Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Quick Comments/Summaries

ITM Power (LON:ITM) - 87p (pre market) £537m - FY 4/2023 Prelims - Paul - RED

Not suitable for a value report, as this is a very ambitious blue sky project, burning prodigious amounts of cash, and massively loss-making.

Just for the record though, FY 4/2023 revenues were £5.2m (significantly ahead of £2m guidance LOL!), with an EBITDA loss of £(94)m (£85-95m range guided).

When’s it going to run out of cash then? Actually, not any time soon, it looks well-funded. There was £283m cash left at 4/2023 (down from £366m a year earlier).

Guidance for FY 4/2024 is: revenues £10-18m, reduced EBITDA loss of £(45)m to £(55)m. Cash remaining at 4/2024 forecast to be £175-200m.

Balance sheet - note that inventories are very high at £59m, several years’ revenues. NTAV looks healthy at £285m.

Paul’s opinion - I just wanted to get some basic info into the system here. It’s clearly a speculative project, not a viable business at this stage. ITM claims to be “state of the art”, and “globally leading” in developing green hydrogen fuel. I wish them well, but it’s not something we can possibly assess here.

All I would say is that in the 25 years I’ve been investing, practically all blue sky shares like this fail to deliver what they set out to deliver. So unless you’re an expert in the tech, why get involved? That said, with plenty of cash in the bank, who knows what might happen, investors might get lucky if the tech really is globally leading, and manages to remain so.

Kin and Carta (LON:KCT) - up 14% to 72.5p - £129m - Trading Update - Paul - AMBER/RED

A surprisingly positive trading update today for FY 7/2023, given that it had previously warned on profit. Cost-cutting seems to have driven a revival in H2 profits, a seemingly positive development. Although there are such huge adjustments in KCT accounts, it's difficult to know what's really going on. I note that it spends multiple millions buying shares for the employee trust, but doesn't pay shareholders anything in divis! Weak balance sheet with negative NTAV.

Rank (LON:RNK) - up 2% to 91p (£426m) - Final Results (in line) - Graham - GREEN

I’ve decided to give this casino/bingo hall stock the green light as it reports improving trends in cost stabilisation. Customers gradually return although high net worth travellers to London remain scarce. Whenever boom times return, Rank should once again do extremely well.

Tremor International (LON:TRMR) - Down 30% to 178p (£255m) - Q2 & H1 Results - Paul - RED

A nasty profit warning today, with guidance lowered a lot. Accounts are so over-complicated that it's difficult to decide whether it's profitable at all! Strange balance sheet with a large cash pile, half offset by borrowings. Overly generous share-based payments for management (mopped up by share buybacks), and repeat Director selling are further red flags. I gave it the benefit of the doubt when the PER looked really cheap, but that support has now gone. So it has to be RED I'm afraid.

Empiric Student Property (LON:ESP) - up 4% to 89.1p (£537m) - Interim Results (in line) - Graham - GREEN

This REIT provides purpose-built student accommodation. The Board is “comfortable with all earlier guidance” after posting strong H1 numbers. I give it the thumbs up at this discounted valuation thanks to its strong financial position, full occupancy and 9% rent increases

Paul's Section:

Kin and Carta (LON:KCT)

Up 14% to 72.5p (£129m) - Trading Update - Paul - AMBER/RED

Kin and Carta plc ("Kin + Carta" or the "Company"), the global digital transformation ("DX") consultancy, provides a trading update covering the year ending 31 July 2023 ("FY23").

Revenue - Q4 in line with exps, and FY 7/2023 also in line, at £192m, flat vs LY.

H1 results show revenue of £98.7m, so H2 is lower, at £93.3m.

Profitability sounds ahead of expectations, due to cost-cutting, that’s how I interpret this bit -

FY23 adjusted operating profit is expected to be £17.9 - £18.4 million, 10.5% - 14.0% ahead of market expectations, reflecting a realigned operating model with a lower cost base and improved operational efficiencies.

The resulting adjusted operating profit margin is expected to be 9.3% - 9.6% and adjusted EBITDA margins are expected to be 11.7% - 12.0%.

Net debt remains modest relative to adjusted EBITDA and is expected to be c. £20 million at 31 July 2023.

H1 saw adj operating profit of £7.5m, so by implication H2 was at least £10.4m, a big improvement, despite revenues being down. Clearly there must have been a lot of costs stripped out, but that’s a good H2 performance - strange, considering it warned on profit on 26 May.

Outlook - sounds mixed, I’d say -

The Company enters FY24 with a healthy backlog and expects further sequential net revenue growth in Q1. Although client engagement levels are strong, it is clear that market headwinds remain across the sector and we continue to manage the business with the necessary caution…

While macro challenges remain across the sector, I am encouraged by the start to Q1 underpinned by a solid foundation of enterprise clients."

Broker updates - there aren’t any available, which limits what I can achieve interpreting today’s update. The only indication is the StockReport disclosing that broker consensus EPS forecast for FY 7/2023 fell from about 8.3p, to 6.1p in June, after the 26 May profit warning.

H1 actual was 3.06p, so the forecast of 6.1p assumes H2 is roughly flat vs H1. Yet as I calculated above, it seems that cost-cutting caused H2 to be well ahead of H1 profits. Hence I’m deducing that maybe the full year might be something like 7.0p to 7.5p? That’s looking a favourable move, and would put the PER on an undemanding c.8.8x (at 64p per share). Updating that for today's +14% share price rise to 72.5p, we now get a PER of 10.0x - which is probably high enough I'd say.

That said, based on its past performance, loads of adjustments in the accounts, and a weak balance sheet, personally I wouldn’t be willing to pay anything more than a mid-single digit PER anyway.

Net debt of c.£20m indicated for 31 July 2023 is called “modest”, but seems to be up from £11.8m net bank debt reported in the H1 results, as at 31 Jan 2023. But it’s not clear if today’s £20m figure is calculated on the same basis (excl. leases). If we assume it is probably reported on the same basis, then net debt is up c.£8m in 6 months. That might be due to paying the £12m contingent consideration shown within current liabilities on the last balance sheet, at a guess? I need to see the full figures, which are out in Oct 2023. Snapshots in trading updates can be misleading I find, for some companies.

Balance sheet - when last reported, was weak. NAV of £84m is more than all intangibles, so taking off that £93m, gives a negative NTAV of £(9)m. Also a pension surplus of £14m would need to come off too, taking NTAV further into the red.

Paul’s opinion - we don’t think much of this share. However, today’s update has seemingly sprung a positive surprise, with H2 being better than expected apparently (but I’d want to see the full numbers in Oct to be sure, as KCT puts through large adjustments).

There are all sorts of funnies in the previous accounts, and I’ve just spotted very large purchases of own shares for the employee benefit trust in previous cashflow statements - £8.4m was spent buying KCT shares just in H1 of this year! That is highly material, so needs careful scrutiny. Bear in mind shareholders don’t get any divis, yet there seems to be plenty of cash available to buy shares for the employee trust (presumably to be given away in awards?) .I recall spotting a similar thing with one of the recruitment companies, and it was a form of hidden employee remuneration, so it's well worth checking every company's cashflow statement for this type of thing that might not appear on the P&L. After all, it's more important where the cash is going, than what a theoretical profit is!

For now I’ll stick with my RED view on this share, although maybe AMBER/RED would be fairer, given a positive surprise today? Yes, let’s go with AMBER/RED - denoting that I don’t like the company fundamentals (the RED bit), but it has issued better than expected news today (AMBER bit).

It would be so much easier if KCT would arrange to use a broker that gets some research notes out to private investors. We create market liquidity, and thereby set the share price, so ignoring us is such an own goal for any small cap, and it makes my job much harder, trying to make sense of the snippets of information they put into trading updates.

I see the market has reacted positively so far, with the share price up 13% to 72p at 08:52, but only 340k shares printed as traded so far. It will be interesting to see if that rise sticks, or whether sellers might snuff it out at a later stage, which is happening quite a lot at the moment, due to institutions needing to sell small caps widely (except the ones that are performing the best), to meet redemptions.

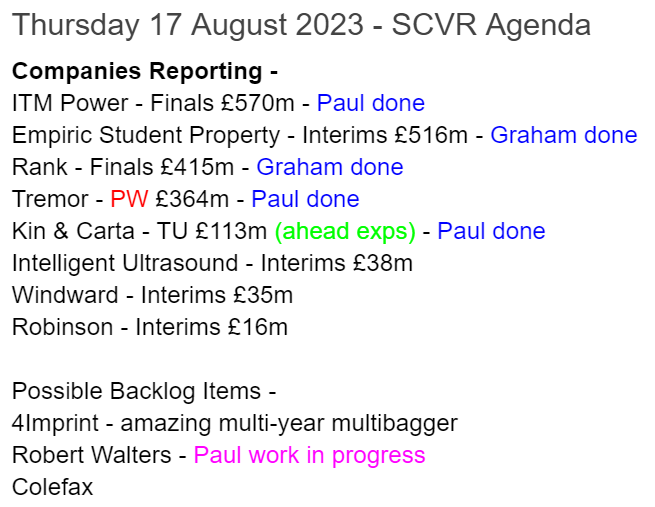

Looking at the chart, I imagine some chart followers might be sniffing around here, as it seems to have formed a base, and with a positive update today, could build on this, for traders anyway -

.

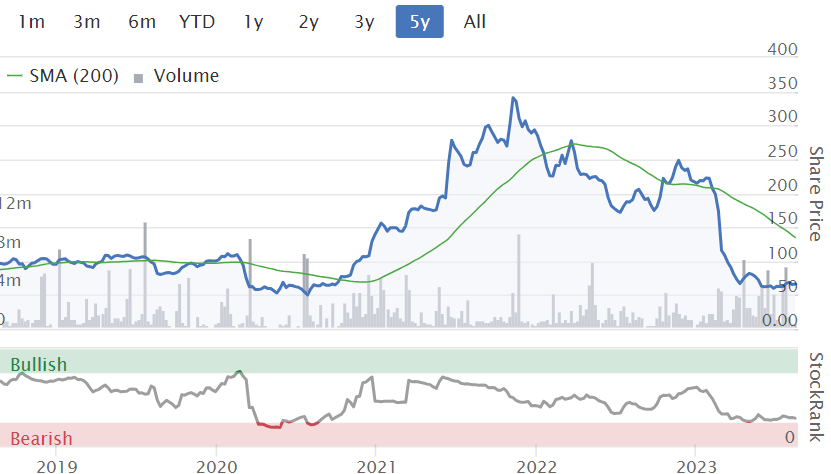

Zooming further out, KCT has been a boom & bust share over the last 5 years - is it just a bad company that has squandered money on poor acquisitions, or could the tide be turning? I don't know, but don't yet see enough evidence to want to take an interest, but will keep an open mind, and we have moved from RED to AMBER/RED today, so that's a step in the right direction!

Tremor International (LON:TRMR)

Down 30% to 178p (£255m) - Q2 & H1 Results - Paul - RED

Commiserations to shareholders in this digital advertising group, who have collectively lost £109m this morning, very painful.

To get me up to speed, looking back at our previous notes this year -

21/2/2023 - 323p - AMBER - SKY reported that TRMR was putting itself up for sale. Paul’s view: very low valuation, but difficult to assess, I don’t like the sector, and excess share options & repeat Director selling further put me off.

31/5/2023 - 280p - AMBER - Q1 results. Again looks very cheap on low PER. OK Bal Sht. Big buybacks. Could be cheap if profits are sustainable. I dislike sector, as online marketing companies often disappoint.

So I can see why people bought this share, as it looked cheap on a fwd PER basis all the way down. Although it was also dripping with bear points as noted above, and also that divis stopped in 2018. Why also have pots of cash on the balance sheet, combined with borrowings?

Tremor International Ltd. (AIM/NASDAQ: TRMR) ("Tremor" or the "Company"), a global leader in data-driven video and Connected TV ("CTV") advertising technology, offering a unified platform that enables advertisers to optimize campaigns and media companies to maximize inventory yield, announced today its financial and operating results for the three and six months ended June 30, 2023.

What a nightmare this statement is! I’d be surprised if many investors in this really understand what it does, and how it (supposedly) makes money. Does it make money at all? The figures are so confusing, with an emphasis on EBITDA. Good quality companies have simple, clear accounts, where you can obviously see how they make money and pay divis. This is the opposite.

Cutting through all the background noise, on any measure, profits have sharply deteriorated in H1 - adj EBITDA is down from $78m H1 LY, to $30m H1 this year.

There are so many adjustments, that this $30m EBITDA turns into a loss of $(21)m at the total comprehensive level. That includes a large $13.5m stock-based compensation charge in H1, which was even worse last year H1 at $31m - so I think it’s pretty clear that this company is not being run for the benefit of outside shareholders!

Cash/debt - this bit below looks peculiar to me. Debt is a lot more expensive now, so surely in uncertain times, the company should be paying off the debt with the cash pile? That’s assuming the cash is real of course -

Liquidity Resources: As of June 30, 2023, the Company had net cash of $94.2 million, consisting of cash and cash equivalents of $195.0 million, offset by $100.0 million in principal long-term debt and $0.8 million of capital leases (consisting entirely of the Company's server leases), as well as $80 million undrawn on its revolving credit facility. The Company intends to leverage its considerable net cash reserves to fund its existing operations and to support future strategic investments and initiatives, including potential future share repurchase programs and acquisitions.

Outlook - a large reduction in guidance, for various reasons, boiling down to: advertisers are spending less -

Full year 2023 Adjusted EBITDA in a range of approximately $85 - $90 million compared to previous expectations for a range of approximately $140 - $145 million

Paul’s opinion - I’ve given TRMR the benefit of the doubt in the past, seeing it as AMBER, mainly because of the low PER. Now that support has gone, with deep cuts to broker forecasts today, all I can see is really over-complicated accounts, and lots of red flags. So it’s got to be RED from now on I’m afraid, and probably should have been RED a while ago, as we’ve never liked it here.

This sector is full of companies that find clever ways of exploiting online advertising to make big profits for a while, but then the golden goose can just vanish overnight, when the online giants change the way things work. Maybe TRMR’s goose has flown to pastures new? Mind you, they might find some other way of making money, they’ve reinvented the company in the past, after previous disappointments. Anything could happen in the future, I have no view on that either way.

This share just has almost zero appeal to me, after reading these results. Good luck with it though, to those that decide to persevere with it. Bull points might include - some impressive major shareholders on the list, someone might bid for it in the USA, and trading might recover.

Graham’s Section:

Rank (LON:RNK)

Share price: 91p (+2%)

Market cap: £426 million

We have full-year results from this casino and bingo hall operator, whose share price (and financial performance) have been greatly affected by the twin challenges of Covid and then the subsequent inflation.

Here are the key points from the results for FY June 2023, which are in line with guidance that was upgraded back in April.

Like-for-like underlying revenues (“net gaming revenues” or NGR) up 7% to £680m.

Like-for-like underlying operating profit £20.3m (last year: £42.5m)

The main reason given for the decline in underlying operating profit is cost inflation. We knew that the cost of keeping the lights on and heating their playing venues, and everything else that goes into running large properties, had increased considerably and would take their toll on these results.

I am however encouraged by the resurgence in revenues seen in H2. At Grosvenor casinos, NGR was up by 4% for the year with a decline in H1 followed by a 15% year-on-year surge in H2.

The Digital products continue to show decent performance, with NGR up 10%.

The statutory results are terrible:

Actual operating loss £110m (last year: operating profit £81m)

Actual pre-tax loss £123m (last year: actual PBT £73m).

The difference between actual operating profit and underlying operating profit is a staggering £130m. This is due to almost £120m of impairment charges, and £8m of closure costs for 16 venues.

Net debt excluding leases is thankfully very low, at just £4m. It has a £100m RCF which it’s hoping to replace with a “longer-term financing package” this year, “when it anticipates securing better financing terms, driven by additional consecutive months of improved trading”.

However, the balance sheet does not offer any tangible asset backing.

Outlook

The outlook statement is very promising: in the opening six weeks of the new financial year, group NGR is up 16%, with the venues (Grosvenor/Mecca) outperforming Digital:

Despite the generally challenging trading conditions, with inflation still running high and the increase in interest rates impacting consumer discretionary expenditure, we expect to see good levels of revenue increase year-on-year and to grow our profitability in 2023/24.

Dividend - no dividend yet, but the Board “expects to recommence dividend payments as soon as circumstances permit”.

CEO comment lays out the long list of external problems faced by the company in recent years, and adds some positivity that they may finally be receding:

"The return of customers to our Grosvenor and Mecca venues continues to pick up and our second half numbers give cause for optimism after a very challenging couple of years. During that time, our UK venues have faced a surge in energy costs, high wage inflation, a tightening in the regulatory environment, the slow return of overseas visitors to London's casinos and the more general pressures on the consumer's discretionary expenditure. However, energy costs have stabilised, inflation appears to now be easing, customers continue to slowly return to both our Grosvenor and our Mecca venues and we now expect to deliver good levels of revenue and profit growth.

Graham’s view

As I’ve noted previously for this stock, it has always priced in some sort of recovery, so it never fell to what I would consider truly “bargain” territory.

At the current £426m valuation, investors clearly expect better days ahead - and I think they are right to.

As noted by the company today, Grosvenor accounts for a significant percentage (43%, they suggest) of the UK’s total casino industry. It can only be a matter of time before Middle Eastern/Asian tourists come back to London again in significant numbers, costs stabilise (the inflation data yesterday was interesting in this regard), and local customers start to feel more confident to spend again.

I’m going to turn positive on this stock today, as I think there is now enough evidence to say that the worst is probably behind it. That’s just a hunch, though - it might be premature. Costs might pick up again. High net worth tourists might be very slow to come back. An unexpected regulatory hurdle might show up. There are many things that can go wrong with a gambling business with physical venues.

However, I think Grosvenor is a trusted name in casinos and that it will thrive again as soon as conditions permit. Rank’s other assets have also performed reasonably well over the years. So I think for patient investors, this could be an interesting stock to hold.

Empiric Student Property (LON:ESP)

Share price: 89.1p (+4%)

Market cap: £537m

Empiric Student Property plc (ticker: ESP), the owner and operator of premium, studio-led student accommodation across the UK, is pleased to report its interim results for the six months ended 30 June 2023.

We last covered this one back in October 2022. The share price hasn’t moved too far since then:

Back then, the company was performing well and was effectively full with 98% occupancy.

That remains the case today - in fact the booking cycle is “significantly ahead” of last year, as its rooms have been booked out faster than ever.

The company has significantly raised rental prices in the face of this very strong demand:

Our accommodation is now effectively full for the forthcoming academic year with occupancy at 98 per cent, a level achieved earlier than ever before. We are confident that like-for-like rental growth of around 9 per cent will now be achieved, significantly ahead of previous guidance.

Few would argue with the claim that there is an “acute undersupply of high quality student accommodation”. As I’ve said before when discussing ESP, I think this might be a sweet spot for investors in the property market, as the supply/demand forces are unique - lots of US, Chinese, Indian and other overseas students. For the coming academic year, 32% of rooms have been sold to Chinese students.

Market outlook - ESP says that purpose-built student accommodation “has continued to defy market trends”, with very large transactions going ahead in 2022 and a growing level of investor appetite in the sector. 2023 has seen less activity so far, but more deals are expected in H2. The student population continues to grow and there is particular growth in the post-graduate sector. ESP has recently started to develop sites exclusively for post-grads.

Financial results

The financial highlights for the first six months of the year are all positive:

“EPRA earnings” excludes gains in the value of properties, profits on disposals, and other non-core sources of income. It is considered “recurring” and comes in at £14.1m for the latest six-month period.

Balance sheet: The portfolio valuation increased 1% like-for-like, and EPRA net tangible assets per share have risen to 117.3p - a nice premium over the current share price.

Loan to value remains cautious at 30% (the company has a long-term target of 35%), and the cost of debt remains low at 4.3%. Most debt is at fixed rates, and the fixed rate debt has an average term remaining of over 5 years.

Energy hedging is also in place until the end of 2024.

Outlook

The Board remains comfortable with all earlier guidance, including dividend guidance. The Company continues to expect to pay a minimum dividend of 3.25 pence per share for 2023. This will be revisited in the fourth quarter, following the start of the 2023/24 academic year.

Graham’s view

Balance sheet net assets here are £715m (vs. market cap £537m). Net tangible assets are nearly 30p higher than the share price. Why the discount? The company is achieving perfect occupancy and inflation-beating rent increases. Leverage is low and its debt is cheap. And it’s in a niche that protects it from some of the wider issues in the property market. I’m struggling to find any reasons to dislike this share.

We don’t talk about REITs all that often in this report but if I was going to invest in a REIT, this would be at the top of my list for further research. So I’m giving this stock the thumbs up.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.