Good morning! Graham is taking a well-deserved break this week, so I'm delighted to welcome back Roland, who I am sure you agree, produces superb work.

Podcast for last week went up on Saturday, and is available on all good podcasting services (and some bad ones), just search for "Paul Scott small caps", that should locate it. I'm really pleased with the listener numbers, which are growing nicely, so it's well worth me continuing with these, and I do enjoy making them too. It's almost like a confessional box, or a therapy session right now, given how awful everything is! But markets always recover, the only question is the timing.

Today we should have a new Prime Minister announced at 12:30, with (according to press reports) an oven ready, and major, package of measures to address the energy crisis also due to be announced this week. Let's hope so, as the price of inaction would be far worse, I reckon. Germany has just announced a big package of energy support measures I see, so that's clearly the way things are going. Let's hope support comes in enough size, and quickly enough, to save the many small businesses now on the brink. Not to mention households worried sick by the potential escalation in utility bills.

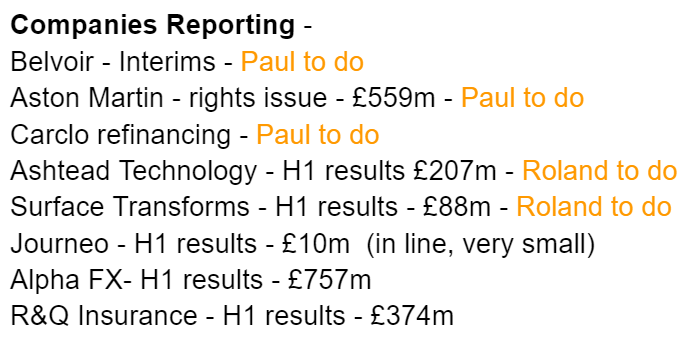

Agenda - here is our initial schedule for today, as usual it's subject to change, based on any additional news, and big price movers, etc. Do bear in mind we can't cover everything, so we try to focus on things that look the most interesting -

Paul's Section:

Belvoir (LON:BLV) - a firm favourite here at the SCVR, as a value/GARP share. Today's interims are in line with expectations, and a strong pipeline reinforces management expectations for the full year. Balance sheet is not great, but the recurring revenues from being a mostly franchise lettings business, means that I'm not worried. Cashflow is used to pay a 4% yield, and fund acquisitions. I believe the current price is a good buying opportunity for long-term investors seeking an income, and inflation protection (since lettings revenues follow rents upwards).

Joules (LON:JOUL) [no section below] - the Sunday Times ran an article yesterday, saying that the largest trade credit insurer has withdrawn cover. For anyone unfamiliar, this is insurance which pays out to suppliers, if a customer goes bust leaving unpaid invoices. We've discussed this a lot in the past. Trade credit insurance is very important, as it can often be on a larger scale than all the bank debt (try comparing trade creditors, with bank debt, to see what I mean). There are ways to get around withdrawal of trade credit insurance, but it adds to Joules' cashflow pressure, and means the clock is ticking to refinance with fresh equity. I no longer hold JOUL shares, as the risk went above what I was prepared to tolerate.

ASOS (LON:ASC) [no section below] - is now back into small cap territory for our purposes here of under £700m, other people define it differently (as is Boohoo (LON:BOO) which I hold). The Sunday Times says the Asos is steering analysts towards the lower end of its guidance range. Not something that sits very well with the rules which require all investors to be told at the same time how trading is going. I was expecting online retailers to start reporting less bad news, because they've now lapped the prior year comparatives that were boosted by the pandemic. Although the cost of living squeeze might now have overwhelmed that theory? Still, share prices have been smashed to pieces for online retail, so how much more bad news can there be, before bidders start to circle and take them private?

£AML I cast my eye over the deeply discounted rights issue. A deep discount doesn't matter with a rights issue, as all existing holders can either participate, or sell their rights for a short period of time in the market. Whilst welcome, this deal doesn't solve AML's debt problem, I see it as a (large) sticking plaster. Another fundraising is likely to be needed, in my view. Upside potential? Could be seriously good, if AML is able to scale up, and reach self-funding cashflow position, but at the moment it's too small.

Roland's Section:

Surface Transforms (LON:SCE) - an encouraging set of half-year results from this firm, which makes ceramic brake discs for high-performance cars. Volume production is ramping up and recent order flow appears to support a confident medium-term view on profits. However, I’m wary of the risk of further delays and cost overruns, given the current macro environment.

Ashtead Technology Holdings (LON:AT.) - this recent IPO is a specialist equipment rental provider serving the offshore energy market. Profitability looks good and growth is being supported by roll-up acquisitions. There also seems to be plenty of potential to expand into renewables. However, I’d like to understand more about organic growth and cyclical risks before going any further. One to watch.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul's Section

Belvoir (LON:BLV)

225p - mkt cap £84m (pre market open)

Belvoir Group PLC (AIM: BLV), a leading UK property franchise and financial services Group, is pleased to announce its Interim Results for the six months ended 30 June 2022.

Company headline -

Growth strategy remains on track

This is one of our favourite value or GARP (growth at reasonable price) small caps. Why? BLV has reliable revenue/profits (as demonstrated during the pandemic), a sensible growth strategy, is reasonably priced (lowish PER), pays good & growing divis, plus management come across as grounded, experienced, honest, and are not greedy with the share options.

In a higher inflationary environment, a lettings business should do well as rents go up, so investors here shouldn’t have to worry about inflation eroding their equity, over the long-term.

There’s a webinar on InvestorMeetCompany today at 16:30.

To refresh our memories, I covered the H1 trading update (which was in line with expectations) here on 1 August 2022, so we shouldn’t get any surprises today.

I’ve been through the interim accounts, here are my notes -

H1 revenues £15.4m (+1% underlying and +11% from acquisitions)

Key point - revenues are 60% recurring (from lettings), so this is a lot less cyclical than we might imagine for an estate agent.

Last year H1 results were boosted by the dash to meet Stamp Duty deadline, a factor we already knew, and baked into the forecasts.

Hence PBT being down H1 2022 is no surprise, being £4.0m vs £4.77m H1 LY.

Admin costs up 29%, due to acquisitions & costs normalising after the pandemic Govt support.

H1 profitability is in line with expectations.

H1 basic EPS was 8.7p - there are no adjustments because it looks as if goodwill (and similar relating to acquisitions) are not amortised, or not much anyway, as the cashflow statement shows a total depreciation & amortisation charge of only £491k in H1 (see note 6).

Diluted EPS is 8.5p, so note the pleasingly modest potential dilution from share options. P&L charges for share options are also small, showing I think that management are far from greedy, unlike so many other listed companies!

Note that profit margins are very high, because this is mainly a franchise business. So the revenues & costs mostly go through the books of the franchisees. Hence BLV revenues look modest, because this will just be the fees it charges to franchisees. Hence it’s a red herring for people to question why BLV has such a high profit margin.

Energy costs - I can’t see anything in the commentary, but being a mainly franchised business, this shouldn’t be BLV’s problem in any case.

Interim divi flat at 4.0p, which is consistent with an expected 9.0p full year payout, as the final divi is usually a more than the interim divi, in the last couple of years.

Outlook - strong pipeline of sales & mortgages - so it confirms full year expectations. Jolly good! I think we can rely on management outlook comments here, due to a reliable track record, and the recurring nature of most revenues.

Shortage of properties for sale & to let is ongoing (hence why personally, I am not expecting any significant/prolonged drop in house prices, which seems to be the opposite view of the entire UK press! But I’d rather get my information from companies, than the sensationalism of the press).

Rents - a very interesting point, saying that rents are currently 30.2% of renters gross salaries. This has remained roughly static for last 4 years, so arguably rents still fairly affordable for most people? What would that be in net income? Maybe getting on for half of net incomes? Which is quite a lot, thinking about it more.

Higher rents are encouraging landlords to invest (quite surprising, as press reports have been saying the regulatory & tax attacks on landlords are leading to many selling their BTL properties).

Mortgage advisory work - lower house sales, but fees are being helped by larger mortgages, due to higher house prices, and an increase in remortgages as people dash to lock in attractive fixed rates Also helped by removal of Govt affordability test.

Balance sheet - bear in mind that this is not an asset-backed share. It’s more about solid, dependable profits & cashflows. NAV is £35.4m, but intangible assets (acquisition related) keeps growing, and is now £37.8m. So NTAV slightly negative, at £(2.4)m. Not ideal, but given the cashflows, that doesn’t worry me.

Bank debt of £8.3m is shown in current liabilities, following this through to note 8 discloses that £7.87m is repayable in March 2023. However, the company already has most of the cash on hand to repay it, and says HSBC are supportive of providing fresh loans if required. So this is not a concern, given the cash generative nature of the business. Hence I don’t see any reason to worry about the modest overall level of net debt.

Note the very low level of lease liabilities, because things like that will mainly be in the books of the franchisees, keeping BLV’s capital base very low.

Cashflow statement is straightforward - this is a reliable cash generative business, which is used to pay divis, and fund acquisitions. That’s it!

My opinion - I see it’s down 10p today, probably because people weren’t paying attention to the guidance that H1 would be softer against exceptional prior year comparatives. There’s nothing to concern me in the numbers or outlook, which sound good actually.

At 215p currently (mid-price), I think that’s an attractive entry price.

Full year forecast for FY 12/2022 is 20.2p (it looks like Finncap make some small adjustments, not sure what those are?), hence the PER is now just 10.6 - and we can lock onto that number, due to the solid outlook/pipeline.

Given that 60% of revenues are recurring lettings income (and with rents going up), the downside looks very limited here, even if we do go into a recession. Actually, this is one of the shares that I would want to hold, in a recession caused by higher inflation. We saw how resilient it was in the pandemic, for example.

The c. 4% divi yield looks sustainable, and should continue, even in a downturn, as evidenced by the continuation of divis during the pandemic.

In an uncertain world, obviously expect some volatility, but I think this is a really good share to just tuck away and forget.

Risks? The only one I can see here, is that management screw up on any future acquisitions, over-paying, or over-stretching the balance sheet. But the track record to date & experience, suggest that’s not something to worry about. I suppose another risk could be the ability of management to control a larger group, as it keeps expanding.

Overall then, Belvoir remains one of my favourite value/GARP shares, which should serve shareholders well long-term.

As you can see below, the StockRank has been consistently high for the last 3 years - to reiterate, this does not guarantee success, but it's statistically back-proven to product better returns, most of the time, for a basket of shares. It's also a terrific sense check I find - e.g. if I get carried away by something too speculative, the StockRank helps me think more about the risks.

.

Aston Martin Lagonda Global Holdings (LON:AML)

430p (down 11%) - mkt cap £498m (pre refinancing)

The sportscar maker caught my eye here in late July 2022, as a possible candidate to watch, given the speculative potential longer term. Whilst being mindful of the poor track record, and the refinancing which has been in progress for a while (cornerstoned by Mercedes-Benz, and the Saudi sovereign wealth fund - so interesting big name, deep-pocketed backers).

Key points:

4 new shares entitlement for each 1 existing share held - so big dilution for anyone who doesn’t take up (or sell) their entitlement.

Huge discount of 79% on price - the new shares are being issued at 103p (market price was 480p on Friday!) - but being a rights issue (not a placing), then existing shareholders have protection due to pre-emption rights. Therefore the size of the discount doesn’t really matter, providing you take up your rights - this discount effectively forces shareholders to take up their rights, or get diluted to irrelevance if they don’t.

Raising £576m (less fees, which are big for rights issues, because a full prospectus is required)

Underwritten, so it’s happening - the underwriting fees are money for old rope when the discount is this big!

Big shareholders with 44.7% are supportive & taking up their entitlements.

Fees are £25m.

Half the funds are being used for debt reduction. Although checking the last accounts (interims to 30 June 2022), net debt (nearly all is loan notes) was a frightening £1.27bn, so this fundraise still leaves it with substantial net debt.

Balance sheet - was dire. NAV of £378m at end June 2022, less intangibles of £1,393m, gives NTAV of £(1.0)bn. Hence today’s rights issue, still only roughly halves the deficit. So I see this as more of a sticking plaster (albeit a big one!) than a complete solution. Expect another fundraise in future, would be my guess. Checking the terms, and repayment date, of the loan notes might help work out when the next cash crunch happens.

What happens next? The share price can be expected to gap down to something nearer the 178p theoretical ex-rights price. It’s ages since I worked out one of these, and had forgotten how to work out this price, but just refreshed my memory with pen & paper, as follows:

1 existing share valued at Friday’s close = 480p

4 new shares at 103p rights issue price = 412p

Total 5 shares = 892p

Divide by 5 = 178p theoretical ex-rights price.

An alternative to taking up the rights, is usually being able to sell the rights, which should have a price of around 75p each (being the difference between the cost price of 103p, and the theoretical ex rights price of 178p, if I’ve worked that out correctly).

If memory serves me correctly, there’s usually a shortish period of time when rights can be sold, providing there’s a buyer of course, but arbitrage traders will probably be active if a discrepancy of any size opens up.

Dealings in the nil paid rights start on 12 Sept.

My opinion - it’s a step in the right direction, and the deep discount doesn’t really matter with a rights issue, whereas in a placing it’s ruinous for existing holders who are not able to participate in any placing.

As mentioned back in July, I can see speculative interest in AML, if the company is able to scale up the roughly 4x it would need to equal the size of Ferrari. That could be transformative in terms of profits & valuation (just look at Ferrari’s £41bn market cap!).

As things stand though, AML still looks pricey for a loss-making, sub-scale brand that needs to spend a lot on product development.

Plus it will still have too much debt, even after this deal is done.

The share count looks set to increase from 116m to 580m, so assuming the ex-rights price does settle at or near 178p, then the market cap would be just over £1bn.

Given the potential, that’s actually looking quite interesting, I think.

If it’s able to pull off a genuine turnaround, then this could be a serious multibagger - e.g. Ferrari is valued at 40x AML’s market cap, despite being only about 4-5x the size in revenues. That gives an idea of the potential upside, if AML can grow aggressively, and catch up somewhat.

In the meantime though, I think it’s likely to need another fundraise at some stage. Definitely one to watch though, due to the multibagger potential, but I don't know how likely that multibagger upside scenario actually is!

The City has once again covered itself in dung, with a ridiculously over-priced IPO 4 years ago - and they wonder why the pipeline for new deals has dried up! Slain golden geese spring to mind (and I'm not talking about over-priced trainers!)

Roland's Section:

Surface Transforms (LON:SCE)

Share price: 45p (pre-open)

Shares in issue: 195m

Market cap: £88m

This engineering firm makes ceramic brakes for high-performance cars. It’s been on the cusp of volume success (jam tomorrow!) for a lot of years, but is finally starting to manufacture at scale and become profitable.

Today’s interim results strike a bullish tone, but I think there’s already a lot of good news priced into the stock.

Let’s take a look at today’s figures and updated guidance.

“the overall effect is to upgrade forecast profitability for 2023 to 2025”

Financial highlights: the headline figures look positive, but show a 45% increase in overheads as the company gears up for expected sales growth. As a result, Surface Transform was still loss-making during the first half of this year.

- Revenue +137% to £2.9m

- Gross profit +129% to £1.7m

- Administrative expenses +45% to £4.2m (in line with previous guidance)

- Pre-tax loss: £2.5m (H1 2021: £2.2m)

- Cash at 30 June 2022 was £6.7m (Dec 21: £13m)

- Profit guidance maintained for FY22 and upgraded for 2023-25

H1 revenue was £2.9m, but forecast revenue for the full year is £13m. This means that sales (and profitability) are expected to be heavily weighted to the second half of the year. That’s always a risk, although I don’t see anything specific in today’s results to suggest further problems.

Balance sheet: Net cash halved in H1 as the business invested in headcount and manufacturing capacity.

However, management says the current net cash position is £5.5m. Given increased revenue and improving profitability, I don’t think there’s any imminent risk that Surface Transforms will need to raise further equity funding.

Contract pipeline: The big story here is about Surface Transform’s ability to secure decent-sized contracts with major car manufacturers. The company is public about some of its smaller niche deals (e.g. Aston Martin Valkyrie, Koenigsegg) but refers to most of its clients simply as OEMs.

Earlier this year, the company secured an expanded £100m contract with OEM8, thought to be Tesla. The start of production was delayed, but is now underway.

Since the end of June, the company has won a £13m lifetime value contract with OEM9, “disruptor entrant to the battery electric vehicle market”.

In total, Surface Transforms now has a contracted order book of £190m (lifetime value) and a prospective order pipeline of a further £400m.

Apparently, it’s the first time the company has disclosed its prospective order pipeline, which only includes “active development programmes, where there is a known model”. On average, we learn that contracts are now normally five years (previously 3.8 years) and typically enter production two years after contract win.

Today’s updated broker note from FinnCap (available on Research Tree) provides some useful additional colour on the company’s client list. FinnCap’s analysts appear to be aware of customer identities and discuss them in more depth.

Manufacturing capacity: Surface Transforms’ move from small batch orders to volume manufacturing is the key to the group’s success. The expanded order pipeline suggests this transition is well underway. Manufacturing capacity is being ramped up accordingly.

Management say the company’s Knowsley factory can now support sales of £20m per year.

Further capacity is being added that should support sales of £50m per annum from early 2023.

Energy costs are fixed until Q2 2023, by which time management expects to have upgraded to use more efficient furnaces that will reduce unit energy consumption.

Outlook: A delay to the start of OEM8 production means that 2022 is expected to be £1.5m below previous expectations. However, improved profitability from development revenues means that overall profitability for the year should be unchanged, at just above breakeven.

Looking further ahead, Surface Transforms says that recent contract wins mean that profitability for 2023-2025 will be better than previously expected.

FinnCap’s analysts have left their 2022 earnings forecasts unchanged at 0.3p per share. However, they’ve increased forecasts for FY23 to 1.6p per share (previously 0.9p) and FY24 to 3.5p per share (previously 2.6p).

My view: Surface Transforms share price has edged higher this morning, but I think it’s fair to say that there is already plenty of good news in the price here.

Today’s upgraded guidance prices the stock on 30 times 2023 forecast earnings, falling to 14 times earnings in 2024.

While this may not seem expensive on a two-year view, Surface Transforms is at the mercy of much larger OEM customers, who may delay new models or require lower-than-expected volumes.

We also can’t yet be sure about the impact of macro factors such as higher energy costs and a possible global recession.

Stockopedia’s algorithms were also taking a cautious view ahead of today’s results, billing Surface Transforms as a possible momentum trap:

I’m impressed by progress, but wary of the risk that a more mature business might attract a lower rating. I’m not sure what the ultimate growth potential is for a company producing ceramic discs - I’d imagine their use will always be restricted to high-performance models.

On balance, my initial impression is that Surface Transforms is probably priced about right at the moment.

Ashtead Technology Holdings (LON:AT.)

Share price: 267p (+2.5% at 9am)

Shares in issue: 79.6m

Market cap: £207m

Half-year results and acquisition of WeSubsea

Ashtead Technology specialises in renting subsea equipment for use by offshore energy producers. It has three service lines:

- Survey & Robotics

- Mechanical Solutions

- Asset Integrity

Core activities involve supporting clients’ installation, maintenance, repair and decommissioning operations.

Ashtead Technology was founded in 1985, but was only floated on the AIM market in December 2021.

This is a new business to me, but appears to have decent scale and profitability, so I think it could be an interesting one to watch. The stock certainly seems to have found some support since its IPO. Ashtead’s share price is up be nearly 70% so far:

The group was previously owned by private equity outfit Buckthorn Partners, who remain the largest shareholder, with 35%. The second-largest holder is Arab Petroleum Investments Corporation, with 20%. APICORP is a Middle Eastern institution that invests (mostly) in the energy sector.

UK institutions seem to have bought heavily into the float; sadly there does not appear to be any significant director ownership.

Given the wider backdrop in the energy market, it’s hard to avoid the suspicion that this could turn out to have been an opportunistically-timed sale. However, today’s results suggest to me that this business could have some attractive qualities.

“The Board is very encouraged by the Group's performance in HY22 and expects FY22 to be at least in line with market expectations”

Financial highlights: it’s a strong market for offshore energy at the moment, both in Ashtead’s core oil and gas business, and in the renewables sector.

Today’s half-year figures suggest strong growth this year:

- Revenue +28.5% to £31.7m

- Adjusted pre-tax profit +95% to £7.6m

- Adjusted earnings +102% to 8.3p per share

- Return on invested capital: 19.1% (H1 2021: 10.9%)

- Net debt/EBITDA 0.9x (H1 2021: 1.8x)

I’m struck by the high rates of growth here. Looking back at last year’s results, it’s a similar story – revenue rose by 32% and adjusted operating profit rose by 118%.

I’d like to understand a little more about how much of this growth is organic, and how much acquisitive – see below.

Operating highlights: The company’s core market is oil and gas, but renewables now generate nearly one-third of revenue:

- Offshore oil and gas revenue +29.8% to £22.4m

- Offshore renewables revenue +25.6% to £9.4m

CEO Allan Pirie says that much of the company’s equipment can be used for both oil and gas and renewables, positioning the group to capture demand in both markets.

Indeed, Ashtead appears to be expecting a sustained period of market strength. The company says that the value of “quoting activity” during the first half was 29% higher than in H1 2021.

To capture these opportunities and minimise lead times, the company has spent £7.6m to expand its rental fleet so far this year. This compares to £2.5m during the same period last year.

Acquisition: Ashtead’s strategy includes expanding by acquisition. The company has today announced its sixth acquisition in five years, Norwegian firm WeSubsea.

This business is said to be a “specialist in subsea dredging technology” supporting customers globally from its base in Aberdeen.

WeSubsea predominantly works in the oil and gas market,”but can be repositioned into the offshore renewables space through leveraging Ashtead Technology’s international network”.

The deal will see Ashtead pay NOK 65m (£5.6m) for a business that generated revenue of £1.9m and an adjusted operating profit of £0.9m in 2021.

A multiple of six times operating profit doesn’t seem too expensive to me. Given that Ashtead is trading at around 16 times operating profit, the deal should be accretive for shareholders.

Regular acquisitions can carry additional risk for shareholders. However, small roll up deals like this one are often easier to integrate, and can create value by leveraging the acquirer’s higher valuation multiple.

Profitability: Ashtead reports an impressive 19% return on invested capital for the first half of this year. However, this is an adjusted measure that appears to be quite volatile - the equivalent figure last year was 10.9%.

On a statutory basis, my sums suggest a trailing 12-month operating margin of 17.5% and a TTM return on capital employed of around 12%. Both are fairly respectable figures, in my view, although we should probably remember that market conditions in this cyclical sector are currently very strong.

Risks: Talk of cyclicality brings me nicely to a brief discussion of the risks facing shareholders.

I haven’t had time to go through Ashtead’s IPO admission document in detail, but I’d suggest that it’s well worth a read for any potential investors in this business. In general, admissions documents include a lot of useful information you won’t find in companies’ result statements.

For example, a quick skim through the risk factors section of the documents immediately highlights two areas that are worthy of further research:

- Ashtead’s cost structure means that “a fall in revenue can have a disproportionate impact on earnings”. My reading of this is that the company has a high proportion of fixed costs that might not be easily cut during a downturn.

- Customer concentration - “the group is dependent on a relatively small number of customers for a significant proportion of its revenue”

Outlook: Management are bullish at present and expect results for FY22 to be “at least in line with expectations”.

I’m not able to access the latest note from Ashtead’s house broker Numis, but consensus numbers in Stockopedia suggest the shares are trading on around 15 times forecast earnings, with a nominal dividend yield:

My view: I think Ashtead might be the kind of niche specialist that performs well over time and rewards early shareholders. However, I’d want to understand more about the company’s customer base, market share and trading history before considering an investment.

I’d also like to learn more about past acquisitions, in order to try and split out organic and acquisitive growth.

The group’s 37-year history gives me some confidence in its quality and reputation, but I’m a little surprised by the recent pace of revenue growth since 2018 (the earliest figures provided).

More broadly, I’d be wary about buying into a private equity IPO operating in the oil and gas sector during an energy crisis.

On balance, I think Ashtead could be an interesting business that’s worth further research. However, I’m not immediately convinced that now is the best time to buy.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.