Good morning from Paul & Graham!

It's going to be an early report today as I have to go into the city for a company meeting, then an investor lunch - exciting! I'll let you know tomorrow if the company meeting was of any interest.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

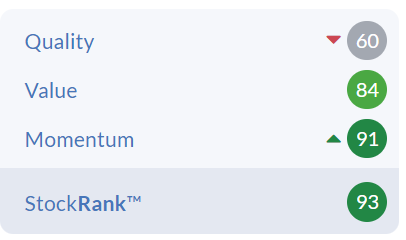

Vertu Motors (LON:VTU)

61.2p (pre market)

Market cap £214m

Vertu Motors, a leading UK automotive retailer with a network of 191 sales and aftersales outlets is pleased to announce the following update with regards to the five-month period to 31 January 2023 (the "Period") ahead of its preliminary results for the year ended 28 February 2023 to be announced on 10 May 2023. The Group continues to trade in line with management expectations.

Trading Update: Group trading in line, Helston integration on track, cash generation better than expected

That’s all straightforward, and not likely to move the share price, because it’s in line. Although forecasts for next year have been raised by 10%, so that should move the price up.

I won’t repeat all the other comments in today’s update, other than these 3 points below, which are interesting for general read-across -

The big question is whether new car supply easing is a good thing or not? As we’ve seen in the last couple of years, constrained supply has been very positive for car dealers, as it’s boosted their margins and overall profits considerably.

Further on in the announcement, the CEO sounds more cautious, talking of “tentative signs of improving new car supply”.

There must be pent-up demand for new cars, after several years of constricted supply, so maybe another profit boom is coming?

The service & repair division, which is nicely profitable, is described as trading strongly.

The recent big acquisition of Helston Motors is also progressing well.

Electric vehicle have plunged in price (as a stroke of luck, I sold my Taycan late last year, for more than I paid for it. Now it would be worth £20k less). I think the energy crisis has highlighted how vulnerable EV drivers are to spikes in electricity cost. Far more so than petrol/diesel drivers, where the % rise in price was much less pronounced, and has largely reversed now -

Within this overall benign picture, however, there has been recent much publicised weakness in the price of used electric vehicles in the UK, which saw average values decline by 17.0% on average over the Period.

Valuation - despite a c.50% rise in share price from last autumn’s lows, the valuation metrics at VTU still look highly attractive. It remains a sector stand-out in being priced below its own NTAV, which doesn’t make sense to me - either the assets are over-valued, or the shares are too cheap -

Outlook - this is the key paragraph, and I read this as being quite positive -

As expected, trading conditions are normalising after a period of exceptional financial performance across the sector. New car supply is improving and should mean year-on-year volume growth of new and used car sales for the market in 2023. Used car supply remains tight given the lack of new car sales in recent years and this is likely to underpin pricing in the year ahead. Clearly consumer confidence is volatile and higher interest rates and high vehicle prices may influence demand patterns. The Group will remain agile and dynamic in adapting to this environment.

The important point with this share, is that broker forecasts already factor in a reduction in profitability from last year’s bonanza. Therefore, even if VTU only performs in line, the shares will remain cheap, as the forecasts are set low. That also means a good probability of out-perform trading updates as calendar 2023 unfolds, which I like.

My opinion - there’s loads more detail in the full announcement, which I didn’t see any point in repeating here. The key message is that trading is in line with expectations, and the outlook comments sound pretty solid.

Have a look at Liberum’s helpful update note today. It’s positive, and raises forecast profit by 10% for FY 2/2024.

I remain positive on this share - it’s still cheap. So a thumbs up from me.

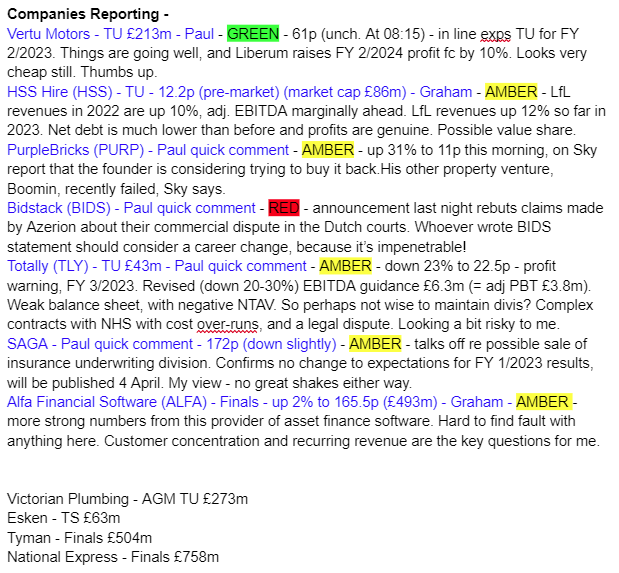

It's a thumbs up from the cold, completely unemotional analysis of Stockopedia's StockRank algorithms too, with a very high score -

Graham’s Section:

HSS Hire (LON:HSS)

Share price: 12.2p (pre-market)

Market cap: £86m

It’s a full-year trading update from this equipment hire company, for the financial year ended 1/1/2023 (I will refer to this financial year as 2022).

Like-for-like revenues +10%.

Adjusted EBITDA to be “marginally ahead” of expectations.

Leverage multiple less than 1x thanks to cash generation.

Operationally, four “large” customers have switched over to HSS’ self-service platform, HSS Pro:

This enables our customers to manage all their hire requirements in one place, therefore significantly improving efficiency for both customers and HSS. With positive results and strong customer feedback to date, we have a healthy pipeline of customers to roll this platform out to over the coming year.

Latest trading: like-for-like revenues up 12% in the first eight weeks of 2023, so that’s a slight acceleration on the average growth seen in 2022.

CEO comment:

"We are extremely pleased with the progress made in 2022, both in terms of financial performance and the implementation of our technology roadmap. Our strong focus on execution continues to underpin our momentum with a very positive start to the new financial year. While we remain mindful of the macroeconomic environment, HSS is well positioned for the year ahead."

Estimates - Stockopedia data suggest £332m of revenues and £16m of net profits for 2022, with further improvement expected in 2023.

In H1 2022, the company earned revenues of £160m and adjusted PBT of £8.4m.

My view

I haven’t got a strong view on HSS. Of course, everyone can see that it’s cheap:

And everyone knows that its balance sheet is much safer than it was before, thanks to equity fundraisings and business disposals.

At the end of H1 2022, net debt had fallen to £49m. Given the capital-intensive nature of the business, I think it’s understandable that companies in this sector will want to use some debt to juice returns for shareholders.

Also in reference to the H1 2022 numbers, balance sheet net assets at that time were £20 million.

If we are treating this as a possible “value” investment, I suppose we would ideally want to find more value on the balance sheet? Though I accept that things are much improved from the days when HSS had negative tangible assets.

Overall, I can see the bullish arguments for this one. Particularly if you are bullish on the economy and on the construction/maintenance sectors, you may feel that it is overdue a rebound:

Alfa Financial Software Holdings (LON:ALFA)

Share price: 165.5p (+2%)

Market cap: £493m

This is a B2B software company, serving the asset finance industry. They say that their “class-leading, cloud-native technology platform is at the heart of the world’s largest and most progressive asset finance companies”.

Much like HSS, this was an overpriced IPO that has been trading at more reasonable valuations in recent years:

Key points from these full-year results for FY December 2022:

Revenue +12% to £93m (+8% constant currency)

Operating profit +20% to £30m

Cash generated from operations £34m

Latest cash balance £19m, no debt.

The financial summary is brimming with positivity: nearly everything is moving in the right direction.

As promised (and as we discussed last year), Alfa has now returned £100m to shareholders since November 2020. Very impressive!

Additionally, the final (1.2p) and special (1.5p) dividends announced today are worth £8m.

Strategic highlights

75% of revenues are said to be “recurring”, but I’m not sure if I fully embrace the definition of recurring that is given: “subscription revenues or services and software revenues with existing customers”.

Surely revenue from an existing customer should not automatically be classified as recurring?

The subscription revenues are, in my view, truly recurring in nature. These account for 29% of total revenues at Alfa.

Customer concentration: top five customers are now 35% of revenues (they were 37% the previous year and 48% the year before that).

Employees: average headcount increased 10% to 420 with a retention rate of 90%.

A new version of their software was released in Q3 2022, with many improvements.

Outlook/CEO comment: there is “great confidence” in prospects for 2023 and beyond.

Pipeline - there is a “strong late-stage pipeline” and the company expects to convert most of these.

My view - as I said at the time of their interim results last year, I’ve warmed to this stock. The trend in customer concentration and concerns around how much of the revenues are really recurring would probably be my main two question marks over it. But it has evolved into a serious investment proposition, in my view.

Any company which returns material amounts of cash to shareholders, as Alfa has done, deserves to be taken seriously.

At its current valuation, my instincts are to keep reading about it and to keep it on the watchlist.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.