Good morning, it's Paul & Graham here as usual!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Companies Reporting

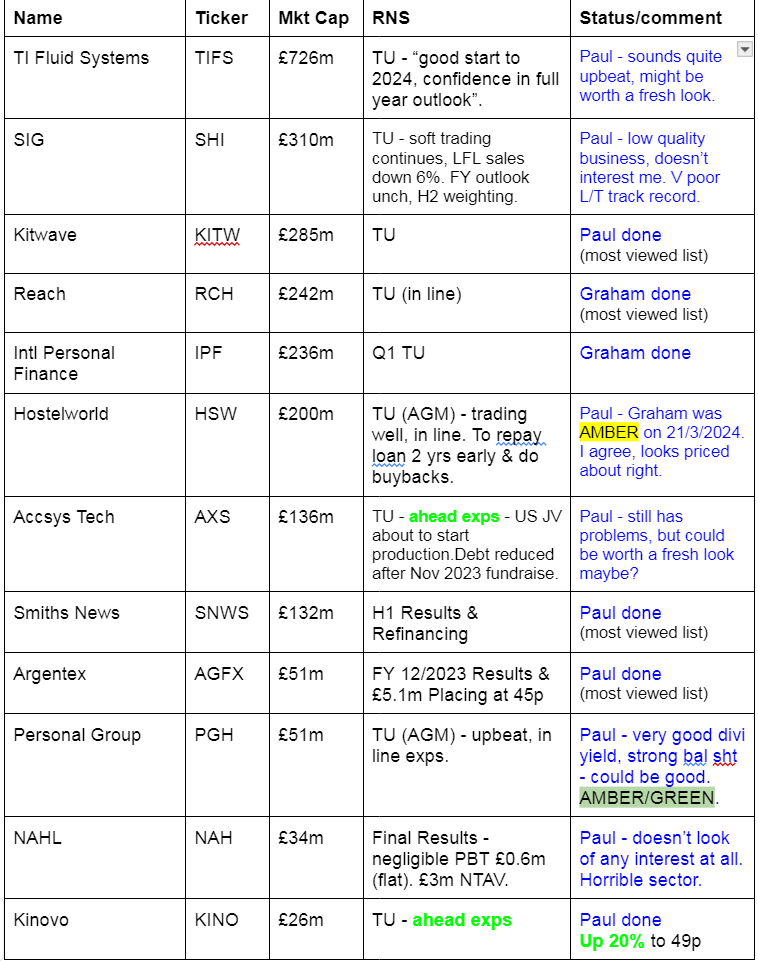

Other mid-morning movers (with news) -

Surface Transforms (LON:SCE) - down 64% to 1.03p - Equity raise at 1p - Paul - RED

Disastrous, but not entirely unexpected news last night of yet another emergency equity raise, following a catalogue of seemingly intractable problems in scaling up manufacturing of its ceramic brake discs.

Today it confirms conditionally raising £6.5m before costs, with c.650m new shares in placing/subscription.

The price was a hideous 66% discount to the already bombed-out 2.9p price beforehand.

There’s another 200m shares available to existing shareholders in an open offer (1 new per 1.76 existing shares). The current market price is 1.0p bid, 1.05p offer, and there seems to be plenty of buying today at 1.05p looking at the printed trades, so obviously a large sell order must be working in the background.

The new share count would look like this -

Existing shares: 352m

New placing/subs: 650m

Open offer: up to 200m

Total: between 1,002m - 1,202m, depending on take up of open offer.

Market cap at 1p = £10-12m.

David Bundred, Chairman of Surface Transforms commented:

"The Board obviously regrets the circumstances that have led to this distressed fund raising and completely understands the frustration and anger of shareholders. The Board is however now confident the combination of this £6.5m Placing, the £2m Open Offer and the £13m local authority loan is sufficient for working capital and capital expenditure needs over the next few years.

Trouble is, does anyone believe this latest assurance? I don’t. With this being very much the last chance saloon, I imagine any further cash requirements could result in de-listing, or insolvency.

Directors are subscribing for trifling amounts, and will only own 2.3% of the company after this fundraise. Interests clearly not aligned, with so little skin in the game. Performance hasn’t exactly been scintillating either.

Paul’s opinion - there are two ways of looking at SCE -

Bulls: With the existing equity now valued at only £3.5m, then new investors are getting the IP and the business opportunity for virtually nothing. If this project works, then the 1p investors could end up with a multibagger, due to the large pipeline & order book for what does seem an exciting product that is in demand.

Bears: So far, SCE has not been able to actually manufacture the product at any scale, beset with a catalogue of production problems. So why would all these problems suddenly get fixed, and with only £6.5m?

Overall, I think this is best seen as a complete punt, with money you can afford to lose. I have no idea how it will turn out, but personally I’m not optimistic, given the history. So I’ll stick at RED, and only move up once we have firm proof that production problems have been resolved. Then you could be onto a multibagger, so I can see the speculative appeal. I might buy a scrap, just so I can say “I hold” if it does multibag! It’s pure punting at this stage.

Argentex (LON:AGFX) - down 21% to 35.6p (£40m) - Fundraise & FY 12/2023 Results (profit warning?) - Paul - AMBER

Argentex Group PLC (AIM: AGFX) ("Argentex"), the provider of currency management and payment solutions to international institutions and corporates…

Proposed fundraise - at nil discount, 45p. I wonder if the investors might try to renegotiate, given today’s share price slump to 35.6p? Dilution not too bad, at 10% enlargement. Some existing large shareholders have indicated support, as have all the Directors.

FY 12/2023 Results - revenues down 1% to £49.9m. Profitability is confusing, as the LY figures are 9 months due to a change in year end. EPS is down, at 4.6p for 12m vs 6.2p for 9m LY. Note the tax charge is much higher in 2023 vs LY. I have to say, these numbers are not as bad as I was expecting considering the share price has been in freefall. Going concern statement is clean. Balance sheet looks fine to me, I don’t see any need to do a fundraise from the Dec 2023 figures, showing cash of £33m. Although the commentary mentions net cash as being £18.3m, so there must be some items netted off against cash. Ah yes here it is, they deduct £14.7m of client’s cash.

Outlook sounds problematic - saying FY 12/2024 is guided for revenues down about 10% to mid-£40s millions, and an EBITDA margin only in “low single digits”. After that, it says revenue growth would only be in single digits, but EBITDA margin increasing to high single digits. The fundraise will allow it to accelerate new product development, raising both revenue growth and EBITDA margins. I don’t have access to any broker research, and am not interested in spending the time building my own spreadsheet to work it out.

Paul’s opinion - it does look cheap, but that’s because it’s clearly being left behind by better performing rival Equals (LON:EQLS) . There are some very good reader comments below from people who have more experience of this sector than me, which reinforce my existing view that profits in this sector look quite flaky, with probably very little sustainable competitive advantage for anybody. After all, it’s only moving money around, so a race to the bottom on margins looks inevitable once rivals have caught up with any technical or service advantages. AGFX seems to have slipped behind rivals, and is paying the price, with profits collapsing. That makes me even more wary of this sector generally.

A more bullish view on AGFX might say it’s well financed (especially after the placing, if that goes ahead), and the market cap is now very modest. So if new management can get their act together, you could have a nice recovery trade on your hands. I don’t feel qualified to judge, so will sit on the fence with AMBER. I could be tempted to have a small flutter though, if spare funds emerge.

Summaries of Main Sections

Kitwave (LON:KITW) - 407p (pre-market) £285m - H1 Trading Update (in line) - Paul - AMBER/GREEN

An in line update for the full year, but it says H1 was soft due to bad weather affecting its hospitality-facing business. Larger than usual H2 weighting expected. With the shares up c.60% this YTD, I suspect some profit-taking is to be expected for now the valuation looks up with events. So I've shifted down a notch from green to AMBER/GREEN.

International Personal Finance (LON:IPF) - up 2% to 108p (£243m) - Q1 2024 Trading Update - Graham - GREEN

A pleasing update from subprime lender IPF with the company growing well, excluding Poland. Importantly, the impairment rate is below the level expected at this point. At a PE Ratio of only 5x and a dividend yield of 10%+, the risk/reward for IPF’s equity could be even better than its 12% retail bond.

Smiths News (LON:SNWS) - up 3% to 55.2p (£130m) - H1 Results & Refinancing - Paul - GREEN

A slight reduction in forecast profit FY 8/2024. However, outweighing that is the confident outlook, and bank refinancing that saves c.£0.4m pa in interest costs, and removes all restrictions in divis, allowing a c.20% rise in divis to a yield getting close to 10%. I think it's still good value, although we do have to bear in mind it's not likely to ever get a PER any higher than mid single digits probably.

Reach (LON:RCH) - up 7% to 79.8p (£254m) - Trading Update - Graham - GREEN

This update is “in line”, despite all metrics appearing to move in the wrong direction and a stunning 33% decline in page views. But the consensus operating profit figure for FY 2024 is a remarkable £97.6m. If Reach hits this target without putting too many costs into its adjustments, the stock is likely too cheap.

Kinovo (LON:KINO) - up 20% to 49p (£31m) - Trading Update (ahead exps) - Paul - AMBER/RED

Profit is £0.5m ahead of expectations for FY 3/2024. Legacy problems are gradually being resolved, and haven't got any worse this time. Balance sheet is weak, and creditors look stretched, so I think it needs an equity raise, and won't be able to pay meaningful divis for a while. Not enough upside to compensate me for taking the risk. Although I've moved it up from red to AMBER/RED, to reflect that things are improving.

Paul’s Section:

Kitwave (LON:KITW)

407p (pre-market) £285m - H1 Trading Update (in line) - Paul - AMBER/GREEN

Kitwave Group plc (AIM: KITW), the delivered wholesale business, today announces a pre-close trading update for the six-month period ended 30 April 2024 (the "Period').

It’s in line for the full year -

The Board is pleased to report that the Group continues to trade in line with current market expectations for the full year ending 31 October 2024. This performance will reflect both continued organic growth and the benefit from acquisitions made over the past 18 months.

However, H1 sounds soft - which I find a bit confusing -

Operating profit performance during the Period is expected to be slightly behind the prior year.

Due to -

Wet weather this year causing demand to drop in the higher margin foodservice division (hospitality sector).

“Increased investment in its infrastructure”, before benefit kicks in for H2.

H2 weighting being larger than usual this year probably won’t go down well with investors I suspect, especially after the shares have had such a good run recently -

Some of the benefits of these investments, in addition to the H2 inclusion of trade from the recent acquisition of Total Foodservice, will further increase this year's weighting of trading toward the second half of the year.

Acquisitions - 2 have been done, integration is going well. I like the acquisitions strategy here, as KITW buys what it knows, and uses that to fill in geographic gaps. It also mentions a “fragmented market”, so that sounds ideal for consolidation.

Overall - nice to know they’re confident -

Overall, the Board remains confident in the outlook of the Company.

"I am pleased to report that the Group has continued to make progress towards its operational and financial targets and that we remain confident of achieving a positive outcome for the full-year results.

Broker update - Canaccord helpfully updates today, leaving forecasts unchanged. It reckons 29.9p adj dil EPS for this year FY 10/204, only 4% up on LY actual, so that should be achievable. It also points out that there is a natural H2 weighting to profits at KITW every year.

At last night’s close of 407p, the current year PER is 13.6x, which looks about right to me.

Paul’s opinion - I’ve not looked at the share price yet, but suspect some shorter term investors might be tempted to bank profits after a very strong recent run. I think it’s gone from cheap, to fairly valued now. I was green on 28/2/2024 at 297p, but given we’re now being asked to pay 407p, for me that means it needs to come down a notch to AMBER/GREEN - nice company, but valuation up with events for the time being.

A successful 2021 IPO, and note that StockRanks like it, with a high score of 95 -

Smiths News (LON:SNWS)

Up 3% to 55.2p (£130m) - H1 Results & Refinancing - Paul - GREEN

Smiths News (LSE: SNWS), the leading distributor of newspapers, magazines and ancillary services to retailers across the UK, today announces unaudited interim results for the 26 weeks ended 24 February 2024 (the "period" or "HY2024").

The key highlights section covers the main points well -

H1 EPS is down 12.5% to 4.9p - not great, as I was expecting profitability to be roughly flat.

Clean numbers, with hardly any adjustments.

Broker update - thanks to Canaccord, who trim FY 8/2024 from 10.0p to 9.8p. However, they’ve slightly raised the next 2 years, due to lower finance charges from the refinancing also announced today.

Valuation - PER of 5.6x FY 8/2024 earnings - low PER is because this is perceived as a slowly dying business, much like newspapers themselves, although both are lasting a lot longer than we thought maybe 10-15 years ago! And remaining strongly profitable too, thanks to round after round of cost-cutting each year.

Bank net debt reduction - great news here, at only £10.0m period end bank net debt has more than halved, not far from being eliminated altogether it seems (although there are likely to be large intra-month swings, depending on when a few big customers pay up, and SNWS itself does its payroll and supplier payment runs.

A big thumbs up for SNWS also reporting its Average Bank Net Debt of £12.5m. It’s wonderful to see a few companies beginning to report this key number, which gives a much more accurate view of the real world typical level of indebtedness. Bravo! Let’s see this from all companies please.

Outlook - sounds good I think - especially the prospect of bigger shareholder returns, although we already knew that looks achievable in future -

Balance sheet - was always this company’s weakness, but it’s reasonable now, with NTAV negative £(16)m, so it does still need a bank facility to plug that equity gap.

Cashflow statement - looks fine. Cash generation is used to pay interest and dividends basically. The larger cash pile last time was used to pay down £15m of a term loan. Although also note a hefty £3.3m was spent on buying shares for the employee benefit trust in H1, quite a large % of H1 profits are being given away to employees (probably management mostly) in this way.

Refinancing - revised bank facility with 2 of the existing syndicate lenders, HSBC and Santander.

£40m RCF + £10m “uncommitted accordion facility” - from googling the “uncommitted” term, this seems to be where the lender has discretion on whether or not it grants a request to use the accordion facility.

Useful saving in interest cost, new: 2.45% over SONIA, old: 4.0% over SONIA. Average net debt was £12.5m in H1, so this means a saving of about £194k in future interest cost per half year, so c.£0.4m interest saved in a year.

Three year term.

Key point - removal of restrictions on paying divis (previously capped at £10m pa, or c.4.2p/share pa)

Dividends - Canaccord reckons it’s likely to pay 5.3p in FY 8/2025, so that’s a lovely yield of 9.6%, twice covered by earnings.

Paul’s opinion - a superb turnaround which we’ve followed closely, and positively, here at the SCVR for quite a few years. It’s panned out exactly as management said it would.

The business seems more resilient than previously expected, and the finances are basically now sorted out and on normal, competitive terms.

It’s very tempting, now the yield is close to 10%, and it should be able to pay that for several more years to come.

I’d like to know more about the growth initiatives, and there’s scope for a possible upward re-rating if the distribution network can be repurposed in some way.

I have to remain GREEN, as the valuation is still attractive, although not as absurdly cheap as it has been in recent years after good gains more recently.

Kinovo (LON:KINO)

Up 20% to 49p (£31m) - Trading Update (ahead exps) - Paul - AMBER/RED

Kinovo Plc (AIM: KINO), the specialist property services Group that delivers compliance and sustainability solutions, is pleased to announce that it expects its results for the continuing business in the year ended 31 March 2024 to be ahead of prior expectations. Numbers presented are subject to audit.

Quite an interesting share, that I covered on -

9/2/2024 - RED at 55p - in line TU, but big legacy issues. Not cheap enough.

8/3/2024 - RED at 39p - core business trading in line, but legacy problems worsen again. Weak bal sht, so risk of dilution. Possible recovery trade maybe?

The core business actually looks quite good, and is profitable, but there are some major legacy issues relating to its accident-prone former subsidiary in building works, which requires expensive rectification work. The risk was that the bad legacy business liabilities could pull down the continuing, quite good business, so I flagged it as red previously due to the high risk.

Today’s news is encouraging, although I don’t think it justifies a 20% rise in share price just for beating EBITDA exps by £0.5m -

The Company expects to report an adjusted EBITDA, for the continuing business, of £6.7 million for FY24, 23% ahead of previous year (FY23: £5.5 million) and ahead of prior management expectations of £6.2 million, as disclosed on 9 February 2024, for the full year ending 31 March 2024.

Some work has slipped into FY 3/2025 due to client delays, but it says this was previously disclosed.

Legacy problems update - relating to DCB. 7 out of 9 sites have now been rectified. The 8th site is due to be completed in July 2024. Leaving 1 remaining problem site due to complete in 2026, so ongoing risk there for a couple more years, isn’t ideal. Says the liabilities are as disclosed on 8/3/2024, so it sounds as if these big problems are now largely resolved, we hope. Although Canaccord says the remaining costs are a hefty £8.6m.

Broker update - another note from Canaccord, they’re really being tremendously helpful today! It leaves forecasts unchanged, but at £0.5m below the company’s EBITDA guidance, so these figures are now understating reality, at £5.8m adj PBT, and 6.9p EPS.

Paul’s opinion - this type of business would usually attract a fairly low PER of maybe 10-12x. On 6.9p EPS that gives me a target share price of 69-83p, usefully above the 49p share price after today’s 20% surge. However, we need to deduct the cash costs of the £8.6m remediation costs on legacy mistakes, which I make 13.7p/share. That narrows the gap, to a target share price of 55-69p. That’s not enough upside to motivate me to want to buy at today’s 49p. Particularly when there are still risks here. Looking at the last balance sheet, I think the finances here are stretched, so it could do with an equity raise to repair the negative NTAV £(3.4)m balance sheet.

Given that trading is a little ahead, and the legacy problems are gradually being resolved, I think it might be safe to move from red to AMBER/RED. Good luck to holders, but personally I don’t see enough upside reward to get me interested in buying a fairly ordinary business, with legacy stuff still hanging around, when there are cleaner, better financed shares around on more attractive valuations.

I've just remembered that the major shareholder (just under 30%) tried to take it over at 56p in Aug 2023, but that fell through.

Graham’s Section:

International Personal Finance (LON:IPF)

Up 2% to 108p (£243m) - Q1 2024 Trading Update - Graham -GREEN

It’s a positive update from this lender:

Lending growth of 5%, excluding Poland (total lending down 3%).

Net receivables growth of 11%, excluding Poland (total receivables down 3%)..

“Robust customer repayment performance and excellent credit quality supports the Group's plans for stronger lending growth through the remainder of the year.”

As you may know from our previous coverage of this stock, new regulations (and different interpretations of those new regulations) have severely impacted IPF’s operations in Poland. Today the company reiterates its previous guidance that the situation in Poland will result in a £10m p.a. hit to profitability. Receivables in Poland are down 33% year-on-year.

CEO comment:

"We've made a very good start to the year and are progressing well against our 2024 financial plan. We delivered good customer lending and receivables growth in all our markets with the exception of Poland, where our actions to adapt our home credit business to the changing regulatory backdrop continue.

Credit quality remains excellent across all parts of the Group, and this provides us with a strong foundation to accelerate growth through the remainder of the year and capture the substantial long-term growth opportunities through delivery of our Next Gen strategy.

An important feature of IPF’s growth plan is that they are willing to allow their levels of impairment to rise, voluntarily taking on some more risk as a price worth paying for growth.

Fortunately their latest impairment rate (11.4%, up from 10.5% a year ago) is still “tracking better than our financial plan”, meaning that they can carry on with their intended growth plan for the rest of the year.

Romania, Hungary, Czech Republic: these countries, in the absence of any regulatory issues, saw an aggregate 9% year-on-year growth in their receivables.

Mexico: 8% growth in receivables. Impairment rates are very high in this country (31.3%) and IPF wants to see an improvement to 30% (still very high!).

IPF Digital: 7% growth in receivables, with very fast growth outside Poland (17%).

Funding: IPF has a bond maturing in November 2025 - see here. They are now looking at options to refinance it. The bond trades at 98 euro cents, suggesting to me that bond investors are relaxed about IPF’s prospects!

Regulatory update: nothing new here.

Outlook: concludes as follows:

We have a strong balance sheet and funding position, and are well positioned to deliver further good quality customer lending and receivables growth in 2024 and beyond whilst maintaining our progressive dividend policy.

Graham’s view

The dividend yield here is already over 10%, so it will be impressive if this keeps growing!

The yield is not the most remarkable aspect of IPF’s valuation, however: it’s the earnings multiple.

In the absence of any share buybacks (and why isn’t the company doing any?) I’d be inclined to reinvest at least a portion of IPF’s enormous dividends in IPF stock - it’s not as useful as a buyback by the company itself, but it’s the next best thing!

I’ve been positive on IPF for quite some time, and I won’t be changing my stance on it today. Flip the P/E around and you get an earnings yield of 20%: that strikes me as attractive for a share that everyone (including myself) will acknowledge does carry more than its fair share of risk, being a subprime lender in foreign locations.

At this market cap I think I would even prefer to buy IPF’s equity instead of its 12% retail bond maturing in 2027 (link).

Reach (LON:RCH)

Up 7% to 79.8p (£254m) - Trading Update - Graham - GREEN

Reach is “on track to deliver full year expectations”.

This is despite the company shrinking from every perspective. Reach describes the performance as “robust”:

As previously flagged and discussed, news was “deprioritised” by social media platforms in 2023, particularly by Meta/Facebook, who decided that the news category was more trouble than it was worth.

The consequence for Reach is that page views fell by a staggering 33% year-on-year.

Digital: Reach has a “data-driven” strategy, trying to use customer data derived from customer registrations and customer behaviour. Data-driven revenues are now 45% of digital revenues (up from 39% a year ago).

Print: rising cover prices have saved the day here:

“...circulation revenues remain a predictable and reliable revenue stream with the expected volume decline mitigated by actions on cover prices and availability.”

Operating costs: the company is delivering a 5-6% reduction in costs.

Outlook: in line with expectations, being an adjusted operating profit of £97.6m.

CEO comment

Nothing too concrete here, but it’s an insight into management’s thinking:

"We have set the business up to succeed - the decision to take cost action early, alongside the continued implementation of the Customer Value Strategy is delivering a growing yield performance and driving results. This gives me confidence that we can continue to navigate current market conditions. With events like the European Football Championships, Olympics and elections round the corner we have the opportunity to generate high levels of interest by entertaining and informing our audiences with brilliant journalism.”

Graham’s view

I covered Reach’s full-year results in March.

The key point around the pension black hole at Reach is that it is not expected to last forever: Reach has to pay about £60m p.a. until 2027. But from 2028, contributions are expected to shrink dramatically, so that they should no longer drag on the valuation of the company's stock by then.

The phone hacking scandal is also likely to finish up its journey through the legal system very soon, with limited future liabilities for Reach (the remaining provision is only £18m).

Adjusting my calculations in March for today’s market cap, I get an increased enterprise value of c. £540m.

My impression is that management is running a tight ship, with a clear focus on profits and cash flow. Somehow, they continue to generate operating profits at a very high level, and pay a dividend of over 7p (the yield is over 10%!).

As always, the devil is in the details and I’ll be eager to make sure that they aren’t making large and unreasonable adjustments to their operating profit numbers, every time they publish results.

For now I’m happy to maintain my “thumbs up” position on this stock. It will be a fabulous achievement if they hit their forecasts this year, and it seems that they are on track to do so.

Personally, I view this as an example of a stock where paying the dividend makes little sense for the company. If they don’t think they are going to survive the pension contributions in rude health, they shouldn’t be paying it. But if they do think they are going to survive, then why pay £23m in annual dividends? For that price, they could reduce the share count by about 10% every year!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.