Good morning! Christmas Eve, who would have thought it? The UK market usually shuts at lunchtime today.

The newswires were buzzing last night with briefings from both sides of the English Channel, that a Breggzit trade deal is imminent, between the UK & the EU. Whether it's a good, medium, or a bad deal, only time will tell. I imagine this might attract some fresh money into the small caps space in the stock market - I know that some investors were very worried about the risk of a no deal Brexit. Limited liquidity at this time of year could see some unusual price spikes - useful for anyone wanting a selling opportunity in a particular stock, perhaps?

Hedging - I was starting to have kittens about Brexit & covid/lockdown risk, and opened an index short earlier this week, to hedge my longs. News of an imminent Brexit deal means that I'm now a lot less worried about the risk from my longs. So I've closed two thirds of my short hedge this morning.

Timing - there's not much news today, hardly any actually. But I'm in the mood to do some writing, so will look back on my pad and catch up on a couple of things from previous days. We'll be done by 13:00.

Holiday timings - I'll be working throughout the Christmas & New Year break. If the stock market is open, I'll be here writing something. So do stay tuned, if you wish to. I usually do a year end review at this time of year, so something along those lines will no doubt gestate soon.

Update on Paddy - it's good news on one of my dogs, Paddy, who had a near-death experience recently. He developed a large lump, which the vet told us was benign, but it grew rapidly and then became cancerous. We couldn't just watch him die, so we took the risk and had the vets remove it, which left a large wound most of the way down one side of his abdomen. There were repeated problems with the wound opening up again, and at one point we really did think it was game over, and I lost the plot unfortunately, and couldn't concentrate on work for a few days, sorry about that.

Well, the good news is, Paddy is on the mend, and the stitches were removed earlier this week. He's still wearing the dreaded "cone of shame", to stop him scratching the wound, but that is due to come off this weekend. So with any luck, my little pal should be around for a couple more years! He's got the most adorable personality, and really is a marvellous companion. Here he is last night, looking a little fed up with the cone!

.

Dcd Media (LON:DCD)

240p (ridiculous 80p spread) - mkt cap £6.1m

This is the only company reporting results today.

DCD Media, the independent TV distribution and production group, is pleased to report unaudited interim results for the six months ended 30 September 2020.

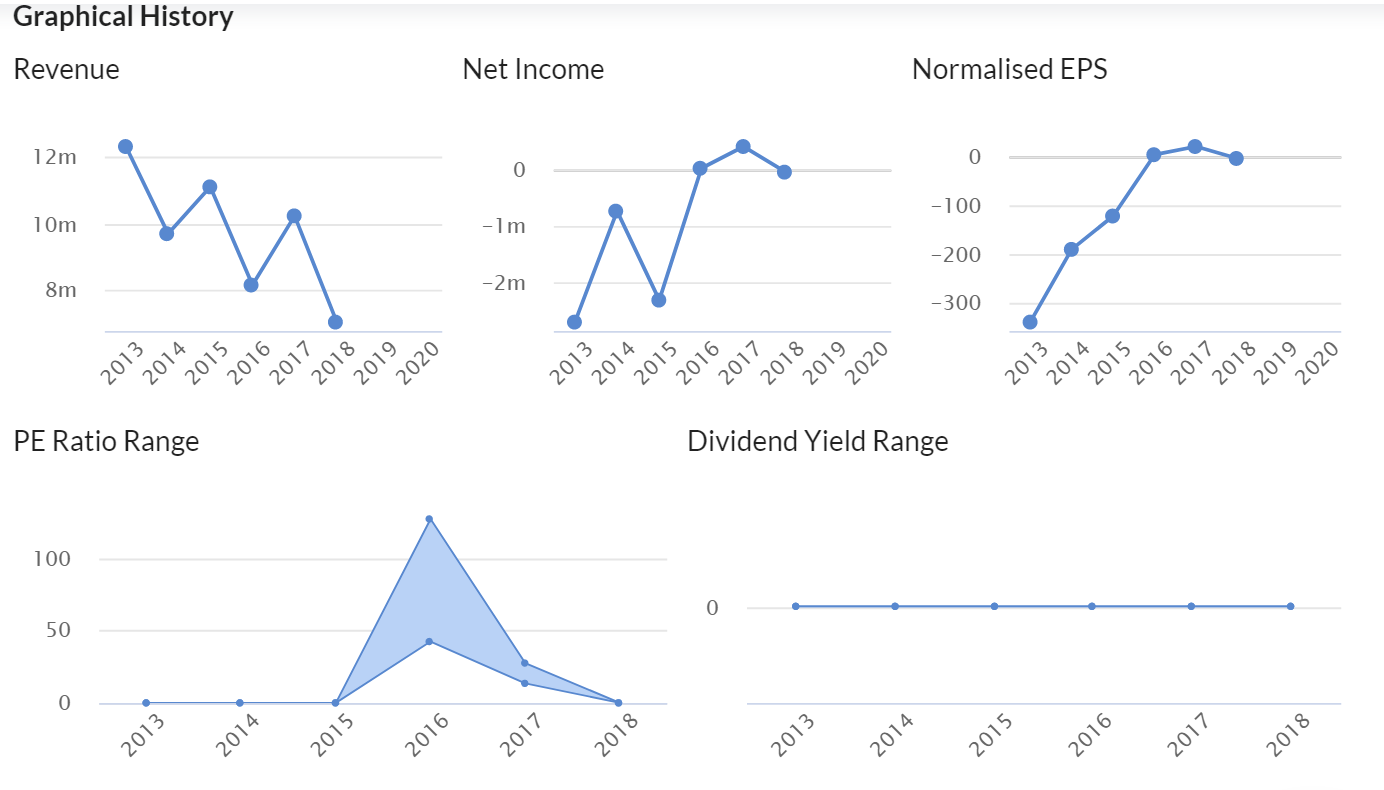

I'm not familiar with this company. Looking at the historical graphs, I'm struggling to understand (a) why it has a listing, and (b) why anyone would want to own shares in this? It seems to have been listed for about 20 years. Imagine how much the costs would have accumulated to over that period? Several million quid probably. What for? Money down the drain, if you ask me. Hence my main worry about this share is the de-listing risk.

Declining revenues, losses or breakeven , and no divis. Looks unimpressive. Is it a lifestyle company, run for the benefit of management & staff, perhaps? -

.

.

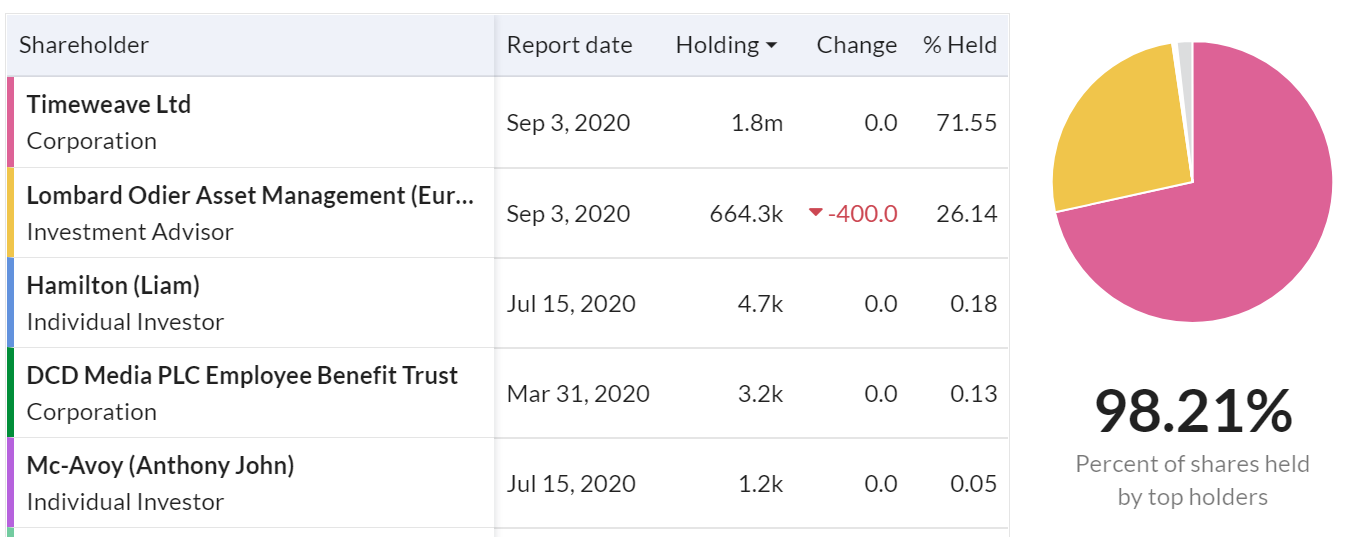

Look at this for a ridiculous shareholding structure - almost zero free float! So why have a listing?

.

.

This is a concern -

There was no recharge from Timeweave Ltd ("Timeweave"), its major shareholder, in the 2019 year or six months to September 2020 for director, management and financial services. As at 30 June 2019 there was a balance payable to Timeweave of £299k in relation to previous management charges that were unpaid. As at September 2020 the balance was £Nil.

.

Interim Results -

- Revenues up strongly to £5.79m (up 63%)

- Adjusted profit before tax of £240k (49%) - in line with expectations, the company says

- Cash of £2.8m, but NB the commentary, which says this cash really belongs to clients

- Flags forex risk uncertainty

- Exploring third-party funding, to expand its TV content

- Funding facility agrees with Coutts (ooh la-dee-da!)

Outlook - sounds encouraging -

The Board is confident that the Company will deliver a strong performance in the second half of FY 2021 and would like to thank its staff for their continued support through a very challenging year and wish everyone associated with the Company well for the forthcoming year.

.

Balance sheet - has huge receivables and huge creditors, which looks strange.

Note the large retained earnings deficit, so the company could have valuable tax losses maybe?

My opinion - this share looks very peculiar, all in all. I can't see any logic for it being a listed company, other than that it might help the company punch above its weight in its sector maybe? It's 98% owned by 2 shareholders, so having a stock market listing seems superfluous, as there won't be any liquidity.

Having said that, it's profitable, and has a sound outlook statement.

Risk: it de-lists at an unattractive price. Reward: it de-lists at a favourable price!

.

Gravy

A friend's mother (who we lost to covid tragically this year), made the best gravy I've ever tasted (outside of Zimbabwe, there's is on an altogether another level of deliciousness, because the staple food Mealie Meal is tasteless, so they enliven it with glorious gravy!).

If you pass this on to whoever makes your Xmas gravy (if it's not you personally), you won't regret it.

Secret ingredients to add to your existing gravy recipe;

- A squirt of pureed garlic

- A dollop of sour cream

- A decent slug of Ribena

It's sublime, you won't regret it!

IS this the most eclectic shares blog in existence? You never know what to expect here, do you?!!!

The sun's come out now, so I'm going for a walk, as part of my health drive , so might add a few more bits later. If not, then wishing everyone a relaxing, and happy break. We can still see loved ones via Zoom, and it's only one year - which will make us appreciate loved ones even more next year, once we're through this ghastly covid aberration.

Best wishes, Paul.

P.S. Thanks for all the lovely reader comments too, they're very much appreciated!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.