Good morning, it's Paul & Jack here with the SCVR.

We're hitting the ground running today, with 3 backlog sections that Jack & I wrote last night. We've split the report into two parts, so it's hopefully clear which of us is writing each section. The idea is to get some work up early, so that I can concentrate on the trading update from Boohoo (LON:BOO) today (my largest personal holding, and the most popular share in the 2021 stock picking competition here).

Just as an aside (not applicable to BOO of course), the main problem with stock picking challenges, is that people tend to pick speculative stuff that could multi-bag, as there's no downside if you get it wrong. That's what I usually do too, to be fair!

Reader comments

Thousands of people are reading these reports now, and the comments. So I think we need to tighten up a bit on what gets posted, to avoid wasting a lot of peoples' time. Could people please consider the following;

- Does your comment really add value? Announcing that you've bought or sold something is irrelevant - nobody cares!

- Please don't comment on thumbs downs - again, nobody cares, and it wastes time for other people having to scroll through so many pointless posts

- Agonising over intra-day price moves generates pointless background noise, we're more focused on company fundamentals here, it's not a day-trading forum.

- Please don't bicker with other readers, and then clutter up the comments section with tit for tat replies. It's incredibly boring for the thousands of other readers, and me!

- Keep it courteous please, that's the style here (most of the time anyway)

- Above all, before you hit the submit button, please consider deleting your post if it doesn't add value for other readers.

- Intelligent & informative comments are hugely welcomed, so please try to keep it to those.

- Let's stick to the subject matter. Nobody cares about our political views, and there are plenty of other places to discuss politics if we want to, so try to stick to shares, markets, economics.

- Please don't waste the time of the lovely admin people at HQ, they're very busy, and it's extremely unhelpful to start flagging comments for review, and generally being a PITA. If you disagree with something, that's fine, but don't make a fuss & waste everyone else's time.

Hope that sounds OK, and many thanks for your indulgences.

Timings - lots to cover today, so I'll probably keep working away until mid-afternoon. Jacks' doing some customer support work now, but many thanks for his contributions today, which takes some of the pressure off me. Today's report is now finished.

Agenda -

Jack's section

M Winkworth (LON:WINK) - Trading update from yesterday for FY 12/2020

Charles Stanley (LON:CAY) - Q3 Trading update

Science In Sport (LON:SIS) - Trading update for FY 12/2020

Paul's section

Renold (LON:RNO) (Paul holds) - Trading update

Boohoo (LON:BOO) (I hold) - Strong trading over seasonal peak - 4 months to 31 Dec 2020

Best Of The Best (LON:BOTB) - stunning interim results!

Gear4music Holdings (LON:G4M) - strong trading update, exceeding expectations.

Portmeirion (LON:PMP) - good update.

.

Jack’s section

M Winkworth (LON:WINK)

Share price: 155p (+8.77%)

Shares in issue: 12,733,238

Market cap: £19.7m

I presented Foxtons at this week’s Mello Monday as a slightly contrarian pick based on the idea that the “exodus from London” narrative has been overplayed. A couple of people suggested M Winkworth as an alternative to Foxtons, and it has just yesterday released a trading update, so that could provide some interesting read-across for the wider sector.

Winkworth is a franchisor of residential real estate agencies established in Mayfair in 1835. It focuses on the mid to upper segments of the central London residential sales and lettings markets. In total the company operates from some 100 offices.

The franchise model provides some attractive investment characteristics, namely strong profit margins, returns on capital, and cash generation. We can see that coming through fairly clearly on the group’s StockReport:

In fact, for all the negative news flow around Covid, lockdowns, and the economy, Winkworth’s shares have been remarkably sturdy over the past twelve months. It’s a tiny free float (c30%), with Simon Agace owning just over 40% of the company, but perhaps this illiquidity has reduced volatility over the past year.

Mind you, if somebody did decide to sell, that could move the share price quite a lot so volatility could always increase here. It looks like that illiquidity has gone the other way on yesterday’s update though, with shares up nearly 9%. Estate agencies are to remain open for business in the current lockdown, although you might expect some impact nonetheless.

Trading update - released 13th January 2021 for the year to 31 December 2020

Despite all the negative news flow, Winkworth's total revenues are broadly flat year-on-year, although profits before tax will come in a little lower and the total dividends have been reduced by 15%. More detailed final results will be released on or around 8 April 2021.

Q4 2020 sales applications were up 44% and lettings applications were up 12% year-on-year, and with a record pipeline of sales still to feed through to trading in Q1 2021, Winkworth has ‘entered the current year with considerable momentum.’

That might not be quite what people were expecting to hear. Additionally, Winkworth says that the group has seen an ‘underlying strength of demand in the sales market’ for much of the year.

The group does credit the stamp duty holiday incentive for helping to fuel a ‘post lockdown boom’. Demand is driven at least in part by these government initiatives which could be changed or adapted for political reasons. It’s a risk worth bearing in mind.

The second half of the year remained strong and Winkworth increased its market share of sales subject to contract in London (where it is number two) from 4.2% in 2019 to 4.6% in 2020. That said, the group adds that ‘until international interest recovers, we see reduced rental prices in London limiting growth’.

The rate of new office openings was subdued in 2020. On the whole though, Winkworth has avoided making significant cost cuts to its operations so that it is well placed to support franchisees once conditions improve.

Conclusion

I do think at some point the London property sales and lettings markets will recover. Now is the time for stronger operators to gain market share, while weaker competitors struggle to steady the ship.

It looks like M Winkworth is firmly in the “eventual winners” category. It remains small, and liquidity will continue to be an issue, but this looks like a well-run company for its shareholders, which occupies a useful niche in one of the most valuable property markets in the world.

Growth has been an issue for Winkworth in the past though. This looks like a high quality, well run company that is prudently managed for shareholders, but some might be looking for more evidence of earnings growth and capital appreciation over the years.

Winkworth does talk about its market share gains this year, so let’s see if that can lead to a step change in revenue and earnings down the line.

.

Charles Stanley (LON:CAY)

Share price: 304p (+2.7%)

Shares in issue: 52,110,163

Market cap: £158.4m

The thing that jumps out to me about this one is that Charles Stanley, apparently, has more than 50% of its market cap in cash.

There are a few cashed up asset and wealth managers around at the moment. The SIC just bought Polar, for instance (see the pitch here).

M&A has been a feature of this sector as operators scramble for scale, so putting two and two together it looks like we can expect ongoing corporate activity here. It could be that CAY services a slightly different niche, though.

A quick look at the StockReport shows that Charles Stanley has some attractive valuation characteristics (for example, a price to free cash flow ratio of 6.7x) and also has some quite respectable operating margins and returns on capital.

It qualifies for seven Guru Screens:

- Dreman Low Price to Cash Flow Screen (Value)

- James O'Shaugnessy Cornerstone Growth (Growth)

- Josef Lakonishok Momentum Screen (Momentum)

- Best Dividends Screen (Income)

- David Dreman Low PE Screen (Value)

- Richard Driehaus Screen (Momentum)

- Free Cash Flow Cows Screen (Bargain)

So we can conclude from this that there are a variety of quantitative indicators across a range of factors that suggest we look at this one.

It’s a brief update for the three months to 31 December, so there’s not a whole lot of substance to move the reader one way or the other.

Total Funds under Management and Administration (FuMA) as at 31 December 2020 rose by 10.1% quarter-on-quarter to £25.1bn, largely due to a market improvement of £2.2bn, with net inflows of £0.1bn.

That compares to a 7.0% increase in the MSCI WMA Private Investor Balanced Index over the same period. The outperformance is good, but the net inflows seems a bit feeble and average FuMA for the year-to-date was £22.6bn, which is 7.8% lower than over the same period to December 2019.

Total revenues over the three months fell by 1.2% to £42.2m (Q3 2020: £42.7m), with increases in fee income of 3.2% and commission income of 4.3% offsetting a ‘significant contraction’ in interest turn.

Revenues for the year-to-date fell from £128.1m to £124.1m, largely as a result of this 65% drop in interest turn following the fall in interest rates in March 2020.

Paul Abberley, Chief Executive Officer of Charles Stanley, said:

The Group has continued to demonstrate significant resilience in the face of the ongoing pandemic, and we are encouraged to see modest net inflows of FuMA during the third quarter as well as stable revenue levels.

Conclusion

Upon reflection, given the year that was, a small net inflow in FuMA for the three months to 31 December is respectable. It does suggest an improving trajectory as well, given the decline in FuMA over the nine month period.

Is Charles Stanley in an attractive niche, or will its margins and possibly even business model ultimately come under pressure? It’s hard to say. The vast majority of CAY’s operating profit comes from Investment Management Services.

There is a question mark over how well CAY can protect its margins over the long term, in my opinion. But, on the other hand, this stock is being flagged across a broad range of indicators and Guru Screens.

The dividend yield has been growing recently, there is a material net cash position, and CAY does operate an asset-light, cash-generative business model. The valuation is undemanding, so it could be worth a closer look for those interested.

.

Science in Sport (LON:SIS)

Share price: 39.95p

Shares in issue: 135,100,931

Market cap: £72.9m

Science In Sport (LON:SIS) is an interesting company that is seeking to become ‘the world’s #1 premium performance nutrition business’. Helmed by chairman John Clarke, the global President of GSK Consumer Healthcare from 2006 to 2011, and CEO Stephen Moon, the ex-Business Development Director for the Nutritional Healthcare Division of GSK, you would think there’s enough experience here to realise that ambition.

This is a fast-growing and higher margin area in sports science that can have a real impact on both elite level and mass market performance. Unfortunately SIS has struggled to impress so far, diluting shareholders and burning through cash as it builds its brands and distribution network.

Those brands are PhD and SiS. While revenue has compounded at about 50% per annum over the past six years or so, losses have also widened. In 2019, sales came in at £50.6m but the net loss was £5.62m.

The group’s cash reserves were once again looking thin in 2020, but the group got a placing away in April 2020 and now has £10.5m of cash (FY19: £5.4m), including £4.2m net proceeds from the placing.

Trading update for the year to 31 December 2020

- Adjusted EBITDA profit of £1.1m (FY19: loss of £0.3m).

- Online grew strongly, +39% to £25.0m and Q4 Online performance was +65% year-on-year. PhD.com revenues grew 105% to £3.2m, and momentum continues to be strong here.

- Retail was affected by COVID but total revenues of £50.3m were in line with the previous year (FY19: £50.6m).

- Online sales were 50% of total revenues, compared with 38% in FY19, and the group ‘see[s] this strong channel switch continuing’.

- Gross margin was up 5% year on year to 49%. The gross margin was 50% for the second half, thanks to Supply Chain efficiencies and the shift to Digital.

So that shift to online is bringing with it enhanced profitability. It could be the break SIS needs.

Meanwhile the group’s balance sheet is secure for now although its track record of shareholder dilution is something else: there are now 135m shares outstanding post-placing in April, compared to around 15m at IPO back in 2013.

Key SIS growth markets of Australia, Football, Italy and the USA contributed 28% of total revenue at £7.2m, with US revenue up 35%. Cash burn ‘is significantly reduced’.

Sales from new products contributed £2.2m, or 4% of total revenues. That’s a promising feature for future growth, and SIS says ‘the 2021 new product pipeline is extremely strong’.

Key senior hires have also been made in Online, Technology, and Customer Experience, and the group has agreed to heads of terms for a new 160,000 sq ft supply chain facility in Blackburn which will be fully operational by Q1 2022. Management says this will give SIS room to grow to ‘more than £150m in revenue’.

Final results for the group are expected to be on the 17th of March 2021.

Conclusion

This sounds good to me, but the massive shareholder dilution in the past is a very clear warning sign.

Putting that aside for a second, the global sports nutrition market is obviously big and SIS cites reports valuing it at over £11bn with projected 8%pa growth to £18bn by 2023. The chairman and CEO look like a highly experienced duo that have worked together before at Glaxo, and probably understand what operating at significant scale looks like.

And the shift to online accelerated by Covid could be an important inflection point, potentially marking a step change in business model, revenue growth, and gross margins.

There is still plenty to prove though and the scale of dilution so far at this company is a serious blot on the copy book - if management were significant shareholders, how would they feel about seeing their stakes diluted by orders of magnitude over the past decade or so?

But at some point, I think that dilution will stop and SIS will make it. Perhaps that stage is at hand? I continue to think caution is required here, as I would want to convince myself that management does indeed consider shareholder value alongside its ambitious talk of becoming a global leader in the sports nutrition market.

For that reason I class it as high risk, although the fundamental picture does appear to be improving.

.

Paul’s Section

Renold (LON:RNO)

(I hold)

13.75p (up 10% yesterday) - mkt cap £31m

Renold, a leading international supplier of industrial chains and related power transmission products, today issues a trading update covering the three months ended 31 December 2020 (the "Period").

The year end is 03/2021, so this update is for Q3 of the current financial year.

Key points;

Continued to deliver a robust trading performance, despite covid disruption

Recovery in revenues & order intake has continued in Q3

Guidance - adj operating profit for H2 should be “broadly similar” to H1

Net debt £23.0m, down £13.6m since 31 March 2020 - not stated whether there has been any creditor stretch or not.

Considerable market uncertainty, but Renold is diversified.

Focused on cost control, efficiency, cash management.

Since H2 is said to be a bit below H1 (“broadly similar”) then I need to look back at the last interim results, which I reviewed here on 11 Nov 2020. Renold made £5.8m adj op profit in H1. Therefore it’s probably heading for about, say £11.3m in FY 03/2021.

The company has to pay about £5m p.a. Into its pension schemes.

Everything else in my previous notes still stands, so there’s not really any change.

My opinion - the huge pension deficit still scares me, but a market cap of only £31m seems extremely low, given that the business itself is trading well. Add some recovery potential onto the numbers, once covid is on the wane, and there could be geared upside on the share price maybe?

Overall I’d say that I'm warming to this one, whilst still rather nervous about the pension scheme deficit. I’m minded to move my position up from a small, to medium size, and then leave it there. I wouldn't want too much exposure to something with such a big pension deficit, in case the deficit explodes upwards. But even then, would it really matter that much? The company looks strong enough to cope with the cashflow drain from the pension scheme, and hasn’t had to raise any fresh equity through the covid crisis.

It would be good to see management - I wonder if they could be persuaded to do a private investor online webinar as part of their annual results roadshow? All companies should do this, it’s incredibly helpful, and helps generate more private investor interest in the shares, thus improving liquidity, and raising the share price if we like the cut of their jib.

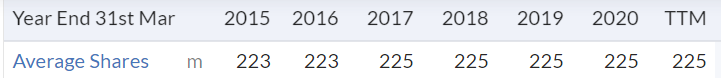

I always check this data field (see below) on the StockReport, to see if the share count is rising. In the case of Renold, the company has implemented a decent-looking turnaround, without issuing any material number of new shares. That's a strong positive, and means that there's no reason why the share price couldn't fully recover in due course, if performance justifies it.

.

.

An investor friend who usually talks sense, reckons this could be a takeover target, with the pension deficit helping to make the takeover price potentially attractive. He reckons the pension deficit could reduce, if Renold were acquired by a larger group, because it could be revalued down on a lower risk basis. Interesting idea! Although a big pension deficit might put off many potential bidders, who wouldn't want to take that onto their books. So you can argue that point either way.

.

.

Boohoo (LON:BOO)

(I hold - my largest position)

369p (pre market open, likely to rise today) - mkt cap £4.66bn

This covers peak seasonal trading, 4 months to 31 Dec 2020.

It looks very good. Key points;

Revenue growth of +40%, both UK & International grew by the identical +40% percentage - better than Asos which grew sales over the same period by +23%.

Asos mkt cap of £5.3bn is 14% larger than BOO, which looks wrong to me - BOO should be worth more than Asos, as it's growing faster & makes a higher profit margin.

USA is noteworthy - becoming an important market, at 25% of total sales, and growth of +52% - this could trigger a further re-rating of the shares, once investors spot the growth potential in this massive market, only scratching the surface.

Gross margin down very slightly (50 bps) at 53.0%, again better than Asos, which achieved 47.4% gross margin in its last annual results (not stated in recent trading update).

Net cash of £386.9m looks very healthy.

Guidance for FY 02/2021 - revenue growth raised from 28-32% previously, to 36-38% now. Very impressive to be raising full year revenues guidance that much, near the end of the year.

Adj EBITDA margin c.10% - no change, as indicated in last update with interim results, published 30 Sept 2020. I'm very impressed that BOO has managed to absorb extra costs such as supply chain investigation & remediation, freight & carriage cost increases, etc.

Brexit - doesn't sound a problem, "small cost headwind"

Sir Brian Leveson is on BOO's website here, I've read the executive summary, which looks fine. No new issues.

Zeus has raised its EPS forecast EPS FY 02/2021 by 5.6%, to 8.7p, a PER of 40 (at current price of 350p, which has inexplicably fallen at the open this morning). Forecast likely to be beaten, as it assumes slow growth of only +9% in Jan-Feb 2021.

We should of course be focusing on FY 02/2022 earnings now, which are forecast at 11.7p, a PER of 29.9 - which looks terrific value to me, for an exceptional growth group. Particularly as BOO usually beats forecasts, which tend to be raised throughout the year. So the actual PER in 12 months time could turn out to be 20-25, not 29.9.

My opinion - this is a very strong update. Unless I've missed something, this should have moved the share price up, not down, so I've no idea why the market has initially reacted the way it has. Still, as we've seen repeatedly in the last year, spikes down with BOO are terrific buying opportunities.

All good, as far as I'm concerned.

.

EDIT: Analyst/investor call - I listened in to this, and took some notes. It's mostly just repetition of the RNS, but did include some useful extra colour in understanding the business better, here are the key points;

USA market - strongly emphasised this as a "huge opportunity". BooHoo, PrettyLittleThing, and NastyGal are doing well in USA, with PLT being the "stand out" growth brand.

Gross margin lower in H2 than H1, as High Street re-opened in Nov 2020, so market was very promotional (i.e lots of discounting)

40% growth achieved despite there being no Christmas party season - very good considering seasonal sales of party wear & shoes didn't happen.

Marketing spend increased in H2. Was c.8% of revenues in H1, higher in H2.

NB. The most important point in my view - of the 40% revenue growth reported, it's mostly organic - e.g. the "established brands" produced 35% of that growth, with just 5% coming from new brands. That's much better than I was expecting.

They held back marketing spend on new brands (e.g. Karen Millen) in 2020, but are now cranking up marketing for expansion. Good results, ahead of plan so far.

Question asked about why period 4 (Jan-Feb 2021) guidance is for only c.10% growth - Answer - just being conservative, due to uncertainties. Seems pretty obvious they're going to beat this, as the Zeus note says, so next trading update likely to be another upgrade.

Buying new brands - is it more competitive? Not really. BOO is only interested in buying brands that have global potential. Plenty of opportunities, e.g. BOO only has 1 menswear brand, not represented in sportswear brand either.

Guidance for 2021/22 not being given just yet - will be provided at time of results. So many uncertainties at the moment, re lockdowns, vaccines, etc,. Although we do have the medium term guidance of 25% p.a. revenue growth target, and 10% EBITD A margin.

End of edit.

.

Best Of The Best (LON:BOTB)

(I hold)

2050p (up 30% at 12:09) - mkt cap £189m

Best of the Best plc runs competitions online to win cars and other prizes.

Online-only model and efficient marketing investment drive ongoing revenue and profit growth

Absolute blow-out numbers here. Amazing stuff. The company has achieved profits/EPS in H1 that’s not far off the full year forecast (itself raised greatly last year).

It’s a long-time favourite here at the SCVR, but I never imagined it would achieve such stellar performance, and am kicking myself for selling many of mine last year, when it looked like the takeover bid wouldn’t happen. The trouble is, with something this illiquid, it’s often not possible to buy back in when you want to.

Yes, BOTB will have benefited from lockdowns, and people not having other things to spend money on, like holidays, going to the pub, etc. However the interims today cover May-Oct 2020, when lockdown had mostly finished, or been eased.

The financial highlights really are superb, and this is all organic growth remember;

.

Broker updates - I can’t find anything, but it doesn’t really matter as it’s so easy to work out our own. I would say double H1, to get to c.120p EPS for FY 04/2021, is possibly a reasonable base case. The company is growing so fast, it could be well above that, who knows? If we run with 120p EPS, then at 2050p the PER would be 17 times - very cheap for such a strong growth situation.

However, I also take on board reader comments that there must be some risk of a well-funded competitor trying to replicate what BOTB has done. Also this area does come with regulatory risk too. There are lots of small competitors springing up - they keep appearing on my Facebook timeline, but I’ve checked them out, and they’re mickey mouse companies, not serious competition..

Even allowing for risk, a 17 times PER seems unduly pessimistic to me.

Takeover bids? Talks are still ongoing, but given these numbers, I don’t want to sell out! Let’s keep going, if this is what can be achieved as an independent company. Unless of course potential bidders are really prepared to offer big money. Management have controlling stakes, so won’t sell out on the cheap. They look after us very well, so I have complete trust in their judgement and integrity;.

The Company, together with its advisers, remains in ongoing discussions with interested parties from a number of sector verticals and including private equity, who are reviewing information in a data room and having management team meetings. These discussions are continuing despite the renewed constraints of Covid-19, though the related restrictions are naturally impacting the speed of discussions and decision making.

The Board wishes to reiterate that there can be no certainty that an offer will be forthcoming or as to the terms of any such offer and looks forward to keeping shareholders updated in due course.

Outlook - given that H1 isn’t far off the full year result, then I’m surprised the statement below didn’t use “substantially”, instead of “materially” - which is usually code for about 10%.

The first half of the year has delivered encouraging sales and profits growth, and importantly, we also completed the transition to an online-only business which has driven a step change in growth. This momentum has continued since the period end and, as a result, the Board now expects full year pre-tax profits to materially exceed management expectations.

BOTB has built a substantial and valuable database, which not only supports its existing competitions, but also offers interesting opportunities for new products and strategic partnerships, which are currently under review.

Special dividend of 40p announced, emphasising how cash generative this business is. More are likely in future, in my opinion.

Balance sheet & cashflow statements both look fine to me. It strikes me how small a lot of the numbers are - i.e. this is a highly profitable business, operating from a lean overhead. Ideal really. Some businesses have to build massive factories & employ thousands of people to make profits that little BOTB manages from a smallish office in London.

My opinion - my only regret is not holding onto more of my shares.

I can’t see any reason to sell, and based on these stellar numbers, it is tempting to throw caution to the wind, and buy some more. It’s so difficult to find stock though.

It's interesting to note that the StockRank has been declining. That's probably because the computers didn't realise that BOTB was going to blast forecasts out of the water! I imagine the StockRank should significantly improve once (or if) updated forecasts feed through.

I've emailed the CEO to thank him for doing such a great job here, and looking after his small shareholders so well.

.

.

Gear4music Holdings (LON:G4M)

(I hold)

885p (up 5% at 13:31) - mkt cap £185m

Like all investors, I’m looking first at the shares I hold personally. Loads of them seem to be reporting positively today. Let’s hope a trend is starting!

Gear4music (Holdings) plc ("Gear4music" or "the Group"), the largest UK based online retailer of musical instruments and music equipment, today announces a trading update for the three months to 31 December 2020.

This is Q3 of FY 03/2021.

Here is the revenue growth table for the peak Xmas season;

.

I’ve highlighted the bits that look striking - namely good, but comparatively modest UK growth of 10%, but absolutely stonking international growth (mainly Europe, I believe) at +51%.

Remember that G4M’s revised strategy is to go after margin, ahead of revenue growth, which has worked superbly, greatly boosting the bottom line. Hence why the share price has recovered so well to previous highs (and beyond possibly in future?)

Gross margin - also decently up on LY at 29.9% - that’s quite low, but the average spend is over £100, so it works out fine. Also, low margins don’t attract too many competitors seeking to eat your lunch.

EBITDA - this looks superb;

FY21 EBITDA to be ahead of expectations, and not less than £16.5m (FY20: £7.8m)

Directorspeak makes the point that when restrictions are lifted, many musicians will be itching to perform together again driving other product categories. Therefore I don’t think lockdown should be seen as a one way street (i.e. just boosting sales), as it’s actually more mixed.

Brexit - carefully planned for & managed. G4M had already set up hubs in Sweden & Germany, some time ago, which has helped get round port & Brexit issues.

I am pleased that the planned reconfiguration of our delivery systems and transport network has performed well, and has supported stronger trading since 1 January 2021 than the Board had initially expected.

Outlook - all good;

As a result of the very successful Christmas trading period, and early indications of positive trading post-Brexit, we expect to report results for the full financial year ahead of recently upgraded consensus market expectations. Notwithstanding what has been an exceptional period of trading since lockdowns began in March 2020, the Board remains confident that the Group is well resourced and positioned to deliver further growth."

Broker note - many thanks to N+1 Singer, for making available to us an update, via Research Tree. This now forecasts 44.8p adj EPS for FY 03/2021. At 885p per share, that’s a PER of 19.8 - that seems great value to me for a growth company.

I suppose it depends if you see this year as a one-off, boosted by lockdown, or if growth is likely to continue (maybe not as such a rapid rate?).

My opinion - I think this looks a very attractive share. Growth at reasonable price. It’s clearly a very well managed business, well done and thank you to Andrew Wass and his team, not forgetting the European division who’ve delivered superb growth there. I very much like that growth in the biggest market is expanding the fastest, as there’s so much more growth to go for in Europe.

An emphatic thumbs up from me.

.

Portmeirion (LON:PMP)

548p (up 10%, at 14:12) - mkt cap £77m

Encouraging performance, ahead of market expectations, due to strong seasonal trading

Portmeirion Group PLC, the designer, manufacturer and worldwide distributor of high quality homewares under the Portmeirion, Spode, Royal Worcester, Wax Lyrical, Nambé and Pimpernel brands, is pleased to announce that it expects revenue for the year to 31 December 2020 to be at least 6% ahead of market consensus expectations following a strong second half and seasonal trading performance.

Encouraging performance, ahead of market expectations, due to strong seasonal trading

Portmeirion Group PLC, the designer, manufacturer and worldwide distributor of high quality homewares under the Portmeirion, Spode, Royal Worcester, Wax Lyrical, Nambé and Pimpernel brands, is pleased to announce that it expects revenue for the year to 31 December 2020 to be at least 6% ahead of market consensus expectations following a strong second half and seasonal trading performance.

H2 sales down 7% LFL, better than 20% in H1 LFL

Online - this is the key area for me, and it looks very good;

Online sales channel growth remains a key area of strategic focus and investment. Online sales performed strongly through the second half of the year. We now estimate that 47% of our total UK/US sales are made through online channels (2019: 30%) and sales from our own ecommerce platforms grew by 60% from 2019 and now represent 13% of total Group sales. We expect to see continued growth in online sales channels in 2021.

My opinion - there’s plenty more detail in the RNS, I’m getting tired now, so want to wrap this up.

Broker notes are available on Research Tree. I don’t see PER as a relevant way to value the business right now, as it’s in gradual recovery mode. To my mind, it should be able to gradually return to previous levels of profitability, so I think that implies a share price which could recover to about double where we are now, with patience.

I see this as a tuck away & forget type of share in my portfolio. Small to medium sized position, long term.

Today’s update reassures me.

.

That's it for today, see you tomorrow.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.