Good morning, it's Paul & Graham here!

All done for today - a mammoth report! I've added some super-brief comments in the agenda section where I just had a very quick look.

Ed's webinar on multibaggers

Wasn't this excellent, last night?! If you didn't manage to watch live, then do check out the recording, which I think the team is planning to email out to those who registered.

I recognised all 10 of the multibaggers from 2013-2023, because we've written about all of them many times here over that period (our archive of SCVRs goes back to 2013). I have to say, it wasn't at all obvious at the time that any of them would go on to become multibaggers. In every case, management just executed very well over the long-term. There's not really any way to measure that in advance, this is the trouble!

However, Ed flagged some fascinating (and surprising!) insights into some of the common traits these multibaggers did possess early on. It's also very encouraging that a lot of the biggest UK multibaggers were mundane small caps on value ratings (at the start of their run), not sexy sectors or blue sky projects (although the £50m minimum market cap would have excluded those).

So the exciting thing is that the next batch of multibaggers are buried somewhere in these reports here & now! Let's hope we can spot them, and have the patience to hold (that's the really difficult bit!)

EDIT: a reminder that I started the SCVRs in 2013. So we have a full 10 year archive of all the multibagging shares. It's quite interesting to look back at how they were perceived before we knew they were going to be multibaggers!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Oh my giddy aunt, have you seen the list today?! We'll get through as many as we can, but it won't be anywhere near all of these -

Summaries

Hotel Chocolat (LON:HOTC) - 139p (£191m) - Recommended Cash Acquisition - Paul

Blockbuster takeover bid at 375p, a 170% premium, from Mars. Congratulations to holders! HOTC didn't stack up as a standalone company, and performance in recent years has been poor. So this is a fabulous outcome, recognising the brand value.

City Pub (LON:CPC) - 99p (pre market) £103m - Recommended Acquisition - Paul

Another takeover bid, from larger brewery Youngs. It's offering a notional 145p, a decent 46% premium, 108.75p in cash, with the balance in new Youngs shares. It's still well below the pre-covid share price though, will that be enough to satisfy CPC shareholders into agreeing this deal?

MJ GLEESON (LON:GLE) - unch 455p (£266m) - Trading Update (AGM) - Paul - GREEN

In line trading update. I crunch the numbers below, and think this starter homes builder looks good for the medium to long-term. More than fully asset-backed, so patient shareholders don't really need to worry about the shorter term macro situation.

CMC Markets (LON:CMCX) - down 0.6% to 94.45p (£264m) - Interim Results (in line) - Graham - GREEN

This trading platform offers unchanged guidance for this financial year and says it remains comfortable with FY March 2025 guidance, too. Client trading is subdued and the company has made a small loss in H1 but I continue to view these shares as offering great value.

Crest Nicholson Holdings (LON:CRST) - down 1% to 187.5p (£482m) - Trading Update - Paul - GREEN

Striking a more cautious tone than Gleeson, this housebuilder lowers the range of possible profit outcomes for FY 10/2023 by up to 10%. Although that seems to be due to one particular problem project. It's trimming costs a little, and build cost inflation has reduced to low-mid single digits. Massive discount to NTAV is a big attraction, along with generous divis. Very appealing to value investors, I reckon.

DX (Group) (LON:DX.) - up 7% to 46.5p (£281m) - Recommended Cash Acquisition - Paul

A takeover bid was already known about, but it's now confirmed at 47.5p + 1p dividend. It's not particularly generous, but logistics companies don't tend to command high valuation multiples normally. A good turnaround has happened at DX in recent years. Although the exit price is way below the IPO price almost 10 years ago.

Pressure Technologies (LON:PRES) - up 7% to 28p (£10m) - Debt Refinancing - Paul - AMBER

This small engineering group today announces completion of a small refinancing by major shareholders which was pre-announced in Oct 2023. Nothing has changed, so no surprises here. I give my take on the situation below, a lot of which is educated guesswork necessarily, due to lack of information on the pending disposal of one division.

Liontrust Asset Management (LON:LIO) - down 0.6% to 94.45p (£264m) - Interim Results (in line) - Graham - GREEN

This trading platform offers unchanged guidance for this financial year and says it remains comfortable with FY March 2025 guidance, too. Client trading is subdued and the company has made a small loss in H1 but I continue to view these shares as offering great value.

Quick comments -

Tyman (LON:TYMN)

Down 2% to 273p (£534m) - Trading Update - Paul - GREEN

Tyman plc ("Tyman" or the "Group"), a leading international supplier of engineered fenestration components and access solutions to the construction industry, provides an update on trading for the period from 1 January 2023 to 31 October 2023

Expects FY 12/2023 adj operating profit to be “in line with market expectations”

*Company compiled analyst consensus of £83.6 million, with a range of £82.8 million - £84.3 million.

Challenging market conditions.

10 month revenue is down 10% (like-for-like), despite price rises, so volumes must be down well into the teens %.

Focus on cost-cutting & efficiency has protected profits well I think.

Strong cash generation (eg reducing inventories)

Net debt expected to be c.1.25x EBITDA by year end.

Paul’s opinion - this looks a resilient performance, given the cyclicality of its business.

I was amber/green when last looking at Tyman, see SCVR 25 July 2023 here. As TYMN shares are now 10% cheaper, and it’s still trading in line, I’m happy to go GREEN for a nice cheap recovery share, that’s also providing a healthy 5% dividend yield whilst you wait. Looks a decent business, worth doing some more research on this one I think.

Kier (LON:KIE)

Down 2% to 104p (£464m) - Trading Update (AGM) - Paul - GREEN

Shares in this construction/property/infrastructure group have been recovering nicely this year. We’ve not looked at it here for about 3 years.

FY 6/2023 results (announced 14 Sept 2023) look good, with £105m adj PBT, up 11%, on £3.4bn revenues. Adj EPS was 19.2p for a historic PER of only 5.4x

Finance costs stand out, absorbing about half operating profit.

Large, complicated balance sheet, with NTAV negative £(132)m.

Today’s update says FY 6/2024 has “started well”, above LY, in line with expectations. H2 weighting expected, same as LY. Re-confirms it intends resuming dividend payments this financial year. Order book is £10.5bn, plus long-term framework agreements.

Paul’s view - not a sector I invest in, as low margin contractors are only one bad contract away from trouble. However, on a quick once-over, I think this share looks appealingly cheap, comes with a nice forecast 5% yield, and seems to be trading well with a decent outlook. Worth a closer look, if you invest in this type of thing. I’ll go GREEN.

Paul’s Section:

Hotel Chocolat (LON:HOTC)

139p (£191m) - Recommended Cash Acquisition - Paul

Stunning news, get out your bunting!

Chocolate giant Mars is bidding a remarkable 375p cash (£534m total) for Hotel Chocolat, a deal which is agreed by HOTC management (who have controlling stakes).

This is an astonishing 170% premium to last night’s share price!

On both fundamentals and share price performance, HOTC has been a considerable disappointment, poorly managed, with failed overseas expansion, disappearing profits, and frequent profit warnings - as you can see below -

So why on earth is Mars buying it for £534m? It’s got to be for the value it sees in the brand. Properly managed, and with Mars financial strength, no doubt the Hotel Chocolat brand will be expanded greatly.

Mars has long admired Hotel Chocolat's impressive credentials as a contemporary, premium brand with a differentiated product offering, world-class product quality and strong direct-to-consumer capabilities through its physical store presence and sophisticated digital commerce platform.

Paul’s opinion - I’ve been negative in the last year on valuation, and fundamentals, because the figures & performance have been poor. So as a standalone company, HOTC didn’t make an appealing investment idea.

However this takeover bid goes to show that acquirers sometimes look beyond the numbers, and see value in other things, especially brands. So a good lesson learned there, that there can be value in companies beyond the pure numbers.

Hearty congratulations to patient holders here, a sparkling payday has arrived!

City Pub (LON:CPC)

99p (pre market) £103m - Recommended Acquisition - Paul

Another takeover bid!

Young & Co's Brewery (LON:YNGA) (market cap: £649m) has agreed with management of City Pubs, to buy it for a notional 145p/share, comprising -

108.75p cash, and 0.032658 new Youngs A shares per each CPC share.

(1,110p/share * 0.032658 = 36.25 pence)

This is a 46% premium to last night’s closing CPC price, which had put in a recent spurt - possibly innocent, possibly some insider dealing, who knows?

Paul’s opinion - coincidentally, we were talking yesterday here about the hospitality sector coming alive again as real incomes turn positive for UK households, and bid interest in the sector after the surprise bid for Restaurant (LON:RTN) .

This bid for CPC reinforces that view, so the whole sector could be in play now maybe?

Will shareholders see a 46% premium as enough, given that this price is still well below the pre-pandemic share price?

Also, the shares element of the remuneration could prove a drag on the price of Youngs, as some CPC shareholders may not want a scrap of Youngs shares.

MJ GLEESON (LON:GLE)

Unch 455p (£266m) - Trading Update (AGM) - Paul - GREEN

Here is the announcement in full, all self-explanatory -

MJ Gleeson plc, the low-cost housebuilder and land promoter, is holding its Annual General Meeting later today at which James Thomson, Chairman, will make the following comments:

"Gleeson Homes has traded in line with the expectations set out in our September announcement.

Net reservation rates for the 9 weeks to 3 November 2023 increased to 0.47 per site per week (0.46 excluding bulk reservations), from 0.43 per site per week during the previous 9 weeks to 1 September 2023.

Mortgage rates have begun to stabilise and, against a more certain backdrop, we would expect buyer interest to pick up into the seasonally stronger Spring selling season.

Gleeson Land has completed the sale of one site since the start of the financial year.

The Board therefore currently expects that the results for FY2024 will be in line with market expectations.

We will provide a further update on 11 January 2024 following the conclusion of the half year."

As you can see below, broker consensus has been static this calendar year, after sharp reductions in autumn 2022. So to report in line trading today does reassure nicely that things haven’t got any worse -

Valuation - the key numbers (below) for me are the PER of 10.3x which seems reasonable, but above all the net tangible asset backing - which is greater than the market cap, evidenced by a Price to Tang. Book of 0.93.

I think the chance of GLE needing to make write-offs against its tangible assets seems low, because its land and work-in-progress are so modestly valued to begin with - due to it building small, cheap starter homes in the Midlands & North.

The product is therefore affordable, which shouldn’t require any balance sheet cuts. A severe recession could change that though, but this seems a low probability scenario in my view.

Paul’s opinion - it’s been a bumpy ride for shareholders in house builders, but I remain positive on GLE (it was one of my 2023 top picks, which have done well in a tough market). GLE is up 32% YTD.

There was a sudden surge in share price yesterday, so we might see some short-term profit-taking perhaps, since today’s update was in line, rather than a beat. You can see below that it’s tended to be range-bound this year at 350-450p, as sentiment on the housing market and macro swings from gloom to hope, and back again!

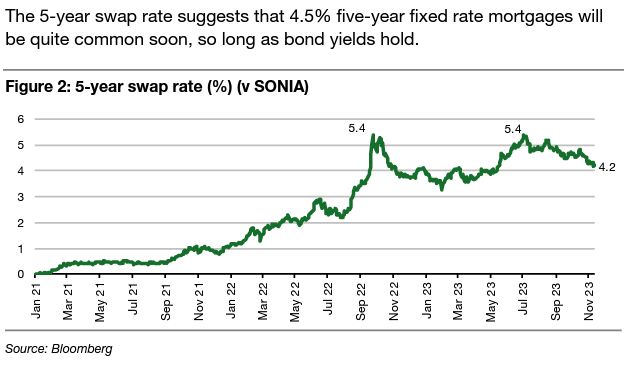

It seems to me that we’ve had pretty decisive economic data in the last fortnight which shows that inflation has fallen most of the way back down, and in election years (UK and USA), there’s bound to be political pressure to reduce interest rates in 2024, which financial markets (eg swaps) are already anticipating. Deals on mortgages have also been getting cheaper very recently. So the tide does seem to have turned, hopefully.

Therefore this seems a good time to be looking closely at cheap, strongly asset-backed housebuilders, and also the wider commercial property sector too, where a lot of shares could have strong recovery potential.

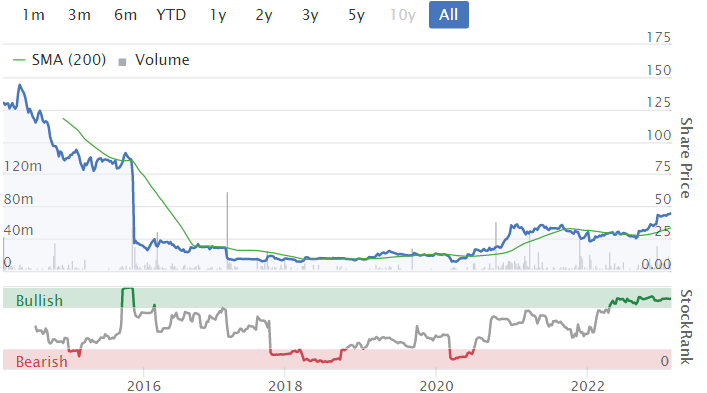

This looks an attractive 5-year chart below, and there’s only been very modest additional share issuance over this period.

Medium & longer term, GLE shares remain attractive, in my view. Earnings have proven resilient this year, despite all the macro trouble, and it’s more than 100% asset-backed. That’s very appealing to value investors.

A wild card could be more Government support for first-time buyers, which would make sense when the sector is struggling, and would I think disproportionately benefit Gleeson, due to its products being low cost starter homes.

Overall, I remain positive, so it’s another thumbs up. This looks well set up for a medium term recovery - maybe 50-100% upside on this share, with patience?

EDIT: An update note has just come through from Liberum, many thanks to them and Research Tree.

Liberum leaves its estimates unchanged today at 42.5p EPS for FY 6/2024, which is consistent with the StockReport here.

I hope it's OK to copy this interesting graph on interest rate swaps, showing a more favourable driver for (lower) mortgage rates, from Liberum's note, with thanks -

Crest Nicholson Holdings (LON:CRST)

Down 1% to 187.5p (£482m) - Trading Update - Paul - GREEN

Another housebuilder, focused mainly on southern & central England - its website showing current locations -

.

Crest Nicholson today provides an update on trading for the year ending 31 October 2023 and a streamlining of Group operations for FY24.

This sounds a bit downbeat, if it’s the only positives they can find! -

STREAMLINING OPERATIONS IN RESPONSE TO MARKET CONDITIONS

STRONG LAND PORTFOLIO TO SUPPORT MEDIUM-TERM GROWTH AMBITIONS

Profit guidance - unfortunately, it doesn’t say whether this has changed from previous guidance, so I have to now waste time trying to find out what previous guidance was. It’s so annoying when companies do this.

FY23 Adjusted Profit Before Tax (APBT) expected to be in the range of £45.0m to £50.0m

OK, I’ve found the previous guidance (21 Aug 2023), which said adj PBT for FY 10/2023 was “expected to be around £50.0m”. So today’s update is a fall in profit guidance between 0% and 10%.

Outlook -

We expect the housing market will remain challenging as we head into 2024 with elevated interest rates remaining in place until inflation comes back down to its target level. In addition, the absence of any Government support for first time buyers, coupled with higher borrowing costs continues to impact affordability.

However, there are reasons to be optimistic with year-on-year inflation now halved and real wage growth starting to be felt in households across the UK. We have acquired some excellent sites that are at advanced stages in the planning process, leaving us well positioned to trade in whatever market conditions emerge.'

Problem project - Brightwells Yard, Farnham, had previously incurred a £4m extra build cost (on a zero margin project). Another £7m extra costs is announced today. So what’s gone wrong, this is a material loss. And why did CRST undertake a zero margin project in the first place? The site is nearing completion now.

Net cash is healthy at £64.9m. Like Gleeson, CRST has a superb balance sheet. The discount to NTAV is extraordinary here, with £848m NTAV at April 2023, compared with today’s £482m market cap! In other words, £366m of tangible assets are thrown in for free, which is astonishing. That seems to suggest the market is expecting deep cuts in the balance sheet value of land & work-in-progress. That seems a very extreme assumption. Although I can see that CRST’s locations look to be in higher house price areas than Gleesons, so the write-down risk would be higher than at GLE. Even so, this is a remarkably bearish valuation, that strikes me as excessively cautious.

Build cost inflation -

“is starting to reduce from mid-single digit percentages and we expect this to continue into FY24”

That sounds as if inflation is no longer a worry here, and the wider sector.

Paul’s opinion - this strikes a more cautious tone than Gleeson, but it sounds like the 0-10% reduction in profit guidance has been caused by one specific problem contract.

The main attraction to this share is the massive discount to NTAV.

With profitability still quite robust, despite tough macro, I think this share is well worth considering for further research, and a potential cyclical recovery candidate.

I wonder if the takeover mania will descend on some of the bargains in this sector? With such a deep discount to NTAV, I think CRST could be a sitting duck for a bid. and it has a fragmented shareholder base. Even at a 30% bid premium, a buyer would still be getting £216m of tangible assets for nothing!

Meanwhile, investors who hold, enjoy a 6.5% dividend yield.

This looks highly attractive risk:reward to me. GREEN.

This 5-year chart looks like we're at or near a nice entry point maybe? Note there has not been any dilution over this period -

DX (Group) (LON:DX.)

Up 7% to 46.5p (£281m) - Recommended Cash Acquisition - Paul

Let’s make it a hat-trick - 3 takeovers in one day, remarkable stuff! Anyone doubting that the UK small/mid caps market is cheap, must surely be questioning their view by now?!

The share price at logistics group DX is only up 7% today on this news because we had already been told that a deal was in process.

The takeover price is 47.5p per DX share, plus a 1.0p dividend which shareholders would have received anyway, so it’s not really part of the acquisition price in my view.

It’s a 33% premium to the undisturbed share price before the offer period started on 9 Sept 2023.

Paul’s opinion - I don’t see this as a generous bid. DX has pulled off an excellent turnaround over the last 3 years or so, which we’ve flagged several times here, earlier this year.

Today’s RNS says it has 54.6% support, so this deal looks highly likely to go ahead, I imagine.

Pressure Technologies (LON:PRES)

Up 7% to 28p (£10m) - Debt Refinancing - Paul - AMBER

There doesn’t seem to be anything new in today’s announcement, just confirmation that the deal announced on 24 Oct 2023 has been finalised.

It’s tiny numbers, almost embarrassing that a listed company has to do a special deal to pay off £900k borrowings from Lloyds Bank.

Major shareholders Rockwood, and Peter Gyllenhammar, have lent £1.5m to PRES.

3% arrangement fee, 14.25% interest, and repayable in full when a pending disposal of PRES’s PMC division goes through next year hopefully.

Also warrants (like options) for 1.93m new shares at a strike price of 32p (a premium to the 28p current price). If exercised (at any time in next 5 years, even if the loan repaid), this would give PRES a fresh £620k in cash, in return for a 5% increase in the share count.

For wider read-across, PRES says how mainstream borrowing facilities from normal lenders, were not available. That should make us all shudder if we hold shares in any highly indebted companies that need to refinance any time soon - it sounds as if lending criteria are getting much tougher.

Paul’s opinion - looks interesting, and all eyes are on Rockwood at the moment, which seems to be working minor miracles in the small caps space. I mentioned Richard Staveley’s superb presentation on Mello this Tuesday - a must-watch for anyone who invests in small caps, basically telling us how it’s done! Or at least detailing one strategy which has worked very well, making Rockwood the top performing small caps fund.

I can’t give an opinion on PRES because I don’t have enough information. The key missing info is what price it is likely to get from disposing (if it can sell it) of the PMC division? That would then leave the Chesterfield Cylinders business, which I’ve always felt looked quite good, but has historically suffered from patchy, unreliable performance.

Also, it looks too small to be a standalone listed business, and with 3 dominant shareholders (the above, plus Schroders) holding well over 50%, I think delisting risk might be a little high here.

Or they could do something wonderful with it, and the shares could multibag (which they did before, in 2013), so who knows!?

Note also the share count has almost tripled since 2017.

Singers seems to be forecasting a tiny profit in both FY 9/2023 and FY 9/2024. I worry that, with cash also tight, there’s little headroom here for any underperformance.

In a downside scenario, if the big shareholders are called on again to refinance it, I imagine they’re likely to completely screw small shareholders, as happened at Fulcrum Utility Services. So don’t ignore the risks here! That said, at the moment it looks as if the major shareholders are supportive of the share price, so it looks like they want to keep the listing and rebuild the share price.

If you want to read about what caused the huge spike in share price in 2013-14, it's all in our SCVR archive here, I covered this share a lot during that exciting time!

Graham’s Section:

CMC Markets (LON:CMCX)

Share price: 95.4p (pre-market)

Market cap: £267m

This spread betting and forex trading company has published interim results to the end of September.

Disclosure: I’m a shareholder in IG group (LON:IGG) who are competitors with CMC.

Key points from today’s update:

CMC Invest Singapore (stockbroking platform) was launched in September.

Various product upgrades including the availability of mutual funds on CMC Invest UK.

Operating cost guidance is unchanged for the current year at £240m (excluding bonuses). Opex is expected to decline “as projects are delivered and we pass the peak of the investment cycle”.

. And now for the financial result in H1. Sadly it is a small loss:

Operating leverage is extreme at CMC, as its operating expenses and net operating income can end up about the same when trading levels are subdued.

On the other hand, when clients are very active, the company roars into high levels of profitability. This is not one of those times.

For investors who can accept the volatility, the good news is that the company tends to have a very strong balance sheet to weather any storm. Own funds are reported today at £273 million, which is higher than the market cap as of last night’s close.

Check the balance sheet for further confirmation of the company’s strength, I see total equity of £359 million. Even if we write down both intangibles and PPE (property, plant and equipment) to zero, balance sheet equity is still nearly £300m.

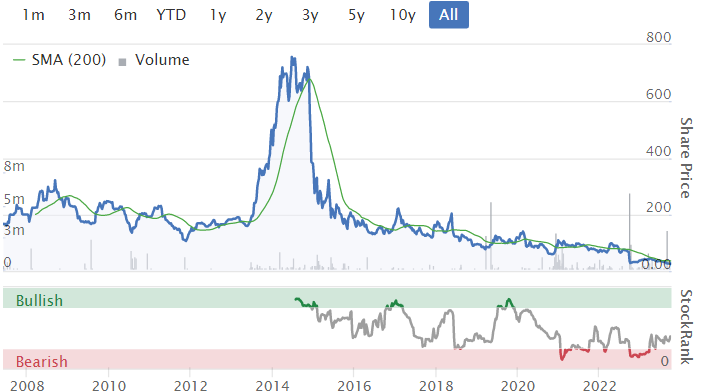

The company doesn’t normally trade this cheaply. The post-Covid slump has brought it here, with the shares down by nearly 80% from their peak:

Let’s go over some of the key aspects of the H1 performance at CMC.

Trading revenue down 32% and investing revenue down 20%: as many similar companies have reported, trading volumes have been very poor this year.

CMC refers to “lower client activity and the uncertain market conditions stemming from the inflationary and higher interest rate environment”.

“Other income” is up from £4m to £18m, thanks to higher interest rates.

I see that CMC’s stockbroking platform currently offers 2% interest on uninvested cash balances, although I don’t believe that there is any such offer from the spread betting or CFD platforms.

Active clients down 7% is no surprise. Revenue per active client also fell by 27%.

Interim dividend is just 1p (vs. 3.5p last year). That will only cost the company about £3m.

Snippets from the comments by CEO Lord Cruddas:

"I am pleased with the resilience the business has demonstrated in the first six months of the year in what has been a tough market environment, with low volatility offering fewer opportunities for clients of our trading business. Despite the subdued market conditions, we have seen continued commitment from our existing clients and positive engagement in our institutional business…

Our technology remains our competitive advantage and we are committed to a disciplined level of continuous investment, however with all that has been achieved over recent years the level of capital investment has now peaked.”

Outlook:

Full-year net operating income of £250m - £280m (versus opex of £240m plus bonuses). This is unchanged from the estimate given in the August trading update.

For the subsequent financial year, FY March 2025, the company expects net operating income in line with consensus forecasts: £302.6m according to CMC’s website.

A cost review is planned for H2.

Graham’s view

I’m a perma-bull on this stock and the share price movement says I’ve been wrong.

We have given this stock plenty of coverage:

August 2023: share price 104p (Paul)

July 2023: share price 147p (Graham)

June 2023: share price 160p (Roland)

January 2023: share price 243p (Graham)

October 2022: share price 222.5p (Graham)

Even with the share price having more than halved since reaching levels where I thought it offered decent value, I think I have to stubbornly remain positive on it.

Analyst consensus figures suggest nearly £40m PBT in FY March 2025 (the financial year starting in five months):

After 25% tax, that would be about £29m of net income.

So that puts the shares on a forward PER of less than 10x but remember that this company already has its entire market cap in liquid assets.

Also remember that in frenzied trading conditions, the company made profits of many times this level. The operational leverage here is key - increased revenues should again drop very efficiently into profits.

Finally, I think the product development here does set the company up very nicely for the future, with a competitive stockbroking platform now available in the UK, Australia and Singapore.

So I remain positive on this one, but I was also positive at over £2 per share so maybe I am just far too optimistic when it comes to this industry! Of course I also think that IG group (LON:IGG) (in which I have a long position) is undervalued.

Paul adds: I agree with Graham! Sure it's going through a tough patch, but the full liquid asset backing at CMCX, and the upside recovery potential on trading make this look very interesting indeed, taking a medium-term view.

Liontrust Asset Management (LON:LIO)

Share price: 584.6p (-3%)

Market cap: £380m

Liontrust Asset Management Plc… the independent fund management group, today announces its Half Year Report for the six months ended 30 September 2023.

This is another beaten-down sector. Liontrust shares are down by nearly 80% from their post-Covid peak:

Let’s see what today’s interim results have in store for us:

Adjusted PBT £36m (H1 last year: £43m).

Performance fees were £6m (H1 last year: zero).

Statutory pre-tax loss £10m (H1 last year: profit £14m).

Assets under management fell by 12% over the six month period to £27.7 billion.

Net flows were negative £3.2 billion.

Mostly bad news, as expected.

Let’s spend a moment to reflect on the £10m statutory pre-tax loss. There are £46m of adjustments added onto this to get adjusted PBT.

Last year, there were “only” £29m of adjustments.

This year, Liontrust made an ill-fated attempt to purchase the Swiss fund manager GAM Investments. Costs for this are in “professional services”.

On top of that, the negative outflows at the acquired business Majedie required about £18m of goodwill impairment. Total impairments as you can see in the above table were almost £30m.

The impairments reflect the loss of value of acquired businesses and so it’s reasonable to treat these charges in a special category - they don’t reflect current losses. But they are still real losses for shareholders, as the goodwill on the balance sheet was supposed to represent the value acquired from previous M&A!

Let’s move on to the CEO’s comments:

"This has been a challenging period for the asset management sector, including Liontrust..

It is in this context that we need to view Liontrust's net outflows and the impairment of recent acquisitions. The majority of Liontrust's assets are invested in UK equities, which is an asset class that continues to be out of favour with investors. UK All Companies was the worst selling sector for net retail sales yet again in September 2023 (with net retail outflows of £884 million), which has been the case for 10 out of the past 11 months.

The impairment of recent acquisitions, which does not affect our net cash, reflects the sentiment towards UK equities, especially among institutional investors, which has negatively impacted the funds and mandates we inherited from the acquisition of Majedie Asset Management.

He goes on to outline various company developments and initiatives, saying there is particular focus on international distribution. I can only imagine how difficult it must be to make sales into Europe at this time.

The Chairman aptly remarks that “no company enjoys linear growth over many years”. He also points to Liontrust’s focus on the UK market, and on small and mid caps. And he defends the attempted purchase of GAM.

Graham’s view

I have said before that the entire fund management sector looks undervalued to me, and Liontrust is one of the cheapest in the sector.

Investors at the current share price get £73 of AuM per £1 invested in Liontrust stock.

In September 2021, AuM was £35.7 billion and the market cap was £1.3 billion. So you only got £27 of AuM per £1 invested in Liontrust.

So the AuM is not far off three times cheaper now than it was two years ago.

Of course the fear is that AuM will just keep falling, with the combination of outflows and a mid-cap market that is slow to recover.

While I do think that Liontrust shares are too cheap, it’s not my top pick in the sector by any means. I’m not sold on the company’s “Sustainable” investment strategies, which stretch the meaning of the word “sustainable” to the limits of credibility. Overall, Liontrust is not very well differentiated, in my view.

Also, their main response to adversity has been to attempt expansion through M&A. Would it not make more sense to simplify and to become as lean as possible, instead of adding more fat? Today’s impairments suggest that prior acquisitions haven’t worked out particularly well so far.

However, I do think that the company’s difficulties and mistakes are probably all priced in at the current level. All they need - and all we need! - is another bull market. A change in sentiment could see a tremendous recovery in the valuation here.

If you’re willing to accept the adjustments as being one-off, the company has just generated £36m of underlying PBT in six months. That’s in terrible market conditions. At a market cap of £380m, how can it not be cheap?

For what it’s worth, the company also has an NCAV (net current asset value) of £85m, with nearly £100m of cash and equivalents. Perhaps it should ultimately be acquired, instead of always being the acquirer?

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.