Good morning from Paul & Graham!

Reminder - 17:30 today Stockopedia's latest live webinar - these are always excellent & thought-provoking, so I'm looking forward to this. You should have received an email invite, I can't find a link unfortunately, sorry.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

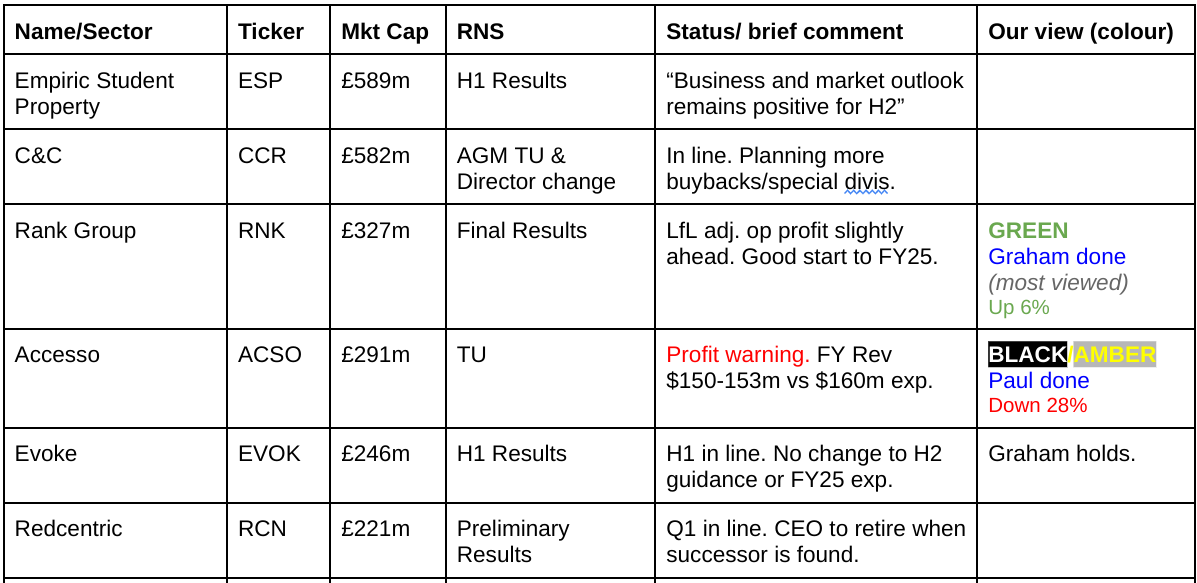

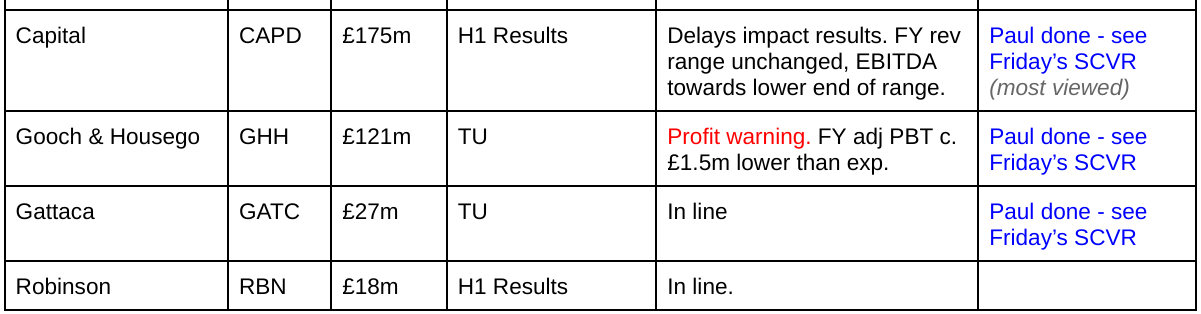

Companies Reporting

Summaries

Rank (LON:RNK) - up 6% to 74.1p (£347m) - Final Results - Graham - GREEN

Rank has declared its first dividend since pre-Covid in a strong signal of management’s confidence in the group’s continued recovery. I’ve been looking forward to seeing this casino/bingo hall operator (with increasingly profitable online operations) return to strength after the Covid/inflationary era. Hopefully it can stay on this positive trajectory for the foreseeable future. I continue to like it at this valuation.

accesso Technology (LON:ACSO) - down 27% to 514p (£213m) - Trading Update [profit warning] - Paul - BLACK (AMBER on fundamentals)

Warns on profit, due to customer project delays, and reduced demand. Still has net cash, but it's declining after lots of acquisitions. Has it gone ex-growth? Overall I'm unenthusiastically AMBER.

Paul’s Section:

accesso Technology (LON:ACSO)

Down 27% to 514p (£213m) - Trading Update [profit warning] - Paul - BLACK (AMBER on fundamentals)

accesso Technology Group plc (AIM: ACSO), the premier technology solutions provider for leisure, entertainment, and cultural markets, today provides the following trading update ahead of its interim results which it expects to release on 26 September 2024.

Bad luck to holders here, as ACSO shares plummet 27% to 514p, and give up all of this year’s bull run - it seems strange that the shares rose so much, when the company fundamentals were deteriorating - which just shows that following the chart isn’t necessarily a good thing -

Longer-term, ACSO shares were an astonishing rollercoaster, back in the days when it was called Lo-Q - with this share amazingly 1000-bagging until it hit the rocks in 2018, going on to lose more than 90% of its peak value in two years. The last 4 years have been relatively stable, with a range from 500-1,000p, now at the bottom of that range today -

This is today’s profit warning -

“Based on recent trading volumes in the early part of the northern hemisphere summer months, and slippage in timelines for specific new park openings, the Group now expects a full year revenue outturn of approximately $150-$153m, rather than the not less than $160m communicated at the time of the Group's final results in April 2024.

The Group is taking measures to manage its cost base in line with this lower revenue expectation, so as to mitigate the impact on Cash EBITDA as far as possible. As a result, the Group expects to deliver a full year 2024 Cash EBITDA margin of 13-14%.”

It’s a calendar year, so FY 12/2024.

What’s gone wrong?

Project delays (new theme parks) mean client milestones have been missed, but only delayed into FY 12/2025, not cancelled - this isn’t too bad.

More serious is a decline in demand -

“Recent consumer trading volume across our key end markets has been below our expectations, notably during the peak trading month of July. Our revised full year revenue guidance assumes these lower volumes persist through the remaining peak months of the year.”

Outlook & cash position -

“Overall, the Group's sales pipeline continues to exhibit positive momentum which will benefit the Group in subsequent years. Furthermore, its focus on operational excellence is expected to ensure continued strong profitability and cash generation as the Group continues its development. The Group balance sheet remains robust, with a net cash position at 31 July 2024 of approximately $23.3m.”

Broker updates - nothing available. I often find that profit warnings are worse than they at first appear, so I have a policy of not buying after profit warnings without access to the latest broker notes, and to be sure that the full downside has been reflected in cautious revised numbers. As we all know, bad news can often be drip-fed into the market, creating a series of profit warnings.

At least shareholders here don’t have to worry about the balance sheet. I’ve checked the 2023 results, and the balance sheet looks solid. Although note they spent a lot of the previously much larger cash pile in 2023 on acquisitions. So it now has $165m of goodwill at the top, which is the bulk of the $194m NAV. They need to stop doing acquisitions now.

Note the progression downwards of net cash: $65m end 2022, $31.5m end 2023 (after $50m acquisitions), and $23.3m end July 2024. Starting to be concerning maybe? This contradicts the company’s comment above about it being cash generative, yet net cash has fallen this year to date.

ACSO has done a lot of acquisitions over the years, and it’s difficult to see how they’ve added value. Maybe more a case of acquisitions obscuring a decline in the core businesses?

Cash EBITDA by the company’s definition was 15.8% in 2023. So the guidance for 2024 at 13-14% is a step backwards.

Is this a useful measure? It excludes quite a lot of costs, but does take into account capitalised development spending, so it’s not complete nonsense, and finance costs are not large due to the net cash position -

(1) Cash EBITDA: operating profit before the deduction of amortisation, depreciation, acquisition and integration costs, and costs related to share-based payments less capitalised development costs (see reconciliation in Financial review).

Cashflow last year was quite good, but dominated by $50m cash outflows for 3 acquisitions.

It only capitalised $2.8m in development spending in 2023, which is reasonable (it used to capitalise anything that moved under old management, so the figures are much more credible now).

I see there’s a dreaded employee benefit trust, which hives off cash to buy free shares for management. This cost $3.7m in 2023, and $5.8m in 2022. Given that ACSO has never paid any dividends to shareholders in its 22 years as a listed company, it’s pretty obvious for whose benefit this company is run! Management. You often find that with US-based companies.

Cashflow statements are far more useful than the P&L to find out what’s really happening under the surface to the cash.

Paul’s opinion - previously I’ve been a bit sceptical on ACSO, but gave it the benefit of the doubt with AMBER on 29/1/2024, although I did raise some questions about growth, and the acquisitions.

Today’s profit warning is disappointing but not disastrous I think. I can forgive contracts slipping due to customer delays on new sites, that’s outside ACSO’s control. The lower demand is a concern though, can we corroborate that with information from theme parks more generally, I wonder?

Cash looks OK, but it has dropped significantly so far in 2024.

It talks about a good sales pipeline, which is helpful, but there are never any guarantees that pipeline turns into firm orders. My nagging doubt remains about whether ACSO is ex-growth, and has done acquisitions to prop up the growth numbers maybe?

Overall then it has to be an unenthusiastic AMBER this time. I think there are much better opportunities in the UK market with faster-growing, and still reasonably priced companies. Remember also ACSO put itself up for sale a while back, with no takers, which raises the awkward question that the business might not actually be very good.

Graham's Section

Rank (LON:RNK)

Up 6% to 74.1p (£347m) - Final Results - Graham - GREEN

This company has a year-end in June. We covered its Q3 update here, and today we have full-year results.

I’m pleased to see this casino/bingo hall operator returning to the black:

As you’ll see above, there is a more than doubling of underlying like-for-like operating profit.

Actual operating profit is materially lower at £29.4m - I’ll take a look at the discrepancy a little later.

The move from net debt to net cash is noteworthy too, and management are confident enough to recommend a final dividend of 0.85p, given “the continuing recovery in profitability combined with the Group’s balance sheet strength”.

Business review

In recent years, Rank has suffered from weak consumer demand during the cost-of-living crisis, combined with higher labour and energy costs. This combination of negative factors meant that profits collapsed. There was also the small matter of Covid-19 in 2020/2021:

I’ve been hopeful of a recovery on the basis that inflation might come under control, costs might stabilise and the consumer might feel a little stronger. While not all of these things are happening at once, the recovery seems to be underway.

Here are some of the key bullet points from today’s business review:

Grosvenor (casinos): net gaming revenue +9%

Mecca (bingo halls): NGR +8%

Enracha (Spanish bingo halls): NGR +7%

Digital: NGR +12%

Grosvenor is the most important contributor to Rank’s net gaming revenue, responsible for 45% of the total (£330m out of £730m total).

As for profitability, Grosvenor and the Digital operations are the main contributors. They have each generated over £23m of underlying operating profits in FY 2024 (before central PLC costs are deducted)..

Grosvenor

The 9% growth in NGR is explained thus:

This is an acceleration on the 3% growth delivered in 2022/23 as the business continues to recover from the impact of lockdowns, the slow return of international customers, particularly to London's casinos, and the tightening of affordability restrictions in recent years.

Average weekly NGR, which was £7.5m in the eight months prior to lockdown in 2019/20, grew from £5.9m in 2022/23 to £6.3m, highlighting the further opportunity to grow revenues, even before the much needed and anticipated legislative reforms.

Digital

This division saw a remarkable 79% increase in underlying profits despite revenues only increasing by 11%. Rank acknowledges the “strong operating leverage within the digital business as revenues grow”.

Digital’s revenue growth in the UK is due to “the delivery of some key technology developments” which are laid out in more detail in the announcement.

Outlook:

We have made a good start to the new financial year. We exited 2023/24 with good momentum which has continued into 2024/25, with Group NGR up 10% for the first 6 weeks against a strong comparative.

CEO comment excerpts:

"This has been a year of strong financial, operational and strategic progress for Rank. We are continuing to rebuild profitability following the impact of lockdowns and the material inflationary pressures experienced in recent years. Trading continues to improve..

We have started the new financial year as we finished the previous one, with good momentum across all businesses. With inflation receding, disposable incomes improving, investment continuing to be made in the customer proposition and a strong pipeline of growth initiatives underway, we are confident in the future prospects of the Group.

Graham’s view

I’m very pleased to see that this one is playing out as hoped, although the share price remains near the bottom of its long-term range:

To my eyes, it looks like a potential opportunity: why is the market not giving Rank more credit already for the improvement in trading? With NGR up by another 10% at the beginning of the new financial year, I think investors can reasonably hope for another year of positive operational leverage leading to further acceleration in profits.

Valuation is as follows:

I promised to look into the adjustments that Rank made to its profit figures (to explain the difference between “underlying” profit of £46.5m, and actual operating profit of £29.4).

These adjustments are numerous, but the ones that really matter are impairment (a net charge of about £8m) and amortisation (£6.6m).

The impairments were driven by some Grosvenor/Mecca venues that failed to meet expectations. Some of these venues were shut down.

Amortisation relates to some websites and is a regular charge, not related to performance.

As always, it’s a matter of opinion how you wish to treat these charges. Personally, I would be inclined to look past the amortisation charge in this case, but I might not look past the impairment charge as it reflects poor trading at some of Rank’s sites.

Unadjusted after-tax net income, the strictest measure of profitability, comes in at just £12m. Of course the market cap of c. £350m implies that things are only going to get better from here, and I agree with that stance. I’m happy to maintain my positivity at the current valuation.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.