Good morning from Paul & Graham!

Today's report is now finished.

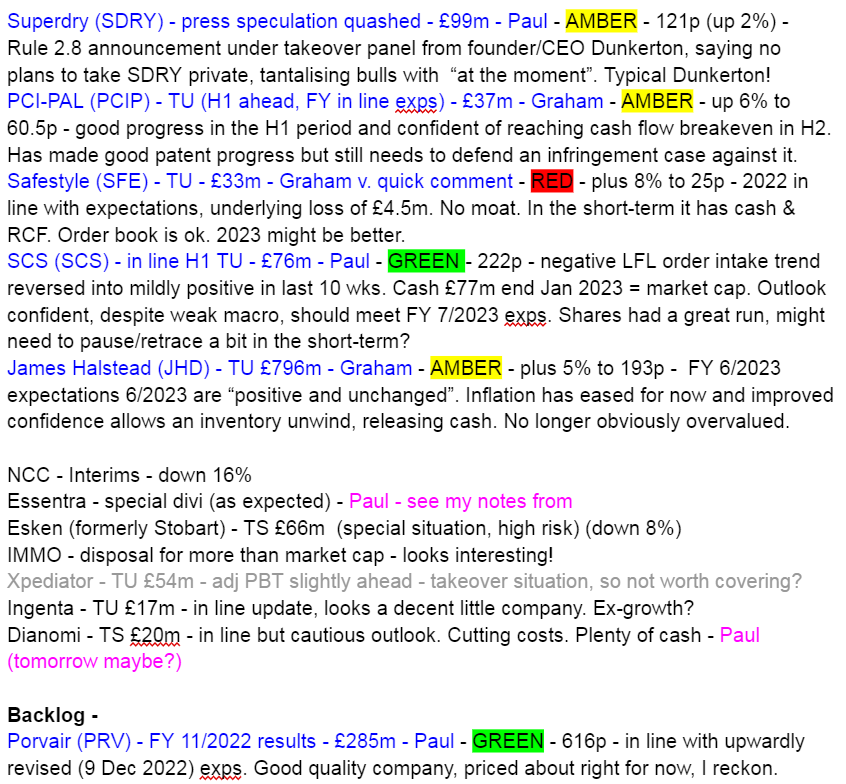

I've got to finish early today, so have started early, and will rattle out as many sections as possible! Anything missed today, I can always look at tomorrow.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Porvair (LON:PRV)

616p - mkt cap £285m

Porvair issued a positive trading update (“ahead of market forecasts”), which I briefly mentioned here on 9 Dec 2023. Key points were: revs up 18% (5% from forex), EPS ahead of forecasts, and net cash of £18.1m. That triggered a big vertical move up in the share price, some of which has since scrubbed off.

Here’s the latest news -

FY 11/2022 Results

Revenue up 18% (as expected) to £172.6m

Adj PBT £19.4m (up 31%) - impressive.

Adj basic and diluted EPS 23% higher at 33.2p (adjustments look only small)

Net cash £18.3m

Total divis for the year 5.7p - less than 1% yield, seems stingy, given plenty of cash, and this is only 17% of earnings. Why does the company need to hang on to the bulk of its earnings, I wonder? More acquisitions, possibly?

Outlook - comments a bit mixed, which is probably why the share price has moderated a little in recent days -

"As we move into 2023 the Board sees some reasons for caution in the near-term: supply chain dislocation, while diminishing, requires vigilance; inflationary pressures continue; the wider economic picture is uncertain and there is a likelihood of currency headwinds.

However, the Group order book finished the year at record levels despite clear signs of lead times returning to normal; the aerospace outlook is healthier than it has been since 2019; the petrochemical orderbook is encouraging; and recent new product introductions will support growth. Consistent investment in productivity over the last five years is improving operating margins and a strong balance sheet will support continued investment in 2023.

Porvair benefits from global growth trends including tightening environmental regulation; growth in analytical science; the need for clean water; carbon-efficient transportation; the replacement of plastic and steel by aluminium; and the drive for manufacturing process quality and efficiency. These trends have supported a consistent medium and long-term growth record and the Board is confident that this can continue."

Webcast - here’s the link for the video presentation, click on download, then input your contact details, and a video presentation comes up, with slides and commentary from the Directors. Very useful, thanks to Buchanan for making this available, very helpful. I very much like to hear management of all companies talking through the numbers & outlook in their own words. It often helps clarify in my mind: what the company does, and its outlook, and a feel for who management are, and if I want to back them or not. Although a generic warning is that the most “impressive”-sounding people are not always the most impressive performing! Although in this case, I think CEO Ben Stocks has a strong track record.

Pension deficit - the all-important actuarial valuation was completed in the year, and annual deficit recovery payments have increased to £2.1m (previously £1.6m), which is a significant although not excessive drain on cashflow, hence probably why the divis are not generous. This requires a downward adjustment to valuation, I feel, since the PER does not factor in pension cash outflows.

Balance sheet - is healthy, with NTAV at £53.2m (being NAV, minus goodwill & other intangible assets).

Given its healthy finances, I do think PRV should be nagged by shareholders to pay out more in divis. It certainly has much higher dividend paying capacity, which I think is more important than the actual yield at any point in time.

Cashflow statement - is healthy. The cash pile grew by £2.9m to £18.3m, after £4.8m capex, £5.0m debt paid off, and £2.5m paid in divis to shareholders. With debt now gone, you can see that the divis could be tripled by redirecting that cashflow in future. It's a decent, genuinely cash generative business.

My opinion - thumbs up from me - this is a good quality business, performing well.

In terms of valuation, it looks priced about right to me. We can’t expect the same strong earnings growth this year, so a forward PER of 19.3x looks up with events to me, and remember the pension cash outflows come out of this, so the adjusted PER would be in the low twenties, but you could argue that the cash pile offsets this, so I'll stick with the 19.3x PER as being a sensible way to value this share.

I think we have to be careful about paying PERs of 20+. That's an earnings yield of 5%. That might have been attractive in the 14 years of near-zero interest rates. But now base rates in the USA look to heading towards 5%, and in the UK maybe 4%, then that's changed the whole valuation dynamic for other assets. There's a risk that investors might chase valuations too high, because we're anchoring to previous valuations. A PER that used to be 20 when interest rates were zero, should arguably be something like 14 now, in my opinion. So be careful with highly rated shares, you might be over-paying!

It’s been a 10-bagger since the 2009-10 lows. So for patient investors, I think this looks a decent long-term, core holding.

Stockopedia likes it too, with a StockRank of 89.

Graham’s Section:

PCI- PAL (LON:PCIP)

Share price: 57p (pre-market)

Market cap: £37m

This is a trading update for the H1 period to December.

PCI-PAL is ”the global cloud provider of secure payment solutions for business communications”.

Among other services, it enables customer service agents to take payments securely over the phone.

But despite impressive revenue growth over the years, profitability has been elusive:

The outlook for this financial year is confidently in line with expectations.

Here are the H1 highlights, with the EBITDA loss being the same as last year:

“revenue growth of 33% to £7.3 million (2021: £5.5m). Adjusted EBITDA loss for the period was better than management expectations at a loss of £0.6 million (2021: loss of £0.6m).”

116 new customer contracts in H1 contributing £1.5 million of new ACV (contracted annual recurring licence revenue)

I make that an average of £13,000 annual revenue per contract. Given the importance of the product - secure customer payments - it seems quite good value / possibly too cheap? Perhaps the alternative providers also have some very strong offerings, which limits PCI’s pricing power?

total expected annual recurring revenue from all contracted customers increased 29% to £14.7m.

Cash balance: £2.7m currently, although this is boosted by the timing of customer renewals. It was £1.9m in December. The company says it is headed for cash breakeven in H2 (we can presume the income statement will still be loss-making).

Intellectual property: the competition in this space must be fierce, and PCI-PAL and others have been engaged in various patent actions. From today’s update:

In April 2022 the Company announced the grant of its patent in the United States covering innovative integration methods for its Agent Assist solution. In particular this patent covers how PCI Pal's public cloud environment leverages modern voice IP capabilities to integrate to its customers and partners own networks in a light-touch, non-invasive, and cost-effective way. This patent has now also been granted in both Australia (AU2018349164) and, within the last month, the UK (GB2569772) respectively.

But at the same time, the company remains on the defensive, as it attempts to prove the invalidity of a competitor’s patent in a case being made against it.

My view

I’d love to be able to take a stronger view on this, but it strikes me that this company’s eventual success or failure does depend on its IP and whether or not it can defend its IP position. That’s what will generate pricing power and returns over the long-term.

Therefore, while it’s being accused of infringing another company’s IP, it’s difficult for me to have conviction in its long-term trajectory.

I consider the lack of profitability to be a secondary issue for a company of this small size, because its revenue growth is so excellent. So I’m neutral for now, pending clarity on the patent case.

James Halstead (LON:JHD)

Share price: 183p (+5%)

Market cap: £833m

We have an H1 update from this commercial flooring company. H1 PBT will be lower than last year, but expectations for the current year are “positive and unchanged”.

Revenues are up 8%-9% (important to keep pace with inflation, as input costs are up).

This is a very encouraging paragraph, which helps to explain the rising share price today:

In December the Company saw signs of reduced international freight costs and raw material costs. Energy costs remain at historically high levels but have not escalated, nor have our key European raw material suppliers faced production interruption as a result of the energy shortage.

I’ve tried to resist making too many inflation predictions, but I didn’t think inflation was going away any time soon. At least in the short-term, JHD are telling us that some of their important input costs have stabilised or reduced. So that’s some good news.

Additionally, stock levels have reduced (presumably due to confidence in the supply chain?) and that has improved the balance sheet.

In the most recent full-year results, the company said that stock had increased “as we sought to mitigate the risks associated with the potential inability to manufacture.” Inventory rose enormously from £61m to £112m, and this took a huge bite out of their cash balance. So if that is reversing, it’s terrific news from the standpoint of the company’s liquidity and flexibility.

My view

Flooring is not a sector I’ve had much luck with in the past, and I’m unlikely to ever get into it again.

That being said, I have to respect these quality metrics, and JHD’s very long record of profitability.

I also note the nice bullish screen that it passes. (For completeness, I should also note that it passes a bearish screen, too.)

Due to valuation, I’m neutral on the stock, but this does appear to be a company worthy of respect and possibly worth looking into as a candidate for long-term investment.

The shares have made little progress in recent years, and no longer appear to be as overvalued as they once did:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.