Good morning, we have Paul & Roland on duty today. Sorry for all the typos in my (Paul) sections yesterday. I was en route back from a week in Malta/Gozo, and wrote my part of the SCVR from a Hard Rock Cafe inside Malta Intl Airport. Not the easiest place to concentrate in a packed airport, on my travel laptop! Also a framed cream jacket that Madonna had worn on stage somewhere a while ago, kept distracting me.

Agenda -

Paul's Section:

Gear4music Holdings (LON:G4M) - a mild profit warning for FY 3/2022, with EBITDA guidance lowered by 8%. Cautious outlook comments too, given macro conditions, which shouldn't really come as a surprise, but seems to have done, as the share price has opened down about 27%. Forecasts slashed by about half for FY 3/2023. Tough in the short term, but at some point the market might start anticipating recovery.

Card Factory (LON:CARD) - excellent news for shareholders, with details announced of a bank refinancing which removes the previous need for an equity fundraise. Risk:reward has therefore greatly improved. Although I think it remains to be seen if the company's longer term prospects are any good, considering online competitors now dominate that space. No divis for c.2 years, as bank debt takes priority. The bounce today is justified, but what happens after that?

Colefax (LON:CFX) - ahead of expectations update. Looks an interesting value share.

Roland's Section:

Newriver Reit (LON:NRR) - this retail property REIT has made good progress with disposals and deleveraging and appears to be nearing the end of a demanding turnaround. I’m impressed by today’s update and tempted by the high yield and potential value I can see here.

Churchill China (LON:CHH) - this family-owned AIM business supplies crockery to the hospitality trade. Sales rebounded strongly during the second half of last year and today’s results are ahead of expectations. The balance sheet looks bulletproof and cash generation is strong. The shares have fallen by 25% since 1 September. I think Churchill is starting to look reasonably priced.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Gear4music Holdings (LON:G4M)

360p (pre market open)

Market cap £76m

Gear4music (Holdings) plc ("Gear4music" or "the Group"), the largest UK based online retailer of musical instruments and music equipment, today announces a year-end trading update covering the 12 months to 31 March 2022.

This looks like a miss, so a profit warning. Given that the share price has already dropped by about two thirds from a peak around 1000p in Oct 2021, it’s difficult to know whether investors would sell on a slight profit miss, or sit tight? We’ll soon find out.

Key points in today’s FY 3/2022 update -

Revenue of £147.6m is down -6% on last year’s pandemic-boosted result. This is only a slight miss, as a drop in revenues from last year’s peak was already expected and flagged previously.

Overseas revenues are down -18%, compared with +5% for UK. So a key question mark is whether G4M can return to growth in overseas markets, with its additional recently opened distribution centres? The jury's out.

EBITDA guidance is now £11.0m - an 8% miss against £12.0m forecast market expectations (helpfully provided in footnote 3)

Weaker demand in Feb & Mar 2022 caused this miss against expectations.

Outlook comments sound cautious short-term, which shouldn’t really come as a surprise to anyone, given the much reported cost of living squeeze. That’s why the share price has already dropped by two thirds, as investors anticipated a slowdown -

Short term inflation-linked overhead cost pressures and weaker consumer confidence across the broader retail landscape will mean the best opportunities for stronger growth during FY23 are likely to be in H2. We are, accordingly, moderating our overall growth expectations for the new financial year, which we believe is the prudent approach in the current environment.

During what may be a more challenging FY23 H1 retail environment, sales and margins will be supported with good levels of inventory across our distribution centres, continuing expansion of our European operations to drive European website conversion, and sufficient working capital to continue investing where appropriate.

We believe we have the right operating structure to continue accelerating our market share gains and remain confident in our medium and long-term profitable growth strategy. We look forward to providing further details of our progress when we publish our full FY22 results in June."

Forecasts - many thanks to Singers for revised numbers this morning.

EPS is a much more useful figure than EBITDA, so I’ll focus on that, as usual.

For FY 3/2022, Singers is now forecasting 15.5p, down from previous expectations of around 20p. This gives a PER of 23 times, which looks too high now, so I imagine the share price is likely to take a dive today.

Probably sensibly, Singers is not expecting any earnings growth in FY 3/2023, with a drop to 14.9p EPS forecast (roughly halving from previous expectations for c.30p), then a recovery in FY 3/2024 to 18.8p - although I don’t think anyone can forecast accurately that far out, given all the uncertainties.

My opinion - I’m sitting on the sidelines at the moment with G4M. As mentioned previously, I was effectively forced to clear out or reduce a lot of positions held in a leveraged account earlier this year, and G4M had to go. There had been one too many large Director sales also, which tilted risk:reward downwards for me.

Would I be buying back in now? Not yet, because I think the valuation could reset further down, given today’s reduced expectations.

The other issue is whether it should still be valued as a growth business at all? The same quandary we have with lots of online companies, that did well in the pandemic, but are now struggling to deliver growth, and experiencing increased costs, squeezing profits. Can they re-establish a decent growth trend? We don’t know at this stage, although it seems to me the shift online for many sectors look permanent, not a flash in the pan.

On the upside, I think G4M is a fundamentally good business, is still profitable, and has an OK balance sheet. There have been acquisitions too, which should boost future profits.

As with everything consumer-related, it depends what your investing timescale is. We all know that short-term company profits are under a lot of pressure, so it’s perplexing why the market reacts so negatively when companies confirm the obvious fact that trading is more difficult at the moment. Hence share prices seem to be punished twice - once in anticipation of bad news, and again on release of bad news. At some stage, that’s going to mean some seriously good bargains, for the longer-term, but it’s a brave person who tries to predict the turning point.

I see G4M has just opened down 27% at 262p (market cap of £55m). It’s getting tempting at that level. It’s a fundamentally sound business, so why sell now, that it’s lost ¾ of its value due to a soft period of trading that should pass once the world has digested higher inflation? If the fall continues, then I’ll be looking to rebuild my position here, let’s see where the dust settles.

There’s nothing in today’s update that is a serious concern to me, it’s just going through a soft patch, as you would expect given the macro picture.

.

.

Card Factory (LON:CARD)

57.5p (up 27% at 09:13)

Market cap £196m

Excellent news for shareholders in this greetings card retailer.

The background is that stretched finances (way too much debt when the pandemic hit) put CARD at very high risk of needing to do a heavily dilutive fundraise, or at one stage it even looked a candidate for possible insolvency.

Hats off to management, as they’re managed to scrape through without dilution, as today’s announcement concerns a refinancing of the bank facilities, with no equity raise. That removes a significant risk, so I can see why the market has reacted so positively this morning.

To be fair, the situation was improving last year, as I reported here in Nov 2021.

Reading through old SCVRs to refresh my memory, this one in Jan 2022 flagged up that CARD was warning of a large increase in costs.

More recently, the share price has slipped down further, to almost 40p, but I think that was just the general market panic we saw, which affected almost everything in small caps, so not company-specific.

Today’s update - I’ll just summarise the key points, see the RNS for full details.

Card Factory, the UK's leading specialist retailer of greeting cards, gift, wrap and bags, today announces that it has agreed terms of a refinancing with its current banking syndicate.

Good progress made on reducing bank debt from cashflows.

Revised bank facilities agreed, of £150m (reduced from £225m previously).

Main facility is £100m RCF, available until Sept 2025.

The other £50m is now term loans, repayable in stages between 2023-25, so this limits any future divis, as cashflows are prioritised (rightly) towards debt reduction. Restrictions on divis likely to end Jan 2024, if debt:EBITDA is below 1.5x

Actual bank debt was £79m at 31 March 2022 - which looks reasonable, and is usefully down from £96.5m reported in the last interim results at 31 July 2021. Although note the balance sheet as a whole is still very weak, with NTAV negative at £(119)m at end July 2021.

For shareholders, this is the key part, and it’s really good news -

The best efforts commitment given by Card Factory to its banks, to raise net equity proceeds of £70m by 30 July 2022 has been removed from the revised facilities. The Board has no current intention of completing an equity raise.

Directorspeak sums it up well -

"I am pleased to be able to announce the successful completion of Card Factory's refinancing today. This is an important milestone for our business, ensuring we have the financial foundations in place to capitalise on the opportunities ahead. We are now well positioned to continue our strategic transition from a store-led card retailer to a market leading omnichannel retailer of cards and gifts. I look forward to updating you on our progress at our full year results next month."

My opinion - an excellent development, which I think management has handled with great skill over the last 2 years.

Remember that dilution/insolvency risks might often be avoided, but that doesn’t mean the risk wasn’t there. So shareholders at CARD got lucky by ignoring risk, rather than having any brilliant insight, in my opinion (especially in 2020, when the risk of dilution/insolvency was very high indeed).

It does worry me that we might be too complacent about balance sheet risk, because interest rates have been so low, for so long, that banks are usually happy to let problem debts reduce gradually over time.

What happens in a higher interest rate environment has historically been very different. If debts are constantly rising due to accrued interest, then banks tended to pull the plug.

Anyway, that now looks academic re CARD, which has reduced its debt a fair bit, and negotiated a good deal with the banks, for gradually reducing facilities. Hence no divis likely for a couple of years, unless it can pay down debt faster than planned.

Now that solvency/dilution risk has gone away, the big question is whether CARD can deliver a meaningful online performance? The CARD shops are nice cash cows, but what worries me is that online competitors in greetings cards are so well-established & have spent a fortune embedding their jingles & brand names into our brains, e.g. Moonpig (LON:MOON) ,that it might be too late for CARD to gain meaningful online market share? Or require such a big marketing investment that it might not be viable, and could cannibalise shop sales possibly?

So as things stand, I think the jury is out on how successful CARD is likely to be in future.

However, the key point is that at least we can now invest (if we wish) without the risk of a bombshell discounted placing being announced at a moment’s notice. That has to be seen as a big improvement in risk:reward for investors.

There’s also the current & impending squeeze on disposable income - how much is that likely to impact CARD? It’s not going to help, that’s for sure.

.

.

Colefax (LON:CFX)

650p (up 8% at 11:02)

Market cap £51m

I last reviewed Colefax here in 2014! It’s a luxury fabric & wallpapers designer/distributor, with 5 brands. Looking at its product website here, these look traditional designs, described as “timeless elegance”. The main difference with Sanderson Design (LON:SDG) (I hold) seems to be that Colefax outsources all production, whereas SDG has its own factories for at least some of its production.

Also, Sanderson is a bit bigger in terms of revenue, and makes a higher profit margin. Hence why SDG is about double the market cap of CFX.

Today Colefax says -

Since we announced our interim results on 27 January 2022 trading in our two major markets the US and the UK has been ahead of expectations reflecting strong demand for home-related spending. In addition our Decorating Division will deliver an exceptional performance this year due to the timing of completion of a major UK project.

Fabric Division profitability is highly operationally geared and as a result of higher than expected sales the Board now expects the Group's profits before tax for the year ended 30 April 2022 to be ahead of market expectations.

Like many businesses we are experiencing significant inflationary pressures so although demand is currently strong this adds a note of caution to prospects for the year ahead.

That’s good overall, although the caution on costs, operational gearing, and a major project, are all potential warning signs for us not to get too carried away with a strong year for FY 4/2022, as it may not be repeatable. There’s also the potential for macro/household budgets to come under strain. Although I reckon customers of luxury fabrics are not going to be worrying about the ‘leccie bill. So this could be a relatively safe part of the market when we’re worrying about a consumer downturn.

Market consensus is 68.6p on the StockReport for Colexfax. Actual is running ahead of that, but we’re not told how much. So maybe 75-90p is my guess? That gives an estimated PER of between 7.2 and 8.7 - an attractively low multiple. As always with PERs, it depends whether earnings can be maintained or grown from that level. Or should we be looking more at the historic earnings in a 20-40p EPS range as shown below?

.

.

The divi yield is very low, but the company seems to prefer doing buybacks, with a significant tender offer done in 2021. This creates an unusual situation where the share count has been steadily going down - so a nice share for people who hate dilution!

This is a hideously illiquid share, with the top 4 holders owning about 75%. Hence the quoted spread is extremely wide, but I usually ignore that, because the real price is usually well inside the spread. With an illiquid share you can even bid the market any price you like, and sometimes there’s a willing seller known to a market maker. That’s why generally the published quotes are best treated with a pinch of salt.

.

.

Interim results - I’ve had a quick look through, and the company’s doing well, with a strong balance sheet. The cashflow statement is positive too, a genuinely cash generative business.

My opinion - not a company I’m familiar with, but this share looks an attractive value share to me. It’s 6-bagged since the 2008 lows. Although looking at the chart, I’d be a bit worried that now may not be the right time to buy.

.

Roland’s section

Newriver Reit (LON:NRR)

Share price: 86p (pre-open)

Shares in issue: 308.2m

Market cap: £267m

Trading update - return to capital growth

“Portfolio returned to capital growth in H2”

This retail property REIT is focused on community shopping centres and local retail parks. It’s been through a difficult period, but a string of disposals have aided deleveraging and the stock now offers a tempting dividend yield of nearly 8%.

Today’s update strikes a positive note, reporting a return to capital growth for the REIT’s portfolio and strong cash performance. With the stock trading around below NAV and offering such a high yield, I’m wondering if this could be an attractive value opportunity.

Financial highlights

In recent years, I’ve had three main concerns about NewRiver:

- Debt levels

- The quality of its property assets

- The sustainability of its dividend

Today’s update seems to address all of these issues.

Portfolio valuation: NewRiver says that an independent valuation of its portfolio as of 31 March 2022 has shown capital growth of 2.5% during the second half of FY22 (y/e 31 March).

This compares to a 3.1% LFL fall in the value of NewRiver’s retail portfolio during the six months to 30 September 2021.

No updated net asset value figure was provided today, but NewRiver’s half-year results showed an EPRA NAV of 131p per share. I’d guess the full-year figure will be lower, as £69m of disposals were completed in H2, from a portfolio valued at £702m at the end of September. However, debt reduction might offset some of these disposals.

I’ve estimated an FY22 NAV figure of 120p-125p per share, but this is only a loose approximation.

Unsurprisingly, the portfolio’s capital growth has been led by retail parks, which performed strongly during the pandemic. However, the group’s Core and Regeneration shopping centres are also said to have returned to growth.

The only area of weakness was the group’s Work Out shopping centres. As their name suggests, these are troubled assets in line for disposal or repositioning.

Disposals and debt reduction: NewRiver has completed £305m of disposals since April 2021. The majority of this came from the sale of the Hawthorn pubs portfolio for £222m last July.

The majority of retail disposals are said to have been in line with last-reported book value. So not fire sale prices.

A combination of disposals and a return to capital growth have enabled NewRiver to reduce debt and leverage.

- Net debt was £222m at 31 March 2022, down from £493m one year earlier

- NewRiver’s loan-to-value ratio is now said to be under 35%, compared to 50.6% at 31 March 2021. The company’s guidance is for LTV of 40%.

These numbers look healthy to me. In my view, they put to rest any remaining concerns that the company might be forced into an unfavourable refinancing.

Cash performance, rent collection and occupancy: Rent collection for the year ending 31 March currently stands at 95% of rent demanded. Rent collection for Q1 FY23 said to be tracking ahead of the same period last year, as I’d hope.

Leasing volumes have improved and long-term leasing deals signed in FY22 were an average of 7.4% ahead of latest ERVs (Estimated Rental Values).

Occupancy remains stable at 95.6% (March 2021: 95.8%).

As a result of this solid occupational performance, underlying funds from operations are expected to be at the upper end of analysts’ estimates for FY22. Essentially, this is a measure of rental profits from the REIT’s portfolio.

This performance should mean that the forecast dividend is assured.

My view: NewRiver was already suffering from difficult retail property market conditions before the pandemic. The trust has been through a brutal downturn and I think CEO Allan Lockhart deserves credit for having made it this far without diluting shareholders.

Mr Lockhart now appears to have returned the business to a stable footing, with the potential for steady growth.

Although I wouldn’t want to overpay for NewRiver’s assets, some of which are fairly uninspiring in my view, I think the stock could be good value at current levels.

Based on my simplified NAV estimate of 120-125p per share, NewRiver stock could be trading at a 25% discount to NAV after this morning’s gains. When paired with a near-8% dividend yield, I think this could be an attractive high-yield stock.

.

Churchill China (LON:CHH)

Share price: 1,500p (+7% at 08.30)

Shares in issue: 11.0m

Market cap: £154m

“Full year results are ahead of expectations”

Churchill China supplies crockery to the hospitality market. It’s one of the leading players in this sector in the UK. Based on my random tableware inspections, Churchill’s client list includes J D Wetherspoon (LON:JDW) and many smaller cafes.

The company says that it saw a strong recovery in sales during the second half of 2021, as hospitality returned to normal. As a result, today’s full-year results are ahead of expectations. Let’s take a look.

Financial highlights: Churchill has always had a strong balance sheet and – in normal times – attractive double-digit profit margins.

Today’s results cover the 12 months to 31 December 2021 and suggest to me that we’re seeing a return to form.

- Revenue: £60.8m (2020: £36.4m, 2019: £67.5m)

- Operating profit: £6.1m (2020: £0.9m, 2019: £11.2m)

- Operating margin: 10.1% (2019: 16.5%)

- Adjusted earnings per share: 37.8p (2020: 6.5p, 2019: 81.7p)

- Total dividend: 24p (2020: nil, 2018: 20.3p)

- Net cash and deposits: £19m (2020: £14.0m, 2019: £15.6m)

- Cash generated from operations: £10.6m (2020: £1.8m, 2019: £11.3m)

Trading report: Churchill says that group sales during the second half of 2022 were 4% ahead of 2019 levels. Sales to the hospitality sector during the period were 7% ahead of 2019.

The company reports further market share gains and strong demand from customers. Although rising input costs are a potential concern, Churchill says that to date, these have been “offset by sustainable sales price increases”.

The company flags up its continued investment in UK manufacturing, a reminder that this Stoke-on-Trent business has a history stretching back more than 200 years. The Roper family, who took control in 1922, continue to control more than 20% of the stock:

Profitability: Given that 2021 was a year of two contrasting halves, I’m very encouraged by today’s numbers. An adjusted operating profit margin of 10% for the year seems very credible, when compared to the company’s historic performance.

Management expects a stronger margin performance in 2022 – broker forecasts ahead of today suggested that Churchill’s operating margin could return to 12% this year.

Free cash flow: My sums show free cash flow of £5.8m, giving a free cash flow yield of around 4%.

This compares to an after-tax profit of £4.2m for 2021, showing excellent cash conversion.

This level of free cash flow covers the dividend twice, making the payout very safe indeed.

Balance sheet: Churchill’s balance sheet is extremely strong, with net cash and equivalents of £19m, no debt and minimal lease liabilities.

I’d imagine that property and other fixed assets valued at £21m would also provide ample collateral, if the group ever needed to raise short-term funding.

We’re starting to see pension deficits fall as a result of rising interest rates. This is the case here. Churchill’s pension deficit fell from £10.4m to £7.2m last year. Although the company contributed £1.4m during that period, the majority of this reduction came from an increase in the discount rate used to value the scheme’s assets.

If this trend continues, I think that we could see pension deficits fall sharply across the market over the next couple of years, potentially leading to reduced employer contributions.

Outlook: Churchill says that productivity and margins are still being affected by “a less than predictable business environment”.

However, the company says that it’s benefiting from growing revenue and “record levels of demand”. So far at least, Churchill says its order volumes have not been affected by concerns that inflation could cause a fall in discretionary spending [on eating out].

Despite various Covid and geopolitical risks, management remain confident they can deliver an improved performance in 2022.

My view: There’s not much doubt in my mind that this is a good quality business.

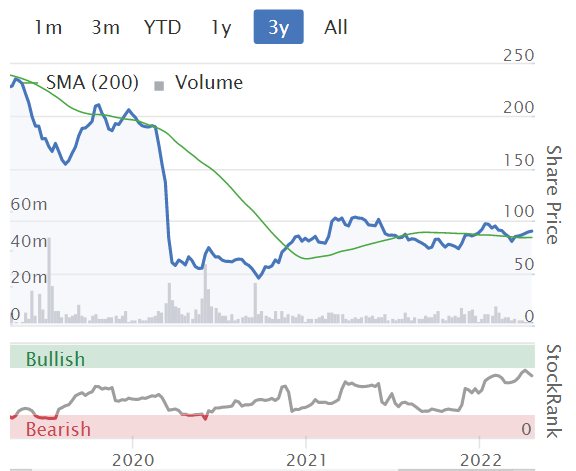

The question is whether the good news is already reflected in the share price. Ahead of today’s numbers, Stockopedia was flagging Churchill as a potential falling star.

The shares have fallen by 25% since we last covered the stock in the SCVR on 1 September last year.

Today’s numbers value the stock at 38 times earnings. Consensus forecasts for 2022 suggest this P/E ratio could fall to 23 times for the current year, with a prospective dividend yield of 2%.

These numbers don’t look cheap, but if we strip out Churchill’s net cash balance, the forward P/E falls to 20x for 2022. That doesn’t seem too unreasonable to me.

I’d like to pay a little less if I bought this stock. But in truth, I suspect that Churchill is probably fairly valued as a long-term investment at current levels. It’s a stock I’d be happy to own and tuck away for the next decade.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.