Good morning, it's Paul here with the SCVR for Thursday.

Please see yesterday's full report, which I carried on updating until nearly 6pm, with new sections.

Timings - I should be done by 1pm today.

Change of plan, I've popped into the De Beauvoir Arms (N1), my new local when I'm in London, so will type up some more notes over lunch here. Revised finish time c.3pm.

Agenda -

Renewi (LON:RWI) - trading update

Halfords (LON:HFD) - trading update

Fw Thorpe (LON:TFW) - final results

Connect (LON:CNCT) - trading update

Tclarke (LON:CTO) - trading update & interim dividend confirmation

All looks fairly dull, so I'm also going to do a bit more on Boohoo (LON:BOO) first.

.

Boohoo (LON:BOO)

372p - mkt cap £4.55bn

(I hold)

In case you missed it, the recording of yesterday's webinar is here.

I find that it's useful to take photos on my phone, of the most interesting slides, and to make paper notes of the key points in webinars, because sometimes the links to webinars don't last very long - they can be taken down for various reasons, including commercial sensitivity.

For me, the key points are that the supply chain issue is being taken very seriously indeed, and the action being taken is so comprehensive, that it's clearly not just a PR exercise. Mistakes were made, and they're dealing with it. That's fine, end of story. I see some journalists are desperately trying to string out the story today, but they're wasting their time (and ours).

There were numerous other insights into sourcing, margins, and how BOO is managing & expanding the newly acquired brands. All in all, essential viewing for all investors who want to profit from a unique growth business.

Are the shares expensive now? Clearly the share has recouped nearly all the losses from the shorting attacks & supply chain issues. However, it's earnings that matter, and the adjusted diluted EPS of 4.53p at the interim stage indicates to me that this full year FY 02/2021 could be heading for 9-10p EPS.

The house broker issued an update note yesterday, forecasting only 8.22p for FY 02/2021, which strikes me as far too low, since it implies a drop in EPS from 4.53p in H1, to 3.69p in H2. H2 earnings down 19% on H1. Really?! Why would that happen?

This is what actually happened in recent years (numbers are all adjusted diluted EPS);

FY 02/2020: H1: 2.91p, H2: 2.97p (2% rise from H1 to H2)

FY 02/2019: H1: 1.99p, H2: 2.16p (8.5% rise from H1 to H2)

As you can see, H2 earnings have tended to be up on H1, not down. Therefore it looks to me as if the 8.22p EPS forecast from Zeus is probably too low. It says as much in yesterday's note;

Management guidance for the full year reflects highly prudent assumptions on consumer spending, normalising return rates, ongoing distribution cost inflation and increased marketing spend.

H1 FY20A has already delivered 50.7% of our full year revenue forecast and 55.9% of our full year EBITDA assumption with H2 growth targets appearing undemanding.

We see clear upside risk to our numbers should the trading momentum seen YTD continue.

This backs up my view that 9p+ adj EPS for this year is probably more realistic.

Should we value the share on this year's earnings? Probably not, given that the stock market is supposed to look at least 6 months ahead, then we should be valuing BOO on FY 02/2022 figures. The house broker has pencilled in 11.37p there, which again is likely to be too low, because BOO normally exceeds forecasts. The Directors have a track record of under-promising, perhaps because they got caught out soon after listing, missing over-ambitious (short term) growth targets. Since then, they've been more prudent.

My view is that we can probably bump up the forecast for FY 02/2022 to at least 12p (I wouldn't be surprised if actual is nearer 15p, but lets leave some upside for another day). What sort of multiple should BOO trade on? Given the unique nature of the business model, and ongoing growth from bolting on more & more brands, then I think anything under 40 is missing the point. Here are some options;

PER 40: 480p per share

PER 50: 600p per share

PER 60: 720p per share

PER 70: 840p per share

In that context, I reckon the current share price of c.370p looks unrealistically cheap - a PER of 31

For that reason, I'm increasing my position size. Did I make a mistake in selling some between 306-320p recently (as discussed here)? Well obviously, yes, because the price is now higher. However, at the time, my decision was logical - I was worried that the supply chain review would be negative (which it was, but not catastrophically so), and I didn't know how the company was trading.

Now however, I am happy that the supply chain issue is dealt with, and we've just had bang up-to-date trading news, showing that the company is trading tremendously well. With this fresh information, combined with my assessment above that the share is looking undervalued, then I'm very happy to buy back my previous shares at c.370p.

As a reader commented, a legal action against the company in the USA is a potential thorn in the side, but it wasn't mentioned by anybody in the Q&A in yesterday's webinar, so clearly it's not bothered any of the analysts.

EDIT: I've made some enquiries about the US legal action, and can't print the actual reply, but translating it am told that it's not a problem at all. Would be good to get some independent confirmation of that though, which I don't have. End of edit.

Overall then, my current view on BOO is more bullish than before, and I reckon the shares look great value, for a unique growth business. Maybe investors are starting to realise how incredibly ambitious the team at BOO is. They see this being a huge, global business in the future. A few years ago they told me it could be a £5bn revenues business in the long term. Now they're talking £10bn, £20bn as possibilities. Hence why I'm inclined to keep buying, and to sit tight on them, almost irrespective of valuation. I've never looked at any share like that before, but this one justifies it, I reckon.

Also I'm hearing that the newish CEO (ex Primark) is very highly regarded, and seen as a very successful hire.

All in all, this is looking very exciting in my (long term) view. Obviously as always, please DYOR, as you should know by now that I do sometimes get a bit over-excited. I think the facts justify it with BOO though.

As mentioned above, the broker forecasts are clearly looking too low again. So more upgrades likely, which is the trend, as you can see below. Hence why the PER is actually a good bit lower than people think it is, because they're using overly pessimistic forecasts.

As an aside, wouldn't it be nice just occasionally, if short sellers would come forward and say, "Sorry, I got it wrong". They never do that, do they? Which undermines their credibility next time.

.

.

The consensus figures above are well below Zeus's upgraded forecasts yesterday, which are now 8.22p and 11.37p for the two years above. Hence expect this graph to show further progress upwards, as increased broker estimates start to feed through in the coming days/weeks.

.

Portmeirion (LON:PMP)

427p - mkt cap £59m

(I hold)

Your questions please!

I'm doing an audio interview with the new CEO of this pottery, candles & homewares group, tomorrow afternoon. It'll probably be shorter than my usual, in depth interviews, because a lot of it was covered here a few days ago, in a very informative interim results webinar on IMC. Therefore I'm not going to duplicate the same areas.

If you have any specific questions for the CEO, please leave them in the comments below. Please keep them brief, and to the point, and I'll do my best to include them in my interview. Thanks!

.

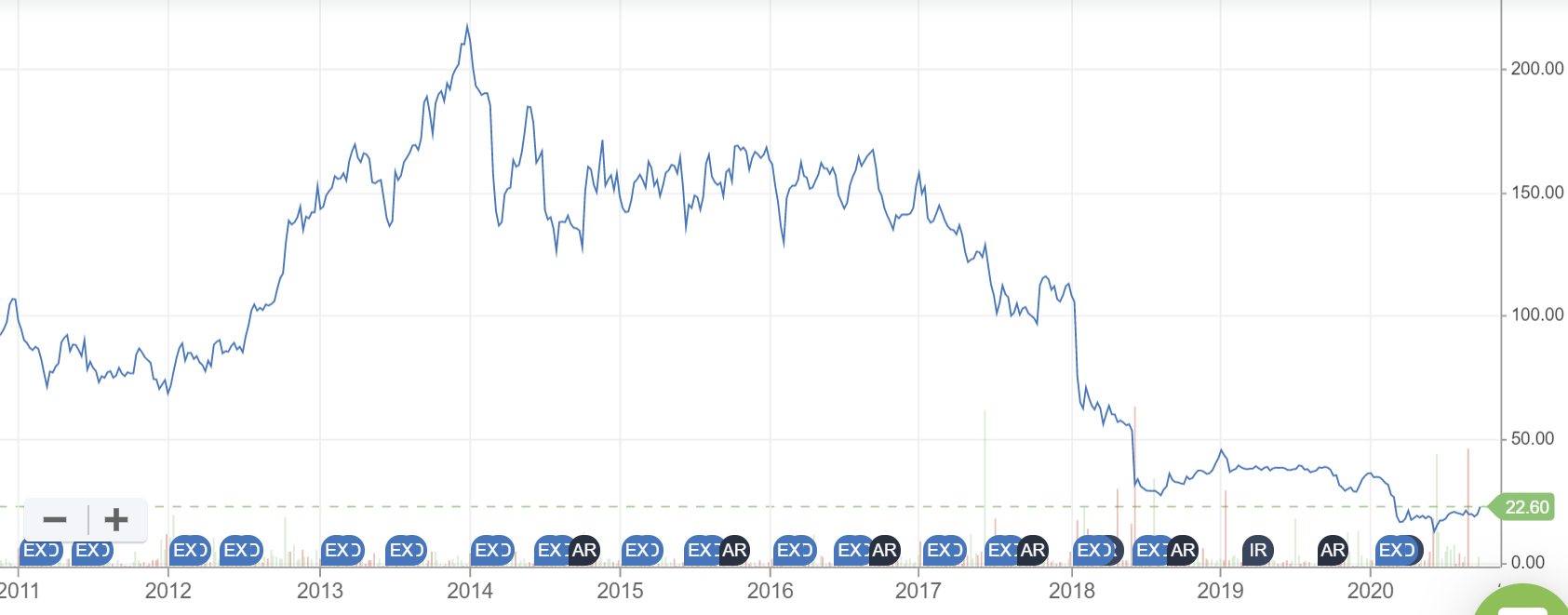

Connect (LON:CNCT)

22.1p (up 19%) - mkt cap £55m

This is a newspaper/magazine/other stuff distributor, called Smiths News. It disposed of the heavily lossmaking Tuffnells subsidiary a while back, which improved the future outlook, with that millstone gone.

The financial year is 31 Aug 2020.

Today it says -

Trading ahead of expectations

Trading in Smiths News over the last quarter of FY2020 has been stronger than management's revised expectations following the further easing of UK wide lockdown measures

Some specific figures are given;

In the fourth quarter ending 29 August 2020, trading EBITDA was £10m with strong cash generation. As a result, the Group expects to deliver Adjusted EBITDA (pre-IFRS16 lease adjustment) for FY2020 of £38.5m to £39.0m, above the top-end of the guidance previously announced in July 2020. The run rate performance in Adjusted EBITDA in the fourth quarter has continued in September trading, in line with the Board's expectations for the year.

That sounds great, so I checked my previous notes to compare. This is worth reading, my notes from 14 July 2020 trading update. The company said then, that adj EBITDA would be £35-37.5m. So today that range is increased by £1.5-3.5m. Useful, but not earth-shattering.

As my notes from July pointed out, the over-sized bank facility, due to be renewed before expiry on 31 Jan 2021, is the big issue here.

There was a "material uncertainty" in the interim results, emphasising how important this issue is.

Improved trading today should certainly help the company refinance.

Net debt - sounds at a reasonable level, but we're not told if this includes any Govt support enabling them to stretch creditors & hence temporarily reduce net debt?

Net debt at FY2020 year end is expected to be circa 2X EBITDA prior to the repayment of the Tuffnells working capital loan (see below).

The Tuffnells loan has been repaid in full, which sounds like £6.5m in the coffers - helpful.

Balance sheet - is very weak. When last reported, NTAV was negative c.£(90)m. At some point, I think the group will need to do an equity fundraising to plug at least some of that gap.

My opinion - positive Q4 trading, and an improvement in the full year estimates, is clearly good news, and this should improve the odds of the company being able to successfully refinance - which it needs to do soon. No doubt it will be currently in negotiations with the bank, to renew the existing facilities, on which the group is heavily reliant, before expiry in 4 months (31 Jan 2021).

The big question is whether the bank is going to insist on an equity fundraising to accompany renewal of the borrowing facilities? With a market cap of only £55m, an equity fundraising could dilute existing holders quite a lot, especially if it has to be done at a discount. Would there be much market appetite to refinance a newspaper/magazine distributor?

Nothing was said today about how the negotiations are going, for a refinancing of the bank facility, which strikes me as odd, given that it's such a material issue. Maybe a fundraising is being worked on behind the scenes?

For me, it's too risky, until a proper refinancing is done & dusted. I think there's a more than 50% chance of it needing to do an equity fundraise imminently. With more equity raised, the balance sheet (at least partially) repaired, and new bank facilities agreed, then this share could be potentially interesting, for value investors. But what long-term future is there for this type of business? It looks inevitably to be a gradually declining business, with constant cost-cutting necessary to offset falling revenues.

Note that there is also a pension deficit, so ultra-low interest rates forever is tending to make these problems worse. That would need checking out too, before buying this share.

The long-term chart tells a story of a business in structural decline. It could be a nice trade, if the refinancing is pulled off without dilution, but it's not the sort of thing I would want to hold long term.

.

.

Halfords (LON:HFD)

216 (up 19%) - mkt cap £430m

Another strong update from Halfords today - well done to holders.

See the RNS for the detail, but to summarise, cycling-related sales are strong, and motoring is improving.

Given stronger than expected trading since week 20, we now expect profit before tax1 for H1 FY21 to be in excess of £55m.

We do, however, remain cautious in our outlook for H2. The potential impact of second waves of COVID-19 now seems more pronounced than just a few weeks ago, and the economic impact of an end to the furlough scheme and the outcome of Brexit

negotiations remains very uncertain. We are well placed to address any headwinds we may face and capitalise on the tailwinds as they arise. Our balance sheet and liquidity position remain strong.

Checking my notes, its last update was covered here on 11 Sept 2020, indicating £35-40m H1 profit. So a move up today to £55m is quite a step up, in just 3 weeks! There must have been a mad rush for bikes, once people gave up on the idea of an overseas holiday.

Remember that H2 is quieter seasonally.

My opinion - it's great to see Halfords doing so well. The shares don't interest me though. How sustainable is all of this? Roll things forward a year or two, and the current cycling trend might have dissipated, and earnings falling? Also, I don't like Halfords weak balance sheet, with negative NTAV.

Well done to holders, but personally I'd want a more convincing long-term earnings outlook to get me interested.

.

Renewi (LON:RWI)

23p (up 19%) - mkt cap £184m

Another strong riser today, but not a company I've looked at before, so please excuse anything I miss, on this first review of the company.

A couple of years ago the market cap was £600m, so it's become a small cap the wrong way around. From a quick skim of the StockReport, it seems to have had a poor profits track record, and I can see the balance sheet also looks a problem, with a lot of debt. It's quite a big company, with operations in several European countries, focused on recycling of waste.

Renewi plc (LSE: RWI), the leading international waste-to-product business, announces its trading update for the period from 1 April 2020 to

30 September 2020, in advance of the Group's interim results which will be issued on 10 November 2020.

The main bullet points below read well (I've cropped the list, as it was too long);

- Overall trading in the first half has been materially ahead of the Board's Covid-19 adjusted expectations

- Good recovery in Commercial volumes during Q2 with Netherlands now operating at 96% and Belgium at 90% of prior year

- Cost savings of €10m delivered during the first half, on track to be ahead of the €15m expectation for the full year

- Strong cash performance, with a cash inflow of €63m to the end of August and leverage is expected to remain below 2.9x as at 30 September, broadly in line with pre-Covid-19 levels and well below the adjusted covenant of 5.5x

- Liquidity remains strong in excess of €300m

I have no idea how to put that in context, so am going to have to look up the last full year results statement & digest that next.

Results for FY 03/2020 - this is quite a large, and complex set of numbers. A few points;

- Revenue of E1.7bn

- Underlying profit before tax (PBT) of E44.5m (down 23% on LY) - not a very good profit margin

- Core net debt of E457m - plus more indirect debt in other structures like PPI

- Debt:EBITDA at 2.98 (covenant of 3.5) - NB covenant has since been relaxed

- Problems with onerous contracts, especially UK municipal waste - quite material

- Interesting debt structure - although debt is huge, some of it is via "green bonds" in Belgium, which are cheap, at c.3.5% pa interest - could be a plentiful source of secure funding, which I quite like.

- Pension deficit recovery payments of E3.5m pa

- Awful, overly indebted balance sheet. NAV: E235.3m, less intangibles of E610.1m, gives NTAV of negative E(374.8)m

.

My opinion - I've seen enough now to realise that researching this company properly would be an all-day job.

The balance sheet is so bad, that I wouldn't be interested in buying any shares in this. Although you could see the equity as almost a call option on the business recovering, which it seems to be doing, getting over the worst of the covid period anyway.

I'm not keen on the onerous, loss-making contracts which reminds me of the many infrastructure companies which have collapsed over the years because large complex projects went wrong.

On the upside, European countries are really keen on recycling, and reading through the commentary, it sounds as if Renewi could be profiting from this favourable attitude of policymakers towards its sector.

A key thing to research would be all the terms of the borrowings, maturity dates, what do the bonds trade at? In a very low interest rate world, I can see why some investors might like an ethical, green bond, that pays more than a bank account. That could mean Renewi is able to keep rolling over its debt, at cheap levels?

Overall, I'd say this is a special situation which would need a lot more work. It's probably not for me, so I'll leave it there. If the company continues recovering from covid though, I could see the shares maybe starting to recover, who knows? So it might be one to spend some time on, for readers who understand the sector.

.

Fw Thorpe (LON:TFW)

290p (down 5%) - mkt cap £338m

Let's have a look at another company, instead of wasting more time reading the fractious junk in the reader comments below.

FW Thorpe Plc - a group of companies that design, manufacture and supply professional lighting systems - is pleased to announce its preliminary results for the year ended 30 June 2020.

As with everything at the moment, it's difficult to know how much emphasis to put on results which cover the covid/lockdown period, as this announcement does.

A few key points;

- Revenues up 2.4% to £113.3m

- Profit before tax down 9.7% to £15.9m - seems pretty robust, considering Q4 was impacted by covid

- Fire at Lightronics facility in Holland very recently, on 23 Sept 2020

- Dividends increased a little, to 5.66p for the full year - a small, but dependable yield

- Pension scheme, but I've not looked into it in detail

- Amazing balance sheet, this is a real stand-out feature here - net current assets (i.e. surplus working capital) of £72.9m. NAV: £128.3m, less £21.0m intangibles, gives NTAV: £107.3m - this is so big that it deserves paying more, in terms of PER, for such a bulletproof financial position

Outlook comments seem a bit mixed. Current orders sound fine, but it goes on to say;

it is difficult to predict anything other than a downturn in orders at the end of the 2020 calendar year.

My opinion - it's a wonderfully well-funded business, with one of the best balance sheets out there in the small caps space.

With uncertainty over the outlook, I'm not interested in paying the current rather toppy valuation. So it's not for me, whilst recognising that it's a very well-run, decently profitable business. I just don't find the valuation attractive.

.

That's it for today. I'll see you tomorrow, and will write about whatever I like. I won't be reading or responding to any reader comments, as they're ruining everything, and life's too short.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.