Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

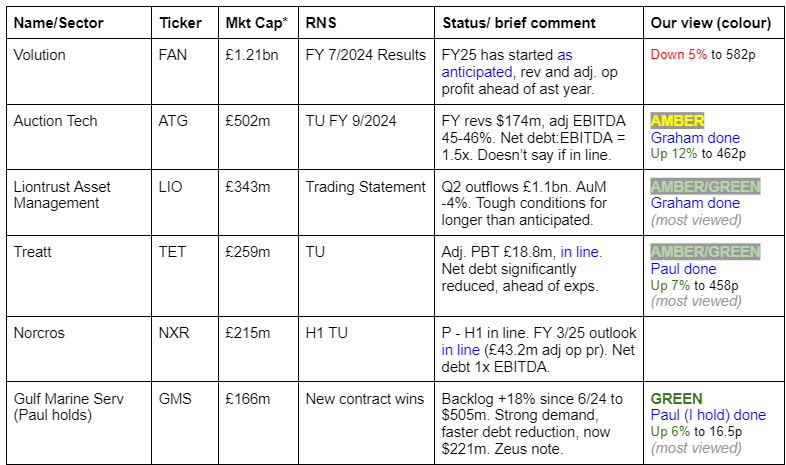

Companies Reporting

Summaries

Gulf Marine Services (LON:GMS) (Paul holds) - up 7% to 16.6p (£178m) - Contract - Paul (I hold) - GREEN

The already large order book grows another 18% in just 3 months after winning new & renewed contracts. Deleveraging is happening faster than expected, and is no longer a problem anyway. Shares seem irrationally lowly valued, with a deep discount to NTAV not making any sense to me, given the prodigious cash generation. Persistent selling related to Seafox may be distorting the market for GMS shares. OR maybe they know something that we don't?!

Liontrust Asset Management (LON:LIO) - down 4% to 508.5p (£330m) - Trading Statement - Graham - AMBER/GREEN

It’s no surprise to see more quarterly outflows at Liontrust. Budget anxiety gets the blame this time but over the last few years there have always been good reasons for outflows. 3-year and 5-year fund performance may not be helping. I’m staying lukewarm on this due to obvious cheapness.

Treatt (LON:TET) - up 9% to 467p (£283m) - Trading Update - Paul - AMBER/GREEN

In line trading update for FY 9/2024. Lacks a proper outlook comment for the new year. Net debt all cleared, and I confirm the previous balance sheet for Mar 2024 is strong, but had excessive inventories - hopefully since reduced. This share was over-priced in 2021-2, but now looks sensible value. I quite like it.

Paul’s Section:

Treatt (LON:TET)

Up 9% to 467p (£283m) - Trading Update - Paul - AMBER/GREEN

Treatt, the manufacturer and supplier of a diverse and sustainable portfolio of natural extracts and ingredients for the beverage, flavour and fragrance industries, today publishes a trading update for the year ended 30 September 2024 ("FY24").

“Strong H2 momentum with full year sales and profits in line with expectations”

Today sees a nice 9% bounce in share price, after a soft patch for the shares in recent weeks, despite this only being an in line update.

It’s still down YTD - with shares being on the main market, so not disrupted by possible AIM IHT sellers.

Longer term, TET shares became significantly overvalued in 2021-22, but are now down to a much more palatable valuation.

Revenues up an impressive 16% in H2, as demand normalises - it previously had customer de-stocking problems in Q1.

FY 9/2024 revenue growth of +5% (or +7% at constant currency) to £155.2m

Adj PBT up 9% to £18.8m, and in line with expectations - a healthy 12.1% PBT margin.

Net debt is particularly good, having reduced from £10.4m a year earlier, to a negligible £0.7m end Sept 2024.

Outlook - I would have preferred a more specific comment on the outlook, all we get is this vagueness. It raises questions when companies are vague about the outlook, and only comment on medium or long-term, so I think this could have been better worded -

“With our value-add products, and available manufacturing capacity following the investments in recent years we will start to target greater customer reach in adjacent markets and new territories. We are confident in Treatt's long-term prospects.”

Broker updates - nothing available to us, so I don’t know if brokers have adjusted the new year’s forecasts or not, I imagine not, since there were no surprises in the FY 9/2024 trading update.

Valuation - the StockReport shows middling valuation metrics as of last night. Remember that today’s 9% pop in the share price will move these figures adversely, so the forward PER will be c.17x now.

Also note the modest divis, but quite good asset backing (it built a sparkly new factory in recent years, to provide more capacity and remove production logjams from a previous hotch potch of facilities in the UK) -

Paul’s opinion - in the past TET reached very high PERs, for reasons that didn’t strike me as terribly convincing - mainly that it would greatly increase production, and improve margins when its new factory came on line. Also that there are only a few players in this sector, and its European counterparts were also on very high PERs.

As it turns out, the financial benefits from the heavy capex look rather limited so far, but maybe there’s more growth to come now it has greater capacity?

Still, it’s a decent business, making quite good margins, and now with a debt-free balance sheet. The last balance sheet was strong, albeit with excessive inventories, so I’d like to see some pruning of inventories in future. Maybe it stocked up to prevent supply chain issues disrupting production, who knows? That would be a good question to ask management - why inventories are so high, and if they’re tackling it to release tied-up capital? Inventories were £61m at Mar 2024, well over the entire cost of sales in H1 - indicating a risk of there possibly being a need to take a hit with a write-off?

Overall though, I see we were AMBER/GREEN twice earlier this year, and I’m happy to stay there. I think it’s a fairly good business, and now at a reasonable valuation too, so moderately attractive.

Gulf Marine Services (LON:GMS) (Paul holds)

Up 7% to 16.6p (£178m) - Contract - Paul (I hold) - GREEN

“Gulf Marine Services (GMS), a leading provider of self-propelled and self-elevating support vessels for the offshore energy sector…”

Contract wins take the already large order book up to a remarkable >$500m -

“award of a new long-term contract in Europe and the extension of two existing contracts in the Middle East, adding a total of twenty five months to the backlog, inclusive of optional extensions.

The current backlog totals USD 505 million, representing 3.3x 2023 revenue and a c.18% increase over that announced at the half year end on 30th June 2024. “

Great visibility, although as I’ve mentioned before, I’d like to ask the company what the contract terms are for any possible client cancellations? Ie how secure is this order book, if eg demand drops off a cliff for any unexpected reason?

GMS mainly operates in the M.East, out of UAE, hence some investors might have geopolitical concerns about that area, although UAE doesn’t seem to get involved in regional conflicts.

Today’s news doesn’t seem to affect forecast profits, as nothing is said about performance vs market expectations. However it does say the key issue of deleveraging is going better than planned -

“The strength of market demand is allowing the Company to meet its deleveraging goal quicker than anticipated…”

Although I would point out that the gearing at GMS is now normal, and no longer the crisis that it was previously. Bank facilities were renewed on normal terms, see our archive for more details, as I regularly update on this interesting value share.

This deleveraging means we should see dividends commence soon, and the dividend paying capacity of GMS should be prodigious if current market conditions of strong demand & large cash generation continue. Shareholders have been very patient, in waiting for the company to dig itself out of a deep debt hole, so I think they deserve some reward. The nightmare scenario is if the company makes the same mistake as before, and orders loads more expensive ships, financed with debt, right at the top of the cycle. Then a shortage of ships turns into a glut, daily rates fall, and we end up back at square one, fighting for survival.

I suspect that management might want to start ordering new ships to service the offshore wind market, a good growth area. Although no doubt competitors are thinking along the same lines, as I think we read something about the sector seeing more capacity in the pipeline. Hence the feast/famine risk with this sector.

Debt reduction is mightily impressive this year FY 12/2024 so far -

“Market fundamentals are steadily improving, allowing us to meet our deleveraging goals faster than expected. As of the end of September, our net debt has decreased to USD 221 million, down from USD 267 million at the start of the year and USD 238.5 million at the end of June.”

Remember that GMS has a fairly modern fleet of ships, and maintenance capex is only about one tenth of cash generation, roughly. As debt reduces, on improved terms, the finance costs decrease, which combined with more attractive terms on contract renewals has delivered remarkable cash generation, which looks locked in for the next 3 years.

The StockReport shows GMS shares trading at a big discount to NTAV, with a price to net tangible asset value of only 0.62x. Some people have questioned the value of the assets (mainly its ships), but given they’re generating huge cashflows, why on earth would they be worth less than book value? That doesn’t make sense to me, if anything maybe they would have a premium value?

The Stockopedia growth & value statistics show a high quality business on a bargain basement valuation -

Overhang - the main issue here is that there’s been a selling overhang from the major shareholder Seafox, which dumped a chunk of shares at 17p when the price was 20p. Then it distributed some more of its GMS shares in specie (ie broke up its holding), to its own shareholders. Some of them might be sellers, as it definitely feels as if there’s still an overhang in the market.

Critics might say that given Seafox operates in the same space, and they seem desperate to sell out of GMS, then is this a warning that something might not be as good as it seems? Possibly, but people sell because they want liquidity, so it might have some other pressing use for the cash perhaps (maybe to finance building more of its own ships, given the attractive returns available)? Also it was originally a turnaround investor, so might just feel its job is done, who knows?

I tend not to worry too much about selling overhangs, as I feel that patient investors are being given a buying opportunity. Although sometimes it does transpire that the seller foresaw trouble ahead, so each situation is unique.

We’ve seen before in the recent past how surges in GMS share price seem to be sold into by sellers. Maybe the same thing will happen again?

For these reasons, I’ve decided to buy the dips, with a small opening position recently taken at c.15p. I’ll add to that if it drops back down to 15p again in the coming weeks.

GMS shares are main market, so we don’t have to worry about possibly disruption from any changes to the IHT treatment of AIM shares, it’s not relevant here.

Warrants - remember there’s dilution from warrants and share options which is quite significant, something like 13-15% dilution from memory, so that needs to be remembered when valuing this share, details are in our archive.

Paul’s opinion - today’s encouraging news just makes the already strong bull case even stronger.

I always listen to bearish arguments too, and none of them stack up for me. Even the cyclical nature of this sector shouldn’t be an issue given that GMS has 3-years bumper trading locked in with its existing order book, by which time it’s likely to have very little debt remaining.

The main risk is that management over-extend and order lots of new ships at the wrong point in the cycle, hence why I hope they prioritise divis, not buying new ships. Risk:reward overall looks very good to me. Any disruption caused by sellers won’t last forever, then it could re-rate. So personally I like to buy before the turning point, to lock in a low price, but some people prefer to wait for a favourable chart, and pay more.

A useful note from Zeus today confirms it's leaving forecasts unchanged. It has a higher EV/EBITDA multiple than Stockopedia, and points out that GMS isn't much cheaper than the oil services sector as a whole. Although the attraction is the GMS is generating so much cashflow and using it to deleverage, that the upside all flows to equity. That's the bit I like the most. So for me it remains firmly GREEN.

Still a very good recovery in the equity, despite the more recent pullback -

Graham’s Section:

Liontrust Asset Management (LON:LIO)

Down 4% to 508.5p (£330m) - Trading Statement - Graham - AMBER/GREEN

It’s a Q2 update (to September) from this fund manager, and the sequence of outflows continues: another £1.1 billion, up from £0.9 billion in Q1 (to June).

Assets under management and advice (AuMA) are down 4% over the period to £26 billion. The year-on-year decline in AuMA is 6% (from £27.7 billion in Sep 2023).

The CEO comment blames “speculation and uncertainty” around the upcoming Budget statement for hurting investor confidence - but of course the sequence of outflows has been around for far longer than Budget 2024 has been relevant! The CEO notes that “the challenging environment for active managers has continued for longer than anticipated”.

Other points mentioned:

New enterprise portfolio management system implemented.

The Global Equities team led by Mark Hawtin (recruited from GAM, which Liontrust tried to acquire last year) is now settled in.

Among UK financial advisors, GAM is ranked 4th best asset manager and 2nd for brand familiarity.

AuM/Flows

As usual, the net outflows during the quarter were concentrated in the UK Retail Funds category (£0.9bn), as that is where most of Liontrust’s AuM can be found.

The “Institutional Accounts & Funds” category saw nearly 10% of its starting AuM leave (£123m out of starting AuM £1.6 billion), as did the “International Funds and Accounts” category (£82m out of £900m).

Performance isn’t mentioned much in the commentary and so I’ve counted the figures in the performance tables today.

Results:

How to read this: this counts the number of funds in each quartile over each time frame.

So for example, over a 1-year timeframe, there are 52 funds. 24 are in the top quartile (top 25%) of performance, 13 are second quartile, 9 are third quartile and 6 are bottom quartile.

The 3-year and 5-year timeframes are worrying to me.

Over 3 years, the majority of Liontrust’s funds are in the bottom half of funds (3rd and 4th quartiles).

Over 5 years, nearly half (48%) of Liontrust’s funds are in the bottom half of funds..

Remember that this is not comparing Liontrust against benchmark indexes. This is only comparing Liontrust against other funds, which is usually much easier than comparing against benchmark indexes.

Also remember that these statistics are always subject to survivorship bias, as fund managers have a tendency to shut down or merge some of their funds over time, and new funds are created. Only 42 of Liontrust’s existing 52 funds are eligible for 5-year return statistics.

Graham’s view

These shares are down by nearly 20% since I reviewed them in July. I am inclined to keep my mildly positive stance due to their extraordinary level of cheapness:

It’s true that I find other fund managers to be much more appealing investment opportunities than this one. I like fund managers with niche expertise, with lean operations and with simple fund ranges. Liontrust is not ticking any of these boxes for me as it seems to want more complexity rather than less. It wants to be the acquirer, while I would like to see it being acquired.

Therefore, Liontrust is one of the last fund managers I would add to my portfolio at this time. However, I still think that, like its peers, it does offer value to investors. The company somehow managed to post a loss in FY 2024, but that should not be a regular occurrence. Under different management or with a different strategy, I could probably be GREEN on this again. For now, I’m lukewarm.

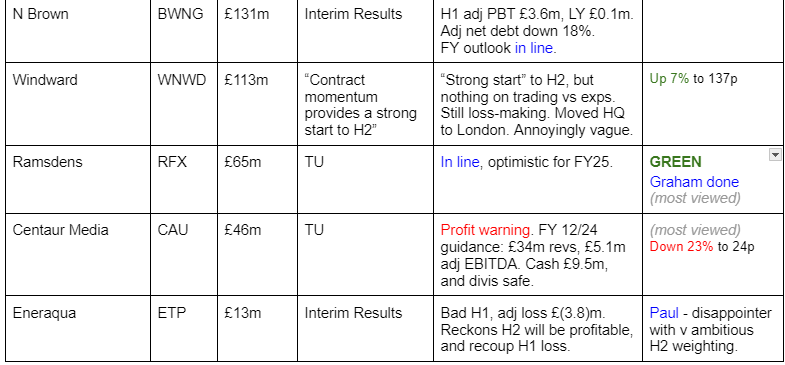

Short Sections

Auction Technology (LON:ATG)

Up 12% to 463p (£563m) - Trading Statement - Graham - AMBER

Auction Technology Group plc… operator of world-leading marketplaces for curated online auctions, provides an update on its trading performance for the financial year ended 30 September 2024.

ATG owns a range of websites that host the sale of art, antiques, collectibles, industrial machinery, etc.

Cavendish have made no changes to their ATG forecasts but the market must have been expecting worse as it seems to like this update.

Key points:

Gross Merchant Value (value of goods sold) slightly negative year-on-year but trends are improving.

Revenues up 2% organically, up 5% in total to $174m.

Costs in line with expectations.

Debt: the year-end leverage multiple is expected to be 1.5x at year-end, in line with forecasts.

At the interim results, net debt was $142m and was declining year-on-year.

Graham’s view

I may have jumped the gun when I went positive on this one in January (at 542p).

Paul was AMBER/RED in July, though he acknowledged that such a stance “will be too harsh if it achieves current forecasts”.

Forecasts have only shifted down marginally since then:

I think an AMBER stance is fair enough in these circumstances, considering the debt load and the continued presence of the private equity seller, TA Associates.

In a separate announcement today, we learn that ATG's CFO is stepping down and moving to a job with another private equity-backed company. He has been with ATG for eight years already, and will stay with ATG until next year to allow for a smooth transition, so I wouldn’t be inclined to read too much into this.

Ramsdens Holdings (LON:RFX)

Down 5% to 195.55p (£62m) - Pre-Close Trading Update - Graham - GREEN

A brief update that’s in line with previous guidance that PBT in FY September 2024 would be at least £11m.

CEO comment:

"We're pleased with the record profit performance in FY24. All key income streams are growing and we have optimism for further progress in FY25."

"This performance once again demonstrates the strength of our diversified business model which underpins our long-term growth strategy."

Graham’s view

No change in my view since the August trading update, which raised the PBT forecast from £10.5m to the current “at least £11m”.

At a single-digit earnings multiple, I continue to have a high opinion of this company and its industry peer H & T (LON:HAT). RFX’s StockRank is an impressive 94.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.