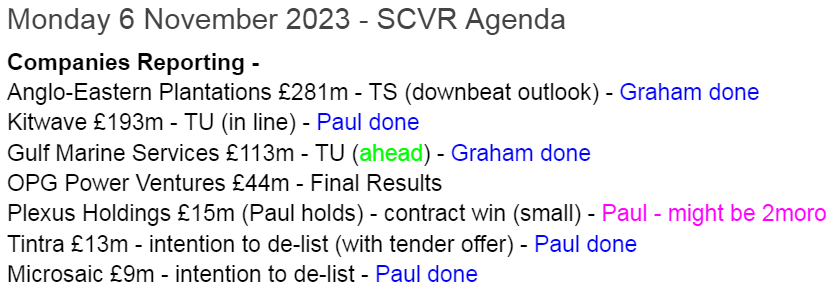

Good morning from Paul & Graham!

Weekend podcast (from Paul) - was fun to record as usual, with a bit of silliness thrown in as usual. I do try to make them shorter, but there's masses of material to cover each week. I went through the profit warnings and takeover bids for Oct 2023 that we've covered, as well as the usual summary of the daily SCVRs.

Here's the link for Graham's youtube show today.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Not an exciting day I'm afraid, but we'll do our best with this hotch-potch -

Summaries

Kitwave (LON:KITW) - 265p (pre-market) £186m - FY 10/2023 Trading Update - Paul - GREEN

The founder CEO is finally hanging up his boots in the spring next year, after a remarkable 36 years at the helm. Today's trading update for FY 10/2023 shows strong earnings growth (in line with increased forecasts), and it reassures on other points too. This share looks attractive to me as value/income/GARP, so it's another thumbs up.

Gulf Marine Services (LON:GMS) - up 5% to 13.15p (£132m) - Trading Update (ahead) - Graham - AMBER

A nice update from this operator of support vessels for the oil, gas and renewable energy industries. EBITDA will be at the top end or perhaps slightly above the previous range. Leverage remains significant but much safer than before. A high-risk, high-reward situation.

Anglo-Eastern Plantations (LON:AEP) - up 2% to 695.5p (£272m) - Trading Statement (downbeat outlook) - Graham - GREEN

This agricultural stock produces palm oil in Indonesia and Malaysia. It’s pessimistic on the short-term outlook for the palm oil price, but shareholders can take comfort in the extraordinary cash balance and the very long track record of dividend payments.

Brief comments from Paul below on proposed de-listings of Microsaic Systems (LON:MSYS) and Tintra (LON:TNT)

Paul’s Section:

Kitwave (LON:KITW)

Down 2.5% to 259p (£181m) - FY 10/2023 Trading Update - Paul - GREEN

Directorate Changes - this is all self-explanatory, with the founder (in 1987) CEO retiring in the spring -

Kitwave Group plc (AIM: KITW), the delivered wholesale business, today announces that Paul Young, Chief Executive Officer, will be retiring and stepping down from the Board at the end of the Company's Annual General Meeting ("AGM") to be held in March 2024.

Ben Maxted, the Group's Chief Operating Officer, will become Chief Executive Officer following Paul's retirement. A handover period between Paul and Ben will commence immediately to ensure a seamless transition of Chief Executive Officer responsibilities prior to the next AGM…

… post my departure, I look forward to being a long-term shareholder in the Company."

That seems to suggest no immediate plans to do a secondary placing, to get rid of his 11m shares. The Director dealings page here suggests 3 individuals with his surname (presumably connected) have together banked £7.6m between 2021 and 2023 from sales.

Investor sentiment was rattled when 5 Directors took £3.3m off the table on 4 Jul 2023 at 324.5p. That certainly dented my view of the company somewhat, which had previously been more positive.

Having said that, checking our previous notes, I’ve been positive overall on KITW -

2/5/2023 - GREEN - H1 TU slightly ahead exps. Good GARP share.

4/7/2023 - GREEN - Good H1 numbers, and outlook. Canaccord ups forecast.

Trading update - for FY 10/2023.

Kitwave Group plc (AIM: KITW), the delivered wholesale business, today announces a pre-close trading update for the year ended 31 October 2023 ("FY2023").

This sounds fine -

Following a strong performance in the first half of FY2023, positive momentum continued across all of the Group's divisions. As a result, and following the significant upgrade in July 2023, the Board expects the full-year financial results to be in line with current market expectations.

Other points - all sound encouraging -

Macro/inflation - challenges have been mitigated effectively.

Acquisition of W.Country Food Holdings - integrating well, and trading in line.

Growth - both organic and more acquisitions sought.

Web platform for suppliers & customers is going well (taking 47% of orders online)

Valuation - nice cheap value scores, and good quality measures too.

Although not much asset backing, with a high Price to Tang. Book - this measure is better when smaller, and bad once it turns negative. This is the quickest balance sheet check you can do - if this field is denoted with a “n/a”, that means NTAV is negative, so the balance sheet a needs careful check.

Broker forecasts - as you can see below, a very strong trend here, helped by acquisitions no doubt, but even so these are large increases in forecast earnings (during a tough macro period, doubly impressive) -

Many thanks to Canaccord and Research Tree for an update this morning. It confirms the above figures, with 29.0p adj EPS for FY 10/2023, which is a lovely 31% increase on LY.

PER of 9.1x is attractive, and that's historic now, so if earnings rise again this year, then the PER would drop even further.

Forecast for FY 10/2024 looks beatable, at 29.3p.

KITW is a rare success from 2021’s otherwise awful stable of stock market floats.

So the founder CEO certainly seems to be leaving on a high, having delivered a considerable success over many years here.

Paul’s opinion - I think KITW shares look very good indeed. Modest PER, good divis, and strong earnings growth.

The last balance sheet was a bit thin - only c.£10m NTAV, with some bank debt (although not excessive), so I wouldn’t want to see debt go much higher, hopefully the new CEO strikes the right balance between acquisitions, shareholder returns, and financial prudence.

A good thing about this group is that it sticks to its knitting, so the companies it buys are simple and it will already know them inside out, I imagine - hence low risk of it buying a dud, probably.

Running this type of business is all about keeping a tight control over all the detailed day-to-day operations - quite similar to retailing really. As we saw a few years ago at Conviviality, if management over-reach on acquisitions, and lose control over the basics, then implosion can be quite rapid. No sign of that here, this looks a well managed business, and so far the acquisitions seem to have been very good.

Thumbs up from me again, this looks a nice value/GARP/income share.

Stocko likes it too - see the very high StockRank, and it's a "Super Stock"

A couple more companies announce today they’re intending to de-list - I'm only mentioning them here, so that we can get them into my spreadsheet as de-listings.

Tintra (LON:TNT) - £13m - intention to de-list (with tender offer) - a change of tack here. Tintra was going to be taken over by an acquirer at 150p per share. That has now changed, as major shareholders didn’t agree with that plan. Instead the acquirer is trying to buy 29.9% through a tender offer. It’s also planning to de-list the shares, and says -

The Board considers that Tintra would be better able to raise the capital it needs to develop the business as a private company.

Paul’s opinion - this is not a share we’ve covered in the last 5 years, as it looked rubbish (from a value investment perspective). This deal reinforces my view that AIM is simply not the right place for tiny, jam tomorrow companies. Brokers need to stop floating things like this - they’re better off in private hands. Float some decent, profitable, cash generative companies please brokers! Although as one broker said to me a while back, why would you want to float if you have a great business in private ownership?! In some cases it can help raise a company’s profile by being listed, but it makes future fundraises a complete lottery, dependent on fickle market sentiment. Private ownership is much better for most small, speculative companies. So I’m pleased that lots of similar companies are now leaving the stock market.

Microsaic Systems (LON:MSYS) - £9m - intention to de-list.

This is another one we’ve never covered in the SCVRs, for the same reason - the figures were bad. It announces today that it’s going to de-list, but continue trading despite getting rid of all its staff, through the use of consultants. So shareholders might salvage something if it works out better as a private company maybe?

Graham’s Section:

Gulf Marine Services (LON:GMS)

Share price: 13.15p (+5%)

Market cap: £132m / $164m

This company operates “a modern fleet of highly versatile self-propelled lift boats''. Its headquarters have an address in Abu Dhabi.

It is a multi-bagger so far this year:

Paul has covered it before (see the archives), but on a quiet news day I thought I would take a look at it for once.

Today it has published another good news update: 2023 EBITDA is now expected to be in the range of $83m to $86m (previously $77m - $85m). So in other words EBITDA will be at the top end of the previous range, or possibly just above the top of that range.

As a reminder: EBITDA is a rough estimate of operating cash flow and should certainly not be confused with profitability!

In the interim results, depreciation and amortisation were about a third of this company’s EBITDA, and finance charges were even larger. So real profits were only a fraction of EBITDA.

The real value of EBITDA - or operating cash flow - is that it can help to prevent insolvency in the short-term, as it gives the company the flexibility to maintain its assets or to pay down debt instead.

GMS does have some balance sheet questions, with net debt of $299m in the interim results (for June 2023).

But first, here is the explanation for the upgrade to the EBITDA forecast. Comment by the Executive Chairman:

Given significant improvement in backlog visibility and market outlook evidenced in the recently announced contract awards, alongside future opportunities we're bidding for, we are confident to increase our market guidance for 2023 and to provide an even higher initial guidance for 2024. We continue to see strong interest for our vessels to support maintenance projects as well as new initiatives to meet growing energy requirements, for Oil and Gas as well as for renewables, and across different geographies.

Oil and gas markets do seem to be robust at the moment: Shell (LON:SHEL) reported Q3 adjusted profits of $6.2 billion last week, in line with expectations, and expanded its share buyback programme.

And now for the debt news from today’s GMS update:

2023 net debt/EBITDA is expected within a range of 3.2x to 3.3x.

2024 net debt/EBITDA is expected within a range of 2.3x to 2.7x

These forecast multiples are much safer than the multiples the company has had in recent years, but I would suggest that they are still on the high side for a capital-intensive company in the oil and gas sector, where there are so many factors that are out of its hands.

But there’s no denying that the company has made significant progress. So far in 2023, it has prepaid $30.2m of bank debt. A fine achievement.

Graham’s view

I tend to avoid commenting on oil and gas stock, for a variety of reasons, but I can see why this one might be interesting. It has a StockRank of 90 and is trading “cheaply”:

Needless to say, it’s unlikely to be a sleep-sound-at-night type of stock. This is more of a multi-bag-or-bust type of deal, with multi-bag being the outcome that is winning so far.

Best of luck to all holders. Of course I am staying neutral on it.

Anglo-Eastern Plantations (LON:AEP)

Share price: 695.5p (+2%)

Market cap: £272m / $338m

Anglo-Eastern Plantations Plc, a major producer of palm oil and some rubber across Indonesia and Malaysia, today announces a trading update covering the nine months to 30 September 2023.

Here’s another stock that rarely gets a look-in at the SCVR. But with a market cap at this level, it deserves a brief look on a slow news day.

Its website describes a company that floated on the LSE in 1985. It looks as if the company has paid a dividend pretty much every year since then (though the payments in 2019 and 2020 were minimal).

Here are the key points from today’s Q3 update:

Production of fresh fruit: down 2% year-to-date, due to the felling of old palm trees over the last two years.

External crop purchases: down 5% due to “intense competition” for external crops.

Crude palm oil production: down 4% for the above reasons.

As for pricing, the benchmark price of crude palm oil is down 33% this year, on average, compared to 2022. “Prices remain volatile”, with other key benchmark prices also significantly lower.

Balance sheet is “strong”, with no bank loans and net cash of $226m - wow! That’s over two thirds of the market cap. That cash balance is actually lower than it was before, due to a variety of investments, dividends and a share buyback.

Development - the company has a landholding of 90,667 hectares of which 68,414 hectares are planted. A portion of planting and replanting takes place every year, and a new mill in Indonesia is “nearing completion” and is expected to start processing external crops by Q1 2024. Another planned mill is however seeing “little progress”, “as we await the relevant government authorities to approve the environmental impact assessment study”.

Outlook is pessimistic for the crude palm oil price:

CPO prices are expected to be weak for the remaining part of the year as the industry enters traditional period of more robust crop production. The reported high palm oil inventory, together with the abundance of other competitive vegetable oils, coupled with a lower demand from the major importers are likely to suppress any upward movement in CPO prices for the last quarter of 2023.

Graham’s view

I do have a soft spot for agriculture stocks, and I’m tempted to go green on this one.

The Stockopedia computers wouldn’t blame me for doing so: this stock passes no fewer than seven bullish stock screens! Let’s list them for fun:

Ben Graham Defensive Investor (Bargain Stocks)

Ben Graham Enterprising Investor (Value Investing)

Ben Graham Deep Value Checklist (Value Investing)

Best Dividends (Income Investing)

Dreman Low Price to Book Screen (Value Investing)

Philip Fisher Growth Screen (Growth Investing)

The Screen of Screens (Quality Investing)

Yes, there is the foreign country risk: few of us will be experts in the local economic and political situation in Indonesia and Malaysia.

Offsetting that, you have AEP’s very long track record of operating profitably in these jurisdictions.

The company has a controlling shareholder: a Hong Kong-headquartered holding company which I understand to be owned by certain relatives of the Malaysian Chinese billionaire Lim Goh Tong.

So that’s another important point to be aware of: a 51% shareholder. It can sometimes be risky to invest in businesses where one entity has control over it like this.

Still, I’m going to stick my neck out and take a positive stance on these shares. What can I say? The cash balance and dividend track record have intrigued me! And the yield is currently 4.7%, according to the StockReport.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.