Good evening/morning, it's Paul here with the SCVR for Thursday.

Covid isn't even touching the sides in Zimbabwe. Please listen to Margaret, who I met in 2019, she's an amazing woman. This is just 9 minutes.

Free Xmas Harp Recital!

A few days ago I promoted Lauren Scott’s (my sister-in-law) online Zoom harp recitals. Unfortunately I think we left it a bit late for the paid-for concerts this year, which have been reduced to just 23 & 24 December, which seems to be when there is demand, there are a few tickets left.

In the meantime, I’ve decided to personally pay Lauren to perform live and exclusively for you, my lovely cultured Stockopedia readers! See it as my Xmas treat for loyal readers here, and a way of helping a talented musician in a year when all her usual gigs have been cancelled.

This special, free, harp recital for Stockopedia readers;

** Saturday 12th December at 6pm, for 45 minutes **

Lauren can only fit up to 100 people on this Zoom concert, so please only sign up (free) if you’re definitely going to attend, as we don’t want a load of no-shows, leading to other people missing out! Lauren only needs your name & email address to send you the Zoom link, that’s it. No spam.

If you like the recital, we’re hoping that you’ll help us spread the word on social media, and recommend Lauren’s Xmas recitals to others. I’m spoiled, because for about the last 20 years, I’ve enjoyed Lauren’s beautiful harp playing in person. It’s a great way to kick off the Xmas season, and singing along with your family/friends is a smashing experience, especially if you get really Christmasy & crack open the mulled wine & mince pies, which is what the Scott family usually do every year! (but not this year).

Harp music is extraordinarily calming, and peaceful to listen to. It’s almost other-worldly in my experience. Whenever Lauren starts playing, I feel the stress just drain away. Ideal treatment for profit warnings, for us investors!

Here’s a reminder (new video below) of Lauren playing Xmas tunes. Like the rest of Xmas, it’s only religious if you want it to be. Personally I’m not religious, but I really enjoy singing along to Xmas tunes, as it reminds me of my childhood, and it’s fun! You can sing along if you want with loved ones (pdf lyrics will be supplied), or just have it as soothing background music, up to you.

Here's a new video (which I've not posted here before) of Lauren playing Silent Night. Feel your blood pressure return to normal as you listen to this! Harp music should be available on the NHS. Actually, Lauren often plays gratis in local care homes (pre and hopefully post covid), as the residents respond so well to it.

Simplybiz (LON:SBIZ)

Share price: 172.5p (down 8% yesterday)

No. shares: 96.8m

Market cap: £167.0m

Capital Markets Briefing & Trading Update

SimplyBiz (AIM:SBIZ), a leading independent provider of compliance, technology and business services to financial advisers and financial institutions in the UK, will be hosting a virtual Capital Markets Briefing...

This was held yesterday, I'm not sure if there's a recording available of it, or not. If anyone finds a recording, please give me the link via the comments below, and I'll copy it here.

Capital Markets days are usually done to drum up some interest for a possible fundraising (maybe for another acquisition?) or if an existing holder wants to sell down.

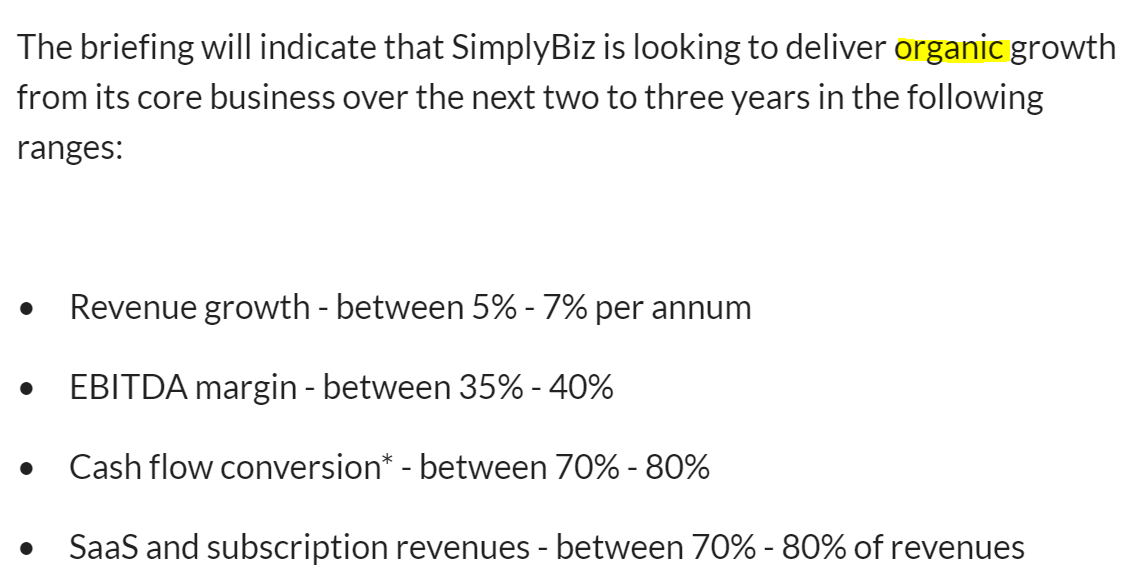

Medium term targets are provided - I've not compared these with actual results, but they look impressive, if achieved;

.

.

Trading update for FY 12/2020 - very clear guidance again, in line with what it's said previously about 11p EPS, a PER of 15.7

• The Board reaffirms, and is confident, that its adjusted EPS will be no less than 11.0p**

• The Board is confident that Defaqto*** will deliver double-digit EBITDA growth in 2020

• The Board announces its intention to propose a final dividend for FY20 of 2.0p per share

*Free cash flow conversion is calculated as adjusted EBITDA, less working capital movements, lease payments, CAPEX, development expenditure, corporation tax paid and interest, as a percentage of Adjusted EBITDA.

** As stated on 23rd July 2020

***Acquired 20th March 2019

As mentioned before, personally I feel divis should be scrapped, and cashflows instead used to strengthen the weak balance sheet (with significant negative NTAV).

Outlook -

... We have an exciting strategy for growth built on firm strategic foundations, and our strong finish to 2020 sets us up well for the year ahead."

My opinion - I covered things in more detail here on 15 Sept 2020 on publication of interim results. My main concerns are balance sheet weakness, and poor cash generation in H1. There was some impact from covid, but overall the business seems resilient.

It's not clear why the company has done a Capital Markets presentation today, but I expect we'll find out in due course - my guess would be possibly a fundraising for another acquisition?

Overall, this does look an interesting group of companies, operating in quite lucrative niches, with lots of recurring revenues. The business model makes a lot of sense to me - financial advisers outsourcing their regulatory & compliance stuff to experts at SimplyBiz. I'm not comfortable enough with it to want to buy any shares, but it's not far off. So it gets filed in my "potentially interesting" tray.

The 3-year chart looks uninspiring. StockRank score looks strong.

.

.

Marshall Motor Holdings (LON:MMH)

Share price: 145p (up c.9% yesterday)

No. shares: 78.2m

Market cap: £113.4m

What a lovely clear update -

Marshall Motor Holdings plc, one of the UK's leading automotive retail groups, issues the following update on recent trading and announces that it is now anticipating an underlying profit before tax for the year ending 31 December 2020 ("Year") of not less than £19m (previously £15m).

That's a good upgrade, coming almost at the end of the financial year.

Marshalls seems to have shrugged off the November lockdown. That does make me wonder, are people seeing cars as a big investment now, or just an affordable item to hire? I was bored the other day, today actually, and almost ordered a Ford Fiesta hybrid on a cheap lease deal (£150 per month) to use as a local runabout. Probably the only reason I didn't hit buy, was I've only got one parking space where I live in Bournemouth, and I wouldn't want to leave a spangly new car parked on the road, underneath trees and seagulls which ruin the paintwork.

Cars are not big ticket purchases any more, most of them work so well, do we even need to test drive them? Just order on the internet, and send it back if you don't like it, that's the way things seem to be going. A new car is now arguably the same as buying a new frock, e.g. Marshalls says;

The Group continued to trade strongly for the remainder of October, benefitting from previously reported sector tailwinds. New retail unit sales were up on a like-for-like basis and significantly outperformed SMMT*-reported new retail market registrations, with like-for-like used car unit volumes also performing strongly.

Whilst trading was negatively impacted by the closure of its showrooms throughout November, the Group was able to continue to operate all of its aftersales businesses, take orders online and by telephone and deliver new and used vehicles through 'click and collect' services. The Group's strong outperformance of the wider new car market continued.

This looks important, as any further lockdowns look subject to the law of diminishing returns, or impact. Something we're seeing in lots of sectors - good businesses are finding ways around lockdowns, and in any case we probably only have a few more months left of covid, so let's look beyond it.

My opinion - there's more positive detail in the RNS, but I've seen enough to say that I think this share looks interesting. It might be something that readers could look into further.

I should mention short term headwinds. As Redde Northgate (LON:REDD) mentioned recently, there is under-supply from Europe (vans mainly, I think), and the press is widely reporting congestion at ports (not just the UK, but more widely), and large increases in freight costs. Those things tend to be temporary, but the UK stock market often reacts violently to short term problems, especially with small caps - because lack of liquidity can cause wild, and completely irrational price movements.

For that reason, I'm adding car dealers to my watchlist of things I'll be buying after Xmas, if temporary supply problems cause a big drop in share prices. It could be a good time to watch from the sidelines, rather than take a risk now, who knows?

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.