast Adjusted EBITDA of £32.4 million (on an IFRS 16 basis) for the year ending 31 December 2023, which the directors of Ergomed believe is highly attractive and at the high end compared to relevant public precedent transactions.

Unusually, there’s an alternative of less cash, 451p, and the balance in (unlisted) shares - which might have been quite a nice option for shareholders who want to remain partially invested in Ergomed, although without the protections of it being a listed company. However, the 5-year lock-in condition makes this less appealing. I'm not sure why this option is being provided, when it seems to have been structured to repel investors, and the advisers decline to say whether it is fair & reasonable!

Note that the founder, who still owns 18%, has agreed to the deal, so I think that confirms the price is fair, and that it’s likely to go through. Although only Amati with 2% has given an undertaking to support the deal. Maybe other institutions are waiting to see if a higher competing offer might appear?

Paul’s opinion - this deal doesn’t look particularly generous when considering the previous share price did peak at more than 1350p previously. Although maybe that valuation was too aggressive in the last bull market? If the founder/major shareholder has agreed it, then I think that tells us it’s a sensible deal. Well done to holders!

There seems a clear trend that private equity buyers are going for structural growth companies, often in medical or software type of sectors, and they’re paying punchy valuations for them. We’re not really seeing much in the way of deals towards the value end of the market.

I see ERGO shares 10-bagged from 2019 to the peak in 2021, so I'm wishing I'd paid some attention to it, this largely slipped through the net here unfortunately. Jack reported positively on ERGO several times, but baulked at the high valuation each time.

Graham’s Section:

Belvoir (LON:BLV)

Share price: 225p (+2%)

Market cap: £84m

Belvoir Group PLC (AIM: BLV), a leading UK property franchise and financial services Group, is pleased to announce its Interim Results for the six months ended 30 June 2023.

This property franchising group tends to get positive reviews at the SCVR. These interim results are as follows:

Revenues +3% to £15.9m. Some moving parts here: acquisitions increased revenues, while the successful franchising out of offices reduced revenues (this is a good thing).

Management service fee (i.e. franchise-related royalty income) +4% to £5.5m, with lettings down and sales up.

Financial services income +11% to £8.6m

Only 4,177 house sales were managed (H1 last year: 4,889) but the lettings portfolio increased to 75,000 (H1 last year: 73,300).

The net result for the period is that PBT gets a 10% increase to £4.4m.

The results are “comfortably in line with management’s expectations”.

Checking the latest note from broker finnCap, I see that full-year forecasts are upgraded: they now expect 2023 EPS of 19.9p (previously 18.4p) and 2024 EPS of 20.8p (previously 19.5p). They also increase the dividend forecast.

Comment by CEO Dorian Gonsalves (emphasis added):

"With 58% of their revenue derived from a strong recurring lettings market, our property franchisees have been able to offset the impact of the reduction in UK housing transactions. Meanwhile our financial advisers are mitigating the lower level of new purchase mortgages by servicing demand for remortgages and other related products from their substantial client banks.

Comment on the housing market: “Whilst the headlines continued to predict doom and gloom for the property sector, the market actually proved to be fairly resilient in the face of the dual headwinds of high inflation and rising interest rates.” He notes that house prices are “fairly stable” (2.3% down on December 2022) and rents continue rising.

But still, there are some bearish factors that can’t be ignored, in my view. In particular, there is the 18% reduction in sale transactions, and the 26% reduction in gross new mortgage lending (both noted by Belvoir today). With the sales market frozen up, it’s a great relief for companies like Belvoir that they can fall back on their lettings income.

Dividend: Belvoir “has reviewed the Group’s dividend policy and intends to increase the proportion of earnings paid to shareholders in future”. Interesting! The interim dividend this year will be 5p (interim dividend last year: 4p).

Outlook statement foresees only another 2% fall in house prices, notes that mortgage interest rates have reduced from their recent highs, and sees continued strong demand from tenants for rental properties. I suppose that estate agents aren’t known for their doom-and-gloom views on real estate!

Balance sheet doesn’t offer much tangible support to the valuation here but the cash position is fine with a small net cash position of £0.4m. A large bank loan has been paid off.

Graham’s view

I liked this company before today, and the valuation hasn’t moved much this year:

So clearly I’ll be inclined to stay positive on it today, after it issues a “comfortably in line” update and its forecasts are raised by the broker!

Its key feature is that it earns high-quality, royalty-like profits from franchisees - a highly lucrative investment theme. The franchisees themselves earn reliable, recurring lettings income and also have the opportunity, when conditions allow them, to earn substantial sales-related income. Financial services revenues should also pick up when bank lending recovers.

Cash flow is excellent, the company’s debts have been paid off, and valuation remains reasonable:

I’m not surprised to see that this share currently enjoys a very high StockRank of 92.

What could go wrong? Belvoir points to increasing regulation of the property market being a reason for landlords to use agents such as themselves. True, but perhaps there is a risk that increasing regulation could ultimately reduce the size of the rental market? And I’m not sure that this would boost the sales market very much, e.g. if owners of second and third homes simply allowed their extended family to live in them instead.

The bottom line is that property is now a more regulated sector; and who knows what regulations might be in 5-10 years, and how this might affect companies like Belvoir?

There are more obvious risk factors too, i.e. interest rates (when will BoE stop raising rates?) and other economic factors.

However, my own investment style is to try to own good companies and to accept that there will be regulatory and economic dangers. Sometimes this pays off, and sometimes it doesn’t. But equities are inherently risky and I don’t think it’s possible to eliminate this entirely. So for me, Belvoir shares definitely get the thumbs up!

Coral Products (LON:CRU)

Share price: 16.5p (+3%)

Market cap: £15m

Coral Products PLC, a specialist in the design, manufacture and supply of injection moulded plastic products based in Wythenshawe, Manchester, announces its audited final results for the year ended 30 April 2023.

We discussed this one in May and last December. It’s a tiny nano-cap, but it has impressed me with the successful (so far) digestion of four acquisitions.

Here are its full-year results to April:

Sales +144% to £35m (in line)

PBT +53% to £2.3m

Basic EPS +87% to 2.6p (ahead of broker forecasts of 2.3p).

April feels like a long time ago, as we are already in September, so I won’t dwell for too long on these historic results.

I have to go into the footnotes to find the net debt position. A key point is that the company finished the year with net debt of £7m (previous year: net cash of nearly £5m). The largest element here is an invoice discounting facility.

After the year-end, it paid out another £1.3m in an acquisition earn-out.

Its liquidity headroom is probably still fine: it has £4.8m of gross cash and perhaps another couple of million in headroom on its banking facility. But I think it’s important to point out the changed position. Reducing its net debt could be an important priority now.

Chairman comment mentions the strong gross cash position, not the net debt:

The four acquisitions completed during the first half of the financial year delivered a significant sales uplift and, have integrated well, adding complementary expertise and products lines. Despite investment in acquisitions and our ongoing capex programme, the Group continues to be highly cash generative and has retained a strong gross cash position. Our objective remains focused on capitalising on our position in the specialists' plastics market where we see significant further opportunity.

The plan is to become “a UK plastics business of scale”

Dividend for the full-year is 1.1p (0.5p interim, 0.6p final), costing around £1m.

Here’s an excerpt from the Outlook statement:

We have planned our business to be flexible, in all areas, to meet fluctuating levels of demand. We have robust financial controls that will ensure we maintain our working capital requirements whilst meeting all our agreed parameters with our financial partners and due to contracts already negotiated all operations will remain relatively unaffected by the current turmoil in energy prices…

We have enjoyed a strong start to our current financial year, and we look forward to a satisfactory outturn for the year given the prevailing conditions.

Graham’s view

I still think that this is an impressive nano-cap, showing decent profitability and shareholder orientation in the form of the dividend. The Chairman owns 7% which I view as a positive sign.

But there are some other important features to be aware of:

Average or low profit margins (gross/profit/net, take your pick!)

In line with most manufacturing companies, the “quality metrics” have never been particularly high.

The company is now significantly indebted and doesn’t acknowledge this in today’s RNS, only in the footnotes.

I won’t be making any changes to my “Amber” view on this share. On balance, the current earnings multiple of 9x seems fair enough to me.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.