Good morning from Paul & Graham!

Let's leave it there for today, before my elderly PC (or me!) blows a gasket!

Mid to large cap news so far this year strikes me as pretty good, which is encouraging for the overall economy, and hopefully smaller caps too - eg.

Larger housebuilders - are much higher share prices up with events now? -

Persimmon (LON:PSN) - y'day seemed surprisingly upbeat - reported FY 12/2023 completions (sales) ahead of expectations, albeit 33% down on 2022. Its outlook sees "highly uncertain" market conditions in 2024, but mortgage rates easing is already helping demand. Build costs moderating. Shares have risen 54% since late Oct 2023!

Taylor Wimpey (LON:TW.) - Today says FY 12/2023 operating profit at top end of guidance (£440-470m), which it says is in line with expectations. Uncertain market conditions, but improving mortgages outlook & enquiries. Order book is reduced. Planning system "extremely challenging" - slow. Build cost inflation almost gone, at 0-1% on new tenders, but 4% in H1 2024 due to time lag. Also trades in Spain, which I didn't know! Net cash £678m. Optimistic medium & long term, PSN said the same thing. Shares up 42% since late Oct 2023 low.

Big retailers - as you know, last week we had -

Next (LON:NXT) reporting a good Xmas & raised guidance, but

JD Sports Fashion (LON:JD.) warned on profits & plunged.

This week so far we have -

J Sainsbury (LON:SBRY) - yesterday it reiterated full year profit guidance at £670-700m. Groceries did well, general (mainly Argos) struggled. They offset. Shares dropped about 6% y'day on this news.

Tesco (LON:TSCO) - today says it traded well over Xmas, and raises retail op profit guidance to £2.75bn (previously £2.6-2.7bn). "Cautiously optimistic" about consumer spending in 2024.

Marks and Spencer (LON:MKS) - strong sales growth, esp groceries. Increased costs. FY 3/2024 looks in line with market expectations. Uncertain outlook for FY 3/2025, and increased costs, esp labour & business rates. Shares down 4% in early trades, after an excellent bull run since Oct 2022, up >150%!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

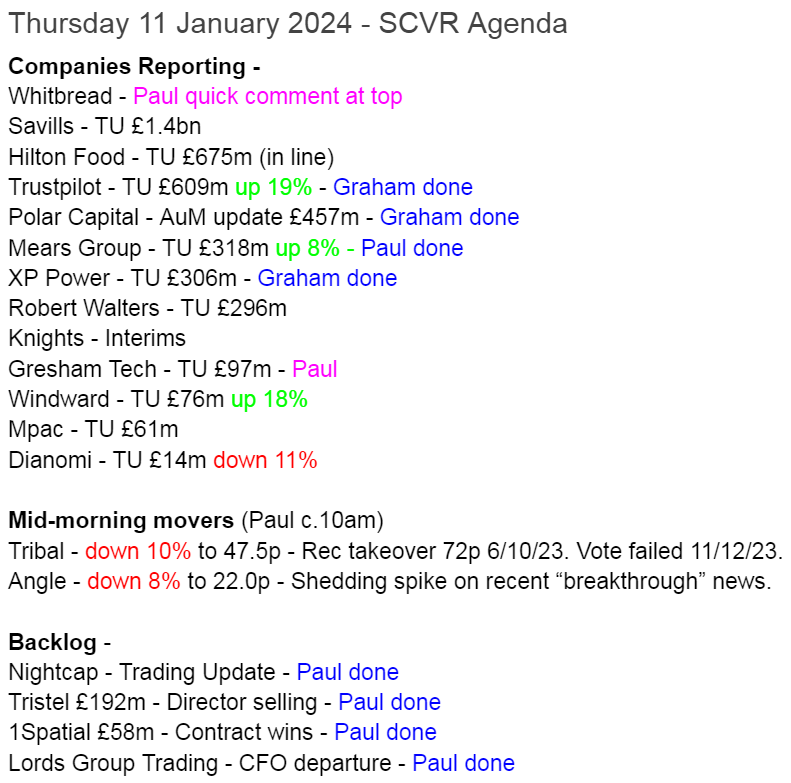

Summaries

Nightcap (LON:NGHT) - Up 10% y’day to 5.65p (£12m) - Trading Update - Paul - AMBER/RED

Strong Dec 2023 trading, but still heavily negative for H1 (Jul-Dec). I don't like this company's fundamentals - too much debt, loss-making, overpaid mgt. However if we have a consumer resurgence in 2024, then there's operationally geared upside for this sector.

Tristel (LON:TSTL) - down 10% to 405p (£192m) - Director sales - Paul - AMBER

CEO & CFO sales announced yesterday afternoon hit the share price by 10%. The CEO is retiring, but why did the CFO also sell? Not vast amounts each, but it has clearly hurt short-term market sentiment.

1Spatial (LON:SPA) - 52.5p (£58m) - Enterprise contract wins - Paul - AMBER/GREEN

Contract wins announced yesterday sound pleasing. I just wanted to flag this share, as we’ve not looked at it for 4 years, but over that time it’s been transformed into a much more credible, and now profitable, growth company. Worth taking a closer look, I think it looks quite good, on a quick review only.

Lords Trading (LON:LORD) - down 8% to 42p y’day (£70m) - CFO leaving - Paul - AMBER/RED

I’m raising an amber/red flag here, due to abrupt departure of the CFO, only days after the year end, which concerns me.

Polar Capital Holdings (LON:POLR) - down 0.1% to 453p (£458m) - Aum Update - Graham - GREEN

Rising markets and strong returns have masked a large outflow of client money in Q3. One fund has generated a large performance fee, and this is also boosting short-term results. I remain positive but want to see client demand recover as quickly as possible.

Trustpilot (LON:TRST) - up 19% to 173.5p (£731m) - Trading Update - Graham - GREEN

Excellent news from Trustpilot as revenues for 2023 are ahead of estimates, with strong margins and the result is that adj. EBITDA is above the range of market expectations. With positive cash flow and a large cash balance, the company announces a £20m buyback.

Mears (LON:MER) - Up 8% to 337p (£343m) - Trading Update [ahead exps] - Paul - GREEN

This housing services group issues a slightly ahead update for FY 12/2023, but materially increases the FY 12/2024 outlook, although only to flat vs 2023, whereas previously it was for a fall in profits. Note the share buybacks are on a large scale, and strongly enhancing EPS, enough to more than absorb the increase in Corp Tax that kicked in from April 2023. Despite a big rise in share price, I remain of the view this share seems good value. Long-winded section below, as I had to calculate my own forecasts due to lack of broker coverage available.

XP Power (LON:XPP) - up 1% to £13.05 (£309m) - Trading Update - Graham - AMBER

Q4 revenues and net debt are both better than expected, due to the delayed relocation of a facility. So Q1 will see the negative impact (lower revenues and higher capex). Net debt has returned to a more manageable level, but I’d continue to treat this one cautiously.

Paul’s Section:

Nightcap (LON:NGHT)

Up 10% y’day to 5.65p (£12m) - Trading Update - Paul - AMBER/RED

I’m just looking back at the Admission Document for this small bars group from Jan 2021, and it floated at only 10p. Then look below at what happened to the share price - which can only be described as an initial frenzy, more than tripling in early 2021 to a daft price approaching 40p!

Maybe it was Dragon's Den viewers getting over-excited, as founder Sarah Willingham appeared on that TV show in 2015-16. She’s appeared on The Chase too. Her Wikipedia page shows other business activities previously, mainly involved in bars and restaurants, so lots of sector experience.

Personally, I’m wary of any kind of “star” management, as they so often seem to go wrong - look at Woodford, Sir Martin Sorrell’s S4 Capital (LON:SFOR) , and in hospitality Hugh Osmond’s Various Eateries (LON:VARE) which have all flopped. Hence over-paying for star management in IPOs is I think often a really terrible idea. If it’s just a startup, they have to prove themselves from scratch, just like anyone else.

On to yesterday’s news.

Trading update

Nightcap (AIM: NGHT), the owner and operator of 46 premium bars, is pleased to announce a positive trading update for the four week 2024 Christmas period as well as the 13 weeks and 26 weeks ended 31 December 2023, with record trading weeks across several of the Group's sites. This positive trading is despite the ongoing challenges of train strikes, inflation and the cost of living crisis.

This is H1, as the year end is FY 6/2024. It’s a good idea having a mid-year financial end, as Dec year ends leave peak trading right to the end of the year, making forecasting more difficult. Revolution Bars (LON:RBG) also has a June year end, but is high risk at the moment due to excessive bank debt used to acquire Peach Pubs.

Peak period (4 weeks to 31 Dec 2023) LFL sales an impressive +11.9% (for comparison, RBG achieved +9.0%, and the shares plunged about 20%). Remember that hospitality needs to achieve these levels of revenue growth, just to absorb the large hike in costs (especially labour, but also energy, and food/drink inflation).

Labour costs in particular rose c.10% in 2023, and is set to do the same in 2024, due to living wage increases. This is the largest cost in hospitality, being typically 30-35% of revenues, so it remains a major sector headwind.

However, customers benefit greatly from higher wages, and should have a lot more disposable income in 2024 (wages up c.5-10%, and inflation maybe 2-3%?), which is why the hospitality sector is coming alive again.

H1 (July-Dec 2023) LFL revenues were down 10.0% - which is awful, given that costs will be much higher than last year. This is despite the strong Xmas trading. So Q1 must have been absolutely dire.

Cash/debt - isn’t good, I don’t like the reliance on bank debt here -

The Group's cash position as at 31 December 2023 was £3.9 million (including cash in transit of £0.9 million). At the same date, the Group had total bank debt of £8.9 million resulting in a net debt position of £5.0 million (excluding convertible loan notes). £1.0 million of the Group's total bank debt is scheduled for repayment during FY2024.

Convertible loan notes are £2.65m (10% coupon, and minimum conversion price of 12p), so total net debt is really £7.65m, not £5.0m above. I don’t like the misleading reporting here.

Balance sheet is weak, NAV £14.5m, included £19m intangible assets, so it’s negative £(4.5)m at 2 July 2023. Fine if the business is profitable, but it’s not, there was a £(4.9)m statutory PBT loss in FY 6/2023.

Note that Director remuneration is excessive for the size (and lack of profits), with Mr & Mrs Willingham-Toxvaerd paid a combined £707k in FY 6/2023! That’s much too high, given the wobbly financial position and losses. Management should get paid handsomely once they've created a successful, profitable business, not before. What happened to sweat equity?!

Forecast - thanks to Allenby, which forecasts a reduced loss before tax of £(336)k for FY 6/2024, but this assumes a large fall in staff costs from 36% to 29.5% of revenues, which strikes me as unrealistic. Hence I’m expecting a profit warning at some stage.

Paul’s opinion - the closer I look, the less I like NGHT shares.

It’s a collection of I think rather tired brands, eg Dirty Martini, The Cocktail Club, and others - some bought out of administration (there’s a reason for that).

NGHT doesn’t make any genuine profit. There’s too much debt too. So overall it has to be a mild thumbs down from me, with AMBER/RED.

The sector opportunity is that consumers may come roaring back in 2024, with large increases in real terms earnings in the pipeline. With typical gross margins around 70-80%, bars and restaurants could see operationally geared upside if demand surges up.

So if you fancy a punt on that upside scenario playing out, NGHT could be of interest. Although it strikes me as a poor quality business, I’d be looking for more interesting, lower risk punts in this sector. I’ve gone with Tortilla Mexican Grill (LON:MEX) (I hold) in the casual dining space as my hospitality sector choice at the moment, where I think risk:reward seems better.

Tristel (LON:TSTL)

Down 10% to 405p - Director sales - Paul - AMBER

CEO sold £211k-worth (50k shares) at 422.5p (£1.1m remaining)

CFO sold £169k-worth (40k shares) at 422.5p (£968k remaining)

This announcement was issued at 14:27 yesterday, and triggered a 10% drop in share price.

Nobody likes to see Directors selling £6-figure (or more) shares, as it raises questions about how much upside they see for the shares.

Although in this case, TSTL’s very long-serving CEO had previously announced his intention to retire, so I think reducing his shareholding is understandable. The CFO following suit isn’t a great signal though. Obviously this has hurt short-term confidence, although we don’t know whether that will linger, or be quickly forgotten?

Paul’s opinion - It’s a pity Directors have sold some shares, as I really liked the last update from TSTL on 19/12/2023, and since it was brimming with positivity, I went up from amber to amber/green.

We always complain about the high valuation of TSTL shares, and even after yesterday’s 10% price fall, the forecast PER remains high at 27.4x

I think Director selling is more important when combined with a high valuation, as it raises the question as to whether the upside is really as exciting as the market thinks?

This does raise a question mark, so I’m dropping from amber/green back to AMBER. Looking at valuation, I’d be happier if the share price started with a 2 or a 3, not a 4. It’s still a nice company though, with a terrific long-term track record, having 20-bagged in the last 11 years. So as usual, my only quibble is valuation, not the fundamental quality of the company, which is very good.

Zooming out to 10 years, the really big % gains happened in years 2014-18

1Spatial (LON:SPA)

52.5p (£58m) - Enterprise contract wins - Paul - AMBER/GREEN

1Spatial, (AIM: SPA), a global leader in Location Master Data Management (LMDM) software and solutions, secured several multi-year Enterprise contracts in December, strengthening the Group's position across its key geographies and closing the year with good momentum.

I wanted to get something into the system here about 1Spatial, as we’ve not reviewed it for 4 years, and things have improved considerably - a good growth track record, and it’s moved into profit - although no divis yet, and the balance sheet needs a look (whenever you see “n/a” here on the StockReport, that means the balance sheet is negative, so weak, and requiring more investigation) -

Good growth track record now -

Is it worth the market cap of £58m though? Possibly, if it achieves forecasts, and if profit growth continues.

News yesterday was about 2 contract extensions, which as SPA says, demonstrates that customers like its software, in Europe and USA.

Director comments - sound intriguing -

Commenting on the contract awards, 1Spatial CEO, Claire Milverton, said: "We are delighted to have been awarded these significant contracts from these major organisations, expanding our presence in Europe and the US. These wins demonstrate that the Land and Expand strategy in our Enterprise business is continuing to deliver organic growth, and alongside our 1Streetworks and NG911 offerings, we believe the opportunity for 1Spatial has never been greater. These wins prove that our customers understand the value of our world-leading and innovative technology as we are increasingly selected as the chosen provider on a repeat basis, and we expect many further opportunities from our patented 1Integrate offering across key geographies."

Paul’s opinion - I don’t know much about the 1Spatial, but I vaguely recall it cropped up recently on my radar as sounding interesting - possibly a webinar, or fund manager interview, I can’t remember.

Anyway, giving it a quick review today, yes SPA does look interesting, it strikes me as a credible software company that seems to be on an interesting growth trajectory. I’d like to learn more about this company, so please do let us know in the comments if you’ve looked at it closely, and what your view is.

This latest RNS doesn’t say anything about trading vs market expectations for FY 1/2024, but this headline implies things are OK - “closing the year with good momentum”.

Interesting how SPA shares have shrugged off the last 2 years bear market in UK small caps - so the relative performance is much better than this chart suggests -

Lords Trading (LON:LORD)

Down 8% to 42p y’day (£70m) - CFO leaving - Paul - AMBER/RED

Lords, a leading distributor of building materials in the UK, announces that Chris Day, Chief Financial Officer and Chief Operating Officer, has informed the Board of his decision to leave the Company to take up another professional opportunity.

One of many disappointing 2021 floats, Lords is a distributor of building products.

Shares hit a new all-time low yesterday, as confidence seems to have taken a knock (understandably) from Tuesday’s news of the abrupt departure of its CFO/COO (same person).

It’s the timing that worries me - it’s not good when a CFO resigns just after the year end - there’s an unwritten rule that CFOs should stick around and get the audited numbers out, and then move on to another job. However in this case it says he will be leaving Lords in H1 2024, and is thanked. But a new CFO is actively being sought asap to “ensure a smooth transition”.

Paul’s opinion - I find this unsettling, so even though Lords looks attractive on value metrics (PER 7.3x, and 4.9% divi yield on the StockReport), I’ll be keeping my distance for the time being. Looking back at my previous notes, it lowered FY 12/2023 guidance by 15% on 7/9/2023, mentioning tough market conditions. Also I’ve flagged before that the founding family has too large a controlling stake for my taste, so the free float is only tiny, hence difficult to trade and possible delisting risk?

It could all turn out to be fine though, so I’ll update you again when the next trading update is issued.

Mears (LON:MER)

Up 8% to 337p (£343m) - Trading Update - Paul - GREEN

Mears (LSE: MER), the UK Housing solutions provider, announces the following update on trading for the financial year ended 31 December 2023 ('FY23') and its expectations for the current financial year ('FY24').

This sounds good -

Strong trading performance and cash generation

Significantly upgraded earnings expectations for FY24

We previously flagged Mears positively (GREEN) 4 times - 8/12/2022, 28/4/2023, then twice more in the last 6 months -

SCVR 16/6/2023 - GREEN - up 8% to 263p - Materially ahead TU.

SCVR 3/8/2023 - GREEN - up 2% to 277p - Good interims. Still reasonable value. Benefiting from asylum seeker accommodation contracts.

What we liked was its low PER, good divis, and sound balance sheet. I hope some members here have gained from the recent surge in share price - up 33% since the Oct 2023 lows. Although lots of shares have surged in the last 3 months, and it remains to be seen if these sometimes rather frenzied rises will hold, or if profit-taking might be the order of the day? As always, it depends on our individual investing/trading timescales and risk tolerance.

What does it say today?

FY 12/2023 trading is “modestly ahead” -

The strong financial performance reported in the interim results on 4 August 2023 continued through the second half of FY23. The Board anticipates reporting results for the full year that are modestly ahead of market expectations1 with revenues and adjusted profit before tax in excess of £1,050m and £43m respectively.

1 The Board consider the current consensus analyst forecasts for FY23, prior to this announcement, to be revenues of £1031m and adjusted profit before tax of £40.9m. Adjusted profit before tax is reported before the amortisation of acquisition intangibles. On the same basis, the Board considers market expectations for FY24, prior to this announcement, to be revenues of £888m and adjusted profit before tax of £ £33.9m respectively.

This is great - Mears discloses adj PBT (good) and not adj EBITDA (bad), well done Mears! Everyone needs to do this, I’m sick and tired of EBITDA nonsense in trading updates, and so are almost all the investors I talk to. So come on other companies, give us the figures we actually want please, not fantasy numbers! Or give both, then everyone’s happy.

Plus a detailed footnote above, top notch reporting Mears!

Note that before today the market was expecting a sharp fall in 2024 PBT vs 2023, it's now guiding profits to be flat from 2023 to 2024.

Net cash - I’m in danger of exploding with excitement here, as it also provides another key item on my wish list for company reporting - average daily cash! -

The Group delivered a strong conversion of EBITDA to operating cash flow, with net cash at 31 December 2023 of c.£105m and an average daily net cash over the 12-month period of c.£75m, both of which are ahead of previous guidance.

The Group delivered a strong conversion of EBITDA to operating cash flow, with net cash at 31 December 2023 of c.£105m and an average daily net cash over the 12-month period of c.£75m, both of which are ahead of previous guidance.

Outlook for 2024 - again, crystal clear guidance here -

The momentum seen in 2023 is expected to continue into 2024 and, as a result, the Board's expectations for FY24 now sit materially ahead of market expectations1.

The Board continues to anticipate a reduction in management-led revenues as the elevated activity level seen across FY23 normalises.

However, adjusted profit before tax in FY24 is now expected to be of a similar quantum to FY23, reflecting continued margin progression.

Share buybacks - authority now used up. Will seek a fresh authority.

Broker updates - nothing available to pond life like us.

Working out the figures manually myself, using the interims (and today’s update), plus the broker consensus figures on the StockReport as guides, here are my numbers.

£43m adj PBT. Note that adj and statutory profit are practically the same. Note that corporation tax was 21% in H1, but is likely to be higher at 25% in H2 (it went up from 19% in April 2023). So I’ll use 23% tax for FY 12/2023. That gives PAT of £33.1m. Divide by 113.5m fully diluted share count (taken from note 8 in interims), ah no hang on, there’s been a big share buyback, so scrap that. The share count seems to have come down from 110.86m at the health year, to just 101.55m in the most recent RNS on 2/1/2024, that’s a huge fall in just 6 months.

For EPS we should use a weighted average share count I think, but I’m going to use the current share count of 101.55 + 2.67 share options dilution (unchanged from interims, I assume), giving 104.22m shares in issue.

This results in 31.8p EPS (diluted) by my calculations for FY 12/2023.

At 337p per share today, that results in a PER of 10.6x - still looks good value to me, considering it also has a nice cash pile on top.

Moving on to FY 12/2024, it says a similar result is likely, so £43m PBT, but higher tax at 25%, so PAT falls to £32.3m, and with more buybacks likely, I’ll estimate a further reduced share count of say 5m, so let’s call it 99m shares by end 2024, and hence a slight rise to 32.6p EPS. Giving a FY 12/2024 PER of 10.3x - good value.

Paul’s opinion - I think the big rise in MER share price recently is fully justified, and shares remain good value. So I’m happy to stick with GREEN.

Sorry this was a bit long-winded, but I wanted to show my workings, and once you start these things, you can’t stop!

Mears shares laugh in the face of a 2 year bear market -

Here it is compared with its benchmark index (SMXX since MER is fully listed) - up 73% in two years, compared with SMXX down -17% - with divis on top of that too - a cracking investment I'd say -

Graham’s Section:

Polar Capital Holdings (LON:POLR)

Share price: 453p (-0.1%)

Market cap: £458m

This is a Q3 update to December, as Polar’s year-end is in March.

Assets under management have risen to £19.6 billion (Dec 2023), versus £19.1 billion at the end of Q2 (September 2023).

Net flows were negative in the quarter to the tune of £1.1 billion - more than the first two quarters combined.

However, AuM still rose as investment returns more than fully reversed the impact of net flows.

CEO comment:

Despite global equity markets rallying in the final quarter, the 'risk-off' stance by investors resulted in net outflows in the quarter of £1.1bn as clients reduced their weighting to active equities, taking profits in many cases following a strong period of performance.

Possibly providing some consolation, the CEO says that “redemptions were concentrated in terms of number of clients, as opposed to representative of a wider trend”.

One fund (not named) has generated a large performance fee, and this has provided a big boost to Polar’s total performance fee income:

Estimates: Many thanks to Paul Bryant at Equity Development who has published new forecasts this morning; with the benefit of these performance fees, his PBT estimate increases from £41.6m to £50.1m.

The EPS estimate increases from 31.8p to 38.2p.

Graham’s view

One difficulty with valuing Polar (or any fund manager) is the uncertainty around performance fees; if we are attaching an earning multiple to profits, it almost feels like we should have one multiple for performance fees - lower due to their uncertainty - and another, higher multiple for profits from management fees.

Personally, I have been positive on Polar and I picked it for my 2024 best ideas list. Today, we have positive news on performance fees, but the news on flows remains poor.

If I had a choice, I think I’d prefer to see positive news on flows, as this speaks to the health of the underlying business and client demand for Polar’s products.

With the Biotech and UK Value funds posting “impressive absolute fund performance and strong performance relative to benchmark” (in the words of Polar’s CEO), I’m hopeful that we might see a stabilisation in flows before too long.

Investors only get £43 of AuM for every £1 invested in Polar shares at the current price, so this fund manager is on a much richer valuation than others in the space we have reviewed (especially the likes of Jupiter Fund Management (LON:JUP) etc.).

I also note that its enormous dividend yield is not fully covered by current earnings

Overall, I continue to like the stock and retain my positive stance, but must admit that I would be alarmed if flows continued at their current rate for much longer.

Trustpilot (LON:TRST)

Share price: 173.5p (+19%)

Market cap: £731m

We have three announcements from Trustpilot this morning - trading update, share buyback, and directorate change.

Let’s start with the trading update for 2023:

Revenue +17% to $176m, annualised recurring revenue +18% (at constant currency) to $197m.

Adjusted EBITDA above the top end of the range of market expectations.

The company helpfully discloses that it believes market expectations to be revenue growth of 15% and adj. EBITDA of $11.1m - 14.1m.

Continuing:

Net dollar retention rate (i.e. revenue from existing customers) dips from 100% to 99% (still v. good).

Net cash rises from $83m (June) to $91m.

Since the company’s cash balance is rising and it plainly doesn’t need all of this cash, it separately announces a buyback of £20m (c. $25m). The company’s intention is to cancel the shares purchased, i.e. permanently reducing the share capital of the company.

The company says:

As previously announced on 19 September 2023, the Company is committed to running an efficient balance sheet and returning excess capital, not required for other priorities, to shareholders.

Indeed, we commented on this in a September SCVR, when the company said that it was cash flow positive and was committed to returning excess capital to shareholders. So there was a clue that this could happen.

Returning to the trading update, here are the CEO’s comments on recent performance:

"Building on a solid performance in the first half of the year, we achieved further growth and margin improvement in the second half, with profitability and positive free cash flow ahead of expectations for the year...

The strong performance in FY23 shows the strength of the Group. We remain confident in our ability to sustain growth and improve margins over the long term as we deepen the network effects in our model to capitalise on large and growing market opportunities."

In the final RNS of the day from Trustpilot, the company announces that a long-standing NED is retiring.

(As an aside, this strikes me as the right way to publish multiple news items - in separate RNS announcements. Jupiter Fund Management (LON:JUP) caused a bit of a stir this week by publishing a trading update at the bottom of an RNS whose main subject was personnel change).

Graham’s view

I’m delighted that the investment thesis is playing out here. Note the very strong earnings momentum, prior to today’s beat:

It’s a powerful situation when a company is making the transition from losses into profitability; small increases in revenues/margins translate to huge percentage increases in expected profits.

Trustpilot is doing that but with the added tailwinds of a) an enormous cash balance, giving it the flexibility to invest as required but also to return money to shareholders, b) a strong - and in my view - increasingly strong - competitive position, where the bigger it grows, the more compelling its product becomes. I believe these are the “network effects in our model” mentioned by the CEO.

Naturally, I must perform the analyst’s equivalent of “letting my winners run”, and keep my positive stance on these shares.

XP Power (LON:XPP)

Share price: £13.05 (+1%)

Market cap: £309m

XP Power, one of the world's leading developers and manufacturers of critical power control components to the electronics industry, is today issuing a trading update for the fourth quarter and full year ended 31 December 2023.

Paul has provided excellent coverage of this one in recent months, most recently the £45m fundraising in November.

The wheels have sadly come off here in recent years, as profitability has evaporated:

Let’s catch up with today’s trading update:

The right-hand column shows a sequential improvement in Q4 orders and revenue vs. Q3, though the numbers are still down compared to last year.

One possible bright spot is that the revenue decline in Q4 compared to last year is “only” 5%, and is ahead of expectations.

However, this is “largely” due to “the decision to reschedule the relocation of our facility in California, from December 2023 to January 2024. This had the effect of bringing forward £5.0m of revenues from orders shipped earlier than expected in Q4 2023 rather than Q1 2024.”

So these £5m of revenues will be missing from the Q1 result.

On a full-year basis, revenues are up 8% (at constant currencies).

Orders

Book-to-bill of 0.6 confirms that the order book continues to decline.

The book finished 2023 at £192m.

XPP doesn’t mention what it was a year ago, which is never a good sign! So I’ve looked it up: a year ago, the order book was £300m.

In the company’s defence, it did say a year ago that the £300m book gave the company “a greater visibility than normal” and that they expected visibility “to return to more normal levels” in 2023 - this has certainly happened!

Net debt

At the end of the year, net debt was £112.6m, better than expected, but again this is due to the delayed relocation of the US facility. £12m of capex payments will hit in early 2023.

Paul’s September report noted that XPP’s net debt position had reached £163m by early October, prior to the refinancing.

Net debt/EBITDA at the end of the year is expected to be c. 2.0x, vs. 2.6x at the end of Q3.

This is consistent with the idea that the fundraising eliminated about a quarter of the net debt.

In very general terms, lenders start to get nervous when net debt/EBITDA crosses above 3x. At 2.0x, XPP should have some breathing room.

Cost and debt reduction plans announced with the fund plan are “on track”.

Outlook

Whilst it is too soon to be definitive about prospects for 2024, we continue to expect that market conditions will improve as the year progresses, with our results being weighted towards the second half. Our performance will be supported by the actions taken to reduce our cost base and we will continue to respond decisively to market conditions as they evolve.

Graham’s view

I’m going to stay neutral on this one, as it appears that the company’s balance sheet can survive in the short-term, given the latest net debt/EBITDA multiple. After that, it’s difficult to say - visibility has “normalised” in the form of a far smaller order book, with revenues now also seemingly under pressure.

I can’t help thinking about the recent trade secrets lawsuit against XP Power. Apart from the immediate financial damages ($40m, including $20m of punitive damages which XP Power are appealing), I wonder if the lawsuit has had any other repercussions for the company, such as reputational issues?

For anyone who previously had XP Power on their “buy” watchlist, maybe now could be a good time to get involved? But personally I wouldn’t be in any rush here.

Paul - Ignore this - just trying something out!

Name | Ticker | RNS type | Mkt Cap | |

Nightcap | NGHT | Trading Update | £12m | Paul done |

Tristel | TSTL | Director selling | £192 | Paul done |

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.