Good morning from Paul and Roland!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

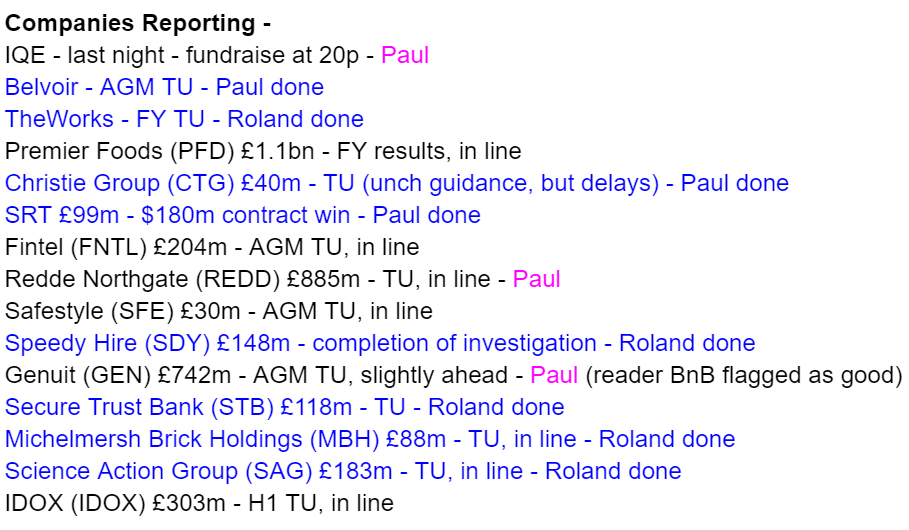

Agenda - lots to look at today, we'll do our best!

Summaries

Secure Trust Bank (LON:STB) unch at 634p (£121m) - Q1 trading update - Roland - AMBER

A solid first quarter update from this specialist lender, with net lending topping £3bn for the first time. The shares’ 65% discount to book value and high yield look tempting, but I think this bank could be riskier than it might seem at first glance.

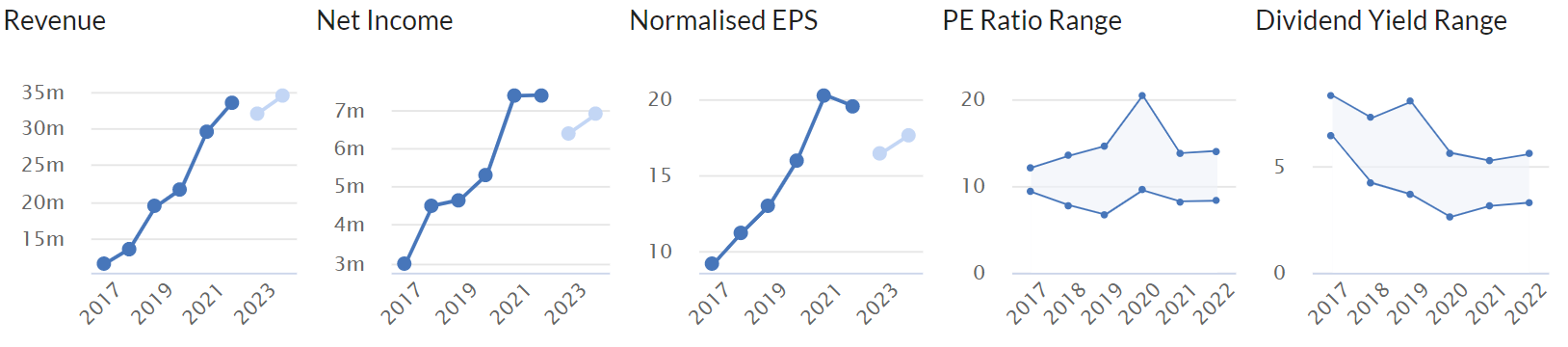

Belvoir (LON:BLV) Up 1% to 205p (£77m) - AGM Trading Update - Paul - GREEN

A reassuring update, saying that FY 12/2023 so far is in line with expectations. Although note that those expectations have been lowered quite a bit in recent months, to reflect subdued property sales. However, lettings are buoyant, balancing things up nicely. Short-term BLV looks priced about right, but looks attractively good value, taking a longer term view.

Works co uk (LON:WRKS) up 10% to £32.9p (£20.3m) - FY trading update, in line - Roland - AMBER

Today’s trading update reports adjusted EBITDA in line with expectations, but my sums suggest margins may have fallen. I’m wary about The Works’ large store estate and slim profitability, but I’m encouraged by progress and can see some value.

Quick Comments

Speedy Hire (LON:SDY)

Up 5.8% to 34.0p (£154m) - completion of investigation - Roland - AMBER

The equipment hire group says that it’s completed an investigation into £20.4m of missing “non-itemised assets” such as scaffolding and fencing. Management has concluded that this loss resulted from problems with financial controls “over a number of years” and was not fraud. No further missing items have been found.

Roland’s view: I’m not sure that incompetence is all that preferable to dishonesty in this case, but it does look like this issue is now resolved. Speedy Hire shares have fallen by 20% since this problem was reported and the stock now yields more than 7%. Is there value here? Perhaps – but last month’s in-line trading update reported some recent “softening of demand”. I don’t see this business as a particularly high quality operator and it carries a fair amount of debt. In my view, Speedy Hire shares are probably fairly priced at current levels.

Christie (LON:CTG)

Down 12% to 133p (£35m) - Trading Statement - Paul - AMBER

The most important division within Christie (commercial property transactions) has experienced delays in lead times, causing a backlog in transactions. Credible-sounding reasons are given. This will push some deals from H1 into H2. An H2 weighting was previously flagged in its FY 12/2022 results & outlook, which I reviewed recently here. Overall expectations for trading in FY 12/2023 are unchanged, but surely that implies that it expects to clear the backlog in H2, which might not happen. So I suspect there is probably a risk that FY 12/2023 forecasts might need to be reduced a bit, perhaps?

Paul’s opinion - if you like the company, then a 12% dip today on something that sounds a temporary hiccup rather than a structural decline, could be an opportunity to top up? I can see some merit in this share, but not quite enough to go positive on it. Hence my view remains AMBER, but it’s not far off GREEN.

SRT Marine Systems (LON:SRT)

Up 19% to 55p (£99m) - $180m contract win - Paul - AMBER

There have been many false dawns in the 18 years this company has been listed on AIM, with an ever-growing pipeline for its coastal surveillance electronics, but only occasional and lumpy actual orders. Hence the financial track record is poor, and repeated fundraises required. However, bulls are having their day today, with a large $180m contract announced, which readers say is with Indonesia, funded with a UK export loan.

We've been discussing it below in the reader comments, with me taking a more cautious view (the upside looks already priced-into the £99m market cap, based on Finncap's forecasts issued this morning), whereas bulls on SRT think there's more upside. I can see merit in both bull and bear points, so my overall view is neutral. Good luck to holders!

Michelmersh Brick Holdings (LON:MBH)

unch at 92p (£88m) - AGM TU, in line - Roland - GREEN

Brick producer Michelmersh operates at the upper end of the market with a number of distinct brands. The company says it’s continued to add to its order book since March, with production volumes remaining in line with expectations. A newly-acquired facility is also performing well. The business is said to remain on-track to meet full-year expectations.

Roland’s view: there are obviously some macro risks here, but Michelmersh is a well-run business with a strong franchise and a decent balance sheet. The shares are down by over 30% from their 2021 peak and trade on nine times forecast earnings. I think Michelmersh looks reasonably priced, on a medium-term view.

Science (LON:SAG)

down 1% to 400p (£181m) - AGM TU, in line - Roland - GREEN

This services and engineering group operates in a range of market sectors. Today’s AGM update confirms that trading so far in 2023 has been in line with expectations. There’s been growth in services but some slowdown in consumer electronics, as excess market inventory is cleared. The integration of former AIM firm TP Group is said to be proceeding well.

Roland’s view: this small-cap benefits from owner management and seems to have a decent record of creating shareholder value. Profitability looks fairly attractive too, with operating margins and ROCE topping 10% since the pandemic. The shares look affordable to me, on 12 times earnings. I think this could be an interesting buy-and-hold stock.

Iqe (LON:IQE)

Down 15% to 20.1p (£163m before fundraise) - Fundraise at 20p - Paul - RED

I remember we caught the bull run in 2017 on this share, doing well on it here. However it’s been downhill ever since, and my harsh comments here on 16/1/23 and 9/3/23 questioned not only the high valuation, but whether it is even a viable business?

A placing has just been announced, 150m new shares (806m existing) to raise £30 before costs.

Paul’s opinion - this seems a really bad business model - it has to spend a lot of capital equipment, but then fails to generate any economic return from the products it makes. So what’s the point? Something pretty fundamental would need to change to convince me that this share is worth anything. Maybe there are new products, or contracts, that sort of thing? Maybe it needs a drastic turnaround & efficiency drive? I can't see any reason to get involved t this stage.

Paul’s Section:

Belvoir (LON:BLV)

204p (pre-market)

Market cap £76m

Belvoir Group PLC (AIM: BLV), a leading UK property franchise and financial services Group, provides the following update on current trading ahead of the Group's Annual General Meeting to be held at 10:00 a.m. today.

A reassuring update -

The Board is pleased to report that trading to date is in line with management's expectations for the year to 31 December 2023.

“Very resilient” performance, despite mini budget & higher interest rates.

High demand for rentals, and new lettings are on 10% higher rents.

8 franchisees have expanded using BLV’s “assisted acquisitions” process.

Franchise fees on lettings up 5% y-on-y.

Franchise fees on sales down only 4%, despite the market being down 15%.

Financial services (mortgage broking, etc) down 12%, but more than offset by TIME acquisition, so overall up 8% (gross profit).

Remortgage activity continuing, despite fall in house purchases.

“A degree of stability has returned to the mortgage market”

Outlook -

…there are signs that the fall in demand for property triggered last Autumn might be bottoming out. Mortgage approvals rose in both February and March, and recent indices suggesting that house prices are stabilizing will improve buyer confidence as the market enters its crucial Spring/Summer season.

Acquisitions -

With the Group now in a net cash position, it is well-placed to secure good quality earnings accretive businesses that are complementary to the Group.

Paul’s opinion - I remain keen on this share. It’s priced as a value share, but has actually established an excellent long-term growth track record, self-funded with hardly any dilution, and paying decent divis too.

Broker estimates have been cut back a fair bit recently, to reflect current market conditions for housing transactions -

I’m looking forward to discussing the housing market in person with management, who will be attending Mello Chiswick next week.

The forward PER of 12 looks fine to me - maybe priced about right in the short-term, but probably providing an attractive long-term entry point, once earnings begin to rise again, both from an improving market, and from more acquisitions. Hence I maintain my positive, GREEN, view of this share.

Roland’s Section:

Secure Trust Bank (LON:STB)

Share price: 634p

Market cap: £118m

The Group has made a strong start to the year and is trading in line with management expectations

This specialist lender trades at a 65% discount to book value and offers a near-7% dividend yield, making it one of the cheapest banking stocks on the UK market.

Shares in this bank have fallen by around 40% this year as the market has turned cautious on small banks. I’m interested to see if this may have created a buying opportunity for small-cap investors.

Secure Trust Bank collects deposits through consumer savings products and lends them to business customers. Products include mortgages for buy-to-let landlords and consumer finance offerings for retailers (e.g. furniture) and motor retailers (V12 Vehicle Finance).

Thus while Secure Trust appears to be a business lender, it’s actually heavily exposed to consumer spending.

Today’s trading update strikes a reassuring tone, but I think potential investors shouldn’t underestimate the risks in this business.

Let’s take a look at the headlines.

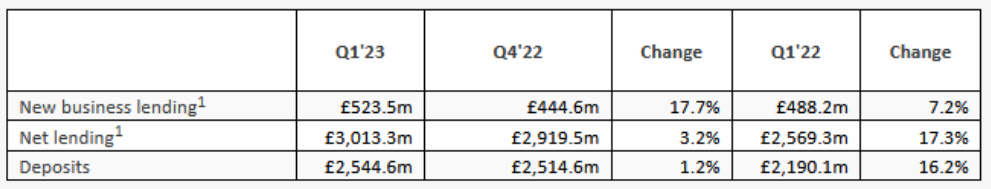

Q1 highlights: Secure Trust has seen a recovery in business lending after a slow patch in the final quarter of last year, with total net lending reaching £3bn for the first time.

Net new business rose by 7.2% compared to the first quarter of 2022, “despite tightened lending criteria”.

Lending: management says that Secure Trust’s share of the retail finance market rose from 11.4% to 11.9%, suggesting the group has a strong franchise with consumer-facing businesses. However, retail finance lending only rose by 3.5% during the quarter.

This combination of numbers suggests to me that consumer spending may be slowing – gaining 0.5% of market share seems a big gain for a 3.5% increase in lending.

In contrast, Secure Trust’s share of the Vehicle Finance is just 1.1%, but lending in this business rose by 7.3% during the quarter. Clearly people are still buying used cars.

Property lending rose by 4.3% “as the pipeline from Q4’22 converted into new business” – presumably benefiting from more stable mortgage rates.

Funding: the company attracted £343m of new customer deposits in the quarter. Total balances were 1.2% higher than at the end of Q4 ‘22 and 16.2% higher than in Q1 ‘22.

A look at the bank’s website suggests customers can now get savings interest rates between 3.5% and 4.7%. I wonder if the overall cost of funding may have increased from the 1.9% figure reported in the 2022 results.

Capital: Secure Trust also issued £90m of new Tier 2 regulatory capital during the period, at a cost of 13.0%. These replace an earlier £50m security and are intended to increase the group’s lending capacity. The high interest rate reflects market sentiment towards small banks at the moment – and the risk that these securities could be wiped out in the event of a run of losses.

Trading performance/outlook: Chief executive David McCreadie says that “arrears across consumer finance have remained stable at low levels”.

The bank is continuing to make cost savings as planned and expects to report an improved cost:income ratio in 2023 (FY22: 55%).

Although the economic outlook is uncertain, Mr McCreadie remains “confident in delivering on our plans for the full year”.

Roland’s view: Secure Trust shares have value potential, trading at a discount of more than 60% to their last-reported book value. The stock’s near-7% yield is also tempting.

However, small lenders with exposure to property and consumer lending are not without risk at the moment. Secure Trust supports more than £3bn of lending with just over £300m of equity. So a 2.5% bad debt rate (£75m on £3bn) could wipe out a quarter of the bank’s equity value.

I think a sizable discount to book value is justified here, especially as the bank’s net interest margin fell from 6.1% to 5.7% last year. This fall took place during a period when most larger banks were reporting increased net interest margins.

I’d need to do a lot more research to decide if I was comfortable with the risks on STB’s balance sheet.

Finally, I think it’s worth noting that bank investors hunting for bargains can currently buy shares in Barclays (LON:BARC) at a 50% discount to book value with a 6% dividend yield. To me, this seems like a more attractive balance of risk and reward for most investors.

Works co uk (LON:WRKS)

Share price up 10.9% to 33p (09.00)

Market cap: £20m

The Company expects to report an Adjusted EBITDA result for FY23 in line with its compiled estimate of the market's forecast, which is approximately £9.0m.

This value retailer sells stationery, toys, arts and crafts materials and books. Today’s full-year trading update covers the 52 weeks to 30 April 2023 and appears to show a fairly encouraging performance.

The Works has been (yet another) disastrous IPO. But with the pandemic now past and the shares trading on a single-digit P/E with cash on hand, I think it’s possible this business could offer some value. Let’s take a closer look.

FY highlights: Full-year sales rose by 6.1% to £316.6m last year.

Stores generated 88.8% of sales, with a LFL increase of 7.5%

Online sales fell by 15%

Overall LFL sales growth of 4.2%

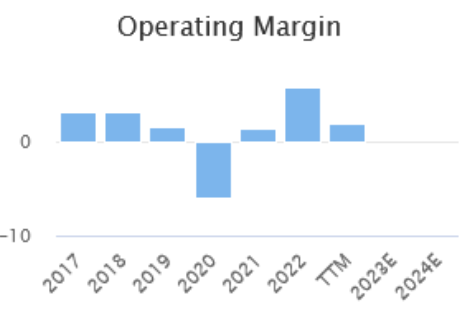

The Works revenue performance appears to be significantly ahead of market forecasts for a figure of £271m. But profit margins appear to have suffered – the company expects to report adjusted EBITDA of about £9m, which is only in line with market forecasts.

Year-end net cash (excluding leases) was said to be £10.2m (FY22: £16.3m). A £30m bank facility was undrawn.

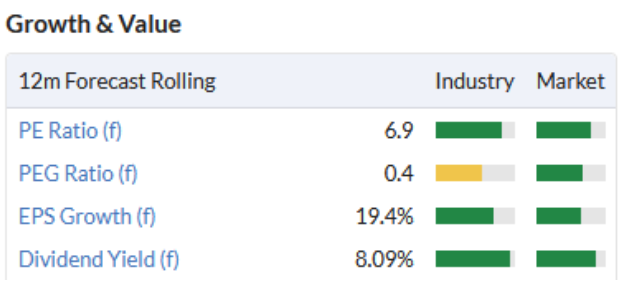

Unfortunately, The Works hasn’t provided any guidance on real profits. There are no broker notes on Research Tree, either. But consensus forecasts shown on Stockopedia suggest a net profit of £1.4m this year, giving adjusted earnings of 3.6p per share. That’s a P/E of 9 after today’s gains.

A full-year dividend of 2.4p per share is forecast. This would cost £1.5m and provide a 7.5% yield. The company has previously said it will consider paying a final dividend, so this seems possible given the group’s cash balance, if not certain.

Trading outlook: trading is expected to continue improving in FY24, despite “challenging market conditions”.

The company says it is comfortable with current market forecasts for FY24 adjusted EBITDA of approximately £10m. This could translate to a 19% rise in earnings this year, according to Stockopedia data:

Roland’s view: I’m broadly encouraged by today’s update and agree that The Works’ value proposition could continue to perform relatively well in current market conditions.

However, I’m a little concerned about the risks entailed in the company’s large store estate and slim profit margins.

I estimate that today’s guidance could equate to an operating margin of about 1%. That’s at the lower end of the company’s historic range and doesn’t seem to leave much room for error.

Checking back to the interim results, The Works had 500 stores in the UK and Ireland. These were represented on the balance sheet by almost £105m of lease liabilities.

The last impairment review on 1 May 2022 found 38 stores were loss-making at a budgeted EBITDA level and identified 30 that “were historically loss making”.

I will be keen to see if these figures have changed in this year’s FY results. The cost of supporting or exiting loss-making stores could easily erode profitability at the bottom line.

On balance, I think there are better quality choices elsewhere among value retailers. But I’m cautiously encouraged by The Works’ performance and will be interested to see the full accounts later this year.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.