Good morning, it's Paul & Graham here!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

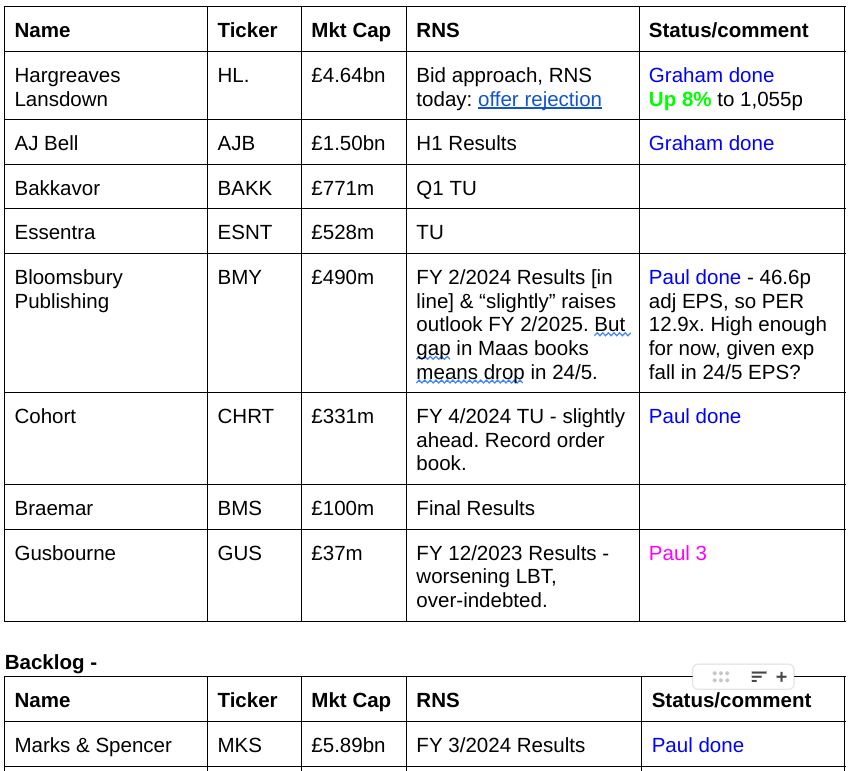

Companies Reporting Today

Other Mid-Morning Movers (with news)

Capital & Regional (LON:CAL) - up 13% to 58p (£131m) - Possible takeover interest - Paul - PINK

CAL it has received potential bidding interest from two suitors -

Vukile - property co approached CAL on 19/4/2024 with an indicative proposal in cash & shares. Vukile seems to be based, and its shares listed, in South Africa - would UK investors want shares listed on the Johannesburg Stock Exchange? Vukile issues a statement here confirming it is in the early stages of considering a bid & has submitted an indicative proposal.

Growthpoint Properties Ltd owns 68% of CAL, so it’s their decision what happens next. CAL says it is aware that Newriver Reit (LON:NRR) has also approached Growthpoint about a possible cash & shares bid for CAL.

NRR has issued a statement today, confirming its possible interest in acquiring CAL, and explains the rationale, things like increased scale, cost synergies, more liquidity in its shares, etc. Makes sense to me, given CAL being sub-scale at £131m mkt cap.

Paul’s view - none, as property investment companies are quite a specialised area, requiring careful assessment of the properties owned, the terms of the tenant leases, borrowings - terms and LTV, interest rate hedging, covenants, etc. There’s also the issue of portfolios of older properties possibly requiring very expensive renovations in order to meet environmental requirements. So well above my ability to assess quickly. The discount to NTAV at CAL does look intriguing though, and is a good starting point. I think selectively there could be rich pickings in the property sector, as interest rates seem likely to have peaked, people are returning to offices, and the economy is now growing again - never mind "soft landing", it's already landed, and it taking off again! Some of the smartest (and most successful) professional investors I know are taking a keen interest in the investment property sector, so I like the idea of looking into these.

Qinetiq (LON:QQ.) - up 13% to 423p (£2.42bn) - FY 3/2024 Results - Paul - GREEN

I’ve not looked at this mid-cap before, but on a very quick skim of the results, and the outlook, plus the StockReport figures, it looks interesting I’d say - well worth a closer look. The market clearly likes its FY 3/2024 results, which are strong, with adj EPS up from 26.5p LY, to 29.4p this time (PER 14.4x) - doesn’t sound expensive for a quality business (good profit margins), with an OK balance sheet (c.£200m NTAV), and a strong outlook. It raises guidance for the new financial year.

Paul’s view - obviously this is not a proper in-depth analysis, but I’m just flagging up that the basics look interesting, and worth you researching in more detail. Quite a few US investors on the major shareholder list - what’s the betting this becomes a bid target? Although as it’s defence-related, I wonder if regulatory hurdles might be a consideration? I’d be interested in hearing from any readers who’ve looked at this interesting company. I’m happy to flag up interesting mid-caps for discussion when we spot them.

Summaries of Main Sections

Quick comment -

Marks and Spencer (LON:MKS) - up 5% to 288p y’day (£5.89bn) - FY 3/2024 Results - Paul - GREEN

Lovely results from MKS yesterday. Brief notes I jotted down - adj EPS 24.6p, PER 11.7x. Lots of adjustments totalling £124m, so there are still problems being worked through. Dispute with Ocado. Modest divis (should rise in future though), as focus has been on debt reduction, which has been substantial - borrowings (excl leases) down £401m to a net cash position of £46m. Also announced tender offer yesterday, to buy back its bonds, which should save interest charges & de-risk the balance sheet. Pension schemes are huge, but look fine, with both accounting and actuarial surpluses, so no deficit cash payments required. Balance sheet is strong, with £2.6bn NTAV. Headwind of wage increases, but other inflation offset by energy cost savings.

Paul’s view - I think these numbers fully justify the big bull run in MKS shares. If it can keep up this out-performance, then there could be further upside. Isn’t it great to see this national institution coming back from years of under-performance? The stores just somehow feel special again when I visit them. [no further section below]

Hargreaves Lansdown (LON:HL.) - up 5% yesterday to 979p (£4.6 billion) - Offer Rejection - Graham holds HL - GREEN

It is revealed that private equity groups, and Abu Dhabi, are interested in HL and made a proposal last month at 985p. I agree with the Board that this undervalues the company; I think HL is a uniquely powerful financial institution and a high quality share that should not be sold at a meagre 14-15x earnings.

Bloomsbury Publishing (LON:BMY) - down 7% to 555p (£456m) - Audited Results FY 2/2024 - Paul - GREEN

Gives back a bit of the recent gains, with a "slightly ahead" update to FY 2/2025 (low) forecasts arguably not being enough to continue the long bull run for now. There's a gap in the schedule of Sarah J Maas books, meaning FY 2/2025 skips any new released from this highly successful author. Balance sheet & cashflow look good. Overall I'm happy to remain at GREEN.

AJ Bell (LON:AJB) - up 11% to 401.5p (£1.66 billion) - Interim Results - Graham - GREEN

It’s a strong interim results statement from AJ Bell with inflows converting to excellent revenue growth and even better profit growth. The full-year outlook seems to have improved and the business is firing on all cylinders with increasing brand awareness, an automated pension product and very competitive charges.

Bloomsbury Publishing (LON:BMY)

Down 7% to 555p (£456m) - Audited Results FY 2/2024 - Paul - GREEN

Bloomsbury Publishing Plc (LSE: BMY), the leading independent publisher, today announces audited results for the year ended 29 February 2024.

Chairman to retire at July’s AGM. Being replaced with an experienced existing NED. Doesn’t seem any cause for concern to me.

Great headlines initially got me excited, which faded when digging into the detail -

Success of portfolio of portfolios strategy leads to exceptional sales up 30% and profits up 57% with full year dividend up 25%

Revenue and profit for 2024/25 upgraded

FY 2/2024 Results - are indeed superb, as expected, with 46.6p adj EPS (PER 11.9x at 555p/share) being a whisker ahead of the 46.4p broker consensus shown on the StockReport. Note that this forecast was upped 4 times since first being introduced in late 2022 at 25.1p, so this has been a terrific year, no doubt about that. We already knew this though, so it’s already in the share price -

Note above how the FY 2/2025 forecasts are now a long way below the FY 2/2024 forecast (and now actual), so the focus needs to turn to whether the forecasts are being set too low and we can look forward to BMY once again beating them, or whether there’s a more fundamental reason for earnings to fall - was FY 2/2024 a bit of a one-off bumper year, thanks to the success of Sarah J Maas’s fantasy books?

If BMY only hits 32p forecast for FY 2/2025, then the PER would be 17.3x, difficult to justify when earnings are falling.

Recent success has been principally driven by the increasing demand for fantasy fiction. Sarah J. Maas is a publishing phenomenon and we are very fortunate to have signed her up with her first book 14 years ago. Her books have captivated a huge audience…

Outlook - there’s a gap in the Maas schedule - good or bad? Some might see this as just a dip in earnings, with a rebound to follow in FY 2/2026 perhaps? -

Trading for 2024/25 is expected to be slightly ahead of current consensus expectation1. Expectations for 2024/25 reflect the exceptional performance in 2023/24, and that we are not expecting to publish a new Sarah J. Maas title in the year ending 28 February 2025.

1. The Board considers consensus market expectation (before this publication) for the year ending 28 February 2025 to be revenue of £283.6m and profit before taxation and highlighted items of £35.4m.

Helpful footnote, thank you. “Slightly ahead” might perhaps point to £36m adj PBT. We don’t have any broker notes available, a recurring bugbear with this share. My figures suggest c.33p is roughly the current guidance for FY 2/2025, a PER of 16.8x - probably enough for the time being. Unless of course you think they’re under-forecasting, and are likely to beat this?

A bad mark for saying “upgraded” in the headline, but reducing this to “slightly ahead” in the detail further down. That strikes me as somewhat misleading, never a good look.

Dividends - interim + final = 14.69p, up 25%. Yield = only 2.6%. It has capacity to pay much larger divis, I reckon, so there could be upside on this.

Balance sheet - very robust, as usual. NAV £202m, less intangible assets of £80m, gives NTAV of £122m. Receivables look very high at £165m, but that reflects increased revenues, and £35m of that is royalty advances to authors, which is usual here. Cash is a very healthy £66m, and no interest-bearing debt. All looks very healthy to me, no concerns.

Cashflow statement - seems OK to me. There are large working capital movements, but they broadly net off, so not a concern. Note that the increase in cash pile of £16m means that the dividends paid of £11.3m could have been more than doubled, and still left an increased cash pile. So my point above that BMY could be much more generous with the divis is supported by the cashflow statement. It has dividend paying capacity of >5% yield.

Queries - it capitalised £5.1m into intangibles, so more detail on this would be useful. Purchasing shares for the employee benefit trust cost £2.8m, which in the context of £37.6m post-tax cash inflow is fairly significant.

Overall I don’t see any problems here, it's a nicely cash generative business.

Paul’s opinion - BMY is a long-standing favourite of ours here at the SCVRs. Shares have had a superb run, and I think it makes sense to see it pause for breath, with some people obviously profit-taking this morning. Where does it go from here? I’d say long-term it should be fine, as the business model seems very robust. The big hits from JK Rowling and now Sarah J Maas seem to generate very long-term returns for BMY, with people buying the back catalogues even if there aren’t any new titles. Hence I think BMY is a very good candidate to include in a buy & hold forever type of portfolio.

Shorter term stuff won’t matter to long-term holders. However, the “slightly ahead” (on low forecasts) today wasn’t good enough to propel it to new highs, so holders might have to be patient, and hope for the (now customary) ahead of expectations updates. With new Sarah J Maas titles expected for FY 2/2026, at some point investors might start to get excited again, and it might require some patience until then, who knows?

Could BMY become a bid target? It doesn’t have any blocking stakes from founders, so it’s entirely possible. The financial performance, growth, and sticky nature of the big franchises like Rowling & Maas must have been noticed by the American private equity people.

Overall I think the fundamentals still look strong, so it has to be another GREEN from me.

Cohort (LON:CHRT)

Unch 807p (£336m) - FY 4/2024 Trading Update - Paul - GREEN

Cohort, the independent technology Group, today provides an unaudited trading update for its financial year ended 30 April 2024.

Performance slightly ahead of expectations

Record closing order book

Previously, I was GREEN on CHRT shares, but at much lower valuations compared to its 807p share price now, so the question is whether to moderate to amber or amber/green, given the substantial rise in valuation?

There’s not really anything new in today’s update, confirming what we’d previously been told that the order book has greatly increased to over £0.5bn. This bit in the commentary has caught my eye though, and seems to suggest earnings upgrades might be likely -

The Royal Navy's recent order for the Ancilia Trainable Decoy Launcher System, was a significant milestone for the Group. It represents a strong vote of confidence in the product; a fully UK designed and built solution for which we see encouraging export prospects. As stated in our announcement of 26 March 2024, this together with other recent order wins, is expected to materially enhance the Group's earnings.

We have an encouraging pipeline of order opportunities for the current year, providing a positive outlook for organic growth in the years ahead.

Overall, our expectations for the coming financial year remain unchanged.

Equity Development today says it sees 36.2p adj EPS for FY 4/2024, and 40.4p for FY 4/2025. To my mind, that modest forecast growth sounds quite cautious compared with management commentary, and the very large increase in order book this year.

It’s also got superb visibility for FY 4/2025 -

The year end order book underpins c.£180m (90%) of the current consensus market revenue expectations for 2024/25, an improvement on the year just finished.

Paul’s opinion - it’s encouraging to see this share re-rate to a more appropriate valuation. It’s tempting to bank profits once an irrationally low valuation turns into a fair valuation. So individual investors have to make up your own minds about what to do. Sticking my neck out a bit here, I reckon this is looking like it could beat forecasts, and please the market with more contract win announcements. The group is clearly on a roll, and my hunch is to stay positive on it, despite the big rise in valuation recently, so I’m going with GREEN again. More cautious investors might want to top-slice - your money, your decision!

Graham’s Section:

Hargreaves Lansdown (LON:HL.)

Up 5% yesterday to 979p (£4.6 billion) - Offer Rejection - Graham - GREEN

At the time of writing, Graham holds a long position in HL.

It has been a busy week for takeover offers with the latest one relating to Hargreaves Lansdown.

This one looks like a poorly kept secret:

Last night, a private equity consortium consisting of funds managed by CVC, Nordic Capital and the Abu Dhabi Investment Authority confirmed that it was a possible buyer of HL.

They made a proposal at 985p per share on 26th April, which the board of HL rejected.

With last night’s disclosure, the clock has started ticking under the rules of the Takeover Code. The consortium has until 19th June to make up its mind on an improved offer.

This morning, the HL Board responds and discloses that the consortium made two proposals, the most recent one being at 985p. Here is the view from HL:

The Board confirms that it unanimously rejected the Proposal on the basis it substantially undervalues Hargreaves Lansdown and its future prospects. The Board is focused on executing its strategy and looks forward to updating the market at the full year results on 9th August 2024. In the meantime, shareholders are advised to take no action.

Graham’s view

I own HL because I think it’s too cheap, so my view is pretty clear! I’ve been bullish on it since around 800p. And I’m not surprised at all that private equity groups would like to buy it for less than 1000p.

In Feb 2024, I reviewed the company’s interim results. As I said then, I do have a few quibbles with the company’s presentation of its numbers. It passes off huge “strategic investment costs” as non-underlying items. Similarly, the costs associated with past abandoned projects are described as non-underlying.

But it’s probably still too early to pass much comment on the work of HL’s relatively new CEO and CSO (Chief Strategy Officer).

I’m invested in this share because I think the company and its brand are bigger than any individual: it’s an institution with tremendous market share (40%) that finds it very easy to grow and to churn out extremely high returns. Although the ease with which it generates profits has, it seems, been accompanied by some degree of excessive spending.

Picking up a unique company like this at an earnings multiple of 14-15x would, in my view, be a bargain for private equity. So I’m glad that the Board rejected the offer.

The way I see things, the bid would need to be about 50% higher to be worth considering. I don’t think that HL shareholders should even consider giving it away for anything less than 20x earnings.

While the cheap UK market has been a great place to pick up bargains, the risk is that we end up losing too many high-quality businesses to opportunistic bids like this.

AJ Bell (LON:AJB)

Up 11% to 401.5p (£1.66 billion) - Interim Results - Graham - GREEN

AJ Bell plc ('AJ Bell' or the 'Company'), one of the UK's largest investment platforms, today announces its interim results for the six-month period ended 31 March 2024.

This is also not a small-cap, but it’s thematic to give it a look on the same day we have bid interest in Hargreaves Lansdown.

Here are the key bullet points for the six-month period:

Revenue up 27% to £131m

PBT up 47% to £61m

27,000 new customers, total 503,000

Assets under administration up 13% to £80.3 billion

It’s a very pleasing progression with 13% growth in AuA translating to even faster revenue growth, which in turn translates to even faster PBT growth.

The growth in AuA was mostly driven by market movements (£6.5 billion) rather than by net inflows (£2.9 billion).

There is a slight drop-off in customer retention, falling to 94.5% from 95.5%.

The CEO’s comments contain many important points, here are some snippets:

"Our continued strong business performance led us to review our approach to capital allocation and the Board has recently approved a new capital allocation framework which reaffirms our commitment to a progressive annual ordinary dividend.

AJ Bell is no longer going to pay out 65% of profits to shareholders; instead it is going to try to increase the dividend progressively every year.

I do prefer the fixed percentage payout model, as it helps companies avoid getting stuck with a payout ratio that’s too high when profits come under pressure.

However, for companies that are very confident in their outlook, such as AJ Bell, they often prefer to go with the progressive dividend model.

Such companies are typically in a mature stage of life, not enjoying the rapid profit growth of AJ Bell!

Continuing:

We are in the second year of our multi-channel brand campaign and are now reaping some of the benefits of this investment, with our brand awareness showing a meaningful improvement over the course of the last year…

I’d be curious to know what readers think: do you feel that the AJ Bell brand is catching up with Hargreaves Lansdown? HL has £140 billion+ of AuA, vs £80 billion at AJ Bell, and I still think that the HL brand is significantly more powerful. But AJ Bell’s TV adverts are trying to address this. According to the company, they are working!

Continuing:

We are delighted to have launched our new Ready-made pension to help people easily consolidate their existing pensions with AJ Bell and invest them automatically via our low-cost, in-house investment solutions.

This is a fantastic initiative, taking on highly-valued fintech start-ups with a product that benefits from AJ Bell’s economies of scale.

And as for the full-year outlook:

"The recent pricing changes were implemented later than originally planned due to regulatory uncertainty around retention of interest margin at the tail end of 2023. Whilst the changes are now live, the delay resulted in particularly strong financial performance in the first half as revenue margins and PBT margin were elevated. These metrics will moderate in the second half as customers begin to benefit from lower overall charges, however our updated full-year guidance reflects our expectation that both revenue and PBT will be higher than we had anticipated back in December.

New guidance from the CEO suggests that revenue from interest on cash (this is currently the biggest source of revenue) will be at the top end of guidance, while share trading will be at the lower end “given continued muted dealing volumes”. Client cash will continue to decline as customers put their funds to work or withdraw it from the platform.

Graham’s view

As noted by Roland recently, AJ Bell offers excellent value compared to Hargreaves Lansdown, e.g. with a new £5 dealing charge (you must trade 20 times in a month to get the £5.95 charge from Hargreaves, otherwise the charge is £11.95). If you trade 10 times in a month with AJ Bell, the charge falls to £3.50!

And AuA growth is very impressive at AJ Bell, e.g. HL generated net inflows of £1 billion in the six months to Dec 2023, while AJB has generated net inflows of £2.9 billion in the six months to March 2024.

Given the faster growth and the strong product offering, it’s a consensus opinion (one with which I agree) that AJ Bell deserves to trade at a substantially richer valuation compared with HL.

AJ Bell’s net income forecast for FY Sep 2025 is £79m per the StockReport, but I’ve also seen forecasts as high as £89m. If we applied a 20x multiple to an £89m forecast, that gives us a value of c. £1.8 billion. Current market cap: £1.66 billion. Of course in a takeover situation, all bets would be off.

I’ll give this one the green light as I think it’s another high-quality financial stock that may appeal as an alternative to HL, for investors who prefer the growth story at AJB or who dislike the recent history at HL.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.