Good morning from Paul & Graham!

Agenda -

Paul's Section:

SDI (LON:SDI) - very good results for FY 4/2022. It's now on a forward PER of 17, but it looks set up to beat fairly soft forecasts. This is a very nice buy & build group, that is self-funding acquisitions in a high margin niche. Thumbs up from me, I think the current price could be a good long-term buying opportunity maybe?

S4 Capital (LON:SFOR) Sir Martin Sorrell's new PR growth company has crashed right back down to its original share price, and amazingly has dipped within our £700m and below remit here. It took me ages to run through the figures, and I unearthed enough to put me off, continuing my previous negative stance on this share over the last few years. That said, it could be worth a punt now, for a bounce? Not something I would want to own longer term though. Massive accounting adjustments, and B shares, put me off. Plus a weak balance sheet, and horribly rampy style in some of its communications.

Graham's Section:

Strix (LON:KETL) (£392m) - this suffers a reduction in its revenue forecasts for the current year, due to spillover from the Russia-Ukraine conflict. Earnings are not expected to be hit, due to optimism around an H2 recovery, the company’s ability to pass on cost increases to customers, and its own variable cost base. Investors have to trust that the company is not storing up a “real” profit warning for later in the year!

Strix is seeking to grow revenues aggressively by FY 2025 and will have to spend big to do this. Hopefully, the management team has the skills to safely pull this off.

Pensionbee (LON:PBEE) (£207m) (-2.5%) [no section below] - this is an IPO from last year (April 2021) that we’ve not covered before. The shares were originally priced at 165p (now at 93p). The company’s mission is to provide pensions in a more modern and convenient way - app-focused and mobile.

Today’s H1 trading update shows good growth in customer numbers and assets under administration (up 35% year-on-year to £2.7 billion). Annual run-rate revenues reach £17m, and the company hopes to reach positive adjusted EBITDAM on a monthly basis by the end of this year. Adjusted EBITDAM is adjusted EBITDA that also adjusts out any marketing costs - but marketing is a very significant expense for this business, so I’m not sure of the validity of this measure.

The company had cash of £44m as of December 2021. This matters, seeing as the cash burn for the immediate future is likely to be significant. Adjusted EBITDA is negative £15m for the six months to June 2022. My view: PensionBee is an interesting growth story but still at a very early stage, and difficult to value. Even after the share price has fallen by over 40% from its IPO price, the P/S multiple here is daunting.

Fulham Shore (LON:FUL) (£78m) (+6.3%) [no section below] - FY March 2022 shows a lovely bounce in trading, after Covid restrictions ended. The company has been very prompt with trading updates in recent months, so this has been well-flagged. Revenues of £82.7m are a new high, assisted by new site openings. The company now has 89 UK restaurants, compared to just 63 three years ago, and continues to expand.

PBT for the year comes in at £3.9m, while net cash has risen to £5.1m. Trading in the first three months of the current financial year is in line with expectations.

It’s interesting to look back on my notes from March 2020, when I was unsure if this company would survive an extended closure. I now see it as a survivor in a badly-damaged restaurant sector. Speaking from personal experience, I know that the food offering is excellent, differentiated, and reasonably priced. However, I’m not entirely sure that FUL is going to generate enough free cash flow to justify this market cap; the restaurant business is notoriously capital-intensive. Perhaps a takeover by a larger group is how shareholders will ultimately be rewarded?

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

SDI (LON:SDI)

148p (before market open)

Market cap £152m

SDI Group plc, the AIM quoted Group focused on the design and manufacture of scientific and technology products for use in digital imaging and sensing and control applications, is pleased to announce its final audited results for the year ended 30 April 2022, with profits ahead of recently upgraded market expectations.

Presentation slides - click this link for access to a download page for today's SDI results slide deck.

Webinar - on InvestorMeetCompany, details -

SDI GROUP PLC will be holding the meeting Full Year Results tomorrow at 22nd Jul 2022 at 4:00pm BST.

Headline numbers look good, and I like the layout below, with adjusted and statutory next to each other, so we can see how big the adjustments are - an issue that cropped up yesterday with Victoria (LON:VCP) where the numbers were adjusted to within an inch of their life! (with a hat-tip to shipoffrogs who flagged this in the comments yesterday) -

.

.

In the case of SDI, note 2 gives clear reconciliations between the adjusted and statutory numbers, and these look OK to me - the majority of the adjustment being stripping out amortisation of goodwill, which most people ignore anyway, so that’s fine -

.

I remember there was an issue which SDI previously flagged several times, whereby it had received a pandemic boost from some one-off orders.

SDI is making acquisitions, and seems to be disciplined & accomplished at this. Hence this share reminds me a bit of Judges Scientific (LON:JDG) . Although as stated in the highlights above, just over half the revenue growth was organic - impressive stuff.

PER - at 148p per share currently, the FY 4/2022 PER is 17.0 - which strikes me as fair, assuming profits are sustainable.

Updated forecasts from Finncap (many thanks!) out this morning show adj EPS only flat at 8.7p (FY 4/2023), and marginally rising to 8.9p (FY 4/2024), which wouldn’t justify a PER higher than 17. So bulls must be hoping that the forecasts are beaten. That looks fairly likely to me, given that forecasts don’t include any uplift for acquisitions. So I’m not getting fixated with the forecast PER. Although with some out-performance (which SDI tends to deliver), and bolt on acquisitions, it’s not difficult to imagine the PER might actually be in the low teens, rather than 17.

Outlook - sounds upbeat -

EDIT: note that the company says demand is likely to reduce for PCR (?) products at its Atik Cameras subsidiary, so that remains a headwind. End of edit.

The key growth drivers within our business remain organic growth and growth through acquisition. The Group is in a very strong financial position and has the resources and flexibility to support these key drivers. While mindful of the potential for further macro-economic turbulence and despite a challenging external environment, FY2023 has begun well.

In addition to reporting today FY2022 profits that are ahead of recently upgraded market expectations, I am pleased to report that the Group now expects to deliver FY2023 adjusted profit before tax* of not less than £11.0m, also being ahead of recently upgraded market expectations."

*before reorganisation costs, share based payments, acquisition costs and amortisation of acquired intangible assets.

And this -

Our businesses remain busy, and several are operating at full capacity with their current staffing. Finding good staff and circumventing supply chain issues are now part of daily business, and our managers have demonstrated their ability to solve these challenges and more.

We have budgeted for organic growth, and, although mindful of a possible consumer-led recession and levels of inflation that have been absent for many years, we have had a good start to the 2022-23 financial year and are confident that we can continue to trade profitably over the coming months.

The market for acquisitions appears buoyant, and SDI expects to acquire additional businesses in the 2022-23 financial year.

Finncap’s latest forecast is £11.5m adj PBT for FY 4/2023, so that looks a fairly safe forecast, and likely to be beaten, is my guess.

Balance sheet - as an acquisitive group, it is dominated by intangible assets of £36.0m (i.e. goodwill, because very little development spend is capitalised [good])

Working capital looks tightly managed, with both inventories & receivables looking quite modest for a £50m revenues group, at first sight.

Although the high gross margin of 64% means that inventories (stated at cost of £7.3m) are actually quite hefty, on reflection. A gross margin of 64% turns into a markup from cost to revenue of 2.76 times, so inventories of £7.3m would turn into revenues of £20m once sold, so it might be worth asking the company whether it has scope to reduce inventories?

Although I’m wondering if it’s deliberately stockpiled key components, due to supply chain shortages?

Overall, NAV is £35.8m, take off £36.0m of goodwill, and NTAV is slightly negative, at £(0.2)m. That’s not a concern, because the business is highly profitable & cash generative, so it doesn’t really need a strong balance sheet.

Further acquisitions, funded by debt, could turn the balance sheet more negative, so that’s just something to monitor.

There’s a presentational mistake (in my opinion) by combining bank debt (which is only small at £4.0m) with lease liabilities of £7.4m on the face of the balance sheet, calling the combined total “Borrowings”. These are fundamentally different things, so should be shown separately on the balance sheet, which many companies do.

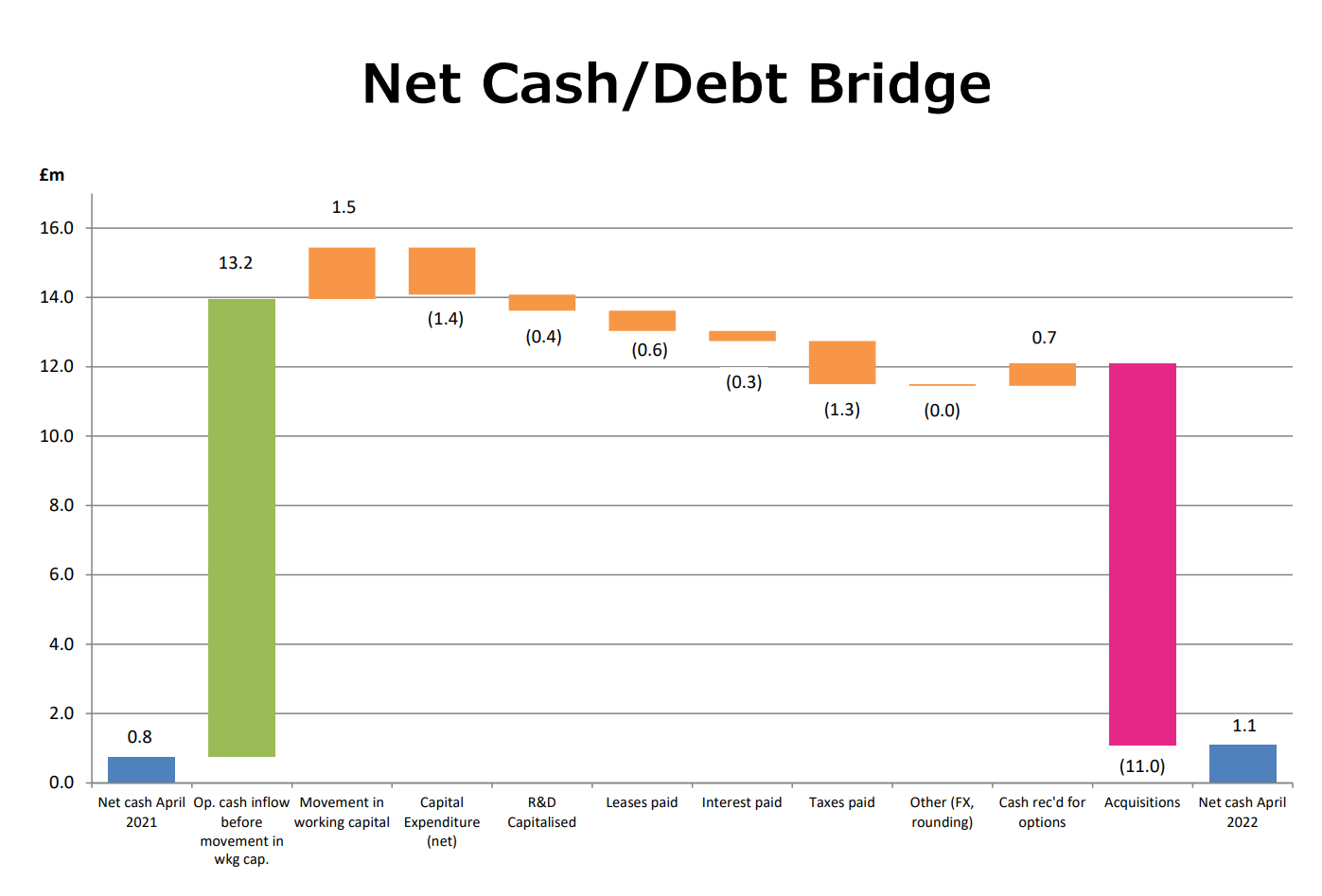

Making this adjustment, and considering the £5.1m gross cash position, means that SDI actually is in a net cash position of £1.1m. But we shouldn’t have to rummage through the notes or the commentary to discover this!

The commentary does include a section that states net cash is £1.1m, but it’s not prominent. I would have included the net cash figure within the financial highlights at the top of the announcement.

So a minor presentational own goal there, but hopefully my suggestion for improvement is helpful. There is no charge! ;-)

There’s an enlarged £20m+ £10m bank facility, giving scope to make some smallish acquisitions.

Anything big (over say £10m) would I think need at least to be partially financed with fresh equity. It’s not worth taking a risk, gearing up at an uncertain time like this.

Cashflow statement - looks good, this is a genuinely cash generative group.

The numbers are very straightforward - all the cash being generated by the group is being used mainly to fund acquisitions. As stated on the tin! Slide 16 displays this very well visually -

No funnies in there. I generally approve of SDI’s accounting - it looks prudent.

Going concern note - is fine, no issues.

My opinion - a solid thumbs up from me. The share price is only up 5.5% at the time of writing (08:29) - I’ll push the boat out here, and say I think this is a long-term buying opportunity, at 156p per share.

For the first time I can remember, the valuation looks quite modest, once you factor in the likelihood that forecasts are set to be beaten, and that more acquisitions are coming through. SDI has proven itself adept at making acquisitions in the past.

This looks a very nice buy & build, and attractively priced.

As with everything, I’ve no idea what the short-term share price might do - it could plunge if we get another panic sell-off. In which case, it would be sensible to buy more, providing nothing has gone wrong at the company itself.

Given SDI's good performance, this chart doesn't make sense to me!

.

.

EDIT: I have flagged this before to support, but there's a data error on broker consensus, which has SDI down as a "strong sell" - this is wrong! I'll chase them up about it again. So please ignore this bit on the StockReport -

S4 Capital (LON:SFOR)

114p (down 49% at 09:37)

Market cap £643m

It’s quite surprising to see Sir Martin Sorrell’s fast-growing digital marketing group reappear in our under £700m range here at the SCVR, as its peak valuation was well up in the £billions.

Although checking back through the archive, I took a dim view of this share in Jan 2021, saying it looked significantly overvalued and over-hyped. Also that it didn’t really make any real world profit back then!

Although before I claim too many smartass points, I did conclude (wrongly) at the time that Facebook looked a better bet for online advertising - and FB has dropped 25% since Jan 2021. SFOR is down 78% since then. So both have been poor, but SFOR especially poor.

Today’s price of only 114p is now all the way back down, to when SFOR was set up, as a rapid acquisition vehicle, hyped up on Sorrell’s outstanding track record previously building up WPP (LON:WPP) from nothing, to a multi-billion global PR/Marketing giant.

As you can see from the chart below, SFOR has been collapsing in price since markets peaked c.Oct 2021. Today’s additional 49% fall is due to a disappointing trading update.

.

My summary -

It’s a profit warning for H1 of FY 12/2022.

... the Company's EBITDA and EBITDA margin will be below its expectations for the first half of the year.

Revenue & gross profit are in line with expectations, at +25%

Higher staff costs have hit EBITDA.

Seasonality is for H2 weighting normally.

EBITDA guidance is lowered -

As a result, the Board has decided that it would prefer to lower expectations for its target EBITDA for the full year to approximately £120 million whilst maintaining the target of 25% like-for-like gross profit / net revenue growth. The Board notes that analysts currently forecast EBITDA in the range of £154-165 million.

Net debt -

Net debt at 30 June 2022 was towards the bottom end of previous guidance of £140-190 million, due to an improvement in working capital. The balance sheet remains strong with sufficient liquidity and long-dated debt maturities.

The balance sheet is not strong, it had negative NTAV when last reported.

Action taken - cost-cutting -

Significant cost reduction measures, including a brake on hiring and discretionary cost controls have been introduced already to better balance the growth in revenue, gross profit / net revenue and costs. The significant investment in financial controls, risk and governance as previously announced and budgeted will not be impacted in any way by these measures.

The problems are in the Content division, which was the bulk of the business in 2021 at 69% of gross profit.

Balance sheet - is weak. When last reported at Dec 2021, NAV was £801m, which included intangible assets (from acquisitions) of £981m, leading to negative NTAV of £(180)m.

Are the shares a bargain now? - target EBITDA of £120m still sounds pretty good, for a group now only valued at £643m. With say £140m net debt, Enterprise Value would be about £783m. So EV/EBITDA looks to be 6.5, which doesn’t seem excessive on the face of it.

How real is the EBITDA though?

I’m looking back at the 2021 Annual Report (because the RNS results are illegible, having been laid out in a super-wide page format - not very impressive from a communications group! Or maybe they don’t want us to look at the numbers?!)

Adjustments to profit are gigantic, as you can see - turning a £94.8m adj operating profit into a statutory loss before tax of £(55.7)m.

.

Following it through to note 26, you can see that the adjustments below mostly consist of £39.5m goodwill amortisation (fine by me), but £83.5m of acquisition related expenses. This is mostly “contingent consideration as remuneration” of £70.5m. What on earth does that mean? I think Graham unearthed something similar (on a much smaller scale) at Begbies Traynor (LON:BEG) recently.

This is a massive number, so properly understanding, and being happy with adjusting out this large cost, is the key issue here.

I don’t have a strong view either way, but am just flagging it, because the massive gulf between adjusted profit, and statutory losses, generally makes me uncomfortable. We also saw that yesterday with Victoria (LON:VCP) where the closer I looked, the less I liked the numbers.

It all smacks of financial engineering.

Acquisitions - seem to be funded half in cash, and half in S4 shares. That must mean that, by now, there will be a lot of very disappointed vendors, holding shares that are worth a fraction of previous highs. That could be a problem.

Cashflow statement - for FY 12/2021 does seem to show real cashflows, of £54.6m (operating) post tax.

That was spent on acquisitions & capex of £106.6m. Borrowings increased by £208.4m.

There was a big cash pile of £299.1m at end 2021, but also large borrowings offsetting that.

Year end net debt was £18.0m. That’s worsened now to c.£140m, presumably driven by the cost of more acquisitions in 2022.

Controlling shareholder - I stumbled across the enhanced rights given to Sir Martin Sorrell’s B shares, which I think is outrageous for a public company!

I wouldn’t invest on principle, as I think this structure is seriously wrong.

He’s 78 now, so what happens if his judgement becomes impaired somewhat, without being obvious, with old age between now and 2032, when this arrangement ends? -

My opinion - I’ve not done enough detailed work on this to form a definite view. However, my general impression is pretty negative, as it has been for several years.

I don’t like the massive adjustments in the accounts, and the weak, negative NTAV balance sheet. Worst of all, the communications from the company sound so breathlessly rampy.

It feels like an old man is in a hurry to recreate past glories.

Then we have the deteriorating macro picture, which can impact discretionary spend on things like marketing & PR. Although the sector remained surprisingly solid during the pandemic.

Having said all that, this is not a share I would want to own long-term, but there might be a nice trade here, for a bounce? Fevertree Drinks (LON:FEVR) has bounced strongly in the last few days. My worry is that such bounces could be short-lived, as traders bank the profits in such nervous markets.

My sector worry about digital advertising, is that the bright young things enjoying big wages, and cosy conditions, might be about to face a squeeze, with redundancies & less willingness to give generous pay rises? Has the sector peaked maybe, for now? Whilst I obviously understand that digital marketing is incredibly important for most businesses. Maybe price gouging by Google & Facebook might lead to companies placing less reliance on expensive digital marketing, who knows?

Graham’s Section:

Strix (LON:KETL)

- Share price: 188.86p (+2%)

- Market cap: £392m

This is a company with patents on kettle safety controls - but in recent years, it has diversified into related categories.

See here for a recent overview by the CEO. The company’s components are said to be used 1.2 billion times every day, by 10% of the world’s population.

What got me interested in this company originally was the claim to have high market share in kettle controls. The company maintains today that it still has 56% value share of kettle controls, globally.

Let’s get up to speed with this pre-close trading update.

- “Broadly in line with expectations” for after-tax profits in the current year. This usually means it is heading for a slight miss. Full marks to Strix for confirming that the consensus figure is £32.2m (only marginally lower than what you’ll find on the StockReport).

Unfortunately, this expectation relies on “an anticipated improvement in trading conditions in the balance of the year”. So if conditions don’t improve, perhaps we could be headed for a more significant shortfall versus expectations?

Strix does say that H2 is usually stronger than H1, and that H2 was resilient even during Covid-19. This offers some encouragement, that H2 will be ok.

Russia - Strix reveals that £5m - £7m of annual revenues (about 5% of total) is from “certain peripheral geographies” that are impacted by the Russia-Ukraine conflict.

I wasn’t sure what to make of this statement - what is the possible/likely impact on Strix from this? Is a total loss of this revenue on the cards?

According to a note from Equity Development this morning, it is indeed possible that all of this revenue could be lost: The overall impact potentially rises by a further £4m to up to £7m in total.

Balance sheet - the company previously reported net debt of £51.2m in its results for FY December 2021. But it is still looking to make acquisitions or buy technologies.

The growth ambitions are aggressive - it has a well-publicised goal to double revenues from FY 2020 to FY 2025. This means hitting sales of c. £190m, three years from now.

Revenue-based goals do strange things to companies. It will definitely be worth keeping an eye on the balance sheet here.

Analyst forecasts - Equity Development have reduced the revenue forecast for 2022 to £126m, but they barely reduce the adjusted EPS forecast at all (only from 15.4p to 15.3p). There is a lot of optimism that any cost increases will continue to be passed on to customers, and that the company’s own self-help measures will keep a lid on costs.

My view - the acquisition/growth strategy rests on Strix succeeding in new business areas. Its “Water Products” and “Appliances” divisions have grown significantly, and I expect more of the same: more M&A and many more product launches from acquired companies.

When this was a sleepy company focused on kettle safety controls, it was easier to analyse.

As with any management team, I will need some convincing that this company will be able to pull off a successful acquisition strategy. People with the skills to do this are rare indeed!

When it comes to valuation, the PE ratio is c. 12x. Given the short track record of Strix as an acquisition-led growth vehicle, and its smaller scale, this may be a fair rating at this stage of its journey.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.