Good evening!

Many thanks to Graham for publishing excellent reports today & yesterday. I took a long weekend break to visit friends & extended family in Warsaw. Unfortunately my flight back yesterday was cancelled, so we had an extra day there. No hardship though, I love visiting Warsaw at any time of year - it's a really up & coming city. Also they extend Christmas until the end of January, so all the decorations are still up, and there's skating & mulled wine in the (rebuilt) old town square. Better still, it only cost £173 per person, for BA flights & a 5-star hotel. Service is a little morose, but that's just their way.

I've just got time to briefly report on a few more small caps that Graham didn't get time to cover today.

XLMedia (LON:XLM)

Share price: 110.5p (down 1.8% today)

No. shares: 200.4m

Market cap: £221.4m

Trading update - for the financial year ended 31 Dec 2016.

The key bit says;

XLMedia continued its strong performance in 2016, with revenues up 15% to $103 million (2015: $89.2 million) and adjusted EBITDA1 up 21% to at least $34.5 million (2015: $28.4 million).

The company doesn't say whether this is above, in line, or below expectations, which is a little unhelpful. From the upbeat tone of the commentary though, it sounds as if the company is pleased with its performance.

Outlook - Directorspeak sounds positive;

The Board believes that the Group is well positioned for further growth and the current financial year has started positively. The Board looks forward to continuing to execute on its strategic plan and looks to the future with confidence.

The Company expects to announce full year results for the year ended 31 December 2016 in March.

Ory Weihs, Chief Executive Officer, commented: "During 2016 we made significant progress having now established ourselves as a dominant player in the performance marketing arena. We continue to execute our strategic plan whilst implementing our know-how, expertise and technology in new business verticals and key end markets. We are very proud to have delivered another record year of performance in 2016 and look forward to reporting our full year results in March."

My opinion - this is a tricky one, as based on the figures alone, everything looks fantastic.

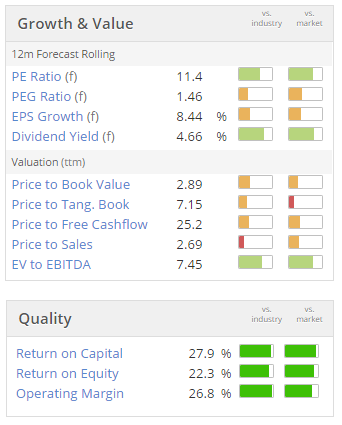

The Stockopedia computers love it, with a StockRank of 97, and the usual graphics below point to a cheap, high quality company;

The balance sheet also looks good, and it pays lovely divis.

However, I'm still not comfortable about specifically how these bumper profits are actually generated. I'd need to better understand the business model by looking at the company's highly profitable marketing websites, and understanding how they work.

We've seen before how online gambling can spring nasty, potentially devastating regulatory surprises on investors. There's no doubt that XLM is a golden goose. The question is, how long will it last? Also how precisely, does it work?

Lakehouse (LON:LAKE)

Share price: 37.9p (up 11.4% today)

No. shares: 157.5m

Market cap: £59.7m

Results for year ended 30 Sep 2016 - I won't revisit the troubled history of this group, but for anyone interested, here is a link to my previous articles covering profit warnings, and a battle for control of the company.

It's really now just a question of whether things are turning around under new management, led by Bob Holt?

A few key points;

- Underlying EPS of 5.2p sounds alright, but the exceptional & other adjusting items are so large, that I'm not minded to rely on this EPS number.

- Kitchen-sinking, with £42.6m of exceptional & other items.

- Ropey balance sheet, with negative net tangible assets, and net debt of £20.6m.

- Surprisingly, it's paying a 0.5p divi, making 1.5p divis for the full year. Is this wise, given the weak financial position? I think not.

My opinion - I'm not fully up to speed on this company, and having had a bad experience with it in the past, catching the falling knife, it's not something that interests me to revisit.

This sector is so problematic, and so prone to things going (often badly) wrong, that I can't see any reason to want to get involved at all. That said, there might be a good turnaround here, possibly? The CFO impressed me at a meeting some time ago. He sounded genuine, when he said that there are some really good businesses within this group.

It's not for me, but readers who understand the sector might want to take a closer look, and maybe report back if you like it!

Murgitroyd (LON:MUR)

Share price: 407p (down 19.7% today)

No. shares: 9.0m

Market cap: £36.6m

Trading update (profit warning) - this group has a 31 May year end, and today warns that a variety of factors mean that H1 has under-performed;

The Board, cognisant of current macro-economic uncertainty, has also concluded that the implied improvement in operating performance during the remainder of the financial year necessary to meet current market forecasts is unlikely to be delivered and, as a result, that the outcome for the full year will fall short of market forecasts, and likely see reduced full-year 2017 earnings.

This is typical of the type of RNS which I dislike. It drops a bombshell, but doesn't quantify anything. So investors are left in the dark about how serious this profit warning is.

What the company should have said, is something like this:

We believe market expectations are for x pence EPS for year ending 31 May 2017. Due to the factors mentioned above, current indications are that our performance is likely to be 15-20% below this. We will update the market further if this situation subsequently changes.

I'm sure most readers would agree that my suggested replacement wording is far better than the original version.

Due to the lack of clarity in the company's announcement, we now have to rummage around to find broker forecast updates. Personally, I can't be bothered, so the company has lost a potential (small) buyer of its shares, due to putting out a poor RNS.

My opinion - this looks a mature business, that makes a decent profit margin, and pays nice divis. Also its balance sheet seems sound.

Therefore, if you like the business, I think today might offer a decent entry point perhaps? It strikes me as the type of business that is likely to recover from short term problems, if that's what these are. Overall then, I'd say it might be worth a closer look. Although I don't really properly understand what it does.

A couple of quick comments to round off with;

Kalibrate Technologies (LON:KLBT)

Trading update (profit warning) - it has a 30 June year end, and puts out a pretty nasty profit warning today, although kudos for giving us some actual numbers to work on;

As a result, the Group now expects its revenue and EBITDA for the current financial year to be materially lower than market expectations with first half revenues of approximately $14.0m (H1 2016: $15.9m) and EBITDA of approximately £0.1m (H1 2016: $1.4m).

Going into the second half contracted year to date revenue is $26 million (which includes the revenue of $14.0m recognised in H1) and the Group enters the second half of the financial year with a strong pipeline.

However the range of outcomes for the full year will depend on the closing of further business the timing of which is difficult to predict. The Board has therefore taken prudent action to reduce the Group's cost base in order to protect profitability and cash flow.

The balance sheet remains robust, with a net cash balance standing at $3.1m at 31 December 2016, up $0.7m from 30 June 2016.

My opinion - I see too many red flags in the accounts. In particular debtors is way too high, and the cashflow statement seems to involve capitalising a lot of costs into intangible assets. Both classic signs of things to avoid. It doesn't pay any divis.

So lots of reasons to avoid this share. Why get involved in low quality stuff, when you don't have to? There are plenty of decent companies out there to invest in. Please do correct me, if I've missed something, but on a brief review of the figures & commentary, I really cannot see any reason to invest here.

Advanced Oncotherapy (LON:AVO) - apologies, formatting problems.

this share is a great example of why I don't touch blue sky crap on AIM any more. They nearly always fail. Back in 2015 this share looked potentially interesting, because it seemed to have a Chinese customer lined up to fund some serious-sounding kit for curing certain types of cancer.

Anyway, in an announcement today, the wheels are clearly coming off, with the Chinese customer cancelling its orders.

If anyone is daft enough to still hold this share, you need your head examining. IF the facts change for the better, then fine, it would be worth revisiting. However, for now, it looks a mess.

In this type of situation before, I've found that it pays to be early to break the spell that a story stock has on you. Most, or at least many punters may continue to delude themselves that everything is fine. This provides a vital gap for the more shrewd to exit stage left, with at least some of your capital preserved.

Also, I suspect short sellers may converge on this stock, as it ticks a lot of the boxes they look for. You have been warned! Personally I'm not going to get involved. Stuff like this just wastes mental energy that can be better deployed elsewhere.

Blue Prism (LON:PRSM) - I cannot resist a brief comment on full year results to 31 Oct 2016 from this sexy growth stock.

Looking at the numbers alone, I am struggling to justify a valuation of more than about, well nothing. It's loss-making, and the losses are increasing rapidly. So if the cash is going to be spent, then it's surely worth nothing?

Amazingly though, this share has achieved a valuation of about £300m, at c.500p right now, despite reporting only £9.6m revenue for y/e 31 Oct 2016, and an operating loss that has gone up from £753k to £5.3m. Am I going mad?! This really does remind me of Medisys, right at the peak of the TMT boom in 2000, when I thought its retractable syringe was the best thing since sliced bread.

Some of my best investing friends really like Blue Prism, so they will be cursing me as they read this. However, I want to throw a massive, air-dropped multi-ton, forest-fire-quenching tsunami of cold water onto this share idea - to challenge the bull case, and make sure it makes sense. So comments in the comments please.

At this 500p valuation, it looks an accident waiting to happen. Smart IT people can do all sorts, why is this unique? Why is it worth £300m+, when it hasn't even got anywhere near to making a profit? To my mind, stories are often a lazy excuse for doing proper number-crunching! They often start with glamour, and sparkle. But end up scraping turds off your cheap trainers.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.