Good morning, it's Paul here with the SCVR for Thursday.

Timing - TBC

Agenda -

Best Of The Best (LON:BOTB) (I hold) - Secondary placing. Directors sell down about a third of their (unusually large) shareholdings at £24, a surprising discount.

Card Factory (LON:CARD) - banks grant another 1 month waiver of covenant breaches. Why has share price been so strong, when an equity fundraising is so badly necessary? Very high risk in my view.

Parsley Box (LON:MEAL) - I've reviewed the AIM Admission Document.

D4t4 Solutions (LON:D4T4) (I hold) - 6 contract wins & "comfortably ahead" trading update for FY 03/2021. Looks good.

Wey Education (LON:WEY) - Recommended takeover bid at 47.5p, a nice 46% premium.

.

Best Of The Best (LON:BOTB)

(I hold)

Share price: 2400p (placing price)

No. shares: 9.38m

Market cap: £225.1m

Proposed Secondary Placing - RNS issued at 18:00 yesterday

For anyone not aware, a secondary placing is where existing shares in the company are sold by a large shareholder(s) (often founders/management, or a cornerstone investor like a private equity firm). So the company itself doesn’t receive any money, and the number of shares in issue remain the same. This method is used when the market liquidity is too small to soak up the number of shares that the seller wants to sell. So it avoids market disruption, by placing large blocks of shares with institutions, in one go.

In this case, there were market rumours recently that, once the FSP (formal sales process) fell through without a deal, management might sell some of their very large shareholdings to institutions in a placing. So this secondary placing didn’t come as a surprise.

Details -

- 2.5m placing shares, at £24 per share, £60m worth. 26.7% of the total company.

- 41,666 shares at £24 = £1.0m also available via Primary Bid - very small, so just a fig leaf offer really. I think they should have done a lot more through Primary Bid, which would have improved liquidity by increasing the private investor shareholder base.

- Finncap organised the deal.

Result of Secondary Placing - RNS issued at 07:00 today

Placing was oversubscribed - they usually are, because people often apply for more than they actually want, expecting to be scaled back. Also the price discount here made this placing highly attractive - the market bid price was £28, so being able to buy at £24 is a complete no-brainer. I don’t understand why such a big discount was offered, I think they under-priced it.

Placed 2,469,352 shares, of the 2,500,000 - I’m not sure what the shortfall of 30,648 shares pertained to, I’ll ask around. Ah mystery solved, these seem to relate to an exercise of options, immediately sold. So the total is 2.5m, all the shares offered.

All the PrimaryBid 41,666 shares were sold. Judging from the comments last night in yesterday’s SCVR, there was a lot of demand, and people were complaining they couldn’t secure any shares on PrimaryBid.

As you can see, after this large secondary placing, Directors still hold 47% of the company, so they still have massive skin in the game.

.

My opinion - I certainly don’t begrudge the Directors banking some of their paper profits. I’ve held this share personally for all the time these SCVRs have been around, about 8 years. It’s been a major multi-bagger, rising c.20-fold in that time. Most of the gains have happened in the last year.

Being a passenger on this journey with management has been a real pleasure. You couldn’t wish to find a more open, honest, and ethical management team. They’ve always treated minority shareholders well, taking relatively modest remuneration for themselves, and sharing the spoils of success equally, with frequent special dividends. Also they’ve welcomed ideas from shareholders, on ways the competitions could be developed, etc.

Having put 20 years hard work into this project, and making us all a lot of money, I’m happy for the Directors that they’re taking some cash off the table. They also retain such large holdings, that this shouldn’t impact their level of motivation or commitment, so it’s fine by me. Worries that Capital Gains Tax (CGT) might rise in future, could have been part of the motivation to part-sell their holdings, possibly?

There are two issues that could have been handled better though, in my opinion -

- Price discount (£24/share) was about 20% to the mid-price of 3000p, which strikes me as excessive.

- Primary Bid - nice to see, but £1m out of £61m total seems little more than a fig leaf. I think there would have been more demand, and it’s left a trail of disgruntled punters who couldn’t get hold of stock.

Hopefully this should improve liquidity in the shares, which has been a big problem in the past.

I'm happy to keep holding my shares permanently. It's a "coffee can" holding for me (i.e. hold forever).

.

.

Card Factory (LON:CARD)

73.6p - mkt cap £251m

Liquidity Update - from yesterday

Card Factory, the UK's leading specialist retailer of greeting cards, dressings and gifts, today issues an update regarding its liquidity.

This share is a really bizarre one. In normal markets, this share would have collapsed to something minimal, say 10p or below. Why? Because the company is highly indebted, in breach of its banking covenants, and clearly needs an urgent equity fundraising, likely to be highly dilutive.

However, we’re not in normal markets. The unprecedented stimulus from QE, funding deficit spending on a scale not seen before in peacetime, and numerous support & guarantee schemes from the taxpayer, mean that many companies which would normally have gone bust, are able to limp on.

This seems to have emboldened some investors, who seem to be completely ignoring solvency & balance sheet risk. The frustrating thing is, that (for now anyway) it’s working - high risk punts have delivered great returns in the last 6 months. New investors are, in my opinion, learning very bad habits. I saw the same thing in 1998-2000, in the TMT (tech, media, telecoms) boom. The most ridiculous speculative shares became major multi-baggers. Anything with a story that sounded good, would rocket to the moon (why stop there?!). Fortunes were made, and then mostly lost, as the bubble burst in March 2000, and repeated downward plunges occurred, interspersed with powerful rallies that sucked people back in. By late 2002, many former tech darlings were down 99% or more. Some even traded at less than half their own net cash.

My point is that, having seen how a speculative bubble ends, it's important to remember that, and recognise that the buoyant conditions we're experiencing at the moment won't last forever. I think there are lots of opportunities to take advantage of, and make money right now, and I can't see any reason why speculative conditions would suddenly end. Maybe a correction, but I think we could have a couple of years more euphoria from the markets, because there's so much money sloshing around from QE & stimulus measures. And little to no chance of interest rates going up. However, I really hope newer investors realise that the current boom times are not normal, and at some point, will end badly - booms always do end badly.

CARD is limping along from one month to the next, with short term one month waivers from its banks being announced on the last day of each month. That’s a highly precarious position to be in.

Yesterday on 31 March 2021, the banks once again gave another month’s grace -

Further to our previous announcements, we are pleased to confirm that constructive discussions with our banking syndicate continue. The banks, who continue to be supportive, have provided further waivers in respect of anticipated covenant breaches through until 30 April 2021, taking account of the Company's cash flow projections, subject to certain conditions.

Logically, it does make sense for the banks to be supportive. Interest rates are very low, so rolling over problem debts incurs little cost. Also, with shops due to re-open shortly, it makes sense to keep the company trading, and hopefully begin to generate positive cashflows again, to reduce the debt pile.

We are hopeful that our stores are able to reopen for trading during April 2021 and look forward to welcoming our colleagues and customers back into our stores.

The key difference with the next re-opening, is that much of the adult population, and most vulnerable people, have now been vaccinated. Therefore, that changes peoples’ behaviour, and makes them more willing to venture out. Hence I completely understand why the banks would want to allow CARD more time to sort things out, and get its shops open again. Pulling the rug out from underneath the company at this point would be counter-productive.

However, in the background, we can be sure that the company will also be under a lot of pressure to do an equity fundraising, on who knows what terms? Logically, such an emergency equity raise would be at a deep discount, due to the risk. However, we’re not in a logical market, we’re in a roaring bull market where it doesn't take much to convince people of the upside case.

As mentioned before, I think the successful IPO of Moonpig (LON:MOON) might have been a game-changer for CARD. If it can convince investors that it has the opportunity to be the next Moonpig, with a chain of cash generative shops as well, then investors might have a punt on it, in a fundraising.

My opinion - to my mind, this share is priced illogically high, given the perilous state of CARD’s finances. Investors seem to be ignoring insolvency risk, and the risk of heavy dilution from an equity fundraising that seems inevitable. Even after it’s refinanced, CARD still has a lot of catching up to do with more advanced internet competition such as Moonpig.

To me, risk:reward looks absolutely terrible with CARD shares, and I have no idea why this has happened to the share price (see chart below). Also, why is the StockRank so high? Maybe I’m missing something?

.

.

Parsley Box (LON:MEAL) (Parsley Box)

185p (floated at 200p this week) - mkt cap £76m

I skimmed through the AIM Admission Document for this new listing yesterday. They seem like daunting documents, typically 100-200 pages. However, with practice, you can skim through and ignore most of it, just homing in on the key points. I tend to read through most of the first section, about the business. Then have a quick read of the historic financial information, and that’s pretty much it - by that point I’ve usually formed a view on whether I want to research it further or not.

Key points I noted down -

AIM listing, at 200p

8.5m shares sold, split;

- 2.5m new shares - raising £3.9m net of fees [£1.1m fees! Ouch] for the company

- 6.0m existing shares sold

Total shares in issue after float: 41.9m, so only a small percentage of the total shares have been sold (6.0% new shares, 14.3% existing shares)

Finncap did the deal - who do a lot of smaller caps, and are private investor friendly I find

Market cap on float was £83.8m (200p * 41.9 total shares in issue)

About the business - providing ambient temperature, long-life ready meals & other food/beverage, direct to consumer via easy to use (in my opinion) website. Product can be stored in a cupboard for 6 months, serving a niche. Demographic is over 60s, and I think is probably more niche than that - maybe for people who are struggling to live independently, can’t go shopping or cook for themselves?

Product itself - I ordered a box of 10 ready meals. NB I am not the target demographic, as I found the portion sizes far too small, but apparently they suit elderly people. Taste was quite pleasant (apart from the fish pie, which was horrible). Strong savoury flavour, and quite salty, meat cut into tiny pieces, so I think they’ve clearly designed the product to suit the palate of older folk, which makes sense. Easy to store in a cupboard. Microwaves fast. Needs to be served with some veg I think, and my Mum & her neighbour also made this point. So if you’re going to microwave or boil some veg, then that undermines the whole point of having ready meals in the cupboard.

Very rapid revenue growth, from founding the business recently, in March 2017,as follows;

2017: £252k revenues

2018: 3,082k

2019: 6,111k

2020: 24,376k - huge growth, driven by massive marketing spend of £5.8m, and benefit from lockdowns

Now the bad news - it’s heavily loss-making, due to the big marketing spend. £3.2m loss for 2020.

Director remuneration increasing, from £105k pre-float, to £250k post, for CEO

Audit reports - were qualified for 3 years, due to auditors not attending stock counts. I can see why this might be an oversight in year 1 of a startup, but 3 years on the trot seems a bit sloppy.

Active customers 154k by Jan 2021. Selling 900k items per month currently.

My opinion - it’s an interesting niche, but I don’t think the business model has yet been proven - it’s making heavy losses. Personally I would rather wait to see what level of profitability can be sustained in future, with more normal levels of marketing spend?

Do customers repeat spend? I think it looks binary - people who like the product might enjoy the convenience of ordering from the internet, and not having to worry about use by dates, etc. But if you can order product online, why not just order proper groceries from any of the big supermarkets? Maybe MEAL customers might be relatives, ordering the meals for a vulnerable or sick loved one? It all feels a bit niche to me.

It will be interesting to see how it pans out over the next few years. How they arrived at £83m market cap, for a loss-making company, is anyone’s guess. There again, Deliveroo is loss-making too, and that’s valued in the billions.

Webinar is today at noon (apologies if you’re reading this too late, but I expect there will be a recording next week) - details here.

EDIT: Management come across really well on the webinar. They're on top of the numbers, and answering the questions in an open way. The re-order figures are impressive. £20 cost of customer acquisition, and they say payback in 6 months. Re-order size is larger at about £43, versus £23 for initial order. Strong emphasis on customer service. Looks good, I'm warming to this share, will add it to my watch list.

.

D4t4 Solutions (LON:D4T4)

(I hold)

320p (up 6% at 11:38) - mkt cap £129m

New Contract Wins & FY21 trading update

Companies issue contract win announcements all the time. The key point is whether they raise profit expectations as a result of the contract wins.In this case, they do raise expectations, so it’s a positive trading update.

Six new contract wins in key sectors

Revenue of c.£3m will be recognised in FY 03/2021

Justifies previous mgt confidence in the pipeline - true, D4T4 mgt has a good track record of confident outlook comments being followed through into decent contract wins & results, even when they had to recoup a lot in H2 after soft H1 periods.

Guidance upgraded -

This will result in the Group reporting results comfortably ahead of current market expectations for the year ended 31 March 2021 at the adjusted PBT* level and provide a healthy year-end increase to the Group's ARR** run rate as it begins FY22….

* The Board believes that consensus market expectations for 2021 prior to this announcement, were as follows: Revenue: £21.8m; Adjusted PBT £3.1m. Adjusted profit before tax is calculated before amortisation of intangibles, one-off reorganisation costs, foreign exchange gains/(losses) and share based payment charges.

** ARR (Annual Recurring Revenue) is the amount of revenue at a point in time that is expected to recur within the next twelve months.

Looking at the StockReport, it shows broker consensus which is consistent with these numbers, with EPS of 6.81p. Comfortably ahead, what does that mean? EPS of maybe 8-10p, or is that too aggressive? We’ll have to see what brokers upgrade their numbers to.

EDIT: Finncap has helpfully provided an update note, many thanks to them. Forecast revenue for FY 03/2021 is unchanged at £21.7m, Adj PBT is raised from £3.2m to £3.5m, and adj EPS goes up from 6.6p to 7.1p. Surprisingly modest increases, so the contract wins must have been in the original budget. Forex movements are noted as a drag. This gives a PER of 45 times FY 03/2021, so definitely not a cheap share! The market is clearly anticipating strong future earnings growth. End of edit.

Contract details - vague information is given (probably due to confidentiality agreements) about the customers concerned. They sound large, and international. I like that a lot, and place great emphasis on investing in companies which can demonstrate they’re winning business with big organisations, internationally. If contracts proliferate, that can then drive tremendous operationally geared increases in profit.

My opinion - this share is difficult to value, and looks expensive on a PER basis, and has had a variable track record.

However, it’s operating in a very much up & coming area, where customers achieve competitive advantage from using D4T4’s software to manipulate data and get commercial insights from that.

Therefore, I think it’s a really interesting share, and I’ve held for a while now. This announcement reinforces my conviction here. I don’t know what it’s worth, but want to continue holding, or buy more after this announcement today.

It’s one of my “coffee can” stocks - i.e. I’m planning on holding long-term, and ignoring day-to-day price movements, just focusing on the fundamentals & the long-term potential, rather than agonising over the valuation.

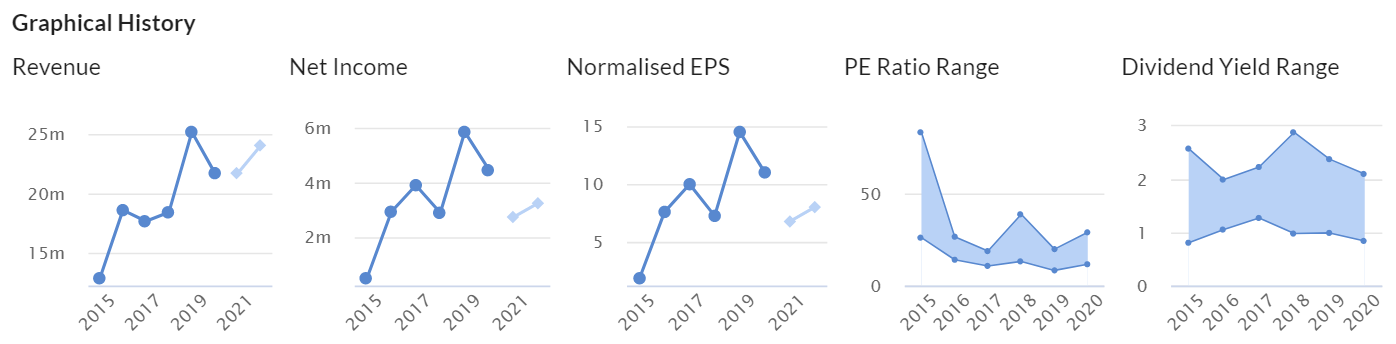

It's always profitable, but performance has been somewhat erratic, as you can see below.

.

.

Wey Education (LON:WEY)

46.5p (up 43%, at 12:45) - mkt cap £65m

Well done to shareholders here, Wey has agreed a 47.5p cash takeover bid, from larger Inspire Education Online Limited.

The price is a healthy 46% premium to yesterday’s close, which looks fair to me. I don’t think anyone can complain about this price, it’s a good price & a decent premium, which is paying up-front for several years’ future growth.

Support for the bid is 53.21%, so it looks like a done deal, probably, but you never know for sure - deals can fall through, or another bidder could emerge. Each situation is unique.

My opinion - Wey is certainly an interesting company, with good future potential. I was too tight to buy back shares I’d previously sold unfortunately, so missed out on this one. Well done to everyone here, this looks a good outcome. A bird in the hand, and all that!

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.