Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

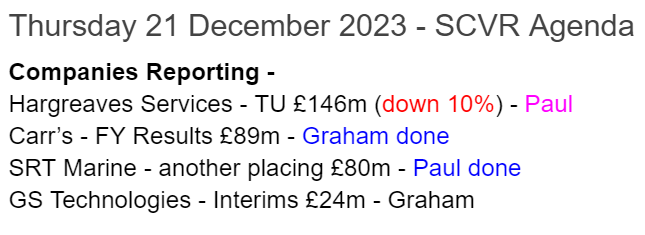

Summaries

SRT Marine Systems (LON:SRT) - 41.5p (y’day’s close) £80m - Equity fundraise - Paul - AMBER/RED

The financial position looked weak last time I reviewed SRT in Nov 2023, so the £10.5m fundraise announced today is welcome at reducing risk somewhat. I particularly like the £7m coming from a "strategic investor" in the sector. Overall, this company is erratic and has almost no visibility, so I'm still leaning towards a moderately negative view (but improved from red last time, to reflect the improved cash position).

Carr's (LON:CARR) - up 2% to 96.44p (£91m) - Full Year Results - Graham - AMBER

Expectations are unchanged at this group of agricultural and engineering businesses. The engineering order book has grown but profits are flat for now, while agricultural business is seeing reduced volumes and profits as inflation curbs demand. Quality seems average here.

Paul’s Section:

SRT Marine Systems (LON:SRT)

41.5p (y’day’s close) £80m - Equity fundraise - Paul - AMBER/RED

SRT, the AIM-quoted developer and supplier of maritime surveillance systems and navigation safety products, announces a strategic investment and conditional fundraising of up to approximately £10.5 million (before expenses) comprising a Subscription, Placing and Retail Offer (together the "Fundraising").

The net proceeds of the Fundraising are expected to fund working capital to strengthen the Company's balance sheet and facilitate the growth of both the surveillance systems and navigation transceivers businesses, with the outlook for these business as expected and reported in the Company's half year report on 20th November 2023.

The price is 35p, a discount of c.16% to last night’s closing price of 41.5p.

There are 3 elements to the fundraise -

Placing of £3m, with 8.57m new shares.

Subscription from a “strategic investor” for 20m new shares, raising £7m.

Retail offer for 1.43m new shares to raise £0.5m.

Who is the strategic investor? It’s Ocean Infinity, “a highly reputable marine technology company…”

Oliver Plunkett, CEO of Ocean Infinity, commented:

"Ocean Infinity is at the forefront of robotic technology deployed to gather data from the oceans. Creating a close and proactive relationship with SRT allows us together to offer clients a complete data solution, from acquisition to insights, for managing and securing coastal territories and beyond."

Dilution ? Not too bad -

Assuming full take-up of the Retail Offer, the New Ordinary Shares will represent approximately 13.48 per cent. of the Enlarged Share Capital.

Paul’s opinion - I flagged the considerable risks at SRT here on 20 Nov 2023, with a RED view, noting the £9.7m debt within current liabilities. So this £10.5m fundraise, after costs, will only offset that debt.

Recent interim results were poor, and current forecasts assume a gigantic H2 weighting in FY 3/2024 - which looks risky. This company is no stranger to missing forecasts.

Given the almost complete lack of visibility, it’s not possible to value SRT shares accurately, in my view. It’s had the occasional good year in the past, but then sunk back into losses subsequently. So how much can we rely on the expected profit this year?

On the plus side, I very much like that a £7m investment is coming from a strategic investor, in the same sector. That validates SRT considerably, in my view.

Given that short term funding issues are now resolved, I’m happy to shift upwards from RED to AMBER/RED, to reflect the range of possible outcomes here, and the great difficulty in predicting what the future holds, given the erratic performance of the past, very long delays in securing contracts, extreme H2 weighting baked into FY 3/2024 forecasts, etc.

Definitely a share for optimists only!

SRT shares have zig-zagged sideways for 18 years, with the same story -

Graham’s Section:

Carr's (LON:CARR)

Share price: 96.44p (+2%)

Market cap: £91m

Carr's Group plc (CARR.L), (''Carr's, the ''Company'', or the ''Group'') the Speciality Agriculture and Engineering Group, announces its audited results for the year ended 2 September 2023.

These results sadly show profits moving in the wrong direction:

Engineering: adjusted operating profit is only slightly lower than last year at £5.3m. The order book is strong at £60m (last year: £41m).

Specialty Agriculture: adjusted operating profit falls from £9.2m to £5.6m. There’s high inflation in this sector - so input prices are up, sale prices up, revenues up, and volumes down as the high prices suppress demand.

Here’s an overview given by the company of inflation in the agriculture sector. It sounds extraordinary:

In the UK, costs of the principal ingredient of feed blocks, sugar cane molasses, have increased by 70% over the past three years, which, with increases in other ingredients along with energy and labour, has necessitated a 45% increase in selling prices over the past two years. When combined with 45% increases in other feed costs, a 180% uplift in fertiliser prices and 60% on diesel, livestock customers limited their expenditure, particularly impacting UK sales volumes during a mild autumn in 2022 and winter 2022-23 that supported continued grazing for longer than usual. Feed block volumes sold in the UK were down by 18% on FY22, a situation consistent at all distributors.

Volumes in the US are down too, impacted by inflation and by three years of drought.

Adjusting items: the statutory results are £6m worse than the adjusted results.

£6m of adjustments include:

£0.9m amortisation

£0.6m restructuring/closure costs

£0.6m cloud-based ERP system

£3.8m goodwill and other impairments, triggered by higher rates.

If someone wanted to ignore the goodwill impairment I could understand that.

The other items are more questionable in my mind, especially the installation of a new ERP system. Companies need new software systems all the time!

So in my view the results aren’t “clean” and the adjusted numbers are too optimistic.

Net cash at year-end is £4m.

Outlook:

Trading conditions in agriculture remain challenging and the Board expects this to continue through the current financial year, while retaining confidence in prospects improving in the medium to long term. The Engineering division delivered a strong second half performance during FY23 and the order book levels will enable year-on-year growth during FY24, while also providing renewed confidence beyond the current financial year. At this early stage in the new financial year expectations for FY24 remain unchanged.

Graham’s view

This one seems priced about right to me.

I managed to avoid looking up the market cap before studying these results, so I was able to ask myself what it might be worth before knowing what the market thought! I came up with around £50m as a minimum valuation - a cheap multiple against the adjusted results, but more stretching if you don’t allow some or all of the adjustments.

It turns out that the market cap is c. £90m. It’s a more generous valuation than I’d want to pay for it, but it’s not outrageous:

The SCVR archives describe how this company has had some accounting difficulties in recent times, which even resulted in its shares being suspended.

While that issue should now be firmly behind it, more fundamentally I still don’t see signs of above-average quality here, either quantitatively or in terms of the company’s operations. Investors have plenty of engineering companies to choose from. And the fall in profits in this group’s agriculture division doesn’t inspire much confidence.

Come to think of it, I’m still unclear as to why these engineering and agriculture businesses should remain under the same corporate roof!

I’ll stick with a neutral stance on this one.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.