Good morning, it's Paul & Graham here, raring to go!

** BREAKING NEWS - interest rates in UK rising 0.5% to 5.0% ** Source document is here on BoE website.

Do have a refresh read of the explanatory notes below, as I tweak them every now and then, and hopefully these points below help avoid misunderstandings. Especially important for new subscribers, who sometimes have unrealistic preconceptions.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

I might have to spend tomorrow morning doing backlog items for the micro caps, we'll see how we get on today. As always, we usually cover 5-6 companies, prioritising ones that over/under perform, or are in some other way more interesting to investors.

Summaries of main sections

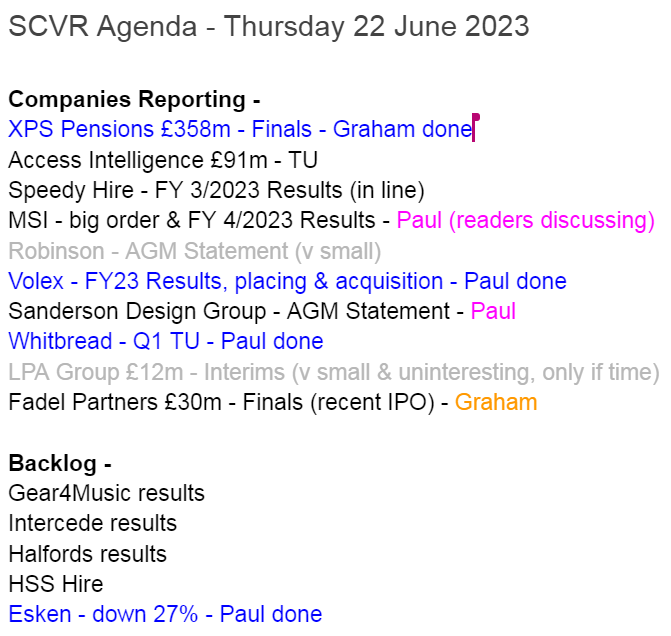

XPS Pensions (LON:XPS) - down 3% to 170p (344m) - Finals (ahead of expectations) - Graham - GREEN

These shares are slightly down today despite beating Canaccord’s estimates. What might initially strike investors as a boring investment consultant could instead be an impressive generator of inflation-proof, recurring revenues. I cautiously give it the thumbs up.

Fadel Partners (LON:FADL) - unch. at 147p (£30m) - Finals (in line) - Graham - AMBER

This is a newly-listed stock (IPO in April 2023) that provides enterprise software in the field of IP management. It did post a loss in 2022, even at the adjusted EBITDA level, and it’s far from clear that the $8m raised will see it to profitability. But I keep an open mind for now.

Quick Comments

Ocado (LON:OCDO)

Currently up 41% to 607p, adding almost £1.5bn to its market cap, now c.£5bn - on rumours of bid talks (The Times).

I've never understood the valuation of this share, which has seemed detached from reality for years. Terrible performance, yet it's still valued in the billions -

Bonkers volatility in its share price too, the market clearly can't decide what it's worth -

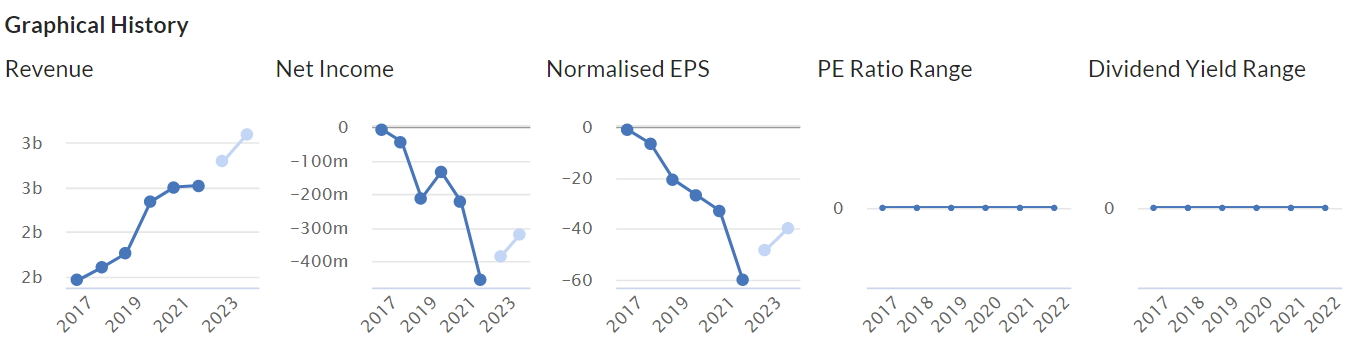

Whitbread (LON:WTB)

£6.8bn - Q1 TU - Paul - AMBER

For read-across to small caps? WTB these days is not a brewery any more, but instead owns Premier Inn hotels (840 hotels in total), Costa coffee, and several branded pub chains, eg Beefeater, and Brewers Fayre. That's from google, so I hope it is accurate & up-to-date. EDIT: no it wasn't, shame on you Google! Thanks to readers who corrected this in the comments, as Costa was sold in 2019. I'll go directly to company's own websites in future, here are WTB's current brands -

Strong trading, and positive outlook, for 13 weeks to 1 June 2023.

Premier Inns “outstanding performance”. Building market share as independent hotels “permanently decline”, and “lack of branded supply”. Doing £300m buyback, £103m done so far. Extended undrawn £775m RCF to May 2028. Food & beverage division also trading well, with total sales up 10% - so keeping up with inflation & wage rises.

Paul’s opinion - shares have had an excellent run recently, and look fully valued now at fwd PER of 19.7x. No sign of consumer caution hurting it, seems to be trading fine, for now. Is it a case of quality businesses hoovering up market share in a downturn? It looks that way to me. Something to bear in mind for other shares & sectors I think - the strong get stronger when conditions are tough, and gain market share as financially & operationally weaker companies go under. Also, as consumers, maybe we should be focused on supporting smaller, independent businesses wherever possible, as some people already do.

Paul's Main Sections:

Esken (LON:ESKN)

Down 27% to 2.7p y’day (£28m) - FY 2/2023 Results - Paul - RED

This is a special situation, where the group owns Southend Airport, and a sizeable renewables business. It is trying to sell both. It has recently relied on an expensive £50m debt facility, on top of other large borrowings, which it says should be repaid from the renewables disposal, which has to happen before Dec 2023 according to the going concern statement - essential reading!

Total net debt is massive, at £290m. It seems to be saying that once the disposals occur, “the remaining value will be returned to shareholders” - suggesting a surplus after disposals.

NTAV is negative £(15)m, so assets will need to be sold for above book value in order to clear the debt, let alone pay shareholders anything.

So it all hinges on what prices will be achieved from the disposals. Note this key bit in the going concern note -

Overall, the Directors are satisfied that the Group will have sufficient funds to continue to meet its liabilities as they fall due until at least 30 June 2024 and therefore have prepared the financial statements on a going concern basis. However, as previously noted this is highly dependent on the successful completion of the Group's disposal plans, which indicate the existence of a material uncertainty related to events or conditions that may cast significant doubt on the ability of the Group to continue as a going concern and, therefore, to continue realising its assets and discharging its liabilities in the normal course of business.

Paul’s opinion - this looks very high risk, therefore I have to mark it as RED.

Shareholders could get lucky, if good disposal proceeds are obtained, and are enough to pay off all the considerable debt, and if funds are received in time. Lots of ifs.

The danger is that potential asset buyers might do their due diligence now, but then hang back and wait for it to go into administration in 2024, then buy the assets for a song from the administrator.

Therefore I think it safest to assume the equity could end up being worth nothing.

This is a complicated special situation, not suitable for ordinary investors, unless you really know what you’re doing, and have done deep research. Occasionally though, special situations like this can be lucrative, and I have no idea how this might pan out. But my job is to flag the risks to you, then you can make up your own mind whether risk:reward appeals to you or not. For me, there has to be much clearer upside before I would want to risk any money on this, so I’m not going to spend any more time digging any deeper.

If any readers have done research on this, then do please share your views. The key question is: how much money will be raised from the disposals? It sounds like the end result will be a cash shell, so how much cash (if any) will remain after all the disposal & shutdown costs? If it’s nothing, then the shares are likely to be a zero. Why get involved?

The shareholder register at ESKN is like a who's who of special situations investors! (who don't always get everything right, but are certainly very clever). With this lot in control, I'd say de-listing and/or heavy dilution on a refinancing are both huge risks. Small shareholders could easily end up being hung out to dry by these sometimes aggressive shareholders -

Volex (LON:VLX)

Volex (AIM: VLX), the specialist integrated manufacturer of critical power and data transmission products...

Fundraising & Acquisition

Key points -

- Placing & retail offer to raise c.£60m, remainder funded by existing debt facilities.

- Fundraising at 275p, which is roughly where the share price has been averaging for May & June, so that looks fine to me.

- Part-funding another (big) acquisition in Turkey, called Murat Ticaret, which makes complex wiring harnesses.

- Total consideration up to 178m Euros (E136.5m initial cash, then E41.6m deferred, subject to performance over 2 years).

- Valuation looks attractively modest, at 5.3x EBITDA (an EBITDA multiple seems to be the method used in many takeovers).

- Volex’s pro forma net debt will be 1.5x EBITDA, with a “clear pathway” to reduce that to 1.0x “in the medium term”. These are generally not seen as problem levels of debt. Although we do have to remember that debt is now a lot more expensive than it has been for the last 15 years.

Paul’s opinion - this looks an attractive deal, and the fundraising is on good terms, which don’t disadvantage small shareholders.

The StockReport shows Volex itself is on a EV:EBITDA of 10.8, so buying something at about half that rating is clearly good business! That’s the textbook way to build value in an acquisitive group - buy cheaper than your own shares are rated, and part-fund deals with debt, which is then repaid by the acquired company over several years. Rinse & repeat! It seems to me that Volex is priced as a value share, but is actually an effective acquisition growth company. That means scope for a re-rating once markets become more bullish again maybe?

It’s one of my top picks for 2023, and so far the story is panning out well I think, despite tough macro.

Volex plc (AIM: VLX), the specialist integrated manufacturer of critical power and data transmission products, announces its preliminary results for the 52 weeks ended 2 April 2023 ("FY2023").

Key numbers -

- Revenue up 18% to $723m

- Underlying PBT up 15.4% to $59.3m

- Underlying basic EPS 30.2 US cents, up 12.3% (this looks to be slightly ahead of expectations of 29.2c shown on the StockReport)

Adjustments from statutory profit to adjusted profit are quite sizeable, at $13.5m, here’s the breakdown in the table below. I’m fine with goodwill amortisation being removed (the biggest item, highlighted). But share options are really remuneration for mgt, so I would add that back in, for valuing the company -

Outlook sounds positive to me -

We entered the new financial year with good momentum, with high levels of customer demand. Our supply chains are now much improved and are therefore enabling us to step up production, particularly for high value-add complex products.

With a diverse offering, proven success in attracting and retaining customers, and extensive experience operating in our highly attractive markets, we believe that Volex has the potential to grow significantly.

We are confident that with a strong strategy, clear demand for our products and solutions, and ambitious team members, we will continue to make excellent progress towards our five-year plan financial targets.

Balance sheet - the obvious danger for acquisitive groups, is that the balance sheet gets hollowed out and ends up being a massive pile of worthless goodwill.

As at 2 April 2023, VLX had $124m of intangible assets. NAV was $233m, so NTAV is $109m, which looks OK to me.

Working capital is healthy, with a current ratio of 1.62, no concerns there, that's quite good.

Finally, long term bank debt is $89.6m, which is fine for the size & profitability of the business, I think. This will obviously go up with the latest large acquisition, but not by an excessive amount, plus the balance sheet will be bolstered by the fresh equity being raised.

Overall then, I think this balance sheet looks fine, before and after the acquisition.

Paul’s opinion - very positive, I really rate this company, under owner-manager Nat Rothschild. Without wishing to be vulgar, with a name like that, I don’t suppose bank facilities are ever likely to become a problem! Since he took over, progress has been excellent, with a string of apparently value-adding acquisitions, and a comprehensive turnaround in the original business too.

Yet shares remain on a lowish multiple (fwd PER) of only 12.1

Bear in mind profit forecasts will now rise significantly, as the new acquisition kicks in, but there will also be dilution which looks to be about 13%.

With a solid outlook statement too, talking about strong customer demand, and increasing production now supply chain problems are easing, this all looks rather good to me.

So it’s another thumbs up, I’ll remain GREEN. This was a podcast mystery share on 18 April at 247p, and is one of my top 20 picks for 2023, and after today’s good news, I’m happy those were good decisions.

Historically VLX shares have been volatile, but I should point out the previous problems were due to low margins, and over-reliance on one lucrative customer (believed to be Apple). The business is now much bigger, and more diversified, with I think much stricter financial controls & strategy, so it's making good, and apparently sustainable margins now. That's what we're told anyway, and the numbers seem to support that story. But as with every company, outside shareholders don't really know what's going on under the surface, we have to trust management to a large extent.

UPDATE: Results of Fundraising RNS has just come out. It confirms, as expected, 21.82m new shares are to be issued, at 275p, a 3.8% discount to last night, raising £60m before costs. One point I forgot to mention before, is that Directors have contributed £15m, a quarter of the total, very impressive - substantially all of that is from Nat Rothschild. It's a 13.7% expansion of the existing share count. Total share count will now be 180.9m shares.

Sanderson Design (LON:SDG)

Up 2% to 130p (£93m) - AGM Statement - Paul - GREEN

Sanderson Design Group PLC (AIM: SDG), the luxury interior design and furnishings group…

Headline -

"The Company continues to trade in line with the Board's expectations for the full year"

Here are my notes from 27 April, where I reviewed the FY 1/2023 results, quite helpful in quickly getting up to speed on the background.

Broker forecasts were cut sharply in Oct 2022, but have since barely moved, save a slight reduction dated today (it looks like this has been updated in real time, which I didn’t realise they did, so that’s very timely, which is good).

Today’s update is also confirming trading in line. It’s irritating that they refer to the Board’s expectations, when they should be saying market expectations, since it’s a reference to the full year results (not a part-year, where Board expectations is acceptable). Why introduce doubt, when you don’t need to?

"The Company continues to trade in line with Board expectations for the full year, and has a robust net cash position. We have a strong portfolio of brands, an exciting pipeline of product and licensing opportunities and we continue to benefit from our business mix, which is currently being led by the strength of our licensing activities. We look forward to providing a further update on trading in the half year to 31 July 2023 on 8 August 2023."

Valuation - many thanks to Singers for an update note, which leaves forecasts unchanged - adj EPS of 12.9p, so a PER of 10x - attractive in normal market conditions, but maybe sensibly cautious in the current volatile macro situation?

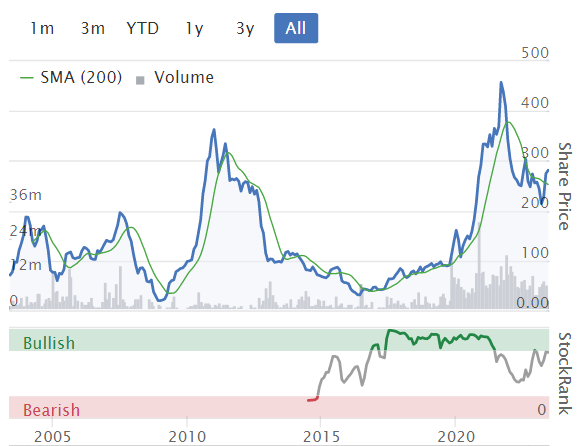

Paul’s opinion - still one of my favourite top 20 shares for 2023 (and beyond). As mentioned before, there’s got to be a chance that difficult macro might trigger a profit warning here, which is probably why the PER of 10x looks modest for a decent quality company, sitting on a lovely balance sheet, with added value of the immense design archive (that generates lovely, high quality licensing revenues). I also see SDG as a potential bid target, as this is a unique company really. So if we sit on the sidelines, we could miss a takeover bid, However, holding the shares also involves taking on some short-term risk from a possible profit warning. Strong licensing revenues have so far saved the day, offsetting reduced demand elsewhere in the business, so all good so far. I think the CEO is excellent too, very backable, having done a lot of really sensible stuff so far.

Overall then, I’ll remain GREEN and keen on SDG, on fundamentals, as a long-term hold I'd say, not a trade. Although there is that risk it might warn on profits if the economy gets a lot worse, so as with so many shares right now, it depends on your risk tolerance, and your holding period. That’s why the valuation is cheap, as it’s building in some slack for possible future disappointments. I would be inclined to treat any future profit warning as a buying opportunity, because the fundamentals are so sound.

Looking at the long-term chart below, I think a lot of the problems that began in 2017 were self-inflicted by previous management, since sorted out under Lisa Montague. It got through covid well too. There's been no dilution, since the balance sheet is so robust. Hence I reckon it's probably only a matter of being patient, before the previous highs are regained. Could be a long wait though, depending on how macro pans out. There's a 2.8% dividend yield to keep things ticking along whilst you wait.

Graham’s Section:

XPS Pensions (LON:XPS)

Share price: 170.5p

Market cap: £344m

XPS Pensions Group plc ("XPS" or the "Group"), the Pensions Advisory and Administration business, is pleased to announce its full year results for the year ended 31 March 2023 ("FY 2023").

Some might consider this stock to be unexciting, but the growth figures it announces in today’s full-year results are a lot more exciting than you’ll find at many other stocks we cover.

We have 20% revenue growth and 24% growth in adjusted EPS, with numbers that are ahead of expectations:

The revenue growth was driven by “strong client demand, inflationary fee increases and bolt on M&A”.

Organic revenue growth was impressive at 17%.

As we have previously mentioned in this report, XPS benefits from inflation-linked price increases, so there’s a lovely hedge for investors in inflationary times.

I note 24% growth in Pensions Consulting revenues, and 31% growth in Investment Consulting revenues. This was partly driven by inflation but also by “strong client demand due to regulatory changes and market volatility”.

The changed interest rate environment, while bad news for many investors, is in my view good news for those who provide advice to investors, i.e. it’s good news for pension and investment consultants such as XPS.

XPS also achieved stunning 54% growth in revenues from its Self Invested Pensions platform, although this was boosted inorganically by an acquisition.

The company isn’t lacking in confidence and explains its success as follows:

Sixth consecutive year of growth since listing - performance underscores the non-cyclical and resilient nature of the business

Strong growth in higher margin value-add services including Risk Transfer, DC Consulting, Scheme Secretarial and Corporate Consulting - areas where we have significantly bolstered our capabilities in the last two years

Good new business performance - winning new clients across all our business units

Outlook

We expect the demand for our services to remain high as we help our clients navigate the complex and evolving regulatory backdrop as well as economic and financial market developments. We have continued to grow market share, but with this still under 10% there are continued opportunities to grow, supported by both market and regulatory tailwinds. We expect the operational gearing that has come through this year to be a continued feature of our results in the future.

The Group has made a strong start to the new financial year with continued high levels of demand for our services particularly within Advisory and further success in winning new business. We remain confident in delivering against our expectations for the current year.

Adjusting items - the main negative feature of the accounts that I’ve found so far is £14m of adjusting items. So adjusted EBIT of £37m turns into just £23m of “actual” EBIT.

Adjusting items include (and they don’t add up to £14m due to rounding errors):

£3m of corporate transaction costs

£5m of share-based payments

£7m amortisation of acquired intangibles.

I think many (most?) investors would agree that the cost of share-based payments should not be adjusted out, as they are a real cost borne by shareholders.

As for the other items, I am happy to adjust out the corporate transaction costs but I have mixed feelings about amortisation. My instincts would be to permit about half of the £14m of adjusting items to be excluded from earnings.

Dividend - the full-year dividend is 8.4p, implying a high payout ratio on 12.6p of adjusted EPS.

Net debt is significant at £55m although the leverage multiple (over adjusted EBITDA) is ok at 1.38x. The debt is an RCF expiring in 2026.

Estimates: today’s results are ahead of Canaccord’s estimates (adj. PBT higher by 5% than forecast), and they raise their adj. PBT estimate for the current financial year by 6% to £35.5m.

Graham’s view

I am close to giving the share the thumbs up. It has several positive features:

Recurring, inflation-linked revenues

Very good organic growth

Tailwinds from the economic/regulatory environment.

Strong earnings momentum; estimates for the current year were already raised twice and were still beaten in today’s results.

On the other hand:

£37m of adjusted EBIT isn’t entirely real; some of the adjusting items should not be excluded.

The market cap needs to be adjusted higher by £55m of net debt (which is floating rate).

Enterprise value is around £400m.

On balance, I think I’ll give this share the green light because my main gripe is only that it’s a little expensive. But if it hits its 2024 estimates and if adjusting items can calm down, then I don’t think the rating is all that high.

Fadel Partners (LON:FADL)

Share price: 147p (unch.)

Market cap: £30m

Firstly, let me say that I’m not sure there is any liquidity in these shares. So I’m inclined to keep this piece very brief.

According to Stockopedia, 90% of shares are held by top holders, which obviously doesn’t leave much for anyone else:

The stock listed in April 2023, and it seems like nothing has happened with the shares since then - the chart is just a horizontal line.

The New York-based company provides “brand compliance and rights and royalty management software”.

Here are the full-year highlights for FY December 2022.:

Revenue up 10% to $13m

Recurring revenue up 34% to $9m thanks to the acquisition of UK-based IDS.

Loss-making at the adjusted EBITDA level.

The company finished the period with net cash of $0.1m and gross cash of only $1.2m, but it then raised $8m (gross) from its AIM IPO.

CEO comment (he is also a 16.5% shareholders):

Following our successful IPO in April 2023, we have started deploying the funds raised in line with our strategic objectives to accelerate our growth. These include key strategic hires such as our recent addition of a global Chief Revenue Officer in June 2023, the rollout of a number of Brand Vision products at key clients and the strengthening of R&D to widen our competitive moat and expand our market share."

I am pleased to report that trading in FY23 has been in line with expectations…

Later, in a section headed “market opportunity”, he adds:

The demand for solutions to effectively manage digital content and intellectual property (IP) licensing is increasing across industries, geographies, and channels. In the area of rights and royalties, where IPM Suite operates, a notable portion of companies still rely on traditional custom-built legacy applications and spreadsheet-based methods for licensing and royalty management. These methods often involve large teams and outdated royalty monitoring and collection systems that are no longer suitable for current needs.

What FADEL apparently provides is a modern, enterprise solution to IP management.

FADEL itself is switching from a “professional services” model to a licence/subscription:

Graham’s view

Like everyone else who has only come across this stock for the first time, I’m new to it so I’ll keep an open mind.

Losses in 2022 don’t concern me, given the size of the business and the stage it’s at, although it’s important that cash burn is managed. If I find that cash is burning to such an extent that a raise will be needed in the foreseeable future, it’s inevitable that I’ll be taking a negative view on shareholder prospects.

For now, however, with $8m raised and with only around $2m of cash outflows last year (according to the cash flow statement), I’ll take a neutral stance.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.