Good morning, it's Paul here!

A theme which I keep coming back to, is the remarkable changes (mainly driven by technology) which are occurring across multiple sectors. This is causing a lot of problems (and creating opportunities) for investors. How do we pick the winners? Anything that looks like a future winner is probably already extremely expensive, because we're in a roaring bull market for growth companies. So that opens up a lot of downside risk, if sentiment on a particular share, or the whole market, suddenly falls.

Last night I read Howard Marks' latest memo, which (as usual) is utterly brilliant. He sounds the usual warning signals, which he is well known for. It's well worth a read, highly recommended. There seems little doubt to me that we're probably now in the euphoria stage of this bull market - i.e. near the end. However, that stage could go on for a while yet, and it's when the biggest profits are often made. Nobody knows when the bubble will burst.

Also, I see differences between now, and 1998-2000, when we had a massive bubble in tech, media & telecoms shares. Back then, all sorts of rubbish blue sky stocks soared to mad valuations. However, this time round, a lot of the very expensive stocks are actually fantastic, highly disruptive businesses (e.g. Amazon). We can argue about valuation all we like, but there's little doubt that once-in-a-lifetime changes are happening across multiple sectors. Just look at the difficulties retailers are facing from online competition, and the trail of destruction that Amazon and Google are leaving in their wakes.

Bargains?

In the past, once certain sectors became really cheap, you could buy them with the reasonable expectation that they would recover - mean reversion. However, that's no longer the case. With, say, struggling retailers, and whole sectors (e.g. car dealers) - lots of investors are wondering if those businesses will still exist in 10 years' time?

Take a look at Dixons Carphone (LON:DC.) which warned on profits today. The share is currently down 24% today, but was down 30% earlier. This is the latest in an increasing long list of big companies which are surprising on the downside.

The company said something very interesting about mobile phone handsets, and I'm wondering what other companies this may have read-across to?

...However, over the last few months we have seen a more challenging UK postpay mobile phone market. Currency fluctuations have meant that handsets have become more expensive whilst technical innovation has been more incremental. As a consequence, we have seen an increased number of people hold on to their phones for longer and while it is too early to say whether important upcoming handset launches or the natural lifecycle of phones will reverse this trend, we now believe it is prudent to plan on the basis that the overall market demand will not correct itself this year.

Over the longer term we believe that the postpay market will largely return to normal but in the meantime we have taken a conscious decision to invest in our margin and proposition to maintain market share and scale so we remain in a strong position as the market leader when this happens.

Don't you just love that absurd phrase, "invest in margin"?! It actually means that we've been forced to lower prices & accept a lower profit margin to avoid sales falling off a cliff! Do the people who write these announcements actually think they're fooling anyone?!

All the above makes me feel that it's time for a redoubling of my efforts to find some similar shorting opportunities with large caps. Shorting small caps is too risky in my view. However, having a smattering of carefully chosen large cap shorts can be good. It also helps hedge against a general market downturn, and allows me to be a bit more aggressive with my longs.

Overall though, I think we need to really think carefully about every share we hold, and consider if & how it might be disrupted by new entrants. Take Rightmove (LON:RMV) for example (in which I have a short position). It seems to me that it's probably only a matter of time before one of the big players (e.g. Google, Facebook, Amazon, etc) disrupts RMV's business. It's simply making too much profit, so looks very vulnerable to attack from a giant, in my view.

What was it that Amazon's boss said?

Your margin is my opportunity.

The effect of operational gearing means that there are plenty of existing large caps which could turn into loss-makers and eventually go bust. Who said small caps are risky? I reckon there are plenty of risky large caps too. We can't be anywhere near as sure about business models, or the outlook for some sectors, as used to be the case. All food for thought anyway.

Revolution Bars (LON:RBG)

Share price: 207.75p (up 11.8% today)

No. shares: 50.0m

Market cap: £103.9m

(at the time of writing, I hold a long position in this share)

Recommended offer for Revolution Bars Group plc - excellent news for holders here. We already knew that Stonegate (a large, acquisitive bars group) had expressed interest in bidding for RBG at 200p. A formal, agreed bid at a slightly higher price, 203p has been announced today.

Why has the share price gone to a 5p premium above the 203p offer price? I think it's because the shares are now really a virtually guaranteed 203p cash offer, plus a call option of 5p on the possibility of an improved offer.

Deltic statement - this has added some spice to proceedings. Deltic (a similar sized bar group to RBG) had previously indicated its interest in merging with RBG, to form a larger, listed bars group. This was declined by RBG management. However, in today's announcement, Deltic says amongst other things;

...Deltic confirms that it is also evaluating a possible cash offer for the entire issued and to be issued share capital of Revolution.

It's clear from Deltic's accounts that it doesn't have the firepower to do this on its own. However, the shareholders of Deltic may have other wealth which could be brought into play, I don't know. Do any readers know the background of Deltic's shareholders? I know they bought Luminar out of Administration (which is what Deltic is), but other than that, I'm in the dark.

It's all the more interesting, in that RBG has granted Deltic access to its books, for due diligence.

Irrevocables - going back to the formal Stonegate offer, I note that it only has a very small level of irrevocables, totalling only 6.17%. This comprises 2.0% of management shareholdings, and 4.17% for Castlefield Fund Partners.

Note that Artemis, which holds 14.77% has only given a "letter of intent", which is much looser than irrevocable support for the 203p Stonegate bid.

My opinion - it seems to me that RBG management seem to have played it rather cleverly. The Stonegate offer clearly undervalues the company, and is indeed opportunistic (as Deltic again points out today;

Deltic notes the announcement made on 24 August, 2017 by Stonegate Pub Company Limited ("Stonegate") of a firm intention to make an offer for Revolution at a price of 203p per share. Deltic continues to believe that this offer significantly undervalues Revolution.

However, rather than rejecting the Stonegate offer, RBG's management seems to have agreed it, whilst leaving the door wide open to invite higher competing offers. So there seems a reasonable possibility that this could turn into a situation like Lavendon - where several parties competed with several increased offers.

One broker points out today that RBG is still significantly undervalued, and I agree. The broker says that if you put it onto a sector average valuation of 8.9 times EV/EBITDA then RBG shares are worth 285p. That's before any synergies are taken into account.

RBG is interesting because it's worth far more to a trade buyer, than to the stock market. Another broker reckons that a trade buyer could strip out c.60% of RBG's central costs, and negotiate bigger volume discounts on the drinks supplies. Throw that into the pot, and it's not unreasonable to see a potential value in RBG to a trade buyer being north of 300p.

For that reason, I'm sitting tight on my RBG holding, given that it now seems de-risked - the 203p looks to be almost in the bag, yet for 5p more (at the current share price of 208p), there could be considerable further upside, who knows?

Looking at the order book, this share has clearly (at long last!) caught the eye of arbs - as there are unusually large amounts on the stock market order book. It seems strange that the share price languished at c.175p for a while, when a 200p bid had already been mooted, but there we go - strange things happen sometimes.

All rather exciting! I can see why some people might want to bank the gains now. Personally however, I think risk:reward is pointing towards possible decent further upside, with only 5p downside risk. That looks decent risk:reward to me, so I'm sitting tight for now.

I almost forgot to mention, note that today's update also includes a reassuring trading update, within section 9 of the Stonegate RNS today;

Trading continues to be in line with the Revolution Board's expectations.

Entu (UK) (LON:ENTU) - this crock has finally gone.

It was unbelievable that some people were still punting on the shares, even after the company had explicitly stated that the shares were worth little to nothing.

I think there should be an enquiry about what went wrong at this company, as it stinks to high heaven.

Utilitywise (LON:UTW) - another trading update today from this trouble-prone utilities cost consultant, with the (previously) dodgy accounts. Things seem to be stabilising, with trading in line with (reduced) expectations;

The Board expects to report Group revenue for the year of c. 3% higher than the prior year and adjusted (2) profit before tax of c. 40% lower than the prior year.

The fall in adjusted (2) profit before tax is primarily because of an adjustment recognised in respect of projected under-consumption of contracts, as announced on 29 June 2017, and the deferral of certain significant renewals contracts, announced on 31 July 2017.

More details are given, but I won't go into that, as this stock is uninvestable as far as I'm concerned, so I don't want to waste time on it.

Net debt was £19.0m at 31 Jul 2017. This has risen a lot, from £5.5m a year earlier, but again I think this had already been flagged before, so isn't price-sensitive now.

Order book - details are given on this, and it seems to have improved.

My opinion - it's just been a catalogue of disasters at this company. To give them the benefit of the doubt now, you'd have to really be certain of your facts. Why take the risk? With thousands of listed companies to choose from, I can't see any reason to get involved here.

Sopheon (LON:SPE)

Share price: 361p (down 2.2% today)

No. shares: 7.5m + substantial dilution from in the money convertible loans (see below)

Market cap: £27.1m

Half yearly report - this is a niche software company, with products which manage innovation & product development. Several friends like this stock, so have asked me to give a brief view on the figures.

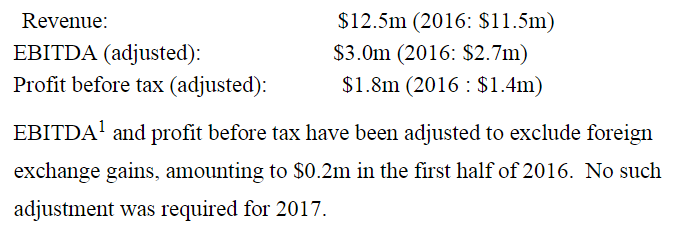

The headlines look OK, showing some progress having been made in the half year;

Whether that's enough to get people excited? My feeling is probably not.

Outlook comments sound more interesting though;

Market activity with and inquiries from leading industry voices Gartner and Forrester have increased materially year on year...

...we have a growing sales pipeline, including several blue chip companies representing major enterprise opportunities. These factors give the Board confidence in meeting our goals for the year, and as importantly, our ambition to accelerate growth in the future.

Full year revenue visibility for 2017 from contracted business and recurring revenue streams is already at $20.3m. In addition we have a growing sales pipeline, including several blue chip companies representing major enterprise opportunities.

That all sounds pretty good. Also a divi is being considered.

Balance sheet - no concerns, although note that the big cash pile is largely offset by borrowings and deferred income (where customers have paid in advance).

Cashflow - the company capitalised about $1m in development spend, but this is about the same as the amortisation charge, so looks fine. Also, the amount being capitalised doesn't look excessive.

Taxation - note that earnings are flattered by the nil tax charge, which I think is from brought forward tax losses.

Dilution - this is a very important point. If you ignore it, you'll value the shares incorrectly. The company has convertible loans in issue, which are deep in the money, at a conversion price of 76.5p per share. Therefore this is likely (almost certain actually) to lead to about 2.6m new shares being issued, which would increase the total shares in issue to about 10.0m.

Therefore investors need to ensure you properly adjust EPS, and market cap accordingly.

My opinion - I don't have a strong opinion either way on this one. It looks quite good, but I can't see anything particularly compelling about the valuation. Nice outlook comments though, so if the good performance continues, or accelerates, then investors might do well.

That's all I have time for today.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.