Good morning! Paul here (not sure yet who's joining me today, am about to find out!). It's Jack, who I'm pleased to say has now partially recovered from a dose of illness last week. Today's report is now finished.

Agenda -

Paul's Section:

Since we've just had the jubilee, today's SCVR will be focused on wine! - results from:

Gusbourne (LON:GUS) - which I think has a poor business model, so not of interest to me as an investment.

I've also glanced at larger competitor Chapel Down (OFEX:CDGP) ) - which turns out to be a lot better than I was expecting. Could be worth a dabble at 30p. Note that the incoming CFO recently spent £212k buying shares at 42.5p - a big vote of confidence there.

And sleeping off the wine! - eve Sleep (LON:EVE) - strategic review & formal sale process is launched. I'm not sure why anyone would want to buy it though.

IG Design (LON:IGR) (I hold) - bank facilities are agreed, with reduced limits, and revised terms. Certainly a step in the right direction, but I think this share remains high risk: potentially high reward.

Jack's section:

Hi everyone, it’s Jack here. I’d just like to announce that I’m moving on from Stockopedia this month. It’s been an absolute blast covering companies with Paul and chatting with the community. I’ll really miss it. In fact, I plan on keeping my subscription, so you’ll probably see me around in the comments.

We’re sorting out a replacement now - I’m sure you’ll like who we’ve got lined up.

As always, best of luck in the markets,

Jack.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Gusbourne (LON:GUS)

64p (pre market open)

Market cap £39m

I’ve never looked at this English wine company in the whole 10 years of writing these reports (we should have a jubilee too! It’s called “tin” for 10 years, how appropriate - a coffee can maybe?!)

The lack of coverage for Gusborne is just because I don’t see any merit in the economics of producing English wine, hence wouldn’t invest. Also I don’t see any merit in the taste or price of the English wines I’ve tried over the years. Why pay more, for lower quality? Better to leave wine making to the French or Spanish, who know what they’re doing, and have better weather.

You can see the poor economics from the graphical history of Gusborne - relentless losses. Although on the upside, it is building up inventories of wine, for future sale -

.

Still, we always try to approach figures with fresh eyes, so let’s take a look -

For FY 12/2021 - very late, but they have been audited.

Decent revenue growth, but still very small at £4.2m (up 99% on LY)

Refinanced, with a £4.5m (before expenses) equity raise, reducing some debt, but large bank borrowings remain.

Operating loss of £(2.76)m

Gross profit of £2.3m was all spent on sales & marketing expenses of £2.46m!

Inventories rising, now £10.6m - that’s 2.5 years’ revenues (at cost) - so obviously the company is building up stocks of vintage wines for future years’ sale (and profit). That could be say £20m of revenues, and £10m future gross profit sitting on the balance sheet currently at cost price, waiting for future sale.

The section headed “Balance Sheet” explains clearly why this is such an awful business model, hence likely to be a lousy investment over most peoples’ investment timescales -

The Group's balance sheet reflects the long-term nature of the sparkling wine industry. The production of premium quality wine from new vineyards is, by its very nature, a long-term project of at least ten years. It takes around two years to select and prepare optimal vineyard sites and order the appropriate vines for planting. It takes a further four years from planting to bring a vineyard into full production and a further four years to transform these grapes into Gusbourne's premium sparkling wine.

This requires capital expenditure on vineyards and related property, plant and equipment as well as significant working capital to support inventories over the long production cycle.

Property - it owns 362 acres of freehold land. In the books at £6.1m.

Very good working capital position, helped by £10.6m inventories (but some of that may not be ready for sale yet). Has £3.1m cash. Net current assets are £13.8m, a current ratio excellent at 12.5

Long-term creditors includes £9.3m of bank loans - that’s too much in my view. Note 8 says this is asset-based borrowing.

Note that some old debt was converted into shares at 75p (current share price 64p). So the share count has risen to 60.76m. That’s risen from c.24m shares in issue 7 years ago. So continuing dilution is a problem here. No wonder the share price has gone nowhere since it listed, apart from a couple of short-lived spikes up.

Balance sheet overall - NAV £15.9m (up 74% on LY).

Outlook -

Net revenue of the Company continues to demonstrate strong year on year growth in line with management forecasts. The Company is mindful of the inflationary pressures that are being seen across all areas of the business as a result of an uncertain political and economic environment generally, but believe it is in a position to mitigate these pressures through its sales and product strategies and increased business efficiencies through scale and careful cost management…

My opinion - it’s one of the worst business models I can think of - having to buy land, then plant vines, wait years for the quality to reach acceptable levels, then leave the bottles of wine produced to mature for a few more years. All the while costs are being incurred to tend to the vines, collect in the harvest, storage, and all the administration and costs of being listed.

Hence investors get nothing, in the development phase, which takes many years.

The only attraction is that, years into the future, it might possibly become profitable. Even then, further expansion would mean incurring loads of capex & operating costs for years before any return is made. So it’s not like sales & profits can be rapidly ramped up once profitability is reached.

So I cannot see why anyone would invest in this. Possibly because they’ve formed an emotional bond with the company at the visitors centre (generally a good day out for vineyards), or they particularly like the wines (which I’ve not tried yet, so must order some). There can be good shareholder discounts & perks too.

As an investment though, it looks lamentable to me. Although as you can see from the chart below, every now and then there’s a burst of speculative excitement in the shares.

Note that Lord Ashcroft owns 54% of the company. Hence small shareholders are just along for the ride, he’s calling the shots. Ashcroft’s wikipedia page is fascinating.

Potential upside could come, if Ashcroft (aged 76) sells the company for a premium, perhaps? He's proven a very shrewd buyer/seller of companies in the past.

Or, once the stock market turns bullish again, investors might start valuing the shares on the basis of potential future profits, who knows? So it could re-rate upwards in a more bullish market, regardless of fundamentals.

With so many decent companies now at bargain prices, I don’t know why anyone would particularly want to buy this share, in a loss-making, long-term project.

.

.

Chapel Down (OFEX:CDGP)

30.5p

Market cap £54m

As it’s a slow news day, I thought let’s check out the other listed English winemaker, Chapel Down. Looking through the archive, I last reviewed it here in 2016. Shares then went on a big bull run, peaking at 103p in 2018, and have since come all the way back down again, to 30p!

Although we’re in a bear market for small caps right now. Plenty of decent companies have fallen a lot in price, due to macro factors. It doesn’t necessarily mean that bears were correct about a particular company, since almost everything has plummeted in price, good and bad, often in sector-wide moves.

.

Could this be a buying opportunity, after such a big fall in share price? Or was it over-priced in the bull market?

Revenues at Chapel Down are 4x those of Gusbourne, in 2021.

It’s profitable too, making £1.1m PBT in 2021 (excl. Disposal of Curious Drinks)

Balance sheet - much stronger than GUS, with NAV of £31.1m. Chapel Down has no long-term debt either, whereas GUS has £9.3m bank borrowings.

Net cash of £6.4m

My opinion - it’s a clear win for CDGP, it looks a far better company on fundamentals than GUS. No contest actually, CDGP looks streets ahead, and the £54m market cap is well supported by NAV (commentary on 2021 results says “the net realisable value of these tangible assets is considerably higher than the … reported values”. The same is probably true of GUS.

Overall then, I wouldn’t go near GUS as an investment, due to too much debt, and continuing losses. Whereas CDGP is much bigger, already profitable, has a much stronger balance sheet, but isn’t that much more expensive (CDGP £54m market cap, GUS £39m).

Hence a tentative thumbs up from me, as a possible investment for CDGP, and a thumbs down from me for GUS, based on reported numbers for 2021. Obviously I have no idea what the future holds for either company.

I also like that CDGP has a new CFO, who's recently spent £212k buying shares in the market, at 42p. We can buy them a quarter cheaper than that today. It's tempting to pick up a few as a starter position.

.

IG Design (LON:IGR) (I hold)

61p (up 23% at 10:30)

One of the world's leading designers, innovators and manufacturers of celebrations, craft, gifting, stationery and creative play products

I’ve only just spotted this, due to the share price being up 23%.

When companies are in difficulties, news on the bank facilities is probably more important than trading updates. The share price has collapsed after a series of profit warnings.

For background, see my review of its FY 3/2022 trading update here, which covers all the main issues. I was waiting for revised banking facilities to be agreed, which was flagged as being imminent in that update on 27 April 2022, and was the main risk facing the company.

Good news today, in that revised facilities and covenants have been agreed. Key points -

Extended term to 31 March 2024

Bank facility size reduced from $225m, to $182m -

The Directors believe these amendments continue to give the Group more than sufficient headroom to fund its seasonal working capital requirements over the remaining term of the banking agreement.

Seasonality is a key point here, and works in IGR’s favour - it needs big borrowings to fund seasonal peaks at Christmas in inventories & receivables, which then turns into net cash by the March year end. As mentioned before, this is good lending, as far as banks are concerned, as they get their money back reliably each year.

Bank covenants are eased, but only until March 2023. It’s difficult to assess how strict these new covenants are, without knowing what the company’s budget is like. My hunch is that there doesn’t seem to be much leeway on the EBITDA covenant -

- Minimum EBITDA performance, measured quarterly at the end of June, September, December and March, which requires the Group to be within $10 million of its EBITDA budget at each quarter end, based on the last twelve-month EBITDA performance at each measurement point

- Minimum liquidity level, which requires the Group to maintain a minimum of $35 million of headroom to the maximum available facility on a monthly basis

Dividends - will require lender approval. I don’t think anyone is expecting divis for now, as the business needs a good sort out first - it’s been hit hard by supply chain problems, causing both the CEO & former CFO to leave.

Costs - $1m fees from the bank, and lending margin has increased, although not unreasonable at 250bps now, rising to 300bps from 1/6/2023.

Directorspeak - this comes from the Chairperson, and contains a hidden trading update, which sounds quite positive -

"We are very pleased to have agreed this extension to our facilities and to have the ongoing support of our banking partners. Our seasonal orderbook remains strong and this revised facility provides us with sufficient funding for our working capital requirements."

My opinion - this is a step in the right direction. The revised bank covenants look quite tight, so it seems to me this update reduces the likelihood of a dilutive equity fundraise, but doesn’t remove it altogether.

Above all else, IGR needs to get its supply chain sorted out - easier said than done, I’m sure.

I dipped my toe in with a small opening position a little while ago, and might add to it at some point, not sure yet.

IGR is quite a decent sized group, with c.$1bn of annual revenues, but profitability has collapsed due to supply chain problems.

If it manages to avoid diluting shareholders, then the % share price recovery from current bombed out levels could be exciting.

The last balance sheet wasn’t bad at all actually, providing the new CFO doesn’t find any nasties buried in there.

This share could go either way I think, but the odds have improved today, with renewed bank support. If trading recovers, and supply chain improves, then you’ve probably got a multibagger on your hands. If it runs into more problems this autumn, then an equity fundraise could be dilutive, and the nightmare scenario, could even be a withdrawal of bank facilities in 2023, if covenants are breached, and a 0p share price, worst case scenario. So it’s still quite risky, and I’ve sized my position so that it wouldn’t kill me if the company went bust. The likelihood of that happening seems lowish at this stage though. Let’s see how things develop.

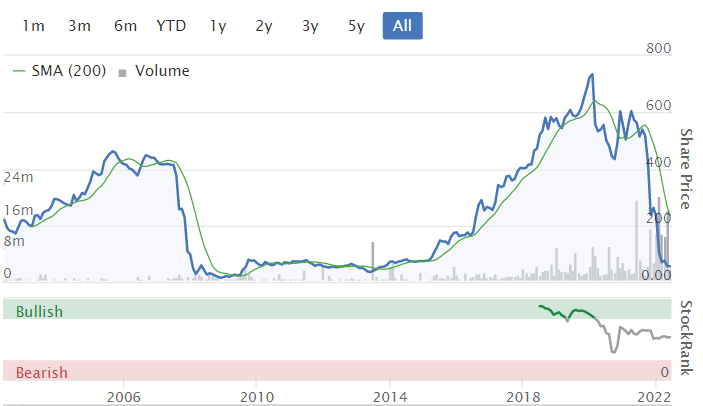

This chart certainly demonstrates the severity of the supply chain problems - risks that probably few of us even thought about in the multibagging bull run in 2014-2020.

.

.

eve Sleep (LON:EVE)

1.26p (down 24% at 11:46)

Market cap £3.4m

Checking our archive, in the autumn of 2021 I’d toyed with the possibility of a turnaround happening, and the cash pile looked interesting.

However, newsflow worsened, so I decided to drop coverage of EVE here in Jan 2022, as the chances of commercial success seemed slim.

Here’s the latest today -

Review of Strategic Options, Formal Sale Process, and Trading Update

Directors want to continue the current strategy, which will need more funding, so forget about the existing cash pile.

US-based investor expressed interest in a strategic investment, but has pulled out.

Use of the dreaded word “stakeholders” (often a sign that existing equity could be heading for zero).

Formal Sale Process (under the Takeover Code - good article here) has been launched.

This is quite interesting background (below) on how the FSP is expected to work. This looks optimistic to me, my view is that beggars can’t be choosers, and EVE will have to consider all & any offers, whether or not they appeal to management, who are not in a strong position - given that the existing business model has basically failed, and looks unlikely to succeed, even if more money is raised -

The Company intends to conduct a targeted process, focused on those parties who understand and value the full potential of the Company. The first phase of the process is expected to be based on public information and management interaction only and interested parties will be invited to submit non-binding indicative offers to finnCap on the Company’s behalf.

The Company will undertake its own procedures so as to establish the credibility of any such parties and their commitment to the Company’s wider stakeholder group, after which finnCap may then provide selected interested parties with additional preliminary information on the Company, following which those parties may be invited to submit further proposals to the Company. Interested parties will be required, at the appropriate time, to enter into a non-disclosure agreement with the Company on terms satisfactory to the Board. Further announcements regarding timings for the FSP will be made when appropriate.

Current trading -

- In the main UK market, direct to consumer sales are down 15% on LY, for the 5 months to 29 May 2022.

- Last 3 weeks boosted into sales growth, by late night Channel 4 TV sponsorship.

- Revenues now expected to be below expectations.

- Additional promotions are reducing gross margins.

- Impact on cash, as year progresses.

My opinion - it’s now just a punt. They might be able to find a deal, but I wouldn’t bank on it.

It’s very difficult for management. Do they husband the remaining cash, or splurge it on a last desperate marketing drive, in an attempt to drive growth? It sounds like they’ve chosen to do the latter.

Maybe someone might see some value in the brand, and previous marketing spend (which often sticks in customers’ minds for years). Or maybe anyone interested might only want to buy the assets cheaply from an administrator?

My abiding memory of a webinar from management at EVE, was when asked about competition, the CEO was perhaps too honest, saying “We’re up against several very well funded competitors”. That’s when I realised her strategy was very unlikely to succeed.

Hence why webinars can be useful, for putting me off investing, and thereby avoid losses.

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.