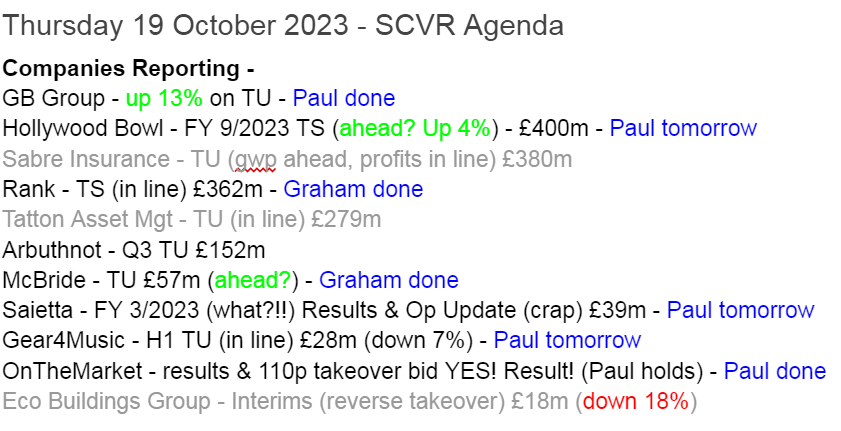

Good morning, it's Paul & Graham here!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Summaries

Marshalls (LON:MSLH) - Up 4% to 205p y’day (£520m) - Trading Statement - Paul - AMBER/RED

Q3 2023 update is in line with expectations, but these have been constantly falling. Debt remains a worry, although cost savings and property disposals have helped, plus more efficient management of working capital. Not expecting a recovery any time soon. It's not a bargain based on current forecasts, but could be cheap once an economic recovery kicks in.

Bellway (LON:BWY) - 2104p (£2.5bn) - Preliminary Results - Paul - AMBER/GREEN

I take a quick look below at this mid-cap housebuilder's FY 7/2023, which look quite good in the tough macro circumstances. In particular a staggeringly strong balance sheet gives £1bn of surplus above the market cap - a very cautious valuation. Obviously reservations & order book are well down, so forecasts factor in a big drop in earnings this year. It's difficult to ignore the value here, which allows for a housing market downturn already. Recovery could be in for free, for the patient investor maybe?

Whitbread (LON:WTB) - Not a small cap but… 3366p (£6.4bn) - H1 Results - Paul - GREEN

I had a quick look at the interim results, and was so impressed that I wanted to flag it up to our readers, despite being way above our usual £1bn upper limit! If I spot something good, I'll tell you, regardless of size. Premier Inns looks a goldmine. PER c.16x looks decent value for a business of this quality, also with a rock solid balance sheet with a load of freeholds.

Gama Aviation (LON:GMAA) - Up 69% to 88.5p - Large disposal - Paul - AMBER/GREEN

Yesterday's 69% share price rise caught my eye. It seems to have agreed a stunning disposal value from its US operation, and intends to return over half the increased share price to shareholders. Management who can achieve this value creation look worth backing maybe?

Ondine Biomedical (LON:OBI) -

An interesting-sounding update on its innovative product yesterday, but on closer inspection I discover that this heavy cash burner must be out of cash. I'll look again once it's refinanced.

OnTheMarket (LON:OTMP) (Paul holds) - Recommended takeover bid 110p cash - Paul (I hold)

An excellent outcome here, with a 56% premium agreed bid (more if we ignore the likely insider dealing that has chased up the share price in the last month). The buyer is a US sector giant, so watch out Rightmove (LON:RMV) - your cosy monopoly probably now has a serious challenger!

McBride (LON:MCB) - up 24% to 40.4p (£70m) - Trading update (ahead) - Graham - AMBER/RED

The cost of living crisis sees continued strong demand for private label products, boosting sales and earnings forecasts for McBride. Inflationary pressures persist but perhaps are beginning to cool. I would still take a very cautious approach given the debt position.

Rank (LON:RNK) - up 3% to 79.2p (£371m) - Trading Statement (in line) - Graham - GREEN

The market likes this “in line” statement. Like-for-like revenues are up 11%, beating inflation, including 13% growth at the key Grosvenor casino business. I’m hopeful that the positive momentum can continue - in boom years of the past, this company was incredibly profitable.

GB (LON:GBG) - up 11% to 241p (£608m) - H1 Trading Update [in line] - Paul - AMBER

Shares have reacted strongly to an in line update today. Digging into the detail, I can't get excited about GBG - which looks ex-growth, and isn't generating much cash. Still looks expensive to me, but this type of company is valued much more highly in the USA, so could it be yet another bid target?

Paul's Section:

Marshalls (LON:MSLH)

Up 4% to 205p y’day (£520m) - Trading Statement - Paul - AMBER/RED

Marshalls plc, a leading manufacturer of products for the built environment, provides the following trading update for the nine month period ended 30 September 2023.

This is a strange one. We covered the series of profit warnings from MSLH a few months ago, and couldn’t understand why the share price had held up so well. That’s changed now, with a steep drop in October, as you can see -

For background, here’s our previous recent coverage -

9/5/2023: AMBER. Profit warning, down 15% to 252p. Softness in some products.

31/7/2023: AMBER. Another profit warning. Down 10% to 248p. Debt an increasing worry.

16/8/2023: AMBER/RED. Down 4% to 247p. Interims - no recovery expected until 2024. Paul - steering clear, more weakness likely, and debt a worry.

As you can see below, there’s a very poor trend on broker earnings forecasts - a brave decision for anyone to call the bottom here! -

Here’s the latest news -

Marshalls plc, a leading manufacturer of products for the built environment, provides the following trading update for the nine month period ended 30 September 2023.

Full year expectations remain unchanged

As you can see from this table below, LFL (ie. excluding acquisitions) revenue falls have moderated a little from -13% in H1, to -9% in Q3.

Total revenue (including the acquisition of Marley) is 3% down for the 9-months 2023 vs 2022.

Outlook -

The Board's expectations for the full year remain unchanged.

Trading in the third quarter was in-line with the Board's expectations which anticipated a sustained period of lower volumes. The Board does not expect any material changes in current trading patterns during the fourth quarter of the year and therefore remains confident of achieving a result that is in-line with its expectations for 2023.

I’m not quite sure how this squares with the steady reduction in broker forecasts in the last 3 months? It sounds like this is in line, but with lowered expectations. So not really in line with what previous forecasts were.

As before, we are thwarted by there not being any detailed broker forecasts available.

Cost-cutting - it says this is now largely done, saving £9m annualised.

Capex has also been reduced, and surplus land of £6m sold, with working capital savings also helping to reduce debt.

Says it has spare capacity ready for an upturn in demand.

Net debt - as mentioned before, this is a key issue. Some progress but it’s still not a comfortable position, given the trend of earnings downwards, in my view -

Balance sheet and liquidity

The Group's balance sheet remains robust, with pre-IFRS16 net debt of approximately £190 million at the end of September (September 2022: £222 million; June 2023 £185 million), with the year-on-year reduction reflecting the cash generative nature of the business and management's focus on working capital. The Board's ongoing priority is to reduce leverage and it remains confident of reporting a reduction in net debt at the full year.

The balance sheet is highly dependent on a £250m long-term bank loan, but apart from that it looks OK. I’m not ringing alarm bells on the debt at this stage. In the interim results, it said the adj EBITDA multiple was 1.6x at June 2023. However, if earnings forecasts continue falling, then there could come a point where bank debt & covenants could come more sharply into focus. Management is aware of that though, hence why they’re doing cost cutting, and trying to manage down debt.

Valuation - how do we value it? This is a bad year, due to macro factors. It’s forecast to do about 15p EPS this year, so put that on a PER of say 10x to be safe, and I get to 150p. That’s well below the current price of 205p.

Or we could assume that earnings will recover at some stage, maybe in 2024, who knows? That might see a recovery to 25-35p EPS, say over 2 years? In which case you could possibly value this share on a PER of 12, giving 300-420p, usefully above the current 205p price.

As it’s struggling to deleverage, I would assume the forecast 4.4% yield might be cut, or even passed for a year or two. I don’t like companies with uncomfortably high gearing paying divis.

Paul’s opinion - Marshalls doesn’t grab me particularly. However, like a lot of building supplies companies, everything seems to be lining up for a strong recovery in earnings and share prices, at some point. It’s only really the timing of that, that’s in question.

So I am sorely tempted to start building up some positions in this sector. I doubt whether Marshalls would be one of them though, as there look to be better bargains at the smaller caps end.

Bellway (LON:BWY)

2104p (£2.5bn) - Preliminary Results - Paul - AMBER/GREEN

This national housebuilder reported its FY 7/2023 results earlier this week, 17 Oct 2023.

I’ll keep this brief, as it’s more a mid-cap, but I like to follow housebuilders for general macro and market read-across.

FY 7/2023 figures look OK, considering tough market conditions -

Revenue down 4% to £3.4bn

Underlying PBT down 18% to £533m (impressive 15.6% margin)

Underlying EPS 328.1p = PER only 6.4x - because everyone is expecting future profits to fall of course.

Balance sheet - is stunning! Look at this - current assets of £5,035m, and current liabilities of £1,006! So c.£4bn just in net current assets.

Note there’s a hefty £404m in provisions in L-T creditors - probably to do with cladding remediation, see note 6.

Total NAV, also NTAV is £3.46bn, way above the market cap of £2.5bn. That’s almost a £1bn buffer in case land & work-in-progress need to be written down below cost. In other words, the stock market is pricing in a big drop in house prices. Although that

Outlook - forward sales are much lower than last year, at £1.23bn (1 Oct 2023), down 41% on a year earlier. It’s guiding FY 7/2024 completions of 7,500 homes, way down on 10,945 in FY 7/2023. A “wider than usual range of outcomes are possible”. Reduction in underlying operating profit margin of “at least 600 basis points” in FY 7/2024, so a drop from 16% to 10%. Although that may not necessarily need a write-down below cost for land & inventories, it could just entail lower future profit margins, but it depends on how large the drop in house prices is. It strikes me that inflation, and much higher wages, could do the job for us, without nominal house prices needing to fall much, because real (inflation adjusted) house prices have already fallen substantially.

Paul’s opinion - that bulletproof balance sheet really appeals to me, providing a substantial downside cushion for patient value investors.

Broker consensus earnings forecasts are still falling, so we could see a further deterioration in the profit outlook possibly? It seems to me that the bad macro news has been built into housebuilder share prices for quite a while now, and I think there’s a really good chance of a nice recovery from these levels, if we’re patient. No idea when though.

Whitbread (LON:WTB)

Not a small cap but… 3366p (£6.4bn) - H1 Results - Paul - GREEN

Have a look at this one, I’m just skim-reading the H1 results, which are tremendously impressive. In particular, Premier Inn looks an absolute goldmine - with structural benefits from little branded competition, and declining number of independent hotels. It’s doing big shareholder returns with buybacks. Confident outlook comments. Balance sheet is great, with £3.7bn NTAV, including lots of freeholds, and cash slightly exceeds all its borrowings (bonds). Stockopedia is showing a forward PER of 16.2x, which isn’t cheap, but this strikes me as a very impressive business, a bit like Greggs, but more sensibly priced. As a nice long-term, quality mid cap, I think Whitbread is worth a closer look, hence why I'm flagging it here.

Gama Aviation (LON:GMAA)

Up 69% to 88.5p - Large disposal - Paul - AMBER/GREEN

A remarkable announcement from this minnow aviation services group. It’s not one we’ve followed for quite a few years. It announced yesterday that it’s reached agreement to sell a subsidiary called Jet East for $131m, with net proceeds of c.$100m. If I’m reading this right, GMAA seems to have paid only $11.9m for Jet East in 2021. That seems to be a staggering return in under 3 years.

GMAA says it plans to return 55p+ per share to shareholders.

Paul’s view - nothing firm, as I haven’t done proper research on it. However, I just wanted to flag that this looks a very interesting special situation, worth doing some more work on it, if you have time. A management team that can generate such a great return, could be worth backing. Also, even after the 69% share price rise, it looks as if 62% or more of the current share price is coming back in some form of shareholder payout.

Ondine Biomedical (LON:OBI)

This share spiked up yesterday on a PR-style announcement that its Steriwave photodisinfection is highly effective against antibiotic-resistant bacteria. So I took a quick look at the numbers, and very quickly dismissed any idea of getting involved!

Main problem - cash burn. It had $13.1m at Dec 2022. That burned down to only $4.4m just 6 months later at June 2023. By my rough calculations, that probably means it’s got roughly nothing left by now.

It nonchalantly said in the Interim results (announced 25 Sept 2023) that it’s confident about being able to raise more cash from non-dilutive capital. For a heavily cash burning company that’s out of cash, I’d want more proof of a fundraise having been done, not assurances that they’ll be able to raise the money.

$260m accumulated losses, so this is quite a big project. But only $428k revenues in H1, and a $8.0m H1 loss.

Rather you than me - too risky at this stage, but if it successfully refinances, then I’d be interested in hearing more about the product, which sounds exciting

OnTheMarket (LON:OTMP) (Paul holds)

Recommended takeover bid 110p cash - Paul (I hold)

Excellent news here, with a 56% premium agreed takeover bid. Note that the share price has been inexplicably rising for the last month, so it looks like a bit of insider dealing might have been going on, possibly? It stood out like a sore thumb, when everything else has been falling every day, something going in the opposite direction for no apparent reason does catch your eye.

The 6 largest shareholders (including Harwood, Downing, Schroders, Herald), well-known institutions active in small caps, have all indicated support for the deal, so 29.5% is in the bag. I think it’s likely to go ahead, unless someone else gatecrashes the party with a higher offer.

The bidder is Nasdaq-listed CoStar, an online real estate company in the US, valued at an extraordinary £27bn (fwd PER of 57x), so I can why such a highly rated US company sees OTMP as a bargain.

Paul’s opinion - this looks a fair price, so I’ll be happy to sell my smallish position (I sold half of it a few weeks ago, doh! Never mind, half a win is still a win!).

I’ve been active in UK small caps for 25 years now, and I cannot ever remember another time when there’s been such a boom in takeover bids, yet market sentiment has been so bombed out. It’s usually the opposite! Another reason to be bullish about UK small caps - it’s not just commentators like me constantly saying small caps are oversold, this is being confirmed as correct from almost daily takeover bid announcements in small and mid caps.

Every takeover bid also injects fresh liquidity into this sick market, which helps the recovery process - since institutions get a liquidity event which enables them to cash out and pay their client redemptions, and a takeover bid also improves their funds’ performance figures. Whilst private investors receive a fresh pot of cash to deploy buying other bombed out, oversold small caps. Sooner or later, this is all going to set off another bull market. Remember also there’s a wall of money in cash savings, where the cautious have (sensibly!) parked their money to protect capital. Sooner or later at least some of those funds will be coming back into small caps, once FOMO kicks in, I reckon! As always, no idea when the bullish scenario plays out, but I strongly feel we’re not far from the bottom now. Especially as sentiment is so bad - could we be near capitulation? I reckon so, yes.

Note that the brilliant Christopher Mills of Harwood has been raving about how cheap OTMP was on several interviews this year, saying he simply couldn't understand the absurdly low valuation. He's always worth listening to, as an active manager who gets things done behind the scenes, and with a lifetime of experience building value for his fund. I don't like him having a dominant shareholding though, as small shareholders are sometimes disadvantaged in deals by the big boys.

Anyway, happy days, this deal has only boosted my portfolio by about 1%, but in current markets, I'll happily take that with grateful thanks!

EDIT - I see that sector dominator Rightmove (LON:RMV) is down 12% this morning to 506p - probably due to investor worry that suddenly an also-ran small competitor looks likely to transmogrify into a potentially well-funded competitor with a new £27bn market cap owner. What if OTMP's new owner decides to abolish fees to agents altogether (OTMP doesn't charge much to begin with), and does a massive advertising campaign? It's possible that Rightmove's network effect could be seriously damaged, or even destroyed with a determined & very well-funded competitor. Unlikely maybe, but a lot more possible after today.

GB (LON:GBG)

Up 11% to 241p (£608m) - H1 Trading Update [in line] - Paul - AMBER

GBG, (AIM: GBG) the experts in digital location, identity verification and fraud software, provides an update on its performance for the six months to 30 September 2023.

Revenue is flattish at £132.4m, and adj operating profit (excluding last year’s forex gain) is up 7% to £23.4m, achieved it sounds from cost-cutting.

It mentions a decline in revenues from cryptocurrency customers. Since I take a dim view of “cryptocurrencies” (aka a giant speculative bubble), then this makes me a little wary.

Outlook - doesn’t sound like a growth company, does it? Although in line is reassuring -

The ongoing focus on simplicity and efficiency underpins the Board's confidence that GBG will deliver its FY24 profit expectations.

Broker forecasts have been steadily declining -

Balance sheet - I’ve had a look at the last one, Mar 2023, and I don’t like it.

NAV of £694m includes £851m intangible assets, after a huge acquisition splurge of £460m in FY 3/2022 alone. So NTAV was £(157)m, or if we’re being kind and deleting deferred tax, then it’s £(122)m.

Net debt sounds high at £105m (hardly changed from Mar 2023 to Sep 2023).

Does that matter though, given that it’s an asset light business model, and highly profitable? Maybe not, that’s your call. I prefer at least some asset backing, and net cash, preferably, but if a great business has a weaker balance sheet, it’s not necessarily a deal-breaker.

Cash generation - is not very good for a company valued at £608m.

I’ve looked back at the last 2 years accounts, and post-cash cash generation was £34m in FY 3/2023, and £45m the year before. Of that, finance costs consumed £6.4m in FY 3/2023, due to increased debt. There’s another £2.1m in lease costs to come off as well. So I make that only about £26m of genuine cashflow last year. This is why the dividend yield is only c.2%, because there’s considerable debt, and not a huge amount of cash generation.

Paul’s opinion - I was hoping to find an oversold, exciting growth company here. But it all looks a bit flat, so I’m not quite sure what the buyers today who’ve taken it up 11% are seeing? Maybe they’re still anchoring to the excessive bull market perception & valuation of this share? Hoping for a return to the glory multi-bagging days of yore -

.

The StockReport here is showing a forward PER of 13.2x which does look quite attractive, although adjusting for the debt would probably take that up to something like 15-16x, less interesting.

The key question is where’s the growth going to come from? Paul Hill mentioned this stock recently on Mello, and made some good points about an increased need for fraud prevention & detection, since AI could clone our voices, etc, to hack into our bank accounts.

There are no broker notes available, which frustrates my wish to drill down more into the forecast numbers.

So based on what I’ve seen, I can’t see any reason to get involved here. Big write-offs last year suggest it overpaid for some of the acquisitions.

I’d like to hear more from the company, so how about they do some webinars, and get some research out to the private investor community? That might help.

I wonder if it might attract a bid from the US? They value companies like this on a much higher multiple, so that’s a possibility.

Graham’s Section:

McBride (LON:MCB)

Share price: 40.4p (+24%)

Market cap: £70m

McBride plc (the "Group"), the leading European manufacturer and supplier of private label and contract manufactured products for the domestic household and professional cleaning and hygiene markets, today provides the following trading update.

This is a highly indebted manufacturer whose shares have been priced as options on its debt load. Net debt was last seen in June 2023 at £166m (a number that includes some lease liabilities).

Despite its balance sheet difficulties, it has been trading well enough over the past year to see a significant bounce in equity valuation (though long-term charts paint a different picture!):

Today’s trading update for Q1 (July to September) has put another rocket under the shares, as it appears to be trading well through this difficult period.

Firstly, the volatile inflationary environment persists:

“While raw material and packaging material costs remain relatively stable, albeit at significantly higher levels than in previous financial years, other costs such as labour, energy and indirect cost inflation continue to be a source of upward cost pressure.”

But…

…the continued effect of increases in the cost of living on consumers has meant that demand levels continue to be driven by a shift towards private label products across all markets and as a result, the favourable trading environment and momentum of the second half of FY23 has continued into the first quarter of FY24.

The result:

Q1 volumes up 8% year-on-year

An additional £8m of EBITA, compared to internal forecasts.

Unfortunately, McBride’s internal forecasts go unmentioned in the RNS, and there is no recent broker research available on Research Tree. This is a Main Market listed company, so it doesn’t have a Nomad. Its joint corporate brokers are Investec and Peel Hunt, whose research is not widely available.

Graham’s view - feel free to ignore my view on McBride, as I wrote negatively about it both in January and in February. The sector didn’t interest me - commoditised cleaning products, and the company was loss-making at the time. Furthermore, the precarious debt situation required a “going concern” warning in the interim results, as the company acknowledged that there was a plausible scenario in which it would breach its banking covenants.

Given those facts again in the future, I would probably again take a negative stance!

However, McBride’s earnings forecasts have been trending higher in recent months:

Checking the recently published full-year results for FY June 2023, I see that there was an adjusted operating profit of £13.5m, and an actual operating profit of £10.3m.

Out of those numbers, the company paid £11m of interest, plus very large exceptional costs and refinancing costs. Even excluding the exceptional items, therefore, the adjusted PBT was only around breakeven.

However, FY June 2024 was forecast to show a significant improvement on that performance, and it has just been significantly upgraded. Remember that revenues are running at over £900m p.a., so small changes in revenues and costs can have an enormous percentage impact on the bottom line.

Paul took an “AMBER/RED” stance on this one in July, and I tend to agree - it has done enough to survive for now, and hopefully it can deleverage in the current year. I still don’t view it as a high-quality business, and I still wouldn’t want to own it personally. But hopefully it can pull through for its shareholders.

Here is the long-term chart. Only recent buyers will be feeling very happy about its progress:

Paul adds: Very interesting, thanks Graham! I'm a little more enthused by today's update. £8m extra EBITA in just a quarter, is a big number when annualised, which you allude to. I think the speculative/precarious bull case just got a lot stronger. So for me, it's maybe even an AMBER now, but I can see why you're sticking at AMBER/RED due to balance sheet concerns remaining. Although I suspect dilution risk would now be a lot lower, as the bank will be able to see significant improvement in profit & hopefully cash generation. Could be a recovery bounce type of trade now? Not something I'd want as a long-term investment though. But I think risk:reward has just improved quite a lot.

Rank (LON:RNK)

Share price: 79.2p (+3%)

Market cap: £371m

Rank owns Grosvenor Casinos, Mecca and Enracha (in Spain) bingo halls, and a range of gambling websites.

I tentatively turned positive on it in August, thinking that the worst was probably behind it. It has had a torrid few years due to inflationary costs, fewer high net worth tourists, etc.

This Q1 (July to September) update is in line with expectations, but the market seems relieved.

Here is the table for like-for-like net gaming revenue (LFL NGR):

It’s great to see like-for-like revenues growing ahead of inflation. At Grosvenor, 13% growth has been driven by sites outside of London. Total site visits are up 9%, with a 4% increase in spend per visit.

Outlook:

The trading environment continues to be challenging with continuing high inflation and interest rates and consumer discretionary expenditure remaining under pressure. However, following a positive performance across our businesses in Q1, we are on track to deliver 2023/24 full year revenue and profit growth in line with expectations.

CEO comment: mentions that Rank is preparing for the “critical modernising reforms in the Government's review of the gambling legislation”. You can read more about possible changes here and here - they include slightly tighter rules around age verification checks in premises, and financial vulnerability checks for customers.

Graham’s view

I have no reason to change my view on this one. Results here are highly variable but in the good years pre-Covid it generated £30m+ of net income p.a. (and in the boom years, much more than that). I am happy to keep my positive stance given its low net debt, improving revenue trend and (hopefully) cooling inflationary cost pressures.

Even based on the current expected rate of profitability, it’s not overly expensive:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.