Good morning,

I'm slightly sunburned after a weekend which included BBQ & watching the football outside. Well done England!

Of interest today are:

- Park (LON:PKG) - new retail contracts

- K3 Business Technology (LON:KBT) - interim results

- Miton (LON:MGR) - AuM update

- Xpediator (LON:XPD) - proposed acquisition and placing

- Naibu - shareholder update

Park (LON:PKG)

- Share price: 73.25p (+1%)

- No. of shares: 185.6 million

- Market cap: £136 million

Park Group Wins New Retail Contracts

(Please note that I currently hold PKG shares.)

An encouraging RNS from this Christmas savings, gift card and voucher business.

I own shares in this and view it as a conservative holding. It has a bunch of attractive features: highly cash generative, low capex requirements, a rich history, a couple of recognisable brands ("Love2shop" and highstreetvouchers.com), and a strong balance sheet.

It offers a hedge against interest rate increases, too (since it holds a very large cash balance on behalf of customers, though I think this needs to be balanced against the reduced High Street spending which could result from higher interest rates).

The only thing it's lacking is growth, and this is why it remains a fairly small holding for me. I don't see its valuation changing dramatically unless its new CEO and the wider management team find growth levers somewhere.

Today's news does offer some hope that they might be able to do this. Four retailers have agreed to accept Park's Love2shop vouchers, including Arcadia (owner of Topshop, Topman and Miss Selfridge).

In addition, Fat Face is joining Park's prepaid card scheme, "flexecash".

The CEO comment is optimistic for the future:

"Love2shop' is already the nation's number one multi-retailer voucher, but these exciting new retail collaborations will open up new, or strengthen existing markets for us, as well as expanding our retailer base...

"Arcadia Group brands are visible on nearly every UK high street or shopping centre, so this is a major new signing for our business and really boosts the opportunities for our customers and clients across the UK."

My view

Park's vouchers are already widely accepted, so there is a natural limit in terms of how quickly their distribution can spread from the current level.

Today's announcement says the vouchers are now accepted by "more than 75 national brands and over 20,000 high street stores across the UK".

This doesn't give much away in terms of the increase since before these deals were launched.

I think there are roughly 300 Topshop and 200 Miss Selfridge outlets in the UK, so that's a start in terms of estimating the increase following on from this announcement.

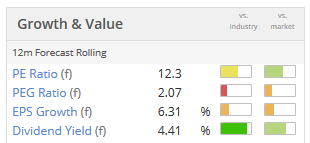

The shares aren't priced aggressively. I bought in at a higher level, before a small profit warning in April that damaged sentiment:

Conclusion - I'm planning to continue holding. Park has an importance in its niche which I think makes it part of the financial infrastructure for the UK consumer. Not a very big part, but a part nonetheless. And not a terribly easy one to disrupt or replace, I think. So I'm happy to stay on board for now.

K3 Business Technology (LON:KBT)

- Share price: 215p (+5%)

- No. of shares: 43 million

- Market cap: £92 million

KBT provides enterprise resource planning ("ERP") software, hosting and IT managed services, and is the unification of many previously independent companies.

It has changed its period-end to November (to reflect its "strong seasonal trading patterns"), and this adds another layer of complexity when trying to understand its historical performance.

It had a rough period in the 17-month extended financial year to November 2017: a pre-tax loss of £16 million.

I tend to resist investigating companies who have recently changed their accounting year-end date.

One reason is that I suspect it is often done to help in some subtle way with the presentation of results in the short-term. Even when it is done for legitimate reasons, it still has the consequence of making financial analysis so much more complicated. Things are complicated enough already, without adding that into the mix!

KBT said previously that its key selling months are June and December, and so changing to a November year-end "will enable the Board to provide shareholders with a more informed view of the Company's trading outlook when reporting full year and half year results."

I don't understand why shareholders would prefer to get a December trading outlook with the year-end results, rather than get the actual results for a 6- or 12-month period ending in December with the H1 or FY results.

Balance sheet - Paul and I have remarked before in relation to KBT's lack of tangible asset backing.

The latest balance sheet shows tangible NAV of minus £1.4 million. This is an improvement compared to minus £11 million a year ago. It raised over £8 million in new equity last year, so that will have plugged much of the gap.

Earnings - It presents an adjusted profit from operations for the six-month period to May 2018, before adjusting for the amortisation of acquired intangibles, reorganisation costs and share-based payments. These elements drag it back into the red.

Dividend - it plans to pay another dividend this year, which is a nice expression of confidence in its underlying cash generation and the outlook. The yield is less than 1% on the current share price, so it's unlikely to be material to the investment case.

My view

IT managed services looks an unattractive sector: labour-intensive, with low margins and difficult clients. I think I'm going to save time by avoiding it as a rule from now on.

Besides managed services and providing 3rd-party software, KBT also sell its own software products. But I'm in no position to assess the investment merits of that side of the business.

Commissioned researchers think the entire group could generate adjusted EBITDA of £8.2 million next year, with statutory pre-tax profit of £2.6 million.

I'm old fashioned: I like to invest on the basis of statutory (reported) profits, not adjusted EBITDA. So I won't be researching this share in any greater detail.

Miton (LON:MGR)

- Share price: 62.5p (+11%)

- No. of shares: 172.6 million

- Market cap: £108million

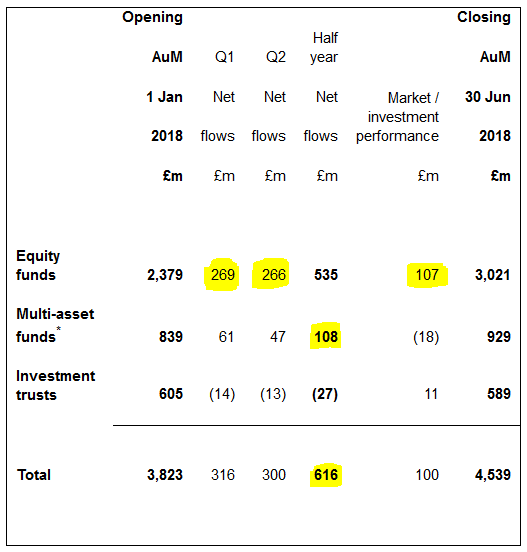

It's a great update from this fund management group.

I have highlighted some of the more important numbers in yellow.

Equity funds are up by 27% in H1 from £2.4 billion to £3.0 billion, driven primarily by equally-weighted net inflows in Q1 and Q2. Performance also made a contribution.

Multi-asset and investment trusts didn't move so fast, and therefore the group AuM is up by "only" 19% in H1.

The year-on-year change in AuM is a whopping 35%.

The value of an asset manager, once it reaches a certain size, becomes directly proportional to AuM. Miton is still relatively small so we should see some gains from increasing scale to accompany its raw increase in fee revenue.

Operationally, signs are encouraging with a couple of new funds having been launched and most of Miton's funds ranking in the first or second quartile against peers (with the qualification that this is "since manager tenure", i.e. since their current managers were appointed).

My opinion

Perhaps reflecting my sector bias, this share looks highly investable to me: financially strong, a good reputation, launching new funds and being infused with net inflows. Its performance probably justifies the run that its shares have enjoyed.

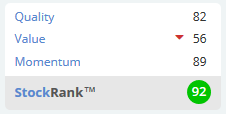

The StockRank remains excellent - high Quality and high Momentum, and the Value is not bad.

It remains to be seen how the funds and the business as a whole will perform with significantly increased AuM. It can be difficult to scale up strategies that have worked well in small-caps.

But small-cap is not Miton's only area of expertise, and I do anticipate that it will be able to deploy this fresh capital well.

Xpediator (LON:XPD)

- Share price: 79.5p (-8%)

- No. of shares: 119 million

- Market cap: £95 million

Proposed Acquisition and Placing

This logistics group announces a £7 million placing (at 71.1p) to help with a £12 million acquisition.

The deal is 50% cash up front with the rest being new shares and defcon.

The target is a warehousing business based in Southampton. Xpediator is paying a multiple of up to 6.7x last year's pre-tax profits. Another cheap deal, then.

CEO comment:

ISL shares similar characteristics to our previous transactions in that it is a well-established, profitable business which is operating in complementary but sufficiently distinct areas to add to both Xpediator's profitability and service capabilities.

My view

Logistics is not a sector I feel very comfortable with. We've seen more than our fair share of logistics companies run into serious difficulties in recent years (DX (Group) (LON:DX.) springs to mind).

I also tend to run away from companies engaged in "buy and build". Xpediator's strategy is to be "a consolidator within the highly fragmented logistics sector".

Management haven't put a foot wrong yet, making a string of acquisitions, and the share price has more than trebled from its 24p IPO, so perhaps this will be one of those few buy-and-build stories which actually succeeds.

Stocko algorithms rank it as a High Flyer. Buying High Flyers can be a winning investment style, as Ed Croft has shown.

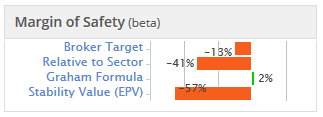

Since this is the "Small Cap Value Report", you won't be shocked to learn that I would be a bit concerned about the lack of value offered by the current share price.

See these margin of safety metrics from Xpediator's StockReport:

Xpediator also passes a short-selling screen. I think this is due to the effects that the acquisition strategy has on its financial statements:

So for these reasons, it doesn't fit my investment style.

Naibu (delisted: NBU)

This was one of the fake Chinese companies on AIM. It delisted back in early 2015. The Chinese CEO disappeared, hiding his residential address from the UK-based directors and refusing to contact them.

Credit to the UK-based directors for continuing to pursue claims on behalf of shareholders. They didn't do much to protect shareholders until the company (and its imaginary cash pile) had disappeared, but at least they have been doing a few things since then.

The process is painfully slow:

The NEDs have requested the Chinese courts to issue an order for new Naibu China chops (official stamps) to be issued...

13 months ago, we were told that the Board were making that request.

Without company chops, they can't even get access to Naibu's bank accounts.

Litigation - the most dramatic piece of news in today's update is that Naibu's legal advisors and Nomad are being pursued for negligence. The proceedings will be funded by a Burford-type litigation finance house. It will be fascinating to see what unfolds!

My view - fortunately, there is a simple rule that can protect us from this kind of accident in future: be afraid of Chinese shares on AIM.

When it comes to Chinese shares, there is a vast array of choice on the Shanghai (上海), Shenzhen (深圳) and Hong Kong (香港) exchanges. An online account with the right brokerage will enable you to trade directly on these exchanges, if you really want to. So there's no need to go fishing in AIM.

That's all I've got for today, thanks for dropping by!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.