Good morning from Paul & Graham.

Today's report is now finished.

Quick comments -

SKY News said last night that Cake Box Holdings (LON:CBOX) has received a low-premium 160p bid approach from an Australian cheesecake company, so it will be interesting to see if that's true or not (it usually is with SKY, who for some unknown reason has now become the pre-RNS go to place to leak news). The founders probably have enough shares to block this, so it would need to be an agreed bid. There have been too many slip-ups (being polite about it) from CBOX, so even though it looks an interesting growth company, personally I wouldn't lose any sleep if it went private, because I don't trust management.

UPDATE at 09:50 - no RNS from CBOX as yet, so it's not clear what's going on. Perhaps SKY can update us?! Share price up 5% to 158p.

UPDATE at 10:30 - CBOX has rejected the bid approach, issued at 10:00, here's the full text -

Response to Press Speculation

The Company notes the recent press speculation.

The Company confirms that it received an unsolicited approach from River Capital to acquire the entire issued and to be issued share capital of the Company (the "Indicative Approach"). The Indicative Approach was made in early June and with an indicative price of 160 pence a share.

The Board unequivocally rejected the Indicative Approach as materially undervaluing the Company and no further discussions with River Capital have taken place.

This announcement has been made without the consent of River Capital.

Paul's view - pretty much as suspected, the controlling shareholders are not interested in selling out at 160p. I think this rather strange approach (why was it leaked, and by whom?) seems mildly positive for the shares. At least shareholders now have some validation of the current price being seen as attractive to a potential bidder. That's probably why it was leaked.

Lookers (LON:LOOK) - many thanks to davidallen77 for flagging in the reader comments below that it looks as if the Canadian takeover deal might be off - because it's been announced that 19.2% shareholder Cinch has switched sides, and says it will now vote against the deal. This was a strange situation, and I've mentioned here a couple of times before that I thought banking the bid premium at c.118-119p looked the safest option. What was strange, was that insitutional shareholders who had given undertakings to support the deal, were then selling in the market. I've not seen that before, and it made me think that deal risk looked high. So let's see what happens next! Expect a fall in share price today though, I imagine. Upside possibility might be if an alternative bidder appears at a higher price perhaps? Who knows!

Update at 09:48 - LOOK share price currently down 14% to 102p -

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

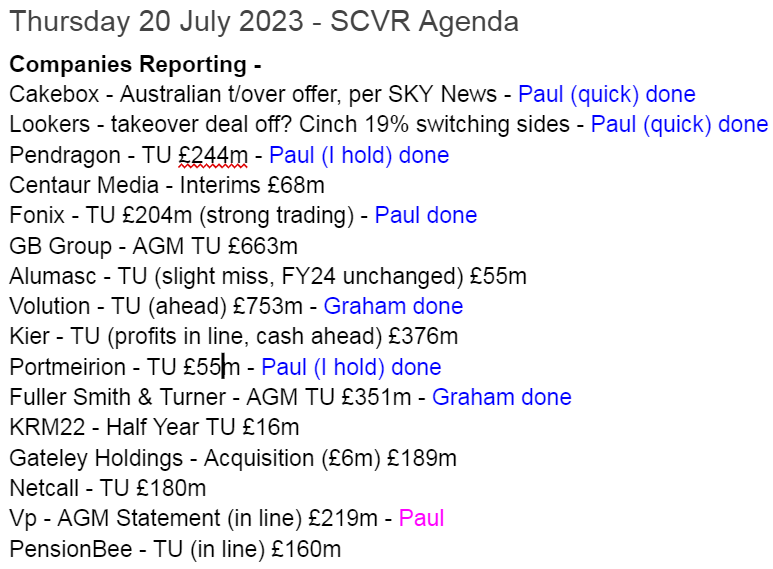

Here's the list of today's announcements, which we'll pick the most significant from (we can't cover everything, as there's loads!) -

Summaries of main sections below

Portmeirion (LON:PMP) - Down 28% to 285p (£40m) - H1 Trading Update - Paul - AMBER

A fairly tame sounding update from this pottery maker, but the "significantly below" sentence is the tip of the iceberg, with broker notes revealing the full scale of the damage - profit forecasts slashed by 68%. Clearly disappointing, and has been badly handled by the company. So I've shifted from green to AMBER, and that's probably generous in the short term. Longer term, earnings should recover, and it's soundly financed, so not a disaster.

Volution (LON:FAN) - up 0.4% to 384p (£758m) - Pre-close trading update - Graham - GREEN

This large ventilation business gets the thumbs up from me. Sturdy refurbishment demand and pricing discipline are enabling it to keep organic revenue growth at 5% and adjusted operating margin over 20%. I like its style of communication, which appears trustworthy.

Pendragon (LON:PDG) - Up 1% to 17.5p (£245m) - H1 Trading Update - Paul - GREEN

H1 profit up 9%, and in line with expectations outlook comments for FY 12/2023. High used car prices are helping margin, with tight used vehicle supply expected to continue for the foreseeable future. Looks excellent value to me, so I'm happy to continue holding. Takeover bid might resurface, who knows?!

Fuller Smith & Turner (LON:FSTA) - up 3% to 600p (£366m? - see below) - AGM Statement - Graham - GREEN

This family-controlled pub and hotel group reports a bounce in like-for-like sales as workers return to offices in London. I study the confusing share structure and conclude that the company might be cheaper than it first appears. A fresh buyback has been announced.

Fonix Mobile (LON:FNX) - Up 1% to 208p (£206m) - FY 6/2023 Trading Update - Paul - GREEN

One of my favourite small caps, but it usually looks too expensive. Giving it the once over today, with a good FY 6/2023 update, and Finncap raising forecasts about 5%, I think the current valuation does (just about) stack up. Tantalising talk about further international expansion also gets me excited enough to consider a purchase here.

Portmeirion (LON:PMP) (Paul holds)

Down 28% to 285p (£40m) - H1 Trading Update - Paul - AMBER

Portmeirion Group PLC, the owner, designer, manufacturer and omni-channel retailer of leading homeware brands in global markets, updates on trading for the six months to 30 June 2023.

Sales for our first, traditionally quieter half, are expected to be £44 million, down 3% on the same period last year.

The last update which I covered here on 23 May 2023, said H1 sales were expected to match last year. So today saying H1 sales will be down 3%, is a small deterioration, although given that it’s happened in the last few weeks only, that could be a more worrying trend, if it continues.

The 23 May update did say that it had seen “some increased caution” from US customers in recent weeks. This spooked the market, understandably, and triggered a significant downward move in the share price in the last couple of months, as you can see below -

Seasonality - H1 is the weak half year - almost all the profit is made in H2, hence at this stage, H2 outlook is more important than H1 results. The same cyclicality happens every year. It’s because a key range is the seasonal “Christmas Tree”, and other products bought as gifts at Christmas, which obviously falls in H2.

Other comments in the update all seem a bit confusing - some markets are OK, others growing, others challenging, so let’s cut to the chase…

FY 12/2023 outlook - oh dear, this is disappointing -

In terms of the full year outlook, it is challenging to assess how long the North America caution amongst our retailer customers will endure and whilst we note the encouraging end customer sell through data and our strong Christmas order book, the Board believes that it is prudent to assume that this caution will continue through the second half resulting in the Group's sales being below and profits for FY23 being significantly below current market consensus.

Broker updates - helpfully, both Singers and Shore Capital update us today (via Research Tree). The downgrades are pretty hideous, and this is another case where the tone of the company’s update (which doesn’t sound too bad) seems to be trying to gloss over the harsh reality. I think whoever writes these updates from PMP needs to be transferred to other duties. I would prefer a much more direct, and clear type of update that just tells it like it is, warts & all. If it’s bad, it’s bad, and we’re going to find out from the broker updates within a few minutes anyway. So where’s the benefit to putting a positive spin on the bad news in the RNS? There isn’t any benefit, it just leaves investors feeling temporarily misled, and opening bell buyers who haven't seen the broker notes are getting fleeced!

FY 12/2023 forecast EPS (from Singers) is now only 16.7p (down from 46.8p in 2022). The StockReport shows a broker consensus of 51.5p, so today’s reduction to only 16.7p is a huge 68% drop in forecast profit for this year. That doesn’t tie in at all with the tone of today’s trading update, so I’m rapidly losing trust in management here, I’m afraid.

On reading the RNS, I thought to myself, this is quite mild, maybe I’ll put in a buy order? On reading the broker update, I jettisoned any idea about buying more, because this is a major change in forecast profits, and hence the company’s valuation. Never buy on a profit warning without first seeing broker updates!

If it is just a customer de-stocking issue, which the RNS suggests, then profit could rebound in 2024. Singers has 38.9p pencilled in for 2024, which could support a share price of say 300-500p, depending on market sentiment at the time.

Shore Capital has a slower rebound in 2024, at 33.4p, with a very similar 2023 forecast of 16.8p.

Remember that the broker forecasts ARE the company’s forecasts, as John MacArthur of Tracsis (LON:TRCS) told us at a brilliant presentation he gave years ago to an investor group I organised in Brighton.

As an amusing aside, in a very recent online webinar (I won’t mention the company name) the CFO started saying, “Our forecasts have been adjusted…. errrr, I mean Finncap’s forecasts have been adjusted….”, which reinforces my point!

Inventory levels - this was a previous concern of mine, but PMP says today it has successfully reduced inventories, and expect to further reduce by end 2023. Good, but I’d like to see the figures in due course to judge properly.

Paul’s opinion - as you can probably tell, I’m not happy with the way this has been handled. It feels like we’ve had the wool pulled over our eyes somewhat, with PMP management very reluctant to deliver bad news that investors needed to hear.

So this is clearly a company where selling on the first sniff of bad news on 23 May was the best strategy, I’ll bear that in mind for the future, and not give the company the benefit of the doubt again.

My view now is that the share price has taken two hits, first from the May update revealing the first sign of trouble, and again today with the company belatedly revealing a large drop in forecasts. Yes, some of that is due to operational gearing, but the forecasting needs to be improved, and communication with the market more timely. So I’m not happy with this.

On balance, I’m neither a buyer (need to let the dust settle first, and think I’d want a lower price than the current 280p), nor a seller (as it’s fundamentally a fairly decent business, when the economy is operating normally, so earnings should recover in due course).

There’s always an outside chance of a takeover bid from overseas too, which we’re seeing a lot at the moment, hence why I’d rather just park my (smallish) position in PMP into a dusty corner of my portfolio and forget about it for a while, with the possibility of a nice surprise one morning that you can only benefit from if you actually hold the share (rather than sitting on the sidelines waiting for the market price to bottom out).

I’ve now been hit with 2 profit warnings this week from my top 20 value/GARP picks for 2023, which sounds bad. However the total 20 shares have barely moved, showing the value of a portfolio approach - now being up 4% YTD, as opposed to up 6% a week ago. In this type of macro situation, we just have to expect a few profit warnings. But we’ll also get some out-performers, and some premium takeover bids. So small cap investing is always swings & roundabouts, and not for nervous types.

Profit warnings happen, and is part of the process of owning small to mid cap shares. The winners usually outweigh the inevitable losers. And if it’s a decent, soundly financed business, we don’t have to panic sell anyway, it can just go into the long-term portfolio for an eventual recovery.

It previously found support around 300p, but that was when they were telling us that trading was going well -

Pendragon (LON:PDG) (Paul holds)

Up 1% to 17.5p (£245m) - H1 Trading Update - Paul - GREEN

Pendragon PLC (the "Group") today provides a post-close trading update covering the period from 1 January 2023 to 30 June 2023 and its outlook for the remainder of the year. Unless otherwise stated, figures quoted in this statement are for the six months ended 30 June 2023 and the comparative period being the six months ended 30 June 2022.

Interesting goings-on today with the Canadian bid for Lookers (LON:LOOK) apparently falling through. I take a close interest in the motor dealers sector, as it’s deep value, with low PERs, and usually very nice freehold property asset backing too. For the required disclosure, I currently hold PDG (bought recently on the Odey dip) and VTU shares personally.

This sounds encouraging -

The Group delivered another robust performance in the first half of FY23, with growth in gross profit more than offsetting the underlying pressures of interest rate rises and ongoing cost inflation.

As a result, the Group expects to report a c.9% increase in underlying profit before tax to c.£36.5m for the first half of FY23 (H1 FY22: £33.5m).

Net cash of £40m at June 2023 was much better than net debt of £23m at Dec 2022. Although bear in mind the listed car dealers have large working capital, with big fluctuations possible in inventories, trade creditors, and vehicle stocking loans. So I would expect net cash/debt to vary a lot. Even so, with interest rates higher, moving into net cash should save on finance costs. Note that the finance costs line in the forecasts has risen a fair bit, so stocking loans could be a nasty headwind, requiring effort to reduce inventories maybe, to mitigate? We need to be told the average daily net cash/debt (for all companies), as period end snapshots are of limited use, and are easy to manipulate.

Outlook - is in line for FY 12/2023, and interesting comments about used car supply remaining tight - this has helped boost profits at car dealers remember, so it’s a good thing! -

There were encouraging signs of improvement in production and supply of new vehicles during the first half, although used vehicle supply is expected to remain tight for the foreseeable future. The Board remains mindful of the influence that both high inflation and increased interest rates have on consumer sentiment, with the potential for these factors to impact demand in the second half.

However, the Board believes Pendragon's strategy, market-leading proposition and mix of business models means it remains resilient in the face of these challenges and it continues to expect to deliver group underlying profit before tax in line with Board expectations.

Paul’s opinion - looks fine to me. The valuation here is really striking, the StockReport has a fwd PER of only 5.7, so to get an in line update on such a low rating, is pleasing.

PDG also has a software division, which makes it potentially more interesting, say if that were to be hived off at a good valuation maybe?

Pendragon did have problems in the past, but I can’t remember the specifics, it will be in our archive.

PDG got up to about 29p on takeover talks with 28% shareholder Hedin Mobility Group AB late last year, so maybe bid interest might resurface? The whole sector is clearly in play, so I think it’s a nice idea to own several of them, so that you’re more likely to catch a premium-priced takeover bid.

Who knows how the macro position will play out? New cars are not really big ticket items any more, as so many people lease them. New car production seems to be gradually returning to normal, leaving a 2-3 year shortage of used cars, hence nice margins for a while yet.

Threats from EVs? Maybe, they need a lot less servicing apparently. Although more recently, I'm hearing that customers are pushing back, and don't want EVs so much, having seen how massively the refuelling cost of electricity can vary due to unexpected macro factors. Whereas the end user price of petrol/diesel was a lot less volatile (because most of the price is tax). Range anxiety is still a big issue, although likely to be resolved as battery tech improves.

At this valuation, I’m happy to stick with PDG indefinitely - why on earth would anyone be selling at this bombed out price?

Also, a lot of the VC-backed new entrants (online) will be running out of cash and retrenching, or going bust. So less competition for the traditional dealers like PDG.

Relationships with manufacturers is another complicated area.

Let’s see what happens, but overall I reckon risk:reward looks pretty good on PDG shares at 17.5p, within a portfolio where you know one or two are bound to go wrong, but hopefully the winners should mop up any such losses most of the time.

Fonix Mobile (LON:FNX)

Up 1% to 208p (£206m) - FY 6/2023 Trading Update - Paul - GREEN

Fonix Mobile plc, the mobile payments and messaging provider, is pleased to provide an update on trading for the year ended 30 June 2023 (the "Year").

This is a nice company, in a good profitable niche, with very sticky repeating revenues. It processes the payments for TV shows where viewers vote, or make charitable donations mainly by phone I think.

Checking our previous comments this year, the quick version is (for background) -

25 Jan 2023 - 219p - GREEN - solid H1 12/2022 TU. Strong outlook. High valuation justified.

3 Mar 2023 - 237p - AMBER - ITV partnership extended. Good, but too expensive at 26x PER.

17/3/2023 - 195p - GREEN - good H1 results , strong pipeline. Tempting to buy recent dip.

So as you can see, I like the company a lot, but quibbled over valuation at the peak.

On to today’s FY 6/2023 update -

Strong trading momentum continues with significant growth in international markets

Revenue & profit have grown, being “marginally ahead of market expectations”

Adj EBITDA up 13% to £11.6m. I have no idea why the company scores an own goal by reporting adj EBITDA, when actually adj PBT is very similar, at £11.0m, whereas many investors (including me) assume that EBITDA is an artificial, inflated number, but in this case it’s not! Most odd.

Finncap (many thanks!) puts through a c.5% uplift today, and now says 8.9p adj EPS for FY 6/2023, so a PER of 23.4x - not cheap, but remember FNX has such a reliable track record - it’s increased profit & EPS by 50% in the last 3 years, despite the pandemic & cost of living crisis - and the profit is also real cashflow, which is mostly paid out in growing divis (policy is 75% of earnings become divis).

If it can keep that growth going, then FNX shares should grow into the valuation.

There’s no dilution either, and all growth seems to be organic.

There are lots of very nice qualities about this business, I like it very much.

“100% retention of all significant customers” - very impressive. Customers use Fonix on the basis of: if it ain’t broke, don’t fix it, so I think it has a decent moat.

Confident outlook -

With high levels of repeating revenue, a strong run-rate entering the new financial year, recent tier 1 wins in the UK and Ireland as well as a growing pipeline of client prospects across all sectors and markets, the Board continues to be confident in the growth potential for Fonix going into FY24 and beyond.

"We are delighted to announce another year of strong profitable growth. We started the financial year with an ambition to be a market leader in a second territory within two years of launch and have achieved that feat in the first year. In recent months, we have announced significant new contract wins in both the UK and Ireland, underpinning our growth expectations for the year ahead and furthering our aspiration to be the world's leading provider of interactive services.

As well as clear growth opportunities in our existing markets, we now also have a proven template for success in international markets, which we will look to replicate and announce as and when other new territories are making a meaningful contribution to our growth."

Paul’s opinion - an intriguing hint above about further international growth - I wonder which countries they have in mind?

Based on continuing good performance, and possible overseas growth, I have to give FNX a thumbs up again, so am happy to stay at GREEN.

Yes it’s a little pricey, but it’s very high quality.

My only potential worry is over technological change. Will this activity become old hat in the future maybe? No signs of that now though.

An October 2020 pandemic float, this is a rare one that has actually worked out well! -

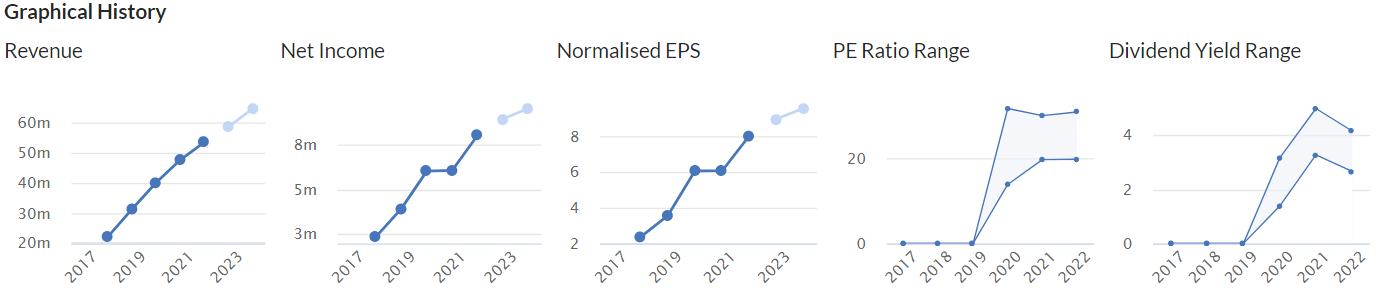

A terrific track record here -

Graham’s Section:

Volution (LON:FAN)

Share price: 384p (+0.4%)

Market cap: £758m

Volution Group plc ("Volution" or "the Group" or "the Company", LSE: FAN), a leading international designer and manufacturer of energy efficient indoor air quality solutions, today releases a scheduled Pre-close Trading Update for the financial year ending 31 July 2023…

This is a substantial international company with 20 brands.

I’ve remarked previously that I like the KPIs it focuses on, and thought the valuation might be interesting to investors after the sell-off that lasted from mid-2021 to mid-2022. The shares fell by around 50%, peak to trough!

Key points from today’s update:

Adjusted EPS will be towards the top end of current market forecasts. The consensus forecast is 24.4p, while the top end of the range is 25.6p.

Organic revenue growth at constant FX is around 5%

(Adjusted) operating margin maintained c. 21%.

Latest acquisition (£8.7m) due to complete in August 2023.

One slight weakness is the organic revenue growth, which remains below the level I’m looking for in this inflationary environment. The company cites “a challenging macroeconomic backdrop in which the rapid rise in interest rates has adversely impacted new build construction levels and consumer confidence”. There is no arguing against that - new build construction is under some pressure at the moment (see our comments on Springfield Properties (LON:SPR) yesterday)..

Interestingly, Volution says that it’s growing faster in the UK than it is in other geographies, thanks to demand for refurbishment RMI (repairs, maintenance and installation), while new build UK demand is underpinned by regulations. Continental Europe is weaker, particularly Germany and the Nordics, and revenue growth has slowed down in Australasia.

The CEO explains it like this:

Whilst higher interest rates, leading to higher mortgage rates, are dampening new build construction demand, RMI, which accounts for approximately 70% of Group revenue, has proved resilient enabling us to deliver Group organic growth of c.5%.

Op. Margin is maintained thanks to “pricing discipline along with robust cost control, value engineering initiatives and good factory efficiency”.

Balance sheet should still be fine. Net debt/EBITDA below 1.0x would in general be considered very low, so the company might continue making acquisitions confidently for the time being.

Graham’s view

Once again I reach the end of a Volution RNS and I feel better informed, without having suffered excessive jargon or any attempts to obfuscate.

As I said before, I like the company’s simple focus on operating margin, and I’m impressed that it continues to get that 20%+ figure it demands. My impression as an outsider is that this must be a disciplined, well-organised company.

Their “actual” operating margin is a little lower than 20%, but overall they have a good track record of quality earnings. Nothing spectacular, but very solid:

There is no founder at the heart of this story who has led the company from its very beginnings, and I don’t think any members of the management team have truly enormous stakes in the business, so that could perhaps be seen as a bear point.

However, I note that their CEO has been with the business since 2008 and has been instrumental in creating it in current form. Based on the director dealings he looks like a seller of shares rather than a buyer, but he does still own over 1% of the company. I would treat him as a “quasi-founder” - not the person who invented the business, but the person who invented it in its current form!

I’ll give this stock the thumbs up because I think there is a lot more to like about it than to dislike, and the rating is reasonable (PER 15x). Worthy of a second look!

Fuller Smith & Turner (LON:FSTA)

Share price: 600p (+3%)

Market cap: £366m (? - see below)

Fuller, Smith & Turner P.L.C. (“Fuller’s” or “the Company”), the premium pubs and hotels business, provides the following trading statement in advance of the Company's Annual General Meeting…

This sounds very good: like-for-like sales up 15.1%. It’s related to the post-Covid recovery: ”Increased tourism and events, along with workers returning to their offices, have contributed to like for like sales growth of 17.9% in our City and Central London sites.”

Buybacks - since business is going well, the company plans to buy back one million “A” shares (these are the shares listed on the stock market). It just finished a buyback of the same size whose purpose was to settle employee bonus schemes, but this buyback seems to be entirely discretionary.

Speaking of the “A” shares, I’ve had to dig deep into the footnotes of the company’s annual report, to find out about the share structure. The company has three classes of ordinary shares: A, B and C!

This goes back to the family roots of the business, as the “B” and “C” are held by founding families.

Let me try to summarise what I’ve learned. I think there are major implications for how we value the company:

A Shares - listed on the stock market. 39 million shares outstanding. Collects the normal dividend.

B Shares - not listed. Held by the families. 85 million shares outstanding. Each of these shares gets one vote but only one tenth of the dividend of the other share types.

C Shares - not listed. Held by the families. 13.5 million shares. Collects the normal dividend.

Total number of shares and total number of votes at meetings: around 137 million.

Things can get very confusing when you have shares classes with different voting rights and dividend rights.

For example, how do we calculate something simple like the market cap of this company? I can find several different answers, depending on which service I use!

What I would do to calculate market cap is to start with the FSTA share price. It’s the only share price that’s available, as the others aren’t listed.

I would then add the number of A shares and C shares together. But I would only add one tenth of the number of B shares, as those only collect one tenth of the dividend.

This gives a notional “share count” of 61 million shares. But if you ask anyone else, you will probably get a different answer!

At £6 per “A” share, I am therefore happy to consider Fuller’s as having a “market cap” of £366 million.

The point of the structure is that the families continue to control the company. The “B” and “C” shares together have over 70% of votes. Economically, however, they collect only about a third of the total dividend payments from the company.

Shareholders of “B” and “C” are restricted on selling their shares and the company rules imply that they should only transfer their shares to other “B” and “C” shareholders, or to certain family members, etc. So the families who founded these pubs and hotels should continue to own and control them for the long-term.

Let’s turn back to today’s AGM statement.

CEO comment excerpt:

…The hard work of our teams, coupled with London’s continued recovery, is driving strong sales momentum.

Our comprehensive strategy, combined with the investments we have made in our people, infrastructure, marketing and estate, is delivering excellent results; and while cost inflation and the ongoing train and tube strikes continue to present challenges, we are pleased with our progress.

Graham’s view

I like family-run businesses which are run for long-term dividends. This one has paid a dividend every year since 1992 (we must have some subscribers who weren’t born then!) with the sole exception of Covid-impacted 2020, when pubs were shut.

I also think the market cap may be a source of confusion, which could cause the shares to be mispriced. It may not be as expensive as it looks, after you factor in that the B shareholders only get one tenth of the dividends.

With what looks like a discretionary buyback looming, maybe the families are hoping to reduce their liability to pay out chunky dividends to the A shareholders?

I am going to give this one the thumbs up.

Long-term chart -

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.