Good morning from Paul & Graham!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

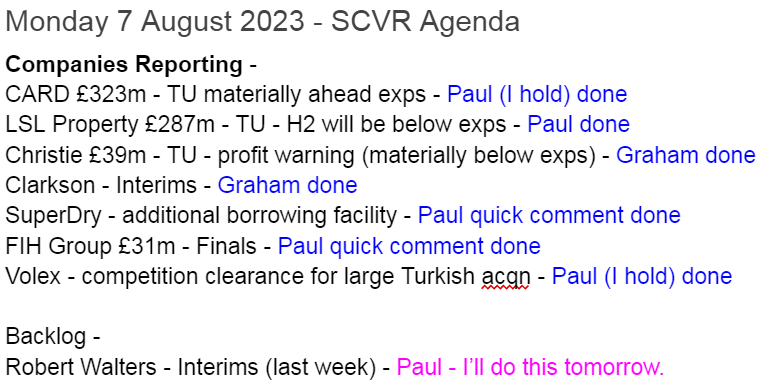

Summaries of main sections below

Card Factory (LON:CARD) (Paul holds) - up 13% to 100p (at 08:12) £344m - H1 Trading Statement - Paul - GREEN

"Materially ahead" of (unspecified) Board expectations. No broker notes available, so a poor show in terms of information. What matters most is it's traded well in H1, and expects FY 1/2024 to also be "materially ahead" of expectations. I remain bullish on this value/GARP share, which looks irrationally cheap, even after this morning's surge adding £40m to the market cap.

Volex (LON:VLX) (Paul holds) - Unch at 295p (£533m) - Receipt of Competition Clearance - Paul - GREEN

This latest acquisition is large, so it's reassuring to have overseas competition authorities give it the green light, although there was never any particular doubt over this. I use this opportunity to recap below on why I think VLX looks one of the best GARP shares out there, but is priced like an ex-growth value share.

Christie (LON:CTG) - down 24% to 112.2p (£29m) - Trading update (profit warning) - Graham - AMBER

The balance sheet at this professional services group isn’t weak enough for me to take an outright negative stance, but I can see few attractions to this stock even after the valuation takes a dive. It has achieved little growth even after many years on the public markets.

Clarkson (LON:CKN) - down 0.5% to £28.55p (£875m) - Interim Results (in line) - Graham - AMBER

Expectations are unchanged here on the back of strong interim results which followed excellent results last year. This large shipping group acknowledges that conditions are easing back towards normality in a post-Covid environment. Could be fairly valued here.

LSL Property Services (LON:LSL) - down 12% to 248p (£258m) - Trading Update (profit warning) - Paul - AMBER/RED

Deteriorating residential property & mortgage market conditions have triggered a major profit warning, with FY 12/2023 broker forecast profit reduced by 63%. I think the share price drop of 12% has been inadequate. The shares look set to drift down further I think, and risk:reward isn't good from my point of view - too much recovery upside is now priced in already. The balance sheet looks safe though, so no dilution/solvency risk.

Quick comments

Superdry (LON:SDRY)

Down 2% to 73p (£72m) - Secondary Lending Facility - Paul - RED

Another sign of financial distress, is how I see this latest update today.

Hilco is providing a borrowing facility of up to £25m, in addition to the Bantry Bay facility, and the small placing earlier this year.

Hilco’s facility is at an eye-watering 10.5% over UK base rate, so I think that’s 15.75% pa interest - it’s getting very expensive for financially distressed companies to borrow now. What a change from a couple of years ago, where free money was being thrown around like confetti.

There was a $50m IP disposal announced on 22 March 2023, and a shareholder vote approved this on 30 May 2023. Unless I missed it, I can’t see any announcement that this key deal has completed. So what’s the betting that might fall through? It’s vital funding, so the risk here matters a lot.

Paul’s opinion - I’m steering well clear of Superdry. This looks high risk - why get involved?

FIH (LON:FIH)

Unch at 254p (£32m) - Final Results - Paul - AMBER/GREEN

A really bizarre listed group, that has activities in the Falkland Islands, a passenger ferry in Portsmouth Harbour, and an art transportation business.

For special situations investors, this share might be worth a proper look. FY 3/2023 results today look good, with PBT of £4.0m being up 48% on LY.

It’s talking about making further acquisitions, but nothing has met its criteria yet - good to see that management is being selective.

Why is this share listed though? I can’t see any reason, and with 4 large shareholders owning over 50%, and a small free float, it could be at risk from a delisting.

Paul’s opinion - quite intriguing, if you like obscure, illiquid special situations!

Paul’s Section:

Card Factory (LON:CARD) (I hold)

Up 13% to 100p (at 08:12) £344m - H1 Trading Statement - Paul - GREEN

cardfactory, the UK's leading specialist retailer of greeting cards, gifts and celebration essentials, announces a trading update following the close of the first half to 31 July 2023.

Positive news today -

The positive start to the financial period, highlighted at the preliminary results, has continued. Trading in the first six months was materially ahead of the Board's expectations.

The macro backdrop continues to be uncertain, and there is still much to be delivered over the remainder of the year. Nevertheless, given the strength of the performance in the first half, together with our current outlook for the second half, the Board now expects the full year outturn to be materially ahead of its' previous expectations.

Unfortunately, CARD doesn’t follow best practice of providing a footnote to explain what expectations are. There are no broker notes available to us either. Therefore preferred clients of the big brokers who cover CARD now have an informational advantage over private investors. This is not acceptable. CARD management needs to address this problem by making sure some broker notes filter down to private investors too. After all, we create the market liquidity, and hence set the share price, so to ignore us is very odd. I’ve emailed the advisers to point out this problem (EDIT: Teneo's email provided in the RNS has just bounced back, saying inbox is full. Hmmm).

All we can do is wait for the broker consensus numbers to change in the next few days.

“Materially ahead” usually means at least 10% above forecast. Here are existing forecasts for FY 1/2024 and FY 1/2025 -

At 11.4p EPS forecast FY 1/2024, we can probably increase that by 10% to 12.5p, which brings the PER down to only 7.1x, which is clearly too low. Even after we allow for the gearing, which is no longer problematic in my view.

Note that divis are already forecast to be resumed this year, so a materially ahead update today reinforces that.

Paul’s opinion - I’m biased, as I hold CARD personally (because I think it’s good value). This update reinforces that opinion. So I’ll remain GREEN on it, and reserve the right to top up my own holding if the price doesn’t spike up too much.

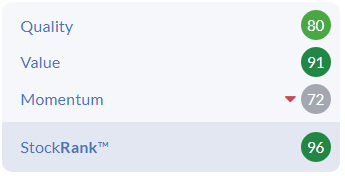

Note also that the StockRank has almost been jammed on maximum since last autumn. With higher broker forecasts now due, the momentum score should improve further -

Volex (LON:VLX) (Paul holds)

Unch at 295p (£533m) - Receipt of Competition Clearance - Paul - GREEN

There was never any serious doubt about this - management indicated previously that competition authorities approval was a formality. However, as the acquisition of Murat Ticaret (based mainly in Turkey) is a significant-sized deal (described as “transformational” in today’s RNS), it’s reassuring to have confirmation that the deal can go ahead, expected to complete at the end of August.

Look at how the growth story at Volex is developing - impressive I'd say, especially as it's continuing to do well, despite tough macro at present -

Paul’s opinion - clearly the acquisitions strategy is adding value, as the EPS has dramatically improved over the years, so I don’t mind the associated dilution from part-funding acquisitions with placings.

As a refresher, I reviewed the most recent trading update here on 27 July 2023, which said trading is in line with expectations, accompanied with a confident-sounding outlook.

Volex strikes me as an excellent GARP share - really a growth business, from reasonably-priced acquisitions, executing very well, yet on a value share rating. That’s an opportunity to me, and for full disclosure I should say that I increased my personal position size after the last, reassuring update.

Many of us are traditionally sceptical about groups which grow by acquisition. However, when executed well, it can be one of the best methods of creating a multibagger - as Judges Scientific (LON:JDG) and others have shown. The lustre has come off SDI (LON:SDI) recently, but it’s still got a great long-term track record of value creation through sensible acquisitions. This type of share can attract a high PER in a bull market, so I see Volex as a potential double gainer from increased earnings, more acquisitions, and probably a higher PER multiple in the next bull market, whenever that occurs.

A 3-bagger over 5-years, and that’s fully supported by EPS growth of a similar percentage - chart also looking quite nice now (looks like it's formed a base, and now above the 200-day MA) - start of another bull run perhaps?

Valuation looks reasonable to me, given the strong track record -

LSL Property Services (LON:LSL)

Down 12% to 248p (£258m) - Trading Update (profit warning) - Paul - AMBER

We last looked at this franchisor estate agents business here on 25 May, viewing it as amber, at 270p, when it issued an in line with (reduced) expectations update. It expected an H2 weighting for FY 12/2023, after a tough H1. It described market conditions as very challenging.

On to today’s news, an H1 update, with a fair bit of detail -

LSL provides the following trading update for the six months ended 30 June 2023 ahead of publishing its Half Year results.

This is the latest, all fairly obvious, given the macro conditions, and what we hear every day from the mainstream media -

As expected, the Group's results over H1 were impacted by significant changes in the mortgage market, particularly our Surveying Division, as well as Financial Services. We had expected some of these changes to moderate during H2, with improved consumer sentiment and more stable lending conditions. However, the larger than expected increase in the Bank of England base rate announced in June has had a material impact on the mortgage market, reducing the level of Purchase and Remortgage activity and increasing further the proportion of Product Transfer business (where customers stay with their existing lender on completion of their mortgage scheme).

Whilst Group Underlying Operating Profit was broadly in line with our expectations in the first half, the recent change in mortgage market conditions will significantly impact second half Group profits which are now expected to be lower than our previous expectations.

H1 underlying operating profit is only £3.5m, which it says is “broadly in line” with expectations, but way down on £14.2m in H1 last year.

Note there have been changes in the business model towards franchising, which means that reported revenue is a lot lower, but that's a red herring.

Net cash of £36.0m at end June 2023 looks healthy.

Guidance/outlook -

The mortgage lending market in H2 remains highly uncertain, resulting in a wider range of possible outcomes for the Group than usual. We now expect that there will be lower levels of Purchase and Remortgaging activity than previously forecast for the second half of the year, with this only partly offset by increased lower margin Product Transfers. This change in the mortgage market will significantly impact Surveying and will also affect Financial Services, although to a lesser extent. Full year Group profits will now be substantially lower than previously expected. We continue to expect Group profits in the second half of the year to be an improvement on H1, reflecting a more typical split across the year.

It’s a bit surprising that the share price is only down 12% today, so for now anyway, the market seems to have taken this in its stride. Or maybe there just isn’t the liquidity for sellers to actually sell?! That’s a good point with small caps, where limited liquidity quite often means the current price is determined solely by small trades. There could be any number of backed up sellers, unable to sell. That applies to many small caps right now, hence why following the price too closely isn’t necessarily giving the full picture.

The last balance sheet at Dec 2022 was confusing, as it was during the restructuring (moving to a franchise model), so there were assets and liabilities “held for sale”. The NTAV position looks OK, at about £59m, including £40m net cash (now £36m at June 2023). So I don’t think shareholders need to worry about dilution or solvency at LSL.

Valuation - this is the tricky bit. As with many cyclical companies/sectors, 2023 is turning out to be pretty horrible for LSL. Many thanks to Zeus for an update today, where it’s taken an axe to existing forecasts, lowering adj EBIT by 63% to £8.5m. This is showing as a one-off bad year, with FY 12/2022 actual EBIT being much higher at £36.9m, and 2024 and 2025 forecasts being much higher than 2023’s £8.5m, at £30.6m and £34.5m.

I’m instinctively wary of relying on forecasts that assume such a strong rebound next year. It could happen though, if mortgage rates peak, and start falling, we don’t know. In that scenario, we could see a strong housing rebound, as pent-up demand is unleashed.

Then again, the Bank of England’s latest utterances seem quite contradictory, and mooted the idea that rates might have to stay high for a long time. It all depends on what inflation readings come out at.

The way I see it, it’s probably reasonable to assume that, at some stage, EPS at LSL is likely to recover strongly. It’s only now forecast at 5.8p for 2023, but historically and forecasts show 20-30p EPS being normal. Put that on a PER of say 10-12, and I get to a target price of 200-360p once the economy & housing market have recovered, which might take some time.

In that context, the current price of 248p doesn’t look particularly attractive to me, because a fair bit of the recovery is already priced-in.

Paul’s opinion - I’d want a much bigger discount to attract me into LSL, if they want me to sit and wait for maybe a couple of years for earnings to recover. There’s not enough upside on the current share price, in my assessment.

I’d rather invest in the residential property businesses that are proving more resilient, which are biased towards lettings - namely Belvoir (LON:BLV), Property Franchise (LON:TPFG) and Foxtons (LON:FOXT) - they look better risk:reward to me at the moment.

Graham’s Section:

Christie (LON:CTG)

Share price: 112.2p (-24%)

Market cap: £29m

Today’s profit warning has wiped out all of the share price appreciation achieved by Christie Group so far this year:

The RNS begins as follows:

The Board of Christie Group Plc (CTG.L) advises that, following continued delays in achieving contractual exchange on ongoing transactions in its agency and advisory business, Christie & Co, and alterations to the expected timing and outcome of certain significant portfolio assignments, it now expects full year performance to be materially below previous expectations.

Christie & Co is “the leading specialist advisor for buying and selling businesses in its sectors”. Its website is worth browsing, if you’re interested in very small businesses - they have everything from pubs and takeaways to dental practices and nursing homes.

Aside from arranging the purchase and sale of these businesses, the wider Christe Group offers a range of related services (which it calls “Professional and Financial Services”). On top of this, it owns a (loss-making) set of stock-taking/inventory businesses.

Back in early May, as flagged by Paul, the company was talking about an H2 weighting for the year, but its overall tone remained positive.

Later that same month, the company issued a profit warning, referring to delays in lead times and a backlog in transactions.

The company now says that the delays in transactions “are anticipated to last at least until the end of the summer period”. The reason is “lower activity levels and sentiment in the wider market”.

There will be an H1 loss reported this year, compared to an operating profit of £2.3m in H1 last year.

But the company still says that H2 will be better: it will be “more consistent with second-half trading in 2022” (I see that operating profit in H2 last year was £3.2m).

Management - one sentence at the end of the RNS catches my eye: “the Group expects to incur one-off exceptional costs this financial year relating to the former Group Chairman and Chief Executive leaving the Group”.

I see that the company lost its long-standing Chairman/Chief Executive in July: he had been at the company since 1986, and owns (through a relative) 5% of the company.

In his place, the company has hired the former COO as the new CEO.

Graham’s view

The CEO departure already occurred before the latest profit warning, but I’m inclined to suspect that there is a close connection between the two events. Did the Board lose confidence in his ability to steer them through this rocky patch, despite so many years of service? Or (perhaps less likely) did he lose confidence in his own ability, and decide to jump before he was pushed?

As for the merits of these shares, I’m going to agree with Paul’s prior stance and stick to a neutral view. Christie Group has been around for a long time and has shown few signs of sustainable growth - where is the ambition?

This long-term chart goes back to 2004 but the shares been listed for much longer than that:

It has many shareholders who are related to each other on the register, which is not a bad thing, but if you take them and Lord Lee out, then the free float here is only worth around £10m. Does this company even need a stock market listing, with such a small free float and with very limited growth having been achieved after multiple decades on the public markets?

I have no reason to doubt them when they say that macro forces are to blame for the recent slowdown, but that puts another question mark over the quality of the stock and its resilience in the face of economic woes.

The StockRank sees quality and value here, at a PER of 10x (before the profit warning). But I see a company that isn’t going anywhere very quickly. Amber it is.

Clarkson (LON:CKN)

Share price: £28.55p (-0.5%)

Market cap: £875m

Expectations for the full year are unchanged at this FTSE-250 shipping group.

It’s a substantial enterprise: 1,800 employees in 63 offices.

It says it has delivered “20 years of consecutive dividend growth”, but there were blips in its dividend record during the global financial crisis and Covid. I suppose we can forgive it for that.

Positive momentum from the previous financial year has continued:

Note that the earnings figures are clean with only marginal differences between reported and underlying PBT/EPS.

The interim dividend marginally increases from 29p to 30p.

The Chair’s statement includes the following nugget, an admission perhaps that business might slow down again soon (emphasis added):

In an uncertain geo-political and global macroeconomic environment, we are now starting to see the softening of rates in some sectors, much of which was anticipated post-COVID-19. Nevertheless, the strategy set out by the Board, and implemented over many years, has put Clarksons in a strong position…

The CEO also acknowledges a weakening of trends:

Energy-related markets have been the key performers as complexity, geo-politics and energy security remain the major trade themes, whilst softer conditions have become prevalent within both the container market, where rates have again normalised, and the dry bulk market, where headwinds have been felt from the unwinding of congestion and lower demand, particularly in the smaller ship sizes.

For 2023, he is expecting “annualised growth in trade volumes with further support for demand and freight rates coming from the increased tonne-mile impact of changing trade patterns arising from geo-political tension”.

Net cash - £148.9m, after deducting amounts accrued for bonuses (Paul flagged this in March).

Graham’s view - I don’t have a strong view on this one, as it’s not really in my circle of competence, but I think it’s potentially useful as a barometer of global trade activity. It sounds as if the Covid-related gyrations are almost over, and we move on to whatever the next great macroeconomic forces might be.

The share are arguably decent value here, but the risks will be significant:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.