Good morning from Paul & Graham!

As expected the USA cut interest rates with a sizeable 0.5% reduction yesterday, which is obviously good for equities (although largely already priced into indices perhaps, as it was widely expected). BBC report here. Where the Fed leads, the Bank of England tends to follow in due course.

"The US central bank has lowered interest rates for the first time in more than four years with a bigger than usual cut.

The Federal Reserve reduced the target for its key lending rate by 0.5 percentage points, to the range of 4.75%-5%."

Lots of bargains around in the UK small caps space after recent weakness, so personally I'm feeling very buoyant about the opportunities all around us in plain sight - so many small caps have sold off as much as 10-20% in recent weeks when there's no fundamental justification for that (tax selling possibly?), so I'm sniffing around for bargains and finding lots of them. I might run a screen on this actually and publish the results.

** Breaking News ** - UK interest rate held at 5.0%

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

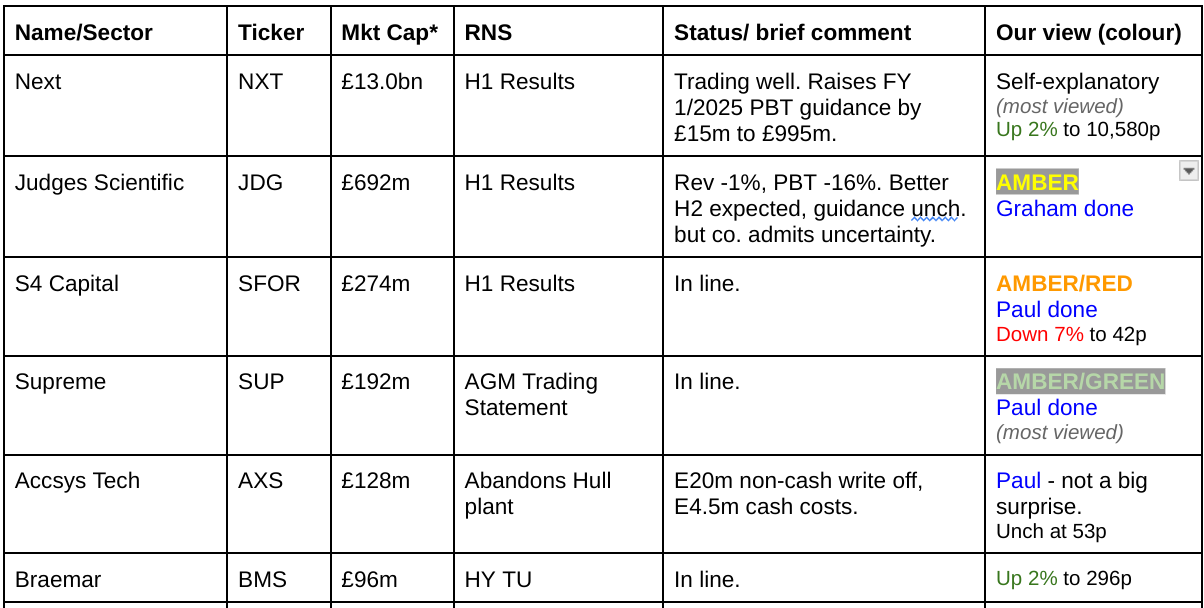

Companies Reporting

Summaries

Supreme (LON:SUP) - up 1% to 166p (£194m) - Trading Update (AGM) - Paul - AMBER/GREEN

I attempt to point out bull & bear points, let's hope it doesn't trigger people like this share usually does! In line update today, resulting in attractive value metrics, but that's because two-thirds of the EBITDA comes from vaping products. Good balance sheet, and more acquisitions in the pipeline. Overall I'll stick at a moderately positive view.

Judges Scientific (LON:JDG) - down 2.5% to £100.38 (£667m) - Interim Results - Graham - AMBER

Guidance is unchanged for a very strong H2 and a full-year adjusted PBT figure of £30m+, although a late profit warning remains very possible. I’m neutral on this for the same reasons as before: a high valuation (remember to take the debt level into account here), the absence of organic growth and my uncertainty around whether or not the company can continue to find meaningful, high-quality acquisition targets.

Portmeirion (LON:PMP) - unch 223p (£31m) - Interim Results - Paul - AMBER

A weak H1, as previously warned, due to problems in the important S.Korean market. Reassured on outlook, but I question if the forecasts are achievable - this share has a feint whiff of another profit warning gestating in my view. Balance sheet concern re over-stocking, but bank position now much improved, and going concern warnings have gone. So I reflect the reduced risk with a move up from amber/red to AMBER.

S4 Capital (LON:SFOR) - down 6% to 42.2p (£260m) - Interim Results - Paul - AMBER/RED

Hopes for a recovery here have been dashed by poor H1 results, with revenues declining and cost-cutting being necessary to keep things on an even keel. Awful balance sheet, and no signs of a trading recovery. Outlook sounds wobbly, and relies on a heavy H2 weighting to be in line with FY exps. Why get involved? It doesn't look a good business at all, but who knows it might recover at some stage maybe?

Sosandar (LON:SOS) - up 3% to 10.0p (£25m) - Launched in Arnotts, and 2 own stores - Paul - AMBER

Precious little information in an update saying the first 2 standalone Sosandar shops have opened.

Paul’s Section:

Sosandar (LON:SOS)

Up 3% to 10.0p (£25m) - Launched in Arnotts, and 2 own stores - Paul - AMBER

Sosandar plc (AIM: SOS), one of the fastest growing fashion brands in the UK, creating quality, trend-led products for women of all ages, is pleased to announce that it has launched in-store with Arnotts, the oldest and largest department store in Ireland.

Googling it (it’s been years since I visited Dublin), Arnotts is said to be the largest & most famous dept store in Dublin. So it’s nice that it will stock Sosandar goods (which are already on its website), but that’s not likely to move the overall dial much for SOS’s financial results.

More importantly I think, SOS has now opened two of its own, standalone shops, in Chelmsford & Marlow. I was expecting SOS to say that the new store openings have been a huge success (which might stimulate a surge in share price maybe?), but we’re not given any detail today other than a generic “fantastic”, which I would expect them to say regardless of how much money the stores have taken -

“The reception since opening has been nothing short of fantastic and we are grateful to the people of Chelmsford and Marlow for giving us such a wonderfully warm welcome.”

I tried to find a picture that is not subject to copyright, hopefully this is OK, published by Sosandar on its Facebook page -

Paul’s opinion - we need some figures on how the new stores are trading, maybe it’s too early to say?

I feel the change of business model to be operating its own physical stores is a surprising development, but am open-minded about whether it’s likely to work or not? The advantage SOS has is that it knows exactly where existing online customers live, so can target shops in areas that are full of their customers already.

SOS is well financed, with a strong balance sheet, so it can afford to trial a few shops and see if it works or not.

For now, the jury is out I think, so it’s got to be AMBER as we await developments and trading updates.

Originally SOS floated at 15.1p, so it's not been great so far, but not a disaster either -

S4 Capital (LON:SFOR)

Down 6% to 42.2p (£260m) - Interim Results - Paul - AMBER/RED

This is another one I don’t rate. My previous notes had it at AMBER/RED twice this year, 27/3/2024, and 10/5/2024. The main things I don’t like are -

Sir Martin’s dash for growth means he probably overpaid for multiple acquisitions.

Multiple profit warnings in 2023.

Soft outlook comments this year.

Tech clients reducing spending on digital advertising (is AI sucking in the cash instead I wonder?)

Incomprehensible accounts relying on huge adjustments to produce possibly artificial profits.

Excessive debt, although long maturity so no immediate liquidity issues.

Weak balance sheet once intangibles written off.

Crazy share structure, with Sir Martin’s golden B share giving him total personal control (very bad practice).

Takeover/deal approaches came to nothing.

Not very appealing is it?! What about upside? That could come from a recovery in trading, and sentiment towards the shares. Possibly the excitement over Sir Martin’s astonishingly successful previous career at WPP might return? Can he sprinkle stardust on the shares again?

Interim Results - I can quickly review this, as the numbers are not good.

Net revenue down 16% to £376m.

Cost-cutting done, reducing staff costs (the main cost for this type of business).

I totally ignore the adjusted numbers, as they look ridiculous to me. The statutory loss before tax in H1 was £(17.2)m vs £(23.2)m H1 LY.

Balance sheet is awful. NAV of £878m contains intangible assets of £1,043m, so write those off and it’s a deficit NTAV of £(165)m funded by too much debt.

Cashflow is negative when all real world costs are taken into account (eg finance charges, rents, etc).

Outlook sounds weak, with more cost-cutting needed to keep EBITDA flat vs 2023. Heavy H2 weighting assumed in forecasts.

Paul’s opinion - I think Sir Martin has created a monster here, not in a good way.

It seems that the days of digital advertising being seen as a licence to print money, are long gone.

Definitely not for me, so I remain at AMBER/RED.

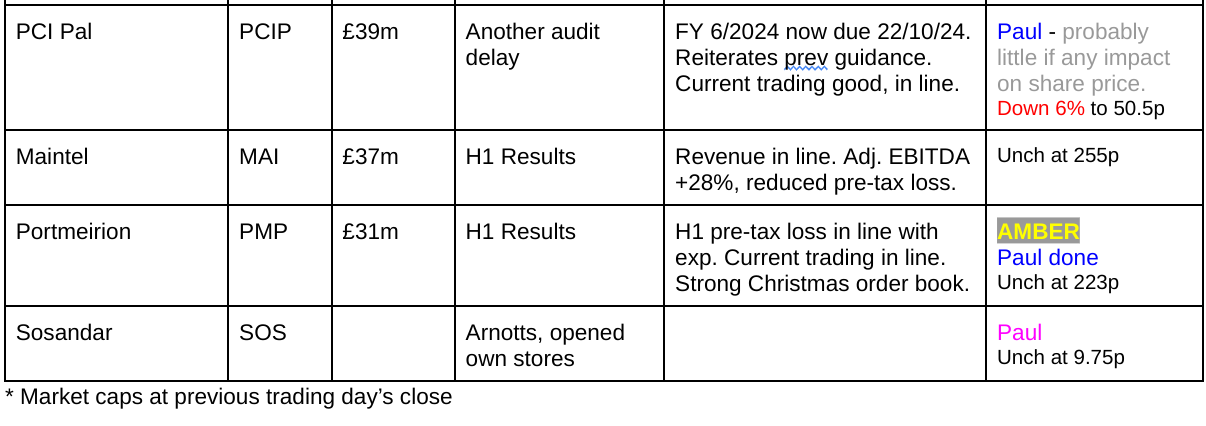

Surprisingly good StockRank, I have to disagree with the computers on this occasion -

Portmeirion (LON:PMP)

Unch 223p (£31m) - Interim Results - Paul - AMBER

Portmeirion Group PLC, the owner, designer, manufacturer and omni-channel retailer of leading homeware brands in global markets, is pleased to announce its results for the six months ended 30 June 2024.

Sales growth in US and UK, South Korea challenging as anticipated

Current trading in line with market expectations with a strong Christmas order book

I’m wary of PMP because their previous communications have been misleading - trying to gloss over profit warnings, then sneaking considerably reduced forecasts out via the broker. So the first port of call should always be the broker updates - which are OK today, forecast unchanged.

This raises the question that if I don’t trust management, do I want to buy the shares at any price? Probably not, so I’ll keep this section brief.

H1 is the seasonally quiet half, but it used to make a small profit or breakeven. Now it’s a loss in H1, c.£2m -

Singers (with thanks) has left its FY 12/2024 forecast unchanged at: £100.0m revenues (down from £102.7m in 2023) and adj PBT £4.5m. Adj EPS 24.5p.

Note that there was a £7.5m drop in revenues in H1, so this forecasts assumes most of that is recouped in H2, ending the year only £2.7m down Y-on-Y for revenues. That looks a tall order to me.

Interim dividend - has been cut from 3.5p last year to 1.5p this year. It shouldn’t be paying anything in divis, given the loss-making H1, this is a mistake.

Checking our records here -

2/2/2024 - Paul - AMBER - uneasy something might be going structurally wrong at PMP.

28/3/24 - Paul - AMBER/RED - Risky. Material uncertainty in going concern statement.

19/7/24- Paul - AMBER/RED - dependent on renewing bank facilities. Risky.

Bank facility - excellent news here today, which addresses my main concern over risk, although the detail needs to be checked -

“In August 2024, the Group signed a new 4+1 year term £30 million revolving credit facility with Barclays to consolidate and simplify our borrowing structure and provide adequate working capital headroom for the future. This replaces the Group's previous facilities totalling £24.5 million.”

Outlook - sounds reasonable, if they can pull off the anticipated increased sales in H2 -

Balance sheet - overall it’s decent enough with NAV of £52m, and NTAV of £42m.

The problem remains excessive inventories, much too high at £40m, which required funding, through £13.4m net bank debt.

It’s fair to say that H1 period end shows higher inventories for the build up to peak Xmas sales in H2, but it’s still much too high. I suspect PMP has too many brands, with too many product lines, and probably plenty of slow-moving stuff within that, which would have to be sold at low margins to shift it.

For comparison (although different products/markets) Churchill China (LON:CHH) has about half the inventories of PMP, despite having similar H1 revenues.

Note also that PMP diversified unsuccessfully in the past, with poor acquisitions that destroyed shareholder value.

Going concern statement - this is now clean, due to the new bank facilities. Hence the “material uncertainty” warning has gone - very reassuring!

Paul’s opinion - I suspect there might be an H2 profit warning gestating, since the forecasts look unrealistic to me.

That said, the renewed bank facilities, and the now clean going concern statement have removed my main risk worries.

Hence I’m happy to up it from amber/red warning, to AMBER. For me, amber/red is automatic, if there’s a going concern warning. With that gone, risk is greatly reduced. I don’t know how the company is likely to trade, but it says Xmas order books are good. Whether that actually turns into an improved H2 performance, who knows?! Market cap is only £31m, so a sniff of improved trading could be nice for the share price. Equally, it might warn on profit again, so it’s up to you to decide which is the more likely scenario. For me, it’s a don’t know, hence AMBER. There's also the question of whether a stock market listing is worth the cost & management time?

Historically, PMP was a good quality business, making attractive margins, but it’s not any more. Maybe some of its customers have died over the years? It would be interesting to know the demographic of buyers, I suspect for some brands it's likely to be quite old. Not a very nice point, but something we do have to think about.

Stockopedia is also middling in its assessment -

Zooming out on the chart, it difficult to avoid the obvious conclusion that this looks a structurally declining business - note the damage really happened in 2019, the year before the pandemic -

Supreme (LON:SUP)

Up 1% to 166p (£194m) - Trading Update (AGM) - Paul - AMBER/GREEN

Supreme (AIM: SUP), a leading manufacturer, supplier, and brand owner of fast-moving consumer goods…

This year is FY 3/2025.

Trading in line -

Following a solid start in H1 2025, Supreme expects trading for the year ended 31 March 2025 ("FY 2025") to be in line with market expectations1."

1 Company compiled analyst consensus for the year ending 31 March 2025 prior to release of this announcement was Adjusted EBITDA2 of £37 million

Broker updates - from ED and Shore today. I got to ED, as it’s directly commissioned by the company, so their forecasts are the company’s forecast in all but name. £37.0m EBITDA turns into £30.4m adj PBT and 19.5p adj diluted EPS (slightly down on 20.2p last year (which was itself a bumper year with very strong profit growth). So at 166p, the PER is 8.2x - cheap, but cheap for a reason, as the bulk of the profits come from vaping products.

ED shows that 64% of the group’s EBITDA will come from vaping products this year FY 3/2025, and 62% next year. So anyone trying to pass this off as a broader consumer products group - nice try, but it’s a vaping company. Hence a single digit PER is correct, in my opinion. You may differ, that’s what makes a market!

Over the coming years, SUP may well further diversify, and I’ve always been impressed with the entrepreneurial owner-manager at SUP, who has a proven knack of spotting lucrative product opportunities. So I imagine more of the same is likely. A recent acquisition was a soft drinks business.

More acquisitions coming -

“Acquisitions continue to underpin Supreme's growth ambitions, and the current M&A pipeline is strong with opportunities spanning multiple product verticals and markets.”

It says this today re vaping, for you to ponder and form your own view -

“The core lines within our Vaping category continue to perform well and we remain well positioned to comfortably manage the anticipated changes to the UK vaping market, having continued investment in rechargeable pod system vaping devices, adapted our flavour range and own-brand packaging, and ensured all retail partners enforce rigid age verification checks.

As an industry leader, Supreme acknowledges the wider concerns of underage vaping and remains fully supportive of proposed legislative changes in the UK. Details of the proactive measures that Supreme is taking to curb underage vaping are available to read in our latest Annual Report on our website.”

Paul’s opinion - an impressive business in some ways, just a pity about the main profit earner being vaping, which is inevitably going to limit the upside on this share, whatever we might individually think (let’s try not to get into the same argument again, but if you absolutely have to, then so be it!)

Valuation is obviously attractive, but given the main products, for me it feels priced about right.

There’s a useful divi yield close to 3%, and the balance sheet is sound. More acquisitions should help drive earnings, although note forecast profit is slightly down this year on the bumper numbers for FY 3/2024.

Shares have wobbled recently, and look superficially cheap, which they tend to be on an ongoing basis. I’ve previously been AMBER/GREEN (moderately positive) earlier this year, and am happy to stick with that again today. I can see why bulls like the numbers. But I also see why bears steer clear. Nobody is definitely right or wrong, they’re just different ways of viewing the same thing.

Chart below since it listed. Note the outstanding StockRank of 98.

Graham’s Section:

Judges Scientific (LON:JDG)

Down 2.5% to £100.38 (£667m) - Interim Results - Graham - AMBER

Judges Scientific, the group focused on acquiring and developing companies in the scientific instrument sector, announces its unaudited interim results for the six months ended 30 June 2024.

I’ve been a little worried about Judges in recent times, as organic growth has seemed to dry up along with a deterioration in its underlying quality. See my comments in March 2024.

The theme of weak growth is evident again in today’s interim results:

Organic growth is -3%, slightly worse than what is shown in the above table (some small acquisitions boosted total revenue).

As of the end of H1, the order book only extended to 17 weeks of business, the same as Dec 2023 but down from 22 weeks a year ago.

Net debt was £55m at the end of H1, and since then there has been a £12m acquisition.

The balance sheet shows net assets of £87m, but this figure falls below zero if you write off intangibles.

Outlook is unchanged, but the company says there are “continued challenging market conditions and short-term vulnerability to the timing of orders and revenue”. So a profit warning at some point in H2 would be no surprise at all, as orders/revenue could easily slip into next year. The small dip in the share price this morning looks about right to me, to help price this in.

Chairman comment:

As announced already, several of our Group businesses have experienced a challenging first half, driven by difficult market conditions and the deferral of some projects into H2 or 2025.

In spite of the trading disappointment, the Group has again demonstrated its resilience and its financial strength. With the completion of three acquisitions since the start of the year, the further strengthening of our management team, and a 10% increase to the interim dividend, we continue to build on our model of delivering long-term shareholder value."

Estimates: Panmure Liberum have kept their adj. PBT estimate for the current year unchanged at £30.7m, rising to £37.4m next year. So a much stronger H2 is expected.

Graham’s view

The company says that H1 2023 was a tough comparative period, as China emerged from lockdowns. I’m sure that’s true, but we have to remember that this stock is trading at a PER of 26x (according to Stocko calculations), and is carrying substantial debts, so we have to be more demanding than we might be with a lowly-rated, cash-rich business.

I do like what I hear about the recent £12m acquisition: Judges have paid six times adjusted EBIT for it, plus the value of freehold property attached. The acquired company (link) is involved in “manufacturing coating instruments and providing coating services.”

A point that I’ve raised repeatedly in relation to Judges, and where I’m still uncertain, concerns whether or not it will be able to continue finding high-quality acquisitions that move the needle.

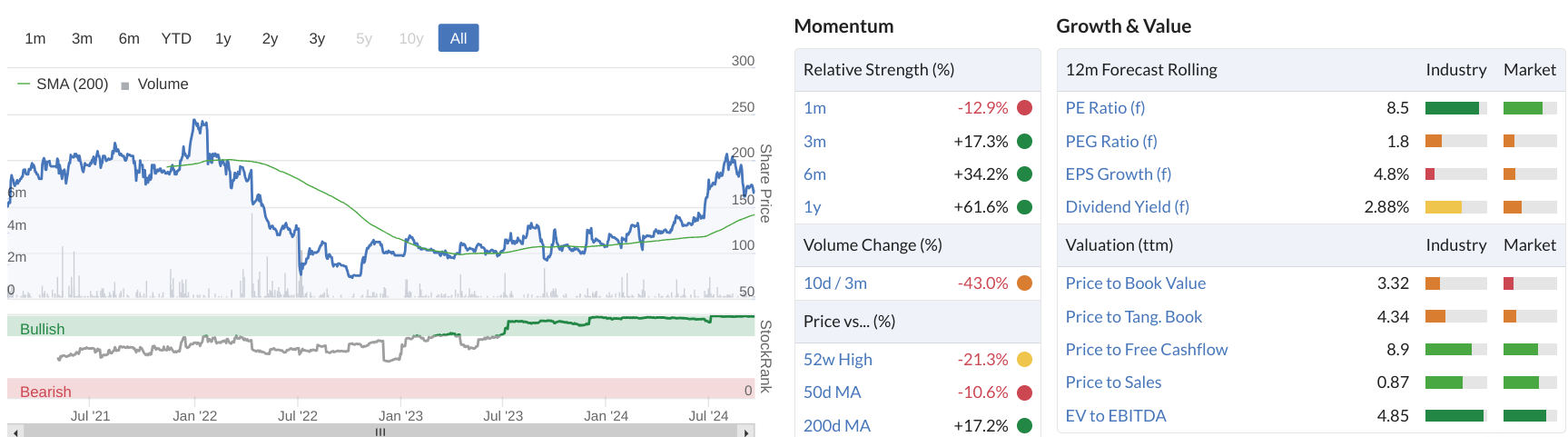

In some ways, it is the victim of its own success: it was so good at making small acquisitions that it successfully compounded wealth for itself and its shareholders, and has become a much larger business:

But does the old formula still apply, now that Judges is so much bigger?

I certainly don’t rule out the possibility that this is the second coming of Halma (LON:HLMA). Halma tends to trade very richly and that hasn’t prevented its shareholders from doing very well indeed.

But before taking a positive stance here, I’d like to see one reasonably large, successful acquisition to demonstrate that the company’s formula is still working.

The recent £12m acquisition sounds promising and yet £12m is less than 2% of the current market cap. Even if it succeeds, several acquisitions of this size would be needed to make a big difference to the value of the company.

Today’s financial results show what can happen without acquisitions, in a challenging economic environment: growth dries up and profits go into reverse. They have not been helped by a slowdown at Geotek, the flagship acquisition by Judges in recent years.

I’m therefore sticking with my neutral stance on Judges. I’m nervous about this stance, as I do think that the stock could continue to multi-bag for the long-term for its shareholders. But the market has occasionally provided good buying opportunities for this one and I hope I’ll be alert if/when this happens again.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.