Good morning from Paul & Graham!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Sorry we didn't get very far today, so I'll park today's report, and have a fresh look at some more agenda items tomorrow.

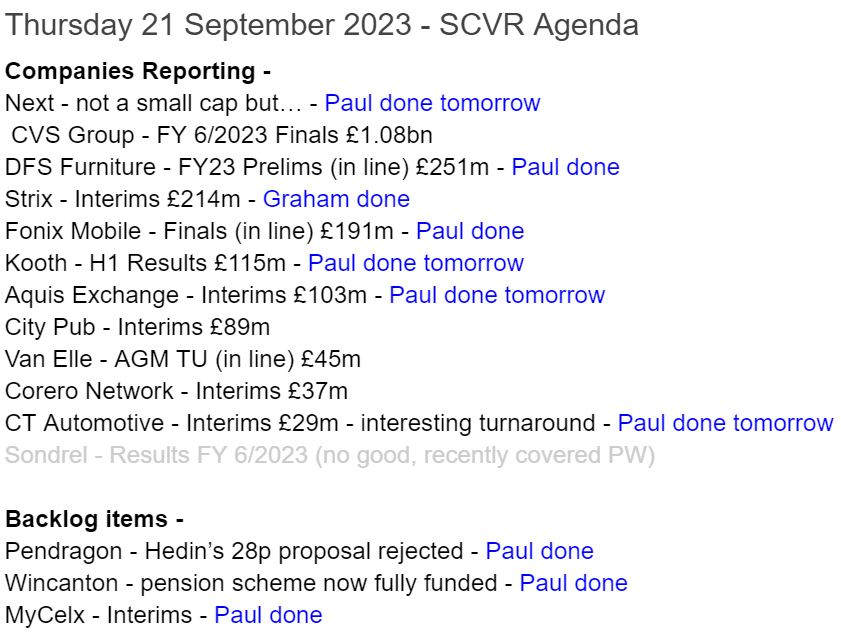

Summaries

Pendragon (LON:PDG) - up 14% to 27p (£377m) - Hedin takeover proposal - Paul - GREEN

Largest shareholder Hedin counters management proposals with an indicative 28p cash takeover bid, rejected by PDG management. I discuss the bull and bear points of both proposals below.

Wincanton (LON:WIN) - up 16% to 283p (£352m) - Update on pension scheme - Paul - GREEN

This has been on the cards for a while (mentioned here in Jan 2023 as a catalyst for the shares to rebound) - the pension scheme is fully funded for now, with the 2023 triennial valuation seeing the deficit completely eliminated (but possible it could come back in future). This results in a huge cashflow saving for WIN, and could open the door to higher divis. I remain positive on this cheap, well-run logistics group.

MyCelx Technologies (LON:MYX) - up 31% to 63.5p (£14m) - Interim Results - Paul - AMBER/GREEN

High risk, speculative idea - an old one has resurfaced from years ago, when it looked to have interesting tech to clean up polluted air & water. Still loss-making, and needs another cash raise I think, but there's good growth, narrower losses, and very bullish outlook comments. Huge potential market. Let me know what you think - strikes me as an interesting speculative idea, for risk-takers only.

Strix (LON:KETL) - down 40% to 54.5p (£119m) - Interim Results (profit warning) - Graham - AMBER

This stock hits an all-time low after it reveals poor results. Brokers have cut their forecasts for the rest of the year. Commentary by management is confusing and offers little comfort that they have control over the situation, and the leverage multiple is near the covenant limit.

Fonix Mobile (LON:FNX) - unch 192p (£191m) - Final Results 6/2023 - Paul - GREEN

Smashing figures, a really impressive niche business, that generates cash and pays divis. Expansion into Ireland has worked well, and further international expansion intrigues me as a possibility. It's difficult to ignore the quality here, thumbs up from Paul.

Paul's Section

Pendragon (LON:PDG)

Up 14% to 27p (£377m) - Hedin takeover proposal - Paul - GREEN

On Monday this week (18 Sept) I reviewed here PDG’s announcement that it has agreed to sell its main car dealer business to US car dealer Lithia in a deal that would result in a 16.5p dividend, and PDG then becoming a SaaS company operating its Pinewood Tech software business on a standalone basis. It looked quite a good deal, with Pinewood looking a nice business, which could then re-rate in the market. However I did worry that the disposal to Lithia of the core business looked as if it might be under-valuing the business.

The biggest PDG shareholder Hedin at 27.6%, did not give its approval to the deal.

The latest news came at 15:06 yesterday saying that Hedin had tabled an alternative deal, for it to buy PDG for 28p cash, subject to raising external debt funding, and doing due diligence. PDG’s Board has unanimously rejected this deal.

Paul’s view - a fascinating situation, which I missed unfortunately, having sold my PDG shares just before the deals were announced, oh well never mind. It’s difficult to say which is the better deal. I worry that management’s deal sells off the core business too cheaply, but quite like the focus on its software business and expansion into the USA.

Whereas the 28p proposal from Hedin also has attractions, in allowing shareholders to potentially cash out cleanly. Maybe if they sweeten it to 30p+ then management might capitulate?

It’s unusual to see management operating effectively in conflict with their largest shareholder at 27.6%. If Hedin’s advisers are on the phones, and are persuasive, it wouldn’t surprise me if they persuade other institutions to pull the rug from under management, and accept the Hedin deal. All fascinating stuff! With the market price now at 27p, small shareholders also have the option to bank your profits now if you want, or hold on in the hope for a sweetened deal from either party.

Wincanton (LON:WIN)

Up 16% to 283p (£352m) - Update on pension scheme - Paul - GREEN

This logistics company has staged an impressive recovery over the years, trading its way out of what looked an insolvent balance sheet years ago.

Excellent news today re the pension scheme’s triennial valuation on an actuarial basis. This is the much stricter valuation basis which pension trustees use to determine the cash payments required from the company to repair pension deficits. Clearly these actuarial numbers are what investors should focus on, ignoring the much more lenient accounting basis pension deficits/surpluses which are included in company accounts.

It’s a highly unsatisfactory situation at the moment, with two sets of rules for accounting for pension schemes, which confuses and misleads many investors. Always focus on the actuarial numbers, as that drives real-world cash requirements. There can be massive differences between the two sets of rules, so this stuff is very important to properly understand.

Great news yesterday - the previous 2020 actuarial valuation showed a huge deficit of £154m. This has now gone! The 2023 triennial valuation is now a £3.9m surplus.

This results in -

The Group and the Trustees have agreed that no further contributions are currently payable into the Scheme as a consequence of the 2023 valuation.

Prior conditions around shareholder distributions have been removed.

This is a massive saving on what would have been the case previously -

Previously, contributions for the year ending 31 March 2024 would have been £23.6m and £25m per annum from April 2024 to March 2027, growing in line with the Retail Prices Index.

The pension schemes haven’t disappeared though. So it is possible that in a negative scenario, some future pension deficit payments might conceivably re-emerge. For now though, it looks as if investors can probably forget about this issue, and enjoy the likely increase in divis.

Paul’s opinion - very good news, but not unexpected. I pointed out here on 13 Jan 2023 that the pension scheme was nearly fully funded - “Large pension scheme is a key issue, and could trigger a shares re-rating if it’s resolved (previously indicated it’s nearly fully funded). I remain positive, thumbs up - shares look cheap to me, for a decent, resilient business.”

There was a profit warning on 7 March 2023, due to the loss of a lucrative large contract with HMRC, but we stuck with our GREEN view of WIN throughout 2023 to date, due to the excellent value, good divis, and the pension scheme being close to fully funded.

With today’s good news confirming the pension scheme is now no longer a drag on cashflows or divis, that reinforces my positive view of WIN, so I’ll remain at GREEN.

MyCelx Technologies (LON:MYX)

Up 31% to 63.5p (£14m) - Interim Results - Paul - AMBER/GREEN

I researched this company with some investor friends many years ago, and we concluded that it has interesting technology, for cleaning up industrial pollution of water and air, with apparently some proprietary IP. However, financial performance has been weak generally, with the occasional good year as a one-off. So I think we must have sold up and moved on.

It caught my eye yesterday on the top % risers list, so I had a very quick skim of interim results to June 2023.

There are some signs of life here I think, so it might be worth a closer look for people who like more speculative ideas. Shares are very illiquid, with a wide spread.

H1 revenue $5.6m (up an impressive 51%), gross margin also up, at 45%. EBITDA loss has narrowed to $0.9m from $2.1m in H1 LY.

Cash looks tight at $1.4m, so I imagine another placing will be needed at some stage, but perhaps could be done on reasonable terms now that the company is producing more appealing numbers?

Commentary & outlook sounds super-bullish, talking about large markets, with big positives driving environmental cleanups. Says it has the best available tech.

Paul’s view - I’m intrigued by this, and will do some more digging. There could be a nice re-rating here, on a similar basis to the one I recently found with Plexus Holdings (LON:POS) (I hold) that has quadrupled in the last month, with the market catching up on previously ignored positive newsflow. MYX looks worth a closer look I think, but only for risk-takers.

Fonix Mobile (LON:FNX)

Unch 192p (£191m) - Final Results 6/2023 - Paul - GREEN

For background, this niche software/services company provides the technology behind TV viewer voting, so think reality TV, charity fundraisings, etc. Clients tend to be very loyal, because Fonix services never go wrong, and so switching to an untried competitor has only downside risk for the TV companies.

These types of TV shows run year after year, and I recall that Fonix says it has never lost a customer to a competitor, dominating this niche in the UK, and possibly also going the same way with its recent entry into Ireland.

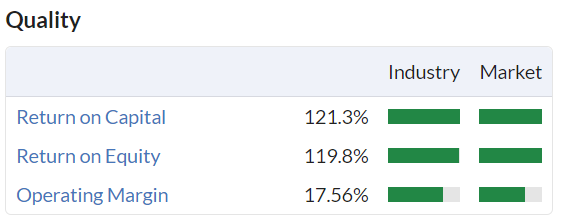

Since listing in Oct 2020, Fonix doesn’t seem to have put a foot wrong, and I think has earned its fairly punchy rating, due to an impressive track record as you can see on the Stocko graphs below. Note also the cash generation and generous divis, from its capital-light business model - lots of boxes are getting ticked here! -

FY 6/2023 key numbers -

Revenue £64.9m (up an impressive 21%)

99% of revenue is “repeating” in nature

Adj PBT £11.0m (up 13.5%) - note adjustments are small, and the profit margin is healthy.

Adj EPS 8.9p (up 10%) - PER of 21.6x - not cheap, but what do you expect for a quality business?!

Dividends - 2.36p interim paid, 4.89p final proposed = 7.25p total, yielding 3.8%

International expansion - this is the most interesting bit. Fonix launched in Ireland, and went from a standing start to 10% of total group gross profit, in one leap in FY 6/2023. The commentary says this very successful launch is now a blueprint for further expansion into other countries, which it says can be done with minimal additional costs. This is very interesting!

Outlook - strong start to FY 6/2024, in line with expectations.

Share based payments - companies are splitting very clearly into the hall of shame (Directors lining their pockets with multimillion charge to the P&L - eg Eagle Eye Solutions (LON:EYE) [I hold] springs to mind as a recent example), and the all of fame - eg Warpaint London (LON:W7L) recently, and I am happy to say Fonix too - only share-based payments charge of £125k for FY 6/2023, and £100k LY. Well done!

Balance sheet - hardly any fixed assets at all. It’s just working capital, with money going in & out. So NTAV of £8.2m is fine, it’s not an asset-based business.

Cashflow statement - couldn’t be simpler - it generates plenty of cash, and pays it out in divis. That’s pretty much it!

Paul’s opinion - as you’ve probably gathered, I really like this company's fundamentals.

I’m trying to think what could go wrong. Is the tech old hat, and could it be overtaken by something internet-based? Just because they’ve never lost any clients before, doesn’t guarantee that an aggressive new competitor might not surface and take business away. What about catastrophic systems failure from eg hacking? It must be an ever-present risk for time-critical, high volume revenue generation when TV shows go into voting mode.

Overall though, I think once again this company impresses me with its clean numbers, decent growth, and the potential for new territories to open up. Is it worth a PER of about 20? Definitely, I’d say. This could be a really nice little share to just tuck away and forget, collect in your divis, and who knows it might manage to expand overseas and see a step-change in performance over time? Something could go wrong that I haven't thought of though, so there's always risk, with everything.

Note management has plenty of skin in the game, another plus point.

Graham’s Section:

Strix (LON:KETL)

Share price: 54.5p (-40%)

Market cap: £119m

This producer of kettle safety controls, and various other related products, has issued interim results.

Commiserations to anyone holding this one overnight, as the shares have hit an all-time low:

Revenues are up significantly, thanks to acquisitions, but profits are significantly lower:

The numbers in this table have already been adjusted - actual PBT is only £4.9m (down from £7.9m last year).

Let’s try to make sense of what has happened:

Kettle controls: revenue down 17.2% to £28.9m, “with the cost of living crisis and the Russia/Ukraine conflict being the key negative drivers in regulated markets”.

Premium filtration systems: includes the acquired Billi businesses. This segment makes a new contribution of £21.5m to revenues in H1. Billi is being “successfully integrated in line with plan”.

Consumer goods: revenues down 6% to £14.9m, “driven primarily by softening of the appliances category market”.

So the existing segments - Kettle controls and Consumer goods - both saw significant revenue declines, and Strix’s overall revenue growth is purely a function of the Billi acquisition.

Net debt grew from £61m a year ago to £93m.

Leverage multiple (net debt/adjusted EBITDA) rises to 2.66x, which is towards the upper end of what would normally be considered prudent. This multiple was 2.2x at the time of the company’s full-year results (discussed here). The company is now seeking to get it back below 1.5x.

Given that leverage is currently too high, the interim dividend gets cut to just 0.9p (interim dividend last year: 2.75p).

Additionally, the company again pledges that “there will be no further M&A activity or investment into new factory builds, with significantly reduced capex and working capital over the medium term”.

It was precisely because the company promised to cease M&A and to reduce capex that I refrained from giving this stock the thumbs down earlier this year. It would be far more investable if the debt was under control.

Note that the debt covenant requires a leverage multiple of less than 2.75x. So there is very little room between that and the actual multiple of 2.66x.

The company is paying a floating rate on its main credit facility (3.5% plus the overnight rate). Finance costs jumped to £5m in H1 this year - more than 50% of the company’s operating profit was needed to service its debt.

Strategy

The company has new “Strategic Business Objectives”, and they are all based on revenue and gross profit targets. It could be worse - sometimes companies don’t even have a gross profit target, and end up gunning almost purely for higher revenues.

I don’t think investors should get too excited about these objectives. The company is clearly struggling to generate much in the way of bottom-line profits and these targets don’t focus on that problem.

The CEO comments, including outlook comments, are confusing to me.

"The continued macro headwinds have resulted in a reduction in demand in kettle controls in the key export regulated markets of UK and Germany during H1 and a slower than anticipated recovery. Whilst recent order rates are tracking in a positive direction, we now anticipate the path to a return of normalised growth to take longer and for there to be a decrease in the short term revenues within this category. The Group's second half of the year is always stronger than the first and weighted to Q4 driven by the replenishment of stock and normal seasonal uplift, the performance required in Q4 to achieve the full year outcome is lower than in 2022 and 2021.

If kettle control order rates are truly tracking in a positive direction, then why are revenues going to keep falling and why won’t it be getting back to “normalised” growth any time soon? And if the performance required in Q4 to hit 2023 targets is lower than before, then why have brokers cut their estimates for 2023?

I think these outlook statements have been overly dressed up, to the point where they simply don’t provide any real clarity or meaning to the reader.

Zeus have cut their adj. PBT estimate for 2023 by 22% to £23m, and have cut the 2024 estimate by 17% to £28m.

Graham’s view

I’m still reluctant to give this stock the thumbs down, because they have proven in the past that they have an ability to generate cash, and they should in theory be able to reduce their debt load.

Underlying cash generation in H1 was once again not that bad: £13.1m of net cash from operations, minus about £6m of capex and development spending, so about £7m in total.

However, that is before interest expense. Interest costs are now eating up substantial amounts of operating profit (on the income statement) and free cash flow (on the cash flow statement).

It’s not yet distressed, but in my opinion it’s clearly showing signs of vulnerability to financial distress, e.g. if macro conditions worsen further or if management makes tactical errors with cash management.

I also think that the poor outlook and the poor performance of kettle controls - whose prospects have been downplayed by management for some time - raise fundamental questions about the quality of the business. What are investors supposed to be excited about, when they buy Strix shares?

Are they supposed to be excited about future acquisitions, when the acquisitions carried out so far have led to the company’s profit shrinking and to a near-breach of banking covenants?

I’m going to (perhaps generously) leave my stance on this as neutral.

Paul adds: I think Graham's being very kind to Strix! I've never liked this share, it somehow doesn't pass the "sniff test" for me, and with debt now problematic and expensive, reading Graham's review above makes me want to run for the hills! So for me it's a firm RED! But as always, the writers here have our own independent opinions, and we love bull:bear debate, if it's kept civil :-)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.