Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

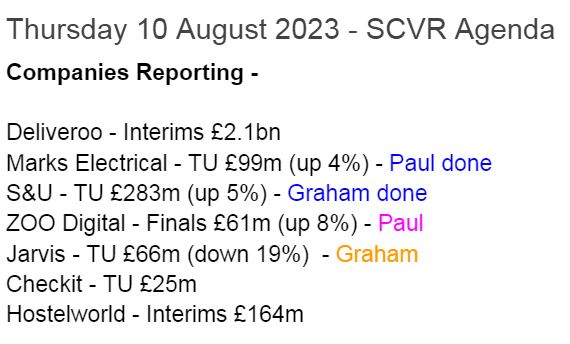

Summaries of main sections

Marks Electrical (LON:MRK) - Up 5% to 99p (£105m) - Trading Statement - Paul - AMBER

Strong revenue growth of +31% in the first 4 months of FY 3/2024, but nothing is said about profits or cash. I think this business is quite attractive, but seems fully priced, so will need to beat forecasts to justify the valuation. Low margin, competitive sector.

S&U (LON:SUS) - up 4.5% to £23.82p (£290m) - Trading Update - Graham - GREEN

The Chairman strikes a cautious and irritated tone but the good news is that S&U continues to carefully manage risk. Loan advances to motor finance customers are down and gearing reduces. Property lending is less than originally planned. I like the value and quality here.

Jarvis Securities (LON:JIM) - down 15% to 124.9p (£56m) - Trading Update (profit warning) - Graham - GREEN

I remain stubbornly positive on this despite brokers writing down the PBT forecast for the current year by nearly £1m, to £6.1m. This includes exceptional costs relating to a regulatory review. UK share dealing is very quiet right now but I still think this can do well long-term.

Paul's Section:

Marks Electrical (LON:MRK)

Up 5% to 99p (£105m) - Trading Statement - Paul - AMBER

Marks Electrical Group plc ("Marks Electrical" or "The Group"), a fast-growing online electrical retailer, provides a trading update for the four months ended 31 July 2023 ("the period"), ahead of the Company's Annual General Meeting to be held today at 11:00 a.m. BST ("AGM").

Strong trading momentum driven by excellent customer service

Impressive revenue growth of +30.7% in the first 4 months (April to July 2023)

Net cash (but no figures provided)

Gaining market share.

“Challenging market backdrop”, with wage inflation and competitor discounting mentioned.

“Started August well”

Nothing is said about trading vs expectations! That’s the whole point of a trading update, so why miss it out? I want to know about profit, not just revenue growth.

Equity Development is forecasting 17% revenue growth to £114.5m for FY 3/2024, so it looks as if the company is tracking ahead of this so far.

EPS is forecast to grow 11% to 5.37p - I would hope there’s upside on this number, as 31% revenue growth should be flowing through better to the bottom line.

As I’ve pointed out before, profitability has been flat at 4.8p to 5.0p in the last 3 years, so there is a danger the company could be buying growth by cutting prices too much maybe?

The valuation is 18.4x FY 3/2024 forecast EPS - punchy for a low margin, highly competitive sector. If it beats forecasts though, that valuation could be justified.

Paul’s opinion - this seems a good company, and owner/management impress me on webinars -seemingly running a tight ship.

Shares look fully priced to me, but I do like the company. It’s a much better investment proposition than larger competitor AO World (LON:AO.) in my opinion. AO has a difficult balance sheet (including large warranty debits & credits), and a patchy history, and delusional management in my view. Although AO has now belatedly started focusing on trying to make a profit, and its broker forecasts are on a rising trend, so maybe I’m being too harsh?

MRK shares have been recovering nicely since last autumn, bucking the grim small caps market trend -

Graham’s Section:

S&U (LON:SUS)

Share price: £23.82 (+4.5%)

Market cap: £290m

S&U PLC, the specialist motor and property financier, today issues its trading update for the period from its AGM statement on 21 May 2023 to 31 July 2023. S&U will announce its half-year results on 3rd October 2023.

This is an H1 update (the financial year ends in January).

It spends more time than usual berating the UK for its economic policies: “record levels of taxation, steeply rising interest rates, massive government borrowing, and a failure to stem the tide of incessant regulation, especially in the financial services industry”.

In another unusual statement, the Chairman expresses frustration with the S&U share price:

…protecting the quality of the Group's assets and producing responsible growth requires constant innovation and attention to detail. These produce consistently good results, although frustratingly given global investor perceptions of the UK, this is not reflected in S&U's or general stock values. Too often it feels like a tuned and trained athlete is required to continue to perform, wearing army boots on a cinder track.

Readers may have noticed engagement by S&U with investor conferences in recent years: they have been trying to get the word out, but their share price is still lower than it was five years ago.

The shares trade at a moderate premium to book value, but the 8x earnings multiple might be considered tempting:

Note, however, that the “Industry” percentile for S&U’s PE Ratio in the above graphic is red: this is telling us that most Banks are cheaper! The entire UK banking industry is trading cheaply right now.

Let’s get back to today’s H1 trading update.

Advantage Finance: this is S&U’s core motor finance business.

Key points are:

In a slower and more price-competitive market year to date, advance levels for H1 23 finished 11% below H1 22.

Average customer risk score improved

Receivables are £313m, up 12% compared to a year ago.

It might seem strange that new loans (“advances”) are down, but the lending book (“receivables”) is up - this is because it takes several years for customers to repay the loans, and last year’s loans haven’t been repaid yet.

In bad news, “net interest margins have unsurprisingly not kept pace with the egregious interest rate rises of the past year”, but “strong repayments performance has also continued in the period with levels of up-to-date customers exceeding our expectations”.

Aspen Bridging: the property bridging division now has receivables of £104m (a year ago: £90m). New transactions have been fewer and smaller than originally planned, given the conditions in residential property, but “solid progress” is expected in H2.

Impairment is “below budget” - that’s good news. It was previously reported that 10 out of Aspen’s 140 loans were in default, but there was an expectation that they would be recovered.

Balance sheet: gearing has reduced and borrowings have reduced to £184m.

At the time of the AGM statement, I noted that S&U was taking a more aggressive approach with respect to their own gearing than they had before. I can’t blame them for taking their foot off the gas, even if momentarily, to help manage the risks they face in this environment.

Outlook statement doesn’t give anything away. Estimates previously published by Edison suggested PBT of £42.9m and EPS of 268.4p in the current year.

Graham’s view

The Chairman seems irritated, but I think investors should take some comfort from the reduced gearing and the cautious stance.

You might be tempted to think of the stock as being ex-growth, but it still has plenty of momentum:

However, with the property market currently challenged, and in a cost-of-living crisis for consumers, I think it’s reasonable to have a focus on higher-quality lending for a period.

As I noted last time I covered this one, S&U is pumping out a solid ROE of 14% - 15% (depending on who you ask). Given its track record, committed management from the Coombs family who founded the company, and only a moderate premium to book value baked into the share price, I’m going to remain positive on this one. NAV per share should hit £20 early next year.

As far as the risks are concerned, I think their underwriting processes are well proven. However, they do face an exposure to rising interest rates through their revolving credit facilities. I think they are acutely aware of this, and would be quick to de-gear if necessary. But of course no investment is risk-free. As far as financial stocks go, this remains a personal favourite.

Jarvis Securities (LON:JIM)

Share price: 124.9p (-15%)

Market cap: £56m

Today’s trading update from Jarvis is a profit warning:

The Q3 quarterly dividend 2.25p is smaller than previous quarterly dividends (the most recent quarterly dividends were 3.5p, 3p, 2.5p).

The regulatory “Skilled Person Review” is starting to hurt the company’s financial performance. Things must have deteriorated since the recent H1 results:

The associated restrictions on Model B clients, has led to the loss of certain Model B clients and the corresponding revenue. In addition the costs associated with the Skilled Person review are higher than anticipated. These factors, combined with reduced trading volumes caused by market conditions, mean that the Company is now trading below current market expectations.

Net cash is £5.2m, slightly down from where it was at the end of June, but “well in excess of current regulatory requirements”.

Estimates from WH Ireland for the current year are reduced as follows. Revenue is forecast at £12.7m (previously £13.6m). Adjusted PBT is forecast at £6.6m (previously £7m). There will also be £0.5m of exceptional costs relating to the review, so actual PBT may be in the region of £6.1m.

Revenue and adjusted PBT are both forecast to increase slightly in 2024.

Graham’s view

The PBT forecast is down by 13%, so that’s the context in which we have a 15% share price fall today.

However, about half of the reduction in the forecast is due to one-off costs.

I have been positive on this stock, so perhaps I have underestimated the bear points? I provided five bull points and five bear points in July.

The way I see it, however, the difficulties faced by the company are very much transitory in nature. The Skilled Person Review will end, sooner or later, with some sort of resolution - hopefully not one which hurts the company too much.

The very quiet trading conditions are also temporary in nature. Although, you could be forgiven for throwing in the towel at this point and thinking that UK equity trading was never going to get out of this trough!

Jarvis’ X-O platform only deals in UK-listed securities and so it is unable to benefit much from shifts to US shares and to funds. It does offer ETFs and investment trusts, but funds are probably not its strong point.

The product is therefore somewhat limited and from an investment point of view, it’s a concentrated bet on a particular asset class - an asset class that is currently out of favour.

The 3-year chart illustrates the declining sentiment around JIM stock:

But it’s not all doom and gloom: go back to the July interim report and you’ll see that revenue was up and PBT was up, thanks to rising interest rates.

If the company does generate £6.1m of PBT this year, even after incurring some exceptional costs, that will still be significantly better than its performance every year prior to 2020.

Therefore, I’m going to remain positive on this one, as I take a long-term view. There are some problems in the short-term, yes. But for long-term investors, I continue to believe this is a quality company and worthy of further research. The latest market cap (£56m) looks overly pessimistic to me.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.