Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

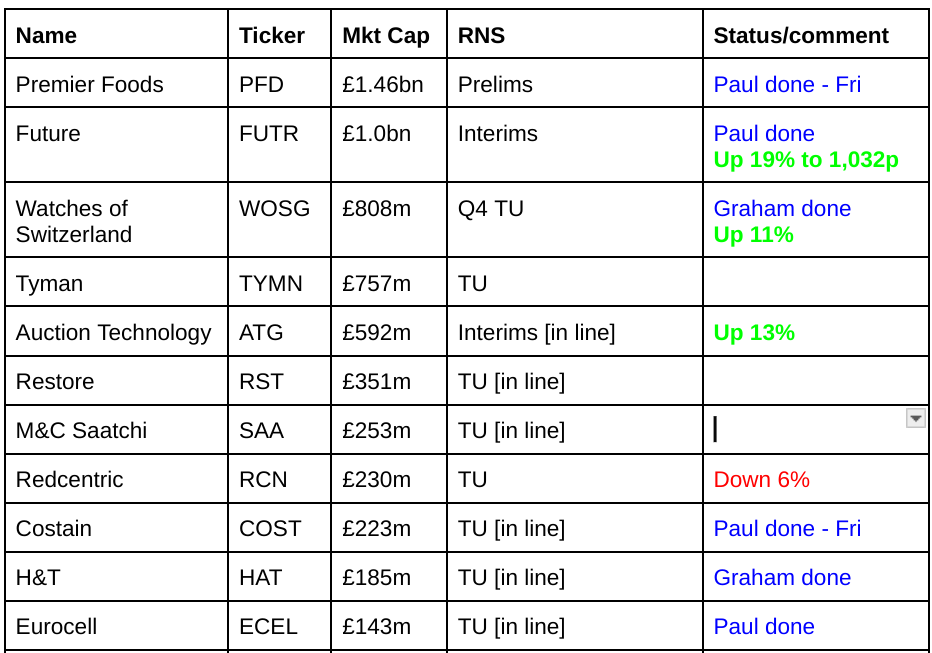

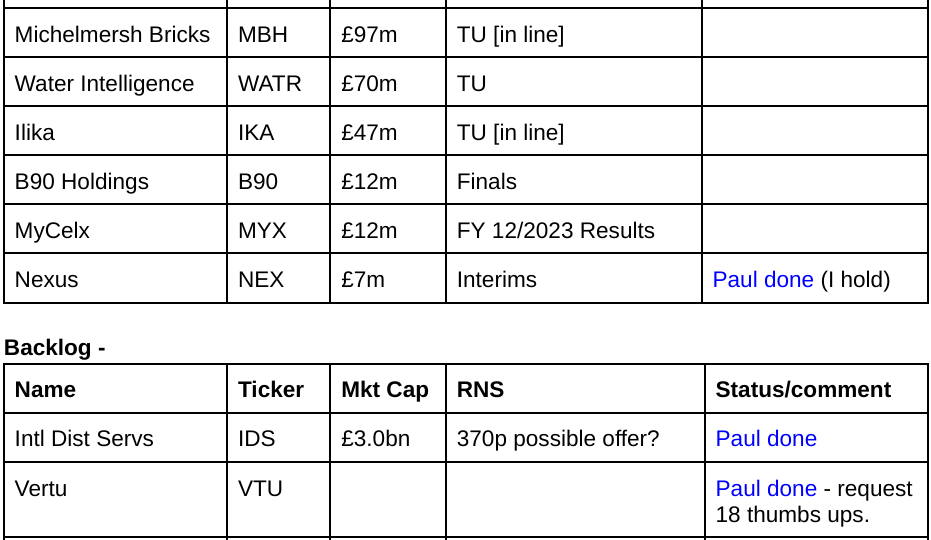

Companies Reporting

Other mid-morning movers (with news)

BT (LON:BT.A). - up 9% to 124p (£12bn) - FY 3/2024 Results - Paul - no view.

Ambitious plans from the new CEO at BT -

"This delivery and greater capex efficiency gives us the confidence to provide new guidance for significantly increased short term cash flow and sets out a path to more than double our normalised free cash flow over the next five years. This enhanced cash flow allows us to increase our dividend for FY24 by 3.9% to 8.0 pence per share. We're also setting a further £3bn of gross annualised cost savings to be reached by the end of FY29.

Huge net debt and giant pension contributions mean that the balance sheet has negative NTAV. Should it be paying such generous divis, when it has a mountain of debt? Anyway, this one’s above my pay grade, so let’s move on!

Nexus Infrastructure (LON:NEXS) (Paul holds) - up 15% to 95p (£8m) - Interim Results - Paul - AMBER/GREEN (but note de-listing risk, small & illiquid)

Nexus does groundworks for housebuilders, so obviously business is depressed at the moment.

A very small, and illiquid share, with 4 biggest shareholders in control with over 50%, so de-listing risk worries me (hence only a small position in my portfolio). The deep (balance sheet) value caught my eye recently. H1 figures today show revenue halved to £26m, but the loss before tax of £(1.5)m isn’t a disaster by any means, showing it must have stripped out a lot of costs. Order book has recovered strongly, and outlook says it has good visibility going into H2, so this looks an interesting potential cyclical recovery type trade. Great balance sheet includes entire market cap in net cash of £9.2m! NTAV dwarfs the market cap too, at £29m. Receivables look much too high at £24.6m though, needs clarifying, that’s almost the entire H1 revenues. No broker notes. IMC webinar is tomorrow at 1pm, so I might tune in to see if I’ve bought a pup or not! Could be an interesting one for nanocap investors to take a closer look at, let me know what you think.

Summaries of Main Sections

Eurocell (LON:ECEL) - 131p (£142m) - Trading Update - Paul - GREEN

Shrugs off challenging market conditions (revenue down 6%), and produces an in line with expectations update, helped by some cost reductions (eg raw materials, and energy). Buyback extended from £5m to £10m. There's lots to like here I reckon.

H & T (LON:HAT) - unchanged At 419.7p (£185m) - AGM Trading Update - Graham - GREEN

It’s a pleasant “in line” AGM trading update. The pawnbroking pledge book continues to grow as, evidently, consumer conditions still drive robust demand for alternative loans. But retail margins are also improving as expected. I remain a huge fan of this business and the stock remains attractive to me at PER of 7x.

Future (LON:FUTR) - up 19% to 1,032p (£1.19bn) - Half Year Results - Paul - GREEN

Nice to see our bullishness on FUTR vindicated, with shares up c.70% in the last 3 weeks! H1 results today come with an in line exps FY outlook. Balance sheet isn't the best, but cashflow is so strong that it doesn't matter. Buybacks also increased. Looks like a proper re-rating to me, rather than a spike up in price. Still decent value I'd say, now it looks as if growth is beginning to return.

Vertu Motors (LON:VTU) - 78.3p (£265m) - FY 2/2024 Results - Paul - AMBER/GREEN

Still looks reasonably priced, and we've always liked the considerable freehold property backing here. A takeover bid seems the most likely end result, although so far almost everything apart from VTU has been bid for, so what do I know?! I'm comfortable with AMBER/GREEN - moderately positive.

Watches of Switzerland (LON:WOSG) - up 10% to 371p (£889m) - Q4 FY24 Trading Update - Graham - AMBER/GREEN

A very nice update from this watch/jewellery retailer. In the short-term, performance is buoyed by strong growth in the US and by the success of its 2nd-hand Rolex product. In the long-term (to 2028), the company sees even better growth opportunities than it originally planned. I remain intrigued by this one.

Paul's Section:

First, a few quick comments from yesterday's other news -

International Distributions Services (LON:IDS) - up 16% y’day to 315p (£3.0bn) - possible 370p takeover bid - Paul - PINK

This group owns loss-making Royal Mail as a sideline, but its main value is in the profitable German distribution business GLS.

Czech billionaire Daniel Kretinsky already holds c.28%, and on 18/4/2024 his indicative 320p bid approach was declined. The latest news is he’s apparently prepared to pay an increased price of 360p + 10p divis. The internet came up with a brilliant quip - “The Czech’s in the post!”

IDS management has indicated they are minded to support this deal as a fair price, subject to various things.

Why did the share price only end yesterday at 315p, a long way short of the potential 370p bid? Presumably the market must see considerable obstacles to the deal actually happening, I don’t know. Or it could be a nice profit opportunity? Press reports talk about regulatory, pension funds, and unions needing to agree things. Good luck to anyone brave enough to take on Royal Mail!

John Wood (LON:WG.) - down 7% to 186p (£1.3bn) - Rejected 212p cash takeover - Paul - PINK

Just before yesterday’s market close, this engineering group announced its Board had rejected a possible 212p cash takeover bid from Sidara (slightly increased by 3% from a previous proposal). The Board said - “continued to fundamentally undervalue Wood and its future prospects.”

It’s not something we’ve looked at here before, so no view from me. But obviously the shares are attractive to a bidder that is prepared to pay more than the current share price, which is clearly a good place to us to be looking for value and doing more investigations of our own. As we’re seeing in the deluge of mid-cap bids, often the bidder raises the price, or other parties get involved. Exciting times!

Britvic (LON:BVIC) -up 11% y’day to 1,018p (£2.6bn) - Interims - Paul - AMBER

Market likes its H1 results. Adj EPS up 19% to 27p. Doing another buyback, of £75m. However, the balance sheet is horrible, with negative NTAV and far too much debt, and valuation looks pricey. So doesn’t appeal to me at all, on a value/GARP basis. Maybe people like the brands, or are valuing it some other way? Each to their own!

Revolution Bars (LON:RBG) - 1.5p (£3.5m) - Update - Paul - RED

Says that a wide-ranging FSP and restructuring process has failed to generate any bid interest in the company as a whole. That’s not a surprise, as it;s trying to do a complicated restructuring to ditch the loss-making sites. So it seems as if this FSP (formal sales process) might be a formality, so it can demonstrate to the court that all options have been explored, in order to justify clobbering the landlords of the closed sites, and releasing it from lease liabilities.

My view is that the backers of the £10m equity raise at 1p hold all the cards, as they’re not actually committed the money. They’ve effectively been given a call option to refinance RBG if the various conditions are met (such as court approval for the CVA, or similar). If those conditions are not met, they they can walk away - losing their existing equity, but not losing any of the additional pledged funds. That’s a much better situation than private investors, who if we buy now (or even just hold), then we’re potentially wiped out if anything goes wrong.

If the restructuring deal does happen, the dilution at 1p is so large, and leaves a still-indebted and not very good business. In a sector where it’s incredibly difficult to make any money at all, since wages costs have soared in recent years, and typically constitute about 35% of revenues, or c.50% of gross profit.

For these reasons, I’m happy to sit on the sidelines, as the upside isn’t clear enough to justify a potential 100% loss for small shareholders if anything goes wrong with this complicated restructuring. Overpaid management have demonstrated several times that they’re incompetent too. So why back poor management in the third fundraise in the last 4 years?

Renew Holdings (LON:RNWH) - 1,054p (£833m) - H1 Results - Paul - AMBER/GREEN

We’ve followed this contracting business for many years, and watched in amazement as it’s done a most unlikely major multibagger, in a sector that is often an investing graveyard (low margin contracting). The key to its success seems to have been just really good execution by management, and gradually increasing the operating margin from about 1% to 5% (I remember them setting out that aspiration, years ago), plus seemingly successful bolt-on acquisitions. Good H1 numbers show adj EPS up 14% to 31.3p. The commentary talks about its “high quality, low risk business model”. Confident full year outlook. Network Rail seems a key customer, with huge maintenance spend. No balance sheet support, with only £14m NTAV.

Paul’s view - I can’t argue with success! This is not a sector I invest in, but the brilliantly named Paul Scott (CEO of RNWH) has clearly demonstrated a stunning performance here over many years. Compare that with all the accident-prone “value” shares in this sector, and I can see why RNWH shareholders are happy to stick with the best. After such a strong run though, there must come a point where it makes sense to bank some profit perhaps?

Eurocell (LON:ECEL)

131p (£142m) - Trading Update - Paul - GREEN

Eurocell plc, the market leading, vertically integrated UK manufacturer, recycler and distributor of PVC window, door and roofline products, provides the following update for the first four months of 2024, in advance of the Annual General Meeting ("AGM") later today.

I wanted to have some building supplies & similar type companies on my 2024 shares ideas list, so included Headlam (LON:HEAD) (profit warning yesterday) and ECEL - partly because both have strong balance sheets, which means they can absorb any further downturn in trading. As we saw earlier this week from HEAD, trading is not yet recovering, in fact it has lurched down again. I was expecting a far worse share price reaction, so it seems that shares in this area might have the bad news already factored in, with investors looking through soft current trading for the eventual recovery in 2025, maybe even late 2024, who knows?

Today’s news from ECEL confirms conditions are still tough, but it seems to be coping alright -

Trading conditions in our key markets have remained challenging, with continuing macroeconomic uncertainty impacting activity levels in both the repair, maintenance and improvement ("RMI") and new build markets. However, we continue to focus on closely managing costs and cash flow and have seen some further reduction in raw material cost pricing in 2024.

As a result, our expectations for underlying profit before tax for the year remain unchanged.

We are on track with the delivery of the early stages of our new strategy. Our balance sheet is strong and the actions we have taken, including those on costs and cash flow, position us well to benefit when our end markets recover.

That’s a very different story from HEAD earlier this week (different products, I know), which lurched into a significant loss.

Note that broker forecast at ECEL has actually been rising in recent months, a fair bit too -

Share buyback - is being extended from £5m to £10m. That’s significant for a £142m market cap company. £4.2m has already been done, and some is being used to satisfy share options in the next 2 years. Let’s hope the options only vest if challenging performance targets are hit, and aren’t just free shares for happening to run the company when a cyclical upturn starts.

I’m impressed that ECEL has the financial clout to do significant buybacks, despite challenging market conditions.

Paul’s opinion - for investors who are prepared to be patient and wait for a cyclical recovery, I think ECEL looks excellent.

Stockopedia shows very attractive valuation measures (see below), together with an in line update today, cyclical recovery potential, generous divis and buybacks, and good balance sheet support, risk:reward strikes me as favourable - tons better than HEAD. So I’m happy to remain at GREEN.

Future (LON:FUTR)

Up 19% to 1,032p (£1.19bn) - Half Year Results - Paul - GREEN

Shares at this specialist media group have gone bananas in the last 3 weeks, up c.70%. I hope some readers caught this terrific move, as it’s been one of our favourite value shares here this year, with us flagging up the superb value, and wondering why the shares were so cheap, with GREENs on 7/12/2023, 7/2/2024, and 4/4/2024. Funny isn’t it, sometimes great value does just stare you in the face, with plenty of time to buy the shares too. Although in practice it’s not always that easy, as we wonder what we’ve missed that the market is negative about, when the shares seemed in a relentless downtrend.

Forecasts have been in a downtrend though, so clearly all is not perfect at FUTR -

Key H1 numbers (6 months ended 31/3/2024) -

Revenue down 3% to £392m

Adj diluted EPS down 20% to 57.2p

Declines seem to be bottoming out -

The Group returned to year-on-year revenue growth in Q2 with organic revenue growth of +3%.

Net debt - as mentioned before, I don’t see this level of debt as being problematic, given how genuinely cash generative the group continues to be -

Leverage1 was unchanged at 1.25x (FY 2023: 1.25x) with net debt1 at the end of the half year of £296.7m (FY 2023: £327.2m). Total available debt facilities at the end of March 2024 were £650m (FY 2023: £900m).

Outlook - in line for this year -

Balance sheet - in isolation this balance sheet looks stretched. NTAV is heavily negative, I’ve been kind and deleted deferred tax liabilities, but even then I get to a pretty horrible £(381)m NTAV. However, FUTR throws off so much cash, that the bank borrowings which make up most of the deficit on its balance sheet are comfortable to both service, and repay. So there isn’t a solvency problem in my view. This is a capital-light business model, with little in fixed assets, and nothing in inventories. So management has taken a view that it can carry almost £300m in net debt without causing any strain. I’d prefer if it was net cash, but never mind, can’t have everything, and we can adjust the valuation to take into account debt.

Cashflow statement - is very simple to understand. It generates loads of cashflow which was used to purchase its own shares (smart move given how depressed the share price was), and reduce bank debt. Note divis are only a token amount.

Paul’s opinion - even after an explosive upward move, the PER is still only about 8.6x likely 120p adj EPS for FY 9/2024. Hardly expensive. If we allow for the c.£300m net debt, then I would see the PER about 11-ish. Not expensive, especially given the high quality recurring cashflows this group generates. Outlook comments suggest we’ve maybe hit the bottom re earnings, and a recovery in advertising might now become evident perhaps? I don’t know anything about any impact (bad or good?) from cookies, maybe someone could explain that for me.

I was expecting to lower it from green to amber/green, given the 70% surge in share price, but as I think it remains good value (but not absurdly good value any more), I’ll happily stick at GREEN. This looks to me a radical change in market sentiment towards FUTR shares, rather than a short-term spike. Although nobody could be blamed for top-slicing after such a great run. Well done to holders! Pity I didn’t eat my own knitting (?), but never mind, I’m almost as happy seeing readers make a bob or two here!

Vertu Motors (LON:VTU)

78.3p (£265m) - FY 2/2024 Results - Paul - AMBER/GREEN

Vertu Motors, the UK automotive retailer with a network of 188 sales and aftersales outlets, announces its final results for the year ended 29 February 2024 ('Year').

Company’s headline -

Record revenues, substantial cash generation and increased dividend

Key numbers -

Adjusted profit before tax of £37.8m (FY23: £39.3m), on record revenues of £4.7 billion. Profit in line with current market expectations.

Adj EPS was 8.37p, so PER is 9.4x

Remember that H2 suffered when there was an unexpectedly sharp downturn in used car values, and other cost increases (especially wages and energy) have also made things tricky in the last couple of years. So I’m not sure if we should be looking for future earnings to increase, or not?

Outlook - lots of information in this, but overall it sounds OK to me -

The Board is pleased with the Group's strong trading performance in the critical first two months of the new financial year. Overall, the performance was slightly ahead of the Board's expectations and expectations for the full year are unchanged.

Balance sheet - NAV is £353m, less intangible assets of £131m, gives NTAV of £222m, which supports most of the £265m market cap. As we’ve discussed before, VTU has large freehold property assets, which gives lovely downside protection. Although it hasn’t made any difference, since practically everything in the sector apart from VTU has received takeover bids! Although I see that Cinch (part of a large group called Constellation) now holds 9.1% of VTU, so wonder if a bid approach from them might be the end game here?

Paul’s view - with c.9p EPS expected for FY 2/2025, and taking into account the strong balance sheet with lots of freeholds, I think a fair price for this share might be c.100p? So it looks reasonable value at 78p. Probably the most interesting thing is the obvious potential for a takeover bid, if that came in at say 100-120p then it would be a reasonable exit I think.

There’s some uncertainty over some manufacturers moving to an agency model (commented on in this latest update), and also a deluge of Chinese manufacturers trying to sell us subsidised electric vehicles that not many people seem to want! I read recently that the US is apparently imposing 100% tariffs on Chinese EVs, so wonder if the EU might do something similar to protect the German manufacturers? There’s also the question of whether aftersales on EV will be as lucrative for the dealers, given the smaller number of moving parts? Lots of things for us to ponder.

Overall I feel most comfortable at moderately positive, AMBER/GREEN.

Not as stunningly cheap as it used to be, but still reasonable value -

Graham’s Section:

H & T (LON:HAT)

Unchanged At 419.7p (£185m) - AGM Trading Update - Graham - GREEN

The UK’s largest pawnbroker issues a trading update for the first four months of the year: it is in line with expectations.

Demand for pledge loans continues to be buoyant and April 2024 was a record month for lending. Consistent with last year, redemptions in March and April were higher than average as customers chose to collect their items, often to wear them at religious and family celebrations. This is expected to reverse in the coming months.

H&T’s overall pledge book is now £105m, up from £101m at the end of 2023.

H&T made an £11m acquisition in February that raised a few eyebrows - a “posh” pawnbroker whose average loan size is over £4,000. In the few months since then, there haven’t been any mishaps: the pledge book has performed “well”.

The short update concludes as follows:

Retail sales and foreign currency revenues are in line with forecasts, with retail margins improving as expected. Gold purchase and scrap revenues are benefitting from a strong gold price.

Three stores have been added to the store estate so far this calendar year, including Maxcroft, with one closure. The store estate currently stands at 280 stores.

Graham’s view

I’ve been very bullish on this one, most recently covering its annual results here.

After an in-line update, there’s no need to change my view, although I see that the share price has been rising off those low levels reach in recent months:

:

The PE Ratio is now the much more demanding 7x, instead of the 6x it was at before:

StockRanks like it too, especially from a Value perspective:

I continue to have a slight preference for H&T over Ramsdens, although I would say both are highly attractive. With H&T, you get an enormous pledge book (ten times bigger than the Ramsdens pledge book) offset by complementary activities such as jewellery retailing.

With Ramsdens, it’s more of a combined offering where each service is of roughly equal importance.

H&T opened a net 10 new stores in 2022, and then a net 11 new stores in 2023 (total 280).

Ramsdens opened a net 8 new stores in FY September 2023 and has 9 new stores planned for FY 2024 (current total 167).

So both companies are expanding in what I would describe as a controlled way, without taking on excessive risk.

It’s a matter of taste which one you prefer. Personally, I prefer H&T because of the pawnbroking focus.

Stockopedia’s “Compare with…” tool also has a slight preference for H&T when you put them in a head-to-head battle:

:

Watches of Switzerland (LON:WOSG)

Up 10% to 371p (£889m) - Q4 FY24 Trading Update - Graham - AMBER/GREEN

Only a week ago I adjusted my stance on WOSG to AMBER/GREEN, as I thought the acquisition of Roberto Coin Inc in the United States seemed to be a promising one, and WOSG shares are on the floor compared to where they were:

This has resulted in some superficially cheap earnings multiples, although of course you have to be very careful in the retail space as things can turn bad quickly.

Fortunately, things haven’t turned too bad for WOSG yet. Today we have a Q4 and full-year update (to April 2024).

CEO comment:

We finished the year strongly, with Q4 sales in line with guidance and ahead of consensus. Particularly pleasing was the performance in the US, with sales up 14% in the period…

Our acquisition of Roberto Coin Inc. (the exclusive North American distributor of Roberto Coin) dramatically accelerates our luxury branded jewellery strategy, and we see enormous potential in bringing together this iconic brand with our retailing expertise…”

Let’s cover the key bullet points for Q4:

Revenue £380m, +4% at constant currencies.

2nd hand Rolex offering (“certified pre-owned”) performing ahead of expectations.

Total pre-owned and vintage revenue doubled year-on-year.

Jewellery revenue was flat when measured at constant currencies; this is much improved versus minus 16% in Q3.

Q4 revenue was equally split between the US and UK/Europe, although with much stronger growth recently in the US. A nice backdrop for the recent acquisition.

The UK/Europe are impacted by “challenging macroeconomic conditions”, and in the UK the loss of VAT-free shopping for tourists has been a particular issue, one we’ve touched on before. Recent hopes that this decision would be reversed have been dashed, but perhaps it will stay on the agenda for future Budgets?

E-commerce continues to do very badly, down 20% on last year, one of the few areas where WOSG investors have received no good news to cheer for Q4.

Full-year results: zooming out from Q4 to look at the full-year to April 2024, it’s again a tale of two geographies. US revenues are up 11% at constant currencies, while UK/Europe revenue is down 5%.

Jewellery performed much worse than watches, and the company previously noted that “non-branded” jewellery was a major source of weakness. This theme continues today as WOSG says:

Luxury branded jewellery continues to significantly outperform in jewellery

With jewellery revenue as a whole down 13%, this implies that non-branded jewellery did very badly indeed!

Adj. EBIT for FY 2024 is expected from £133 - £136 million (previous year: £165m). Given the dramatic fall in the share price, you may have expected worse!

Net cash: has fallen to £1 million (last year: £16m); it would have risen if not for an acquisition.

Since year-end, the $130m Roberto Coin acquisition has been announced and WOSG has borrowed to fund that deal, seeing its leverage multiple rise to 0.8x.

Besides its financial debt, the company also has significant lease liabilities. So it can be argued now that the balance sheet is in risky territory. As I said last time: elevated risk for elevated rewards!

Long Range Plan: WOSG is still planning to double sales and Adjusted EBIT by the end of FY28, and are “confident” in these targets.

The 2nd-hand Rolex offering is an important part of this; its initial performance is ahead of expectations and it is now expected to outperform its previous targets.

Similarly, “we see further growth opportunities for Roberto Coin Inc. ahead of what was previously assumed within the LRP”.

Outlook for FY 2025: “cautiously optimistic”. Watch production is “conservative”, given recent volatility.

On a pre-IFRS 16 basis (i.e. treating rents as operating costs), we get the following guidance:

Graham’s view

I’m inclined to stay AMBER/GREEN on this one: I see very high rewards for shareholders if the company’s strategy succeeds, but I’m also cognisant of some important risk factors:

Retailing risk: exposed to consumer sentiment generally, with the ongoing cost of expensive leasehold properties.

Watch market risk: the value of luxury watches has been extraordinarily volatile in recent years, as we’ve discussed previously.

Financial risk: WOSG has borrowed to fund its recent US-based acquisition.

Are these risks priced in? I’m inclined to believe that they are, which is why I’m leaning towards a positive view on these shares:

I still think of this stock as a recent float but it has been listed since 2019. It hasn’t paid a dividend yet but it remains very ambitious, and its top and bottom lines have grown impressively over this time. At a single-digit earnings multiple, I think it’s certainly worthy of further consideration

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.