Good morning! It's Paul here.

I read an astonishing article in the weekend press. It stated that the cost of tax relief for private pension contributions has now risen to a staggering £53bn p.a. - enough to wipe out the entire Govt spending deficit. Bear in mind that this is mostly going to the affluent, and I don't see how the present arrangements can possibly be justified, or continued. So I think we'll see another raid on private pensions by the Government fairly soon.

I have an ancient SIPP, however it's a system which makes me very nervous. The money is tied up for years, and in the meantime who knows what awful policies successive Governments might implement to raid my savings? ISAs seem much more attractive - at least you could grab that money & wire it abroad, if a hostile Government were to be elected.

Elegant Hotels (LON:EHG)

Share price: 84.8p (up 5.7% today)

No. shares: 88.8m

Market cap: £75.3m

(at the time of writing, I hold a long position in this share)

Trading update - for the year ended 30 Sep 2017.

This company owns & operates 7 freehold "upscale" hotels, plus a restaurant, in Barbados. Note that renowned entrepreneur Luke Johnson is a NED, and owns 12.5% of the company.

Rather surprisingly, things seem to be going well;

Trading since the interim results in June has remained in line with market expectations. Whilst the Group is only 12 days into its new financial year, it is pleased to report that bookings are currently tracking ahead of the same period last year.

I say surprisingly, because this company is heavily reliant on tourists from the UK - who make up something like 70% of its revenues. So my main worry was that the post-Brexit plunge in sterling might trigger a reduction in British tourists visiting. Apparently not!

Also, the refubishment of one of its hotels is going to plan, with re-opening scheduled for the start of the peak tourist season.

Valuation - this share looks strikingly cheap, which makes me worry that there might be something wrong?

Zeus are forecasting 8.1p EPS for the year just finished, 09/2017. That's a PER of 10.5 .

For y/e 09/2018, they are forecasting 10.4p EPS, for a PER of 8.2 .

Dividends are forecast at 7.0p for each year, giving a divi yield of 8.3% - usually that's too high to be sustainable, so a question mark hovers over such a high payout, which is only just covered by earnings. Personally I think the company is over-paying, and should probably halve the divis, and redirect the saved money into refurbs to keep the properties in tip-top condition. Reviews on TripAdvisor seem to indicate that inadequate maintenance is a problem.

Asset-backing - what I like about this company is that it owns the freeholds for these prestigious properties. So the balance sheet looks solid, with $118.3m NTAV - that's $1.33 per share, or a whisker over 100p per share. So at 84.8p, the shares are trading 15% below NTAV.

Two brokers today state that the discount to NAV is much larger. I've checked their figures, and the discrepancies seem to be that they're using an outdated exchange rate of £1 = $1.25 (whereas I have used the current exchange rate of £1 = £1.32). Also the brokers seem to have uplifted the value of the freeholds by $20m over book value, in their calculations.

Given how cash generative the hotels are, I can't see any reason to question book value, which seems reasonable. There is $173m in property assets, and $61.5m in net debt, shown in the most recent accounts. That looks a perfectly reasonable position, so there are no worries about excessive debt.

My opinion - this seems a very reasonably-priced share. I like the low PER, the monster divi yield, and the asset-backing. That Luke Johnson has given it his seal of approval, by buying about £10m-worth of shares, and joining the board, is nice confirmation.

I wouldn't normally buy shares in any overseas companies on AIM, but this (and Somero Enterprises Inc (LON:SOM) ) are rare exceptions. I see upside to maybe 100-120p per share, with patience. Along the way we get huge divis to keep us interested. Plus there is expansion (contracts to manage other hotels) in the pipeline. Overall then, I like it.

Norcros (LON:NXR)

Share price: 175.5p (up 4.4% today)

No. shares: 61.7m

Market cap: £108.3m

Trading update - for the 6 months to 30 Sep 2017.

This group sells bathroom fixtures & fittings, including Triton showers, and Johnson Tiles, plus other more recently acquired companies such as Vado and Croydex.

Today's update sounds quite good.

Group revenue and underlying operating profit1in the first half is expected to be in line with the Board's expectations.

Group revenue for the first half is expected to be approximately 144.9m (2016: 128.8m), 12.5% higher than the prior year and 7.1% higher on a constant currency basis.

The growth reflects a robust performance in our UK business and continued growth in our South African business

Net debt has reduced from £27.5m a year ago, to £21.0m now - this looks a modest level of bank debt. However, the elephant in the room is the massive pension scheme - no mention is made today about how that is looking.

Outlook comments - again, reassuring;

Against the backdrop of challenging market conditions, our performance demonstrates the strength of our market positions and the resilience of our diversified business portfolio delivering revenue growth in all UK sectors, strong growth in exports and sustained progress in South Africa. The Board remains confident that the Group will continue to make progress in line with its expectations for the year to 31 March 2018.

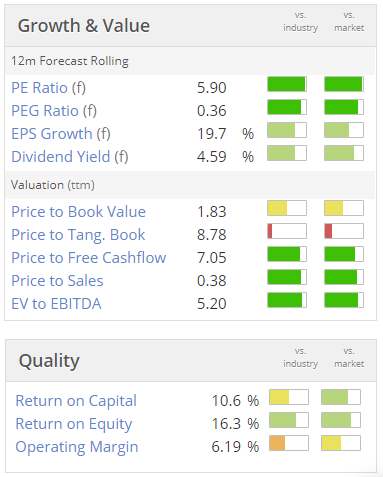

Valuation - strikingly cheap on a PER basis, and with a decent dividend yield too. The reason for this lowly valuation seems to mainly be due to investor concerns over the pension scheme;

My opinion - the valuation strikes me as excessively pessimistic. Sure, the pension scheme is a big issue, but it's been managed perfectly well in recent years. The trouble is that the deficit is highly volatile, and being a very large scheme relative to the size of the company, it's an ongoing thorn in the side.

Another problem is that this share seems to forever trade sideways. So shareholders buy, hold for a while, get bored, then sell up & move on to something with more perceived upside. There has been quite good earnings growth in recent years, and a series of seemingly good, sensibly-priced acquisitions, with good synergies.

I'm tempted to buy a few shares in this, but have been disappointed & frustrated by the lack of progress in share price before.

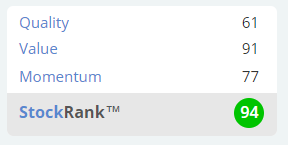

Note that the Stockopedia computers love it - classifying it as a "super stock", and with a very high StockRank;

Renold (LON:RNO)

Share price: 46.1p (down 10.4% today)

No. shares: 225.4m

Market cap: £103.9m

Trading update (mild profit warning) - relating to the 6 months ended 30 Sep 2017.

This group makes industrial chains & other power transmission products.

The share price put on a nice spurt earlier this year, but has come most of the way back down again now. That pattern has occurred with lots of small cap shares this year - a sign that investors perhaps got rather over-excited in the strong bull market of this spring/summer.

I like the no-nonsense wording used in this announcement;

Trading in the period has been mixed. The Torque Transmission division performed in-line with expectations. The Chain division delivered organic growth, but profitability was affected by machine break-downs at our Einbeck facility and by sustained increases in raw material costs.

Consequently, the Board now expects adjusted operating profit1 for the Group for the year to 31 March 2018 to be slightly below the lower end of the current range of analyst forecasts.

That's obviously a bit disappointing, but hardly a disaster.

A lot more detail is given in the RNS, which I won't go into here - you can read the announcement yourself, if interested. The gist seems to be that problems have been, or are being resolved, and the order books sound healthy. So if you like the company, this could perhaps be an interesting buying point?

My opinion - the balance sheet is the deal-breaker for me. There's a gigantic pension deficit of £102.0m shown in the most recent accounts. As we know, the actuarial deficit can often be a lot worse than the amount shown on the balance sheet. So this is a huge issue - more so even than with Norcros above.

Renold hasn't paid divis for years either, so there's nothing to enjoy whilst waiting for a potential capital gain. Overall then, this share has no appeal whatsoever to me.

Revolution Bars (LON:RBG)

Stonegate update - with Deltic now out of the frame, Stonegate has taken the opportunity to try to scare RBG shareholders into accepting their 203p cash offer - pointing out that market conditions are challenging, etc.

Also Stonegate emphasises that its 203p offer is final - and won't be increased (unless someone else comes along and offers a higher price).

What to do? Personally I think the Stonegate offer could yet be increased, as they're getting RBG on the cheap. So the issue now is how RBG shareholders will vote in the imminent shareholder meeting? Will investors vote against the 203p offer, in the hope that Stonegate will increase it? Or will shareholders prefer a clean cash exit and vote for the deal? It's a tricky one. Given that the share is illiquid, the institutional holders might decide they prefer a cash exit.

Personally, I'm sitting tight for the time being. I think there's still a chance that the offer could be improved, or a late suitor might crash the party.

I have to leave it there for today, as I'll be on a train visiting relatives this afternoon.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.