Good morning. It's Paul & Graham here, raring to go! Well, slowly coming round with a strong coffee is probably more accurate for me (Paul), here in London this week! Already I'm missing the tranquility of seaside life in Bournemouth, with London so far serving up its usual heady mix of antisocial people (eg. a loud girl facetiming at full volume on the bus, whilst stinking it out with a kebab), intermittent & slow internet, and unfortunately both my dogs are now incontinent (well they are nearly 16), and I've already got one wet sock this morning. Never mind!

Anyway, on to today's stock market trading updates & results shortly.

This weekend's podcast just went out on the main podcast platforms (search for "Small Caps Podcast with Paul Scott" and you should find it). My own personal website isn't working, but I hope to have that fixed later today. It's getting almost 1,000 listens each episode, enough to make it worthwhile making them.

Mello Monday - I'm delighted to say that renowned investor David Stredder's early evening webinars are back! It starts at 5pm this evening. I think it's important to support ventures like this, on a use it or lose it basis - especially during lockdowns and recessions, or bear markets. I tend to put on my bluetooth headphones, and potter about doing other things, zoning in & out depending on how interesting I find each section of the webinar.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

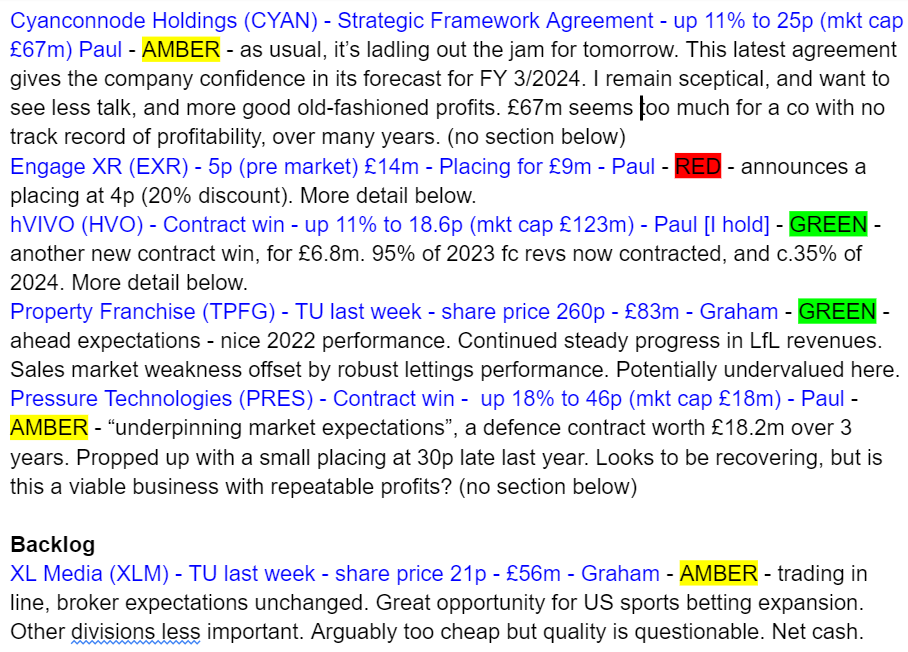

Agenda / Summaries

Paul's Section:

hVIVO (LON:HVO) (I hold)

Up 11% to 18.6p (mkt cap £123m)

Contract win

Another new contract win announced, for £6.8m. This is for FY 12/2024, with c.35% of 2024 revenues now already contracted.

Revenue visibility for 2023 is almost fully booked, at 95% (same as previously announced). Therefore it’s obvious that management is expecting to beat the FY 12/2023 forecasts - something the CEO made abundantly & repeatedly clear from a recent webinar!

Readers flagged this share to us here on 25 Jan 2023. As is often the case, when several shrewd readers here all like a particular share, it’s good, and I tend to also give it a thumbs up from my own review of the fundamentals. In this case, I like HVO a lot, and picked up some shares myself after doing some more research on it. Although this is not a sector I understand, so I’m really just relying on a few key points that attract me, namely - move into profit (last figures were good), high visibility of future orders, repeat contracts with large pharmas, growing cash pile (thanks to favourable working capital, receiving non-refundable deposits up-front), and HVO claims world leadership in its niche. The niche itself seems very attractive, as it allows pharmas to see if their drugs work on human guinea pigs, before embarking on expensive & long-winded full trials.

On the bear side, the poor historic track record is putting off some investors, overly-promotional CEO raises some hackles, and a profitable growing niche is surely bound to attract competition?

I wonder if there could be regulatory risk, if heaven forbid someone were to die after being given an experimental drug by HVO?

Today’s news is another in a long line of decent-sized contract wins, suggesting that something positive is going on at this company, and keeping investors interested - it's much more comfortable to hold a share where you get repeated contract win announcements, and forecast upgrades. It's also dangerous, as that can lead to shares becoming over-valued.

My opinion - positive obviously, because I bought some shares personally. The newsflow should be good, as it’s set up to beat modest forecasts in 2023. To see the contract backlog for 2024 also growing nicely, gives further comfort. Obviously a contract doesn’t automatically mean revenues, say if something goes wrong, or it’s delayed, but it’s a pretty good forward indicator.

I think the forward PER of 21x can be justified, given that these forecasts should be comfortably beaten, with 95% of 2023 revenues already contracted. Although I wonder if capacity might be approaching the limit, given that it’s now booking for 2024? This was touched on in the webinar, but I can’t remember precisely what was said.

Anyway, I remain green on HVO, and think it’s definitely worth readers taking a deeper look at it, and post your views - especially if bearish, as I want to hear counter-balancing views, to stop me getting over-excited with the bull case!

Note that the low StockRank is now beginning to respond to improved momentum, so that could continue rising.

ENGAGE XR Holdings (LON:EXR)

5p (pre market) £14m

Placing for £9m at 4.0p

I flagged here on 12 Dec 2022 that this share was best avoided, as it was obvious a fundraising was needed. A 4p (discount of about 20%) placing is announced today to raise c.£9m. That's not bad actually, the discount could have been far worse. With cash burn of E0.4m per month, this is said to be enough to get it to cashflow breakeven (companies always say that!). The investment case still looks weak to me, but once this deal completes, at least funding won’t be a worry for the time being. Can it turn a poor track record into something worthwhile? Who knows? It's just a punt at this stage, but must have impressed fund managers at the roadshow for this placing, so there could be an interesting story here, given that it has been able to raise fresh funding on reasonable terms.

Raising fresh money at a 3-year low of 4p doesn't impress -

Graham’s Section:

XLMedia (LON:XLM)

Share price: 21p

Market cap: £56m

Long-time readers will remember that this stock was once considered to be a high-tech stock with enormous potential. But that perception was eroded rather quickly.

It can be fairly described as a collection of content-driven websites covering the sports, gambling and personal finance genres, whose economic purpose is to send visitors to betting websites and other advertisers.

Let’s review their recent full-year trading update, that is in line with expectations:

Revenue $73.7m (2021: $66.5m)

Adjusted EBITDA $16.1m to $16.6m

Cash falls by $14m to $11m (using round numbers). The company did spend $21m on acquisition-related payments, so underlying cash generation is likely to be good.

The legalisation of sports betting in the United States is a theme that has affected many stocks. XLM now covers 18 states: Ohio went live in January, and Massachusetts will go live in March.

As a result of its focus on this opportunity, XLM’s sports-related revenues have surged 72%. On the other hand, casino and bingo gambling revenues have fallen as “old tail revenues declined”. And the personal finance websites could be sold.

My view

I won’t change the view I expressed last time: the new management team should be able to make some decent returns for shareholders, and they appear to be doing so based on the cash generation implied by the above figures.

Indeed, XLM shares surged last week despite this trading update making no difference at all to analyst expectations.

Perhaps the market just got overly negative and uninterested?

You can find examples of the websites it owns here and here.

XLM is of Israeli heritage, but the new managers are based in England and I doubt there is any foreign discount that needs to be applied by investors who may worry about investing in foreign companies. The company is technically still registered offshore in Jersey!

I won’t take an outright positive view here because I don’t think I could call XLM a high-quality business, but it could be trading at the right price for value investors to get involved

Property Franchise (LON:TPFG)

Share price: 260p

Market cap: £83m

This trading update was issued last week, but is something I would have liked to cover at the time.

TPFG is the company behind estate agents including Hunters and Martin & Co., and also owns the hybrid agent Ewemove. It issued a trading update for the full-year 2022, with the following highlights:

7% like-for-like revenue growth, 13% total revenue growth to £27m (2% higher than forecasts from Canaccord Genuity)

5% like-for-like increase in “royalties” to £11.8m (this is the management service fee paid by franchisees, and is very high-quality income).

Good growth in Ewemove territories, up by 44 to 189

Net cash £1.2m

In a complicated year for the housing market, these strike me as some encouraging figures.

Like other companies in the sector, there is a mix of income from both sales transactions and from lettings management. 76,000 rental properties are managed by TPFG companies, helping to take some of the pressure off the sales side of the business.

In TPFG’s words, their “strength in lettings has more than offset the significant reduction in residential sales transactions in 2022”.

New rents increased at a double digit rate during the year. And ominously for existing renters, TPFG expects “more substantial in-tenancy rent increases during 2023” (existing tenants having been spared from large rent increases in 2022).

As we all know, homeownership rates are in a long-term decline and so it’s highly beneficial for companies in this sector to have a strong lettings proposition.

As for the immediate outlook:

It is too early to tell where the number of residential sales transactions will end up this year although early signs of more normal stock levels and instructions along with the improved conversion times suggests the market for second hand residential properties is likely to align with that of 2019.

Cash flow

During 2022, the Group generated £8.2 m of free cash flow which enabled it to repay the £7.5m term loan originally drawn in 2021 providing a strong balance sheet for opportunistic growth. Furthermore, the strong operating performance underpins the expected FY dividend to be declared alongside the preliminary results in April.

Estimates

As a result of this update, Canaccord Genuity increased their adj. PBT forecast for 2022 by 5% to £10.1m. Their equivalent 2023 forecast is £10.9m.

My view

I gave TPFG an honourable mention in my article, “Ten Small Cap Value and Growth in 2023”, so it’s clear enough where I stand on this company. I think the business model is the type of model that investors should value highly - capital-light, with recognisable consumer brands, and strong cash generation capabilities.

My view on this aligns with the StockRanks, who give it a Quality Rank of 97.

As you can tell from the £8m cash flow vs. c. £80m market cap, this is trading on an after-tax earnings multiple of roughly 10x (there shouldn’t be a large discrepancy between net profits and cash flow).

Profits here have increased significantly in recent years but I’m not sure the share price fully reflects this. Macro fears are presumably responsible for the fall from last year’s 360p high:

Historically, this usually trades at a PER higher than 10x:

So I can’t help but take a positive view on this one at its current valuation. And if sales transactions do continue to suffer, then I’d look for this to be offset by strength in lettings.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.