Good morning, it's Paul here!

I'm going to start today's report by catching up on several stocks from yesterday, then on to today's announcements.

I see that Halfords (LON:HFD) has reported on its Christmas, and year to date (ending 03/2018) trading. It seems to be doing well at the retail sales level (with cycling being the biggest growth area). However, group profit only expected to be broadly in line with current market expectations. I refuse to shop in Halfords after they stung me for about £3-4 (I forget the exact amount) for a tiny pack of washers that was of vital importance to me at the time, that was only worth about 10p, if that. Retailers need to learn that today's high gross profit margin is tomorrow's lost sales from an alienated customer.

Several readers yesterday asked me to look at:

City Pub (LON:CPC)

Share price: 169.5p (up 1.2% yesterday)

No. shares: 56.5m

Market cap: £95.8m

The City Pub Group, the owner and operator of premium pubs across Southern England, is pleased to announce a 2017 trading update.

For the year ended 31 December 2017, like for like sales were up by 3.8%. Total turnover for the year was approximately 37.4m, an increase of approximately 34% on the prior year, with 33 pubs trading at the end of the financial year.

Trading over the Christmas period was strong with many of the recent openings trading ahead of management's expectations and a number of pubs achieving a record result.

Following a successful December trading period, the Group confirms that it has traded in line with market expectations for 2017 and remains optimistic about its prospects for 2018.

This small pubs group listed on AIM in Nov 2017. A pleasingly clear update above, and the company is trading well. This is in common with other pub groups, which generally seemed to have good trading over Xmas.

Good sector? - There seems a clear trend amongst consumers to skew spending more towards experiences, and less towards buying stuff in the High Street. Pub operators generally reported stronger LFL sales growth than many retailers. Some commentators have speculated that we might have already reached "peak stuff" - i.e. most people already own everything they need, and hence want to spend discretionary income more on days or nights out.

This makes pubs potentially attractive investments at the moment, I think. Another reason why pubs are interesting now is because, after years of contraction, previous issues with over-capacity may now have been resolved through thousands of pub closures in the last 10 years or so. That is in stark contrast to the casual dining sector, where capacity has gone through the roof in recent years - hence that sector is best avoided, in my view.

No broker notes - unfortunately, I don't see any broker forecasts shown on Stockopedia. Nor is City Pubs set up yet on Research Tree - I'll give Rob a nudge about that, as I've noticed that it seems to take a long time for new issues to appear on RT.

So unfortunately, I can't progress this section until I get some broker forecasts. I've put in a request, but in the new world of MiFID II, there's no guarantee I'll be able to get hold of anything.

I think the City needs to wake up to the fact that just putting "in line with market expectations" isn't good enough - because many investors now cannot find out what market expectations are, post MiFID II. Therefore we need to see more companies adopting best practice of including a footnote, stating clearly what the company believes market expectations actually are - at both the PBT and EPS levels. Without this information, trading updates are only of partial use.

So as things stand, I can't inform readers on whether City Pubs is any good or not, because there's no information available. Nor can I buy any shares in it, for the same reason. So clearly things need to change, in terms of how companies get information out to the market, especially the under-served private investor market. We create the liquidity, and set share prices, so ignore private investors at your peril! Smaller companies like this really do need to put out commissioned research through the likes of ED or Edison. Otherwise investors are in the dark, and hence unlikely to want to buy the shares.

Expansion - this sounds impressive, but let's hope they pick the right sites, at the right price. We've seen how rapid expansion in the related restaurant sector can lead to poor decisions being made, thus creating big problems, e.g. Tasty (LON:TAST) in the listed sector. Privately-owned chain Byron looks to be doing a CVA, to extricate itself from over-rented sites, taken on during a poorly executed roll-out. Going back to City Pubs, re expansion it says;

Following its admission to AIM on 23 November 2017, the Group now has the funding available to execute the strategy of doubling the size of its estate over the next 3 to 4 years.

I very much like that City Pubs is buying a lot of freeholds - it currently has 33 sites, of which 23 are freehold. Asset-backing is great, providing debt is not excessive, and has capped interest rates over the long-term.

Board changes - co-founder David Bruce resigns with immediate effect - seems odd, and possibly suggests there might have been a Board room bust-up over something?

Neil Griffiths has joined, as a new NED. I see he has previously been a Director of various Punch companies, so looks a good addition to the Board.

My opinion - until I can get hold of some research on the company, I am not able to form an opinion.

Portmeirion (LON:PMP)

Share price: 977p (up 5.9% today, at 08:53)

No. shares: 10.85m

Market cap: £106.0m

(at the time of writing, I hold a long position in this share)

Portmeirion, the manufacturer and worldwide distributor of high quality homewares under the Portmeirion, Spode, Royal Worcester and Wax Lyrical brands is delighted to confirm that it expects to report record revenue for the year ended 31 December 2017 of over 84.5 million.

Sales - Stockopedia shows broker consensus of £83.3m, so this is 1.4% ahead of expectations for revenue - a solid outcome.

The update starts off by trumpeting increased sales. That's of limited interest, because it's profits that matter.

Record sales for the ninth consecutive year

As you would expect, since the acquisition of Wax Lyrical

This represents an increase of at least 10% over the previous year and is the ninth consecutive year in which we have achieved record sales. Excluding the full year impact of the Wax Lyrical business (which was acquired by the Group on 4 May 2016), like-for-like sales growth exceeds 5%.

That's more like it! I'm impressed. Looking back at the H1 figures, LFL sales were up 3%. So the growth rate seems to have accelerated in H2, maybe to c.6-7% (in order to achieve 5% growth for the full year where H1 saw 3% growth. There is an H2 weighting to the year). I expect there's some benefit from forex in that 5% growth number.

At a constant US dollar exchange rate our total Group revenue increase would have been nearer 8%.

EDIT: I initially got the wrong end of the stick on this. So I've just phoned the FD to clarify. This 8% number includes Wax Lyrical's contribution. So the 10% figure above includes a 2% forex benefit when converting into sterling. Apologies for any confusion over this.

The most important point though, is that forex helped the top line, but was then reversed by negative currency impact on costs. So he reckons the overall forex effect on profit is negligible.

Profitability - this is also positive;

We are also pleased to confirm that we expect profit before taxation for the year to 31 December 2017 to be slightly ahead of market expectations.

Directorspeak - the Chairman, Dick Steele, sounds happy. He confirms the accelerating growth trend;

"We are delighted with another record sales result. In particular, our year-on-year sales growth strengthened as we moved through the year and the second half results exceeded management expectations.

Highlights included the United States, export markets and online sales that achieved double digit revenue growth in the second half aided by well received new product launches. With this momentum we therefore look forward with confidence to 2018."

I'm pleased that online is growing well, as this should be a potentially lucrative growth area for the company, and at higher margins (since there's no intermediary retailer taking a big chunk of the profits).

Valuation - current broker consensus is 66.3p for 12/2017. Slightly ahead probably means, say 68p? At 977p per share, that's a PER of 14.4 - in an expensive market, that looks good value, for a company with outstanding brands, a strong & stable (no laughing at the back!!) profit margin, strong balance sheet, and good, growing dividends. Plus it's benefiting from weaker sterling, being an exporter, and its big 2 export markets (USA and S.Korea) seem to be in good shape. There's always the risk of nuclear war, but tensions appear to be reducing at the moment.

With an acceleration of growth in H2, I would guess that 2018 might deliver 70-80p EPS perhaps, assuming no mishaps. That would give a PER range of between 12.2 to 14.0, at the current share price of 977p. That seems excellent value, and I think this share could easily rise by 25% from the current price, to achieve a rating that is more appropriate for a nice quality company.

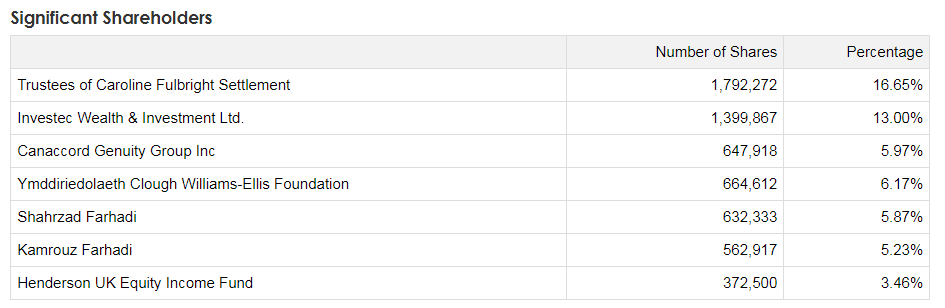

I also see good potential takeover value here. This is pure speculation, but I wouldn't be at all surprised if a takeover bid from across the pond were to arise. A best-seller is the Christmas Tree range, which is very popular in the USA. So Portmeirion has clear attractions as a takeover target for an American buyer - it's cheap, is profitable, and owns iconic brands. Any deal would need the support of the top 6 shareholders to make it happen;

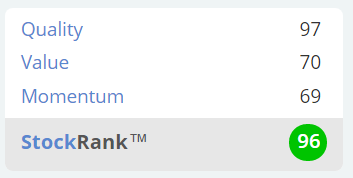

My opinion - I think this is a very good company, at a bargain price. The share price weakness (it's gone nowhere in 3 years) made me wonder whether a profit warning was on the cards. Today's announcement has dispelled that notion completely. As such, I feel the share is overdue a re-rating, to catch up with a market which has become considerably more expensive (rightly or wrongly). PMP seems a fairly obvious valuation anomaly, relative to the rest of the market.

Stockopedia loves it too, with a StockRank of 96, and a style of "Super Stock".

The shares are illiquid, as they're quite tightly held.

Cloudcall (LON:CALL)

Share price: 150p (up 7.1% today, at 09:56)

No. shares: 22.6m

Market cap: £33.9m

(at the time of writing, I hold a long position in this company)

CloudCall (AIM: CALL), a leading cloud-based software business that integrates communications into Customer Relationship Management ('CRM') platforms, is pleased to announce the following trading update for the year ended 31 December 2017...

Key points;

- Revenues of £6.9m, in line with expectations (raised in Sept 2017), up 41% (organic) on 2016.

- Recurring/repeating revenues 87% of total.

- Gross margin & operating costs also in line with expectations.

- User numbers now 23,500, up 45% on 2016.

- Cash of £4.9m (plus unutilised £1.8m debt facility)

- Key relationship with Bullhorn is going well.

- Recently launched integration with Microsoft Dynamics (2nd largest CRM platform).

- Confident outlook for 2018

My opinion - this has been a long & painful journey for me. I bought far too early, when it was little more than a blue sky company. The trouble is that blue sky companies practically always take far longer, and burn a lot more cash, than originally planned.

This has been a great learning curve for me, as it's taught me not to buy on the initial hype. Instead I think it's best to sit on the sidelines, wait for things to go wrong, and then buy on a much cheaper valuation once there is clear evidence that success is actually going to happen.

CALL has clearly now gone past a tipping point where it will reach profitability, this year or next year. It's got strong revenue growth of around 40%, most revenue is recurring in nature, high gross margins, and enough cash in the bank to reach breakeven (although they've said that several times before, then done unexpected placings).

Breakeven doesn't actually matter that much. I have no problem with the company increasing costs if there's a compelling payback on offer. The big issue is not letting losses balloon again to unsustainable levels. The company sailed close to the wind on this, previously.

There's a strong parallel with LoopUp (LON:LOOP) - a stock which I've previously written positively about. That also was achieving high margins, recurring revenues, and 40% sales growth. It tipped into profits, and the market cap has ballooned to £162m (at 395p per share). CloudCall looks to be a on a similar trajectory, but about 4 years behind. So maybe CALL could be a 5-bagger from here, if it maintains the current growth rate? That's nice potential upside, but of course it might not happen.

Overall, I'm probably more positive on CALL than I have been for years. The risk of it going bust has now basically disappeared. It's now a tech stock delivering strong organic growth, and not far off profitability. So I think this could re-rate very strongly, at some point. No idea when though! That would also rely on general market conditions remaining bullish. There's also a nice stair-step chart pattern in place. Fundamentals mean most to me, but a bullish chart is the icing on the cake too, as it pulls in momentum traders, helping to drive the price up further.

Cello (LON:CLL)

Share price: 124.4p (up 0.3% today, at 11:07)

No. shares: 104.6m

Market cap: £130.1m

Cello Group plc (AIM:CLL), the healthcare-led marketing consulting group, today publishes the following trading update for the year ended 31 December 2017.

It's an in line update;

The Group traded well in 2017, with continued strong overall and like-for-like growth from Cello Health. The Group has also successfully integrated two US acquisitions into Cello Health. Accordingly, the Group expects to report a full year result in line with expectations.

Cash position - looks good;

As expected, and in line with the regular seasonality of cash flow, the Group has experienced strong cash inflows in the second half of the year. Accordingly, the Board is pleased to confirm that the Group is in a net cash position at the end of the year. In addition, the Board is also pleased to confirm that Group's banking facilities have been renewed with RBS until 31 March 2022.

My opinion - looking at the StockReport, I can't see anything interesting there. The PER of 15.1 looks about right for this type of business in current market conditions. I rarely invest in marketing businesses.

Today's update sounds reassuring for existing shareholders, but I can't see any reason to rush out and buy.

That's it for today. I shall try to revisit City Pub (LON:CPC) as there is now some research from Liberum on Research Tree.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.