Good morning from Paul & Graham!

It looks as if we're in for a bumpy ride, as Bloomberg reports this morning,

"Global Rout Deepens With US Stock Futures, Asia Stocks Plunging"

The Japanese market has fallen around 11% today, and almost 20% in the last 5 days. Bloomberg reckons it's due to high levels of margin trading in Japan, reaching an 18 year high recently. There's also been a sell-off in many other global markets, as I touched on in this weekend's podcast. I'll leave it to others to analyse the reasons, I'm just flagging that we could be in for a bumpy ride here. Personally I'll be ignoring this volatility, as I'm in good stocks, and don't use margin any more, so I can ride out any market volatility.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

Companies Reporting

Very quiet for news today, so we'll have plenty of time to watch our portfolios dropping in real time!

Summaries

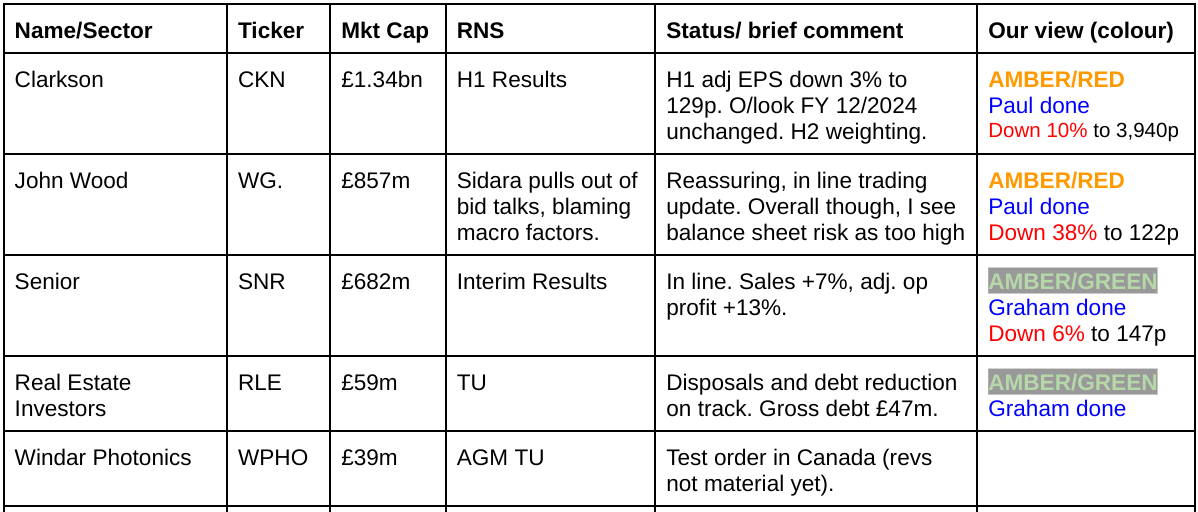

Clarkson (LON:CKN) - 4,370p (pre-market) £1.34bn - Interim Results - Paul - AMBER/RED

H1 numbers are in line, and the outlook sounds confident about hitting the FY 12/2024 forecasts. However, on doing some digging, I refresh my memory on the outrageously generous management and staff remuneration here. This puts me off, so I'm flagging that there are issues here, with a drop to AMBER/RED. The shares could still do well of course, other investors might not be so bothered about this as I am.

Senior (LON:SNR) - down 5% to 150p (£654m) - Interim results - Graham - AMBER/GREEN

Decent results here and full-year expectations are unchanged, although it must be said the outlook is a little cloudy, e.g. due to ongoing 737 MAX difficulties. I’ve upgraded from a neutral stance as the valuation for new investors has improved substantially over the past 18 months. It does remain unclear how the medium-term ROCE target of 13.5% will be achieved.

John Wood (LON:WG.) - down 38% to 122p (£857m) - Bid talks off & trading update - Paul - AMBER/RED

Bid talks are called off by Sidara, which blames macro factors. Whatever the reasons, it's done DD and walked away. Reassuring mini trading update today is in line. I have a recap on the numbers, and dislike the stretched balance sheet, with some nasties in there. So I have to flag the higher risk, but will happily move up once it's de-geared the balance sheet in future, if the turnaround gains traction.

Real Estate Investors (LON:RLE) - up 2% to 34.7p (£58m) - Trading Update - Graham - AMBER/GREEN

This Midlands-focused commercial property investor is pleased with its progress as it seeks to sell down its property portfolio and reduce its debt burden. A sale of the entire portfolio is also possible, according to the most recent full-year results statement in March. I’m intrigued by the discount to NAV on offer here.

Paul's Section:

John Wood (LON:WG.)

Down 38% to 122p (£857m) - Bid talks off & trading update - Paul - AMBER/RED

We’ve been following the bid approach (from Sidara) for Wood, with the timeline so far being -

16/5/2024 - Wood rejects 212p approach from Sidara as undervaluing it.

6/6/2024 - after pressure from shareholders, Wood management agree to allow due diligence on a fresh 230p indicative potential bid from Sidara.

Today’s update -

5/8/2024 - Sidara issues a rule 2.8 statement that it does not intend to bid for Wood. Reason given is -

“Sidara confirms that in light of rising geopolitical risks and financial market uncertainty at this time, Sidara does not intend to make a firm offer for Wood.”

Obviously we don’t know if that’s the real underlying reason, it could just be a face-saving type of announcement, who knows? Maybe they did their due diligence (detailed analysis of the financials & commercials, legals, etc) and decided 230p was too high?

Wood issues its response here - which echoes the Sidara announcement.

It adds the following detail -

“The Board remains confident in Wood's strategic direction and fundamental prospects. As set out in the HY24 trading update on 11 July, the growth strategy continues to deliver, with further growth in EBITDA, margins and order book in the first half.

As we look ahead, we remain focused on delivering our potential, including generating significant free cash flow next year.

We are pleased to reconfirm our outlooks for both this year and 2025.

The Board is grateful for the substantial engagement of its shareholders and the support of its clients and employees throughout this process. The management team looks forward to continuing to deliver against the strategy set out in November 2022.

Wood will publish its half year results on 20 August 2024.”

I find that mini trading update reassuring.

How to value Wood shares? This is the tricky bit! As you can see, performance has been volatile in recent years -

(note the figures above are in US dollars)

Valuing it on a PER basis is tricky, as forecast for FY 12/2024 is 3.1 cents, and FY 12/2025 is a large rise to 13.5 cents. With massive revenues of >$6bn, and low margins, there’s a wide range of potential outcomes re profits. Hence valuation is really tricky.

I don’t have access to any broker notes, so am largely in the dark here.

2023 accounts - I’m having a rummage through last year’s numbers, to get a better feel for things. It’s a very big business, and the accounts look complicated, with large adjustments in 2022 and 2023. Profit all comes from adjustments. There’s also worryingly negative cashflow, leading to debt looking uncomfortably high. Although the position with its unsecured loan notes looks OK, with a big chunk having been repaid from disposal proceeds, and remaining expiries into 2025 and beyond, which looks OK.

The balance sheet puts me off. NTAV was negative $(677)m at 31/12/2023. There are some nasties in there too, eg a $307m liability called “asbestos related litigation” dates from the 1970s or earlier, and is in the US. Remember that liabilities are (usually) estimates of cash outgoings in future. So Wood will need to generate tons of cash in future, just to pay down debt, and clear these onerous legal costs, before it can even think about paying divis. The last divi seems to have been paid in 2018, so this looks like a multi-year problem company.

Paul’s opinion - there’s too much risk here, with a lousy, overly geared balance sheet, and the hefty legal claims provision. So for me, it has to be AMBER/RED, due to elevated risks. However, I can also see that, if the turnaround actions gather pace and cause an operationally geared increase in profits, then this share could fly.

Since I don’t know what the outcome will be, I don’t want to get involved. One for sector specialists I suspect, rather than generalists like me.

Sidara walking away doesn't help.

Clarkson (LON:CKN)

4,370p (pre-market) £1.34bn - Interim Results - Paul - AMBER/RED

Clarkson PLC ('Clarksons') is the world's leading provider of integrated shipping services. From offices in 24 countries on six continents, we play a vital intermediary role in the movement of the majority of commodities around the world.

Shares have had a very good bull run this year, but I suspect we’re likely to see a sharp sell-off this week, due to adverse stock market conditions, and results that are only in line.

Shares had a fantastic run from Oct 2023 to last week - is this sustainable though?

My main worry with Clarkson is that its performance dramatically improved when the pandemic kicked in. The big question being, how much of this (and why?) is a permanent improvement in business performance, or is it temporary due to all the disruption to supply chains, which is still ongoing (lots of companies we cover are mentioning delays and extra costs linked to the Red Sea) -

Hence the only question that needs answering with Clarkson, is whether higher profits are sustainable?

The company’s summary shows H1 profits slightly down on LY, but FY 12/2024 outlook unchanged -

Note that adjustments to profitability are only small in both this year, and last year comparative.

Broker update - thanks go to Panmure Liberum for an update this morning. It sounds pretty upbeat, and emphasises that an H2 weighting is normal seasonality for Clarkson.

Forecast is 277p for FY 12/2024, barely changed from the previous year. 2025 and 2026 are in a similar ballpark, so there doesn’t seem to be any expectation of further earnings growth.

I see that shares are down c.10% to 3,930p at the time of writing (08:32), which makes sense to me, giving a PER of 14.2x - I can’t see any reason to pay more than that, given that it seems to have gone ex-growth. With possibly a risk that earnings might actually fall eventually, once global shipping returns to normal?

That said, shares were rated at roughly 16.5x on Friday, and are now usefully cheaper, so some might see this as a buying opportunity. Also note that the trajectory of broker consensus has been upwards -

Dividends - nothing to write home about, with a forecast yield c.2.5%.

Although the message that this is the 22nd consecutive year of divi increases is a powerful one.

Outlook - nice and clear, and sounds confident -

Andi Case, Chief Executive Officer, commented:

"I am immensely proud of everyone within the Clarksons team for delivering this strong set of results for the first half of 2024. The profile and further development of the forward order book, level of new business being transacted and pipeline for the second half, means that we have confidence that we will be second half weighted and deliver full year results in line with the Board's expectations. This confidence has enabled the Board to increase the interim dividend by 2p to 32p, continuing the progressive dividend policy into the 22nd year.

Balance sheet - is strong with NAV at £468m. This includes £180m intangible assets, so NTAV is £288m. That supports about 21% of the market cap, so useful, but this share is mainly about earnings, not assets.

Director & employee pay - I think we’ve discussed here before - for whose benefit is Clarkson run?

It seems to me that the answer is very clear - it’s run mainly to benefit Directors and staff. See this table below for the Directors remuneration from the 2023 annual report - they take astronomical remuneration, similar to the entire dividends paid out (hence the low divi yield) -

I also flag up last year’s cashflow statement, which shows £28.3m total divis paid to shareholders, which is dwarfed by the £49.5m cash spent on buying shares for the ESOP!

Note that higher up the cashflow statement it reveals that £58.7m was expensed through the P&L in 2023 for staff bonuses. The figure was even higher in 2022, at £88.8m!

These figures are absolutely outrageous in my opinion, and rule out this share as an investment for me.

I suppose a more bullish view would say that the business is far more profitable and cash generative than the headline numbers suggest, but the money is being diverted to employees rather than shareholders.

Another eye-opener from the 2023 annual report is note 19, where it gives the breakdown of trade creditors - look below at the money owed to employees in unpaid bonuses of £237.7m! If these are bonuses which have been accrued for, then a good question to ask management is when this £237m is going to be paid out?

The key point here being that the cash pile of £276m at 30/6/2024 would presumably largely disappear if the accrued bonuses were paid out in cash. Hence if you’re valuing CKN on an enterprise value basis, you’re probably significantly over-valuing the shares.

Paul’s opinion - I’ve previously been positive about CKN shares, because it has performed so well in the last few years.

However, refreshing my memory about its outrageously generous employee remuneration has really put me off.

In reality most of the profit made ends up with the employees, not the shareholders. The cash pile effectively belongs to employees too. On top of that, I don’t know if it can keep growing profits, or if it’s been boosted by the disruption to global shipping.

Putting it all together, I need to flag that there are significant issues here, hence I’m lowering it to AMBER/RED.

You might not be concerned about the issues I’ve flagged, and look how well the shares have done, so it doesn’t necessarily follow that these issues will harm the share price. It’s my job to flag up accounting issues, and you can then decide how you view them, armed with the facts.

These numbers do look crazy to me though, in terms of the rewards flowing to staff, and very little to shareholders.

hVIVO (LON:HVO)

It will be interesting to see if the mainstream media report on this, because it doesn't fit their doom & gloom agenda about how awful the UK is.

"HVO has announced the proposed cancellation of its shares on the Euronext Growth market. The company has noted that its primary operations, majority of employees and main investor base are in the UK and it makes sense to consolidate trading of its stock via the primary AIM listing. There are associated costs and duplication of activities involved with maintaining dual listings, and these will be removed."

(excerpt of a note from Cavendish)

Graham’s Section:

Real Estate Investors (LON:RLE)

Up 2% to 34.7p (£58m) - Trading Update - Graham - AMBER/GREEN

On a quiet day for company news, let’s cover this one for the first time:

Real Estate Investors Plc (AIM:RLE), the UK's only Midlands-focused Real Estate Investment Trust (REIT), with a portfolio of commercial property across all sectors, is pleased to provide the following trading update, ahead of the announcement of its Interim Results on 23 September 2024.

Key points:

£12m of planned disposals year-to-date, either completed or conditionally exchanged.

Further strong sales pipeline expected to complete in H2.

Debt: £7m of debt repaid year-to-date. Strategy is to prioritise debt repayment. Total drawn debt reduced to £47m (year-end 2023: £54m).

Average cost of debt 6.5%.

Rents: annualised rental income reduces to £10m (year end 2023: £11m) due to disposals and vacant possession needed to sell assets.

Occupancy at 84% could improve with new lettings and the disposal of vacant assets.

Q1 dividend reduces to 0.5p (Q1 2023: 0.625p)/

CEO comment extracts:

"We are pleased with the performance of the business year-to-date and remain on track with our strategy to make targeted sales to private investors and special purchasers during 2024, repaying debt with the proceeds…

Sentiment so far in the second half of the year has been positive with business confidence in our region growing by 15 points since the result of the election in July. We believe the recent 0.25% interest rate reduction, announced by the Bank of England last week, will further enhance confidence and support a return to more normalised investment market conditions that will allow us to start to sell our larger assets, utilising funds more rapidly to eliminate our debt with a view to then returning surplus capital to our shareholders.

Graham’s view

I’m not sure what to make of this one yet. The Dec 2023 balance sheet showed total assets of £156m (including properties of £143m) and net assets, after all liabilities, of £96m. That’s a significant premium to the current market cap of £58m.

Recent asset disposals have been slightly above their balance sheet values, which tends to give some reassurance that balance sheet values may be accurate.

Strategically, the Board has decided that paying down the debt should be the priority, and are “open to a corporate transaction that is in the best interest of shareholders”, which could include selling the whole portfolio.

This is a very small company by REIT standards and I’m inclined to think that a disposal of the entire portfolio to a larger REIT could make sense.

That transaction would hopefully be closer to NAV than to the current market cap, giving shareholders an uplift.

On the other hand, if RLE succeeds in selling down its portfolio and reducing debt, without taking any large discounts to balance sheet values, then perhaps it can prove that it deserves to trade closer to par without needing to sell the entire portfolio?

Net tangible assets per share, according to the Dec 2023 results, were 54.9p. If that number is still approximately right, it provides an opportunity of well over 50% from the current share price.

And with interest rates moving in a more favourable direction, maybe it won’t be so difficult to offload more properties?

I’ll tentatively go AMBER/GREEN on this one, but more research is needed.

Senior (LON:SNR)

Down 5% to 150p (£654m) - Interim results - Graham - AMBER/GREEN

A reassuring headline for Senior’s investors:

Robust results, full-year expectations unchanged

Key bullet points from the results table (all growth figures are given at constant exchange rates)::

Revenue +7% to £501m

Adj. operating profit +13% to £25m

Adj. PBT +8% to £18m

Other key points:

Return on Capital Employed (as calculated by the company) increases from 6.3% to 7.3%.

“Book-to bill” ratio is 1.15, meaning that orders are coming in faster than they are being fulfilled.

Interim Dividend is increased by 25%.

Net debt increases by £24m to £156m (excluding leases). Free cash flow was held back by growth in inventories and receivables, and higher capex. On top of that, Senior then had to fund deferred consideration (defcon) for a prior acquisition, £7m of dividends and £3m of share purchases for employees.

Net debt to EBITDA is 1.8x, up from 1.6x six months earlier.

CEO comment snippets:

Our Aerospace revenue and profits have grown strongly notwithstanding 737 MAX volumes being subdued as a consequence of the ongoing situation at Boeing.

Our Flexonics Division continued to perform well, maintaining double digit margins, albeit revenues and profits were lower as land vehicle markets started to normalise and upstream oil & gas customers reduced inventory levels.

For the full-year we still expect to maintain good performance in Flexonics with H1 slightly higher than H2 due to a return to more typical levels of land vehicle demand.

Some additional commentary on the 737 MAX follows later. In short, businesses within Senior were planning for higher build rates of this aircraft and are awaiting clarity on levels of future production, but they do have production schedules agreed for the time being.

Adjustments to the results: while there is nice growth in H1 adj. operating profit, this is only possible with the help of adjustments. In particular, there are £2.6m of “site relocation costs” that are adjusted out. Without the adjustments, H1 operating profit slightly decreased.

Outlook: Aerospace performance in H2 should be higher than H1, thanks to “sensible schedules” agreed with Boeing and other customers. Flexonics is the opposite, with H1 slightly higher than H2. “Overall, the Board’s expectations of good growth for the Group in 2024 are unchanged”.

Graham’s view

It’s been a while since I covered this stock (see last year’s report). The main difference since then is that the forward PE multiple has improved for prospective investors:

The forward PE multiple is now about 15x, versus 25x when I covered it last! While protracted weakness in the share price has played a part in this, the main reason is higher forecast profits over the next year:

I was neutral on Senior early last year. One major gripe I’ve had with the company has been its low ROCE over the years: it had in general failed to achieve a ROCE of over 10%, even in good times. It has a target ROCE of 13.5% that it has been working towards “over the medium term”.

As noted above, the latest ROCE measurement from the company is 7.3%.

Here is today’s update on its progress with this metric.

We understand the importance of considered and effective capital deployment towards maximising shareholder value creation. The Group has a medium-term pre-tax ROCE target of at least 13.5% on a post IFRS 16 basis. Our strategy of expanding Senior's high-quality fluid conveyance and thermal management businesses remains a priority. We have a rigorous appraisal process to evaluate the business case of all significant investments.

The Group actively reviews its overall portfolio of operating businesses and evaluates them in terms of their strategic fit in order to grow returns, maximise Group operating efficiency and optimise value for shareholders.

We continue to progress strategic options for our Aerostructures business including the potential divestment of the business. Within the period, revenue in Aerostructures grew strongly by 16% from £121.9m to £141.2m on a constant currency basis. We have secured notable new contract awards and important contract renewals bringing pricing up-to-date from various customers, with multiple ongoing discussions regarding attractive new business opportunities.

So perhaps a disposal or even a set of disposals is how the company will achieve higher ROCE?

I’m happy to upgrade my stance on this one to AMBER/GREEN as the valuation has become more interesting and at the end of the day, I still view this as a high-class aerospace & defence group. But it seems that it does still need to figure out how it can achieve sustainably high returns for investors.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.